Silver Price Chart

Metal Price Alerts

Success

The price alert has been setup. You will be notified as soon as the price reaches the level you selected.

Live Silver Price Chart

Keep track of today’s most recent silver price using our interactive silver chart. This silver price chart displays the current spot price of silver in ounces and its price for a range of time periods and in three significant currencies.

By clicking the interactive timeframe tabs, you’ll be able to check the following:

- The silver price per day

- The silver price per month

- The silver price per quarter

- Yearly

- 5 Yearly

- Historically back to 2006

Live silver prices from Physical Gold are updated every 30 seconds to provide you with the most recent pricing data.

Use this chart to determine the current silver price or to compare the price performance across GBP, USD, and EUR over various periods.

Even if historical results don’t predict future prices, they can guide your purchasing and selling choices.

Consider using our custom alerts if you’re thinking about buying or selling silver. Set an alert if you want to be informed when a purchase price drops to a specific level or if you want to sell your silver coins or bars at a particular price.

You’ll receive a notification in your email inbox within a minute of reaching your price target, enabling you to act in a fast-moving market.

Silver Price in UK Today

Use the Silver price chart above to determine the current Silver Price in the UK and compare it with it’s Sterling price over various time periods.

As of June 2023, the silver price in GBP was around £19/oz. Its price has lagged behind the rise of gold over the last few years due to gold’s direct appeal as a safe haven.

The world-changing events of Covid, followed by the ensuing economic slowdown and high inflation, have caused a majority of precious metals investment to go to gold. This has widened the gold-to-silver ratio to a relatively high level of 85:1.

Despite silver somewhat lagging gold’s price, silver investors have enjoyed great returns over the last 25 years:

- 5 year + 60%

- 10 years unchanged

- 15 years +112%

- 20 year +550%

- 25 year +360%

Unlike gold prices, silver prices are influenced by mining other commodities, including copper.

However, as a precious metal, it does (to an extent) follow the trend of gold prices. As a result, investing in silver is seen as a traditional bedfellow to investing in gold and further diversifies an existing investment portfolio.

With the recent tumultuous activity of traditional paper assets, physical gold and silver are commonly being seen by many investors as a sensible way to create financial security by balancing an investment portfolio.

Silver Price Per Gram

You will have noticed that the spot price of silver is generally set in troy ounces.

Not to worry, you need to apply a simple calculation to get the prices per gram:

The price per troy ounce / 31.1035. So if the price of gold is at £19 per troy ounce today, the calculation would be 19/31.1035, giving us a silver price per gram of £0.61.

Factors Affecting Silver Prices

Silver is possibly one of the most complicated assets to value and predict. It’s price is impacted by supply & demand and sentiment, just like many other asset classes.

Silver is one of the most complicated assets to value and predict. Its price is impacted by supply & demand and sentiment, just like many other asset classes.

The main factors affecting the price of silver are:

- Industrial use. As one of the primary industrial commodities, the price of silver can hinge on the demand for its use within industry.

- Silver scrap. As an industrial commodity, there have been times when scrap silver has been abundant, weakening the market. The levels of silver scrap are now almost depleted, allowing the market to rise once more.

- Supply. Silver is a precious metal and, as such, is in relatively scarce supply. Due to this, silver will always hold value, no matter which direction the price for silver changes.

But it’s the demand side which is particularly interesting. The silver price has risen during economic downturns as investors seek the security of tangible stores of value.

Precious metals are perceived as safe havens due to their lack of supply and intrinsic value. However, silver isn’t entirely regarded as a global safe haven in the same way as gold.

The flip side to this argument is that silver’s unparalleled conductive qualities make it the go-to for any electronics.

With the digital age upon us, silver is now being used industrially in many applications, including mobile phones, electric switches and solar panels.

In times of economic booms, consumption and demand for electronics rises and consequently, so does the need for silver, meaning it could benefit from price increases in the future as the global economy recovers once more.

How Does The Price Affect Silver Coins?

The price to buy silver coins is a premium over the current silver spot price based on the quantity purchased, the coin type and the market environment.

