What Are The Best Silver Coins To Buy

21/07/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Investing in silver coins is a popular strategy among both seasoned and novice investors. The tangible nature of silver, coupled with its intrinsic value, makes it an attractive investment option.

But with a plethora of choices available, the question arises – what are the best silver coins to buy? Here we give you the 6 very best options available in our store.

Silver Britannia coins, such as the2023 King Charles III Silver Britannia stand out as a unique investment choice.

Since 2013 these coins have a 99.99% fineness (pre 2013 have a 95.8% fineness), and feature the renowned Britannia warrior on the reverse, making them recognisable and very liquid.

Advanced security features, such as surface animation, fortify the Silver Britannia against counterfeiting. Minted by the illustrious Royal Mint, this coin is a part of the Britannia series, which boasts a variety of gold and silver coins.

Shop our range of Silver Britannias, buy in confidence with our buy back guarantee. Or call us on 020 7060 9992.

The Tudor Beast series, containing coins such as the 2023 Silver Bull Of Clarence serve as a welcome follow up collection to the esteemed Queen’s Beast series.

Each coin in this series is celebrated for its intricate designs, which also double as a security measure against counterfeiting.

Produced by the Royal Mint, the Tudor Beasts is a part of a series that includes multiple designs each representing a heraldic beast. So far, the range of Tudor Beasts are:

Explore our full range of Tudor Beasts silver coins at Physical Gold. Secure your purchase today with our buy back guarantee or contact us at 020 7060 9992.

Each myth comprises 3 coins by the Royal Mint, each featuring a character from that story. The Myths and Legends series are 999.9 purity silver coins each featuring the design of a British folklore legend.

The first set of releases depicted the three main characters from the Robin Hood legend, with the follow-up set focussing on the story of King Arthur. The Robin Hood, Little John and Maid Marian coins from the first series are already trading at a premium due to limited-time issuance.

The intricate designs of each myth are a strong security measure for each coin. Take the 2023 Merlin Coin, the design features a beautifully engraved sickle, an owl perched on Merlins shoulder and the legendary Glastonbury Tor in the backdrop.

The beauty of investing in a series such as this, is that alongside the pure silver value you have the likely long-term numismatic premium that can come with holding collectors coins.

Explore our Silver Myth’s & Legends coins at Physical Gold. Secure your purchase today with our buy back guarantee or contact us at 020 7060 9992

Contact us directly to arrange a call with our 5 star team (just read the reviews)

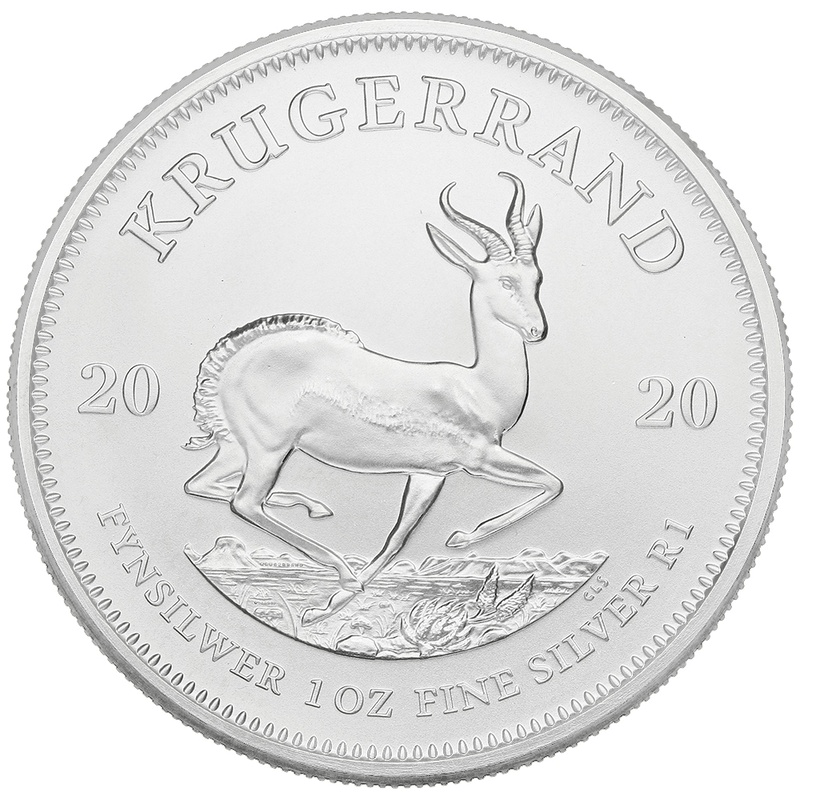

The Silver Krugerrand is a globally recognised and respected bullion coin. The 2023 Krugerrand, with its detailed design and unique reeding on the edge, provides a measure of security against counterfeiting

Minted by the Rand Refinery in South Africa, one of the world’s largest and most respected refineries, the Krugerrand is available in both gold and silver, the former metal being minted in a variety of sizes.

The design features the iconic image of Paul Kruger and the Springbok antelope, symbols of South African heritage.

Join the ranks of discerning collectors with a Silver Krugerrand from Physical Gold. With our buy back guarantee and support at 020 7060 9992, you can purchase with confidence.

