Gold Investment FAQs

We are frequently asked many questions about investing in gold. As a guide to customers and for clarity, we have listed many of these questions in this article, which we hope you enjoy reading!

1) Are gold coins a good investment?

We have written a detailed answer to this question, simply read our answer at this blog post.

2) Is gold ETF a good investment?

Read our detailed answer at https://www.physicalgold.com/insights/is-a-gold-etf-a-good-investment, we also recommend reading buying a gold ETF.

3) Which is the better investment, gold or silver?

See https://www.physicalgold.com/insights/which-is-the-better-investment-gold-or-silver for a comprehensive answer to this question.

4) Best gold investment for beginners?

The best gold investment for beginners is to focus on the well-established UK bullion coins such as Sovereigns and Britannias. Premiums are low on these coins and it’s difficult to go wrong as they’re so easy to sell at excellent prices. Avoid buying proof coins or boxed collectors coins which will cost far more.

5) Is gold a good investment?

Please read our detailed to answer to this question at this link.

Gold bars, in particular, are usually classed as a long-term investment

6) How does gold investment work?

The idea behind gold investment is that the underlying value of gold increases over time. Historically this rate of increase is higher than inflation, so the value of your investment increases in real terms. Investing in gold can take the form of physical bars and coins, gold equity funds, mining shares or ETFs.

7) Gold investment vs Bitcoin?

For our dedicated article on this topic, please read https://www.physicalgold.com/insights/gold-investment-vs-bitcoin/.

8) Best gold investment UK?

The best UK gold investment is to buy Sovereigns and Britannia coins. Physical ownership means you have no counterparty risk. The bullion coins represent great value compared to proof coins or collector’s coins, and both benefit from a strong second-hand market, so they’re easy to sell. As UK legal tender profits from selling these coins are also free from Capital Gains Tax.

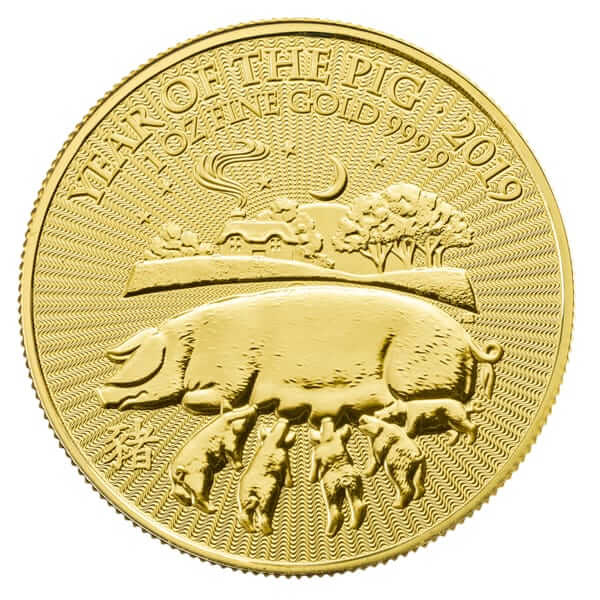

Britannia gold coins are a solid investment buy

9) Where to buy gold for investment?

Click https://www.physicalgold.com/insights/where-to-buy-gold-for-investment to read this article, which answers the question.

10) Gold investment vs stocks?

Click https://www.physicalgold.com/insights/gold-investment-vs-stocks for an answer to this question.

11) Gold coins vs bars?

Visit https://www.physicalgold.com/insights/gold-coins-vs-bars for a comprehensive answer to this article.

Why not also view our video, “Gold coins – collecting as a hobby and for-profit”?

12) Gold investment for 2018?

2018 is a good year to start off in gold investment as gold prices are significantly lower than at the height of the market. Gains may not be straight away, but 2018 is a prudent starting point with Brexit still looming, equity markets due to a large price correction, and credit bubbles brewing in the background. The gold price would likely increase in any of these events.

13) How safe is gold investing?

Click how safe is gold investing to read our detailed answer to this question.

14) Gold investment vs fixed deposit?

Read https://www.physicalgold.com/insights/gold-investment-vs-fixed-deposits in our detailed FAQ answer blog article.

15) How good is gold investment right now?

As of March 2018, the gold price was around 20% off its all-time high, and around 13% off its high from the past 12 months. This provides a great buying opportunity to buy more gold for the same money. Many experts predict a significant stock market correction any times in the next 18 months which would propel the gold price upwards.

16) Which is a better investment, gold or diamonds?

Please read our detailed answer to this question by clicking this link – https://www.physicalgold.com/insights/which-is-a-better-investment-gold-or-diamonds/.

17) How to do gold investing?

If you’re wondering how to buy gold investment, then the simplest and safest way is to buy online from a reputable dealer. Research into the broker first and ensure they have a track record. They may be able to offer you guidance as to which coins and bars to buy. For example, gold bars are available in various sizes such 1oz, 100g and 1 kilo and you may need dealer advice as to which is the best to buy for your circumstances. You can either receive the gold yourself or have the dealer store it for you. When the price has risen over time, sell the gold at a profit.

18) Which gold is best for investment?

Please read our detailed answer to this question here.

19) How to buy gold investment coins?

We have written a detailed answer to this question which can be read at https://www.physicalgold.com/insights/how-to-buy-gold-investment-coins.