Quantity discounts are available in the same way as buying most products online. The price per silver coin reduces as more coins are bought, and most online dealers will display the price breaks clearly on their website.

Silver bullion coins such as the Britannia, which is mass-produced for investment, command a lower premium than limited edition, collectors, or older coins with historical value.

In a buoyant market, premiums to buy will rise slightly and vice versa when sellers dominate the market.

How is the Silver Price Determined?

The silver spot price is based on the supply and demand of 1 troy ounce of silver before being minted into a coin or bar. While it represents the price for immediate trade, the market participants strongly factor in future prices and contracts. This adds an element of future supply and demand to determine the current price.

How to Calculate the Silver Price

The spot silver price is an almost constantly moving target, based on supply and demand and anticipated future dynamics. This is quoted in US Dollars, along with the daily silver price fix, derived from an electronic auction. This price is then converted into Sterling to produce the 3 silver spot price. To derive the silver price of coins and bars is more complex. A premium is added to the silver spot price to reflect production costs, desirability and rarity. The premium falls as higher quantities of silver coins or bars are sought. Most silver dealers will now quote a live price, updated every 60 seconds, on their websites.

The Ultimate Insider’s Guide to Silver & Gold Investment

Top tips to enhance your silver returns

Why is the Silver Price Low?

The silver price should be higher from a precious metals perspective, with gold vastly outperforming it. It should also be trading at a higher price from an industrial usage point of view, especially when compared to other commodities. Price manipulation is the most obvious answer.

Warren Buffet profited from creating an artificial shortage in 1998, and now it seems JP Morgan could be controlling the price.

With JP Morgan selling vast quantities of futures contracts, pushing prices lower enables them to continually accumulate silver at bargain prices.

So far, they’ve collected around 675 million ounces, six times the amount Buffet held in 1998. With a weakening Dollar, every other commodity has increased in value.

Silver has been left behind, but it’s likely to soar when JP Morgan begins to unravel the manipulation.

How Much is the Silver Price Per Gram?

The current silver price per gram is around 60 pence as of June 2023. The live price can be seen at the top of the website.

This is the live spot price of silver. It’s derived from the US Dollar spot price per troy ounce, converted into grams and finally into Sterling. This represents a benchmark rate from where physical silver is priced from.

Live Silver Bar and Coin Prices

Silver Britannia Coins

View products

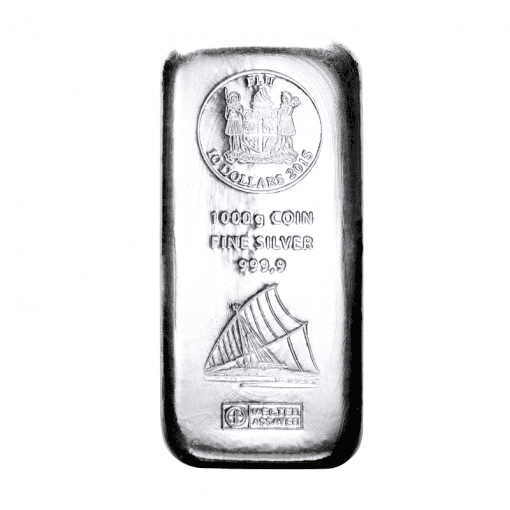

1kg Silver Bar

View products

Silver Tudor Beasts Coins

View products

100g Silver Bar

View productsWhat Makes the Silver Price Go Up?

Increased demand due to harsh economic factors or increased industrial usage pushes the prices of precious metals like silver up.

Market sentiment also plays a role. If concerns over a global recession increase, then so does the demand for silver, pushing up the price.

Silver futures traded on markets such as COMEX significantly impact prices, with trading reflecting expectations of price increases or falls.

When Was the Silver Price Highest?

The highest historical silver price was in April 2011, when it reached $48.70, during the credit crunch and ensuing global recession.

In Sterling terms, the peak was in July 2012 when prices hit 325 an ounce.

The silver price hit an all-time high in 1979/1980 of just under $50 an ounce. This was due to market manipulation by a set of brothers named Hunt. They focussed on physical silver and futures to artificially move the market in their favour.

