Gold has fascinated humans throughout history and the yellow metal has always been preferred by institutions, investors and governments as a great repository of value. Today, gold is bought and sold in a regulated marketplace, and the spot price of gold has been standardised and can rise or fall depending on economic and political factors.

At the practical level, gold has certain special properties like malleability, conductivity and ductility that make it invaluable for use in industry, especially the manufacture of electronics. However, at the economic level, gold delivers steady returns for investors over both the short term and the long term. Gold is also seen as a ‘safe haven’ for investors and individuals and institutions who moved their money to gold, did so during periods of economic uncertainty. Gold is a scarce metal that is mined out of the ground.

The historical site of the Roman gold mines in West Wales

History of gold mining

It is uncertain exactly when human beings started mining gold, but archaeological evidence tells us that it could possibly have been around 4,200 to 4,700 BC. Historians agree that the world’s oldest known gold mine has been found on an archaeological site in southern Georgia. It is now thought that gold mining was popular at the time of the Roman Empire.

The Romans frequently used methods such as hushing and ground sluicing to extract gold from mines that contained loose alluvial deposits. These hydraulic mining methods were later used across Europe. Many Roman gold mines have been unearthed today and one has even been found in the UK, in West Wales. Gold was mined in different regions, which formed parts of the Roman Empire. These were spread across the Balkans, Armenia, Egypt and Nubia.

At the same time, gold was also being mined in other parts of the world. The Kolar gold fields in Karnataka, India has been active since the second century A.D. Later, during the 19th century, there were many gold rushes in different parts of the world. Some of the most famous ones that we would have heard of are the California Gold Rush of 1849 and the Klondike Gold Rush. Statisticians estimate that all the gold that has been mined throughout human civilisation could be close to 6,109 million ounces.

Placer gold mining in Alaska

Different types of gold mining

Today, due to the advent of technology, mining, metals have become more sophisticated. Gold mining is a large commercial operation undertaken by mining companies who fund their operations through the sale of gold as well, as money raised from the stock markets. Investors often invest in gold mining companies, as a form of paper gold investment. Let us take a quick look at the four main types of gold mining methods.

There are four main types of gold mining, varying according to the country of production and their method of extraction – placer mining, hard rock mining, by-product mining and processing of gold ore. Gold which has accumulated as a placer deposit (naturally separated from rock through gravity) is extracted through placer mining which uses water as the loose material is unsuitable for tunnelling. This is the type recognised by many as typical gold prospecting, where manual panning can be used, although not commercially.

The most recognised gold mining is hard rock retrieval which uses tunnels underground and machinery in open pits to extract gold. The larger scale enables far greater quantities to be mined.

Of course, mining for other minerals can sometimes provide the added bonus of accumulating gold in small quantities. Typically, mining for copper and gravel can end up discovering deposits of gold as a by-product. Due to the scale of the operations, some mines subsequently find large quantities of gold this way.

Gold ore describes rock and earth with fine traces of gold which are extracted through the addition of chemicals. The use of chemicals (namely cyanide), is expensive for the small yield of gold achieved, so this method is shrinking in popularity.

Dredging

One of the old mining methods which have now been replaced is dredging. This operation is carried out through the use of suction dredges. There are small floating machines on the water operated by the miners, which consists of a sluice box attached to a suction hose that pulls out the gold.

Ask Physical Gold about all your queries related to gold

Physical Gold is one of the most reputed gold dealers in the UK and the members of our team are always available to answer your queries regarding precious metals. Please call us today on (020) 7060 9992 or get in touch with us online via our website.

Image Credits: Glen Bowman and Wikimedia Commons

Gold investments are often seen as a lucrative investment option by investors. Gold has always been an excellent store of value and the yellow metal has posted healthy returns in short term as well as long-term investment horizons. Gold provides investors with incredible opportunities to beat inflation and hedge their risks in adverse market conditions. As one of the most popular precious metal options for investors, we need to understand how profits can be generated when investing in gold. In this article, we will explore the various options that investors can choose to book healthy profits on their gold investments.

