Sovereigns are one of the most popular British coins that investors opt for. When compared to other gold coins, Sovereigns tick many boxes, which make them attractive to investors. Firstly, they are available in a variety of sizes. The full, half and quarter Sovereigns are found in many investment portfolios. There are fractional ones as well – the one-tenth and the one-twentieth of an ounce. If any investor focuses on divisibility, these are great options. There is even the quintuple Sovereign or the 5-pound gold coin which presents great value for money.

Of course, the coin has been around for 200 years, and many issues are freely available. They are extremely well-known all over the world, which makes the Sovereign one of the most liquid coins in the market. In addition to all these reasons, investors love the Sovereign due to its tax friendliness. Sovereigns are VAT and CGT free for all UK residents. The question is – should one buy the older coins or the new ones? The brand-new ones are released as a bullion coin, available in an attractive blister pack. Which ones are a better buy?

Download the 7 crucial considerations before you buy gold coins. Click here

The best type of Sovereign to buy will depend on your objectives and budget. Brand new (current year) Sovereigns are actually the cheapest to buy as they do not yet hold a historical or scarcity value. Older Sovereigns cost more to buy for these reasons but are worth more and may rise in value quicker. Ideally, a mix of the two types will achieve the most balance.

1959 Queen Elizabeth II gold Sovereign

Setting your objectives

It is probably apt to start with objectives first. There are a variety of different reasons and motivations for buying gold Sovereigns that vary from numismatists to investors. Collectors will usually search for older Sovereigns that carry a scarcity premium. George III Sovereigns are extremely rare and valuable and these coins have fetched prices well over £100,000. An investor will think differently. Collectors are always happy to pay premiums and purchase proof coins, which are more attractive and expensive. Investors, on the other hand, would always opt for bullion coins, which offer a far better potential for investment.

Buying newer bullion coins

New gold Sovereigns have certain distinct advantages. Price plays an important role in the acquisition of newer Sovereigns. Since the new coins do not attract large premiums based on scarcity, rarity and age, investors can bag a bargain and acquired these at lower price points. The demand for Sovereigns is great and the secondary market price remains buoyant on the back of healthy demand.

Therefore, good resale prices can be expected in the future and investors can maximise their profits by investing in these coins. However, December is not a great month to buy, as premiums tend to escalate during this time, in anticipation of the next year’s issue. If you plan to buy large quantities, you can get better discounts from reputed dealers. It is also important that you evaluate the different deals offered by several dealers. You can get the best deals by simply shopping around and checking the prices offered by different dealerships.

King George V Half-Sovereign

Larger Sovereigns are a better buy

There can be great advantages when you buy a larger Sovereign coin. Larger coins benefit from lower production costs. The costs incurred in designing and cutting smaller versions of the same coin add to the overall margin. By purchasing the double Sovereign or the quintuple Sovereign, you can acquire more gold content at a lower price point.

Call Physical Gold to understand the best opportunities in gold Sovereigns

As the Sovereign is one of the most popular British coins for investment, our team conducts extensive research on the availability, demand and market price of the coin. You could benefit from the impartial advice that we can offer you. Call us on (020) 7060 9992 or simply reach out to our team online via our website.

Image credit: Wikimedia Commons and Wikimedia Commons

Sovereign coins

Sovereign coins are 22 carat UK gold coins issued by The Royal Mint since 1817. With a face value of £1, they were initially circulated but are now popular amongst investors and collectors. The coin is minted by the Royal Mint, as a bullion coin and some designs of the coin are released in limited numbers. This is one aspect of the gold Sovereign that elicits healthy interest from investors and numismatists alike. The gold Sovereign enjoys a reputation of being one of the most liquid coins in the world.

Investment in these coins is widely regarded as safe and secure, and can also be used as a strategy to create diversification within a traditional investment portfolio, creating a good balance of paper asset classes and physical assets like gold and silver. Due to the scarcity of certain issues of the gold sovereign, the coin may attract high premiums. Their value can rise with the price of gold and also with their scarcity and antiquity. The gold Sovereign provides investors with plenty of options since this iconic British coin has been around for more than 200 years.