After missing a margin call in 1980, the price plummeted to $11 an ounce.

Why Silver Was High in 2011

The silver price doubled in 6 months by the time it reached April 2011 and $50 an ounce. The main driver of this steep price increase was the ongoing global credit crunch and bank crisis. After 2008’s mortgage market losses, 2011 threatened a European breakup with the ‘PIG’ members threatening bankruptcy. Silver prices benefited from safe-haven demand, combined with projections of silver shortages due to industrial usage of silver in the solar panel industry.

When Will the Silver Price Increase?

Demand for physical silver is still high, and increased demand from market downturns should see prices of silver go even higher in 2023 and 2024.

After a decade of stock market gains, a market correction was overdue, and the post-Covid inflation figures have expedited this process.

Silver will benefit from increased demand during a market downturn as a safe haven asset, pushing up its price.

The precise timing of this is unknown, but recent job losses, high street closures and major company bankruptcies suggest it will be in the next 12 to 18 months.

Why the Silver Price Will Go Up

The silver price is likely to rise from its current position as it benefits from two possible areas of demand. As the most conductive metal on earth, it’s the go-to choice for the electronics industry. In our technological age, constant increases in electronics will further increase industrial demand for silver due to its many uses.

With stock markets selling off in light of global interest rate hikes, the silver price will likely continue rising due to safe-haven demand. Investors fear losses during market downturns and switch their attentions to precious metals, pushing up prices of silver. If the suspected silver price manipulation eventually unravels, there are projections that the silver to gold ratio will close from current levels of 85:1 to its long term average of 15:1, dragging up the silver price in the process.

What Was the Silver Price in 1980?

The silver price reached an all-time high of just under $50 an ounce in late 1979 and into 1980 after the Hunt brothers successfully cornered the silver market. They mopped up both silver futures and physical silver in an attempt to propel prices upwards. This soon collapsed in the spring of 1980 when the brothers overstretched and failed to meet a margin call. Prices quickly fell to $11/ounce.

What is the Silver Spot Price?

The spot silver price is the price of silver for immediate delivery before being manufactured into individual bars or coins. The market is open (and the spot price fluctuates) on a near to 24-hour basis as silver is traded over-the-counter (OTC) rather than within set exchange times. In 2015 the London Gold Fix was replaced by the LBMA Gold Price which is a daily spot price fixing derived from an electronic auction.

What is the Silver Price Forecast?

We have a strong outlook on silver for 2023 and 2024, and believe towards the end of 2023 prices could start to rise.

This is supported by analysts across the industry, with German firm Heraeus predicting that increased indistrial usage could support growth into 2024 and beyond. The experts at Coin Price Forecast predict that is could rise as high as $40 by the end of 2024! As with all analysis and forecasts though, nothing is set in stone and it’s important to take expert advice at all times.

More visionary market participants predict massive silver price increases due to unforeseen events caused by the rapidly evolving digital age and our growing exposure to intangible risk.

With the primary aim of silver investment being capital appreciation, price forecasts and tools could help to time your purchase and sale.

What is the Silver Price in Sterling (£)?

The Sterling silver price is around £19/oz as of February 2023. This spot price of silver is a benchmark from where various physical silver items are priced. Higher quantities of silver coins and bars can be purchased closer to the benchmark silver price than single items. Silver coins and bars are sold close to the spot price.

How Low Can the Silver Price Go?

The silver price could fall further from its current level. There’s no fixed ‘floor’ to the price, so in theory, the price of silver is free to fall and rise with supply and demand. Most analysts, even those bearish on silver, only anticipate a limited potential fall to around $11/oz. However, the upside potential is vast, with many market participants expecting silver to increase by multiples of its current price. Its tangible nature is the most significant factor protecting the silver price from dropping too much. Unlike paper assets like stocks, which can be deemed worthless overnight, physical silver benefits from an intrinsic value which prevents it from ever becoming of no value.

