Gold Britannia vs Gold Sovereign: Which Is The Best Investment?

27/03/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold has always been a favoured investment option for those looking to diversify their portfolios and safeguard their wealth.

Two highly sought-after gold coins in the UK are the Gold Sovereigns and Gold Britannias, both of which are produced by the esteemed Royal Mint.

In this article, we will acquaint you with these iconic coins, offering an all-encompassing analysis of their history, characteristics, and investment potential.

By comprehending the main distinctions between Gold Sovereigns and Gold Britannias, you can decide which coin best aligns with your investment objectives and preferences.

Gold Sovereigns are celebrated for their historical importance and classic design, whereas Gold Britannias have a higher gold content and modern aesthetic.

Both coins present unique benefits for investors and collectors, making them valuable inclusions in any investment portfolio or coin collection.

As we examine the attributes of these coins in-depth, we will explore their market demand and liquidity, numismatic value and collector’s appeal, and the various factors that may impact your decision to invest in one or both of these emblematic British gold coins.

Gold Sovereigns possess a rich history that began in 1817 when the coin first emerged as part of the Great Recoinage of the United Kingdom.

The original Gold Sovereign showcased the iconic St. George and the Dragon design by Italian engraver Benedetto Pistrucci.

This design has largely remained consistent since its inception, signifying the lasting allure and tradition of the Gold Sovereign.

Over time, the coin has experienced various modifications in its design, size, and gold content, with some older coins containing more gold than their contemporary equivalents.

The Gold Sovereign has been minted in various locations, including London, Melbourne, Sydney, Perth, Bombay, and Ottawa, contributing to the coin’s historical charm and collector’s appeal.

Throughout its existence, the Gold Sovereign has symbolised British power and prosperity, with the coin’s reputation for quality and purity making it an attractive choice for investors globally.

Gold Britannias, in contrast, are a more recent addition to the gold coin market, having been first introduced in 1987.

These coins were designed to cater to the growing demand for high-purity gold coins and to rival other popular bullion coins like the American Gold Eagle and the Canadian Gold Maple Leaf.

The Gold Britannia features a contemporary design, with the iconic figure of Britannia, a symbol of British strength and resilience, displayed on the reverse side of the coin.

The obverse side showcases the portrait of the reigning monarch, which has evolved over the years to represent the current ruler.

Despite their relatively brief history, Gold Britannias have rapidly gained popularity among investors and collectors, owing to their high gold content, modern design, and Capital Gains Tax (CGT) exemption.

Similar to Gold Sovereigns, the Royal Mint has issued several special editions and design variations of the Gold Britannia, providing collectors with a variety of options to select from.

Gold Sovereigns consist of 22-carat gold, containing 91.67% gold and the remaining alloy being copper. This copper alloy fortifies the coins, making them more durable and wear-resistant.

Although the gold content in Sovereigns is marginally lower than that of pure gold coins, their historical importance and long-standing reputation have made them popular among investors and collectors.

Gold Britannias, conversely, are crafted from 99.99% pure 24-carat gold, ranking them among the purest gold bullion coins available in the market. The high gold content of Gold Britannias renders them an appealing choice for investors seeking top-quality gold coins.

Gold Britannias are the winners in this category due to their high gold content of 99.99% pure 24-carat gold.

Gold Sovereigns are available in several sizes, including 1/4 Sovereign, ½ Sovereign, Full Sovereign, Double Sovereign (also know as £2 gold coin) and Quintuple Sovereign (£5 gold coin) , with face values of 25p, 50p, £1, £2, and £5, respectively.

The most common and popular size is the full Sovereign which weighs just under a quarter of an ounce , and contains 7.322 grams of gold. The larger Double and Quintuple Sovereigns tend to be produced in far fewer mintage numbers and are aimed more at the collector’s market.

Therefore a majority of Sovereign investors focus on the standard full Sovereign, with restricted choice to purchase the bigger coins.

Gold Britannias are available in a wide range of sizes, including 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz, with face values of £10, £25, £50, and £100, respectively.

This variety of sizes makes Gold Britannias suitable for investors looking to purchase different amounts of gold to suit their investment needs.

Generally speaking, investors may consider the smaller size of the Sovereign to be a benefit if they’re seeking portfolio divisibility and flexibility.