How can you make money from your gold investments?

Two elements will help you buy gold and make money. The first is timing. Only buy gold for the medium to long term as markets can go down as well as up in the short term. Buying when the price is low provides more profit potential than when it’s risen for the past 6 months. Secondly, buy the right type of gold. Appointing a reputable gold broker will help you obtain the best prices and be guided to buy the right type of coins. Buying UK Sovereigns is great value and any money you make is tax-free.

It is best to invest in leading brands like Metalor, for gold bars

Most investors will channelise their investments into gold bars and coins. Gold investments cannot provide you with a dividend payment like other asset classes. So, to make money it is important to set your investment goals and book profits by selling gold when your objective has been met. A reputed UK gold broker can help you to achieve these objectives by understanding your philosophy towards investment and contacting you when the right buying or selling opportunities are available.

Always invest in easily available bullion coins

If you want to obtain the best possible buying price for your gold coins, you should invest in bullion coins. These coins have low premiums and do not carry higher prices due to easy availability. Buying bullion coins like the sovereign or the gold Britannia is an excellent step towards ensuring the liquidity of your gold portfolio. Obscure coins may carry a certain level of rarity value, but they are extremely difficult to sell. Also, by investing in obscure coins, you are reducing your buyer market. So, when you are investing in gold, the best solution is to go to a reputed gold dealer and discuss your investment objectives with the company. When investing in coins, this is likely to get you a wider choice of great bullion coins that are available in the market.

Rare and obscure gold coins like this Gold Ducat are not good for investors

Liquidity, variety and value

The three most important things that you can focus on when building your gold portfolio are liquidity, variety and value. Liquidity implies that the gold investments that you make must have a strong secondary market. Well-known coins like the Gold Sovereign or the gold Britannia can generate instant sales, allowing you to make money. Likewise, if you are investing in gold bars, well-known brands like Metalor can also ensure a quick sale.

Download the Insider’s Guide to tax free gold investment here

You can make profits by investing in a variety of coins of different dimensions and denominations. In this way, you can take advantage of different price points in the market, at the time of sale, to maximise your profits.

Capital Gains Tax

Another important consideration for you, as an investor is to focus on Capital Gains Tax (CGT). Taxes can eat into your profits and it’s best to invest in popular UK gold coins that are considered to be legal tender. In this way, you can gain the double advantage of avoiding VAT and CGT.

Get in touch with Physical Gold to discuss your gold investments

Physical Gold is a highly reputed gold dealer in the UK and our investment advisors offer free advice to all customers. Call us today on (020) 7060 9992 or get in touch with us online to discuss the right way to invest in gold.

Image credits: Wikimedia Commons, Snappygoat.com

Buying investment-grade gold can often mean conducting a lot of research and finding out the best options for your gold portfolio. If you purchase gold with an unplanned approach, wrong results are inevitable and the overall value of your portfolio may shrink. Many investors opt for gold coins, but it is important to know which gold coins to purchase. Buying obscure gold coins will hamper the liquidity of your portfolio, as obscure gold coins are harder to sell. There are certain fundamental elements that one needs to consider when planning a gold portfolio.

Buying gold from the high street

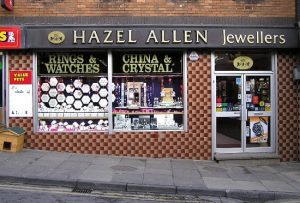

Several investors decide to buy their gold from high-street jewellers and shops. This is usually not a good idea, as it can be fraught with risk. It is difficult to ascertain the authenticity of the gold you buy from the high-street. Ensuring the percentage of pure gold in the bars and coins you purchase is an intricate process that requires certain measuring tools. In many cases, high-street vendors will not perform this task in front of you, and many do not provide a certificate of authenticity. There is also the risk of security when you buy your gold from a high-street shop and leave.

