Buying a gold bar can often create great advantages for an investor’s portfolio. Firstly, gold bars allow you the opportunity to acquire gold at a slightly lower price point than coins. This is primarily due to lower manufacturing costs in terms of design and finishing.

The spot price of gold itself does not change, whether you are buying bars or coins. Additionally, gold bars are available in different sizes. Many investors prefer to purchase larger bars like the 1 kg gold bar. They may treasure the joy of purchasing and owning a large quantity of gold that they can add to their investment portfolio. However, many investors prefer to buy smaller bars, and a popular choice is the 10 gram gold bar. Let’s understand why.

Buying many 10 gram gold bars can get you a good discount

Divisibility

The first reason that any investor would want to buy smaller bars, is to enhance the divisibility of the portfolio. Owning a 1 kg bar may seem satisfying and rewarding, but at the time of selling, the investor gets only one chance to sell all the gold at a single price point.

This means that investors cannot plan to take advantage of different price points in the market. They have to decide to sell at a particular price, believing that its right for them. So, while smaller bars may be more expensive, although only slightly so, investing in a 10 g gold bar offers you the advantage of divisibility. Also, if an investor purchases a large number of them, dealers are happy to offer discounts. Therefore, if the plan is to acquire 1 kg of gold, buying these smaller bars is likely to be more advantageous.

Payment advantages

Purchasing gold bars from a reputed dealer can often be carried out over the phone or online. It is not mandatory or essential for the buyer to visit the dealer’s premises personally. However, there are certain rules and regulations one needs to follow. For example, large transactions that are typically over £10,000, requires identification to be provided.

However, when buying a 10 gram gold bar, this isn’t required. Purchases can be planned in batches so that the value of the transaction does not exceed £10,000. It is also important to note that credit and debit cards will generally be accepted in the case of smaller transactions and purchases of smaller bars. However, larger purchases require the buyer to pay online. Many investors prefer to use the debit or credit card route, so buying a 10 gram gold bar could be better.

Gold bars as big as 250 kg are available

Variety

Any gold portfolio would generally benefit from a variety of coins and bars. This is also an essential factor to bear in mind when investing in gold bars. A 10 gram gold bar is a popular product and is produced by different well-known refiners across the world. So, buying these smaller bars gives you the advantage of choice. You may choose to invest in bars manufactured by two or three different refiners, with a different look and feel, design and refiner stamp.

Tax efficiency

In the UK, all investment-grade gold is VAT exempt. Similarly, gold bars may also be capital gains tax (CGT) exempt. However, if the gold bars you are purchasing isn’t, some tax planning may be required. CGT is only chargeable on profits that you accumulate, over and above the £12,000 threshold in a single tax year. Therefore, buying smaller bars can help you plan your taxes better, e.g., having a £24,000 threshold if bars are sold over two years.

Get in touch with the gold experts at Physical Gold

Whether you are investing in large bars or a single 10 gram gold bar, our experts at Physical Gold are best placed to offer you the right advice for your purchases. Call us on (020) 7060 9992 or get in touch with us online and a member of our team would be happy to answer your questions and offer you the right advice.

Image credits: Reverent and Wikimedia Commons

Where to buy gold bullion

Everyone wants to possess their own piece of gold bullion. Certainly, physical gold beats paper gold in anyone’s mind. However, unless you’re an expert, it’s not always obvious where to buy gold bullion. You want to feel comfortable that the gold is genuine, in good condition and at a great price. So, if you’re looking to buy gold bullion in London there are several options. Investors can buy gold London-wide, here we provide some insights as to the best places to shop.

West End jewellery shops

You can’t beat the feeling of browsing and unearthing hidden treasures. London is fortunate to possess many obscure boutiques and jewellery shops selling all sorts of collectables. There is every chance that you may unearth the odd modest-sized pieces of gold bullion.

Also, watch our YouTube video – “How much is a gold bar worth?”

However, you are far more likely to find collectable and historical gold coins in these places. The problem is that you may well end up paying far more than the bullion price as the gold is deemed to hold a degree of numismatic value. After all, do you know the value of a Victorian gold Sovereign? – See our guide to buying gold Sovereigns here and also view our main gold sovereigns page here

Before you buy gold bullion, make sure you read our FREE Ultimate Insider’s Guide to Gold Investment

Hatton Garden

One of the most famous jewellery quarters in Europe is the area known as Hatton Garden, not far from Farringdon tube station, it is a must-go place to visit when you buy gold in London. This is one long road of continuous jewellers, meaning that they have to be relatively competitive to gain your business. Their focus will be more on selling jewellery so any second-hand bullion bars they receive may well be melted down before you get the chance to buy them.

