Investing in silver coins may be attractive, but there are certain important points we need to consider first. In this article we explore “Are silver coins a good investment?”

Size and investment options

Silver coins are available in a variety of sizes. Apart from the normal sizes up to an ounce, they are now available in larger versions of 10 ounces and 1 kg. There has been speculation in the market for a while that the prices of silver are likely to go up significantly. With the spot price currently hovering around £11 per ounce, there are great profits to be made if it rises threefold. The other reason that silver is attractive to investors is that it is 85 times cheaper than gold. Gold can be prohibitively expensive for retail investors. Silver offers access to the precious metals market at an unbelievable price point.

The industrial demand for silver

Silver has a huge industrial demand. It is widely used for the manufacture of electronics, computers, solar panels, and has a range of other industrial applications. Reducing supplies of the white metal has prompted investment experts to speculate about a possible hike in prices. If you are thinking of silver coins investment and taking a calculated risk on its price, you may have to wait for at least 3 to 5 years before you can get a reasonable return.

They can be a great investment if bought in the right way at the right time. Silver is significantly undervalued compared to historical levels, so a medium to long term holding is advised to maximise returns.

Silver coins can be a great investment if the right coins are chosen

Need for liquidity and buying coins which can be resold

Your investment is only as good as its liquidity. If you cannot take advantage of the right price point in the market by selling easily and quickly, the investment is useless. Therefore, always buy silver coins with a mass appeal and avoid purchasing obscure and rare coins. Well-known coins enjoy a vibrant secondary market, which makes it much easier to sell when the time is right. 1-ounce silver coins like the silver Krugerrand is an ideal choice.

How about collectable coins?

You may be able to extract better value from your investment if you choose a collectable coin. The premiums on these coins usually rise very quickly and investing in them can be an excellent strategy to get quick returns. Likewise, a popular coin like the 1-ounce silver Britannia makes an excellent addition to your investment portfolio. It ticks all the boxes for divisibility, liquidity and collectability. So, it’s evident that investing in silver coins can be a great idea as long as you plan properly and buy the right coins which are likely to meet your investment goals.

Understand purity levels

When choosing coins, purity is an important factor. Many silver coins are available with 95.8% purity. But, if you do your research well and choose a coin like the Canadian Silver Maple Leaf, you have a coin with 99.9% purity. There can be different strategies for choosing the right silver coins for your investment. Purity, divisibility, variety and value are important considerations.

Tax advantages and efficiencies

From a tax perspective, silver coins which are legal tender in the UK will automatically be CGT free.

Prior to the UK leaving the EU, Physical Gold were the only silver dealer in the UK who could provide VAT free silver. Post-Brexit this is no longer possible. Due to the following reasons though, we are able to sell silver coins and bars at similar “all in” prices to previous:

- Free delivery – we can now provide free delivery, previously this was chargeable

- Reduced product range – we now provide a reduced range of silver products. This means we have negotiated better prices for the products we supply, we pass this discount on to our customers!

The overall net result is that the price difference when you buy silver coins and bars the price difference even with paying VAT is negligible and certainly competitive with other UK dealers.

We also can now accept orders for mixed gold and silver purchases, whereas previously we could only process “silver only” orders to obtain VAT free silver.

Contacting Physical Gold for Advice

Please visit the Physical Gold website for more information on how to profit from your investment in silver coins. Speak to us today on 020 7060 9992, leave an instant message or complete our contact form. We look forward to being of service and support.

Image credit: feiern1

When investing in any form of silver, it is recommended that you always go to a reputable broker. Lots of companies offer similar deals or services and it’s easy to be swayed by promises of deals that are more often than not too good to be true. A reputable broker will have extensive knowledge of the market and will able to properly advise you on the right investments for your requirements. Here is an idea of what to expect from a reputable broker.

Transparent pricing

A reputable broker should always be transparent about their prices. Before working with any broker, you should make sure there are no hidden costs involved as some brokers will charge extra for insurance and shipping costs. You may also want to find out what rates they charge to cover their admin costs, as well as these, can vary a great deal from broker to broker.