This category results in a tie, as both Gold Sovereigns and Gold Britannias are available in a number of sizes.

When comparing the standard full Sovereign and standard 1oz Britannia, it’s obvious to see that the Sovereign is around a quarter of the size. For that reason, it represents a far more accessible entry point to the physical gold market than Britannias.

For those with modest means, Sovereigns offer a more affordable option, especially if investors are seeking to buy little and often.

Investors are able to opt for the smaller fractional Britannias such as the half, quarter and tenth ounce versions if the larger 1oz coin is out of their price bracket.

Premium is a term used to describe the cost of a particular gold coin, over and above the spot price value of its gold weight. This premium can cover production and delivery cost, dealer margin and rarity value.

The relative production cost per gram of the 1oz Britannia is lower than the standard Sovereign as it’s a larger coin and benefits from economies of scale. For that reason, serious investors prefer the Britannia as it represents a slightly lower premium than the Sovereign.

This enables the investor to obtain more gold for the same money if buying 1oz Britannia coins.

Premiums on the Double and Quintuple Sovereigns tend to be relatively high as many are commemorative and production runs are smaller and therefore less cost efficient for the Royal Mint, despite their larger size.

Fractional versions of both coins are significantly higher for all the reasons above.

Gold Britannias are the winners in this category, as the standard coin saves a percent or two for the avid investor, which leads to higher profits.

Both Gold Sovereigns and Gold Britannias offer tax advantages for UK investors. Gold Sovereigns are exempt from Capital Gains Tax (CGT) due to their status as legal tender, making them an attractive option for investors looking to minimise their tax liabilities. Since both coins enjoy CGT exemption, this category results in a tie.

Gold Britannias are also exempt from CGT, provided that the coins are legal tender and meet certain conditions. Additionally, Gold Britannias are VAT-free, making them an appealing choice for investors seeking to maximise their gold holdings without incurring additional taxes.

This category results in a tie, as both Gold Sovereigns and Gold Britannias enjoy CGT exemption for UK investors.

Insider's tips on buying tax-free precious metals

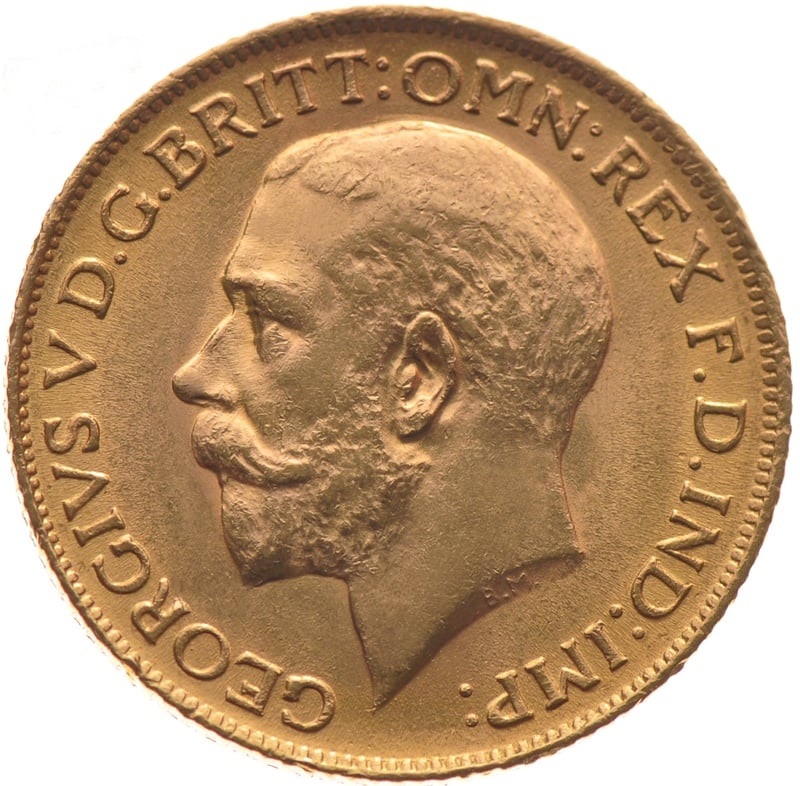

Gold Sovereigns feature the iconic design of St. George slaying the dragon, created by Italian engraver Benedetto Pistrucci in 1817. The obverse side of the coin features the reigning monarch’s portrait.

