Gold Sovereign (Victoria – Present)

Country: Great Britain

Face Value: £1GBP

Gold Content: 0.2354 ounce (7.3224g) – Alloyed with copper, or copper and silver

Purity: 917/1000 (22 karat)

Gross Weight: 7.9881g

Coin Diameter: 22.05mm

First year of issue: Modern Sovereign 1837

The Gold Sovereign coin was first issued in 1489 for Henry VII of England and is still in production today. Sovereign coins are arguably the most famous of all gold coins and should form a part of every gold portfolio. They are desirable to investors and collectors alike. Due to their long history of production Gold Sovereign coins are split into several types, each with their own pricing and nuances. Modern coins will be of the last 10-15 years and probably still be in their plastic blister pack. Older coins, particularly dated pre-1933 tend to exchange hands either loose or in rolls of 50. Physical Gold offers an easy way to buy and sell sovereign coins.

[button size=”medium” style=”primary” text=”Shop Gold Sovereigns” link=”https://www.physicalgold.com/buy-gold-coins/gold-sovereign-coins” target=”_blank”]

These British coins typically have a face value of £1 sterling or 20 shillings. When it was first released it was primarily an official piece of bullion with no mark of value on the actual coin itself. The coins were 23 karat gold and weighed 15.552 g, Henry VIII reduced the purity to 22 karats with a weight of 7.322 g.

Download the FREE Insiders Guide to Gold Sovereign Investment

The core Full Sovereign coin has spawned several other Gold Sovereigns of varying sizes. These include the 2 Pound coin (or double Sovereign), the Five Pound Coin (you guessed it – a quintuple Sovereign, making it the largest gold content of any British coin), the Half Sovereign and the Quarter Sovereign. Generally, you’ll pay more per/oz for the smaller fractional coins than the full Sovereign or larger coins.

Sovereign coin production ceased in 1604, being replaced by Unites, and later by Laurels, and then Guineas. In 1817 production of Gold Sovereign coins restarted.

Modern Sovereigns are those minted during the reign of Victoria, Edward VII, George V, George VI And Elizabeth II. These Sovereigns feature the monarch who reigned during their production on the obverse side.

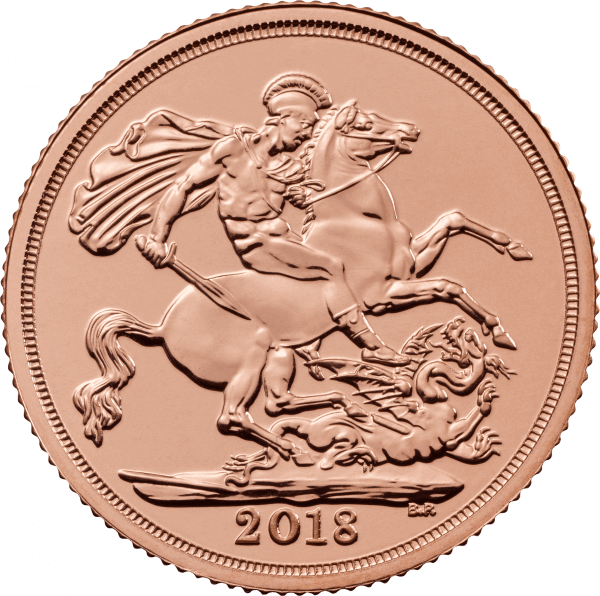

The reverse most commonly features Saint George slaying a dragon which was designed by Italian engraver Benedetto Pistrucci. A number of different shields have also featured on the reverse and often attract a higher price tag.

As a coin of the realm in the UK, buying gold sovereigns benefits from being free from Capital Gains Tax for UK residents. You can buy gold sovereign using any of the order, delivery and storage options throughout the Physical Gold website

Sovereign Coins

Alongside the Union Jack, bulldog and red telephone box, the gold sovereign coin is one of the most iconic British symbols, providing the basis of timeless gold investment as well as a treasured lifelong possession.

Another reason for their popularity amongst collectors is their worth. A fantastic way to preserve value against inflation, gold sovereign coins hold their value particularly well over time and provide an excellent all-round investment. This also makes them a popular starting point for those thinking of investing in gold.

Some choose to buy gold sovereigns from recent years, others from hundreds of years ago meaning that the value of gold sovereign coins can be hard to determine. At Physical Gold we are experts in buying and selling sovereign coins and can precisely value new and old coins.

