The sovereign is an iconic British coin that is popular amongst investors and collectors. The modern sovereign has been in existence since 1817, and the coin has witnessed the reigns of several British monarchs.

Over the years we are regularly asked questions about sovereign gold coins. So, we decided to provide these handy FAQs with answers, which hopefully will provide you with all the answers you will need!

1) Is it best to buy old or new Sovereigns?

Please read our dedicated answer to this question at https://www.physicalgold.com/insights/is-it-best-to-buy-old-or-new-sovereigns/.

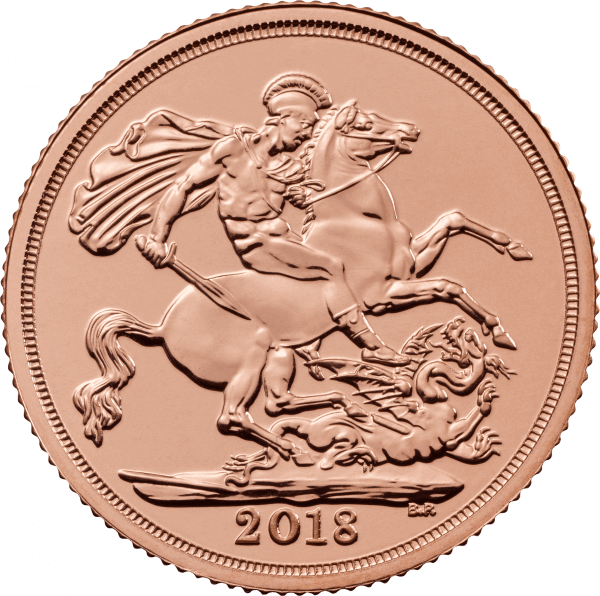

New sovereigns like the 2018 gold sovereign are a great investment

2) What are gold Sovereign bonds (SGB)?

SGBs are an alternative to holding physical gold. Paper bonds denominated in gold grams are issued by The Reserve Bank of India and offer a fixed maturity date whereby the investor receives back an amount based on the underlying gold price.

3) What are gold Sovereign coins?

We have written a detailed answer to this question. Please visit https://www.physicalgold.com/insights/what-are-gold-sovereign-coins/ for a detailed explanation.

4) How much are gold Sovereign coins worth?

We have provided a separate answer to this question, which can be viewed at https://www.physicalgold.com/insights/how-much-are-gold-sovereign-coins-worth/.

5) How heavy is a gold sovereign?

The total weight of a gold Sovereign is 7.98 grams or 0.2566 ounces. However, the gold content of the coin is only 7.32g, with the remainder consisting of copper and silver alloys to toughen the coin. Care should be taken not to mistake the Full Sovereign with the smaller Half Sovereign which weighs 3.99g.

6) How to clean gold Sovereigns?

The best way to clean dirty gold Sovereign coins is in a mix of warm water and liquid soap. Let the coins soak for 15 minutes before carefully wiping dry with a cloth. Boiling water from a kettle can be added into the bowl for stubborn grime. Avoid using a brush or strong chemicals.

7) How to sell gold Sovereign coins

For our detailed reply to this question, visit https://www.physicalgold.com/insights/how-to-sell-gold-sovereign-coins/.

8) How much are gold Sovereign rings worth?

The main value will come from the Sovereign itself. If the coin is in good condition and features a previous monarch, it will be worth more than an Elizabeth Head coin. The value of the coin itself is £200 – £300 depending on age and condition. The ring is likely to be lower purity so will only add a marginal value of 10-15%.

9) Why buy gold Sovereigns?

10) What is a gold Sovereign worth in Sterling?

The value will depend on its condition and age. Brand new coins are worth around £240 each while Young Head Victoria coins are worth over £300 due to their age and rarity. Selling privately on an individual basis may yield higher prices if you can find a keen buyer. If selling in bulk, a gold dealer is best.

11) What carat is a gold Sovereign?

Gold Sovereigns are 22 carat purity, the same they’ve been for over 200 years. This works out around 916/1000 parts gold. The other two carats are a mix of copper and silver alloy. The exact mix can vary from year to year. This alloy mix ensures the coins are more resilient to scratched than 24 carat coins.

12) Which gold Sovereign coin is the most valuable?

Click https://www.physicalgold.com/insights/which-gold-sovereign-coin-is-the-most-valuable-2 for a detailed answer to this topic.

13) Which gold Sovereign should investors buy?

