Buying Gold Sovereigns

This is a common question we get asked all the time. “Why buy gold Sovereigns?” Do they really add value to your portfolio? How are they different from other popular gold coins like the Krugerrand or the Britannia? Well, it’s one of the oldest British coins and has been in circulation for more than two centuries. It was first issued in 1489 during the reign of King Henry VII. Its production was stopped in 1604 and then resumed once again in 1817.

Modern sovereigns have been minted across the reigns of several monarchs – Queen Victoria, Edward VII, George V, George VI and Queen Elizabeth II. On the reverse, the coin features an image of St George slaying a dragon, which is a design created by the famous Italian engraver, Benedetto Pistrucci. As such, it has an unbeatable reputation as one of the most famous British coins of all time.

FREE Download. 7 Crucial Considerations before you buy Gold Sovereigns. Click here to download.

Liquidity and divisibility

The gold Sovereign is very easily available and enjoys an extremely vibrant secondary market. Its availability is a direct result of its long years of production. So, you can easily find Sovereigns issued in many different years at different price points. Due to its popularity, it’s very easy to sell and this enhances the liquidity of your portfolio. In terms of divisibility, the Sovereign is a winner. There are many different sizes to choose from, including the half and quarter Sovereign, the full Sovereign, the double Sovereign (2-pound coin) and the quintuple Sovereign (5-pound coin). The quintuple Sovereign has the largest gold content found in any British coin. Due to its variety of sizes, you can distribute your gold investments, enabling you to take advantage of different price points in the market, when selling.

This half Sovereign from the reign of King George V was minted in 1914 in Sydney

Old and new

Old Sovereigns are small in size and therefore affordable. Having been produced for over 200 years, they’re very easy to sell and can make a good investment if the gold price goes up. Their value generally increases with age and any profit made on their sale is completely tax-exempt in the UK. Older Sovereigns can, therefore, attract a premium due to the numismatic value. This means that its market price far outweighs the value of its gold content.

Newer Sovereigns, on the other hand, may not attract a rarity premium but can make a sound investment, due to their ability to lock in value. All sovereigns produced post-1817 are minted using 22-carat gold. This means that the coin has 11 parts crown gold and one part copper, which make up all 12 parts of the coin.

Comparison with other famous coins

The gold Britannia is a larger coin and it weighs one Troy ounce. This makes it affordable for investors with modest means. However, the Sovereign allows access to the gold market for these investors. In terms of choice, the Sovereign is a better option due to its variety of monarchs and years of issue.

Owning several different Sovereigns adds balance to your portfolio. In terms of tax efficiency, both the Britannia and the Sovereign benefit from their status as UK legal tender. Capital gains tax is exempt on both. However, the same tax advantage isn’t shared by other famous gold coins like the Krugerrand, since these coins are not legal tender in the country.

Our investment experts can help you buy the right gold Sovereigns

Call the investment team at Physical Gold on (020) 7060 9992. Our team is always available to work with you to identify the right sovereigns that can help you attain your investment goals. You can also get in touch with us online with any queries regarding gold Sovereigns.

Image credit: Wikimedia Commons

Buying Britannia coins

The Britannia is considered by many to be the flagship British coin to include in their portfolio. Originally minted in gold, it was introduced in 1987 by the Royal Mint. The current editions also include a silver version since 1997. The gold coins are a great investment, as they contain one Troy ounce of gold with a face value of hundred pounds. The silver version also contains one Troy ounce of silver with a face value of 2 pounds. Since 2013, the Royal Mint has been minting the gold Britannia with 24 carat gold and purity of 999.9. The Royal Mint also sells gold Sovereign coins, which are another popular range.

The coin features an image of Queen Elizabeth II on the obverse and the iconic Britannia image on the reverse. The coin enjoys immense liquidity and is available in a variety of editions. There are definitive tax advantages to investing in these coins. The coin is legal tender in the UK, and therefore attracts no capital gains tax. But the question is – should we be buying older or newer versions of these coins? What is likely to generate better value?

