Buying Gold and Silver Bullion

Gold and silver bullion commonly refer to bars rather than bullion finish coins. Precious metals merchants generally buy and sell both metals so it’s possible to buy gold and silver from the same place. There are certain distinct advantages to buying bullion. The most important advantage is the elimination of counterparty risk and taking control of one’s wealth. Counterparty risk refers to the risk associated with the promise of delivery from a third party. If you invest in gold company stocks, paper gold or other gold instruments, you open yourself up to these risks. Therefore, buying gold and silver bullion can be an excellent strategy to minimise risks and maximise returns.

Click here to download the FREE Insider’s Guide to Buying Gold and Silver Bullion

Knowing the spot price of gold and silver

The first step in purchasing gold and silver bullion is to know the spot price and how it works. Nowadays, it’s very easy to find out the prevailing spot prices of these precious metals. Most reputed online dealers and regulatory bodies like the LBMA display the spot price on their website. Since the spot price is a dynamically changing number, it will be displayed as a ticker. It’s important to understand that you will never buy gold or silver bullion at the exact spot price. When buying, you would likely pay a small premium, over and above the spot price. Similarly, when selling, the price you achieve will be slightly below the spot price. Researching the spot prices and knowing about the market is an essential first step to buy gold and silver bullion.

Buying bullion coins can generate healthy returns

Getting to know a reputed dealer

Another important step in making the right investments in gold and silver is to go through a reputed dealer. Firstly, a high-street gold seller will not have a wide choice of products available to purchase. Secondly, making high-value purchases on the high street is usually a risky business. Check out the company’s track record and reviews before placing an order online. It may be worth calling them first to check their customer service. Larger bullion will be better value, but divisibility should also be a consideration.

Gold bullion bars carry lower production costs

At Physical Gold, every product we sell comes with a buyback guarantee. This assures customers that the gold bullion they buy from us is certified and genuine. This also makes a difference to buyers, as they can sell off their investments easily through the same dealer. It’s important to do your own research when selecting a dealer so that you can pick the right one.

Dangers of buying from Mints

Another way to buy gold and silver coins is to buy it directly from the Royal Mint. If you choose to buy non-UK bullion, there are other reputed mints in the world, like the Perth Mint in Australia, from where you may be able to purchase your bullion online through their websites. However, you may end up paying more for packaging and processing costs. Many reputed mints will also try to sell you proof coins. These are more polished and better looking and attract higher prices due to their finish. However, you must bear in mind that the gold and silver content remains the same. So, you are unlikely to receive a higher price at the time of selling, simply because they are proof coins. If your objective is to maximise your gains, you may be better off picking the right bargains from the secondary market through a dealer.

Get in touch with us to plan your gold and silver bullion investments

The economic crisis of the post-pandemic era has already started unfolding through the first half of 2020. Many investors are moving to precious metals in order to hedge their risks. If you are thinking of buying bullion, call us directly on (020) 7060 9992, to discuss your investments. We are certain you can benefit from the right advice. You may also reach our investment team through our website.

Image Credits: Tony Media and Pxfuel

physical gold index page

Value of gold bars

When most people think of gold, they imagine the classic gold bars from films. But how much is a gold bar actually worth?

In this video, you’ll discover the 5 proven factors to calculate the value of a gold bar. By the end, you’ll learn how to buy and sell gold bars at the optimum price.

1. Gold spot price

The starting point with calculating the value of a gold bar is the current spot price. This is a moving gold price, displayed in ounces and grams and in various currencies. This isn’t the price where you can buy and sell gold but instead acts as a benchmark to calculate prices. You can see live prices at the top of websites like our own and historical price fixes on the LBMA website.

2. Weight

It may come as no surprise that gold bars are minted in a

Retail sizes are also commonly available from 1g to 1oz, 100g, up to 1kg. The next step to calculating the value of a gold bar is to multiply the spot price with the weight. So if the spot price of gold is £30/g and the gold bar weighs 100g, we simply multiply £30 x 100g = £3,000.

Find out how to buy 1kg gold bars here.

3. Buying or selling premium

As I mentioned at the beginning, £3,000 isn’t the price you can necessarily buy and sell the gold bar at. In fact, you’ll pay slightly more when buying the bar and receive slightly less when selling it. This is known as the bid/offer spread. An easy comparison would be when obtaining travel currency. The Sterling Dollar rate may be quoted at 1.33, but you can buy Dollars at 1.30 and sell at 1.35.

