What are the best silver coins to invest in?

There has been great interest in silver in the recent past. The silver market has become buoyant with positive sentiment over expectations of huge price rises in the future. When buying silver, it makes more sense to invest in coins, rather than silver bars, although a mix of both can be desirable for your portfolio. These choices are likely to be governed by individual investment objectives. Having said that, what are the best choices out there in the silver coins’ market?

The silver Britannia

The best coins to invest in for UK investors are the Royal Mint produced coins. The UK silver Britannia should form the backbone of the investment as the standard coin is cheap but very liquid. Premiums are low, as it is a mass-produced bullion coin. The upside potential of buying these coins is tremendous, as it enjoys great availability. Buying large quantities of these coins from dealers can get you hefty discounts.

The Royal Mint issues regular additions of this coin, so, buying the current edition will ensure that you pay little or no premium at all. The Britannia is legal tender in the UK, making it highly tax-efficient in terms of CGT. This is likely to be an advantage for investors who want to cash in their profits after the price of silver rises.

The silver Britannia is a highly collectable coin

Combining Britannia investments with some more limited issue coins such as the Queens Beasts and Lunar series will provide portfolio balance and create the chance to benefit from these coins rising in value quicker due to limited issue.

The Lunar series

One of the great flagship coins launched by the Royal Mint is the Lunar series. It is a set of coins that features a different animal from the Chinese calendar for every issue. The 2019 issue depicts the year of the pig, according to the Chinese calendar. These coins are a must-buy, due to their collectability – there are 12 coins in the set. Each coin has a limited mintage and demand is great due to its popularity in Asia. So, investing in these coins can make your tidy profit, as the demand pushes prices up.

The Queen’s Beast series

The silver Queen’s Beast coins, that are minted by the Royal Mint is yet another beauty. This coin can add great variety to your collection as two sizes are available – a 2-ounce version and a large 10-ounce coin. Once again, they have great collectability value and are tax-efficient. All UK silver coins have the advantage of being Capital Gains Tax-free.

The silver Krugerrand

It is one of the best-known coins in the world and benefits from a very strong secondary market. Investing in the silver Krugerrand ensures great liquidity for your portfolio. The silver version has recently been launched in 2018 and it makes a great addition to any silver portfolio in terms of value and liquidity.

We can help you select the right silver coins

At Physical Gold, our silver investment experts can discuss your investment objectives and suggest the best silver and gold coins to buy. The current gold-silver ratio is around 88:1, so you can purchase quite a large amount of silver for your money compared to when you buy gold. The guidance you receive from our team can ensure that you make the right investment decisions. Call us today on (020) 7060 9992 or contact us via our website to find out more.

Image credit: Eric Golub

If you’re going to invest in gold coins, you will need to ensure they are the genuine article, rather than fake. But how can you tell if a coin is nothing more than a convincing counterfeit? Here are eight techniques to help you avoid being scammed.

Gold coins

How Do I Detect Counterfeit Coins?

1) Check gold and silver coins with a magnet

Anyone who knows a little about precious metals will already be familiar with the fact that gold and silver do not interact with magnetic forces. This means that a high quality, genuine coin should remain unmoved if exposed to a magnet.

If a coin that is claimed to have a high gold or silver content is attracted to a magnet, then it is likely a counterfeit that contains more steel or iron than advertised.

It’s worth remembering that for this reason, some counterfeiters use other non-magnetic metals like copper and lead. This means the magnet test should be carried out alongside the other techniques if it proves inconclusive.

Download our FREE Insiders Guide to Tax-Free Gold and Silver Investment here

2) Examine coins closely for visual imperfections

Even the best counterfeiters in the world make mistakes, and with a well-trained eye, you should be able to spot the difference between the real deal and a fake. This applies to counterfeits of mainstream coins as well as rare collectable coins for investment.

To do this most accurately, pick up a magnifying glass, or go a step further and invest in a specialised loupe used by jewellers to get a closer look at the surface.

If you don’t have a genuine coin to hand, find a high-resolution image of the coin online and use this to make your comparison.

3) Weigh and measure coins

From modern silver Britannia coins to vintage  gold half sovereigns, all high quality coins will have been struck consistently and only put into circulation if they adhere to strict standards for their dimensions and weight.

gold half sovereigns, all high quality coins will have been struck consistently and only put into circulation if they adhere to strict standards for their dimensions and weight.

Because major mints are so reliable in these terms, spotting a fake coin is fairly easy. You just need a calliper and a set of electronic scales.

A standard set of kitchen scales will not offer sufficiently accurate measurements, so buy a scale that displays weights to at least two decimal places. Weigh the suspicious coin and if it is out of kilter with official figures by a significant margin, reject it.

Even a coin that is on the ball in terms of weight can still be a fake. By using a calliper to measure its depth and diameter, you will be able to spot any inconsistencies.

Counterfeiters find it almost impossible to create the perfect phoney coin which both weighs the same as the currency it is spoofing and also has the same dimensions. With the right kit, you can steer clear of dodgy deals.

4) Stack suspicious coins

Another obvious sign that a coin is not of sound origin can be seen in the relief. Even small variations in the height of the relief can become apparent with a straightforward stacking test.

All you need to do is place the coin in a small stack with other examples of similar heritage. Real coins will stack neatly and remain stable, while fakes that are not struck with the same attention to detail or high-quality craftsmanship will teeter, totter and tumble over.