The silver Britannia was first issued in 1997

Buying older Britannia coins

The Britannia does not command a rarity value or historical premium. Most editions of the coin are easily available. Most of the time, the current year of issuance will also be the cheapest due to plentiful supply. Buying particular year Britannia’s from the past may well command a premium due to scarcity. However, you may find that the older coins can also rise in value quicker than the new ones in the context of the time you intend to hold onto the coins.

Download the FREE Insider’s Guide to Tax Efficient Gold & Silver Investment here

Commemorative and special issues

The Britannia has also been released

Needless to say, these types of special issues attract a lot of interest as a collectable coin. Therefore, they command high premiums in the secondary market once supplies run out. But, investing in these special issues would require a higher capital outlay.

Buying newer coins

The current editions are a great buy if you consider their value in gold and silver. As these coins are available in plentiful, premiums are very low. It’s also a great idea to order these coins in bulk from your dealer.

Buying current years of an issue would result in a lower price commitment at the buying stage. This would mean that your profit margins could be a lot higher when you sell off your gold in the years to come.

Contact Physical Gold to buy Britannia coins

A proven and hassle-free way to acquire Britannia coins were your collection is to simply give us a call. Our precious metal experts are best placed to advise you about buying the right gold and silver coins. They can let you know when older versions of the Britannia become available at the price you want. Similarly, you can also benefit from sound advice and assistance in buying newer coins. Call us on (020) 7060 9992 or get in touch online through our website, which has a wealth of information about Britannia coins.

Image Credit: Eric Golub

Best Value Sovereign Coins

In this video, we’ll be taking a look at the Royal Mint’s flagship gold coin The Sovereign. For keen investors, I’ll reveal 6 smart ways that you can buy Sovereign coins for the best value.

The modern Sovereign has been around for more than 200 years so there’s plenty of secondary liquidity and choice when it comes to buying. Exploiting these proven methods will help you build the best value Gold Sovereign portfolio.

1. Buy the current year of issue

With older Sovereign coins fetching a premium for their age, rarity and desirability, it makes sense to focus on the most recent Sovereign year of issuance which commands a lower premium. Avoid buying them in the last month or so of the year when premiums can rise as supplies dwindle in preparation for the next year’s issue.

Buying the current Sovereign coin is a low price option as the coins are plentiful and most dealers will have them in stock so you’re able to shop around for the best prices. With wide availability, an extensive volume discount is offered by dealers on the latest Sovereign. So if you’re looking to buy a fair amount of Sovereigns, then you’re rewarded handsomely with progressive price reductions.

2. Buy big coins!

The full Sovereign is a relatively small coin, weighing around a quarter of an ounce.

3. Nearly new pre-owned coins

Sometimes offering even lower prices than brand new coins, are nearly-new Sovereigns. Perhaps gold dealers have bought Sovereigns back from customers which are between 3 and 10 years old. They’re too recent to command a historical value yet, but may be offered at a discount to clear stock. We actually call this product ‘Best Value Sovereign’ in our online store. If you don’t mind us choosing the year and monarch, then you can end up getting a lot of gold for your money.

4. Buy when the market is quiet

Just like any other market, sales are on when demand is low. Premiums on Sovereigns can reduce when interest in gold is low. So if you have patience, waiting to buy your Sovereigns during a quiet patch gives you a little more negotiation than when demand outstrips supply.

5. Speak to a dealer

Again, patience is key for this one. If you’re willing to wait, then you could achieve a 1-2% discount off website prices. Let your gold dealer know which coins you’re after and they may be able to pair you with a seller. When a dealer’s customer wants to sell their Sovereigns, they can then call you to snap them up. This prevents selling back into the wholesale market and the saving can be passed onto you!

Read our the common questions about Sovereign coins and our expert answers

6. Buy when a particular Sovereign coin’s premium falls

With such a variety of Sovereign coins available, it’s no surprise that premiums vary considerably between new ones and Victoria Young Headshield back coins. Best value doesn’t necessarily mean the lowest price.