Because gold bars have no historical value, the premiums you’ll pay above the spot price are modest. Coins, on the other hand, can be worth more per gram due to a historical and scarcity value. We study the merits of gold coins versus gold bar investment, focussing on five key factors.

Higher quantity and size reduces the premium

The general rule of thumb is that the larger the gold bar, the lower the premium you’ll have to pay. Similarly, buying a large number of bars will also reduce your price per gram.

The bar brand can also impact the value when buying. Certain top-end Swiss brands will be more expensive than a near-identical bar of the same weight, manufactured by a lesser-known brand.

Focus on value, not brand

My advice is to buy the best value bar as long as its gold content is 99.99% pure.

When selling a gold bar, you’ll likely receive a slight discount to the spot price value, usually around 2%.

[button size=”medium” style=”primary” text=”Shop Gold Bars” link=”https://www.physicalgold.com/buy-gold-bars” target=”_blank”]

4. Tax impact

One overlooked aspect of a gold bar’s value is Tax. Gold bars are VAT-exempt so tax doesn’t play a role in its value when buying. However, when selling gold bars, it’s possible any price you receive will be taxed for Capital Gains. This will only apply if you’ve made more than £12,000 profit on the sale when compared to the price you paid. Even then, tax is only applicable to the profit above this threshold. It’s also possible to sell some gold bars before the tax year-end and some afterwards to spread your profit and avoid incurring tax.

If you are considering purchasing a larger quantity of gold and want to remain tax-efficient, then UK coins could be a better option than gold bars due to their CGT-free status.

5. Timing

Clearly, the value of your gold bar will vary with time. While the gold spot price moves, so will the value of your gold bar.

But to really maximize the price at which you sell your bar, or minimise the price at which you buy, you should consider market sentiment. If you can buy when the market is very quiet, there’s every chance that gold dealers will reduce premiums or offer sales to move stock.

In the same way, if you can sell your gold bars when market demand is high, then dealers may improve the prices they’ll pay, as they know they can re-sell them quickly.

Buy gold bars from Physical Gold

If you’re looking to buy or sell gold bars, or want some guidance on the market, then feel free to contact us at www.physicalgold.com.

Our team are available 7 days a week on 020 7060 9992, live chat on the website, or you can leave a callback request here.

If you found this video useful, then please check out our other videos here which cover our most common questions on both gold and silver investment (including bars and coins).

Guide to Buying Gold Bars

In this video, we’ll explain 4 key considerations when buying gold bars, so you know exactly how to get the most from your purchase. We cover the Why, what, where and how of buying gold bars. Stick to these guidelines and you’ll source the best gold bars to meet your needs, at the lowest possible prices.

Why Buy Gold Bars

The best place to start is to ask yourself WHY

So why would you choose to buy gold bars rather than coins? Well, the main reason investors choose gold bars is value. If you’re seeking the lowest cost of physical gold per gram, then gold bars can be the best choice.

Gold bars come in a range of weights and sizes, with the bigger retail bars coming in at a kilo in weight and the commercial bars weighing a whopping 400 ounces! Because bars are available in much bigger sizes than coins, the relative manufacturing cost is far lower, reducing the overall price per gram. Designs on coins are also more intricate, further increasing manufacturing cost versus gold bars.

What Bars to Buy

Next up, I’ll tell you exactly how to choose the best bars to purchase. The ‘what’ can be split into bar size and bar brand.

While the price per gram reduces as the gold bar size increases, it doesn’t mean you should go out and buy the biggest bar you can afford. Agreed, buying a 1-kilo gold bar provides great value, but this choice can seriously hamper your divisibility. Owning one large gold bar means you can’t sell part of your portfolio…it’s all or nothing. A far better choice is to buy a number of smaller bars, providing flexibility to sell part of your holding at any time. While small bars are more expensive per gram, most dealers will offer discounts if you buy higher quantities of them. The amount you wish to invest and your overall cashflow will help you find the sweet spot between size and quantity.

So, how about the brand of the bar. Does it matter? Generally speaking, the answer is no. Certain premium brands such as Pamp will sell their bars significantly higher than many other reputable brands. I’d avoid buying brands at the top end as you probably won’t receive a premium for them when you come to sell.