Ask what they have as it’s unlikely that such small gold bullion bars will be on display. There is also a chance that you may be able to unearth the odd gold bullion coin at reasonable prices, but they may be in poor condition. Undoubtedly though, Hatton Garden has to be one of the best places where to buy gold in London.

Finding gold bullion from a reliable dealer in London can often involve quite a hunt

Buy Gold London – Other Areas to Consider

Within the Central London area, many retail outlets deal in gold jewellery and bullion. However, do bear in mind that much of this is likely to be jewellery and coins. There is one shop now though, where you can buy gold bars.

There are several shops around Old Bond Street, New Bond Street, Piccadilly Circus Station and Oxford Street. Oxford Street caters to the international tourists who flock to London each year and has nearly 20 shops on it. These range from mid-priced to extremely pricey. For example, the Selfridges building itself boasts of big names like Cartier, Van Cleef and Tiffany. That’s the high end.

Another area worthy of mention is Sloane Street near Knightsbridge, where several gold dealers London premises are. This is a stone’s throw from Harrods, which is right next to the Knightsbridge tube station subway. Of course, Harrods is expensive, but there are many concession stores within the premises of Harrods. The concession model involves a brand using a designated space within a large departmental store, where deals are offered to customers. By association with Harrods, these gold retailers boost their brand image significantly. One such example is the Graff Diamonds Concession.

and in the city…

Another area worth scouting is the area around the Bank of England. This is a well-spread area with Threadneedle Street and the Cornhill Road on one side and Princes Street and Queen Victoria Street on the other side. Near the Bank subway station, opposite the Bank of England lies the Royal Exchange – a shopping mall with several gold dealers in it. There are other large bullion dealers in the area as well on the Cornhill Road, as you go towards the Aldgate train station.

Gold dealers

There are many specialist gold dealers located in and around London. These guys should be able to offer you a variety of bullion options, from bullion gold coins or gold bars in a variety of sizes. Always buy from members of the British Numismatic Trade Association (BNTA) or British Numismatic Society as you’ll be able to trust the authenticity of their gold. However, before you decide to hunt down your nearest gold dealer and turn up with cash to buy your gold bullion, there are security issues to consider.

Criminals target people emerging from such premises as they know there’s a good chance that you’ll be holding some gold. As well as the threat of being mugged, it’s unlikely your gold will be insured – leaving you nursing a possible financial loss. Most gold dealers will not accept passing trade for this very reason and tend to despatch from alternative, discrete premises. You would also need to bring identification if you wished to purchase and walk away with more than £5k of gold. However, many of these suppliers will safely and securely post the gold bullion direct to your door or offer an insured storage option, this is particularly the case for bulk purposes.

When choosing where to buy gold bullion, choosing gold dealers assures you of authenticity, purity, price and security.

Our London despatch centre address:

- Physical Gold Limited, 63/66 Hatton Garden, London EC1N 8LE – All purchases have to be completed online as we don’t sell over the counter. Pick up of orders is possible from our despatch centre by appointment.

Call our investment advisors to find out more about reliable dealers in London

We hope you have enjoyed our guide to where to buy gold in London. Our team of experts can be reached if you need to find out more about the safest and most reliable way to buy gold as well as silver and take delivery physically. Physical Gold experts have been in the gold business selling products such as gold Britannia coins for years and can advise and guide you to avoid common pitfalls. Call us today on 020 7060 9992 or get in touch via our website. We’re always happy to help.

Image Credit: tao_zhyn

Best place to buy gold bullion

Everyone wants to own their own gold bars and coins. You only have to open the papers to read that traditional investments are flagging, and alternative assets should now play a part in everyone’s portfolio. Of course, it is common knowledge that savvy investors always turn to precious metals during times of economic uncertainty. Well, the global markets have had an unprecedented run – probably the longest spell of economic uncertainty ever since 2008. Well, if you look back at the gold price charts for 2011, you will see that at the peak of the crisis, everyone turned to gold. Infact, gold prices climbed to above $1900 for one troy ounce in August 2011.

Bullion prices set to rise

Right now, the news is probably getting worse. If the pundits are to be believed, over 12 years of economic uncertainty has now culminated in what looks like yet another possible global economic crash. The predictions of gloom and doom have now been in the news for a while. Europe has been neck-deep in economic crisis for a long time, driven by a number of factors, including fears of a hard Brexit. Now that Brexit has actually happened, the uncertainty has not gone away. Speculations are rife about how the new rules of engagement are likely to affect the already beleaguered European economy.

Gold bullion bars are attractive to investors due to lower production costs

Elsewhere in the world, regional political instability and the US-China trade war has created a boiling pot of economic turmoil that could destabilise the global economy once again. Already, gold prices have shot up to $ 1600 per Troy ounce. If we look back in history, this is usually an indicator of investors pulling out of the global capital markets and parking their money in gold.