Again, you may wish to build a relationship with a good gold dealer. Letting them know that you’re after a particular monarch and quantity of coins means they can call you when premiums fall.

So an older Sovereign coin which usually trades at a higher premium may have a brief period of higher supply which lowers its market premium. Their premium returns to usual levels once the supply is mopped up, so buying in the dip can reap great value.

Similarly, you may take a view that there’s a good chance that premiums of a particular Sovereign issue will rise in the future. For example, buying on a jubilee year may offer value at the time as it may become collectable in future years.

Buy great value Sovereigns from Physical Gold

So there you have it, 6 amazing hacks to obtaining the best value Sovereigns available.

If you found this video useful, please take a look at our full suite of 20 video guides covering all aspects of gold and silver investment.. If you’re looking to buy great value Sovereigns, then check out our online Sovereign store at https://www.physicalgold.com/gold-sovereign-coins/

If you need guidance on which coins or bars to buy, how to store, or how to buy online, then don’t hesitate to call our team on 020 7060 9992.

Gold Coin Collecting

In this video, we discuss how gold coin collecting can also produce a healthy profit if done correctly. We used to consider gold investors and hobbyist coin collectors as two different groups of people.

But, we’re increasingly asked by those who enjoy accumulating coins as a hobby, which ones are best to also turn a profit.

So I thought I’d look at some of the best ways to combine a passion for collecting coins with a desire to make money! I’ll run through step-by-step, how best to collect gold coins AND make money.

I’ll even be telling you exactly what type of coins to focus on to maximise returns.

Today, I’ll cover 2 main areas. Firstly, which type of coins to focus on and then how to buy and sell them for the biggest profit.

Type of coin to collect

So which coins are the best coins to collect in the first place?

Choosing coins with your head, rather than buying from the heart, will more likely result in the most profitable choice. Too many coin collectors buy coins based on personal desire or preference, rather than buying for more logical reasons. Going down the route of very rare or obscure collectable or numismatic coins can be risky as they can be illiquid and require high degrees of knowledge.

This doesn’t mean you should stick simply to mass-produced bullion coins because they’re the cheapest. It’s important you achieve a balance between value and enjoying the gold coin collecting process.

Gold Britannias – A Great All-Rounder

A great example would be the Gold Britannia coin.

But unlike many other mass-produced coins, the design of the coin’s iconic Britannia image is updated every couple of years. This makes the coin highly collectable, but without demanding the high cost associated with collectable coins.

Queens Beast series

Another great example of combining investment with a collectors hobby is the Queens Beast Series of coins. Like the Britannia, these coins are produced by the Royal Mint and benefit from being tax efficient and well-known. Two coins are released each year, with a total of ten coins in all. Each coin is beautifully designed and features Queen Elizabeth on the front, and one of ten heraldic beasts on the reverse.

The challenge of collecting all ten coins, and their quarter ounce and silver versions if you like, is satisfying, but being part of a set means premiums should rise quicker than on regular mass-produced coins. We’ve seen values of some of these coins increase by 40% in a year, even when the gold price has remained the same.

How to buy and sell

Next, I reveal how best to collect and buy coins. The key here is to develop a relationship with a reputable UK gold dealer. Dealers such as Physical Gold will offer the best access and choice to collectable coins, meaning you can base choices on value and upside potential rather than simply what’s available.

When buying limited issue coins such as the Lunar series and Queens Beast coins, being on a top dealer’s mailing list will mean you’ll hear about these coins before others. Generally, collectable coins will have the lowest premium when first released and can sharply increase in cost as stocks run low and time elapses. So getting in as soon as a coin is launched will lower your purchase price and increase profits.

If you have a really good relationship with a dealer, they may be able to call you when opportunities on older numismatic coins arise. With large customer bases, dealers sometimes buyback collectable older coins and can offer these at a discount to those who’ve expressed interest in such deals.

So, how about selling?

Alternatively, selling back to your gold dealer is a simple and quick path to lock in your profit, as you can quickly turn around a sale when the gold price hits a certain level. If time is on your hands, then working with a gold dealer can achieve a higher sale price if they can match you with a specific buyer.