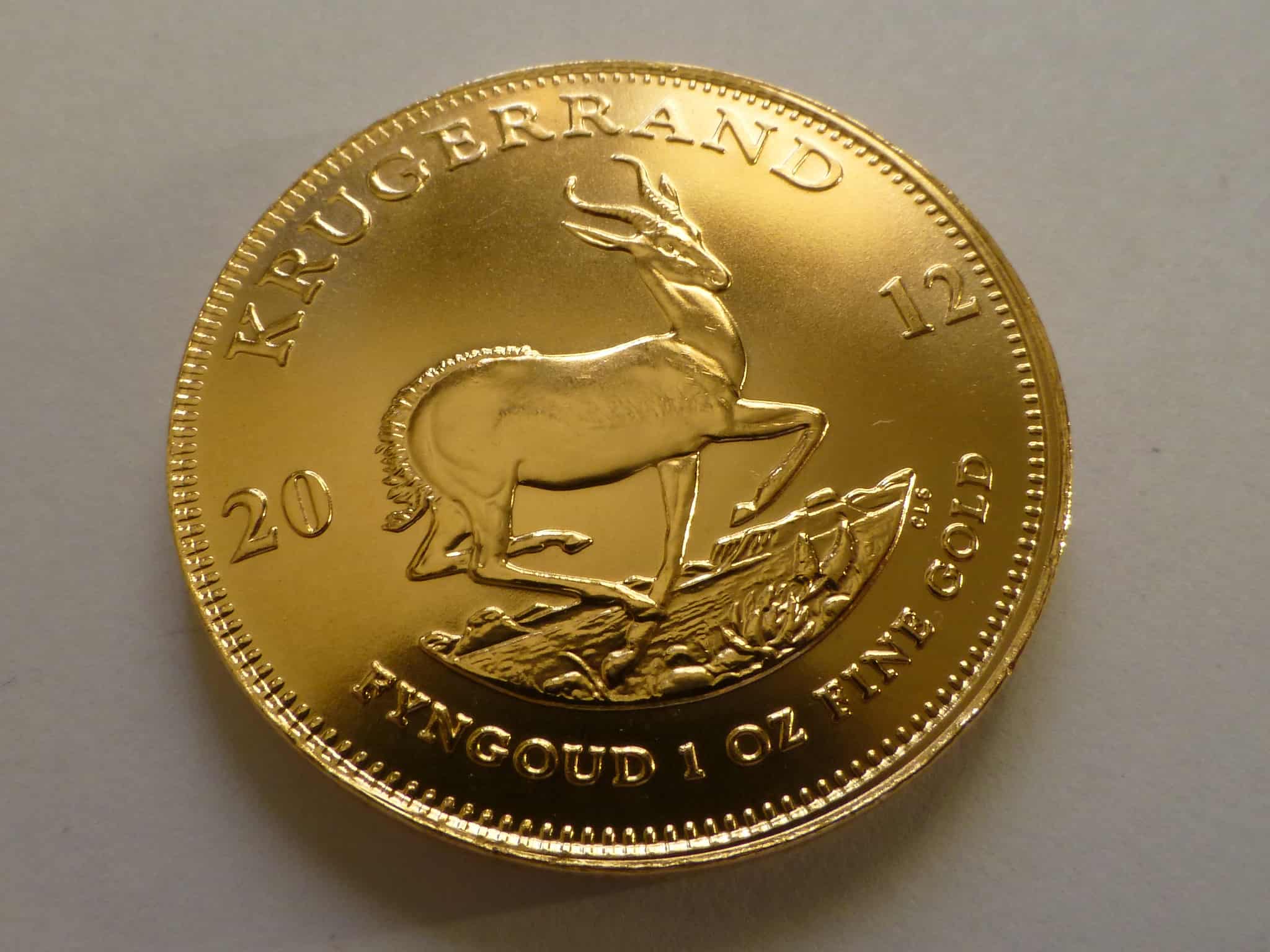

Gold investment coins include foreign coins such as the Krugerrand

20) Where to buy gold bars for investment?

Visit https://www.physicalgold.com/insights/where-to-buy-gold-bars-for-investment, which answers this question in detail.

Why not also view our video, “Buying gold bars – a guide for investors”?

21) What is gold investment?

We have written a detailed answer to this question. This can be accessed by clicking here.

22) What is ETF gold investing?

Buying gold ETFs is an important topic to understand. Read our answer to this question at https://www.physicalgold.com/insights/is-a-gold-etf-a-good-investment.

23) Gold investment vs property?

Click https://www.physicalgold.com/insights/gold-investment-vs-property for our answer to this question.

24) What is paper gold investment?

Read https://www.physicalgold.com/insights/what-is-paper-gold-investment for more detail on this topic and an answer to the question.

25) Gold investment and risk?

Click https://www.physicalgold.com/insights/what-risks-are-involved-in-gold-investment for a detailed answer about gold and risk.

26) Gold investment for dummies

Visit https://www.physicalgold.com/insights/gold-investment-for-dummies for a detailed answer to this question.

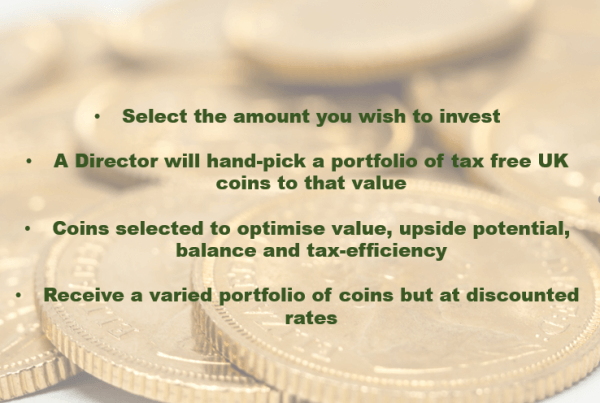

Why not choose our Directors Pick for great value gold investments?

27) Which is the better investment, gold or platinum?

Visit https://www.physicalgold.com/insights/which-is-the-better-investment-gold-or-platinum for a comprehensive answer.

28) Which gold coins are a good investment?

We have created a detailed answer to this question. Please visit https://www.physicalgold.com/insights/which-gold-coins-are-a-good-investment/ to read our detailed answer.

29) Should investments in gold be for the long term?

We have created a detailed answer to this question, simply visit https://www.physicalgold.com/insights/should-investments-in-gold-be-for-the-long-term/ to read this.

Contact Physical Gold today

Why not contact Physical Gold today to discuss investment approaches to gold and also with any more questions! We are here to serve and can be contacted at 020 7060 9992, also view our contact details here.

World Money Fair 2019

An integral part of life as a numismatist is to research and view important coin collections from around the world. This is probably as important as setting up one’s own collection. This year, numismatists from around the world will be flocking to Rosemont, Illinois to attend the World’s Fair of Money, an important global event organised by the American Numismatic Association (ANA).

What is the event all about?

The event is a 5-day exposition which will be held from 13th to 17th August 2019 at the Donald E. Stephens Convention Center, located in Rosemont, Illinois. The centre is strategically located for all visitors and has convenient transport links from all over. The convention centre has 6 halls and 840,000+ square foot of space for exhibitions.

The event will not only showcase rare coins and currency bank notes but also stamps, postcards and other items of antique and philatelic importance.

Registration and timings

If you are a keen numismatist and are interested in

The fair is open to visitors from 1 pm on Tuesday, 13th August. From Wednesday 14th to Friday 16th August, the show will open at 10 am. The event will close at 6 pm on all days, barring the last, when it will close at 4 pm. Members of the ANA will enjoy free entry and special entry timings that allow them to enter the event half an hour earlier than the general public. The admission price is $8 per adult non-member, with the exception of Saturday, which is free to all visitors. Kids below 12 go free to the event on all days. Admission to the event will close 30 minutes before the official closing time.