Bullion once again a safe haven asset

Apart from the global economic downturn, this earlier period of the 2008 economic crisis witnessed a tumultuous time in the US economy, as the debt ceiling crisis unfolded. Due to this, investors lost confidence in the US dollar and turned to gold. Well, in the present day, apart from global geo-political tensions, uncertainty continues to rear its ugly head in the form of Brexit, as well as the unfolding US foreign policy. Once again, it’s time to turn to gold bullion, in order to hedge against the risks of a possible downturn in the global capital markets, as well as forex markets.

Thinking of buying gold bullion? Download our FREE Insiders Guide to gold investing here

The important part?

Just as important to know is that physical gold beats paper gold for security hands down. This is simply because paper gold companies often sell off their gold holdings when gold prices take a beating. Additionally, paper gold – aka ETFs carry counterparty risks. This simply means that the company that issued the paper certifying your investment in gold holdings can underperform and sink. If that were to happen, your paper gold investments are worth nothing. Many paper gold companies also issue gold bonds in excess of the actual physical gold holdings to back them up.

Ultimately, this undervalues your investment as there is now lesser gold to back up your paper certificate. So, if it’s physical gold that you should be buying, in form of gold bullion, it’s important to find out where one can get the best deals. But where is the best place to buy gold bullion?

To get a genuine deal, it’s important to buy bullion from a reputed dealer

Where should I buy gold bars and coins?

Many people we speak to ask us where the best place to buy gold bullion is and they often mention eBay. Clearly eBay is a wonderful marketplace to pick up some great prices on almost anything you may wish to buy. However I would strongly urge you never to buy gold bullion through eBay. Gold appeals because it reduces your overall risk of being hit by market downfalls and shocks. So why would you want to take on the huge risk of buying from eBay.

Unless you have very sophisticated testing equipment, there is no way of knowing the gold is genuine, its purity or quality. You are leaving yourself exposed to fraud. If you are happy that it is the right time to buy then the other consideration is price. Gold is not a great fit for eBay due to the associated PayPal fees. Any seller will have to factor these fees into their gold price and pass them onto yourself.

The Royal Mint

At the other end of the safety spectrum is The Royal Mint. The name itself provides the reassurance that your gold can be trusted and is of top quality and condition. The restriction with this avenue is that The Mint only sells new gold coins (such as the Sovereign or the Britannia), it doesn’t offer circulated coins or gold bullion at all. So if you’re looking for tax free gold coins then The Royal Mint can certainly offer you pretty coins. However, if gold investment is your main driving force, then this is an extremely expensive option. You will essentially be receiving far less gold for your money than if you source the gold elsewhere. You cannot sell the gold back to the Mint so to realise a profit on your gold investment you will need to sell at the prevailing rate to a gold dealer. Paying this initial premium on the gold will severely hamper your returns. However, I’d say that The Mint are a decent source for obtaining presents for a family as some of their coins come in wonderfully packaged boxes, albeit at inflated prices. They also offer a huge number of collectors’ editions if that’s your interest.

Overall best place to buy gold bullion?

A source you can trust to obtain top quality gold bullion,

at competitive prices and you can also sell back to them when you need? The answer is a UK gold dealer. The best place to start is the British Numismatic Trade Association (BNTA) who registers all the trustworthy gold dealers in the UK. If dealers are a member of this association, they need to adhere to a strict code of ethics, and you will have a dispute process should their service and goods fall below this code. Generally, you will have a decent choice of gold bullion and coins with a dealer, depending on their area of speciality. Some may focus on numismatic or collectors’ coins, while others focus on investment gold coins and bars. Prices are very competitive (particularly for bulk deals) or buying a kilo gold bar and crucially they may be able to provide access to circulated tax free gold coins which provide the best value of all. You will receive full documentation with any good dealer and even benefit from market guidance on the gold price and types of gold.

Bullion coins are easily available at low premiums

Identifying a reputed gold dealer

Many investors are daunted at the prospect of looking for a trustworthy gold dealer. However, this can be a simple task if a common-sense based approach is followed. As explained earlier, the BNTA can be an excellent starting point. As a regulatory body in the industry, they have a verified list of several gold dealers in the country. The first step is to select a few dealers from that list and vet them yourself, before trading.

Remember, online dealers, are likely to provide you with a larger catalogue of products than the traditional high street gold dealer, who may offer you limited choices. It’s also easier to check the market reputation of an online dealer via the Internet. If the business has had a long track record of being in the market, they are likely to have several customers who have posted reviews online. Going through these reviews would give you an idea of the trust factor of each dealer.