We have answered this question through a separate blog article, access this by clicking https://www.physicalgold.com/insights/which-gold-sovereign-should-investors-buy.

14) Where can owners sell gold Sovereign coins?

The best overall place to sell gold Sovereigns is to a specialist gold dealer who will pay you based on the sell-on value rather than just a melt value. A BNTA accredited dealer is a must if you consider trust to be a selling consideration. Selling privately is an option for rarer Sovereigns as collectors may pay a premium.

15) How do I found out where to buy gold Sovereign coins?

Click https://www.physicalgold.com/insights/how-do-i-find-out-where-to-buy-gold-sovereign-coins for a comprehensive answer to this question.

Gold sovereigns can be bought in proof sets, these are published each year

16) Can you melt gold Sovereigns?

Under the 1971 UK Coinage Act, it’s illegal to melt down any UK coin with a face value. Which covers Sovereigns. More importantly, melting a Sovereign will devalue the gold, which is worth more minted as a Sovereign due to its tax efficiency as legal tender and recognisable trading format.

17) Can you spend a gold Sovereign?

Yes! Gold Sovereigns have a face value of £1, which means shopkeepers would have to accept it as legal tender. But with the gold content alone, pushing the value above £200, it would be foolish to use a Sovereign to buy goods.

18) One gold Sovereign is how many grams?

The total weight of a newly minted Sovereign is 7.98 grams. The old content itself weighs 7.32g, with the remainder consisting of a copper and silver alloy. Coins may weigh slightly less as they become older and wear on the face and edges.

19) Is a gold Sovereign legal tender?

Click https://www.physicalgold.com/insights/is-a-gold-sovereign-legal-tender to read a separate article, which answers this question.

You could spend a gold sovereign if you wanted to, but with a value of only £1 it would be unwise

20) Gold Sovereigns or Britannias – which are the best to buy?

Read our comprehensive article about gold sovereigns and gold britannias to this question at – https://www.physicalgold.com/insights/gold-sovereigns-or-britannias-which-are-the-best-to-buy.

21) Gold Sovereigns or Krugerrands – which are the best to buy?

Read our detailed article here – https://www.physicalgold.com/insights/gold-sovereigns-or-krugerrands-which-are-the-best-to-buy, which answers this question.

22) How much gold is there in a gold Sovereign vs a Half Sovereign?

Click https://www.physicalgold.com/insights/how-much-gold-is-there-in-a-gold-sovereign-vs-a-half-sovereign for a detailed answer to this topic.

23) What is the difference between a sovereign and a half sovereign?

We have provided a detailed response to this question at this link – https://www.physicalgold.com/insights/what-is-the-difference-between-a-gold-sovereign-and-a-half-sovereign/.

Talk to our experts before buying or selling gold sovereign coins

We always love to hear from customers, new and old and are always here to answer questions about all precious metal topics including ones about gold sovereign coins. Why not call Physical Gold Limited now on 020 7060 9992 or complete our contact form. We look forward to hearing from you soon!

Gold Sovereigns have been in circulation for over two centuries, making it one of the most popular iconic British coins with a large secondary market. The Royal Mint struck these coins, using 22-carat gold from the year 1817. They have now been put out of circulation and are available as a bullion investment coin. The iconic design of St George and the Dragon, created by Benedetto Pistrucci make these coins unmistakable and they are in great demand from numismatists and investors alike.

Gold sovereigns can carry hefty premiums depending on the monarch and the year. For example, the Young Head Victoria can fetch prices of around £300. There are even rarer ones like a proof set created for Edward VIII. A single coin from this set can command a price of £516,000. So, investors need to know how to sell these coins in order to maximise their profits.

Selling a gold Sovereign can be very lucrative

Identifying a reputed online dealer

Since the Sovereign carries a numismatic value as well, as its value in gold, it’s best to sell your Sovereign gold coins to a reputable gold dealer. This will ensure you receive a fair price that reflects the gold content and the numismatic value of the coin. Members of the British Numismatic Trade Association (BNTA) are trustworthy. Going through a reputed dealer can get you access to a wider secondary market, increasing the chances of a quick sale at a good price. Preparing to sell is a key factor. If you want the best possible price, let the dealer know in advance that you want to sell your Sovereign coins. It’s important to let your dealer know about the complete details of all the coins you want to sell. You must decide on a timeline for the sale. This will help your dealer identify the right buyer and bring the coins into the market at a time when the best price can be achieved. Don’t be in a hurry to sell, unless you need the funds for an emergency. A distress sale is always likely to get you a far lower price.