The World’s Fair of Money is being staged in Illinois in 2019

Exhibitors from all over the world

Important numismatic entities will participate in the event. Coin grading experts like PCGS, ANACS and NGC will have their stalls up at the event. PCGS will start accepting submissions for on-site grading of coins on 13th August and have advised attendees to the exhibition to check with a PCGS representative at their booth for the exact timings for acceptance of submissions.

About the 2018 World’s Fair of Money event

The 2018 World’s Fair of Money was held at the Pennsylvania Convention Centre, located in Philadelphia and was staged from 14th to 18th August, 2018. The event had 483 bourse tables, which represented 405 companies and 1,373 dealers/support staff. The official auctions were very active and raised over $81million. In total, the event had nearly 10,000 visitors and was attributed as a great success.

About the 2017 World’s Fair of Money event

The 2017 World’s Fair of Money was held at the Colorado Convention Centre in Denver, Colorado in August 2017. The event had 500 bourse tables, which included a special sale by the US Mint that attracted considerable public interest. There were two auctions held at the 2017 event by renowned auctioneers – Heritage Auctions and Stacks-Bowers. The two auctions generated several million in sales. Interestingly, prior to the 2017 World’s Fair of Money, the previous one was held 11 years ago in 2006.

Talk to the numismatist team at Physical Gold

If you’re a keen numismatist and want to know more about buying rare coins, look no further. Our team of numismatic experts can guide you on where and how to invest in valuable coins. Call us on 020 7060 9992 or email our numismatic team to find out more.

Image Credit: World’s Fair of Money

5 Step Guide – How to Buy Gold

In this video, I’ll be revealing how to buy gold effectively. Clearly, there are many ways you can gain exposure to the gold market and buy gold itself – from gold jewellery, gold ETFs and gold mining shares.

But today I’ll be focussing on the 5 exact steps you need to take to buy physical gold coins or bars as an investment.

1. Find a reputable gold dealer

The best place to start is to find a gold broker. A top class specialist gold dealer will be able to provide low prices, choice, guidance, authenticity and a clear buyback process.

Ensure the gold dealer you choose is credible and has a track record. They should be members of leading associations like the BNTA.net and have excellent customer reviews.

You may find that different dealers specialise in different areas, so you should select based on which seems the best fit with your objectives. For instance, some may focus on tax efficient gold investments, while others specialise in collectable coins.

Some dealers offer a buyback guarantee and certificates of authenticity with every purchase.

2. Discuss your objectives

The most effective way to ensure you’re on the right path

Building a trusting relationship can produce fantastic guidance and prevent you from buying the wrong type of gold for your needs.

Considerations will be how much you wish to invest, whether you want to buy regularly, your investment horizon and the purpose of your investment.

3. Select the best solution

There are three main solutions for buying physical gold. It may be that one suits your needs better, or that you combine more than one solution.

- Firstly you can add gold bullion to your pension

- Secondly, you can invest a lump sum into gold coins or bars outside of your pension

- And finally, you can invest small amounts into gold regularly

Investing in your pension suits those with larger budgets and a long-term time frame. Tax relief is granted when buying gold bars within a SIPP, so it can be a cost-effective way of buying. Considerations would be that paperwork can take a while and you must have the correct pension to qualify for a SIPP in the first place

Buying gold outside of a pension is more flexible. You can start with buying one small bar or coin, and your money isn’t tied in until retirement like with a pension. With this route to market, you have the choice between buying gold coins or bars, or a mix of both. Your dealer should help steer you towards which is best for you, depending on value, divisibility, tax efficiency and liquidity.

Buying gold on a regular basis, like with Physical Gold’s Monthly Saver, provides access to the market for those without large available capital to invest. Buying monthly will gradually build a nest egg and enable you to exploit any price drops in the market.

4. Decide on storage or delivery

Receiving your gold is ideal. You can enjoy the comfort of having direct access and enjoy its tangibility. In all likelihood, storing it yourself can be cheaper than paying someone else to do it for you. However, you need to ensure that your gold is stored safely and is fully insured. It’s not worth cutting corners on cost and put your gold at risk. Owning gold is about reducing risk, not taking on worry.

If selecting professional storage with your dealer, make sure your gold is fully allocated and segregated. In other words, it shouldn’t be leveraged and should be ring-fenced from everyone.

5. Payment and ID

The final stage is making payment for your gold purchase. When purchasing online from a gold dealer, you can usually pay with a debit or credit card up to £5,000 and with online banking up to any amount.

When buying £10,000 or more in any one go, you’ll be asked by the dealer to provide two forms of ID for anti-money laundering.

How to Buy gold from Physical Gold

So, that’s your 5 steps. Clearly, the success depends largely on how well you select a gold dealer. Bad guidance can lead to you paying over the odds or buying obscure gold. So do your research and speak to them on the phone before you choose. Our team at Physical Gold are available to offer you as much or as little guidance as you need. We can help to select gold, as well as answer questions on storage, payment, selling and buying. Call us on 020 7060 9992.

If you liked this video, we have 20 in a series of gold & silver video guides.

How To Sell Gold

In this video, we look at the best ways to sell gold at the highest possible price. Specifically, I’ll focus on selling your gold coins or bars at the best profit, but many of the principles can also be applied to selling gold jewellery. I’ll reveal step-by-step, the five best techniques to sell gold for the most cash.

1. Look after your gold

This is a simple one. Just like maintaining your property, gold is a physical asset, so the price you achieve will be affected by its condition. 24 carat gold is especially soft and liable to scratching so handle and store with care and you’ll be able to achieve a higher price than selling scratched, chipped and dirty items.

2. Don’t buy obscure coins in the first place

This requires some forward thinking. Buying the most recognisable gold coins prove to be the easiest to sell. Let’s draw that comparison to property again. When you select which gold to buy, try to emulate buying that 2 bedrooms flat close to a train station. The more desirable your asset, the more buyers you have and the better price you’ll receive. Desperation to sell obscure gold can lead to accepting reduced prices.

Focus on balance and variety

Buying a variety of gold coins can also help squeeze extra profit out of your investment. Older and commemorative coins, for example, can command a higher price than newer coins due to scarcity and desirability.

What many investors don’t realise is that coin premiums are not fixed. Infact, they can vary by up to 20% depending on supply and market dynamics. So selling the same coin when supply is tight can yield a far higher price than selling at other times. How do we know which premiums will spike? We don’t. So owning a variety of coins increases the chances that you can sell the right coins at the right time to increases your sale price.

Enjoyed this video? Check out all 20 gold & silver video guides here.

3. Plan ahead when selling

Planning your sale can boost your profits in 2 ways.

Firstly, it enables you to watch underlying gold prices to strategically sell items on days when the price spikes. The gold price can easily move 2-3% in a day so pulling the trigger on those days rather than waiting until you need the money can enhance your sale price.