A 1959 Queen Elizabeth II gold Sovereign

A coin that has seen the reigns of many monarchs

The earliest version of the gold Sovereign was issued in 1489 and is popularly known as the English Gold Sovereign. Today, this is extremely rare to find and it can fetch very high premiums due to its demand and scarcity. These coins were around until 1604. The weighed half a Troy ounce and was originally minted with 23-carat gold. During the reign of King Henry VIII, the gold content was reduced to 22 carats. Years later, during the Great Recoinage of 1816, the gold Sovereign was reintroduced in 1817, effectively replacing the original English Sovereign. By this time, the Coin Act had come into place and stringent technical specifications were introduced for the new Sovereigns, which are followed even today. The gold Sovereign was in circulation until 1932 and has since been released as a bullion coin.

Where are the Sovereigns minted?

Between 1817 and 1917 – a period of hundred years, the gold Sovereign was minted in the UK. However, mintage was shared with other reputed mints across the British Empire after 1917. The new production of the Sovereign was distributed across Canada, Australia and South Africa. By 1957, colonial rule had ended across the world and the Sovereign was once again minted exclusively by the Royal Mint till 2013.

Since then, the Royal Mint has inked a deal with MMTC-PAMP, a company based in India to share mintage of the gold sovereigns. This move was undertaken primarily due to the high demand for gold products in Asia. Although the production has been partly outsourced, strict quality controls continue to be in place and the Sovereigns produced in India are identical to the ones minted in the Welsh-based Royal Mint. The only difference is that the ones produced overseas bear a special ‘I’ mark.

A rare half-sovereign of King Henry VIII

The tax efficiency of gold Sovereigns

Gold Sovereigns are manufactured using investment-grade gold. Therefore, they enjoy VAT free status in the UK. Since the coins are considered legal tender in the country, they are also free from capital gains tax. Any gains are tax-free.

Speak to the gold experts at Physical Gold, if you want to invest in gold Sovereigns

At Physical Gold, we have gold investment experts who can offer impartial advice on investments in gold coins, especially iconic ones like the gold Sovereign. Please call us today on (020) 7060 9992 or get in touch with us online by dropping us an email

Image credit: Wikimedia Commons and Metropolitan Museum of Art

Buying Gold Sovereigns

This is a common question we get asked all the time. “Why buy gold Sovereigns?” Do they really add value to your portfolio? How are they different from other popular gold coins like the Krugerrand or the Britannia? Well, it’s one of the oldest British coins and has been in circulation for more than two centuries. It was first issued in 1489 during the reign of King Henry VII. Its production was stopped in 1604 and then resumed once again in 1817.

Modern sovereigns have been minted across the reigns of several monarchs – Queen Victoria, Edward VII, George V, George VI and Queen Elizabeth II. On the reverse, the coin features an image of St George slaying a dragon, which is a design created by the famous Italian engraver, Benedetto Pistrucci. As such, it has an unbeatable reputation as one of the most famous British coins of all time.

FREE Download. 7 Crucial Considerations before you buy Gold Sovereigns. Click here to download.

Liquidity and divisibility

The gold Sovereign is very easily available and enjoys an extremely vibrant secondary market. Its availability is a direct result of its long years of production. So, you can easily find Sovereigns issued in many different years at different price points. Due to its popularity, it’s very easy to sell and this enhances the liquidity of your portfolio. In terms of divisibility, the Sovereign is a winner. There are many different sizes to choose from, including the half and quarter Sovereign, the full Sovereign, the double Sovereign (2-pound coin) and the quintuple Sovereign (5-pound coin). The quintuple Sovereign has the largest gold content found in any British coin. Due to its variety of sizes, you can distribute your gold investments, enabling you to take advantage of different price points in the market, when selling.

This half Sovereign from the reign of King George V was minted in 1914 in Sydney

Old and new

Old Sovereigns are small in size and therefore affordable. Having been produced for over 200 years, they’re very easy to sell and can make a good investment if the gold price goes up. Their value generally increases with age and any profit made on their sale is completely tax-exempt in the UK. Older Sovereigns can, therefore, attract a premium due to the numismatic value. This means that its market price far outweighs the value of its gold content.