So there you have it, if you like the idea of collecting beautiful gold coins as a hobby, but want to be smart in the way you do it, then follow these basic guidelines. And remember, my number one rule to selling coins at the highest price, is ensuring you select the right coins in the first place.

Buy beautiful collectable gold coins from Physical Gold

We stock an array of fantastic gold coins, ideal for collectors and investors alike. If you need any help or guidance about gold coin collecting, our knowledgable team are available on 020 7060 9992 or on the live chat function on the website.

If you found this video helpful, we have 20 of our top video guides covering both gold and silver coins and bars together on this page.

Britannias versus Sovereigns

This article focuses on the two main UK investment coins – Gold Britannias and Gold Sovereigns.

For UK investors especially, these two coins are the go-to choice when putting together a gold portfolio.

But which ones are better? The Britannia or Sovereign? I’ll look at 5 factors to compare the two coins.

1. Price

Let’s start at the most obvious place, with the price. The Britannia is around four times bigger than the Sovereign, weighing 1 troy ounce. That means, its price is far higher, so for those with very modest means, the smaller Sovereign coin provides access to the market where perhaps the Britannia is out of reach.

For most investors though, a larger allocation to gold is granted, so the price per gram between the two coins can be compared. With its larger size, Britannia’s production cost is lower as a percentage of the price, allowing for a lower price per gram. So if you’re looking for the most gold coin weight for your money, then gold Britannias are the better choice.

Winner: Britannia

2. Variety

While there is the occasional special edition gold Britannia launches, usually, there is one type of coin to choose from – the standard 1oz bullion coin. Fractional versions also exist, allowing the investor to buy half, quarter and tenth ounce version, but these can be expensive for the privilege.

As Britannias have only been around since 1987,

In contrast, the modern gold Sovereign has been around for 200 years. Like the gold Britannia, there is also various size option including Half Sovereigns, Double and even Quintuple Sovereigns!

But it’s the variety in age and monarch which really creates investment options. Sovereign coins can be bought with the current Queen on the front, but also there is a strong market in gold Sovereigns featuring King George, King Edward and Queen Victoria. The latter coins even vary between 3 different types of design, the Young head, jubilee head and old head versions and can be worth substantially more than newer Sovereigns.

Owning a variety of Sovereigns adds balance to an investment portfolio. It varies your upside potential between just owning bullion coins and perhaps also benefiting from numismatic gains.

I’m a strong believer in mixing the coins your own rather than owning all of one type, as it creates other profit opportunities.

Winner: Sovereign

3. Divisibility

One of the most overlooked aspects of buying physical gold is obtaining divisibility within your portfolio.

This is one of the main reasons investors opt for gold coins rather than bars, it gives them the flexibility to sell small parts of their holding when they need.

Clearly, gold Sovereigns offer four times the divisibility of the standard 1oz Britannia. Yes, you can buy quarter and half ounce gold Britannias, but they’re a less economic method of obtaining flexibility than owning Sovereigns and Half Sovereigns.

So if you’re putting together a modest portfolio of coins – say £2-£5k – then we’d always recommend gold Sovereigns so that you can own a variety of coins and keep flexible.

However, for those looking to invest larger amounts, say £10k+, then you could still buy enough gold Britannias to achieve a great degree of divisibility.

Winner: Sovereign, unless you’re investing £10k+

4. Tax Efficiency

This one’s simple. Both the Sovereign and Britannia are VAT exempt when buying them as they qualify as investment grade gold.

In a similar way, any profits made on either coin are also free from Capital Gains Tax. That’s because both coins feature a face value and so qualify as legal tender in the UK. Selling any legal tender currency is free from Capital Gains tax.

Winner: Tie

5. Liquidity

The second-hand market in any asset class is

Luckily, both the Sovereign and Britannia are highly sought and liquid coins globally. In the UK both coins are popular due to their tax free status. They can be sold in a matter of hours.