Working with a gold dealer will enhance prices

Secondly, providing your gold dealer with

And don’t forget, that investing in gold is a medium to long term strategy. So the longer term you plan, the higher your sale price is likely to be. That’s because the gold price can be volatile, so short term sales can be at risk of reduced profits. Over the long term, market dips have more chance of being overcome.

4. Consider Capital Gains Tax when you buy

If you’re only selling a small amount of gold, tax won’t impact you. But for those making profits of more than £12k from where they bought the gold, tax considerations can really impact the final cash you receive.

That’s because Capital Gains Tax of up to 28% is applied to gains made over the £12k threshold. But this can be avoided altogether, boosting your profits massively. By focussing your gold investment on UK legal tender gold coins, any profits when you do come to sell, are free from CGT. That’s because the Government aren’t able to tax profits made on legal tender.

[button size=”medium” style=”primary” text=”Sell Your Gold” link=”https://www.physicalgold.com/sell-gold-silver-metals/” target=”_blank”]

5. Shop around

Using a reputable gold dealer usually means you get a buyback guarantee for the gold they sell you. This provides a quick and easy exit strategy when you wish to sell. But it’s always worth making a few calls to other gold brokers. Depending on their stocks, some dealers may pay slightly more on any given day for a certain coin, bar or jewellery than others. Generally, cash for gold business will try to exploit your lack of expertise and offer vastly reduced prices. Read our article on How to find out the tax free gold price.

Private collectors may pay more

In fact, if you have time and patience, it’s also worth testing the private market if you have coins with more of collectable value. While large gold dealers will provide a fair price for the gold content, private buyers may be willing to pay higher premiums based more on their desire to complete a collection or to own a unique piece of gold.

Sell your gold with us

So there you have it. 5 simple strategies about how to sell gold at the highest price. If you liked this video, download our more detailed 10 commandments when selling your gold coins from our website www.physicalgold.com

If you’d like to sell your gold coins, bars or jewellery, then call a member of our team on 020 7060 9992. They’ll provide an indicative live price and email over a step-by-step process to complete your sale.

Gold investment’s role in a balanced portfolio

In this video we focus on the crucial function gold performs in a balanced investment portfolio. Specifically, I’ll reveal 7 amazing roles gold investment plays and exactly how you can use gold to enhance long term returns and provide portfolio insurance.

1. Reduces inflation risk

While different assets can provide varying returns in your portfolio, inflation always needs to be factored in. In other words, if an equity fund returns 5% year on year but inflation is at 3%, then your money has only really grown by 2%. Some assets like bonds have fixed returns, meaning their actual return after inflation can even be negative if inflation rises. This is certainly true of cash which may return around 1% in the bank while inflation stands close to 3%.

Gold has historically more than kept pace with inflation, providing a degree of wealth preservation.

2. Currency hedge

With traditional currencies such as the Dollar,

Owning gold in the portfolio protects against a weak Pound. In fact, as Sterling weakens, the value of your gold rises, regardless of the underlying gold price. Read our study Gold v Paper Money.

3. Liquidity

Gold is globally recognised and liquid, especially if you own bullion coins or bars. Not only can gold be converted back into cash quickly anywhere around the world, but it can also be sold in small quantities, enabling flexibility to liquidate part of your holding.

This high degree of liquidity enables the adventurous investor to combine gold investment with less liquid assets such as property and fine wine. Read our analysis or gold investment versus property.

4. Balance and portfolio insurance

A majority of a balanced portfolio’s assets are dependent on a strong economy to perform well. Stocks and property prices will perform well when an economy is thriving. 2008 was a stark reminder that when the global economy breaks, all your assets can fall in value at the same time. Gold is known as a safe haven asset, meaning it has a particular appeal to investors in times of economic uncertainty. This increased demand, in turn, pushes up its price.

So owning some gold alongside the other economy-dependent assets spreads investment risk in a unique way so that even in a recession, your portfolio value is protected. The majority of independent financial advisors would always advise investors to seek a balanced portfolio of investments.

5. Tax efficiency

Tax plays a crucial role in calculating your investment returns. Tax is applied to income on cash in the bank and dividends on shares. It is deducted from gains made on assets appreciating. So what can seem like a strong performing asset, can actually underperform once the tax is deducted.

There are various ways that gold investment can be completely tax free. Gold bullion, for example, qualifies for a UK SIPP pension. That means you get tax relief off your purchase price and any gains made are completely protected from tax.

You can even achieve tax efficiency with gold investing outside of your pension. Investment grade gold is VAT exempt to buy in the UK, while UK legal tender gold coins are also free from Capital Gains Tax.

6. Reduces volatility

By owning a percentage of gold in your investment portfolio, it actually reduces the overall volatility of its overall value. If stocks and property fall in value, gold is likely to rise. This irons out volatility and enables a more predictable performance.

7. No counterparty risk

Owning bonds, stocks and even cash, essentially amounts to owning pieces of paper with the promise of value. History has demonstrated that this perceived value can fall to zero overnight. This happens if a company goes bust as Lehman Brothers did, a Government defaults on its bond repayments or there’s a run on a currency.

Focusing on physical gold bars and coins reduces this exposure to counterparty risk. Holding the real thing enables you to own a tangible asset with intrinsic value. In a growing digital age, where stock values are increasingly based on future potential rather than profits and the threat from cybercrime, physical gold provides a simple comfort in a complicated world.

If you’ve enjoyed today’s video, please feel free see all 20 of our video guides in the series.

Add balance to your portfolio with Physical Gold

If you’d like to discuss how best gold coins or bars can provide a great balance to your finances, call 020 7060 9992 to speak to a member of our knowledgable team.

Britannias versus Sovereigns

This article focuses on the two main UK investment coins – Gold Britannias and Gold Sovereigns.

For UK investors especially, these two coins are the go-to choice when putting together a gold portfolio.

But which ones are better? The Britannia or Sovereign? I’ll look at 5 factors to compare the two coins.

1. Price

Let’s start at the most obvious place, with the price. The Britannia is around four times bigger than the Sovereign, weighing 1 troy ounce. That means, its price is far higher, so for those with very modest means, the smaller Sovereign coin provides access to the market where perhaps the Britannia is out of reach.

For most investors though, a larger allocation to gold is granted, so the price per gram between the two coins can be compared. With its larger size, Britannia’s production cost is lower as a percentage of the price, allowing for a lower price per gram. So if you’re looking for the most gold coin weight for your money, then gold Britannias are the better choice.