[button size=”medium” style=”primary” text=”Shop Gold Sovereigns” link=”https://www.physicalgold.com/gold-sovereign-coins/” target=”_blank”]

Gold Sovereign Coins

Those looking to sell sovereign coins often cite their flexibility as one of the motives behind their decision, allowing them to keep their investment in smaller units. Whether to sell or buy gold sovereigns, the consistency of the production quality is often still hailed as one of the finest in the world.

Gold sovereigns are made with 22-carat gold. This consists of 11 parts crown gold out of 12 and one-part copper out of 12. This composition has not changed since the issue of the 1817 sovereigns. This particular composition of the alloy used in making the sovereigns ensures the coin is more durable and protects it against scratches and dents.

With opportunity, lies danger

Gold sovereigns enjoy high demand from numismatists around the world. Due to its great demand, the coin commands a much higher price than its weight in gold. Unfortunately, this has also led to some instances of counterfeit coins appearing in the market. When buying a gold sovereign, it is therefore important to ascertain whether the coin is genuine. Gold coin dealers or brokers use a coin gauge to detect fakes, as well as checking measurements and weight. In one instance, a few fake 9-carat gold sovereigns had started circulating in the market. However, an experienced coin dealer will spot the counterfeit coin immediately due to its discrepancy in weight and thickness. Gold itself is a difficult metal to counterfeit, owing to the density and colour of the metal. Fake gold sovereigns are usually underweight or have the wrong dimensions. Today, the gold sovereign is a protected coin and enjoys protection from the UK government through the forgery and counterfeiting act 1981.

Buy Gold Sovereigns

If you wish to buy gold sovereigns, ensure you purchase from a reputable dealer to ensure the lowest price. If you are looking to sell sovereign coins Physical Gold can make the process easier. As proud members of the British Numismatic Trade Association (BNTA) Physical Gold is committed to dealing coins in a legal and efficient way. In addition to this Physical Gold is a member of the National Association of Pension Funds making it possible to buy and sell gold coins as part of a wider long term investment plan.

The sovereign is an iconic British coin that is popular amongst investors and collectors. The modern sovereign has been in existence since 1817, and the coin has witnessed the reigns of several British monarchs.

Over the years we are regularly asked questions about sovereign gold coins. So, we decided to provide these handy FAQs with answers, which hopefully will provide you with all the answers you will need!

1) Is it best to buy old or new Sovereigns?

Please read our dedicated answer to this question at https://www.physicalgold.com/insights/is-it-best-to-buy-old-or-new-sovereigns/.

New sovereigns like the 2018 gold sovereign are a great investment

2) What are gold Sovereign bonds (SGB)?

SGBs are an alternative to holding physical gold. Paper bonds denominated in gold grams are issued by The Reserve Bank of India and offer a fixed maturity date whereby the investor receives back an amount based on the underlying gold price.

3) What are gold Sovereign coins?

We have written a detailed answer to this question. Please visit https://www.physicalgold.com/insights/what-are-gold-sovereign-coins/ for a detailed explanation.

4) How much are gold Sovereign coins worth?

We have provided a separate answer to this question, which can be viewed at https://www.physicalgold.com/insights/how-much-are-gold-sovereign-coins-worth/.

5) How heavy is a gold sovereign?

The total weight of a gold Sovereign is 7.98 grams or 0.2566 ounces. However, the gold content of the coin is only 7.32g, with the remainder consisting of copper and silver alloys to toughen the coin. Care should be taken not to mistake the Full Sovereign with the smaller Half Sovereign which weighs 3.99g.

6) How to clean gold Sovereigns?

The best way to clean dirty gold Sovereign coins is in a mix of warm water and liquid soap. Let the coins soak for 15 minutes before carefully wiping dry with a cloth. Boiling water from a kettle can be added into the bowl for stubborn grime. Avoid using a brush or strong chemicals.

7) How to sell gold Sovereign coins

For our detailed reply to this question, visit https://www.physicalgold.com/insights/how-to-sell-gold-sovereign-coins/.

8) How much are gold Sovereign rings worth?

The main value will come from the Sovereign itself. If the coin is in good condition and features a previous monarch, it will be worth more than an Elizabeth Head coin. The value of the coin itself is £200 – £300 depending on age and condition. The ring is likely to be lower purity so will only add a marginal value of 10-15%.

9) Why buy gold Sovereigns?