Communication is key

Calling the dealer is an excellent idea and any reputed dealer worth its salt will be open to answering any questions that you may have regarding investments. They would also be able to offer you a buyback scheme and documents guaranteeing the quality of the gold they’re selling. Of course, if the dealer refuses to buyback what they’re offering, clearly something could be wrong. Most reputed dealers would also offer you the option of storing your gold with them in an LBMA approved vault. They would also offer you a secure, insured delivery option in the event you choose to collect the gold at your home. Once you’ve gone through these steps, you’re likely to shortlist a couple of reputed online dealers whom you can start doing business with.

Get in touch with us for advice on identifying a specialist gold dealer

So next time you’re looking to buy gold, look no further than a specialist gold dealer. The Physical Gold investment experts can help you identify specialist gold and silver investments. To speak with our investment experts, please call on 020 7060 9992 or get in touch with us online. Our team of experts are always on hand to assist you in making the right investment decision. Start off modestly, perhaps with 1oz or 100g gold bars. It’s the best call you’ll ever make. Also, why not read our beginners guide to buying gold, here?

Image credits: Matthias Wewering and Brett Hondow

The joy of owning a physical gold bar is fantastic. Investing in a gold bar can create great value for your investment portfolio while adding liquidity to it.

Why are gold bars more cost-effective than coins?

Many investors prefer to invest in a bar since they are a bit cheaper. You may be wondering why gold bars are cheaper than gold coins (such as Sovereigns and Britannias). Well, the spot price of gold would be the same whether you buy a coin or a bar. However, the premium charged over and above the spot price is lower. The manufacturing cost involved in producing a gold bar is cheaper than making a coin. This is primarily because a gold bar is a rectangular block, and does not have an intricate design element.

The importance of purity

Of course, the first point to check when buying

Buy a variety of bars – sizes and dimensions

When buying gold bars, it’s better to purchase a variety of bars of different dimensions. The attribute of variety is very important in building a robust portfolio. It enhances the divisibility of your holdings. If you’re selling a 1 kg bar, you’ll get one chance to sell it and your gold is gone. On the other hand, owning a variety of bars gives you the flexibility and advantage of selling at different price points. Smaller bars (such as 100g and 1oz) may be slightly more expensive, but your dealer is sure to give you discounts if you buy a large number of them. You may not be planning to liquidate your entire gold holding. In that case, you may only need to sell a couple to meet your short-term financial objectives.

Where is the best place to buy gold bars?

It’s important to do your research when selecting a reputed dealer. It’s best to buy gold bars from a specialist bullion dealer. Avoid buying privately as authenticity could be a problem. Buying gold bars from a dealer can either be carried out online or over the phone. For transactions over £10k, identification will be required. When buying smaller gold bars, credit and debit cards are generally accepted, while online banking can be used for larger purchases. Most gold brokers will deliver your gold bar to your home address and insure the transit.

Check if the dealer has a buyback policy on gold bars. If they don’t want to buy back what they’re selling you, something is wrong. Every reputed dealer will be registered with an authorised regulatory body like the BNTA. Checking customer feedback on the internet is also an important part of ascertaining whether the dealer has a good track record. Once you’ve got all these bases covered, you’re good to go ahead and purchase the right gold bars to strengthen your portfolio.

Gold bars are an attractive investment due to lower production costs

The importance of tax efficiency

Tax efficiency is an important consideration when investing in any gold. We all know that bullion coins are legal tender in the UK. As a result, they are Capital Gains Tax (CGT) exempt. Likewise, they are also VAT exempt, as they are considered to be investment-grade gold. But, do the same rules apply to gold bars? Of course, they are VAT exempt too. But, CGT would be chargeable on any profits accumulated above the £ 12,000 mark.

Physical Gold – how to contact us

We are easy to contact, so why delay contact Physical Gold Limited through your preferred method. Contact us via our Contact Form, by calling 020 7060 9992 or by leaving an instant message. We look forward to working with you.

Image credit: Wikimedia Commons

One of the questions we hear regularly, particularly from investors who are new in the gold business is one touching on the worth of a gold bar. In a bid to answer this question comprehensively, we will explore all the factors that directly affect the value of a gold bar.

Gold bars aren’t all worth the same

Before we begin, it is worth noting that all gold bars cannot cost the same. Even those that have similar weight and size may not necessarily have the same value. Also, worth noting is that the price of gold bars keeps changing each day that markets are open in accordance with the gold spot price.

Read the Ultimate Insiders Guide to gold bar and coin investment. FREE pdf

Factors that determine the value of a gold bar

1) The current spot price of gold

Since the gold bar is just a piece of precious metal, it makes sense for the going price of gold to determine its value. The gold spot price tells buyers about the market’s dollar value of one troy ounce of pure gold. Visitors to our site can always see the latest spot price for gold and silver at the top left-hand side of our web pages.