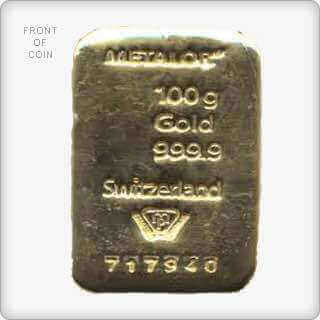

However, it is important that you ensure you buy brands that have the following 4 pieces of information stamped on them.

Weight

Purity – don’t buy less than 99.99%

Refiner stamp

And serial number

Private mints may not include these, so stick with well-known brands like Metalor, Heraeus and Umicore.

My TOP TIP – Some dealers also offer pre-owned gold bars. These may not be brand new but will be available at a discount to brand new bars. Don’t forget that you’re looking at gold content with bars, rather than anything else, so reducing your purchase price in this way will increase your profits.

Where to Buy Gold Bars

With the increased value of larger gold bars, it’s no surprise that criminals target them to forge. Gold bars are easier to forge than intricately designed gold coins, usually by filling a thin outer shell of gold with cheaper material. So buying gold bars from a reliable source is crucial. The best source of gold bars is specialist gold dealers. But how do you know they’re reputable?

The answer is, do your research, but there are 5 key indicators to look for;

- Have they got a track record? Being around for 10 years or more may not guarantee the quality, but it suggests they’ve pleased enough customers to be in business that long

- Check out their reviews. Services such as Trustpilot allow customers to make uninvited anonymous reviews, avoiding dealers handpicking customers for review.

- Buyback policy. Does the dealer have a policy in place to buyback what it sells? If they don’t want to buyback the gold, why would you want to buy it in the first place?

- Ensure the dealer is a member of an established association such as the British Numismatic Trade Association (BNTA)

- Finally, delivery promptness. Ask them how long the bar will take to despatch. Most bars should be in stock and despatched as soon as funds clear.

How To Buy Gold Bars

- Choice and no hassle. Browsing an online gold store means you can research different prices and bars from the comfort of your own home. You can purchase at any time of the day, meaning you can lock in prices whenever you want. This can enable you to secure a low price when the market dips, rather than having to physically find a dealer before prices bounce back up.

- Usually, online dealers will be able to offer lower prices than physical shops who have to cover additional costs like expensive West End premises

- While walking out of a shop with a gold bar under your arm sounds exciting, it makes you a prime target for thieves. Insurance won’t cover loss, so your gold investing could come to an abrupt end. Buying online is far safer. Delivery is fully insured to your door, and with some dealers is completely free.

So, they’re the 4 key considerations when buying gold bars. Once you’ve found a reputable dealer, don’t be afraid to ask for their guidance. They should be able to recommend which weight and quantity combination best suits your needs.

If you need your gold bars stored by professionals, most dealers will offer a vaulting service.

Ask if the storage includes insurance and whether your gold is ring-fenced (known as segregated).

Let us help

If you’re ready to buy your gold bars online from us, simply shop here. If you have further questions, need guidance, or would like to discuss the merits of gold bars versus gold coins, then please get in contact. We can be reached by calling 020 7060 9992, through live chat on the website, or by contacting us here.

Don’t forget to check out our full suite of video guides.

Luckily for the average investor bullion bars are available in many sizes to suit even the most modest pocket. Bar weights come in both imperial and metric denominations. The common weights you’ll see are 1g, 2.5g, 5g, 10g, 20g, 1oz, 50g, 100g, 5oz, 250g, 10oz, 500g, 1kg, and 12.5kg.

Various bullion bar producers

There are thousands of different producers of bars and many of the top refiners are members of the London Bullion Market Association (LBMA) which provides accreditation and guarantee of quality. Some of the best known manufacturers are Credit Suisse, Johnson Matthey, Pamp Suisse and Umicore. Each may produce bars of equal gold content and weight, but with varying dimensions and shape. All will be regarded as 24 karat which is virtually pure gold and is often quoted as 99.99% pure. Some bar refiners will offer certification and serial numbers on some of the smallest bars, while others only provide documentation for bars of 250g or larger.

The main advantage of investing in gold bars

is that you will more often than not receive the most actual gold for your money as their value solely consists of their gold content. However, a popular misconception is that bars can be bought exactly at the gold spot price. This is never true unless you are a large central bank dealing in tonnes of gold! In practice, the spot gold price is the benchmark from which all types of investment gold are priced. Gold bars will generally trade at a narrower premium to gold coins and this premium falls as the size of the bar increases. Obviously, when selling back a 1oz gold bar, you will no doubt receive a lower price from a dealer than its equivalent-sized coin (such as a 1oz gold Britannia).