Winner: Britannia

2. Variety

While there is the occasional special edition gold Britannia launches, usually, there is one type of coin to choose from – the standard 1oz bullion coin. Fractional versions also exist, allowing the investor to buy half, quarter and tenth ounce version, but these can be expensive for the privilege.

As Britannias have only been around since 1987,

In contrast, the modern gold Sovereign has been around for 200 years. Like the gold Britannia, there is also various size option including Half Sovereigns, Double and even Quintuple Sovereigns!

But it’s the variety in age and monarch which really creates investment options. Sovereign coins can be bought with the current Queen on the front, but also there is a strong market in gold Sovereigns featuring King George, King Edward and Queen Victoria. The latter coins even vary between 3 different types of design, the Young head, jubilee head and old head versions and can be worth substantially more than newer Sovereigns.

Owning a variety of Sovereigns adds balance to an investment portfolio. It varies your upside potential between just owning bullion coins and perhaps also benefiting from numismatic gains.

I’m a strong believer in mixing the coins your own rather than owning all of one type, as it creates other profit opportunities.

Winner: Sovereign

3. Divisibility

One of the most overlooked aspects of buying physical gold is obtaining divisibility within your portfolio.

This is one of the main reasons investors opt for gold coins rather than bars, it gives them the flexibility to sell small parts of their holding when they need.

Clearly, gold Sovereigns offer four times the divisibility of the standard 1oz Britannia. Yes, you can buy quarter and half ounce gold Britannias, but they’re a less economic method of obtaining flexibility than owning Sovereigns and Half Sovereigns.

So if you’re putting together a modest portfolio of coins – say £2-£5k – then we’d always recommend gold Sovereigns so that you can own a variety of coins and keep flexible.

However, for those looking to invest larger amounts, say £10k+, then you could still buy enough gold Britannias to achieve a great degree of divisibility.

Winner: Sovereign, unless you’re investing £10k+

4. Tax Efficiency

This one’s simple. Both the Sovereign and Britannia are VAT exempt when buying them as they qualify as investment grade gold.

In a similar way, any profits made on either coin are also free from Capital Gains Tax. That’s because both coins feature a face value and so qualify as legal tender in the UK. Selling any legal tender currency is free from Capital Gains tax.

Winner: Tie

5. Liquidity

The second-hand market in any asset class is

Luckily, both the Sovereign and Britannia are highly sought and liquid coins globally. In the UK both coins are popular due to their tax free status. They can be sold in a matter of hours.

Globally, the Sovereign is better known as it’s been around for a lot longer than the Britannia. But the playing field is quickly changing. Since 2013, the Britannia has been minted as a 24 carat coin. While this doesn’t make any difference to gold content, it opens up the lucrative Asian market. In a land where only 24 carat appeals, the growing Chinese market love the Britannia but are more tentative towards the 22 carat Sovereign.

However, liquidity when buying is switched. While the latest year’s issue of either coin is plentiful and easy to obtain, buying pre-owned coins is a different matter.

If you wish to buy second-hand Britannias, they’re not always easy to buy when you want them. That’s because they’ve only been around for 30-odd years so there are less on the market.

In contrast, with the Sovereign’s long trading history, you’re able to obtain most types of gold Sovereign from any age, more or less when you want.

Winner: Sovereigns….just

Conclusion – gold Britannias or Sovereigns?

So there you have it, we’ve looked at 5 of the most important considerations when choosing gold coins for investment.

Ideally, owning a mixture of both, and in a range of ages and sizes, produces the most balanced portfolio. But that’s not always attainable for everyone’s financial means.

For the smaller investor, Sovereigns is the best starting point. For those seeking simplicity and the lowest purchase price, Britannias are the choice.

Either way, you won’t go wrong when investing in gold Britannias or gold Sovereigns. Silver Britannia coins are also available.

Contact a gold investment expert when buying Britannias and Sovereigns

Don’t forget that our team are here if you need any guidance on buying gold coins. Our Directors Pick is a popular choice if you want to own a gold portfolio of mixed UK coins but prefer our expertise to pick a balanced choice. You can leave a message on our Contact Us page, call our team on 020 7060 9992, or engage in the live chat function on the website.

Gold and Silver Investment Jargon

Complicated jargon exists everywhere in life. Within the investment world, jargon can sometimes prevent you from understanding the details of the investment, or cloud key facts.

Some terminology stems from the historical use of words, while others seem convenient for financial advisors to validate their existence to explain these complications.

At Physical Gold, we believe in stripping back jargon to simplify what should really be very straightforward assets – gold and silver.

This video unravels a few select pieces of jargon which crop up time and again. For the full list of investment jargon busting, click here.

1. Bullion

This is one of the most widely used terms in the market but can refer to a number of things. Some people use the term as a blanket expression for non-numismatic gold. So any low-priced gold coins and bars. This tends to be when the price is the focus and suits those wishing to avoid paying premiums for more valuable older coins.

It can also be used to explain a certain type of coin production. Most of the main gold investment coins will be produced to a number of finishes, each with their corresponding price. Bullion finish is the most basic and cheapest finish, so is targeted at the investment market, where quantity and price are the primary focus. In contrast, proof finish coins, are struck 2-3 times when minted and offer a more detailed, albeit expensive finish.

Finally, the term bullion can be used to refer to gold or silver bars. Bullion is used interchangeably with bars and wafers to focus on this area of the market rather than coins.

My recommendation is to ask questions if it’s unclear which of these meanings is being indicated.

2. Alloy, purity, carat

Very simply, alloy denotes the mix of metals within a

Alloys are used to toughen up a coin and minimise scratches. Some of the most common alloys in popular coins such as Sovereigns will be silver and copper.

One of the biggest misconceptions with carats and purity is that 24 carat coins are far better and more valuable than 22 carats. Looking at the Gold and Silver Britannia coin is a useful example.

Up until 2013, the Britannia was produced as a 22 carat coin. While it weighed around 34g in total, the gold or silver content was 31.103g (1oz). Coins produced after 2013 were minted as 24 carat coins. The newer coins still only contain 31.103g of pure precious metal and that is now also their total weight. So in other words, both coin purities still contained exactly 1oz of pure gold or silver.

3. Face Value

While this term is simpler to understand, its implications are crucial to precious metals investors.

When a coin benefits from having a face value, that means that the mint who produced the coin have actually allocated a face value in that country’s currency to the coin. This face value will be shown either on the front or back of the coin. In theory, that means you are legally allowed to walk into a shop in the relevant country and use the gold or silver coin to buy goods up to the face value.

Now, this may sound ridiculous because the face value of a Gold Britannia, for instance, is £100, while the coin’s gold content is worth ten times that. This is where the implications come in useful.