The price of gold bars continuously changes

It is important to keep in mind that the gold spot price varies from minute to minute when the market is open, and also after hours in the Asian markets. After knowing the latest spot price of gold, you should then proceed with the following steps to know the value of a gold bar.

2) Weight and purity

After knowing the current price of gold, you should proceed to know more about the

purity and weight of the gold bar. Typically, manufacturers stamp purity and weight details somewhere on the gold bar – either at the back or on the front.

For the most part, gold bars are either .9999 or .999 pure albeit some brands may be .995 pure. If a buyer comes across a gold bar devoid of this information, it might not be real gold. Copper and bronze are common alloy metals that resemble gold in appearance. On the other hand, gold bar weights vary dramatically from about one gram to 1 kilogram. So, the size may affect the pricing as well.

3) Gold bar melt value

After obtaining the information about the purity and gold spot price, buyers should take gold bar’s weight (in troy ounces) and multiply that by the purity. The result will be the bar’s total pure-gold weight. After that, multiply the result by the gold’s spot price.

For example, if the gold bar weighs 10 grams (or 0.321507 troy ounces), and the gold spot price is $1250 with the purity of .9999, the gold bar value will be:

[0.321507 x .9999] x $1250 = $401.84

Therefore, in this case, the value of pure gold in the 10-gram gold bar is $353.62. This doesn’t include the premium, which is the cost above the melt value that the gold bar might sell for.

Gold bars have a melt value

4) Premium

A premium refers to the price added to the melt value of the gold bar. Calculation of the premium depends on many factors. Often, the demand and cost of production are the main reasons a gold bar may sell high and above the spot price. Premiums may vary depending on the gold bar’s weight, manufacturer or condition. It is usually indicated as a dollar value or percentage. Typically, as the gold bar’s weight increases, the premium will reduce.

So what’s the best value gold bars when buying?

The price you pay for physical gold will generally reduce as you buy more. In the case of gold bars, if you calculate the price per gram, larger bars are far better value than small gold bars. Infact any gold bars below an ounce in weight are really not of great value due to the high production cost. Most new small bars will be beautifully manufactured to include being encapsulated in a plastic cover, complete with certification. In comparison, similar size gold bullion coins such as Sovereigns (7.32g of pure gold) and Britannias, can be bought at lower premiums as they’re sold loose. 100g gold bars offer decent value, with 250g and 500g slightly better again, and 1kg trading pretty close to the underlying spot price.

Watch our related video – “How much is a gold bar worth?”

So 1kilo bars are the best for worth?

The problems with 1kg gold bars are that many people can’t afford to invest £30k+ into gold at once and secondly, it limits flexibility. After all, if you buy a 1kilo gold bar to reduce the cost as far as possible, then you can’t liquidate £10k worth of gold if you need to. You’re forced to sell the whole bar or nothing at all.

An alternative method to buy gold bullion at the best value is to approach quantity discounts in another way, depending on how much you have to spend. While 1kilo bars undoubtedly offer the best value, discounts are still available for buying a quantity of more modest-sized gold bars (e.g. 1oz).

Instead of buying one 1 kg gold bar, it could provide a good compromise to buy 10 x 100g bars instead. Buying ten 100g gold bars at once will enable you to receive a discount (although not quite as cheap as 1x1kilo bar), but still maintain a degree of divisibility so you can sell some of your holdings if needed.

5) Does brand matter in worth?

When buying gold bars, then the worth absolutely varies according to which brand bars you purchase. Brands such as Umicore tend to be priced slightly lower than Swiss brands such as Pamp, which command a premium. However, the importance of brand diminishes when you look to sell. Certainly, we’d pay the same for a gold bar regardless of its brand. We simply base our price on the gold price, weight and purity. So unless you especially want a Swiss brand for ego, prestige, or as a present, buy the cheapest bar possible. Its value will be the same when it comes to selling. We sell pre-owned gold bars which are amongst our best sellers to savvy investors who realise a brand shouldn’t impact a gold bar’s worth.

6) Value of gold bars versus coins

If you’re interested in gold as an investment, then there are two main types of physical gold to consider. Gold coins and gold bars. As long as these forms of gold are at least 22 carats in purity, then both are exempt from VAT. Other types of gold like jewellery, gold dust, lower purity coins, etc, will attract VAT and so are less attractive as effective investments. Generally speaking, your gold bar will not be worth quite the same as the equivalent weight in gold coins. The value of both tracks the factors already discussed. However, gold dealers will likely pay you very slightly more for desirable bullion coins such as Sovereigns than a gold bar. This reflects that the British coins are Capital Gains tax free and can be sold to a number of potential buyers due to their modest size. Certainly larger gold bars will usually be sold back into wholesale, so premiums are slightly lower to reflect that. We’re not talking a big difference, but perhaps a percent or so, depending on the market.