Globally, the Sovereign is better known as it’s been around for a lot longer than the Britannia. But the playing field is quickly changing. Since 2013, the Britannia has been minted as a 24 carat coin. While this doesn’t make any difference to gold content, it opens up the lucrative Asian market. In a land where only 24 carat appeals, the growing Chinese market love the Britannia but are more tentative towards the 22 carat Sovereign.

However, liquidity when buying is switched. While the latest year’s issue of either coin is plentiful and easy to obtain, buying pre-owned coins is a different matter.

If you wish to buy second-hand Britannias, they’re not always easy to buy when you want them. That’s because they’ve only been around for 30-odd years so there are less on the market.

In contrast, with the Sovereign’s long trading history, you’re able to obtain most types of gold Sovereign from any age, more or less when you want.

Winner: Sovereigns….just

Conclusion – gold Britannias or Sovereigns?

So there you have it, we’ve looked at 5 of the most important considerations when choosing gold coins for investment.

Ideally, owning a mixture of both, and in a range of ages and sizes, produces the most balanced portfolio. But that’s not always attainable for everyone’s financial means.

For the smaller investor, Sovereigns is the best starting point. For those seeking simplicity and the lowest purchase price, Britannias are the choice.

Either way, you won’t go wrong when investing in gold Britannias or gold Sovereigns. Silver Britannia coins are also available.

Contact a gold investment expert when buying Britannias and Sovereigns

Don’t forget that our team are here if you need any guidance on buying gold coins. Our Directors Pick is a popular choice if you want to own a gold portfolio of mixed UK coins but prefer our expertise to pick a balanced choice. You can leave a message on our Contact Us page, call our team on 020 7060 9992, or engage in the live chat function on the website.

Why Buy Gold Sovereigns?

Gold Sovereigns have been around for hundreds of years, so clearly their popularity must have a good reason. Investing in physical gold is growing in popularity, but the type of coin or bar can be crucial to the performance of that investment. Options vary between gold bars, non-UK coins such as Krugerrands and the popular Royal Mint coins, the Britannia and Sovereign.

We reveal five compelling reasons why Sovereign gold coins should provide the backbone of any investment into physical gold.

Reasons to buy gold sovereigns

In this video, I’ll talk about the main reasons investors buy Gold Sovereign coins. If you’re thinking of starting a gold portfolio or even adding gold to an existing collection, this video will explain exactly why Gold Sovereigns play such an important role.

1. Divisibility and balance

With most other bullion coins weighing an ounce, the Sovereign coin provides a complete alternative at just over a quarter of an ounce. We’re strong believers here at Physical Gold that portfolio variety is key to success, so mixing up the size of your coins helps achieve that.

Owning smaller denominated coins also allows for more flexibility when selling gold. Rather than being constrained to selling a minimum of one ounce, owning Sovereigns offers the chance to sell in far smaller sizes. Even the best-laid plans change, so having this added flexibility can be hugely beneficial.

2. Affordability and value

Next up is value. For the more modest investor, buying even a

One growing gold investment strategy is to buy gold coins on a monthly basis, check out our Monthly Saver to find out how. Saving in gold each month gradually builds a nest egg, but also irons out price fluctuations. Small coins such as Sovereigns are the ideal choice for such saving plans as larger coins are simply too expensive.

One question we do get asked is whether Sovereigns are an expensive choice per gram. The very simple answer is NO! Due to mass production, Sovereigns are far cheaper per gram than alternatives such as quarter ounce Britannias.

3. Liquidity

One aspect of buying gold which should never be overlooked is liquidity. Just like developing properties, the more desirable and easy to sell your asset is, the better price you’ll achieve when you sell.

Sovereigns have been around since 1489, with the modern Sovereign thriving for over two centuries now. No other gold coin has a second-hand market as established as the gold Sovereign. It’s well-known around the globe, so combined with its affordability, is the most liquid coin in existence.

[button size=”medium” style=”primary” text=”Shop Gold Sovereigns” link=”https://www.physicalgold.com/gold-sovereign-coins/” target=”_blank”]

4. Variety

The saying goes, that there’s a different Sovereign to suit everyone, from price-obsessed investors to passionate coin collectors.