Any coin with a face value cannot be taxed for capital gains for residents of that country. In other words, if a UK investor buys £20,000 of Britannia coins and sells them 5 years later for £50,000, their profit of £30,000 is completely tax free!

4. Segregated

Next up is a term used in the storage of gold and silver. If you choose not to physically hold your coins or bars, then many dealers can offer storage solutions. But beware, not all solutions are the same.

If gold or silver is segregated, it means that it’s legally ring-fenced as yours. That means it isn’t mixed in as a pooled investment with other investors’ gold and crucially cannot be touched by any counterparty.

For investors seeking absolute security and minimal risk, segregated storage is the only way.

5. Premium

This final piece of investment jargon is bandied around when talking about the price of physical gold and silver. Rather than indicating a top end item, it refers to the spread over the gold or silver spot price of various coins and bars.

It’s important to understand that when buying any gold or silver, whether electronic or physical, you will always buy at a premium over the live spot price.

That premium varies according to a few factors.

Firstly, coins and bars trade at a higher premium than electronic gold and silver ETFs as they have to encompass production, design and delivery costs.

Secondly, the type of coin or bar will dictate the level of premium. Brand new mass-produced bullion coins are attainable at lower premiums, then rarer old gold coins.

Finally, quantity plays a large role in the premium. Buying one coin will cost a higher premium than buying 100 coins. Similarly, buying a small 5g gold bar will cost a higher premium than a huge 1kg bar.

Our team are here to make gold and silver simple

So there, you have it, 5 key pieces of jargon busted for you. Any dealer who cannot explain these, shouldn’t be used. Websites should clearly display live prices for various quantities of coins and bars, and each product should have a comprehensive description so you know what you’re buying. If you found this video helpful, be sure to check out 20 of our best video guides.

If you have questions regarding specific gold & silver investment jargon or are seeking guidance on how to invest, then our expert team are here to help. You can either call us on 020 7060 9992, engage on live chat or leave a call back request on our contact us page.

Reasons to Invest in Gold

We all know that the world we now live in is evolving at the fastest pace in history. Globalisation, technology and devalued currencies are leading to huge changes that are set to impact us all.

While the rise of the internet provides us with unprecedented access to consumer goods, it’s also quickly eroding the global economy as we know it. Margins are being squeezed, leading to high street giants closing down and job losses. Most of us have escaped these changes so far, but the bubbles being created in the stock and housing markets and record levels of national debts will cause a huge market adjustment in the coming years.

Investing in gold is the best way to protect ourselves from many of these dangers. Today, I want to highlight 5 compelling reasons to invest in gold.

1. Protection from a house market crash

In the UK, we’re a nation obsessed with property ownership and it’s easy to understand why. House prices have rocketed over the past decade in a market where investors have benefited from record low-interest rates and easy money. 5% deposits and low mortgage APRs have granted buyers easy access to the market. A competitive mortgage market has thrived on offering interest-only mortgages.

As prices have risen year on year, many house owners have remortgaged and pushed borrowing to its limits. But now we’re entering a period where all these dynamics are reversing at the same time.

Interest rates have now risen both in the UK and US, with promises of more hikes to come. No longer can mortgages be obtained with tiny deposits or interest-only repayments. New mortgages and remortgages are now based on higher rates, deposit requirements are higher and monthly repayments are sky-rocketing. All of this is set against a backdrop of falling house prices.

With the average UK resident highly exposed to the property market, a crash in prices will impact us all. Repossessions will hit lenders hard, while stock markets will decline as less disposable income crimps corporate profits.

Owning gold offers protection against such market crashes. As a safe haven asset, it’s gold investors who will benefit when the markets go through a prolonged period of pain. Have a read of our study, Gold Investment versus Property.

2. Tax efficiency

A good reflection of how much tax can reduce your investment returns is the fact that every financial adviser will encourage you to fill your annual ISA allowance before you look at anything else.

However, returns on cash ISAs are lower than inflation, effectively reducing the buying power of your money. Even equity ISAs remain very exposed to market bubbles, and annual limits reduce the amount you can invest.

Any investment grade gold is exempt from VAT. Two elements are needed to qualify. The gold needs to be in the form of a coin or bar, and its purity needs to be 22 carats or higher. SO if you stick to these types of gold, you’ll pay no tax when you buy.

Even better, is that certain gold coins are also free from Capital Gains Tax. This means that unlike every other asset in the UK (except your primary residence), any profits made in this type of gold cannot be taxed.

To qualify, gold coins need to be UK legal tender. In other words, if it has a face value, it is classified as legal tender. Any profits made on selling legal tender are tax-free to UK residents!

3. No counterparty risk

Owning a variety of investments is a great way to diversify.

Owning stocks has one huge risk, you’re depending on one particular company to perform. Look what happened to the entire banking sector in 2008. Values of bank shares plummeted in a matter of weeks.

Bonds are similar. Even owning Government bonds means you’re exposed to political choices. Italy is a great example where huge debts and political instability have led to plummeting prices.

Even cash in the bank and credit cards can be vulnerable to cybercrime and online fraud.

Owning physical gold means taking personal possession of the gold coins and bars you’ve bought. It doesn’t matter how a certain company performs, your gold always has an intrinsic value. In today’s digital globalised economy, the threat to paper assets and cybercrime is growing.

4. Liquidity

Gold can be traded anywhere around the world. It has a historical track record stretching back more than 5,000 years and the gold spot price is published daily. Gold coins allow for selling small parts of your asset when you need, so you can sell whatever quantity you want at the prevailing rate.

Compare this to the inflexibility of selling a property where the whole asset is sold, providing no scope to sell only part of it. Sales can extend to months or even years.

Check out our full suite of video tutorials here

5. Currency devaluation

Last but not least is the growing threat to today’s global currencies. Actually, global currency systems change every 30-40 years. We’ve seen a traditional gold standard, evolve into a gold exchange standard, then the Bretton Woods system, and finally into the US Dollar standard.

The problem with so-called Fiat currency like the Dollar is that its value becomes undermined as US Governments print more and more of it. Unchecked US debts in the Trillions further devalue the currency.

In Europe, we’re also seeing the dismantling of the Euro with Brexit. There’s a significant threat that other European countries will also withdraw in the coming years.

No doubt, when deflation and then inflation take hold, Governments around the world will seek a new system and new solution to replace the US Dollar standard. In that case, they’ll look at what’s worked best in the past, and likely return to gold.

This could be catastrophic if you’re holding all your assets in Dollars, Euros or Pounds, but provide huge riches if you already own gold.