Newer Sovereigns, on the other hand, may not attract a rarity premium but can make a sound investment, due to their ability to lock in value. All sovereigns produced post-1817 are minted using 22-carat gold. This means that the coin has 11 parts crown gold and one part copper, which make up all 12 parts of the coin.

Comparison with other famous coins

The gold Britannia is a larger coin and it weighs one Troy ounce. This makes it affordable for investors with modest means. However, the Sovereign allows access to the gold market for these investors. In terms of choice, the Sovereign is a better option due to its variety of monarchs and years of issue.

Owning several different Sovereigns adds balance to your portfolio. In terms of tax efficiency, both the Britannia and the Sovereign benefit from their status as UK legal tender. Capital gains tax is exempt on both. However, the same tax advantage isn’t shared by other famous gold coins like the Krugerrand, since these coins are not legal tender in the country.

Our investment experts can help you buy the right gold Sovereigns

Call the investment team at Physical Gold on (020) 7060 9992. Our team is always available to work with you to identify the right sovereigns that can help you attain your investment goals. You can also get in touch with us online with any queries regarding gold Sovereigns.

Image credit: Wikimedia Commons

Best Value Sovereign Coins

In this video, we’ll be taking a look at the Royal Mint’s flagship gold coin The Sovereign. For keen investors, I’ll reveal 6 smart ways that you can buy Sovereign coins for the best value.

The modern Sovereign has been around for more than 200 years so there’s plenty of secondary liquidity and choice when it comes to buying. Exploiting these proven methods will help you build the best value Gold Sovereign portfolio.

1. Buy the current year of issue

With older Sovereign coins fetching a premium for their age, rarity and desirability, it makes sense to focus on the most recent Sovereign year of issuance which commands a lower premium. Avoid buying them in the last month or so of the year when premiums can rise as supplies dwindle in preparation for the next year’s issue.

Buying the current Sovereign coin is a low price option as the coins are plentiful and most dealers will have them in stock so you’re able to shop around for the best prices. With wide availability, an extensive volume discount is offered by dealers on the latest Sovereign. So if you’re looking to buy a fair amount of Sovereigns, then you’re rewarded handsomely with progressive price reductions.

2. Buy big coins!

The full Sovereign is a relatively small coin, weighing around a quarter of an ounce.

3. Nearly new pre-owned coins

Sometimes offering even lower prices than brand new coins, are nearly-new Sovereigns. Perhaps gold dealers have bought Sovereigns back from customers which are between 3 and 10 years old. They’re too recent to command a historical value yet, but may be offered at a discount to clear stock. We actually call this product ‘Best Value Sovereign’ in our online store. If you don’t mind us choosing the year and monarch, then you can end up getting a lot of gold for your money.

4. Buy when the market is quiet

Just like any other market, sales are on when demand is low. Premiums on Sovereigns can reduce when interest in gold is low. So if you have patience, waiting to buy your Sovereigns during a quiet patch gives you a little more negotiation than when demand outstrips supply.

5. Speak to a dealer

Again, patience is key for this one. If you’re willing to wait, then you could achieve a 1-2% discount off website prices. Let your gold dealer know which coins you’re after and they may be able to pair you with a seller. When a dealer’s customer wants to sell their Sovereigns, they can then call you to snap them up. This prevents selling back into the wholesale market and the saving can be passed onto you!

Read our the common questions about Sovereign coins and our expert answers

6. Buy when a particular Sovereign coin’s premium falls

With such a variety of Sovereign coins available, it’s no surprise that premiums vary considerably between new ones and Victoria Young Headshield back coins. Best value doesn’t necessarily mean the lowest price.

Again, you may wish to build a relationship with a good gold dealer. Letting them know that you’re after a particular monarch and quantity of coins means they can call you when premiums fall.

So an older Sovereign coin which usually trades at a higher premium may have a brief period of higher supply which lowers its market premium. Their premium returns to usual levels once the supply is mopped up, so buying in the dip can reap great value.