The current year of issue will always be plentiful, so this offers the investor rock bottom prices and a lot of gold for your money. The strong secondary market provides a supply of nearly-new Sovereigns from the past 10 years which may even be obtainable at a discount to new coins.

Going back in time, George V Sovereigns remain cheap but with an element of numismatic value and interest. The Edward VII coins are slightly more valuable again. Then finally, the irrepressible Queen Victoria has 3 different Sovereigns minted under her reign, the young head, jubilee head and old head. These are the most expensive of the modern Sovereigns but have the chance of increasing in value more than new ones due to their historical and scarcity factor.

For those wanting even more choice, Sovereigns are also available as Half Sovereigns, Quarter Sovereigns, Double Sovereigns and even a huge Quintuple Sovereign.

5. Tax efficiency

Finally, one of the most important aspects of any serious investor is tax efficiency. With its investment-grade status, the Sovereign is free from VAT. That’s great, but the real benefit comes when Sovereigns are sold. As legal tender in the UK, the Sovereign is also free from Capital Gains Tax. That means any profits made upon selling are completely tax-free. That puts it head and shoulders above most mainstream investments.

So there you have it, Sovereign gold coins form the backbone of any serious precious metals portfolio. They are the go-to coin for a majority of our customers as they simply don’t compromise in any way.

If you found our “5 Reasons to Buy Gold Sovereigns” video helpful, you may want to check out all 20 video tutorials.

If you’re interested in buying gold Sovereigns, check out our website at www.physicalgold.com where we stock thousands of different Sovereign coins. If you need guidance, don’t hesitate to call our expert team on 020 7060 9992.

Chinese New Year

The Chinese New Year starts on 5th February 2019 and lasts until 24th January 2020 – the next animal to be represented is the pig. This is good news for investors as the pig is seen as a symbol of luck and financial success, it’s viewed as a good year to make money and invest! With this sentiment and the size of the Chinese investment market this is a positive indicator for gold prices in 2019.

The year of the pig 2019

The pig is the twelfth and final of the Chinese zodiac animals. The pig is last because it is said that pig arrived last to the part of the emperor! The pig belongs to the earthly branch and is “yin” in terms of “yin and yang”.

In Chinese culture pigs are highly esteemed and viewed as a symbol of wealth, pigs are seen as a sign of good fortune, especially their large ears and chubby faces. People born in the year of the pig are said to be gentle, loyal and generous in personality.

Previous years of the pig occurring in the last 50 years were 1971, 1983, 1995 and 2007. Why not buy a year of the pig coin as unique gift for someone born in this zodiac sign? It makes for a unique gift.

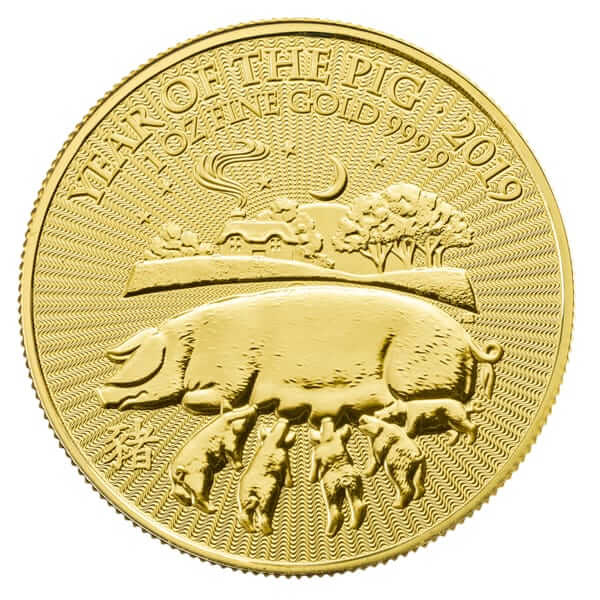

1oz Lunar Pig gold coin

Year of the pig – coin issues

These commemorative coins are typically offered in both gold and silver and always have a collectability premium when compared to the current gold/silver spot price. So, if getting the most metal for your money is a key priority, investing in gold bars or silver bars would work best.