How High Can the Silver Price Go

It’s very possible that the silver price could go considerably higher to levels of $100 an ounce or more. Its current gold ratio signifies that its price has huge upside potential and represents very good value. Suspicions of JP Morgan controlling the market could prevent the price from reaching these highs, but similarly, the current price suppression could be unwound, propelling the price skywards. With its unrivalled conductivity, the silver price could be propelled upwards with increasing industrial demand for silver. Some analysts predict silver could reach incredible highs of $300 or $500!

Silver Price Without Manipulation

It’s difficult to predict ‘what ifs?’, but most silver buyers and sellers suspect the price is artificially low, in the same way, it was manipulated upwards in the late 1970s. The silver market is far smaller than its gold counterpart, so the scope for manipulation is high. On a simple calculation, if silver naturally traded at its historical ratio to gold of around 15:1, its current price would be about $360/oz, a 500% increase on its existing ‘manipulated price’.

Silver Price vs Inflation

The price of silver, like gold, can increase with inflation, but historically this has been to a much lesser extent.

The dynamic between silver and inflation has evolved. For the first 175 years of silver price tracking, its value remained relatively constant as Western Governments predominantly controlled it as the preferred choice for coinage.

This has changed over the past 50 years as only small quantities of silver are now used in currency, while the fiat money supply has increased at a far greater pace than actual economic growth.

Silver hasn’t consistently kept pace with inflation during this period and has witnessed periods of declines, non-movement and spikes

Silver Price vs Copper

Silver and copper are traded worldwide, and although ratios can vary, silver trades around five times higher than copper price, making silver far more valuable.

Both are used industrially and are frequently mined together, with silver discoveries occurring due to copper mining.

Silver Price vs Bitcoin

Bitcoin has only existed for a handful of years, so the silver price can only be compared briefly. Bitcoin’s price has risen exponentially in the past five years, while silver has floundered. Silver is frequently compared to cryptocurrencies.

Both assets are similar in that markets believe they have substantial potential price upside. In that way, they are both relatively high-risk, high-reward choices.

The significant difference is that Bitcoin’s value is intangible, so that it could fall dramatically, even to zero. In comparison, silver benefits from its intrinsic value; it can be physically used in industry, so its price is far more stable.

Silver Price vs Stock Market

Unlike gold, silver tends to mirror the stock market, and prices generally fall when recessions hit due primarily to its reliance on industrial use.

Generally, though, both stock markets and silver prices will rise over the long term. Recent years have witnessed tremendous stock market growth soon after the 2008 credit crunch and global recession. In the same period, the silver price increased dramatically from 2010 – 2012 and has fallen away somewhat since.

Rather than considering silver and equity markets as two mutually exclusive asset classes, we feel both can work together.

All assets experience cycles, so owning physical silver and stocks can dilute the downsides, with silver performing well when stocks flounder. Most analysts anticipate a stock market crash in the next year or so, which propels precious metals prices skywards.

Silver Price vs Oil

Generally speaking, the silver price will rise with the oil price. With many of the oil-producing nations being situated in areas of conflict, an increasing oil price is sometimes a reflection of rising political tensions.

Safe havens such as silver and gold tend to benefit in such circumstances, with increased demand pushing the price of silver higher.

High oil prices can also increase inflation and pressure global economies due to higher transport costs. Both can boost silver prices. This isn’t a hard and fast rule but more a common occurrence.

Silver vs Gold Price Ratio

One of the most talked-about aspects of the silver price is its changing ratio to that of gold’s price. The fascination with this ratio stems from a significant change in recent years, coupled with the knowledge of the history of silver investment that the price ratio has been steady for decades.

Both suggest that silver is significantly undervalued. As of 2023, the Silver to Gold price ratio stands around 85:1. This compares to an average of 47:1 over the past century and a modest 15:1 historically.

Silver Price vs US Dollar

Silver’s price is far more erratic than gold’s, so its comparison to the US Dollar is more complicated. While the silver price has witnessed extreme peaks and troughs, the Dollar has steadily depreciated as more money supply has weakened its value. Gold represents a more obvious choice as a store of wealth and hedge against a declining Dollar, while silver offers higher risk-takers the opportunity for higher returns.

You May Also Find Useful