Similarly, you may take a view that there’s a good chance that premiums of a particular Sovereign issue will rise in the future. For example, buying on a jubilee year may offer value at the time as it may become collectable in future years.

Buy great value Sovereigns from Physical Gold

So there you have it, 6 amazing hacks to obtaining the best value Sovereigns available.

If you found this video useful, please take a look at our full suite of 20 video guides covering all aspects of gold and silver investment.. If you’re looking to buy great value Sovereigns, then check out our online Sovereign store at https://www.physicalgold.com/gold-sovereign-coins/

If you need guidance on which coins or bars to buy, how to store, or how to buy online, then don’t hesitate to call our team on 020 7060 9992.

Britannias versus Sovereigns

This article focuses on the two main UK investment coins – Gold Britannias and Gold Sovereigns.

For UK investors especially, these two coins are the go-to choice when putting together a gold portfolio.

But which ones are better? The Britannia or Sovereign? I’ll look at 5 factors to compare the two coins.

1. Price

Let’s start at the most obvious place, with the price. The Britannia is around four times bigger than the Sovereign, weighing 1 troy ounce. That means, its price is far higher, so for those with very modest means, the smaller Sovereign coin provides access to the market where perhaps the Britannia is out of reach.

For most investors though, a larger allocation to gold is granted, so the price per gram between the two coins can be compared. With its larger size, Britannia’s production cost is lower as a percentage of the price, allowing for a lower price per gram. So if you’re looking for the most gold coin weight for your money, then gold Britannias are the better choice.

Winner: Britannia

2. Variety

While there is the occasional special edition gold Britannia launches, usually, there is one type of coin to choose from – the standard 1oz bullion coin. Fractional versions also exist, allowing the investor to buy half, quarter and tenth ounce version, but these can be expensive for the privilege.

As Britannias have only been around since 1987,

In contrast, the modern gold Sovereign has been around for 200 years. Like the gold Britannia, there is also various size option including Half Sovereigns, Double and even Quintuple Sovereigns!

But it’s the variety in age and monarch which really creates investment options. Sovereign coins can be bought with the current Queen on the front, but also there is a strong market in gold Sovereigns featuring King George, King Edward and Queen Victoria. The latter coins even vary between 3 different types of design, the Young head, jubilee head and old head versions and can be worth substantially more than newer Sovereigns.

Owning a variety of Sovereigns adds balance to an investment portfolio. It varies your upside potential between just owning bullion coins and perhaps also benefiting from numismatic gains.

I’m a strong believer in mixing the coins your own rather than owning all of one type, as it creates other profit opportunities.

Winner: Sovereign

3. Divisibility

One of the most overlooked aspects of buying physical gold is obtaining divisibility within your portfolio.

This is one of the main reasons investors opt for gold coins rather than bars, it gives them the flexibility to sell small parts of their holding when they need.

Clearly, gold Sovereigns offer four times the divisibility of the standard 1oz Britannia. Yes, you can buy quarter and half ounce gold Britannias, but they’re a less economic method of obtaining flexibility than owning Sovereigns and Half Sovereigns.

So if you’re putting together a modest portfolio of coins – say £2-£5k – then we’d always recommend gold Sovereigns so that you can own a variety of coins and keep flexible.

However, for those looking to invest larger amounts, say £10k+, then you could still buy enough gold Britannias to achieve a great degree of divisibility.

Winner: Sovereign, unless you’re investing £10k+

4. Tax Efficiency

This one’s simple. Both the Sovereign and Britannia are VAT exempt when buying them as they qualify as investment grade gold.

In a similar way, any profits made on either coin are also free from Capital Gains Tax. That’s because both coins feature a face value and so qualify as legal tender in the UK. Selling any legal tender currency is free from Capital Gains tax.

Winner: Tie

5. Liquidity

The second-hand market in any asset class is

Luckily, both the Sovereign and Britannia are highly sought and liquid coins globally. In the UK both coins are popular due to their tax free status. They can be sold in a matter of hours.