Bullion bars are a great long-term investment

While a gold bar is the most efficient purchase for someone looking to melt down the gold for jewellery, it can present some obstacles for other investors. The very fact that it’s 24 karat gold means that unless the bars are kept in a specialist depository, it can scratch and tarnish. This can affect the price you’ll receive when selling the bar.

Ease in selling your bars can be affected by two other factors. Firstly make sure that you buy a well-known manufacturer, as there are many obscure producers whose bars may be more difficult to sell. Secondly, while purchasing larger bars may save a couple of per cent off the buy price, you cannot break this bar up if you only want to cash in some of your investment. You may find a 1kg bar may be more difficult to sell than a 1oz bar as there are fewer buyers. Finally, unless bought as part of a pension, the profit made on the bullion bars is taxable. If you’re keen to own gold bullion as part of your pension, then bullion bars are the only type of gold that qualifies. Gold coins (such as Sovereigns) of any type are not currently permitted into UK pensions. The advantages of Pension gold are that you receive up to 40% discount off the price of bars through tax relief, the bars are in 1oz denominations offering full flexibility, and are stored in a licensed gold depository – maintaining the integrity of the bars.

Gold Bullion Bars

Bullion Bars are more practical if you are planning on buying a large amount of gold and wish to save your money this way for a long time before cashing it in as whole for a lump sum. When storing a lot of gold, gold bars are generally the easier and more practical option. This is why you will often see that central bank reserves of gold are kept in blocks of 400 Troy ounce gold bullion bars.

One kilo gold bars always make a stunning addition to any investment portfolio

Gold Bars

Gold bars don’t have to be restricted to huge amounts of cash either, as they are available in a range of sizes. While the trading of gold bullion bars won’t necessarily be as fluid as coins, you may prefer bars so you can trade it in at a later date as a nest egg.

You can choose to store your gold bars either at home or in a bank, but it is vital to ensure it is secure and protected. Any damage to the surface of the gold can lower its value, and with higher purity gold – tarnishing is more likely. If you are choosing to store your gold at home, it is also important to ensure you inform your home insurance company and have somewhere safe and secure where it can be stored such as a safe.

Buy Gold Bars

Physical gold is a popular form of insurance for those anticipating the event of complete financial or societal breakdown – as gold is likely to retain its value and still be easily traded as a form of currency. Saving for the future is important and by choosing to buy gold bars, you can ensure you protect the value of your money and hedge against inflation.

Gold as a safe haven

In the present economic climate, there is global uncertainty across all the continents. This uncertainty is geopolitical in nature and not necessarily linked to financial markets. However, due to its knock-on effect on global capital markets, financial markets have taken a huge hit as well. In Europe, we are dealing with the never-ending uncertainty surrounding Brexit, while the US markets are dealing with two issues. The first is the trade war with China, which has had a domino effect across the world.

Consequences of Trump’s policy

Then there’s Donald Trump’s foreign policy and internal policies, which seems to be stemming from a wave of protectionism and nationalism. This has led to a hostile environment for immigrant workers, particularly for those in America on H1B visas. For India, a country that depends on earning its petrodollars through the export of IT workers to US firms, this has created a sizable dent, if not significant, which has, in turn, had an impact on real estate markets within the country. Banks and mortgage companies have historically depended on steady pay increases of employees within the country’s burgeoning IT sector.

Suddenly, the immigrants are returning, outsourcing from US firms are thinning out and along with it, the money supply is drying up. As banks become increasingly tight-fisted when it comes to approving mortgages, buyers have disappeared from real estate markets in major cities, causing the markets to go stagnant. So, you can see how economic and political conditions in one part of the world has an impact on a completely different part of the globe thousands of miles away. Political ambiguity, the war on terror, it all adds up. In the meantime, we are again witnessing the rise of gold prices. Through August 2018, the COMEX gold price has started steadily climbing from around $1,180 to $1,220 and finally settling in at $1,206. Historically, we have seen that investors always return to gold as a safe haven during times of turmoil and our current times are no different.