They know the market

If you’re planning to invest your hard-earned

They’ll act in your interest to ensure the safety of your investment

A reputable broker will ensure safe delivery of your goods by providing insured shipping and real-time tracking. They may also offer you secured storage of the goods in their own vaults or secure delivery to a vault of your choice. Some brokers may even have a physical office or premises where you can personally take delivery of the goods by arrangement. Before purchasing silver coins through a broker, you should first make sure of their policies with regards to access to your goods. For example, can you access the goods at any time? Are you able to withdraw the goods whenever you wish? These are all questions you should be asking your broker before investing with them.

1887 Queen Victoria double florin

Access to a wide range of suppliers

A reputable broker will have access to the best suppliers. As an investor, this means you will benefit from the best selection of goods at the best possible prices. At Physical Gold, for example, we offer a huge selection of silver in a variety of forms including bullion coins, semi-numismatic coins, and silver bars.

2oz silver Queen’s Beasts coin

High standard of customer support

When dealing with any broker, good customer support is essential. A reputable broker should be easy to contact whilst also being able to offer you the investment advice you need. You also may want to check that they offer some form of telephone support, particularly if you don’t have much previous experience of investing in silver.

How to check whether a broker is reputable

Before buying through any broker, you should first do a bit of background research to check that they are who they say they are and that their services are legitimate. There is a lot of bait and switch companies out there, particularly online, so you need to make sure of their authenticity. A good place to start is by checking review sites and reading what other people have said about them. If they are an established broker and have been about for some time, then they should have accrued a fair amount of reviews allowing you to make an informed decision over whether or not to go with them. The top dealers will be members of the British Numismatic Trade Association (BNTA) as well as other smaller society’s such as The Royal Numismatic Society.

Purchase silver coins through Physical Gold

Physical Gold is one of the UK’s leading dealers in gold and silver. We offer a range of tax-efficient ways to buy precious metals at market leading rates. Should you require our assistance, Physical Gold’s brokers can offer you their valuable expertise, helping you put together a portfolio of hand-picked, high-performance silver coins. To speak to one of our experienced advisers today, please give us a call on 020 7060 9992.

Image Credits: Wikipedia and Money Metals

Sell Scrap Silver

Over the years numerous stories have appeared in the papers about lucky folks who discover precious metals in their lofts and attics which were left behind by parents and grandparents. Many of us even have old silver around the house. At a time when the price of silver is increasing and some experts are of the view that it could soon touch $30 an ounce, you can make some quick cash by selling off this scrap silver.

Although gold may be the first thing that comes to mind when it comes to investing, silver is actually highly investable just like any other precious metals. It’s been a solid and reliable form of currency for over 4,000 years – and silver scrap trading is booming. However, since the end of the silver standard, pure silver has lost its status as legal tender. In 2009, the global demand for silver was primarily for industrial applications at 40%, coins, silver bars, jewellery, and exchange-traded products. By 2011, worldwide silver reserves were equal to around 530,000 tonnes.

But how do you go about selling scrap silver? Indeed, there are newspaper adverts from dealers who offer cash for your scrap silver. But is this a viable proposition? In this article, we’ll look at some of the basic things you need to know if you intend to sell your scrap silver.

Antique silver watch

How can you tell if something is real silver or not?

The main way to check is magnetism as silver isn’t magnetic. By placing a strong magnet called a Neodymium magnet onto a silver bar or coin, it should repel and not stick to it. When testing bars, simply angle the bar at 45 degrees and allow the magnet to slide down – the magnet should only slide very slowly. Don’t forget to give it a good polish too, by using a lightly coloured, soft cloth. Once you’ve finished, inspect your cloth and if you witness black marks on the cloth then the object is very likely real; this is because real silver oxidises and tarnishes when exposed to air, and that’s the darkness you see on the cloth.

Download our FREE 10 step guide to selling your coins at the best price

Know your prices

Silver is traded around the world at spot prices. Each troy ounce of silver will command a spot price on a given day. It’s important for you to look at these prices before you walk into a dealer shop or contact an online dealer about selling your scrap silver. If you don’t know the trading price of silver in the first place, you’re likely to be short-changed.

Separating your silver

Getting ready to sell your silver is a process during which you should separate the different items of silver that you have. For example, if you have silver coins it’s important to segregate these from the rest of the silver that you plan to sell. Do a bit of research about the coins that you have, as some of them may have numismatic value. If you sell your valuable silver coins at scrap prices you’re losing a lot, so a bit of homework usually goes a long way.