The classic design of the Gold Sovereign has remained largely unchanged over the years, making it a recognizable and cherished symbol of British history and heritage. In terms of design and aesthetics, the winner is Gold Sovereigns, due to their classic and historical appeal.

Some versions of the Sovereign are minted with an alternative ‘Shield Back’ reverse design, replacing the George and Dragon depiction.

These coins are only produced to commemorate events such as jubilee years and can fetch far higher prices due to their relative scarcity.

Gold Britannias showcase a more modern design, featuring the figure of Britannia, a symbol of British strength and resilience, on the reverse side of the coin. The obverse side features the portrait of the reigning monarch. Since their introduction in 1987, Gold Britannias have seen a few design variations, offering collectors a range of options to choose from.

While Gold Britannias may not have the same historical significance as Gold Sovereigns, their contemporary design appeals to many investors and collectors.

In recent years, the Royal Mint has focused on developing the Britannia into a cutting-edge bullion coin with unique anti-forgery design features such as waves which seem to move when the coin is angled.

Gold Sovereigns are the winners in this category due to their classic and historical appeal.

Gold Sovereigns possess a well-established reputation in the gold market and attract robust demand from investors and collectors globally.

Their historical significance, coupled with their CGT exemption, renders them a preferred choice for gold buyers in the UK and beyond. The substantial demand for Gold Sovereigns enhances their liquidity, enabling investors to effortlessly purchase and sell them in the market.

With a 200 year history, the second-hand market for Sovereigns is far more established than the much younger Britannia. Investors are able to source and sell Sovereign coins with various monarchs adorning its obverse, including George V, Edward VII and Queen Victoria.

Gold Britannias also experience strong market demand, particularly within the UK. Their high gold content, CGT exemption, and VAT-free status make them an alluring investment option.

Their purity upgrade in 2013 reflected the preference for super-pure gold coins within the rapidly growing Asian precious metals market.

While they may not enjoy the same worldwide appeal as Gold Sovereigns, Gold Britannias remain a liquid investment and can be easily bought and sold in the market.

Gold Sovereigns are the winners in this category, thanks to their widespread demand and established reputation in the gold market.

Gold Sovereigns boast a rich history dating back to 1817, making them highly sought after by numismatists and collectors. The various designs and minting years offer collectors a chance to build a diverse and valuable collection.

In addition, limited edition and commemorative issues, as well as coins with low mintages, can command a premium in the market due to their rarity and historical significance.

While the various monarchs offer the chance to own a piece of British history, the creative designs on some Double and Quintuple Sovereigns also create collector demand.

While Gold Britannias may not have the same extensive history as Gold Sovereigns, they still hold some appeal for collectors due to their design variations and special editions.

However, their primary focus remains as a bullion investment rather than a numismatic treasure.

Gold Sovereigns are the winners in this category, thanks to their widespread demand and established reputation in the gold market.

In conclusion, both Gold Sovereigns and Gold Britannias offer unique advantages for investors and collectors alike.

Gold Sovereigns boast a rich history, strong collector’s appeal, and CGT exemption, making them an ideal choice for those seeking a classic and time-honoured investment.

Gold Britannias, with their high gold content, range of sizes, and modern design, cater to investors seeking higher purity and a more contemporary aesthetic.

Ultimately, both coins have their unique merits and are valuable additions to any investment portfolio or coin collection.

To make an informed decision, it’s essential to research the current market conditions, stay updated on any changes to tax regulations or market trends, and read guides about investing in gold coins. By doing so, you can ensure that your investment in gold coins will be a rewarding and fulfilling experience.

As the UK’s preferred choice for gold investment, Physical Gold offers numerous advantages to investors and collectors:

We take a flexible and personalised approach to each customer’s needs, offering guidance and a range of investment solutions:

Physical Gold holds accreditations from the British Numismatic Trade Association (BNTA), National Association of Pension Funds (NAPF), Chartered Institute for Securities & Investment (CISI), British Numismatic Society, and Royal Numismatic Society.

We adhere to strict standards and maintain a reputation for the best customer service in the industry.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.