There are many other benefits and reasons to invest in gold, a handful of which I’ve covered in today’s video. The key is recognising that the global economy is at breaking point and it’s a matter of when, not if, it will implode. Reverting to owning gold, takes the guessing game away, securing you in the knowledge that you’re prepared for any outcome.

We’re here to help

If you have questions about how to get started with gold investment, then please contact us by calling 020 7060 9992, using the live chat widget on the website, or by contacting us here. Our expert team has helped thousands of people with their first foray into gold.

Gold & Silver Video Guides

If the content is queen for websites, then the king must be multimedia content! With this in mind, Physical Gold set out to create 20 gold and silver industry videos, related to questions and topics, we are frequently asked about relating to the gold and silver industry.

Precious metal investments need careful thought and planning. In this article, we will review 20 important educational videos that have been published by Physical Gold, one of the most reputed gold dealers in the UK. These videos are an excellent educational tool for experienced and new investors alike. Each section below provides a brief summary of the video and tells you why it’s worth watching.

We have published these on YouTube, so, why not click on any of the 20 videos below and learn what Daniel Fisher, the CEO of Physical Gold has to say on each of the topics.

1) 1oz silver coins – the available options

Silver coins have steadily gained in popularity amongst investors. Learn about the value of buying 1oz silver coins, including the Krugerrand, Canadian Maple Leaf, Australian Silver Kangaroo, the UK Royal Mint’s Lunar series and annual Britannia coin. In this video published by Physical Gold, Daniel Fisher, CEO some valuable insights are shared as to why this coin denomination is great to add to a portfolio as well as the tax-efficiency benefits, which are available for UK residents.

This video guides investors on how to make the best decisions when buying 1-ounce silver coins. Daniel reveals his top five choices, with each selection based on a different investor objective. As a silver investor, the video is an excellent guide to making smart silver investments.

2) 5 Reasons to buy gold sovereigns

Sovereigns have been around for centuries and enjoy a vibrant secondary market. Of course, this provides excellent liquidity for your portfolio. Divisibility and flexibility can be achieved, as the sovereign is available as a quarter ounce coin. Sovereigns were issued through the reigns of different monarchs, creating excellent variety and easy availability. In this Physical Gold video, five important reasons are unveiled as to why sovereigns can be an important inclusion in your portfolio. Watch the video to learn more.

3) Britannia silver coins – a collectable investment

This video focuses on the fact that any investor thinking about buying silver should seriously consider buying the Britannia silver coin. An ideal low-priced 99.9% pure coin (since 2013) and are available with low premiums. The iconic image of Britannia is updated frequently, making it attractive to collectors. The silver Britannia is also available as a limited-edition proof set and in sets of fractional sizes.

The Britannia’s history is explored as well as investment potential, tax-efficient status as well as various options including proof sets and storage solutions. The video analyses several factors that make the silver Britannia a great choice for both collectors and investors.

4) Buying gold online with Physical Gold LTD

The easiest way to purchase gold is to simply buy online. In this video, Daniel Fisher, CEO and founder of Physical Gold tells us how easy it is. The video walks buyers through five easy steps from creating a free online account on the website to adding products to your shopping cart and finally checking out. Daniel also explains the inherent advantages of purchasing gold online in the video.

Several iconic British coins were struck at the Royal Mint

5) Buying gold bars – a guide for investors

Why buy gold bars rather than gold coins? This video reveals all and expands upon many of the benefits and the investment philosophy to adopt when buying gold bars. Listen here to some quality investment tips and how having a combination of bars with differing sizes, weights and quantities all make perfect investment sense!

The investor awareness video kicks off with an analysis of the reasons why people buy gold bars, followed by a lesson on how to choose the best bars. Investors should be equipped with good knowledge of buying gold bars after watching this video.

6) Buying gold – 5 reasons to invest

We could have written 55 reasons but limited ourselves to just five within this video! Daniel Fisher talks about how gold investments can protect you from exposure to global economic turmoil. Five compelling reasons are discussed in the video, including the impending possibility of a housing market crash. The thought-provoking video is a must-watch for every investor.

7) 6 Hacks to buying the best value gold sovereign coins

The next video from Physical Gold unveils six strategies that investors can employ when buying Sovereigns. So, you might be sold on the idea of buying gold sovereign coins, produced by the UK Royal Mint. But, how do you get the best value for your money when buying them This is the question posed and answered within this video, which explores a range of approaches (hacks) to getting more gold Sovereign coins for your money!

Investors are advised to buy the quintuple sovereign, as it’s a much bigger coin and provides greater value for money. Other strategies include buying nearly new used coins, waiting for a lull in the market and speaking to a dealer to buy a particular Sovereign when its price comes down.

Gold bars have their purity value inscribed on the face

8) 5 best silver coins to invest in

This silver investment video addresses the confusion faced by investors about which silver coins to buy. In the video, Daniel Fisher, founder, and CEO of Physical Gold reveals his top five choices in silver coins. Analysts are predicting an explosive price rise for silver in the future, but which coins do you buy Daniel reveals all in this highly informative video, which selects five of the best silver coins, which can leave investors with no doubt as to which coins, they should buy. The list includes the legendary silver Britannia and Krugerrand. The Fiji 5 kg silver bar is also included as it has a face value.

9) Gold & silver investment jargon explained

Do you know your alloys from your carats Learn about these and other gold and silver industry jargon terms in this helpful video. Listen to understand what the terms mean and blast away any myths or misunderstandings from the crevices of your mind! This video is an excellent educational tool for investors and the general public alike!

10) Gold Britannias or Gold Sovereigns – which is the best investment?

The flagship coins of British coinage have always been the gold Britannia and Sovereign.

Do you like the idea of investing in Gold Britannias and Gold Sovereigns, but only have funds for one, so which do you choose Daniel answers all in this informative video, Daniel Fisher explains the investment rationale behind both gold coins based on five essential factors. Learn about both coins in terms of tax efficiency, liquidity, and other factors too!

11) Gold coins – collecting as a hobby and for profit

Collecting coins makes you a Numismatist, but is it possible to make a profit too. The answer is YES, learn how in this Physical Gold video which explains how coin collecting is not only for fun but is for profit too! As with all investments, it’s important to let your head rule rather than your heart, so why not become an informed numismatic investor?

12) Gold investment as part of a balanced investment portfolio

Balanced it’s such a lovely word, especially when it’s used in the phrase “balanced investment portfolio”. Gold often plays a pivotal role in balancing a portfolio and providing portfolio insurance. In a ground-breaking video, Daniel Fisher, CEO of physical gold reveals seven great ways in which gold can play an important role in providing liquidity, hedging currency risks, and fighting inflation. By watching this video, you can learn how gold can help protect your investments during economic uncertainty.