Identifying uneven relief height using this technique does require that you have access to real coins of the same age and denomination. This might limit its usefulness if you are new to investing in or collecting coins, but will help those who are expanding an existing hoard.

Find fake coins with the stack test

5) Ping silver and gold coins

This technique is specific to gold and silver coins as a result of the properties of the metals and the noise that coins make when they collide with a hard surface.

Pinging is a straightforward test for valuable coins, as the sound produced by silver and gold as they hit a tabletop, or are struck against another coin, is unique. While coins made with lesser metals, including counterfeits, will sound dull when dropped, a genuine coin will ring out for longer and produce an unforgettable high-frequency sound.

Prepare yourself to scrutinise potential coin purchases by performing the ping test on a gold or silver coin you know to be genuine, or check audio examples online. That way you’ll have a fixed idea of what to listen out for later on.

6) Place an ice cube on the coins

Gold is a great conductor of heat, silver even more so. That means as soon as an ice cube comes in contact with the surface of a gold or silver coin, it will begin to turn back into liquid water.

If a coin is made of a less conductive and less valuable metal, this process will not begin as quickly. Try this test out with genuine gold and collectable silver coins to see what the reaction should look like.

Historic gold coins

7) Check the specific gravity of gold and silver coins

This is a far more technically advanced test than the others covered so far, which makes it a little harder to recommend to the average coin investor. However, arming yourself with as much knowledge as possible is always a good thing, so understanding the specific gravity test will be helpful for everyone.

The specific gravity of gold and silver will be unique and thus different from that of other metals. You can calculate the expected relative density of a coin made of a precious metal, then test it in real time using a set of scales, a container and some distilled water.

Weigh the coin, then fill the container with the water and place it on the scales, before resetting the measurement to zero. Tie a small length of thread around the coin and slowly place it into the water until it is entirely beneath the surface, but not touching the bottom of the container. Take a note of the weight that has been added and then divide it by the ‘dry’ weight of the coin you took earlier.

For gold, the specific gravity you are looking for is 19.3 for a completely pure sample. For silver, it’s 10.49.

8) Work with respected silver and gold coin dealers

If you want to avoid all of the complications that come with trying to detect counterfeit coins under your own steam, the best option is to only buy from dealers that have a good reputation.

This isn’t just about avoiding first-hand contact with con artists, but also about building up a trusting relationship with a company like Physical Gold which you can rely on for all your future precious metal investment needs.

Most of all you should avoid coins that are being sold well below their market value, or being pushed upon you by a dealer who seems eager to get the sale over with as quickly as possible. The signals of an attempt to shift fake coins should be clear, so long as you are willing to look for them and don’t fall for a deal that’s too good to be true.

Call or email Physical Gold for more coin advice

Our experts know everything there is to know about gold and silver coins, such as Sovereigns and Britannias. So, if you are thinking about investing and want more information, then the best option is to get in touch. Make a quick phone call to 020 7060 9992 or email us for outstanding coin advice.

Image Credits: Pixabay, Pixabay, PickPik, Pix4Free and Pixabay.

Coinex numismatic trade show is an annual event held every September in London. It marks one of the most anticipated events of the British calender for avid coin collectors and enthusiasts. Organisers, The British Numismatic Trade Association (BNTA) are opening up the event to more dealers than ever, promising excellent choices for collectors and investors alike. 2023 is a special year as it marks 50 years of the BNTA and more than 4 decades of the Coinex event.

Coins from around the world

Who are the BNTA?

The BNTA was first formed all the way back in 1973 in order to help the nation’s community of coin dealers engage with the government on tax issues impacting their industry, while also attempting to stamp out forgery and counterfeit coin operations.

Just five years after its formation it launched the first Coinex event, traditionally hosted in the heart of the capital at hotels and event centres near Mayfair.

Interested in buying gold or silver? Download our FREE 7 step Investment cheatsheet here

Plans for Coinex

Coinex is traditionally held each year at The Ballroom of The Biltmore Hotel, Mayfair, Grosvenor Square, London W1K 2HP. This at the Millennium Hotel, London, Mayfair. This venue is rebranded from the old Millennium Hotel. The hotel has was recently upgraded to a five-star status following an extensive renovation and facelift. Today, the prestigious hotel at 44, Grosvenor Square, Mayfair is part of the Hilton group. The hotel has been renovated at a cost of £50 million through 2018 and will celebrate its brand-new opening in September 2019. The BNTA believes that it will be an ideal location for Coinex for years to come. The luxurious new conference halls will mean that a larger line-up of coin dealers and attendees can be accommodated. With excellent public transport links, secure delivery access and the perfect positioning for people who want to explore London as well as buying gold coins, the Biltmore, Mayfair should be an ideal setting for Coinex Trade Fair.

Why attend this event?

Quite simply the BNTA’s size and influence mean that this annual get-together of dealers is one of the best places to find valuable coins of every conceivable age and quality.

The involvement of the BNTA also gives buyers peace of mind about the provenance of what they are buying. Every dealer this year will either be a member of the association or have been invited specifically to set up shop because they are known to be reputable. A total of more than 45 exhibitors are in attendance, representing the top UK numismatic traders, auction houses and European dealers.

It’s worth noting that over the years Coinex has expanded to include more than just rare coins. Everything from banknotes and medals to bonds and shares will be on sale, so even people with a passing interest in rarities and collectables should make an effort to attend.

With the event increasing in size year on year, you can also expect to see antiques of other types mixed in amongst the stalls, ensuring there’s something for everyone.