UK high street stores may not have a great inventory of gold products

Buying gold from an auction

E-commerce sites like eBay offer gold auctions as well. However, it is unsafe to purchase gold from an unknown seller on eBay. You have no way of knowing whether the products are genuine or not. Also, in general, it is not a good idea to purchase items of large value from auction sites or even pawnbrokers on the high street.

Buying paper gold

There are several options to buy gold as an investment. If you’re seeking to actively trade the gold market, then spread betting is one option. Buying a Gold ETF provides online access and economic spreads to buy and sell regularly. If stock markets are attractive, then the Blackrock Gold fund is popular, or if you’re prepared for higher risk, investing in gold mining stocks is an option. For those motivated by safety and protection, buying physical gold coins and bars is the best investment choice. This is primarily because most paper gold instruments carry counterparty risks. However, these risks are mitigated when you hold the precious metal in its physical form.

Gold bullion coins are an excellent investment option

Identifying a reliable gold dealer

The best way to buy gold for investment is to identify a reputed and reliable gold dealer near you. Most online gold dealers can provide you with a greater choice of products like bars and coins when compared to their high-street counterparts. A good online dealer will also answer all your questions regarding the purchase and offer you free advice before you close the deal. Typically, they also provide a buyback scheme and the products come with a certificate of authenticity. Once you have bought your gold, most reputed online dealers will dispatch your purchases to you via an insured courier service. The package will arrive unmarked, so there is no way of outsiders knowing that the contents of the package are valuable.

It is relatively easy to identify an online gold dealer. Dealers who have been in business for years are listed and registered with the British Numismatic Trade Association (BNTA). Once you identify a reliable online dealer, it’s important to establish a good relationship with the company. Discussing your investment objectives with your dealer can go a long way in ensuring that you acquire the right gold bars and coins for your investment portfolio.

Talk to our investment advisors at Physical Gold

Physical Gold is one of the country’s most reputed and reliable gold dealers. . Our investment advisors can guide you on the best purchases to make when building a strong gold portfolio. Call us on (020) 7060 9992 or get in touch with us online to reach out to our investment team.

Image Credits: Wikimedia Commons and Public Domain Pictures

Investing in gold isn’t just about buying a few gold bars or picking up some gold coins at an auction. A serious investor who wants to build a robust gold portfolio should have an investment plan. Lack of planning is likely to result in wrong investments and you will end up getting stuck with gold bars and coins that have no liquidity and add no value to your portfolio. A good investor will first study the subject and understand the fundamentals before investing a penny.

Understanding the types of gold to buy may not be enough. One needs to find out where to buy them from. Many gold investors who have built lucrative portfolios have years of experience trading in the precious metals market and have the right connections to source their gold. Let us take a quick look at the fundamentals of gold investing that every beginner should know.

Planning your objectives

It is always important to first understand why you want to buy gold. You need to decide the right investment horizon for you. If you want to make short-term investments, the choice of gold products may be different. Investors who want to build wealth and acquire gold at the cheapest price per gram would often choose to buy gold bars. Gold bars have lower production costs than coins and offer investors the opportunity to acquire gold at a cheaper price. The time horizon is important – gold investments can be volatile over the short-term but generate steady and healthy returns over the longer term.

Investing in gold coins can have great tax advantages

Gold investing follows the common rules of buying the investment at a low price and selling at a higher price. There is no interest received for holding gold, so profits are only made on capital appreciation. The gold price tends to rise when the economy takes a downturn and other investments fall in value. In that way, it offers protection to an investor who owns many assets. The gold price can move down as well as up, so it is advised to hold the gold over the medium to long term.

Never invest in obscure gold coins as they may have little or no liquidity

Identifying a reliable gold broker

Once you have your objectives in place, the next step is to identify a reputed and reliable gold broker. This is relatively easy to do. Most reputed brokers are registered with the British Numismatic Trade Association (BNTA). A quick visit to the association’s website can help you shortlist the best brokers near you. It is important to initially approach more than one broker and try to build a relationship.