Download our FREE 7 step cheat sheet to successful gold investing here

..and how about the worth of gold bullion versus older coins?

The bigger discrepancy will be when comparing the value of a gold bar with the equivalent weight in a more numismatic coin. If you look at the value of a Victorian gold Sovereign, for example, its worth is not only based on its gold content but also its age, scarcity and desirability. For that reason, the value of a gold bar will always be lower per gram. The value of gold bars will never outpace the general gold price as they don’t contain a historical or collectable value. However, gold bars would have been cheaper to buy in the first place.

Gold bars are not the same value as gold coins per gram

Will tax affect my gold bar’s worth?

While UK coins issued with a face value, such as Britannias and Sovereign coins, are Capital Gains tax free, gold bars are not. That means the value of your gold bar could be impacted by the tax. Obviously, if you sell your gold bar below the price you paid for it, then CGT will not have any impact on the gold bar’s worth. Similarly, if you’re gold bar has risen in value, but by not more than the annual CGT threshold (around £12k per annum), then no tax is applicable, and the bullion’s value is straightforward. However, for the larger investor, selling a considerable amount of bars at once, at a profit exceeding your annual £12k allowance, will incur tax, and therefore reduce the overall sale value of your gold bar.

One way around this for sellers of larger quantities of gold bars is to sell some bars before the April 5th tax year and others after the tax year. Spreading profits over two years, ensuring gains are below annual allowances will mean no tax. This strengthens the argument for buying lots of medium-sized bars instead of very large bars which may incur CGT.

7) Timing

Obviously, the underlying gold price affects the

Firstly, the general market sentiment and supply/demand dynamic can impact the value of gold bars. That’s because the premium or discount to the spot price can vary according to how busy the market is. When the gold price rises, demand for gold increases and the number of sellers reduces. In this scenario, premiums to buy gold bars can increase to reflect the robust demand and prices paid to buy back gold also increases.

The opposite is true when the gold price is in a period of downside. Fewer buyers mean that gold bars may be snapped up at slightly lower premiums, while dealers may pay a percent less for your gold bar if you’re selling as there are an increased number of sellers.

What can I learn from this?

To maximize your gold bar’s value, buy when the market is quiet (and low) and sell when the market is on fire (even though everyone will think you’re mad!).

Secondly, the value of your gold wafer or bar can be based on either the live gold price or one of the two daily fixings. This may sound like a moot point, but it’s important to understand that on a volatile day, perhaps when important economic figures are released or interest rates increase, the price can vary greatly from morning to afternoon. So if you’re seeking to sell your gold bar, make sure you agree if you’re basing it off the live price, the morning fix (10.30am) or the afternoon fix (3 pm), as this can greatly impact your bar’s worth.

Buy Gold Bars directly from us

Now that you know how to determine the value of a gold bar, why not contact Physical Gold to buy gold bars (or even silver bars) of the weight you want? You can call us on 020 7060 9992 or send us an email through our contact page, and we will be glad to serve you.

Image Credits: Public Domain Pictures and Hamilton Leen

We receive a lot of questions about buying gold bars. For convenience, we have summarised some of the most popular questions we receive in this handy gold bars FAQs with answers guide, which we hope helps with your investment questions.

Are gold bars a good investment?

Bars of gold are a good long term investment to provide balance and protection from economic downturns. The value tends to rise during times of political and economic instability and has averaged more than the inflation rate over time. Large bars offer better value than smaller ones, although divisibility should be a consideration. To be Capital Gains Tax-free, buying UK gold coins offers an alternative.

Are gold bars illegal?

Owning bars of gold is completely legal. The question arises due to a period in US history just after the great depression in 1933 when the US Government issued a decree making it illegal to hold gold in the form of gold bullion without a unique warrant. Any gold owned privately could be confiscated in an attempt to stabilise the floundering economy. This lasted until 1974, and all restrictions have been rescinded since 1 Jan 1975.

Are gold bars traceable?

Unlike financial securities such as equities and bonds, there is no requirement to formally register gold bar ownership. Electronic gold ownership such as ETFs would be more easily traceable as an ownership register exists which is why so many investors prefer the physical, tangible nature of bars of gold.

Are gold bars 24 carats?

Generally, all bars sold by gold dealers will be 24 carats in purity. However, not all sold globally are 24 carats. The term ‘bar’ really only refers to the format of the physical gold. You should not assume that purity is automatically 24 carats. Many mined on the African continent are only 22 carats, which make them difficult to sell outside of Africa. Often these bars are melted down and used for jewellery.