The 2023 Coinex event will be from 29 September 2023 – 30 September 2023. Opening times are 11am-4,30pm on Friday 29th Sep (last entry 4pm). VIP entrance fee £30. Saturday 30th Sep 10am-3.30pm (last entry 3pm), entrance fee just £5.

Why buy gold and silver coins?

Some people buying precious coins just for the thrill of collecting rare, historic objects. Others do so to make an investment in a physical commodity that will appreciate in value. Whichever category you fall into, Coinex should pique your interest. Gold coins have historically kindled the interest of numismatists and investors alike. As a stable asset class, gold coins add balance to an investment portfolio. Silver coins, on the other hand, have gained popularity over the years, as investors see the white metal as a promising investment vehicle that could provide rich returns in the foreseeable future.

Invest in precious coins with Physical Gold

If you are interested in buying rare gold coins and collectable silver coins, you don’t have to head all the way to an event in London and haggle with dealers. Contact Physical Gold by calling 020 7060 9992 or using our contact form for advice, quotes and assistance.

Image Credit: Burst

Spotting an investment opportunity in precious metals can be lucrative if you buy early. Silver is currently very low-cost compared to gold so is seen as a bargain, providing more likelihood of future gains. The current gold-silver price ratio is 85:1. It’s interesting to note that this ratio was 47:1 some years ago. In other words, the spot price of silver has fallen significantly over the years. Of course, many investors believe that there is a downside risk of investing in silver. The present price of silver is around £12 per ounce. So, is there a risk involved in buying silver coins?

A case for the appreciation of silver prices

Silver is in great demand all over the world. As the most conductive of all metals, silver is the preferred use in technological goods, so analysts predict demand to continue rising. Silver continues to remain the preferred metal for conductivity in photovoltaic cells, which is an integral part of solar panels. As the world moves toward sustainable energy solutions, the production of solar panels is likely to keep rising. Silver is also used in all electronic products like mobile phones, laptops and tablets. As our world becomes increasingly connected through technology, the demand for silver will rise.

Silver coins can be a great investment over the long term

Rise in prices due to falling supplies

Electric cars are soon becoming the obvious choice for land transportation. With petroleum and diesel passenger vehicles expected to be phased out from Europe between 2030 to 2040, electric cars will occupy the lion’s share of the market. Silver is a critical component for e-mobility and the overall demand is expected to shoot up due to the above factors. On the other hand, there has been a significant drop in the production of silver from the world’s largest producing countries like Peru, Mexico and China. So, on the basis of supply and demand, we can reasonably expect prices to go up eventually.

How can silver coins deliver value?

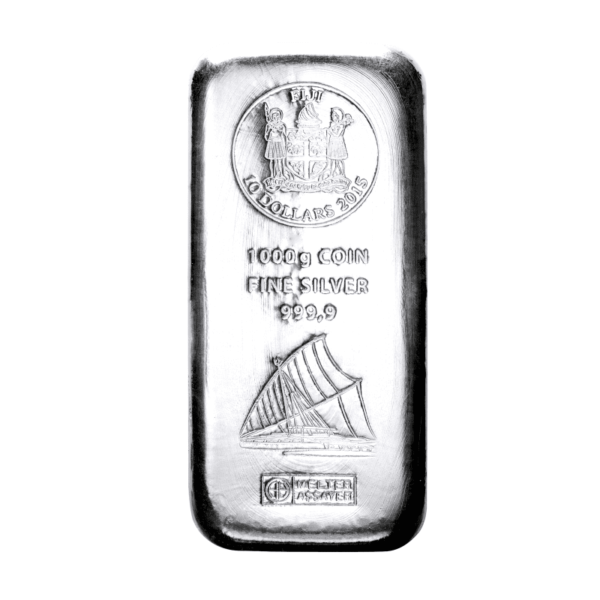

First of all, silver coins provide divisibility to any precious metal portfolio. Many investors prefer to purchase silver bars. However, when selling back into the secondary market, bars (such as a 1 kilo silver bar) give you only one chance to sell. Coin investors, on the other hand, benefit from holding a variety of denominations. They can sell small parts of their silver holding as and when the price is right.

Silver coins (such as the silver Britannia) also provide a tax-efficient avenue for investment. Many silver coins are considered to be legal tender in the UK since they have a face value. Investing in these coins can provide an attractive CGT exemption.

Silver coins can deliver value over the long term

The value of silver coins can be volatile. They can go up and down in the short term. Over the long term as a precious metals with limited supply and increasing demand, they are likely to rise in value. Premiums on collectable silver coins can rise quicker than the market price of silver due to interest from both collectors and investors.

So, we can surmise that the downside risk involved in buying silver coins is minimal. Coins, in particular, can deliver good returns over a period of time while maintaining tax efficiency for your portfolio.

Contact Physical Gold to buy silver coins

The investment team at Physical Gold are always helpful in guiding buyers to make the right choices when it comes to silver coins. Contact the team on (020) 7060 9992 and you can benefit from advice, as well as guidance in buying the right silver coins that can provide great value.

Image Credit: Pixabay

Silver Britannia coins have become a popular investment vehicle for investment in silver. Regularly we are asked questions about these coins, so have summarised some of the most popular questions and provided answers in this silver Britannia coins FAQs guide.

Are silver Britannia coins a good investment?

Click here https://www.physicalgold.com/insights/are-silver-britannia-coins-a-good-investment to read our detailed answer to this article.