Globally, the Sovereign is better known as it’s been around for a lot longer than the Britannia. But the playing field is quickly changing. Since 2013, the Britannia has been minted as a 24 carat coin. While this doesn’t make any difference to gold content, it opens up the lucrative Asian market. In a land where only 24 carat appeals, the growing Chinese market love the Britannia but are more tentative towards the 22 carat Sovereign.

However, liquidity when buying is switched. While the latest year’s issue of either coin is plentiful and easy to obtain, buying pre-owned coins is a different matter.

If you wish to buy second-hand Britannias, they’re not always easy to buy when you want them. That’s because they’ve only been around for 30-odd years so there are less on the market.

In contrast, with the Sovereign’s long trading history, you’re able to obtain most types of gold Sovereign from any age, more or less when you want.

Winner: Sovereigns….just

Conclusion – gold Britannias or Sovereigns?

So there you have it, we’ve looked at 5 of the most important considerations when choosing gold coins for investment.

Ideally, owning a mixture of both, and in a range of ages and sizes, produces the most balanced portfolio. But that’s not always attainable for everyone’s financial means.

For the smaller investor, Sovereigns is the best starting point. For those seeking simplicity and the lowest purchase price, Britannias are the choice.

Either way, you won’t go wrong when investing in gold Britannias or gold Sovereigns. Silver Britannia coins are also available.

Contact a gold investment expert when buying Britannias and Sovereigns

Don’t forget that our team are here if you need any guidance on buying gold coins. Our Directors Pick is a popular choice if you want to own a gold portfolio of mixed UK coins but prefer our expertise to pick a balanced choice. You can leave a message on our Contact Us page, call our team on 020 7060 9992, or engage in the live chat function on the website.

Why Buy Gold Sovereigns?

Gold Sovereigns have been around for hundreds of years, so clearly their popularity must have a good reason. Investing in physical gold is growing in popularity, but the type of coin or bar can be crucial to the performance of that investment. Options vary between gold bars, non-UK coins such as Krugerrands and the popular Royal Mint coins, the Britannia and Sovereign.

We reveal five compelling reasons why Sovereign gold coins should provide the backbone of any investment into physical gold.

Reasons to buy gold sovereigns

In this video, I’ll talk about the main reasons investors buy Gold Sovereign coins. If you’re thinking of starting a gold portfolio or even adding gold to an existing collection, this video will explain exactly why Gold Sovereigns play such an important role.

1. Divisibility and balance

With most other bullion coins weighing an ounce, the Sovereign coin provides a complete alternative at just over a quarter of an ounce. We’re strong believers here at Physical Gold that portfolio variety is key to success, so mixing up the size of your coins helps achieve that.

Owning smaller denominated coins also allows for more flexibility when selling gold. Rather than being constrained to selling a minimum of one ounce, owning Sovereigns offers the chance to sell in far smaller sizes. Even the best-laid plans change, so having this added flexibility can be hugely beneficial.

2. Affordability and value

Next up is value. For the more modest investor, buying even a

One growing gold investment strategy is to buy gold coins on a monthly basis, check out our Monthly Saver to find out how. Saving in gold each month gradually builds a nest egg, but also irons out price fluctuations. Small coins such as Sovereigns are the ideal choice for such saving plans as larger coins are simply too expensive.

One question we do get asked is whether Sovereigns are an expensive choice per gram. The very simple answer is NO! Due to mass production, Sovereigns are far cheaper per gram than alternatives such as quarter ounce Britannias.

3. Liquidity

One aspect of buying gold which should never be overlooked is liquidity. Just like developing properties, the more desirable and easy to sell your asset is, the better price you’ll achieve when you sell.

Sovereigns have been around since 1489, with the modern Sovereign thriving for over two centuries now. No other gold coin has a second-hand market as established as the gold Sovereign. It’s well-known around the globe, so combined with its affordability, is the most liquid coin in existence.

[button size=”medium” style=”primary” text=”Shop Gold Sovereigns” link=”https://www.physicalgold.com/gold-sovereign-coins/” target=”_blank”]

4. Variety

The saying goes, that there’s a different Sovereign to suit everyone, from price-obsessed investors to passionate coin collectors.