Gold as a stable investment avenue

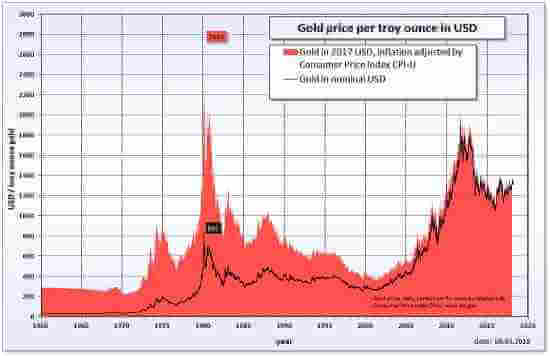

Gold has proven to be a stable asset class over the years. While it’s true that the price of gold does fall periodically, gold has eventually triumphed over the years, holding strong and proving to be an asset class with rock-solid fundamentals. Let’s take a quick look at how gold has fared over a twenty-year period – 1996 to 2016.

Buy bullion low, sell high….

A quick look at those figures shows fewer falls in gold prices than rises. Notably, there are significant highs in 2002 and 2003 where prices rose by as much as 23.96% and 21.74% in the consecutive years. Once again, shortly thereafter gold closed at $836.50 per troy ounce in 2007, a significant rise of 31.59%. Thereafter, in 2010 we saw the price rise to $1,420.25. So, in comparison, the August 2018 price of around $1,220 per troy ounce could once again be a movement towards a similar direction. Investing in bullion bars follows a philosophy of buying low and selling high, so now be a good time to invest in bullion bars. Among the many types of gold investments, bullion bars provide you with 999.9 purity gold, which is a great all-time investment. The other option would be bullion coins, or coin sets, which you can also purchase from Physical Gold, although it’s more of a preferred option for numismatists.

Buying bullion bars from Physical Gold

Physical Gold is a highly reputed gold broker with a BNTA membership, giving you peace of mind when you invest with us. Our prices are extremely competitive and offer customers great value for money in building a portfolio with us. Our pricing structure even offers customers like your discounts as you buy more bars. Every gold bar we sell is vetted, tested and verified to be 100% genuine. If the product doesn’t meet our stringent standards, we don’t sell it. We issue a genuineness certificate with every product we sell and even offer a buyback guarantee for each product.

Of course, if you’re unsure in any way about which product is best for your investment goals, our investment advisors are always there to help you along the way. Our team of advisors have several man-years of expertise in the precious metals business and all you need to do is discuss your long-term investment goals with a member of the team. We will then work out a solution that’s right for you and revert to you at the earliest.

Call us today on 020 7060 9992 or simply drop us a line by filling out the contact form on our website. We will be more than happy to schedule a call with you according to your convenience, which could be the best call that you ever made.

Image credits: Wikimedia Commons and Pixabay

An excellent investment to build your gold portfolio is a 1kg gold bar. Even if you are starting out on building your gold investment portfolio, a 1kg bar is a great way to start. However, when making a firm commitment towards investments in gold, you need to be sure that you are buying from a reliable gold dealer.

Buying gold from Physical Gold

Our star product is the Metalor 1kg gold bar which is available at a starting price of £31,322. The current price of gold is $1313.40 per troy ounce. This works out to around £955 for 31.10g. Physical gold incentivises customers to buy more, so, when you buy in excess of 10 bars, you save £135 per bar. This works out to a saving of £1350 for 10 bars. The Metalor bar, manufactured by Swiss maker Metalor is made of pure gold with a fineness of 999.9.

The dimensions of the bar are 117 X 52 X 9 mm. The product is recognised by the London Bullion Market Association (LBMA), the world’s foremost authority in bullion products. The LBMA sets global standards for the purity and form of the products that are traded. So, customers can buy with confidence. The best part is that buying gold bars is VAT free from Physical Gold, so that gives you great savings on your purchases. When buying multiple quantities of the one kilo bar, you save on VAT as well as on price.

One kilo gold bars are a certified and highly re-saleable big value investment

The trust factor when buying from an online dealer

However, it’s not just about the price and savings, when making a large investment in gold bars. Every product you buy from Physical Gold comes with a certificate of authenticity and purity. You can also view our testimonials page to see what customers are saying about us.

Buying gold bars from Physical Gold

Buying from Physical Gold is really easy.

Call us to know more about buying 1kg gold bars

Our gold investment experts are always ready to guide customers on making the right purchases. Call us on 020 7060 9992 or get in touch with our team online to discuss how buying a 1kg gold bar can be a great investment and an addition to your wealth portfolio.