Once you do this, you will be able to share your objectives with your broker and he/she would know what kind of gold you are after. So, when it comes to the market, you can be the first to know. A good broker will always be willing to answer your questions and will also issue a certificate of authenticity for all the products. They would also have a buyback scheme. You should always check online reviews of the broker and find out how long the company has been in business.

Tax planning

It’s also important to do your tax planning at the time of planning your investments. All investment-grade gold is VAT free in the UK, however, if you want to capture the benefits of Capital Gains Tax exemption, you can invest in gold coins that have a face value and are legal tender in the UK.

Our experts at Physical Gold can guide you on your investments

If you are a beginner investor who wants to start building a gold portfolio, speak to one of our advisors. Physical Gold is one of the most reputed gold dealers in the UK. You can reach us on (020) 7060 9992 or send us an email to get in touch.

Image credits: QuoteInspector.com and Wikimedia Commons

Investors looking for portfolio diversification often turn to paper gold investments. Investors view gold as a safe haven and hedge their risks by investing in all types of gold. In 2020, during the height of the global pandemic, the price of gold rose steadily to reach its highest point ever. This was made possible by increased investor demand due to the safety and security that gold provides. Usually, physical gold investments can be categorised into gold bars, gold coins and gold jewellery. Investors usually park their money by buying bars and coins. However, paper gold investments can be another viable option.

What is paper gold?

Paper gold investment refers to the purchase of an asset that isn’t tangible but instead represented on paper. This can take the form of gold mutual funds such as the Blackrock Gold & General Fund, individual mining shares, spread betting on the gold market, gold futures and gold ETFs. Those seeking tangible investment need to buy gold bars or coins.

Physical gold bars do not carry counterparty risks

Gold ETFs

The abbreviation ETF stands for Exchange Traded Funds. In other words, it is a fund that invests the money collected from investors into various types of gold investments. These investment choices are spread across all types of gold-related investments in the market.

Physical gold could be one of them, but the fund usually diversifies its gold portfolio by investing in many other categories, like gold mining stocks, refiners that produce gold, companies that manufacture gold products and government bonds. It is important to note that individual investors who subscribe to the fund have no say in these investment decisions. The decisions are made by professional investment managers, who are responsible for running the fund.

Gold futures

Another type of paper gold investment is gold futures. Since gold is a commodity, it is actively traded every day on the gold markets. Therefore, speculation can be made on the price of the commodity for a future date. Gold futures are contracts entered into by investors, who agree to take delivery of the gold on an agreed date at a price point. The contract can be finalised by making an initial payment. It is a speculative risk-based transaction. The price of gold can fluctuate, and the investor may lose money on the transaction if there is a significant price drop between signing the agreement and the delivery date.

Paper gold funds also invest in gold mining stocks

Counterparty risk

The biggest downside to paper gold investments is counterparty risk. This is the risk of a third-party dishonouring a contract due to poor performance in the market. In a worst-case scenario, the company may even become bankrupt. All paper gold investments carry this risk since the investor is entering into a contract with a third party. However, physical gold investments are tangible and the investor is in possession of the asset at all times. Therefore, the question of counterparty risks does not arise as there is no third party involved in the trade.

Prefer the idea of investing in real gold coins and bars? Download our investment cheat sheet FREE

Tax efficiency

Investment-grade gold is VAT free in the UK. Additionally, investments in gold coins that are legal tender in the country, like the Gold Britannia or the Gold Sovereign can also make your investments Capital Gains Tax (CGT) free. However, paper gold investments do not qualify for these tax exemptions. Most paper gold investments attract long-term capital gains tax.

Speak to our gold experts for all your gold investments

Physical Gold is one of the U.K.’s most reputed gold dealers and our investment advisors are always happy to hear from you and offer free advice on any gold investments, you might want to make. Call us on (020) 7060 9992 or contact us online to speak to a member of our investment team.