How to buy Britannia silver coins

Visit https://www.physicalgold.com/insights/how-to-buy-silver-britannia-coins for a detailed answer to this question.

What are Britannia Silver coins?

Click here to read our detailed answer.

What is the value of Britannia silver coins?

We have created a comprehensive answer to this question. Click here for details.

Is there a limit on Britannia silver coins mintage?

Please click this link to read a detailed reply to this answer.

How do I sell silver Britannia coins?

As a popular investment coin, the easiest and safest way to sell them is to a reputable precious metals dealer. This enables you to agree on a competitive price with the dealer, send them your coins, and receive payment quickly. An alternative is to sell privately where collectors may pay a premium. However, this can be fraught with danger.

Buy and sell silver Britannia coins with Physical Gold Limited

Are Britannia silver coins legal tender?

Absolutely, they are legal tender within the UK. They possess the requirements of featuring the monarch’s bust and a face value, £2 in the case of the 1oz version. In theory, you could use it to buy goods up to the value of £2 in a UK shop, however, the silver content alone, makes the coin worth many times that. In practice, the legal tender status increases the coins’ appeal as an investment as this qualifies it as tax-free.

Silver Britannias vs American Eagle

Read our article – by clicking here for an answer to this question.

Any more questions? Speak to us at Physical Gold Limited

We always welcome enquiries, so if you have any further questions about silver coins, including Britannias then please do not hesitate to get in touch. Call Physical Gold Limited on 020 7060 9992 or complete our contact form to start discussions.

We are frequently asked questions about silver coins. This is why we have created this silver coins FAQs page, which is full of questions with model answers.

Are silver coins a good investment?

We have prepared a detailed article to answer this question, please visit by clicking here to learn more.

The American Eagle is an example of a popular silver investment coin

Is silver coinage magnetic?

Genuine coins made from silver are not magnetic. With purity of popular silver investment coins such as Britannias close to 100%, only replica (fake!) coins will be magnetic. Coins made with far lower purities of silver, mainly mixing in steel or iron will show signs of magnetism, so should be avoided. Non-magnetism does not guarantee that the coin is silver though. Metals filled with a core of non-silver will likely not be magnetic either.

Are silver coins worth anything?

Yes, their value is a combination of the underlying silver price, their weight, and the coin’s rarity and desirability. Generally, a silver coin will sell for around 96-98% of the current silver value for its weight. So, a 1oz coin may fetch around £11 or so. If the coin is part of a limited issue and demand is higher, the value is likely to be 5-10% higher.

When to sell silver coins?

It is advised to hold coins for the long term and always hold a portion of your wealth in silver as a balance and hedge against market downturns. Having said that, the amount you hold can vary according to market conditions and the silver price. Timing will depend on the price and time you bought them (was the market high or low), your need to liquidate and the current silver price. Buying low and selling high is the ideal scenario!

Are silver coins legal tender?

Yes, they are legal tender in their country of issue if they possess a face value. In the UK, Silver Britannias and other Royal Mint issued coins have face values and can, in theory, be used in shops. But this would be an uneconomical choice. With a face value of 2 Pounds, the silver content alone is worth at least five times that. Instead, the legal tender status helps silver investors as any capital gains made upon selling the coins are free from tax.

Will silver coins go up in value?

We have provided a detailed answer to this question, at this separate page.

Silver rounds vs coins

Choosing silver coins vs silver rounds will depend (ultimately) upon your objectives. Silver rounds can generally be bought at lower prices for their weight as they are produced by private companies rather than national mints. With less liquidity, rounds are likely to be sold as scrap in the future. Certain legal tender coins are also CGT free, so any profits are tax exempt.

How to store silver coins?

The best way is first to keep them in the plastic capsules or tunes they arrived in. If they came loose, then purchase some coin tubes. Large orders of 250 coins or more can come in monster boxes of 20 tubes or more and can help with neat stacking. Try to handle your coins as little as possible. Placing carbon pieces from a pet shop in the box can help prevent the hydrogen sulphide from tarnishing the coins.

Silver coins can be stored in boxes like this one available from Physical Gold Limited

Will a silver coin purify water?

Silver acts as a preserver for many substances. As a colloidal metal, it can help prevent diseases and be anti-bacterial. Certainly, adding a clean silver coin to some water will help with its purity. However, simply dropping a silver coin into a glass of dirty water will not rid it of all its nasty elements.

What silver investor coins should I collect?

We have written a detailed and dedicated blog article on this topic. Click here to read our full answer.

Where can I buy silver investment coins?

Read our detailed article, where we explore this topic here.

Are silver bullion coins worth buying?

Currently, they are incredibly cheap relative to their historical ratio to gold. This would suggest that their value is set to rise in the future. Coins offer superb divisibility rather than buying silver bars but still offer quantity discounts. UK coins can be CGT free, which foreign silver bars and coins cannot. With industrial demand for silver in computers on the rise, the future looks bright for silver.

Silver bars like the one above do not offer the tax advantages that UK silver coins do

What silver bullion coins are worth the most?

Read https://www.physicalgold.com/insights/what-silver-coins-are-worth-the-most for a full answer to this question.

Are coins made from silver pure silver?

Click https://www.physicalgold.com/insights/are-silver-coins-pure-silver for more detail on this topic.

Can you buy silver coins at a bank?

The number of banks offering a retail service is dwindling. It is now only possible to buy from certain banks such as Scotiabank in some countries, but not in the UK. This is because the banks do not want to commit the necessary resource for dealing in precious metals. For this reason, many banks who can source your silver coins from, will not buyback. The price they sell at will be relatively high, reflecting their lack of appetite for the business.