10) What is a gold Sovereign worth in Sterling?

The value will depend on its condition and age. Brand new coins are worth around £240 each while Young Head Victoria coins are worth over £300 due to their age and rarity. Selling privately on an individual basis may yield higher prices if you can find a keen buyer. If selling in bulk, a gold dealer is best.

11) What carat is a gold Sovereign?

Gold Sovereigns are 22 carat purity, the same they’ve been for over 200 years. This works out around 916/1000 parts gold. The other two carats are a mix of copper and silver alloy. The exact mix can vary from year to year. This alloy mix ensures the coins are more resilient to scratched than 24 carat coins.

12) Which gold Sovereign coin is the most valuable?

Click https://www.physicalgold.com/insights/which-gold-sovereign-coin-is-the-most-valuable-2 for a detailed answer to this topic.

13) Which gold Sovereign should investors buy?

We have answered this question through a separate blog article, access this by clicking https://www.physicalgold.com/insights/which-gold-sovereign-should-investors-buy.

14) Where can owners sell gold Sovereign coins?

The best overall place to sell gold Sovereigns is to a specialist gold dealer who will pay you based on the sell-on value rather than just a melt value. A BNTA accredited dealer is a must if you consider trust to be a selling consideration. Selling privately is an option for rarer Sovereigns as collectors may pay a premium.

15) How do I found out where to buy gold Sovereign coins?

Click https://www.physicalgold.com/insights/how-do-i-find-out-where-to-buy-gold-sovereign-coins for a comprehensive answer to this question.

Gold sovereigns can be bought in proof sets, these are published each year

16) Can you melt gold Sovereigns?

Under the 1971 UK Coinage Act, it’s illegal to melt down any UK coin with a face value. Which covers Sovereigns. More importantly, melting a Sovereign will devalue the gold, which is worth more minted as a Sovereign due to its tax efficiency as legal tender and recognisable trading format.

17) Can you spend a gold Sovereign?

Yes! Gold Sovereigns have a face value of £1, which means shopkeepers would have to accept it as legal tender. But with the gold content alone, pushing the value above £200, it would be foolish to use a Sovereign to buy goods.

18) One gold Sovereign is how many grams?

The total weight of a newly minted Sovereign is 7.98 grams. The old content itself weighs 7.32g, with the remainder consisting of a copper and silver alloy. Coins may weigh slightly less as they become older and wear on the face and edges.

19) Is a gold Sovereign legal tender?

Click https://www.physicalgold.com/insights/is-a-gold-sovereign-legal-tender to read a separate article, which answers this question.

You could spend a gold sovereign if you wanted to, but with a value of only £1 it would be unwise

20) Gold Sovereigns or Britannias – which are the best to buy?

Read our comprehensive article about gold sovereigns and gold britannias to this question at – https://www.physicalgold.com/insights/gold-sovereigns-or-britannias-which-are-the-best-to-buy.

21) Gold Sovereigns or Krugerrands – which are the best to buy?

Read our detailed article here – https://www.physicalgold.com/insights/gold-sovereigns-or-krugerrands-which-are-the-best-to-buy, which answers this question.

22) How much gold is there in a gold Sovereign vs a Half Sovereign?

Click https://www.physicalgold.com/insights/how-much-gold-is-there-in-a-gold-sovereign-vs-a-half-sovereign for a detailed answer to this topic.

23) What is the difference between a sovereign and a half sovereign?

We have provided a detailed response to this question at this link – https://www.physicalgold.com/insights/what-is-the-difference-between-a-gold-sovereign-and-a-half-sovereign/.

Talk to our experts before buying or selling gold sovereign coins

We always love to hear from customers, new and old and are always here to answer questions about all precious metal topics including ones about gold sovereign coins. Why not call Physical Gold Limited now on 020 7060 9992 or complete our contact form. We look forward to hearing from you soon!

Gold Sovereigns have been in circulation for over two centuries, making it one of the most popular iconic British coins with a large secondary market. The Royal Mint struck these coins, using 22-carat gold from the year 1817. They have now been put out of circulation and are available as a bullion investment coin. The iconic design of St George and the Dragon, created by Benedetto Pistrucci make these coins unmistakable and they are in great demand from numismatists and investors alike.

Gold sovereigns can carry hefty premiums depending on the monarch and the year. For example, the Young Head Victoria can fetch prices of around £300. There are even rarer ones like a proof set created for Edward VIII. A single coin from this set can command a price of £516,000. So, investors need to know how to sell these coins in order to maximise their profits.