Royal Mint

The UK Royal Mint has produced a range of coins in both gold and silver, click here for info. The coins were designed by Harry Brockway and feature a sow feeding piglets with a night-time country sky setting. The following coins are available:

- Gold coins – are available in one-tenth of an ounce, one ounce and five ounces sizes

- Silver coins – are available in one ounce, five ounces and 1KG sizes

Detailed information about the Royal Mail mintages is available here.

Other Countries with the year of the pig mintages in 2019

There are many countries, which will have the Chinese Year of the PIG issues. Just a few examples of a special year of the pig coins are:

- Laos – click here

- Monnaie de Paris, France – click here

- New Zealand Mint – click here

- Perth Mint, Australia – click here and

- Royal Canadian Mint – click here

Call Physical Gold – experts in Chinese Zodiac coins

It’s good to know if you need helpful advice on all aspects of gold investment that you can always turn to Physical Gold. We always recommend you call us on 020 7060 9992 or contact us by email before making an investment in gold coins. We believe in general that Chinese Zodiac coins are a worthwhile investment as part of a collectable gold coins portfolio. Speak to our experts now and we can guide you through the process.

The Bloomsbury Coin Fair

The Bloomsbury Coin Fair is a hugely popular event that is held 8 times a year in central London. With a highly affordable entry charge of only £2.00, it is a great place to visit and connect with the world of numismatists. It is a veritable treasure trove for those with a passion for collecting. They can not only see great coins first hand at the fair but also connect with experienced collectors.

There is plenty of advice available about coin investments and of course, the opportunity to browse catalogues and participate in auctions during the day. The Bloomsbury fair usually has around 40 dealers present and the owners of the event are John Philpotts and Sophie Dickenson, who are also responsible for running the show.

Looking to buy gold coins? Download the FREE Insider’s Guide first

Contact information for the Bloomsbury Coin Fair are:

- Website – http://www.bloomsburycoinfair.com/

- Telephone – 01242 898107

- Facebook – https://www.facebook.com/bloomsburycoinfair

- Twitter – https://twitter.com/coinmedalfairs

Getting to the fair

For 2019, the fair has moved from its previous venue (and namesake – the Bloomsbury Hotel) and will now be staged (still in the Bloomsbury area) at the Royal National Hotel, 38-51 Bedford Way, Bloomsbury, London, WC1H 0DG.

Russell Square is the nearest tube station for visitors arriving via public transport, with Euston, Euston Square and Goodge Street being also within easy walking distance.

For those driving in, parking is available in over half a dozen car parks in the local area, click this link for further details.

Numismatic fairs are a great place to mingle and network with like-minded collectors

2019 Bloomsbury coin fair dates and times

2019 promises to be a great year for gold and silver coins. The dates for the Bloomsbury Coin Fair in 2019 are as follows:

- 6th January 2019

- 2nd March 2019

- 6thApril 2019

- 4thMay 2019

- 6thJuly 2019

- 5thOctober 2019 and

- 7th December 2019

“Understanding the gold price per oz”, a YouTube video from Physical Gold Ltd.

Timings of entry are 9:30 AM to 2 PM

Call us for helpful advice when you build your collection

There are many exhibitions across the world where collectors congregate to find out more about coins and gain knowledge about numismatics and investing. Of course, the Bloomsbury Coin Fair is one of the most popular ones in the UK to attend.

However, expert knowledge is always helpful before you dash off with your hard-earned money to a coin fair to make investments. You need to have deep knowledge about the subject before you put your money on it and this does not come easy.

For those interested the fair also has a range of other antiquities for sale as well as banknotes and medals. If you enjoy visiting the Bloomsbury Coin Fair then you may also enjoy attending the London Coin Fair too – visit https://www.physicalgold.com/insights/london-coin-fair-dates-2019/ for details.