Image credits: Mark Herpel and TheDigitalArtist

Property ownership has always been the holy grail of most UK residents. As a country, we are seen as a nation of property owners. In many ways, this makes sense. After all, why should you rent a property to provide an income for a landlord, if you can acquire your own? Over the last three decades, this sentiment has been targeted by mortgage providers and banks.

Easy property acquisition

The late 80s, 90s and early 2000s were a time when mortgages could be acquired for next to nothing. Banks were willing to fund up to 95% of the value of the property, with easy terms of payback. Many people re-mortgaged their properties after paying back the loan, to simply acquire capital based on the equity value that the property had accrued. However, the 2008 financial crisis and the decade that followed has made property acquisition more difficult. Now, the property that you bought and you’re living in cannot be considered an investment. An investment property is usually a second property that you have purchased to rent out and make profits on its equity value, as property prices rise. Of course, the increments in value would vary on the location and size of the property.

The UK is a country of homeowners

Comparing gold investments with properties

Both are asset classes worth considering when constructing a portfolio. Due to the physical nature of the assets, both are tangible investments that do not carry counterparty risks. However, the two asset classes behave quite differently. Property markets are subject to volatility depending on the economic situation in the country. The 2008 financial crisis was triggered off in the US when large numbers of people defaulted on their sub-prime mortgages. Banks and mortgage providers are not in the core business of buying and selling property. Therefore, when a large number of foreclosures happen, the bank is stuck with all these properties and the value plummets fast.

Property investments also carry additional costs like council tax, if not rented and maintenance costs. However, gold investments do not have any counterparty risks or maintenance costs. Also, the sale of a property may take a substantial amount of time, while gold enjoys far greater liquidity and the returns are immediate. Both investments tend to appeal to the same people as they share their tangible nature and appeal to those worried about the true value of paper assets. Both perform extremely well over the long term but can be volatile. This volatility can provide buying opportunities in both gold and property investment. The UK property market has taken a significant hit recently.

Gold investments are free from capital market downturns

Property markets react adversely to an economic crisis

Property markets are prone to devaluation when the country’s economy is plunged into crisis. Gold, on the other hand, has an inverse relationship with poorly performing stock markets, money markets and the economy. When the world goes into crisis, investors move to gold. This is evident from the gold peaks that we witnessed during 2011 and 2020. Therefore, we can surmise that investments in an immovable asset class like real estate carry greater disadvantages than gold investments.

Discuss your investment strategy with Physical Gold

Physical Gold is one of the most reputed UK gold dealers, and the company’s investment team offers free advice to investors on the right asset classes to invest in. Call us today on (020) 7060 9992. Alternatively, you can also reach our investment team by getting in touch online via our website. We look forward to hearing from you.

Image credits: ChrisGoldNY and Pixnio

While some investors prefer gold coins, others prefer gold bars. Gold bars can be a great repository of value and they are a vehicle for investors who believe in owning a tangible asset like a chunk of gold, in the form of a gold bar. Let us now explore why gold bars can be a great addition to your portfolio and where to buy them.

Advantages of investing in a gold bar

Gold bars present an attractive value proposition for investors because they provide an opportunity to buy gold at a lower price per gram. This is possible because the manufacturing costs of producing a gold bar is lesser than minting a coin. Gold bars do not carry an intricate design element.

The bars are produced by pouring liquid gold into a mould, and the purity value and the refiner stamp is engraved on the bar. Gold bars also come in a variety of sizes and weights. There are large gold bars that can weigh a kilo. However, if you are buying gold bars to strengthen your portfolio, it is better to invest in smaller bars than larger ones. This creates divisibility, variety, and liquidity for your portfolio.

This approach can provide advantages when selling. Investing in a large gold bar like a kilo simply means that you have to let go of a large quantity of gold at a single price point in the market. However, selling smaller bars allows you to take advantage of the price movements and generate better profits.