Image credit: Wikimedia Commons

Spot prices of gold

The spot prices of gold change each day on the international commodities markets. These prices of gold are set by the COMEX exchange in New York. These prices remain prevalent through that day. Indeed, like all other commodities, these prices vary due to a number of factors. Of course, one of them is supply and demand. In 2017, the total amount of gold produced was 3.15 thousand metric tonnes. In contrast, this figure was 2,470 metric tonnes in 2005.

The fluctuating demand for gold

The demand for gold, however, is not dependent merely on supply and demand. Like all precious metals, gold is a lucrative asset class that investors turn to in times of turmoil in the international capital markets. For example, the current imminent trade war between China and the US has already seen several risk-averse investors move their money to gold.

Download our FREE 7 step cheat sheet to successful gold investing here

Gold prices, therefore, are dependent on macro-economic factors such as economic stability around the world, geo-political triggers such as terrorist action and wars, as well as seismic shifts in the international capital markets. If we study gold prices over the last ten years, we can see that the spot price skyrocketed to $1900 levels in August 2011. This was a huge surge from 2008, only three years back, when gold was $869.75.

The value of gold rises exponentially during economic crises

Volatility in gold prices

This meteoric rise of gold in just 3 years was largely due to the bubbling global financial crisis, which eventually saw the stock markets implode on August 8, 2011, commonly known as Black Monday 2011. But, again the fall of the stock markets at the time was not an isolated event in itself. It was a knee jerk reaction by paranoid investors pulling their money out of the beleaguered US economy, as a result of the US debt ceiling crisis. The American national debt basically spiralled out of control, with Standard and Poor downgrading the AAA rating for the US economy.

During every crisis over the last 20 years – the dotcom bubble, the 2008 US sub-prime debt crisis and the 2011 crisis, investors turned to gold to hedge their risks. So, we can see that the prices of gold react heavily to the economic environment at large. Even inflation is a driving factor, as is the weakening of the US dollar or the pound. However, in the middle of all the ups and downs, gold has steadily become dearer over the decades. The word ‘decades’ is an important thing to note here. As a savvy gold investor, you have to be able to take a long-term view. If you want to extract value from the precious metal, you need to remain invested over a ten or twenty-year period. It’s not the kind of game, where you can make a fast buck, get in or out. Investors who have a speculative approach to investing aren’t going to extract value out of gold.

One kilo of gold is a great investment, but with gold, you have to have a long-term view

So, how much is a kilo of gold?

So, to answer our initial question – how much is a kilo of gold worth?

Call us to find out more about buying gold

At Physical Gold, we pride ourselves on being a reputed online broker and giving investors a fair deal. We have many types of gold that we sell. Please call us on 020 7060 9992 or contact us via email to get in touch with a member of our investments team. We are always happy to discuss your investment goals and advise you on the best gold products to buy.

Image credits: Wikimedia Commons and Wikimedia Commons

Paper Gold

As the market continues to resist all sorts of financial risk – the question that keeps coming up is – How to buy gold bullion? People tend to be less attracted to gold shares or “paper gold” especially given the counterparty risk prevalent in such securities. That being said – those that do opt for this avenue tend to do this either through a share dealing service provided by a bank or a financial intuition’s managed service where clients pay a management fee for the facility. In both instances, clients have to pay Capital Gains Tax on any growth that they incur from holding their paper gold.

Owning paper gold may have a number of other disadvantages as well. Investors usually turn to gold in order to hedge their risks against volatility in the global stock markets. Since paper gold is linked to gold mining stocks, it defeats the very purpose of hedging. Mining stocks depend on spot prices of gold in order to forecast profits. So, when gold prices are sluggish, paper gold stocks do not invest in new supply locations, as it may not be profitable. In fact, gold stocks may sell physical gold at these times. This can create further problems for owners of paper gold, as the paper is useless if there isn’t enough physical gold to back it up.

Read our 7 step cheat sheet revealing the best way to buy gold bullion and profit. Download FREE

Spread Betting

We have spoken to people who have made and lost a lot of money by “spread betting”.

The term almost defies the very point of why people buy physical gold in the first place – to minimise risk and to protect one’s wealth. It’s a form of gambling whereby the winnings and losses are extreme and people can bet on things like who will win the next primary elections to what will the weather be like tomorrow. This sort of gambling is not for the faint-hearted. Be prepared to lose but hope to win!