Are gold bars taxable?

Gold 24 carat bars are not taxable when purchased in the UK. They benefit from a VAT exemption on investment gold (gold in the form of a coin or bar with a minimum of 995/1000 parts gold). Therefore, sub-grade 22-carat versions would be taxable. When bars are sold, any gains should be declared and are applicable for Capital Gains Tax if the annual allowance is breached.

Are gold bars registered?

The production of bars of gold is registered with the relevant assayer, and a serial number recorded. However, there does not need to be a register of private buyers. Gold dealers will need to invoice buyers and keep records, but these are not publicly available.

Are gold bars soft?

They are hard to the touch. But due to their high purity (24 carats), they are relatively soft in metal terms. Pure gold is malleable, so have a major possibility of scratching due to this. This is the reason why Sovereigns coins are produced in 22 carat format, which is deemed a more robust alloy.

Are gold bars tax free?

They are VAT free if they are 24 carats in purity due to the VAT exemption on investment-grade gold. There is no income tax when holding them, and Capital Gains tax will only be applied on any gains in value upon sale that surpass your annual allowance. Investors should sell bars strategically that have increased in value, i.e., some either side of tax year end will deem the bars tax free.

Are gold bars worth buying?

They are worth buying if you seek a tangible asset with no counterparty risk. Physical ownership is beneficial to provide balance to a portfolio consisting of mainly paper assets. The value can go up and down and is related to the underlying gold price. The gold price generally moves up in times of uncertainty so is desirable for those seeking a hedge against unstable markets.

Are gold bars pure gold?

Most bars are 24 carat gold which is the highest carat possible. Some bars on the African continent are a lower purity of 22 carats. The 24 carat bars are referred to as pure gold, but technically they are not 100% pure. Purity can be anywhere from 995 parts per 1,000 upwards, but most reputable bar producers make bars of 999.9 purity.

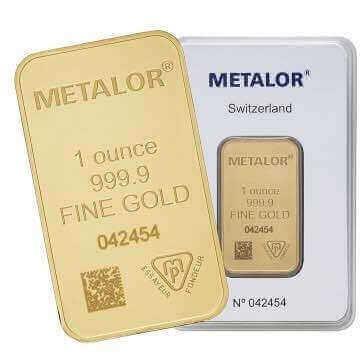

This 1oz bar from Metalor is clearly marked as 999.9 purity and is available to buy from Physical Gold Limited

Gold bars vs bullion

The terms gold bullion and bars are somewhat interchangeable. Both generally refer to 24 carat gold in the form of a rectangular bar. However, bullion is also a term used to describe the ‘investment finish’ of certain coins. Bullion coins are minted for value purposes as opposed to proof finish coins which are more expensive collector’s items.

Are gold bars real?

It is easier for fraudsters to fake or add non-gold substances to bars than coins. This is because the design of a coin is far more complex and difficult to copy. The best place to buy is from a trusted gold dealer, where they tightly control their supply network. All genuine bars should also come with serial numbers and many with a certificate from the mint.

Are gold bars heavy?

This all depends on the size of the gold bar. Due to its high value, most people are surprised by quite how small and light a bar £1,000 will buy you. However, as a dense metal, the larger buys can be very heavy. For instance, the largest is 400 ounces or 12.5kg but are smaller than a standard brick which weighs a mere 3.5kg.

Gold coins or bars for investment?

Gold coins are generally deemed to be a better investment than gold bars, as long as you buy the right ones. Buying gold coins offers more divisibility than bars, benefit from quantity discounts, can be easier to sell, and be Capital Gains Tax-free. Of course, the investment objectives and investment amount will also determine which is best.

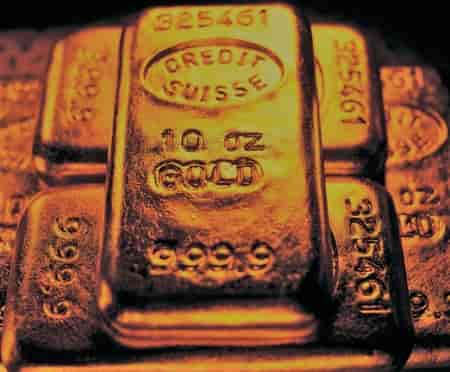

How are gold bars made?

They can be made in 2 distinct ways. Generally smaller bars tend to be minted, whereby a sheet of gold is stamped and cut into the required size, shape, and weights. These minted bars tend to be exceptionally clean looking with a smooth precise finish. For larger bars, a second method is used to create what is known as cast bars. Molten gold is poured into set size moulds to produce ingots. The finish of these tends to be more natural and rougher.