Gold bars offer investment-grade gold at a lower price per gram

Avoid premium brands

Premium brands like PAMP or Metalor can be attractive to investors, however, remember that you are paying a premium simply for the brand name. When buying a gold bar, the only things you need to check are the refiner stamp, serial number, weight, and purity value. It’s often a good idea to invest in pre-owned bars, as they provide better value for money with the same gold content.

Where should you go to buy a gold bar?

There are many options available to investors if they wish to purchase a gold bar. There are high-street gold dealers or jewellers who can sell you a gold bar. Alternatively, you can also find gold bars on auction sites like eBay. But, should you buy an important and valuable investment product from these sources?

Investment-grade gold bars are VAT free in the UK

Gold investment bars should be bought from a professional dealer only. If you want to buy gold bullion bars, then they should also come with a serial number, be certified and have a purity of 999.9 at least. Don’t be tempted to buy lower grade bars or from eBay. Finding a reputed UK gold dealer is the first step you should take when buying a gold bar for investment.

How can you identify a reputed UK gold dealer??

Most reputed gold dealers in the UK will be registered with the British Numismatic Trade Association (BNTA). So, by visiting their website, you can easily shortlist several reputed gold dealers near you. The next step is to call them and find out if they provide a certificate of authenticity and a buyback scheme. Most reputed dealers will also offer free advice for you to buy the best gold bars.

Talk to Physical Gold about buying your gold bars

Physical Gold is a highly reputed UK gold dealer and the company’s investment team offers free advice on buying gold bars to investors like you. Call us on (020) 7060 9992 or reach out to us online via our website. Our investment team will be happy to answer your queries and advise you on buying the right gold bars for your portfolio.

Image credits: Wikimedia Commons and hamiltonleen

Gold coins have been a source of great attraction for many individuals over the centuries. Numismatists who collect gold coins are thrilled with the idea of acquiring a precious and rare gold coin. Investors choose to buy gold bullion coins due to the returns they can make on their investments. Of course, there are certain compelling advantages to buying gold coins.

They are easy to store and often come packaged in monster boxes. They provide divisibility to an investor’s gold portfolio. Also, they have a certain aesthetic value, which many investors prefer over gold bars. However, if you’re thinking of investing in gold coins, there are certain parameters to be aware of.

Gold coins are a fascinating investment

Checking gold coin authenticity

How will you know that the gold coins, you have just invested in are authentic? You will need the services of a gold expert who can certify the authenticity of the coins. But, there are certain checks you can do at home that can help you decide whether the coins are genuine or not. Gold, like other precious metals, has a high density. Therefore, the size of the coin would depend on its weight.

If the gold content of the coin has been tampered with and a certain percentage of base metals introduced into the coin, it will be lighter than it should be. Therefore, you can measure the diameter, thickness, and weight of the coin. To do this test at home, you will require a set of Vernier callipers and a weighing scale used by jewellers. You can also use a magnet to detect the purity of gold in the coin. Since gold is non-magnetic, a pure gold coin will not be attracted by a magnet. There is also a device called the Fisch Tester that allows you to test popular gold coins like the Krugerrand or the Gold Britannia.

Gold weighing scales are often used by jewellers

Apps to test your gold coins

Yes, in 2021, there is an app to test gold coins as well. These apps emit a sound and generate a ‘ping test’ by measuring the echo your coin produces. One of these apps is called Coin Trust and there is a drop-down menu that allows you to select the particular coin you’re testing and proceed from there.

Buy your gold coins from a reputed coin dealer

If you know which coins to buy, then simply purchase them online from a trustworthy broker. If you need guidance as to which gold investment coins to buy, then any good dealer will be able to advise you. Generally, stick to bullion finish coins, rather than proof finish, and only buy really well-known coins. In the UK, Sovereigns and Britannias are best as they’re also tax-free.