In the same way, you need to separate out your junk silver, including bits and pieces of old and damaged silverware that may be in your house. Sterling silver, silver plated artefacts and pure silver are different things. So, it’s important that you determine what you have before you rush off to get a price for them. There may be different marks on your silverware, which could give you an indication of whether your silver is Sterling or plated. For example, the letters EP often stands for electroplated and the letters EPNS denotes electroplated nickel silver. There may even be a number indicating the purity.

What is classed as scrap silver?

Clean 925 grade silver is classed as 92.5% pure. Many scrap silver facilities will also accept Dutch, Austro-Hungarian, 1st Standard French, Russian and Danish silver as well as any articles which are marked as “Sterling”. Check out our buying and selling guide for guidance too.

In order to be accepted, the silver generally needs to be “clean” i.e there’s nothing in it that isn’t silver (e.g. wooden handles, resin filling etc). If you’re worried about it, plenty of places also buy lesser grade silver, for example, foreign silver, 500 standard coins and 800 standard silver too. They are likely to offer you a pay rate proportional to the 925 rate.

What items are generally considered “scrap”?

Items that are purely valued on their metal value (for example by weight) include most smaller objects like cups, tea sets, bowls, dishes, trays, baskets, mugs, napkin rings etc. Other items include chains, bracelets, necklaces, and other pieces of jewellery whether repaired, worn or damaged.

Antique silver

As metal, in general, has risen so much in value it’s had a massive impact on the antique silver market. The aesthetic, antique values of many objects have now been overtaken by their intrinsic metal value.

A large number of second hand, antique silver pieces are now valued by their weight, meaning the value will fluctuate depending on the daily price of silver. Any items which are particularly interesting or unique are likely to be given a higher value than less quality scrap metal, however, any facility will judge each item on its own merits.

Your old silverware can have good value, but it’s important to research it

Keep your silver unpolished

Many people don’t know about this but leaving you’re silver unpolished is likely to fetch you a better price. It’s true that your silver may look shiny and new when you polish it, however, the polishing process may damage the silver and erode the surface, devaluing it in the process. If you feel the need to clean it at all, it’s best to use a jewellery polishing cloth.

Finding a silver buyer

It might be a good idea to take your silver to a professional dealer if you know one, to get an appraisal on the price of the silver you’re about to sell. You can check the website of the British Numismatic Trade Association (BNTA) to find a reliable dealer. Physical gold is a reputed BNTA approved, online dealer and our team of experts will be happy to help you out on this.

Always shop around and check the different offers that buyers are giving you. If you have silver coins, you might consider visiting a coin show in order to sell your collection. You could definitely get a much better price for your coins at an event like this. Similarly, if you have silver items of value, it might be worth visiting a high-street pawnshop to see what they offer. Another way to get a good price for your items is to list them on eBay and auction them. If any of your items are valuable, it’s likely that buyers on eBay would pick up on this and bid against each other, raising the price.

Sell to Physical Gold today

If you are unsure whether your item would be considered “scrap” or antique the experienced team at Physical Gold can help when selling precious metals. Simply call us on 020 7060 9992 or email us so we can speak to you about your options.

Image Credits: J.S. Klingemann

The popularity of silver has risen significantly over the last few years, based on investor sentiment. A couple of years ago, the spot price of silver was approximately $16 per Troy ounce. At the time, market experts had been putting out their forecasts and there was an expectation that silver would rise to $21 per ounce.

The white metal started enjoying considerable interest from investors who were hoping to buy silver at a lower price point and book profits when the prices rose. The expected rise of silver was also dependent on several market factors that included the dynamics of supply and demand, and rising industrial requirements for silver. Before we move on to exploring the factors that influence the silver market, let’s take a step back and understand the most important concept – the silver spot price.

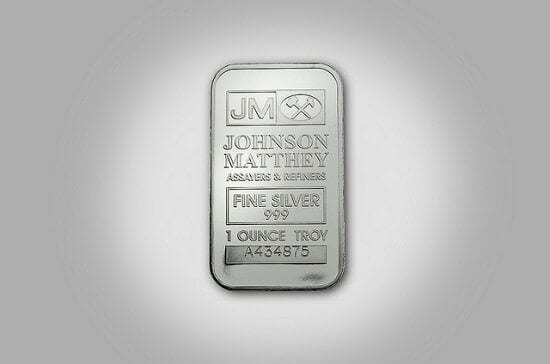

A silver bullion bar can be a great investment with the expected rise in the silver spot price

The silver spot price

The silver spot price is essentially a current market price that needs to be paid by a buyer at a particular point in time. So, the first important consideration is that the spot price of a precious metal changes continuously. It is a dynamic price value that rises and falls throughout the day when markets are open.