The current year of issue will always be plentiful, so this offers the investor rock bottom prices and a lot of gold for your money. The strong secondary market provides a supply of nearly-new Sovereigns from the past 10 years which may even be obtainable at a discount to new coins.

Going back in time, George V Sovereigns remain cheap but with an element of numismatic value and interest. The Edward VII coins are slightly more valuable again. Then finally, the irrepressible Queen Victoria has 3 different Sovereigns minted under her reign, the young head, jubilee head and old head. These are the most expensive of the modern Sovereigns but have the chance of increasing in value more than new ones due to their historical and scarcity factor.

For those wanting even more choice, Sovereigns are also available as Half Sovereigns, Quarter Sovereigns, Double Sovereigns and even a huge Quintuple Sovereign.

5. Tax efficiency

Finally, one of the most important aspects of any serious investor is tax efficiency. With its investment-grade status, the Sovereign is free from VAT. That’s great, but the real benefit comes when Sovereigns are sold. As legal tender in the UK, the Sovereign is also free from Capital Gains Tax. That means any profits made upon selling are completely tax-free. That puts it head and shoulders above most mainstream investments.

So there you have it, Sovereign gold coins form the backbone of any serious precious metals portfolio. They are the go-to coin for a majority of our customers as they simply don’t compromise in any way.

If you found our “5 Reasons to Buy Gold Sovereigns” video helpful, you may want to check out all 20 video tutorials.

If you’re interested in buying gold Sovereigns, check out our website at www.physicalgold.com where we stock thousands of different Sovereign coins. If you need guidance, don’t hesitate to call our expert team on 020 7060 9992.

First struck back in 1910, this vintage coin has grown in value and gained a following in the century since it was originally produced. Here is a look at the heritage and pedigree the King George V half sovereign represents, and the bright future it’s set to enjoy.

King George V half sovereign obverse and reverse

History of the King George V Half Sovereign

When King George V came to the throne in 1910, Britain was a global superpower, unknowingly sitting on a precipice of events that would eventually lead to the start of the First World War just a few years later.

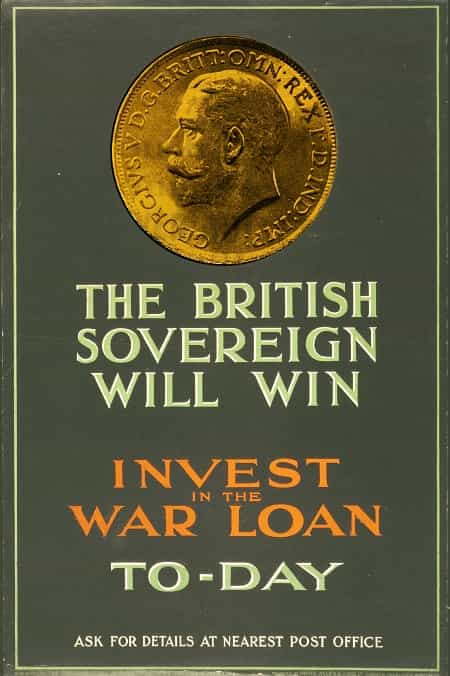

This, in part, is the reason that the King George V half sovereign holds so much significance. It was quite literally the poster boy for the war efforts once the fighting had begun, forming an important part of the campaign to get people to invest in a war loan to bolster the finances of the nation as a whole. It was also used, along with the larger gold sovereign, to pay the countries war debts to the US.

Wartime poster encouraging gold sovereign investment

The strong historical associations that the coin enjoys today have much to do with the way that gold coinage was changing in Britain when it was initially produced.

How to get the best possible price for your gold coins. Download our FREE 10 step guide here

The country was leading the world in terms of minting gold coins, so much so that economists and politicians alike were concerned about having such a large proportion of the gold in the country proliferated in this way.

Global reach

The sovereign was envisaged as becoming a gold coin with global reach, reinforcing Britain’s power and consolidating its influence worldwide. However, this half-sovereign would be the last of its kind to enter general circulation, as the switch to banknotes began and fewer precious metals were used for coinage.

The final King George V half sovereign was struck in 1924, but its popularity during its time in production was enough to secure its lasting impact and collectability.