Click here to download the FREE 10 Commandments when selling gold coins

Attempting a private sale

Some investors believe that they can get a far better price by arranging a private sale. But, be aware that it may not be possible for you to check the backgrounds of the buyers. It could be risky to have them visit your home. As an individual investor, it is unlikely that you will have a large network of interested buyers. So, you will be forced to depend upon only a few interested buyers who may have responded to your ad. Of course, it may also take a lot of time and effort to post your ads and reach out to the right audiences. A dealer would be far more adept at reaching out to interested parties.

Research your dealer well

You aren’t forced to sell through one dealer only. If you identify two or three reputed dealers, feel free to engage all of them. Doing your research means connecting with other investors and buyers in the marketplace. Find out all about a dealer’s reputation and background by speaking to other investors and viewing their ratings online.

Contact Physical Gold for the best way to sell your gold Sovereign

An effective way to properly market your gold Sovereign is to simply speak with our investment team. Physical Gold Limited is registered with the BNTA and have a long track record in providing exemplary service. Getting in touch with our team is easy. Simply call (020) 7060 9992 or visit our website to reach out to us.

Image credit: Wikimedia Commons

One of the most common questions I hear is from keen investors wanting to know the best gold coins to buy as an investment.

The most important thing people seem to overlook is the ease in which you’ll be able to sell the coins. It sounds obvious, but so many buyers focus purely on trying to get as much gold for their money when they invest that they forget to consider the liquidity of the gold.

Liquidity makes the best gold coins

Remember that your profit is only realised on physical gold when you actually sell the coins at a profit. So when buying coins your primary focus must be on choosing well-known coins in desirable condition. So please don’t be tempted by an obscure coin just because its £10 cheaper than its globally renowned alternative. With this in mind, any of the well-known bullion coins are a safe bet. These could be Sovereigns, Britannias, Krugerrands, Eagles, etc. You can find a comprehensive list with thorough descriptions at Bullion coins.

A novice should never try to be too smart by delving into the world of numismatic or historical coins. These generally present high potential profit, but also large losses for those without market experience. Proof coins should generally be avoided by the gold investor as you won’t necessarily get the full premium back that they command.

Sovereign coins

For very modest investors it can be fun to select a variety of bullion coins for your portfolio, perhaps choosing some Sovereign coins with an interesting background or coins with beautiful designs.

Queen’s Beasts coins

For those seeking a chance to turbo charge their returns and willing to take a modest increase in risk, the Royal Mint’s Queen’s Beasts series of coins can be a clever option.

This is a series of 11 one ounce 24 carat gold coins (also produced in silver and fractional versions), which are limited in issuance. In contrast to the Britannia or Sovereign bullion coins which are unlimited and mass produced, the Queen’s Beasts coins have been released coin by coin, every 6 months. Once a particular version is all sold, they’re not produced any more.

This relative scarcity, combined with a degree of collectability, has pushed up premiums on these coins far quicker than standard bullion coins.

While the first 8 coins in the series already command high prices, the most recent 2-3 coins are still being produced, albeit not for long. Therefore, premiums on the most recent releases are still only slightly higher than the standard Britannia. While there’s no guarantee that their prices will mirror the earlier coins in the series, there’s a good chance.

Tax efficiency

However, for those UK investors considering a more sizeable investment you must consider factors such as tax. Capital Gains tax was recently increased for higher rate tax payers in the UK to 28%. That means that if you sell your gold coins at a profit exceeding your annual limit (currently around £12k) then you’ll pay away almost a third of that excess to the taxman. Any other assets you sell in that year will use up that £12k limit too. So if you sell shares or an investment property and make a profit, you’ll no doubt be paying CGT on all your gold profit!

Download our FREE 7 step cheat sheet to successful gold investment here

The great news is that with some careful planning and help from a reputable gold dealer, you can source tax free gold coins. Britannia, Sovereign and Queen’s Beasts coins are all free from Capital gains Tax for UK residents due to their status as legal tender. Quite simply the taxman cannot tax the movement of legal currency. For this reason, together with the fact that these two coins are amongst the world’s best known, most UK investors are best off investing into these tax free gold coins.

The most important rule with gold coin investing is that everyone’s situation, needs and motivations for buying differ, and so the best gold coins to buy may also vary. This is where the real value of a knowledgeable gold dealer pays dividends!