The large gold bars seen in the movies are called ‘Good-Delivery’ bars and are used by central banks

13) How much is a gold bar worth?

There are so many different factors, which determine the value of a gold bar? So, how much is a gold bar worth? Find out by watching this video, which gives viewers the “lowdown” on the calculation process behind valuing gold bars and how this can be used to the advantage of informed, streetwise and “savvy” gold investors.

14) How to buy gold

Is there a formula for investing effectively in gold coins and bars? Open your eyes to the world of gold investment by watching Physical Gold’s video “How to buy gold”. It sounds like an easy question to answer, but we explore “buying gold well” here and guide listeners through the steps to a healthy buying process. From finding a reputable gold dealer and discussing objectives to the eventual buying process, every step is explained in detail in this comprehensive, insightful video. Many think that gold is only for the extremely wealthy, but Daniel also explores more affordable monthly saving options too.

15) How to sell gold for the most cash

15) How to sell gold for the most cash

Do, you own some gold and want to realise the highest cash price for it? Of course, you do! Daniel Fisher explores the various techniques here and learns how to maximise your profits, with a particular emphasis on buying correctly in the first place. Are you intrigued to learn more about selling, then simply click on the video!

16) Should I invest in gold or silver?

We know the answer to this question, but the video explores the often-asked question of should people invest in gold and silver Daniel guides viewers through the many reasons that investors should consider these precious metals and the contrast between investing in the two of them.

The silver Britannia is a truly iconic British coin

17) Silver bars or silver coins – which is the best investment?

So, you have decided on investing in silver – but what suits your investment purposes better, silver bars or coins? Investors are hugely attracted to silver because it is 85 times cheaper than gold and holds the promise of rich dividends in the years to come. This illuminating video created by Physical Gold takes a look at four points of comparison between silver bars and coins. The video is extremely helpful for silver investors in making the right choice.

18) Silver investing in 2019 and beyond

We have come to 2019 and silver investment has now been popular for millennia. So, we can predict with optimism that silver will flourish into the future, it’s safer than low-interest earning cash. Listen to Daniel in this video to hear his views on the investment potential of silver in 2019 and in years to come.

19) The Gold price today & investing in gold medium to long term

The Holy Grail of the gold investment market is the spot price. In this back to basics video, Daniel Fisher, founder of Physical Gold teaches investors how to stay abreast of the current gold price and analyse it. He also explains effective strategies and themes that investors can employ when planning their investments with a medium to long-term horizon.

The Gold Krugerrand is one of the best-known coins in the world

20) Understanding the gold price per oz

Why is gold priced per oz (ounce), what is the spot price and why is this so important Daniel discusses this and more in our final of 20 videos. If you haven’t watched any then watch this video, which is highly educational to investors, Numismatists, and quizzers alike!

About Physical Gold Limited

Physical Gold is a highly reputed precious metals broker in the UK. Please view the video links above to gain an understanding of the market. The Physical Gold investment team is always open to discuss your investment goals.

Physical Gold – YouTube channel

We hope you have enjoyed these 20 gold and silver videos? If so, why not view all of our videos at the Physical Gold YouTube channel? As a business, we believe in removing the “trade jargon” and hope that visitors will find our videos to offer sound advice and information.

Buying gold and silver from Physical Gold

We are only a phone call away on 020 7060 9992 or complete our contact form for a speedy callback. We offer competitive prices, a fine selection of gold and silver coins and bars all with our hassle-free customer-focused service.

Image Credits:

Wikimedia Commons, Michael Steinberg, Eric Golub, Wikimedia Commons and Evan Bench

Buy Gold Online

Being able to buy gold coins and bars online has many advantages. Live pricing, the convenience of ordering from the comfort of your home and free insured delivery in many cases. But if you’re daunted by the process of how to place an order online, this video runs through 5 easy steps to placing an online order.

For those needing the human touch, our friendly team of experts can be contacted for help either by calling, live chat or emailing. But if you’re ready to buy and want to transact online, then you can order from our online store 24/7.

Step 1: Register a free online account

You can set up an online account with Physical Gold at any time. There’s no obligation to buy and you can benefit from the latest news, special offers and new product notifications if you also subscribe to the newsletter.

Simply click on ‘Register’ from the homepage’s top bar and enter some basic details

Step 2: Add products to your basket

Hovering over the ‘Buy Gold’ title in the black bar will reveal two columns of navigation. On the left is various product categories. So if you know you want gold coins but want to browse, click on this category. If you’ve narrowed your choice down to Gold Sovereigns, then this category will display the various Sovereign gold coins available on one page. From these category pages, simply click in to view each product and add to your basket from there. You can then either continue shopping to add more products or view your basket.

The second column of navigation goes directly to our best selling product pages. So if you know exactly which product you want or need inspiration from our best sellers, then this takes you straight there.

The final alternative is to use our intelligent search function. By clicking on the magnifying glass in the black bar, you’re able to search for particular products. As you start typing, it will make suggestions based on your search.

Step 3: Proceed to checkout

When you’ve added all your

Ensure the items in your basket are correct, adjust if necessary and click update cart.

On the right-hand side, you have the choice of selecting delivery or storage and adding a coupon code if you have one. Storage is only available for orders over £2,500 so smaller orders will not offer the choice. When everything is correct, click on the green ‘Proceed to checkout’ button.

Step 4: Make payment

Now you’re just 1 step away from completing your gold order. If logged in, you should see all your details on the left-hand side. If not, login now. On the right-hand side, you can now select your payment method.

After clicking the agreement to our terms and conditions, you simply click the green ‘place order’ button.

If you choose direct bank transfer, you’ll receive an email with the bank details and an order number for reference. If you selected card payment, then you’ll be taken to a secure Sage Pay portal to enter your card details once you click ‘place order’. You’ll be reassured to know that we use 3d Secure to protect you and your card.

Step 5: Receive your gold and documents

Once your order is placed, you’ll receive an email confirmation with your order number and our bank details if you’re paying by online banking. If you bought more than £10,000 of gold, you’ll also have to email over 2 forms of ID for anti-money laundering purposes.

Once payment has cleared, your gold will be packed and sent either directly to you or to the storage facility if selected. You’ll receive full documentation including a certificate of authenticity.

So it’s that simple. 5 quick steps to buying gold online from Physical Gold Ltd. Don’t forget that our team are here to help guide you if you get stuck in this process or simply need advice on which coins or bars to buy. They can be contacted on 020 7060 9992, on live chat or by leaving a message here

If you liked this video, don’t forget you can view all 20 of our videos here, covering all you need to know to successfully invest in gold and silver.