Here’s the deal

It is a speculative way of investing that is risky and used only by tactical investors who want to short sell their positions. These decisions are driven by predictions derived by investors who wish to time the stock markets and believe they know which way the markets are likely to move on a daily basis. A large number of investors lose money by trying to speculate in this way, while spread betting companies make their money on dealing charges as investors continue to place bets.

Savvy investors invest in the gold market backed by solid research conducted by market analysts. They usually have a clear strategy and know when they want to enter the market, as well as exit. In the absence of a concerted strategy, spread betting is simply a gamble and any trades you make can be impacted by market movements. If you are unable to pull out in time, you will lose your money.

Investing in gold bullion is an excellent choice for investors

Physical Gold

The safest way to buy gold bullion is to buy the physical stuff, expect lower prices for bulk purchases. In doing so, you eliminate counterparty risk and control your own wealth. The added benefit here is that you can purchase tax-free gold including gold Sovereigns or gold Britannias. It does what it says on the tin – it removes any Capital Gains Tax upon sale thereby allowing you to keep all of your growth.

In 2000 – VAT was made exempt to the purchase of physical gold and since then demand for physical gold relative to paper gold has soared.

Unfortunately – physical gold is unregulated so you have to take care when selecting who you purchase your gold from. You need to consider the best place to buy gold bullion, ensuring that the company is BNTA (British Numismatic Trade Association) regulated and has a viable and proven track record.

Some people buy and sell their gold on eBay. This method isn’t hugely recommended as there is no way of proving the authenticity of the gold before you buy it. People often get stung this way.

People also buy directly from the Royal Mint. Their website is excellent and showcases each and every coin immaculately however they tend to be considerably more expensive than gold dealers like us.

As the reliance on technology has increased over the years – people are able to conveniently find reputable companies online that specialise in selling gold. Some of these companies are merely gold sellers and won’t offer you any recommendations or guidance.

How to buy gold bullion to meet your objectives

We are an investment company and therefore have a vested interest in our clients growing their portfolios. We, therefore, take more of a consultative approach with our clients to ensure that they have all the answers before making any decisions. The question “How to buy gold bullion” can be different from investor to investor. We maintain the relationship from when they buy until when they choose to sell. We are also distributors of the Royal Mint and as a result, our prices are far more attractive.

So if you’re considering investing in gold, the best method is to buy real physical gold coins or bars through a reputable dealer. Call us on 020 7060 9992 or drop us an email and our experts will be in touch with you to guide you on the best way to invest in gold.

Image Credit: Bullion Vault

Also known as gold notes, due to their passing resemblance to paper money, Aurum Gold Wafers are currently the smallest verifiable unit of gold available on the market. Trademarked and manufactured by Oregon-based company Valaurum, they are easier to authenticate than most other forms of gold due to the gold content in an Aurum being manufactured in a very thin sheet rather than being hidden within a coin or bar.

What are Aurum Gold Wafers?

Aurum (Latin for gold) Wafers are incredibly thin sheets of gold, typically weighing only 1/10th gram, although there are other units of weight available, including ¼ gram Aurums and 1/20th gram Aurums. Each individual Aurum contains pure 24 karat gold.

Find out all there is to know about gold with the Ultimate Insiders Guide. Download FREE

Here’s how it works…

The process used to create Gold Aurums is known as deposition. It involves heating the Aurum deposit to 2000 degrees Fahrenheit, before sealing the resulting gold between two layers of polyester film in order to protect it. The gold used in each Aurum has been weighed using only the most accurate measuring scales and has undergone rigorous testing carried out by the company themselves as well as their manufacturer, and independent laboratories. This allows Valaurum to confirm the precise amount of gold in each Aurum.

Pure Gold in its Rawest Form

Why invest in Aurum over other forms of gold?

One of the major advantages of investing in Aurum over gold bars or other forms of gold, is that it is much more affordable. Investors who are new to gold investing or just want to invest in a small amount can do so fairly easily with Aurum wafers. Due to its incredibly streamlined form, gold Aurum is very easily stored and transported, saving you valuable storage/shipping expense. The fact that it is easily verifiable and already in note form also makes it much easier for bartering and trading.

Why does this matter?