Economic instability

With central banks around the world still printing QE money going into 2022 to support their Covid-affected economies, the value of fiat currency is diminishing. Signs of inflation, possible interest rate increases and tax hikes, suggest to many experts that a global recession, the size of which we’ve never known, is upon us.

It’s no surprise then, that investors are increasingly turning to gold to provide some diversification and protection from the coming economic storm. But if most people are asked which gold coins to buy, they will be stumped.

The Krugerrand coin is one of those coins which most people, even my grandmother, have heard of and this is for good reason. For many, it represents one of the best choices of gold in which to invest your hard-earned money.

A South African coin first minted in 1967, the intention was to lure global investment into

To appeal to the investment market it was the first coin to contain exactly 1oz of pure gold, ensuring a straightforward marketing proposition compared to the likes of a Sovereign which contains 0.2354oz. Interestingly this fixed gold weight rather than a fixed face value (like most other bullion coins) meant that the Krugerrand coin represented a convenient store of wealth regardless of inflationary levels.

Krugerrand coin most common globally

Despite no face value, the coin is legal tender in its home country and is therefore minted in a durable alloy mix. Its overall gold content is 22carat or 91.67% pure as the gold is alloyed with copper to provide resilience and maintain its integrity. This is one of its major selling points now. With approximately 50 million in circulation, it represents one of the most active secondary markets in gold coins and a vast majority of the Krugerrands we see of 30 or 40 years old are still in fantastic condition.

Indeed due to the huge number in circulation and its global recognition, the depth of the Krugerrand’s liquidity is only matched by that of the British Sovereign, a coin that has built up its liquidity over many more years. There are more Krugerrands in circulation than all the other gold bullion coins combined. As an investment into a physical asset, this is very important. Just like when buying and selling a house, it is not only the price you manage to purchase the property at but also the sale price which will determine your profit. If you buy a house for a great price but it’s on the main road and appeals to a very niche market, then it is more difficult to sell and the eventual sale price will inevitably be affected. The same goes for gold. Buy a Krugerrand and you’ll be able to sell the coin easily at any time, maximising your chances of securing a good price.

Download the 10 secrets to selling your gold coins at the highest price. FREE pdf here

Incredibly by 1980, the Krugerrand coin accounted for 90% of the gold coin market. It’s a telling recognition of its success that it has spawned so many other copycats worldwide including the Canadian Mapleleaf in 1979, the Australian Nugget in 1981, the American Eagle in 1986 and the UK Britannia in 1987.

So the Krugerrand is a very liquid coin, easy to buy and sell and it maintains its condition well. But how does it’s price compare to other 1oz bullion coins? From what we see at Physical Gold Ltd, the Krugerrand offers amongst the best value of ANY 1oz gold coin. Due to its resilience to scratches, I’d recommend buying second-hand coins rather than the most recently minted. Like a new car’s premium, it’s almost always better value to buy a ‘nearly new’ version. Brand new Krugerrands can be 3-5% more expensive. I’d also try to steer clear of the smaller half, quarter and 1/10th ounce versions as premiums rise with each smaller coin. I’d also avoid Proof versions of the coin. Although pretty, I’m not convinced you’ll receive the same premium that you paid for the coin when you come to sell. Your best bet is to stick with the better value bullion version.

The only potential drawback I see for UK investors as that of Capital Gains Tax. Like a majority of other assets, any profits on Krugerrands have to be declared and are liable for tax of up to 28% if you breach the modest thresholds. Now, this may not be an issue if you only buy a handful of Krugerrands, have no other assets to breach your tax-free threshold or, the sin of all sins, decide not to declare the sale to HMRC.

However, for those playing by the book who invest £10k or more into gold coins, the last thing you’ll want to do is give almost a third of your profits back in tax. For this reason, we always prefer mixing Krugerrands with a portfolio of coins such as the UK tax free coins – The Sovereign and Britannia. This way a shrewd investor can dispose of these assets strategically so they never pay any tax at all!

Contact Physical Gold

Is a Krugerrand a wise investment? You bet! Why not contact Physical Gold Limited to discuss Krugerrand gold coins and silver coins investment. Call us on 020 706 0 9992 to also discuss buying gold bars and silver bars too. Visit our contact page for general contact information.

Collecting gold coins

If you’re a coin collector, numismatic scholar or just a hobbyist with an interest in gold coins, it’s likely that you already have a great deal of knowledge of the UK gold coin market. Turning that knowledge into a profitable investment for your future is a very realistic endeavour, especially given the positive state of today’s gold coin market.