Why do silver coins tarnish?

A natural by-product of silver is its reaction to chemicals and humidity in the air. Tarnishing occurs when the silver atoms encounter oxygen, forming a silver oxide. Unlike rust, this protective layer does not infiltrate into the silver. Tarnishing, also known as toning, can be removed by using a coin cleaning solution and minimised by keeping coins in airtight containers.

Silver coins vs face value

Read https://www.physicalgold.com/insights/silver-coins-vs-face-value for our answer to this question.

Are silver proof coins a good investment?

We have provided a detailed answer to this question, at this separate page.

Will a silver coin keep milk from spoiling?

Placing a silver coin into milk will delay the time it takes to go off. The coin has to be 99.9% pure rather than a lower mix alloy to work. The natural anti-bacterial qualities of colloidal silver will not prevent the milk from spoiling entirely but can prolong its life for 5-10 days. Infact, before refrigeration, silver was used regularly to achieve longer life milk and keep water pure.

Are silver bars or coins better?

Please read our dedicated post to answer this question, which is available at this link – https://www.physicalgold.com/insights/are-silver-coins-or-bars-better/.

Gold coins vs silver as an alternative

Silver is far cheaper than gold, making it more accessible to the modest investor. The current price ratio between the two metals is at its widest point in history, suggesting silver has far more potential upside. Gold acts more like a classic safe haven to protect investors in economic downturns. While silver also acts in a similar way it also benefits from industrial demand due to its conductive qualities. Silver can be more volatile and dealer spreads are slightly wider than the gold market.

Are silver coins in circulation?

Our 50p and 5p coins are known as silver. However, they no longer contain any silver at all. Instead, they consist of cupronickel, a mix of nickel and copper. This is far cheaper and more resilient than using silver. Silver investment coins like the Britannia consist of 99.99% pure silver. While they have a face value, they are not actively in circulation. In theory, you can legally spend this coin in the shops, but its £2 face value is less than a fifth of its silver value.

Will vinegar clean silver coins?

Vinegar can be used to clean non-valuable coins but is not recommended for pure silver coinage. The use of vinegar could lower the value of the coin. The best bet to clean is with warm soapy water. Avoid using a brush as silver can be soft and scratch. Instead, use a cloth and fingers to rub any dirt away after soaking.

What are silver coins made of?

Silver investment coins are made from pure silver (99.99% purity usually). Silver currency coins such as the fifty pence piece or 5p are made from a mixture of nickel and copper. The alloy consists of 75% copper and 25% nickel, which when combined form a resilient metal known as cupronickel. UK coins were made from 92.5% sterling silver until 1920 and then this reduced to around 50% purity until 1947. Cupronickel was introduced in 1971.

Are silver eagle coins a good investment?

Visit https://www.physicalgold.com/insights/are-silver-eagle-coins-a-good-investment where we have created a separate blog article.

How do I sell silver investment coins?

We have created a separate article on this topic. Please visit https://www.physicalgold.com/insights/how-do-i-sell-silver-coins to access this article.

What silver bullion coins to invest in?

The best coins to invest in for UK investors are the Royal Mint produced coins. The silver Britannia should form the backbone of the investment as the standard coin is cheap but very liquid. Combining this with some more limited issue coins such as the Queen’s Beasts and Lunar series will provide portfolio balance and create the chance to benefit from these coins rising in value quicker due to limited issue. All UK Silver manufactured coins have the advantage of being Capital Gains Tax-free.

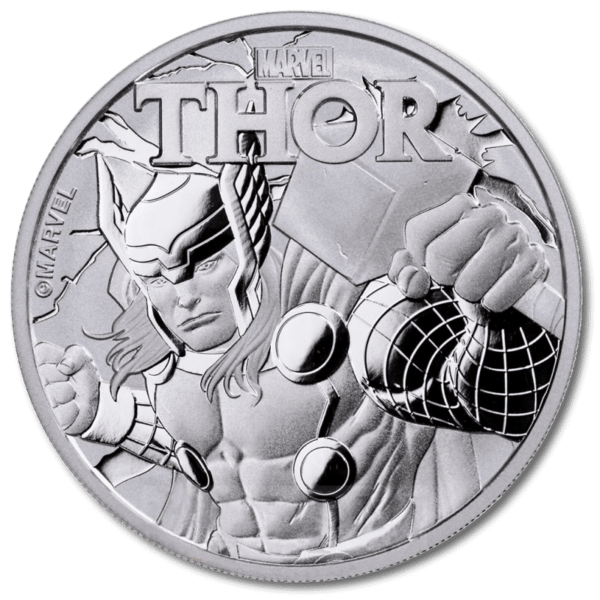

Certain silver coins like this 1 oz Marvel’s Thor Silver Coin 2018 are highly collectable

Will banks buy silver coins?

Your average high street bank will not buy them from you. It is possible they would exchange the coins for their face value but that would be a foolish strategy as these values fall well short of the actual value. It is far better to seek the help of a reputable silver dealer who specialises in precious metals and will pay well for them as they can sell them on to other customers.

Can silver coins conduct electricity?

In theory, yes, they can conduct electricity. But we are only talking about the pure silver investment coins that contain 99.9% silver. Silver is by far the most conductive of all elements, to the point, where all other metals are benchmarked against silver to gauge conductivity. Silver currency coins that contain no silver at all will conduct electricity at a far lower level.