Selling a gold Sovereign can be very lucrative

Identifying a reputed online dealer

Since the Sovereign carries a numismatic value as well, as its value in gold, it’s best to sell your Sovereign gold coins to a reputable gold dealer. This will ensure you receive a fair price that reflects the gold content and the numismatic value of the coin. Members of the British Numismatic Trade Association (BNTA) are trustworthy. Going through a reputed dealer can get you access to a wider secondary market, increasing the chances of a quick sale at a good price. Preparing to sell is a key factor. If you want the best possible price, let the dealer know in advance that you want to sell your Sovereign coins. It’s important to let your dealer know about the complete details of all the coins you want to sell. You must decide on a timeline for the sale. This will help your dealer identify the right buyer and bring the coins into the market at a time when the best price can be achieved. Don’t be in a hurry to sell, unless you need the funds for an emergency. A distress sale is always likely to get you a far lower price.

Click here to download the FREE 10 Commandments when selling gold coins

Attempting a private sale

Some investors believe that they can get a far better price by arranging a private sale. But, be aware that it may not be possible for you to check the backgrounds of the buyers. It could be risky to have them visit your home. As an individual investor, it is unlikely that you will have a large network of interested buyers. So, you will be forced to depend upon only a few interested buyers who may have responded to your ad. Of course, it may also take a lot of time and effort to post your ads and reach out to the right audiences. A dealer would be far more adept at reaching out to interested parties.

Research your dealer well

You aren’t forced to sell through one dealer only. If you identify two or three reputed dealers, feel free to engage all of them. Doing your research means connecting with other investors and buyers in the marketplace. Find out all about a dealer’s reputation and background by speaking to other investors and viewing their ratings online.

Contact Physical Gold for the best way to sell your gold Sovereign

An effective way to properly market your gold Sovereign is to simply speak with our investment team. Physical Gold Limited is registered with the BNTA and have a long track record in providing exemplary service. Getting in touch with our team is easy. Simply call (020) 7060 9992 or visit our website to reach out to us.

Image credit: Wikimedia Commons

You can’t go wrong with Sovereign coins

While most UK investors have owned property, shares, bonds and ISAs at some point, gold investment is still pretty new. If you’re a novice, what’s the best place to start a physical gold portfolio? In our opinion Gold Sovereigns provide a perfect starting point for the new gold investor!

1. Great value – Sovereign coins have existed for hundreds of years so there’s a very deep second hand market. This means that older Sovereigns provide a lower price per ounce as than any other gold coin – perhaps along with Krugerrands. Buying any asset at a low price is a great starting point!

*Pro-tip: Buy the pre-owned ‘Best value’ Sovereigns. They’re cheaper than brand new ones, but will obtain the same price when you sell.

2. Further discounts with volume – Specialist dealers like Physical Gold will generally be able to offer even lower prices if you buy 50 Sovereigns or more. In fact discounts can be achieved on a sliding scale once you look at more than a single coin. Our website has handy volume discount tables for each coin.

3. Easy to sell – Sovereign Gold Coins are arguably the most established bullion coin in the market so you’ll always be able to sell the coins at a great price. If you try to sell an obscure coin, the reduced number of buyers will be reflected in a lower price per ounce for that piece of gold

*Pro-tip: Give your dealer a week or two notice that you wish to sell, and you may achieve a slightly higher selling price if the dealer can match up your sale with a buyer.

4. Affordable – While 1oz gold coins are now trading around the £1,400 mark, Sovereign coins are around a quarter of the size and price. This provides a great opportunity to dip your toe in the market or even set up a regular gold savings scheme, whereby you receive a Sovereign coin every month

5. Tax free – Sovereigns are VAT exempt like all other forms of investment grade gold. However, they have the huge added benefit of also being Capital Gains Tax free due to their status as legal tender in the UK. For a novice seeking to buy gold, this provides peace of mind that you’ll never be hit with a tax bill

6. Flexible – Due to their small size, even a modest investment of say £2,000 will provide 6 Sovereign coins. This provides versatility that you can sell as little as one coin at any time of you need to realise some cash. Larger coins or bars do not offer this flexibility

7. Talking Point – The sheer variety of issue dates and Sovereign heads available means that a novice investor can own a piece of history as well as a superb investment. For anyone who’s enjoyed watching The Crown on Netflix, modern Sovereign coins date back more than 200 years, reflecting the various monarchs and periods of reigning.