If we were to ever return to a gold backed monetary standard, which many experts argue could be a very real possibility in the future, the technology used to create Gold Aurums could lead the way for future currency. One factor to consider before investing in gold Aurum, however, is that you will likely pay a higher premium than if you were purchasing gold bars or coins. From an investment point of view, you would need to buy quite a large amount of Aurum gold wafers to see any significant sort of return. Their high resolution, beautifully presentation, engraved imagery, however, makes them ideal as an investment gift for a loved one or family member.

Discover all the latest news & insight into the gold industry with Physical Gold

For more gold industry news, investment tips and advice, please head over to our insights page. Physical Gold are experienced and respected dealers of gold and silver based in the UK. If you would like to speak to one of our advisors, please contact us on 020 7060 9992.

Image sources: Wikipedia

Diwali, the Hindu festival of lights, falls on 30th October this year and is celebrated by the giving of gifts. Gold is traditionally given, amongst other carefully considered gifts, to show thoughtfulness and creativity. Have a look at our special Diwali infographic, which will hopefully ‘shed some light’ on the dilemma of what to give the person who has everything.

The Indian gold market has suffered some challenging times over the past few years, but yet every year during the final quarter, as wedding season gets under way, there’s a renewed interest as Indian families flock to buy the yellow metal.

Diwali, the Hindu festival of lights, falls in October and is celebrated by the giving of gifts. Gold is traditionally given, amongst other carefully considered gifts, to show thoughtfulness and creativity. Have a look at our special Diwali infographic below, which will hopefully ‘shed some light’ on the dilemma of what to give the person who has everything.

Give Gold this Diwali!

Diwali (or Deepavali) the Hindu festival of lights, is celebrated by the giving of gifts. Lakshmi, (one of the goddesses to whom Diwali is dedicated), is, in fact, the goddess of wealth, fortune and prosperity and the festival is a vibrant, joyous occasion – full of colour and light.

Gold is traditionally given, amongst other carefully considered gifts, to show thoughtfulness and creativity. So what are some of the usual presents exchanged? Well, we’ve done a quick round-up of some of the gifts you might expect and some that are a little more… unusual!

Hopefully, if you’re scratching your head for gift ideas, you’ll be inspired after reading this.

Sweets

The traditional brightly coloured delicacies of gulab, juman, soan papdi, rasgulla and barfi make the perfect treat for anyone with a sweet tooth.

Dried Fruits

Are always well received as can be stored for long periods of time

Gift Hampers

There are some amazingly luxurious hampers available, combining flowers, fruit, sweets and even maybe a statue of Lord Ganesh

Now on to …

Gold – the gift that lasts

Any Diwali celebration is incomplete without gold based gift items.

Jewellery

Gold jewellery is always a firm favourite. For the lady in your life, how about a beautiful gold chain studded with jewels, or a stunning pendant, gold earrings, an ornate ring, bracelet or ankle chain …the list is endless! For kids, there are studded pendants of everything from penguins to elephants or even rocking chickens and glittering guitars!

And if you’re buying for a gentleman, how about some impressive gold cufflinks or a stunning watch?

A sleek, gold pen for recording all those momentous occasions in life? Or how about a smart gold business card holder or a gold paperweight to sit on their desk for all to see?

As Diwali is a time of celebrating family and creating memories, what better idea than a gold photo frame?

We also came across a gold telescope, and an antique record player complete with gold horn. But if you think a more modern gift might be more appreciated, how about a gold iPad or iPhone case?

Gold coins – you could also make a gift of gold coins, depicting the goddess Lakshmi, which is thought to bestow luck and prosperity on the recipient. Coins are something to treasure for a long time and make great heirlooms.

Silver

It’s not just all about gold. Silver is also a traditional gift for the occasion of Diwali. There are Lakshmi and Ganesh silver coins available, as as well as ornate silverware pieces.

Decorative pieces

For the home are always a good idea as it’s a great opportunity to give something they wouldn’t necessarily buy themselves. Diwali is all about new beginnings, so wall hangings, metal lanterns, gold vases & silver teaspoons are all well received. We even found a decorative gold canon! You might even opt for a gold statue of Lord Ganesh engraved on a leaf.

At Physical Gold, we offer various options for purchasing tax-free gold from rare coins – which are collector’s items – to gold bullion. By investing in certain gold coins, such as UK Sovereigns and Britannias, there’s no Capital Gains Tax as they are actually legal tender in the UK.

We also offer a range of options for investing in silver too and a monthly savers account. Maybe not quite as romantic as a necklace, but still just as attractive if you’ve made a generous first deposit!