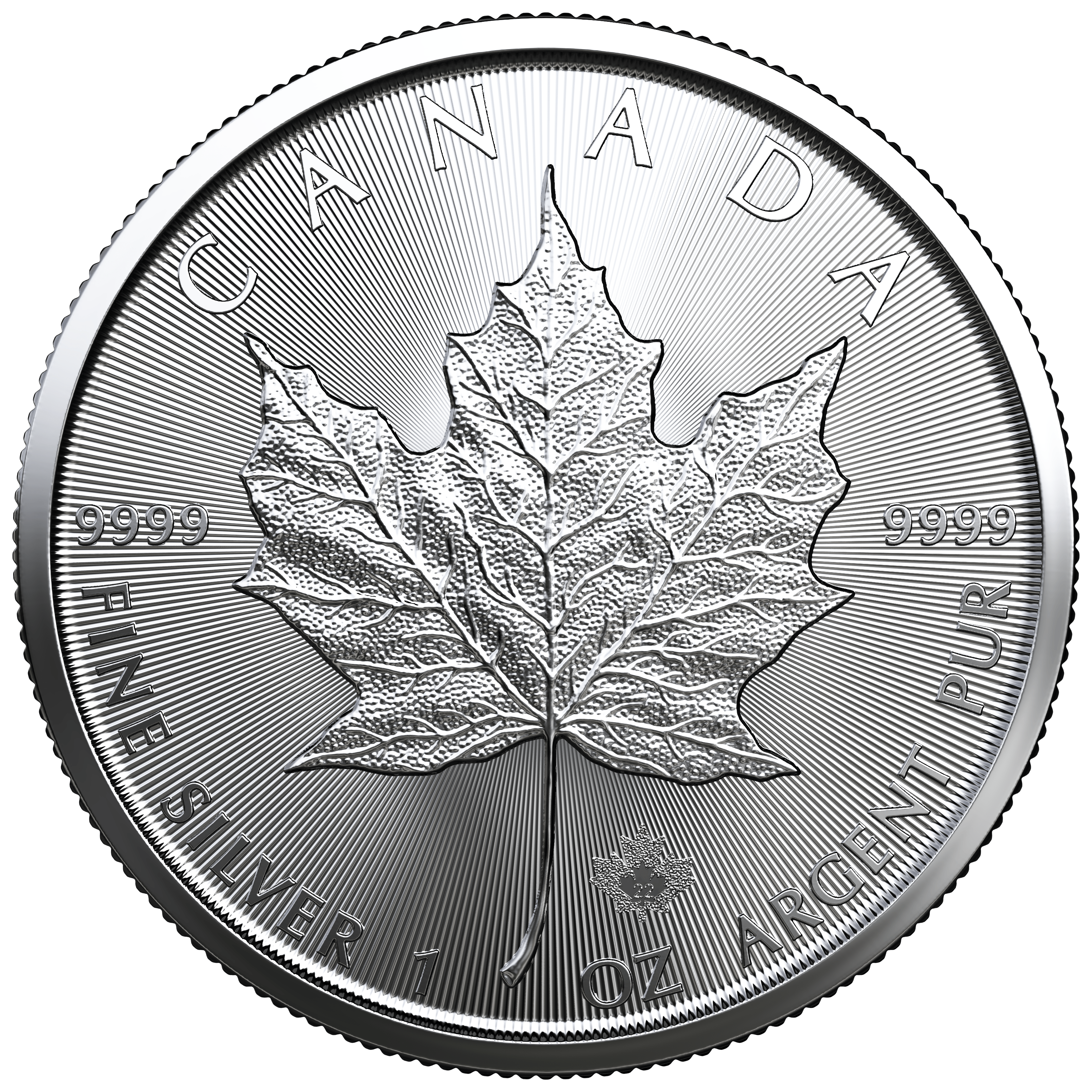

Silver Maple Leafs are a popular choice among global silver bullion investors. Struck to 999.9 purity, each coin contains exactly 1oz of pure silver.

The 2023 Silver Maple Leaf incorporates several advanced security features, including radial lines and a micro-engraved laser mark it has become famous for since 2014.

Minted by the Royal Canadian Mint, known for its high-quality bullion products, the Silver Maple Leaf is a part of the Maple Leaf series and maintains a strong liquidity especially in the strong North American market.

The design features the iconic maple leaf on one side, and a portrait of Queen Elizabeth on the other. It’s expected that the 2024 edition will be updated to feature King Charles III.

Invest in the timeless Silver Maple Leaf coins from Physical Gold. Enjoy our buy back guarantee and feel free to call us on 020 7060 9992.

Use our automated portfolio builder and see just how far your investment can go.

American Eagles are a famous, liquid coin extremely popular in the North American markets.

The2023 Silver Eagle is the latest bullion coin from the United States of America, certified by The US Mint.

The obverse showcases a design of Lady Liberty by American sculptor Adolph Alexander Weinman, draped in an American flag with the sun rising behind her.

The reverse features the classic US design of the Eagle and Shield by John Mercanti, along with 13 stars representing the original colonies of America.

Experience the elegance of Silver American Eagle coins with Physical Gold. Buy with confidence thanks to our buy back guarantee, or dial 020 7060 9992 for more information.

For those who have been in the investment game for a while, silver coins offer several unique advantages:

Insider tips to investing in precious metals

For those new to investing, silver coins also offer several benefits:

Physical Gold is a specialist in the buying and selling of gold coins, offering the best prices in the market. With over 1000 5-star reviews from clients just like you, we continue to be the preferred choice for all gold coin investments. Our accreditations from a number of professional bodies specifically linked to gold coins ensure our standards of practice and our expertise.

We are proud to hold the following accreditations:

We are located in the very heart of Hatton Garden, the Gold capital of London. Give us a call today on 020 7060 9992 to have a chat about your portfolio (or starting one), we’ll try to help you as much as we can.

We offer a range of investment solutions including lump sum purchase, monthly saver, and pension gold. We also provide secure storage or FREE insured delivery within the UK.

We are committed to providing the best customer service in the industry. From initial guidance and answering your questions, to updates on order despatch, we put our customers first. No robots here, just human beings ready to help.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.