So if you want get started in the world of gold, buy Gold Sovereigns and you won’t go far wrong.

The gold Sovereign is the pride and joy of British coinage and has been around for a very long time. The modern gold Sovereign was launched in 1817, however, the Sovereign has a history that dates back even longer. The 1817 coin was part of the great British Re-coinage of 1816. The original 1817 gold Sovereign was designed by the Italian designer, Benedetto Pistrucci, who created the classic image of St George slaying the dragon. This is the image that appears on the gold Sovereign. At the time, the brother of the Duke of Wellington, William Wesley Pole commissioned the Italian designer to create the new coin for the re-coinage. Thereafter, the Sovereign was created to replace an older British coin called Guinea.

A fine example of an 1838 Gold Sovereign

The early history of the Gold Sovereign

The gold Sovereign is based on an even older British coin called the English Sovereign. This was issued in 1489 by King Henry VII. The English Sovereign weighed of 15.55 g in gold. It was the first coin with a value of 1 pound, and its size and fineness of gold changed over the years. In 1603, when King James I acceded to the throne of England, a Sovereign was released to commemorate the occasion. After that, the Sovereign was withdrawn from circulation and did not resurface until 1817.

How much gold did the 1817 Sovereign contain?

Under the proclamation of King George IV in 1817, the weight of the gold Sovereign was set at 5 pennyweights, three grains, Troy weight of standard gold. When we calculate this amount in grams, it becomes clear that the 1817 gold Sovereign contained approximately 7.942 g of gold. According to the proclamation, the 1817 gold Sovereign would also be known as the 20 shilling coin. It was this occasion that heralded the birth of the modern Sovereign, as we know it.

The changing Sovereign

Over the years, the design of the Sovereign was modified with the reign of each British monarch. For example, the Sovereign of King George IV features a laureate head of the King. Once again, when King William IV took over the throne in 1830, a new makeover of the sovereign was created.

By the reign of Queen Victoria, the Sovereigns size and weight were standardized, containing 7.98 g of gold, with a purity of 91.7%. The coin, popularly known as the Young Head, had a diameter of 22.05 mm and a thickness of 1.56 mm. However, the gold content of the Sovereign was eventually brought down to 7.32 grams of gold. This weight continued through the reigns of King Edward VII, George V, right up to the 2022 gold Sovereign of Queen Elizabeth II. Currently, the half Sovereign of Queen Elizabeth II contains 3.66 g of gold.

The obverse of the Sovereign of King George IV with a laureate head

Both coins are tax-free when bought and sold in the UK. A full Sovereign contains 7.32g of gold, with the smaller coin containing exactly half that amount. Half Sovereigns tend to cost more per gram to buy but provide more divisibility to a coin portfolio. A mix of both types of Sovereign is preferable for a balanced collection.

A bullion coin

Both the full Sovereign and the half Sovereign are now released by the Royal Mint as a bullion coin. Since 1932, the Sovereign has been withdrawn from circulation. However, it continues to enjoy its status as a legal tender coin. In the UK. However, its gold value makes it unfit for use in the economy as a payment method.

Talk to the gold experts to know more about the British Sovereign

Physical Gold is proud to be one of the largest and most reputed gold dealers in the UK. If you wish to invest in gold Sovereigns, please speak to our investment team, who can guide you on getting the best deals for this coin. Call us on (020) 7060 9992 or drop us an email via our website.

Image credits: Public.Resource.Org and Wikimedia Commons

There are many gold coins in the market and an investor needs to decide which ones to add to his portfolio. Undoubtedly, two of the best British coins that are attractive to investors are the Gold Britannia and the Gold Sovereign. In this article, we will explore the merits and demerits of both these coins and assess them based on key attributes and fundamentals required for building a strong portfolio.

Variety is the spice of life

A key consideration when choosing any gold coin for your portfolio is variety. As an investor, you need to have a good distribution of popular gold coins in different sizes and dimensions. There can also be variations based on the year of issue. The Gold Sovereign is an excellent choice when it comes to variety. The coin has been around for more than two centuries and several issues over the years are available from the reigns of different British Kings and Queens. In terms of size, there is also a wide choice that’s available.