How do I buy gold bars?

It is best to buy directly from a precious metals dealer. Prices will be transparent and based on the live market. Usually, discounts are offered for purchasing bars in quantity. You benefit from the peace of mind knowing your investment is genuine and high quality and you will have a place to sell the bars when the time comes.

How do I sell gold bars?

It is best to sell bars through a reputable gold dealer. In the UK, stick to a gold broker who is a member of the British Numismatic Trade Association (BNTA). Try to ensure you have the bar certificate if it is loose. It is possible to take bars into jewellers, but they will likely pay a lower price as they will simply melt down the bar.

Gold bars versus ETF

Both Gold ETFs and bars have their value linked to the underlying gold price, so they both provide a degree of balance to mainstream assets. Bars benefit from having no counterparty risk whereas gold ETFs can be leveraged and there are additional risks associated with the provider. Buy/sell margins are tighter with ETFs due to their electronic efficiency. Fees may exist with both investments, ETF management fees, and gold bar storage costs.

How much are gold bars worth?

The value of a gold bar depends on the underlying gold price and the weight of the bar. The approximate value of the bar can be calculated by multiplying the current gold price in grams by the weight in grams in the bar. As most bars are 24 carats, pure gold), no other sums are needed. The actual price will likely be slightly lower by a couple of percent depending on supply and demand in the market.

Should I buy gold bars without a certificate?

We would recommend that all bars of gold should have an accompanying certificate. This certificate will come from the refiner and will prove that strict quality control standards set by the LBMA have been met. The certificate will provide a serial number, proof of authenticity and will have the place of origin on it.

Gold bars vs coins

Unless buying a substantial quantity of gold, choosing the right gold coins can be a better investment than bars. Bars can command lower premiums when large in size, but coins benefit from being more divisible. UK coins have the added advantage of being free from Capital Gains Tax for UK residents, and older coins provide more historical interest than bars.

When to buy gold bars?

As an investment, buy bars when the gold price is low to enjoy capital appreciation when the gold price rises. Prices tend to rise during times of Dollar weakness and general economic instability. So, do not wait for the economy to slump as the gold price would already have risen. Buying gold in good times and selling in bad times will reap the biggest profits.

When to sell gold bars?

It is best to sell bars in the middle of an economic crisis as the price will likely be the highest. Gold is sought as a safe haven in these times, so demand goes up and the price of gold follows. This directly impacts the price you can fetch for your gold bar.

Gold bars versus Krugerrands

Bars of gold can be cheaper per gram to buy than Krugerrands if bought in a large size like 1kg. However, Krugerrands are a good value coin, so the gain is minimal. An advantage of Krugerrands is that you can sell one coin or a handful whenever you need to. Owning one large gold bar does not allow this. Buying lots of smaller bars is expensive.

Buy a 1kg Metalor gold bar from Physical Gold Limited

What gold bars should I buy?

If you are seeking investment, then try to buy the cheapest 24 carat bar possible. Premiums are paid for certain brands, especially from Switzerland, or enhanced packaging, but these premiums may not be recouped upon sale. Pre-owned gold bars can be bought cheaply, just ensure they have a certificate and buy from a reputable gold dealer.

Can gold bars be confiscated?

In the UK, bars can only be confiscated if they are linked to money laundering or crime. In the US, under current federal laws, gold bullion can technically be confiscated in times of crisis, but rare coins do not fall into the confiscation category. All privately-held bullion could be confiscated during the Executive order 6102 after 1933, but that expired by 1975.

Can I buy gold bars at my bank?

Very few banks sell gold these days as they have many other revenue streams and gold is deemed to be a specialist area. To purchase bars, it would probably be best to go to a reputable gold dealer to benefit from extensive choice, guidance, and general good advice about the timing of purchasing and selling.

Do all bars of gold have serial numbers?

All bars over 250g should have a serial number on them. This serial number helps an assay office authenticate the gold bullion. Generally, this serial number will be on your invoice, so it can be traced back to your dealer.

Gold versus silver bars

Silver bars are clearly far more affordable than bars of gold due to the price differential of around 80:1. This means that buying a bar for £3,000 can be underwhelming for those expecting a large brick-like bar. In contrast, a huge 5kg silver bar cost less than £2,500. Due to the low silver price, the relative production cost is higher than for gold, so bid/offer spreads are wider. Both bars can be held as safe havens, but the value of silver can also go up with industrial demand.

5kg bars like this Umicore bar are available from Physical Gold Limited

Talk to Physical Gold

If you have any further questions we are only a phone call away when you call us on 020 7060 9992. We can also be contacted via webform, so please contact us and we will do our best to help with all your gold bar-related enquiries.