Where to sell silver coins?

If you have old coins with a value far greater than their simple silver weight, then sell them through an auction of a specialist dealer. Silver dealers will provide the best price and trustworthy service. If you have time on your hands, then you can try selling privately through portals such as eBay, but this poses risks. For scrap coins, local jewellers are easy to sell to but be prepared for low prices.

Silver coins proof vs uncirculated

Silver uncirculated coins are recommended for investors. They are far cheaper than proof coins so you can get more silver for your money. Silver dealers will not pay much more for silver proof coins when you come to sell. If you are a coin collector, then proof coins can add a higher sense of finish and exclusivity to the coin.

How do I clean silver metal coins?

The best way to clean valuable coins made from silver is with warm soapy water. Soak the coins for 10 to 15 minutes turning them occasionally. The coins can then be rubbed dry with a cloth, paying attention to removing any surface dirt. Avoid using a brush that could scratch the silver or chemicals like vinegar that could detract from the coin’s lustre.

When to buy silver coins?

Silver coins should ideally be bought when the economy is quiet, and the stock markets are doing well. This usually means a low silver price so you can secure coins at this level. The value of coins rises with the underlying silver price and should be considered a medium to long term hold due to short term volatility. Buying silver regularly is another strategy to gradually accumulate a substantial holding by averaging out buy prices.

Can I buy silver coins directly from the US mint?

Yes, they can be bought directly from the US Mint’s website. In a similar way to the Royal Mint, you are restricted to buying coins only produced by the mint. They will not sell 3rd party coins. Due to their reputation, the mint does not need to be super competitive on prices and will not generally offer quantity discounts. There is a focus on boxed proof coins rather than bullion coins. Better deals will be had from buying from a silver dealer, who will offer to buy back the coins, provide lower prices and more choice.

Where to store silver coins?

If you want hassle-free storage, it is best to store coins with the silver dealer from whom you bought. This usually entails storage in a specialist warehouse to maintain the silver’s integrity and includes insurance. If you want to store yourself, then the coins should be kept somewhere secure and be insured against theft. Reducing the amount of handling and oxygen to the coins will help prevent tarnishing. Keep the coins in their tube and keep them airtight if possible. If bought in large quantities, silver coin tubes can be stored in monster boxes (of 20-25 tubes), and the boxes conveniently stacked.

Why invest in silver coins?

We have provided a detailed answer to this question, which is available at https://www.physicalgold.com/insights/why-invest-in-silver-coins/.

How to test silver coins?

A very quick way to test silver coins is to place an ice cube on top of the coin. As the world’s best conductor of electricity, the ice cube should start to melt immediately compared to one placed on a wooden surface. Testing the silver coin for magnetism cannot prove it is genuine, but any sign of sticking to the magnet will prove it is a fake. When looking at well-known silver coins, careful visual comparisons with a real silver coin will usually unearth some straightforward differences with finish, detail, and edging.

Which silver investment coins are the best to buy?

Silver Britannias are the best silver-based coins to buy for investment. They are mass-produced bullion coins so offer a high degree of value. Limited issue coins tend to command a premium. Britannias are 1oz in weight so provide divisibility. Any profits made on selling silver Britannia coins are CGT exempt as the coins are legal tender in the UK. There is a strong second-hand demand for the coins so selling prices are high.

Are silver Britannia coins a good investment?

Britannia coins are an excellent investment for the medium to long term. Silver is currently unbelievably cheap compared to historical values. Industrial demand for silver is rising with advances in technology as silver is used for its conductive qualities. Silver Britannias are an excellent option is they are highly liquid, world-renowned, and tax-free for UK investors.

Buy silver Britannias direct from Physical Gold Limited

Why buy silver investment coins?

Buying silver coins is an excellent option for those seeking a tangible asset with no counterparty risks. The value of silver can rise with industrial and investment demand, but supply is limited due to its precious metals status. Coins can be a better option to buy than silver bars as they can be tax-free and can be sold in small sizes. Discounts are available for buying in larger quantities of coins.

Where to buy silver coins online UK?

Do not be tempted to buy coins from online shops like eBay and Craigslist. Authenticity can be a huge problem if you buy privately. Stick to buying from prominent silver dealers so you can rest assured that the silver is real. They will also provide the facility to store the silver if you wish, deliver it to your door, and buy it back in the future.

Call Physical Gold Limited with your further questions

We appreciate that you may have additional unanswered questions, if that is the case why not contact us? Simply call us now on 020 7060 9992 or complete our contact form and we will seek to help clarify any questions you may have.

The American Silver Eagle is one of the most prestigious coins to be minted in the US. The coin is a relatively new one, having been released in 1986. This makes the first edition of the coin only a year older than the gold Britannia. The US Mint released the silver Eagle with one Troy ounce of silver that has a purity of 999.9. The coin was released with a face value of one dollar.

Interestingly, ever since the American silver Eagle has been released, the designs have never changed. Unlike the silver Britannia, the coin is presented in the same style, look and feel and the only difference from one coin to the other is the respective mint mark, which is found on the reverse of the proof coins. Well, the coin enjoys healthy interest from investors, and we want to find out whether the silver Eagle is worth its salt as an investable coin.

The American Silver Eagle coin known across the world as a liquid coin.