The simplest way to buy authentic and genuine gold coins, without going through the hassle of testing them at home is to buy your gold from a reputed UK dealer. Most reputed dealers will provide you with a certificate of authenticity, which is stamped by a coin certification agency like the PCGS or NGC. Storing the gold coin is important and you should never remove the coin from its original packaging so that there are no doubts regarding genuineness when you want to sell the coin.

Call Physical Gold to find out more about buying gold coins

Physical Gold is one of the U.K.’s most reputed gold dealers and has a team at your service that can guide you on how to buy gold coins and advise you on the authenticity of the coins you own. Please reach out to us on (020) 7060 9992, or simply send us an email and our team will connect with you to help you purchase the right gold coins.

Image credits: Mark Herpel and Pxhere

Managing a good personal portfolio can allow you to retire peacefully, knowing that you have a nest egg to fall back upon. Diversifying an investment portfolio is always a good practice. But, asset allocation is the most important thing. Identifying the right asset classes that will bring good returns to your portfolio can be tricky. Gold has always been an asset class that has attracted investors due to the stable returns generated by the precious metal. It is also a great store of wealth and provides investors with an opportunity to hedge their risks. In this article, we will explore the pros and cons of putting your money into fixed deposits and how this asset class compares to gold.

Why invest in fixed deposits?

Most UK high street banks have different fixed deposit schemes that generate steady returns over time. If you already hold an account with a high-street bank, applying for a fixed-term deposit is easy. So, the three main conditions that you need to fulfil when applying for a fixed deposit is that you must be over 18 years of age, have an account with the bank and be a UK resident.

Download the free Cheat Sheet to buying Gold and Silver for Investment

You can invest your money with the bank for a fixed term, which is usually six, nine or 12 months. Another feature of these schemes is that the interest rate is also fixed. So, if the Bank of England base rate changes during the term of your fixed deposit, there will be no change in the interest rates provided to you. A popular fixed deposit scheme is the ISA.

High street banks like NatWest are popular for their ISA schemes

What are the other features of fixed deposits?

There are a few other features of fixed deposits that we need to be aware of. Most high-street banks have a minimum deposit that you must make. For example, NatWest asks for a minimum deposit of £5,000. Also, once you start the deposit scheme, you cannot add or withdraw money from that account. You have to invest your money for the entire term period.

Cash ISA accounts

A cash ISA is a popular scheme because you can take advantage of the tax-free allowance every year. The current tax-free allowance for an ISA is £20,000 during the financial year 2021/2022. A cash ISA can also be opened with only £1. However, fixed-rate ISAs are a different product available from many high-street banks. The minimum deposit amount is lower than other fixed-term deposit schemes. For example, to open a fixed rate ISA with NatWest, you need to invest £1000.

Gold investments generate better returns than fixed deposits

Gold versus fixed deposits

Overall gold is better than cash in the bank. Fixed deposits such as cash ISAs and bank deposits promise an explicit and predictable return. Gold investment, on the other hand, can go down or up in value and at various rates. The current low-interest-rate environment means that fixed deposits offer 1% or lower returns. This can even be taxed if outside of an ISA, reducing the yield still further. These rates are well below inflation which means the value of your money is diminishing in real terms. Gold is riskier in the short term but has the ability for high returns and at a minimum, has proved to beat inflation, successfully acting as a store of wealth. Buying UK gold coins is also tax-free.

Importantly, the returns generated by gold over the short term is far greater than investing in a high-street bank deposit. Bank deposits also carry counterparty risks. If the bank goes out of business, it may be difficult for you to recover your money. If we examine gold price charts over 20 years, it becomes clear that gold has always generated steady returns over decades. However, interest rates in the UK have fallen abysmally over the last 20 years and were only 0.5% during the 2008 financial crisis.

Discuss your investment plans with Physical Gold

If you are building a portfolio that can bring you peace of mind during your retirement years, talk to our investment experts. At Physical Gold, we are happy to offer free advice to investors and explain how you can maximise your returns by investing in precious metals. Call us on (020) 7060 9992 or simply drop us an email via our website.