A Sovereign from the reign of King George IV

The Sovereign comes in different denominations such as the half, double and quintuple Sovereigns. Within the reign of just one British monarch – Queen Victoria, there are three available variations of the Sovereign. These are well-known as the Young Head, the Jubilee Head and the Old Head. When one takes into consideration all the attributes of the Gold Sovereign, it can be called an excellent choice that adds divisibility, variety and balance to your investment portfolio. When we compare the Britannia to the Sovereign, it’s worth noting that the Britannia only carries the portrait of our current Queen, Elizabeth II. On the other hand, the modern Sovereign carries the images of eight British monarchs.

Value for money

Gold Sovereigns are around one quarter the size of Britannias (1oz), making them slightly more expensive per gram due to the higher relative production cost. However, their smaller size provides more flexibility for gold investors. A mix of both is preferable in a portfolio, especially as both coins are tax-free in the UK due to their legal tender status.

The Gold Britannia is the flagship coin of the Royal Mint

Some Sovereigns may carry premiums based on their rarity and historical value, however, Sovereigns that were minted as a bullion coin are easily available at low premiums. By this comparison, the Gold Britannia is also a bullion coin that has been around since 1987. Since it is a recent coin, Gold Britannias do not carry any historical premiums. The coin is easily available from most gold dealers with greater discounts on larger volume purchases. However, the Britannia is four times larger than the Sovereign in size, making it a more expensive coin.

Download the 7 Crucial Considerations before you buy Gold HERE

Divisibility provides balance to your portfolio

The Sovereign provides a greater variety and choice when compared to the Gold Britannia. Due to its smaller sizes, the Sovereign provides investors with the freedom and flexibility to sell the coin at various price points in the market by trading in different sizes and denominations.

Liquidity is an important consideration

In terms of liquidity, both coins are evenly poised, since they enjoy a strong secondary market. For investors, liquidity is a very important factor as investing in obscure coins defeats the objective of investment. The coin should be saleable at any given point in time for an investor to redeem its value. The Gold Britannia and the Sovereign are both excellent coins in this respect.

Which is the right coin for you?

The gold experts at Physical Gold can answer this question, based on the fundamentals and objectives of your investment. They can offer you free advice on whether you should buy, the Gold Britannia or the Gold Sovereign. Two find out more, call us on (020) 7060 9992 or drop us an email and a member of our team will be happy to get in touch with you.

Image credits: picryl.com, Wikimedia Commons

Gold Sovereign coins are one of the most popular British coins that attract investors every year. The Sovereign has been around for more than two centuries and benefits from abundant availability and low prices. The modern Sovereigns are available as bullion coins and carry low premiums due to mass production and lower manufacturing costs. The gold Sovereign is also a very affordable coin, since it is available in smaller sizes, as a quarter of an ounce. The gold Britannia, on the other hand, is a 1-ounce coin that is far more expensive than the Sovereign.

Great value for money

Due to their affordability factor, the gold Sovereign allows beginner investors access to the gold market by investing a smaller sum of money. Investors can also enjoy the flexibility of owning gold Sovereigns. Due to their smaller sizes, they add divisibility to an investor’s portfolio. From a tax perspective, Sovereigns are a great investment. Investors do not pay any VAT when buying the coins. Since the Sovereign is considered to be legal tender, investors can also avoid paying Capital Gains Tax (CGT) on the profits made from the sale of these coins.

A gold proof Sovereign featuring the portrait of our Queen, Elizabeth II

Buying gold Sovereigns

The growing interest amongst investors in buying gold Sovereigns, leads many people to ask the question – what is the best route to buy Gold Sovereigns? Of course, many would turn to high-street jewellers and gold shops. This is an old route, mainly for people who like to see and touch the gold they’re buying. However, over the last 10 years, much of the gold trade has moved online. Today, if you’re buying investment-grade coins like the gold Sovereign, it’s best to buy from a reputed online dealer.

It’s safest to buy gold Sovereigns directly from a reputable precious metals dealer. If the dealership has the right credentials, it will ensure the Sovereigns are authentic, in great condition and sell at a competitive price. Many now have e-commerce stores, making it easy to buy online. Buying from a jeweller, an auction or privately are other options, but they pose significant risks.

Reputed online gold sovereign dealers

Moreover, large online dealers are more likely to stock a diverse range of gold products. By visiting the dealer’s website, you will probably see a variety and volumes of investable gold coins like the Sovereign. High-street dealers usually do not have such a large inventory. Due to their buying power, reputed online dealers are also able to offer rock bottom prices, especially on larger volume purchases. Many dealers, like Physical Gold, also have a monthly purchase scheme, through which you can regularly invest in gold Sovereigns and build up a formidable gold portfolio.