King George V Half Sovereign Design

This coin features Bertram Mackennal’s

Future of the King George V Half Sovereign

As with many half sovereign coins, this King George V example is available in various quantities. Whether you are a collector looking for a single coin, or an investor who is interested in how it will appreciate over the years, there are options for you.

Enhanced profit potential

At the moment its value is equivalent to that of similarly aged half sovereigns, including the Queen Victoria half sovereign and the King Edward VII half sovereign. However, it is arguably a coin that has the opportunity to increase in value more consistently than its contemporaries.

The future appreciation of the King George V half sovereign will have a lot to do with how its historic significance is perceived in years to come. Its associations with the First World War, the golden age of British coinage and the eventual end of the general circulation of gold coins leave it in a great position to build a stronger reputation.

Collectable gold coins of this era have even been found squirrelled away for safekeeping in some unusual hiding places. This makes it a good idea to carefully plan where to store your investment.

Speak to us for gold coin investment guidance

If you are considering investing in gold coins which are valuable for their historic importance as well as their precious metal content, speak to Physical Gold’s expert advisors today. You can call us on 020 7060 9992 or use the contact form on our site to get an email response.

Image Credits: Wikipedia and Wikipedia

If you’re a numismatist, the British Gold Sovereign is an absolute must-have for your collection. But, before you actually put down your money and buy these beautiful collectable gold coins, it’s important to know more about them, how to buy them and what to look for. In this article, we take you through all that you need to know about buying a Sovereign. Also, be sure to read our beginners guide to buying gold.

The gold sovereign

The Sovereign is a 22-carat gold coin that is the flagship product of the Royal Mint, which also manufactures the gold Britannia. It measures 22.05 mm across and has a thickness of 1.52 mm. The coin weighs 7.98 grams, with a fineness of 916.7. Over centuries, the Sovereign has remained an integral part of the coinage of Britain and has never lost its unmistakable charm.

Early days…

The sovereign was first introduced in 1817 and had a nominal value of a pound. The coin was earlier in circulation but has now been accepted as a bullion coin. The 1817 edition features the iconic design of St. George and the dragon on the reverse. The design was created by world-famous designer, Benedetto Pistrucci, as part of the great re-coinage and the coin has his initials on it as well. The sovereign was taken off circulation in 1914 at the start of World War I. It was never reintroduced after the war, but the circulation of the already issued editions continued in other parts of the world, including the Middle East. Due to rising demand across the world, the Royal Mint struck new sovereigns in 1957. One of the reasons behind the popularity of the sovereign across the world was the fact that it was a reputed and trusted coin, containing an amount of gold that was known and could be easily verified.

Read our Insider’s Guide to buying Gold Sovereigns here

The sovereign is an iconic landmark of British coinage

Buying gold sovereigns

When you buy gold sovereign coins, you are investing in gold bullion. This is a very stable and secure asset class and is classified as a Capital Gains Tax (CGT) free investment in the UK. Gold sovereigns are more divisible than gold bars, with a 1 kilo gold bar being out of the reach of many investors.

However, when investing in gold, it’s important to find a reliable and trusted dealer. Buying gold sovereigns from Physical Gold is very easy. We provide you with a certificate of authenticity and all the sovereigns we sell are vetted by numismatists. We are also able to offer you storage facilities, along with insurance that protects your purchase and underwrites any risks.

Should I buy new or old Sovereigns?

With their long and illustrious history,

But that’s not the full story…

Older Sovereign coins can be classed as semi-numismatic. In other words, their value now consists not only of its gold content and production values but also possesses an element of scarcity and history. Coins may be less shiny than brand new Sovereigns, but due to their optimum 22-carat alloy mix, they’re far more resilient than 24-carat coins which can mark more easily. Prices are generally higher than for new Sovereigns due to these elements, however, their resale value is also higher, and there’s a greater chance that the older coins will appreciate in value quicker than new ones, especially if supply becomes particularly tight in the secondary market.

How about buying Halves, Fulls, or Double Sovereigns?