Contacting Physical Gold for further advice

The good news is that our experts at Physical Gold are always at your service to give you valuable advice, help you build your collection and even procure specific coins that you may want for your collection. Call us on 020 7060 9992 to talk to one of our experts who can help you learn more about numismatics and make the right investment decisions.

Disclaimer: Physical Gold is in no way connected to the Bloomsbury Coin Fair, but we do wholeheartedly recommend the fair as a good place to visit for both coin enthusiasts and investors.

Image Credit: bleantiquities

The London Coin Fair is a long-running numismatic event in the British capital. It has been staged for about 30 years now. It is held four times a year and is an important date in the UK numismatic calendar. Of course, one of the highlights of the event is the dealer stalls that are set up. The many UK and European collectors flock to this event to buy coins. However, there are also many books and educational materials available for people who are growing an interest in coin collecting.

Contact information for the London Coin Fair are:

- Website – https://www.coinfairs.co.uk/london-coin-fair/

- Telephone – 01694 731781

- Email – veissid@btinternet.com

- Twitter – https://twitter.com/coinmedalfairs

Where it’s held

The London Coin Fair is currently held at the Holiday Inn hotel on Coram Street in London. The nearest London underground station is Russell Square. Once out of the station, visitors can walk up the road on to Woburn Place and take a right on to Coram Street, before Tavistock Place. The Holiday Inn is on Coram Street. If you’re travelling by car, the nearest car park is the NCP car park on Marchmont Street, very close to the Holiday Inn, off Tavistock Place.

Sell your gold coins at the highest possible price. Download our 10 Crucial Rules

The event is held on the first Saturday of the month in February, June, September and November and is the largest international coin fair in the UK. In 2019 the dates for the fair are as follows:

- 2nd February 2019,

- 1st June 2019,

- 7th September 2019 and

- 2nd November 2019

The event spans two floors of the hotel and features more than 75 dealers. There are specialist displays and dealer tables for ancient and modern coins, books, medals, lots of antique stuff and medals

Admission timings are 9:30 am – 4:00pm. Entry charges cost £5, concession £3 for one adult. For any additional information, please visit this page and email or call Mike Veissid.

The London Coin Fair is one of the most important numismatic events in the UK

Highlights of the fair

There are some famous auctions held at the fair. For example, the Baldwins Argentum Auction is a long-standing feature at this coin fair that starts at 2 pm. Buyers are allowed to view the auction items in the morning. Many European dealers exhibit at the coin fair. For example, the 4th of February 2017 event saw a number of European participants like Agora Numismatics from Netherlands, Athens Numismatic Gallery from Greece, Collector’s Universe from Paris in France and Volodimir Dalinitchi from Germany.

One of the big differences between the UK and US numismatic events is that the coins are not embedded in a slab. Coins are embedded in the US for safety and security, however, at the London Coin Fair, collectors enjoy a greater ‘touch and feel’ experience before buying a coin.

If you enjoy visiting the London Coin Fair then you may also enjoy attending the Bloomsbury Coin Fair too – visit https://www.physicalgold.com/insights/bloomsbury-coin-fair-dates-2019/ for details.

Anybody interested in coin investment will benefit from viewing our YouTube video “The Gold price today & investing in gold medium to long term”

Bargains and rarities

There are bargain bins at the London Coin Fair, but collectors need to get to the event early in order to catch some good deals. But, for more serious collectors, there are some great treats in store. John Blyth, a boutique dealer who specialises in rarities had an 1859 Ansell Sovereign for sale, priced at 6,500 GBP during the fair held on 4th February 2017.

Call us today to discuss your collection

Numismatics is an absorbing passion for many. It’s a great activity to be involved in. If you’re starting out on your journey as a collector, pick up the phone and speak to our experts today. We have many years of experience in guiding collectors about what to buy and we might even be able to procure many special coins of interest that you badly want for your collection. Call us today on 020 7060 9992 and speak to one of our experts.

Disclaimer: Physical Gold is in no way connected to the Bloomsbury Coin Fair, but we do wholeheartedly recommend the fair as a good place to visit for both coin enthusiasts and investors.

Image Credit: Alex Schreyer