Image credits: Howard Lake and hamiltonleen

Over centuries, gold has remained an asset class that investors can trust. Investors have repeatedly turned to gold during periods of economic uncertainty. Gold is generally seen as a precious metal that generates steady returns over the short term. In recent years, the world has been plagued by economic crises and investors have always turned to gold. A glaring example from the recent past is the highest peak price ever achieved by gold in August 2020, when it touched close to $2,000 per ounce.

However, with all the interest in gold, it is pertinent to find out how safe is gold investing?

Investors enjoy the safety of gold

Gold as safe haven insurance for investors

In 2011, during the peak of the 2008 financial crisis, gold breached the $1,900 barrier for the first time. At the time, the global recession was also at its highest. The collapse of Lehman Bros was quickly followed by the downfall of many UK banks and investors who lost their confidence in the global economy and capital markets. Clearly, they decided to move their investments to gold as a safe haven. The partial recovery that the global capital markets made since those years was nipped in the bud by renewed economic uncertainty from many factors.

It was abundantly clear from the gold price trend that investors moved their money to gold in search of a safe haven. Interestingly, as the world plunges once again into a possible economic catastrophe, the spot price of gold has already crossed the $1400 mark.

Brexit created uncertainty across the European economies, while the US-China trade war and a host of other geopolitical factors ensured that the global economy never made a full recovery. This phase was followed by the global pandemic, which came upon us in 2020. By August 2020, gold had once again breached price barriers to reach a new high. Looking back at these events, we can conclude that investors frequently move to gold, due to the safety and security it provides.

Counterparty risks

There are numerous factors that established gold as a safe investment vehicle. The lack of counterparty risk is one of them. Counterparty risk is present when an investment you make is dependent on fulfilment by a third-party. For example, investing in direct equity implies that you are putting your money into a listed company. To generate returns, that company must perform.

Similarly, when you invest in a gold ETF, the exchange-traded fund needs to perform in the market for you to realise your investment. When that does not happen, the value of your investments can sink to nothing. Almost every market-linked investment vehicle carries counterparty risks. However, when you buy physical gold, you possess a tangible asset that you have taken ownership of. It is not linked to the delivery system of any company or market. Therefore, counterparty risks are non-existent.

Gold investments are not subject to counterparty risks

The rise and fall of gold prices

The gold price can go down as well as up, depending on supply and demand. Over the short term, there’s the risk that your investment could fall in value. Over the medium to long term, gold has proven to increase in value quicker than the inflation rate, proving to be a reliable store of wealth. Buying in paper form, like ETFs, gold futures or gold shares, poses further risks with leverage and counterparty exposure. Owning gold investment coins and bars negates both of these risks.

It’s important to note that gold prices have never collapsed over the medium to long term. It is a defensive asset class that provides steady, long-term returns. Most asset classes that provide quick returns are risky, on the other hand.

Over the last 10 years, gold prices have never sunk below the $1,000 price point. While equity and debt investments, mutual funds, debentures or derivatives can all be devalued to a point where they are worth next to nothing, gold continues to have an intrinsic value that provides safety.

A quick look at the gold charts reveals that gold is not just a safe investment in times of trouble. The spot price of the yellow metal was under $400 way back in 1996. From these modest prices, it hit an all-time high in 2011 and then settled down to $1600 levels by 2012. An asset class that quadruples in value over a 20-year horizon is certainly a safe investment. Additionally, it is capable of unlocking great value and generating steady returns.

Get in touch with Physical Gold to discuss your gold investments

Physical Gold is one of the U.K.’s most reputed gold dealers. We provide free investment advice about any precious metal investments that you choose to make. We are always happy to discuss your investment plans and identify the best options that can generate optimal returns. Please call us on (020) 7060 9992 or contact us online and our investment team will be in touch with you right away.

Image credits: Marco Verch and Wikimedia Commons