A reputed dealer can store your gold in an LBMA approved vault

Safety and security

Online gold dealers will also ensure that your transaction is conducted with utmost safety. Online payments are made using a debit or credit card, through a secure, encrypted payment gateway. Physical Gold, a reputed UK dealer uses a 3D secure payment method. Your gold Sovereigns are dispatched via a secure courier, and your package is fully insured. Many large dealers may also offer you the option of storing your gold securely with them in an LBMA approved vault. Lastly, all reputed dealers will provide an authenticity certificate and a buyback scheme. It is unlikely that you would get all this when you shop for your coins on the high street.

Download the Insiders Guide to buying Gold Sovereigns HERE

Get in touch with Physical Gold to find out more about buying gold Sovereigns

At Physical Gold, we pride ourselves on being one of the country’s most reputed online gold dealers. Our experts are always willing and ready to work out the best deal on gold Sovereigns for you. Call us today on (020) 7060 9992, or reach out to us online by visiting our website.

Image credits: Adam Greig, piqsels.com

If you want to collect a piece of history, along with unmatched value, look no further than the Gold Sovereign. While the Gold Britannia may be the flagship coin of the Royal Mint, the Gold Sovereign is perhaps the most iconic coin ever issued as a part of British coinage. The coin is heralded as one of the oldest British coins that have been around for more than 200 years.

The gold Sovereign

There is a distinction between the modern Gold Sovereign and the older coin that was issued during mediaeval times. The modern Sovereign has seen the face of several British monarchs. The coin was around during the reigns of the great Queen Victoria and Edward VII, followed by King George V, Emperor of the British Empire during the First Great War.

The Sovereign was continued during the reign of King George VI, who ruled the Empire during World War II and continued into the reign of his daughter, Queen Elizabeth II, our current British monarch. The older Sovereign was issued in 1489 during the reign of King Henry VII. However, the mintage of the Sovereign was terminated in 1604. The coin was reintroduced only in 1817.

A rare George III half Sovereign from 1817

An illustrious history

It’s not just the history that makes this coin attractive. The Sovereign has a unique design. The reverse of the coin features an image of St George slaying a dragon. This iconic image was conceptualised by the famous Italian designer and engraver, Benedetto Pistrucci. The coin is indeed a work of art, as well as a representation of the fineness and elegance of British coinage.

Which Sovereigns should I buy?

The first consideration for any investor is affordability. Most investors want value for money. Old Sovereigns are small in size and therefore affordable. Having been produced for over 200 years, they’re very easy to sell on and can make a good investment if the gold price goes up. Their value generally increases with age and any profit made on their sale is completely tax-exempt in the UK. It’s also important to research the secondary market. Due to its long years of production, the gold Sovereign enjoys a vibrant secondary market. Many Sovereigns that have been issued over the years are available at different price points. So, it’s important to build a relationship with a reputed gold dealer and find out the best deals on Sovereigns that you can benefit from.

A proof Sovereign from the reign of Queen Victoria

Divisibility is an important differentiator

A definitive reason to invest in gold Sovereigns is the divisibility it brings to your portfolio. There is a wide variety of different sizes to choose from. As an investor, if you prefer larger coins with lower production costs, the full sovereign, the double Sovereign, and the quintuple Sovereign could be just right for you. The latter two are known as the 2-pound coin and the 5-pound coin, respectively. However, it may make sense to invest in smaller coins, which gives you the flexibility of selling small amounts of gold at the right price points. In that case, you have the option of acquiring the half and quarter sovereign. Incidentally, the quintuple Sovereign is perhaps one of the most famous, as it has the largest gold content ever found in a British coin.

Accessibility to the gold market

Another important reason to buy gold Sovereigns is that it is an affordable coin when compared to the gold Britannia. Investors can therefore own a sovereign, with a lesser amount of capital outlay and enjoy its benefits, including VAT and CGT exemptions.

Get in touch with Physical Gold for the best deals in gold Sovereigns

Our numismatic experts at Physical Gold can advise you on how to avail of the best deals when buying gold Sovereigns. Call us on (020) 7060 9992 or visit our website and get in touch with us online.

Image credits: Wikimedia Commons and Picryl