Divisibility and liquidity

In terms of divisibility, the silver Eagle does not offer much choice. As discussed above, the coin has always been available in the same size, shape, and design. However, there are some variations in its design that can add to the variety of an investor’s silver portfolio. The obverse of the coin features an image of Lady Liberty, created by the designer Adolph A. Weinman. Apart from the famous image of Lady Liberty, the obverse of the coin also features the American national motto – “In God we trust”.

Design options

The reverse of the coin carries the image of the Heraldic Eagle. Right above the head of the bald eagle, there is a cluster of 13 stars, each of which represents one of the original colonies of America, at the time of its founding. The only design change for the American Silver Eagle was in 2021. In the new 2021 design, the bald eagle on the reverse of the coin is featured flying back with its wings spread out. So, this is perhaps the only element of variety that an investor can hope for when investing in the American Eagle. The 2021 design commemorates the 35th anniversary of the coin, and the US Mint has taken this opportunity to refurbish the design of the coin.

Liquidity

The American Silver Eagle is a famous and well-known coin across the world. This ensures the liquidity of the coin and the coin can be easily cashed in at any point in time, bringing in cash as you need it. Previous editions may command a premium due to increased numismatic interest. American Eagle coins are available in uncirculated, proof, and burnished versions, giving a certain amount of choice to investors. Being a well-known coin, the coin has a good chance of being sold for its value in a short period.

The obverse of an American Silver Eagle – the year 2000

Silver Eagles can provide a good medium to long term investment and balance to other assets. The 1oz coins afford high flexibility to sell small parts of the silver holding compared to owning huge silver bars. The mass-produced coins are relatively cheap compared to collectors’ coins and their value can rise along with the underlying silver price and age of the coin. Many analysts feel the silver price is very undervalued, suggesting holding silver Eagles will benefit the investor in the long run.

Talk to the coin experts at Physical Gold

One of the country’s most reputed and well-known precious metal dealers is Physical Gold. Our advisors are always happy to discuss your silver coin purchases with you and can offer valuable advice. Get in touch with us on (020) 7060 9992 or simply drop us an email by visiting our website.

Image credits: Eric Golub and Wikimedia Commons

As the demand for silver has risen over the years, primarily due to industrial requirements, the price of silver has seen some volatility. Investors want to get into the silver market because of two reasons – they believe that the price of silver will rise significantly in the future and offer them the opportunity to book lucrative profits. Silver also allows investors access to the precious metals market at a fraction of the price of gold.

The popularity of silver coins

Many investors prefer silver coins since the coins allow them to add divisibility and liquidity to their portfolios. Investing in different sizes and denominations of silver coins has its advantages. One can use a variety of coins to sell the silver at various price points in the market and book profits.

Close up of the Silver Britannia – one of the most popular silver coins

Collectable silver coins

Silver coins are also attractive to investors for their collectable value. Silver has been in circulation as a precious metal for minting coins over several centuries. As a result, there are plenty of historical silver coins that command hefty premiums based on their rarity value. These premiums are payable due to the historical value of the coin and its demand. Therefore, such coins are worth a lot more than their silver content or their face value.

They are worth significantly more than their face value. A £2 silver Britannia has a melt value more than 5 times its face value. Also, they can possess a degree of numismatic value, which reflects their rarity, age and desirability. Limited issue coins may be worth more again. The face value benefits the buyer by qualifying the coin as capital gains tax-free

Many silver coins have embossing on the sides

Limited edition silver coins and proof coins

For example, in 2013, the Royal Mint released a £20 coin minted with silver that carries a fineness of 999.9. Despite the coin having a face value of £20, it is worth much more and is viewed as a collector’s item, by numismatists. The coin is considered to be legal tender, with a face value of £20. Similarly, the 2018 five-ounce silver Britannia proof coin has a face value of £10 but is listed on the Royal Mint site for £455. The coin is minted with 99.9% pure silver and enjoys great demand as a proof coin, leading to the high value of the coin.

Silver Britannia coins and their face values

The current year silver Britannia (2021) carries a face value of £2. This is a 1-ounce coin, manufactured with fine silver (999.9). Although it is a bullion coin, its face value has nothing to do with the market price. The 2021 silver Britannia 1 ounce coin is priced at approximately £31.

Some coins achieve their rarity status by default. A good example of this would be a batch of silver Britannias struck by the Royal Mint in 2014. 17,000 of these coins were erroneously struck with the obverse used in the lunar series. So, you had a silver Britannia with the “year of the horse” image on the obverse. These coins were later called the Mule Britannia and attracted large premiums due to their rarity. These are often sold at prices close to $700, as collectors are willing to pay lucrative amounts to secure a coin for their collection.

Our coin experts at Physical Gold can help you make the right purchases

Physical Gold is one of the U.K.’s most reputed precious metals dealers and coin specialists. Get in touch with our team by dialling (020) 7060 9992 or send us an email via our website. We are always happy to speak to customers like you and offer advice on buying the right silver coins.

Image credits: Eric Golub and Pixabay

Silver is gaining in popularity due to its investment potential that has grown over the years. Due to the rising industrial demand for silver, many investors envision making windfall gains in the future, on the rising price of silver. However, silver has a long history of usage in British coinage and coinage across the world.

Most precious metal investors will insist on finding out the purity of the coin before investing. This may not be entirely true for collectors, who wish to acquire a coin, based on its rarity and numismatic value. However, many collectors have also moved to become investors and want to build a strong portfolio of coins that are both collectable and deliver good value for money. Therefore, in this article, we will explore the purity of silver coins across continents.