Another choice you need to consider when buying Sovereigns is which size to buy. For many years now, the UK Sovereign has been produced in four sizes. The smallest is the half Sovereign, next up is the classic full Sovereign coin, then the Double Sovereign (also known as £2 gold coin), and finally the largest is the Quintuple Sovereign (or £5 gold coin). All have their merits, with the half Sovereigns providing extra divisibility, and the £5 coins offering unparalleled satisfaction due to their impressive size. Generally, the smaller coins are more expensive per gram to buy, due to their relatively higher production cost. However, some £2 and £5 coins are also commemorative coins, so can trade at far higher values than simply their multiple of the full Sovereign.

How can I best use this info?

Depending on how much you wish to invest in gold Sovereigns, and your particular objectives and timeframe, we always recommend buying a mix of Sovereign sizes and ages. The newer and larger coins can help bring down the overall cost of your portfolio. The smaller coins can provide flexibility to sell small quantities in the future. Older coins and collector’s editions can help achieve quick possible price rises if the coins become scarce. As with investments in general, a mixed portfolio will always be preferable to owning all of the same assets.

Call us to buy sovereigns

You can order gold sovereigns online via Physical Gold. Our online process can provide you with great value for money. We have a membership of the British Trade Numismatic Association (BNTA), allowing you to buy with confidence. The buying process is very simple, however, if you would first like to speak with a member of our team of experts, call us on 020 7060 9992.

In our video, we answer the question – “Gold Britannias or Gold Sovereigns – which is the best investment?”

We endeavour to provide the best customer service and can offer you great deals on gold sovereigns, particularly for bulk purchases. Since we do not deal with any form of online or paper gold, you can rest assured that the gold you buy from us is physical gold of the highest quality, which can be a prized investment in your portfolio for years to come.

We also sell silver in the form of silver coins (like silver Britannias) and silver bars (such as a 1 kilo silver bar).

Image Credit: Money metals

This year marks the 50th anniversary of the 1968 gold sovereign. The last gold sovereign to portray a young Queen Elizabeth II and the last sovereign to be issued before decimalisation (in 1971).

The obverse of 1968 UK Gold Sovereign

Elizabeth II young head sovereigns were issued between 1957 and 1968 and are considered highly collectable due to the fact they were the last sovereign to depict a younger-looking Queen Elizabeth II. Although gold sovereigns were no longer issued for circulation after 1932, the production of gold sovereigns has continued in order to meet the growing demand for gold coins. There were no proofs minted of the 1968 gold sovereign and a total of 4,203,000 sovereigns were produced that year.

Want to learn how to profit from Gold Sovereigns? Download the 10 Commandments now

A history of the gold sovereign

The first gold sovereign was minted in 1489 on the orders of King Henry VII. The idea was to make a statement in order to symbolise the countries strength and unity after years of civil war and turmoil. At the time it was the largest gold coin ever minted in Britain.

Following the King Henry VII sovereign, succeeding monarchs each chose to strike a new version of the gold sovereign as a way of displaying their own power and strength, however, this practice died out after the reign of Elizabeth I. It wasn’t until George III decided to replace the guinea with a new gold sovereign 214 years later that the coin was reintroduced into circulation. Since then the sovereign has gone on to become one of the UK’s most prized, most sought-after coins and it is still highly valued by many coin collectors today.

The reverse of 1968 UK Gold Sovereign

Why gold sovereigns make great investments

Gold sovereigns are one of Britain’s most striking and beautiful coins,

Due to the fact that gold sovereigns are classed as semi-numismatics, (coins whose value is based on their numismatic value as well their bullion value) they often trade above the gold value, making them attractive investments for collectors. Gold sovereigns are also fairly liquid should you need to raise funds quickly and investors from all over the world are interested in purchasing them which means that you won’t have any trouble finding a buyer.

To learn more watch our related video – “5 Reasons to buy gold sovereigns”

Purchase gold sovereigns through physical gold

We stock a huge selection of gold sovereigns including those produced from 1957-1968. Click here to browse our complete collection. Whatever your requirements, whether you’re looking for single investment opportunities or help to select a mixed portfolio of gold bullion coins, we can assist. Why not give us a call on 020 7060 9992?