As you may already be aware, there’s a sweet spot in the UK market at the moment for semi-numismatic coins. In particular, Victorian, Edwardian and Georgian sovereigns are trading at higher prices than brand new sovereigns. These higher prices are due to the scarcity of these coins compared to their newer compatriots. This presents a prospective opportunity for collectors, who may wish to retain their collection for now, in anticipation of a potential value rise as the coins age. The alternative is to cash in on an existing opportunity to trade the coins, at a price currently above their intrinsic gold weight.

If you’re new to collecting gold coins, it is important for you not to make mistakes when buying gold coins. One of these is purchasing from a TV infomercial. There are many TV commercials which promise collectors on the best deals on the rarest of rare coins. The problem with buying off these shows is that it will never be the best deal, no matter what they say.

10 steps to maximizing your profits with gold coins. Download the FREE PDF now

Simple logic should tell us that there are exorbitant marketing and advertising costs involved in selling coins in this manner, including the costs of producing the infomercial. These costs will be added on to the price of the coins, making them a lot dearer. Another point to consider is the rarity of the coin. If a coin is being mass marketed through advertising, it means there is a huge supply of the coins in order to meet the demand. This also means that they cannot be very rare, and often these commercials talk about the rarity of the coin in a bid to lure you into purchasing. A quick online search of the same coin will prove that it is available from other reputable sources online and offline dealers often at far more reasonable prices.

Gold Coins Investment

Gold investment research sources

It is also important to research a coin properly before purchasing it or speak to a gold investment expert. A good starting point is the Numismatic Guaranty Corporation (NGC) or the PCGS. Both of these are reputed coin certification companies and their websites contain a wealth of information about rare coins and their values. Another great source of information about which rare coins to buy are the mints around the world, like the Royal Mint. When buying a rare gold coin, one must ensure it is certified and graded by a professional grading service. If the coin is in a slab, it should have been encapsulated by the NGC or PGCS, otherwise, it may not be in a condition that the seller claims it is in. Likewise, one should never remove a coin from a certified slab as it would affect the value.

This is crucial….

Another point to note is that a rare coin should never be cleaned. Cleaning it with solutions will simply damage the coin and erode its value. Touching a coin with bare hands is yet another complete no-no. Coins should only be handled when wearing gloves. Last but not least, when a coin is sold as a low mintage, it does not mean that it is rare. The intrinsic value of a rare coin is directly proportional to its demand, not to the numbers that were minted.

Numismatic gold coins

The above scenarios are two examples of opportunities available to utilise your knowledge of coins for your benefit. The value of gold coins is based on their gold content, coupled with a further premium reflecting their historical worth and scarcity. Because numismatic coins are valued this way – both on gold weight and historical value – it’s possible to achieve greater gains than you may otherwise be able to achieve, if you were solely investing in modern coins. This can be particularly true if you begin to save now, for the longer term, or have amassed a collection already which you’re willing to start liquidating

What should I be aware of…

However, if you’re just starting out in your coin collecting and investing, it’s wise to take care when interacting with numismatic or semi-numismatic coins. As some trade significantly above their intrinsic value, it’s feasible that you’ll pay a much higher premium. And whilst you may be able to recoup this premium upon sale, you may find yourself in a situation where it’s difficult to find a specialist buyer willing to match your valuation.

Specialist collectors may also wish to add to their holding with modern gold coins. Agility is required to capitalise on semi-numismatic coins, as they need to be purchased when premiums are low and sold at times when premiums rise. However, new sovereigns can be used to add flexibility to your collection and ensure you enjoy the benefits of owning gold coins over a longer period.

Help from Physical Gold

Whether you’re a new or experienced collector of coins, Physical Gold can help with information on your collection, whatever your financial requirements. To learn more about how we help collectors and private individuals just like you, contact us here, call 020 7060 9992 or download our Guide to Investing in Gold and Silver.

Image Credit: Prawny

Gold Britannia coins are popular with numismatists and investors alike. We frequently receive questions about these popular coins, so have prepared this page of gold Britannia coins FAQs with answers, which we hope helps you with your research.

What are the cheapest Britannia gold coins?

Please visit https://www.physicalgold.com/insights/what-are-the-cheapest-gold-britannia-coins to read a comprehensive answer to this question.

How do I sell Britannia gold coins?

Please refer to our detailed answer to this question by clicking this link.

Are gold Britannias legal tender?

Read our answer to this especially important question here, https://www.physicalgold.com/insights/are-gold-britannias-legal-tender.