The purity of investment-grade coins

Investment coins are as near to pure as possible. Popular bullion coins such as the Britannia are struck to 99.99% purity. None are 100% pure silver. Silver currency coins such as the 50 pence piece are not made from silver at all despite their colour. Their alloy is 75% copper and 25% nickel, a mix known as cupronickel.

Sterling silver is often used to make jewellery

Similarly, in the United States, most silver coins in circulation contained 90% silver. It was only in 1986, when the American Eagle bullion silver coin was introduced, that the purity of silver was raised to 99.9%, to qualify the coin for investors.

Purity of silver coins across the world

The silver used for coinage in Britain has a minimum purity of 95.8%. Typically, this implies that the silver used for coinage will be an alloy of pure silver, copper and other base metals. The percentage of pure silver in this alloy is 95.84%. Likewise, the alloy would contain 4.16% of copper and other base metals, if any. This standard was developed in Britain as early as 1697. However, we have seen that in recent years, most silver bullion coins minted by the Royal Mint have a purity of 99.9%.

Similarly, France also follows a standard known as the ‘French first standard’. According to this, the alloy contains 95% pure silver and 5% of other base metals, including copper. Russians, on the other hand, use their own standard, known as “91 Zolotnik Russian Silver”. In this, the proportion of pure silver is 94.79%, while 5.21% represents copper and other base metals.

Queen Victoria silver coins from British India

Britain also used “Sterling Silver”, as early as the 12th century. Sterling silver was used for coinage across the British Empire, and many commonwealth countries continued this tradition after the end of colonial rule. Sterling Silver uses 92.5% of pure silver and 7.5% of copper and other non-precious metals.

Other nations may use different standards. For example, Scandinavian silver uses the number 830 to denote its fineness. This simply means that the silver alloy contains 83% pure silver and 17% base metals. In the same way, German silver is denoted with the number 800/835. German silver typically uses 80% to 83.5% of pure silver. However, the term “German silver”, also popularly called nickel silver or alpaca, may contain no silver at all. It is an alloy constructed out of different metals. So, it’s helpful to know and understand these details as an investor, which may help us to ascertain the value of the silver products we are buying.

Talk to our precious metal experts at Physical Gold

At Physical Gold, we have a team of precious metals experts who can advise investors, just like you on making the best investments. Call us today on (020) 7060 9992 or get in touch with us by email regarding your silver investments.

Image Credits: starbright and P.L.Tandon

Over the years, investor interest in silver coins has increased manifold, with the expectation of rich dividends when silver prices skyrocket in the years to come. While gold has been consistent in delivering steady returns to investors, silver has had a more volatile ride. Although silver prices fluctuated in the short term, the high industrial demand for the white metal has ensured healthy interest from investors.

The industrial use of silver

Silver is used in industry, across many applications. As the electronics industry has grown, so has the demand for silver. Silver has certain unique properties like conductivity and ductility that makes it perfect for use in electric cars, computers, mobile phones and solar panels. Most of the components under the hood of these devices use silver extensively.

British commonwealth silver coins

Advancing technologies

Due to the advancement of technology in the world, these industries have flourished and are likely to continue growing at an unprecedented pace. Therefore, large volumes of silver will be required to fuel the growth of these industries. However, the production of silver has also dropped over the years. Silver is mined in a select few countries across the world and its production has been continuously falling. The easy inference that one can draw from this situation is that the prices of silver will eventually go up. Silver has also been attractive for precious metal investors since it offers an easy entry into the precious metals market. It is much cheaper than gold and many investors prefer to buy the white metal.

Why buy silver coins?

The two obvious routes for silver investors to take is to buy coins and bars. UK silver coins are preferred by many investors, since they qualify for Capital Gains Tax benefits, as they are considered to be legal tender in the UK. All investment-grade gold is VAT free in the UK, however, in most cases, silver purchases would be subject to VAT. Silver coins are also available in various denominations. Investors who are building a precious metals portfolio will follow their investment objectives, and decide to maximise the liquidity and divisibility of their portfolios. Investing in prestigious silver coins like the silver Britannia, or the silver Maple leaf can increase the value of the portfolio.

Bullion coins like the Silver Maple Leaf can be bought from reputed dealers

Where can you buy silver coins?

The best place to buy all precious metals is from a reputable dealer. They will likely have a wide choice and stock which can be delivered to you with insured delivery, saving you the time and security of having to pick them up in person. A good dealer will be able to offer guidance and a buyback guarantee. Some silver brokers can sell coins without charging VAT.

Download the Insiders Guide to buying silver and gold here

Reputed silver dealers can be identified by visiting the website of the British Numismatic Trade Association (BNTA). Most reputed dealers are listed on this website, and once you have identified the right ones for you, it’s down to shortlisting them by making contact. If you prefer to invest in silver coins, it is best to identify a good dealer who specialises in this area. Discussing your investment objectives with the dealer may be an excellent idea, as the dealer then becomes aware of what you want from the market and will give you a heads up when the right products become available. When identifying a reputed dealer, always ensure that they provide the certificates of purchase, and have a buyback scheme. Most reputed dealers will also have storage options for you and will deliver your silver purchases through a secure, insured parcel service.

Speak to the silver experts at Physical Gold

At Physical Gold, we pride ourselves on being one of the country’s most reputed silver dealers. We are fully registered with the BNTA and offer free advice to investors on their silver purchases. Please call us today on (020) 7060 9992, or get in touch with us online and a member of our team will contact you very shortly.

Image credits: Wikimedia Commons and Silver Torch 66