While we may think of gold and silver as precious metals, it is important to note that the market trades it as a commodity. The spot price is also different from a future price. A future price denotes a contract value for a particular commodity for a given date in the future. For example, if an investor were to invest in a futures contract for silver, that person agrees to purchase a certain quantity of the precious metal at a pre-determined price, at a point of time in the future.

The investor, therefore, agrees to pay this price, irrespective of a rise or fall in the price of the commodity at that point in time. So, it’s all about protecting the buyer’s risk. Investors often use futures contracts to protect their price point. However, immediate purchases need to be bought and sold at the spot price.

The spot price of silver now

Market pundits had predicted back in 2018 that the silver spot price could reach $21 per Troy ounce. Silver has outperformed this prediction and today, the spot price of silver stands at $ 25.71 per ounce. However, this is not even close to the point where the highest price of silver has reached. The all-time high silver spot price was reached on 18th January 1980 when the precious metal was traded at $49.45 per ounce.

The solar panel industry has a huge appetite for silver

The determination of the spot price of silver

While spot prices are often determined by speculation, they are also fixed by studying futures contracts and the dynamics and volumes of trade in the precious metal across the global exchanges for the current months and the months ahead. Futures contracts that have been agreed upon on a month-to-month basis are often studied.

The volumes of trading over a given period of time are also taken into consideration. However, we must understand that apart from these factors, other macroeconomic factors may also play a role in the determination of the silver spot price. For example, political events around the world, financial decisions made by governments and the performance of the global stock markets, may all have a significant impact on the silver spot price. Another factor that has had an impact on the silver spot price in recent years has been rising industrial demand.

Rising industrial demand

Industrial demand for silver has been continuously on the rise over the last decade. The automobile industry requires 36 million ounces of silver each year. According to the Silver Institute, the global automotive sector will soon require 90 million ounces of silver by 2025.

The 7 crucial considerations before buying silver & gold. Download FREE here.

This number is expected to rise exponentially as the world moves towards e-mobility. Electric vehicles will require more volumes of silver when compared to current car models. Additionally, the global thirst for green energy has skyrocketed the solar panels industry. The photovoltaic cells used in the solar panels use a lot of silver and has resulted in the spot price of silver rising due to this industry.

Rare silver coins can often fetch higher values than the spot price

How is the spot price of silver used?

When you buy silver from a dealer, the silver spot price is used as a guide price for the trade. In reality, you can neither sell nor buy at the exact spot price of silver. A premium needs to be paid over and above the silver spot price when purchasing. Similarly, you would always sell at a price below the prevailing silver spot price. The price you pay would also depend on whether you are buying bars or coins. Silver bars or bullion coins can be traded quite close to the spot price. However, if you decide to purchase older coins with a rarity value, you will need to pay a substantial premium.

How can you check the spot price of silver?

Most reputable dealers will publish the current silver spot price on their websites. This will usually be visible as a dynamic ticker near the header or footer bar of the website. Many dealers may charge you an additional cost to cover logistics like shipping and insurance for your purchase. Once you have considered all these costs, you can decide to purchase the quantity of silver that you want.

The spot price of silver may continue to rise through 2021 and beyond

The global pandemic has been one of the contributors to the mercurial rise of silver. Governments across the world are taking steps to battle the economic impact of the pandemic. The US Federal Reserve has set the US short-term interest rates at 0% and it is likely to remain so until 2023. In a lower interest rate regime, precious metals will always thrive and so, there is an expectation that silver will continue to rise beyond 2021.

Talk to Physical Gold about silver trading in the current year and ahead

Physical Gold is one of the nation’s most reputable online dealers of precious metals. Our team of advisors continually study the trends in the silver market and are best placed to guide you on making your investments. Call us on (020) 7060 9992 or reach out to us online and talk to our advisors to make the right silver purchases.