Are gold Britannias a good investment?

Please visit https://www.physicalgold.com/insights/are-gold-britannias-a-good-investment/, for a detailed reply to this question.

Gold Britannia vs Sovereign

Please read our detailed answer to this question at this link.

Buy the Gold Britannia coin directly from Physical Gold Limited

Was Britannia on Roman coins?

Britannia has actually appeared on Roman coins since 119 AD. The practice of using the persona of an authoritative female to portray a nation has existed for hundreds of years. When the Romans invaded Britain, they used the depiction of Britannia to signify the colonised country on their coins.

Can you get Platinum Britannia coins?

We have provided a separate blog post to answer this question, please see https://www.physicalgold.com/insights/can-you-get-platinum-britannia-coins.

Should I buy old or new Britannia coins?

For a detailed reply to this question, visit this link.

What is the value of Britannia gold coins?

See https://www.physicalgold.com/insights/whats-the-value-of-gold-britannia-coins/ for a detailed answer to this question.

Which years does Britannia face left?

There is no pattern to which way Britannia faces on the reverse of UK coins and this adds to the collectability. Examples of Britannia facing to the left include the 2001 ‘Una & The Lion’ Britannia and the 2005 Philip Nathan designed coin which features a seated Britannia.

Who is Britannia on the coins?

Read our detailed answer to this question at https://www.physicalgold.com/insights/who-is-britannia-on-the-coins.

What are Britannia gold coins?

Please read our detailed answer to this question by clicking this link.

How to buy gold Britannia coins?

The best place to buy Gold Britannias is directly from a reputable bullion dealer. Most will have online stores where Britannias can be bought with a variety of payment methods and delivery is usually free, insured, and quick. These sites usually feature live pricing which updates with the spot price every 60 seconds. Bullion dealers should be members of the BNTA to ensure trustworthiness.

Do you have any more questions?

No worries, if you need any further support, please contact us at:

- By phone – 020 7060 9992

- By contact form – https://www.physicalgold.com/contact

You can’t go wrong with Sovereign coins

While most UK investors have owned property, shares, bonds and ISAs at some point, gold investment is still pretty new. If you’re a novice, what’s the best place to start a physical gold portfolio? In our opinion Gold Sovereigns provide a perfect starting point for the new gold investor!

1. Great value – Sovereign coins have existed for hundreds of years so there’s a very deep second hand market. This means that older Sovereigns provide a lower price per ounce as than any other gold coin – perhaps along with Krugerrands. Buying any asset at a low price is a great starting point!

*Pro-tip: Buy the pre-owned ‘Best value’ Sovereigns. They’re cheaper than brand new ones, but will obtain the same price when you sell.

2. Further discounts with volume – Specialist dealers like Physical Gold will generally be able to offer even lower prices if you buy 50 Sovereigns or more. In fact discounts can be achieved on a sliding scale once you look at more than a single coin. Our website has handy volume discount tables for each coin.

3. Easy to sell – Sovereign Gold Coins are arguably the most established bullion coin in the market so you’ll always be able to sell the coins at a great price. If you try to sell an obscure coin, the reduced number of buyers will be reflected in a lower price per ounce for that piece of gold

*Pro-tip: Give your dealer a week or two notice that you wish to sell, and you may achieve a slightly higher selling price if the dealer can match up your sale with a buyer.

4. Affordable – While 1oz gold coins are now trading around the £1,400 mark, Sovereign coins are around a quarter of the size and price. This provides a great opportunity to dip your toe in the market or even set up a regular gold savings scheme, whereby you receive a Sovereign coin every month

5. Tax free – Sovereigns are VAT exempt like all other forms of investment grade gold. However, they have the huge added benefit of also being Capital Gains Tax free due to their status as legal tender in the UK. For a novice seeking to buy gold, this provides peace of mind that you’ll never be hit with a tax bill

6. Flexible – Due to their small size, even a modest investment of say £2,000 will provide 6 Sovereign coins. This provides versatility that you can sell as little as one coin at any time of you need to realise some cash. Larger coins or bars do not offer this flexibility

7. Talking Point – The sheer variety of issue dates and Sovereign heads available means that a novice investor can own a piece of history as well as a superb investment. For anyone who’s enjoyed watching The Crown on Netflix, modern Sovereign coins date back more than 200 years, reflecting the various monarchs and periods of reigning.

So if you want get started in the world of gold, buy Gold Sovereigns and you won’t go far wrong.