Image credits: Wikimedia Commons, Pixabay and Wikimedia Commons

Everyone is well aware that if there is a Mecca for shopping in the centre of the world, it is London. Precious metals remain high on the lists of desirables that people want to purchase, whether they are serious investors or hobby shoppers, and London is a great place to do just that. But, where can one go to purchase silver in London? There are innumerable sellers of silver in the UK’s capital, online as well as brick and mortar. Many of these are reputed and reliable sellers who have been plying the trade for long. Let’s take a close look at some of them.

Download our silver cheat sheet to learn the 7 crucial considerations before buying

The premises of the London silver vaults dates back to 1876

Physical Gold

Although the name indicates that the company is a gold coins, bars and silver dealer, Physical Gold is also a leading silver dealer in the UK. Based out of the 5th floor of Tower 42 on Old Broad Street in London, the company is a reputed dealer of precious metals and definitely worth a visit if you’re shopping for silver. Of course, the company also has a very strong online presence and buyers can speak to a member of the team on 020 7060 9992 or send an email.

The company employs a team of experts, ranging from  numismatist specialists to investment advisors who can help you purchase silver to suit every investment need. The company’s investment specialists provide investors with tax-efficient avenues to invest in precious metals that help them diversify their portfolios and hedge risks associated with investments in the global stocks and bonds markets. One of the greatest advantages of investing in silver is that investors benefit from a low priced entry point as opposed to gold. This allows an individual to gradually build up their portfolio by diverting their savings.

numismatist specialists to investment advisors who can help you purchase silver to suit every investment need. The company’s investment specialists provide investors with tax-efficient avenues to invest in precious metals that help them diversify their portfolios and hedge risks associated with investments in the global stocks and bonds markets. One of the greatest advantages of investing in silver is that investors benefit from a low priced entry point as opposed to gold. This allows an individual to gradually build up their portfolio by diverting their savings.

The best part?

The company provides bespoke investment advice, taking into account an individual’s personal investment goals. As a gold and silver specialist, the company’s investment team helps individuals make planned investments in precious metals. This is a sophisticated and planned approach to buying silver, rather than making a one-off purchase from a high street retailer.

That’s not all…

However, Physical Gold also caters to customers who simply want to buy silver as a collectable or for gifting. Numismatists frequently purchase silver bullion coins like the silver Britannia or the 1oz silver UK lunar year of the dog. Customers can rest assured that when they buy silver online from Physical Gold, their purchase is always protected by a 3D authentication payment system, ensuring that their bank details do not fall into the wrong hands. The company also assists customers in easy liquidation of their silver and also has investment schemes like a self-invested personal pension (or SIPP).

The company has a delivery scheme through which your silver is delivered directly to your location or your silver can also be stored at the company’s secure storage facility at Loomis International. Loomis International is a member of the British Security Industry Association. Physical Gold also ensures that your investments are protected via insurance through Lloyds of London.

Apart from coins, silver bars are a popular purchase for silver enthusiasts in London

Other places to shop for silver

London’s Hatton garden is another great place to shop for silver. There are many dealers in the area who offer good deals on silver. Another way to source silver is to go to auctioneers. There are online auctioneers, as well as physical ones in London where you can grab a bargain on silver items.

Yet another place to shop for silver in the British capital is the London Silver Vaults. It was earlier known as the Chancery Lane safe deposit and dates back to 1876. These were basically strong rooms where citizens could keep their valuables and artefacts in safe storage.

The facility was also open to businesses who were required to use safe storage. After the war, the premises was re-built in 1953 and rented out to silver dealers who continue to ply their trade even today. There are approximately 30 silver dealers who operate their businesses within the premises and could be worth checking out when shopping for silver. Indeed, rumour has it that the London Silver Vaults has served elite clientele, including Hollywood stars, rock n roll stars and members of the royalty.

“Britannia silver coins – a collectable investment” – a YouTube video from Physical Gold Ltd.

Call us to get the best deals on silver

At Physical Gold, we guarantee that the silver coins and silver bars (such as 1 kilo) you buy from us are 100% genuine and vetted by qualified numismatists. A certificate of authenticity accompanies every purchase made from our store, discounts are available for bulk purchases. If you’re looking for great deals on silver, contact us online or simply call us on 020 7060 9992.

Image credits: Sprott Money and Matt Brown