Research by Digital Ethos and Physical Gold – the UK’s leading provider of gold and silver coins and bars – has found that online searches for the investment in gold have surged since 24th February 2022, the day Russia launched a large-scale invasion on Ukraine.

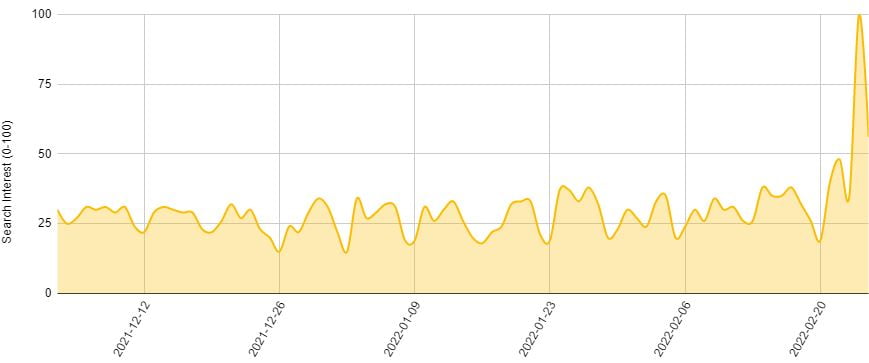

We have witnessed a 400% increase in search interest compared to the last three months – with peak interest on the day of invasion. Search interest peaked at 100 on the day of the invasion, a huge increase on the 20-25 average of the past three months.

There has also been an 80% increase in gold price searches in the UK and across Europe over the past week.

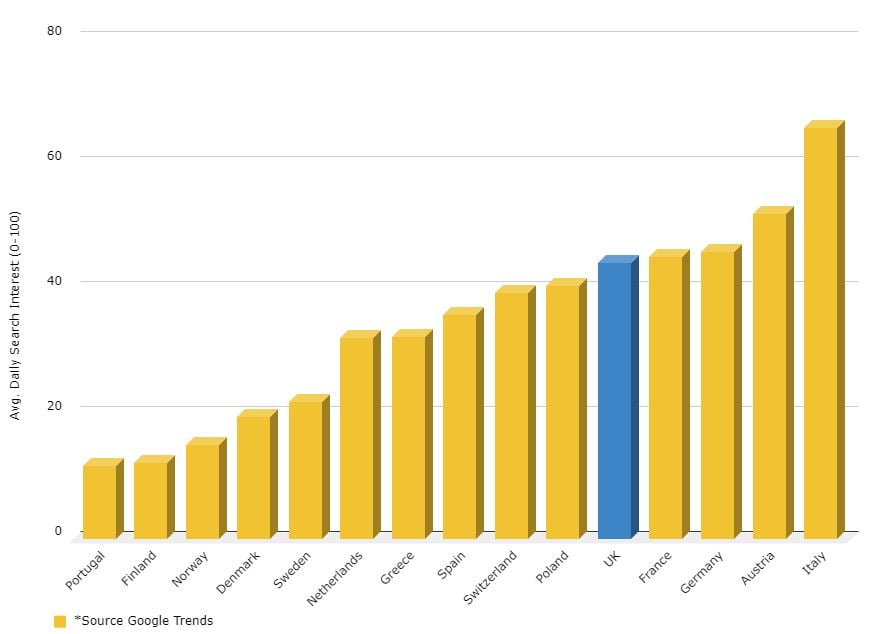

Here, we have analysed how gold searches increased throughout Europe in the days leading up to the invasion and shortly after.

Daily search demand for gold over the last three months

The UK saw a 40% increase in search interest around investing in gold and where to buy gold over the last five days, as well as a huge increase in searches for mining company shares.

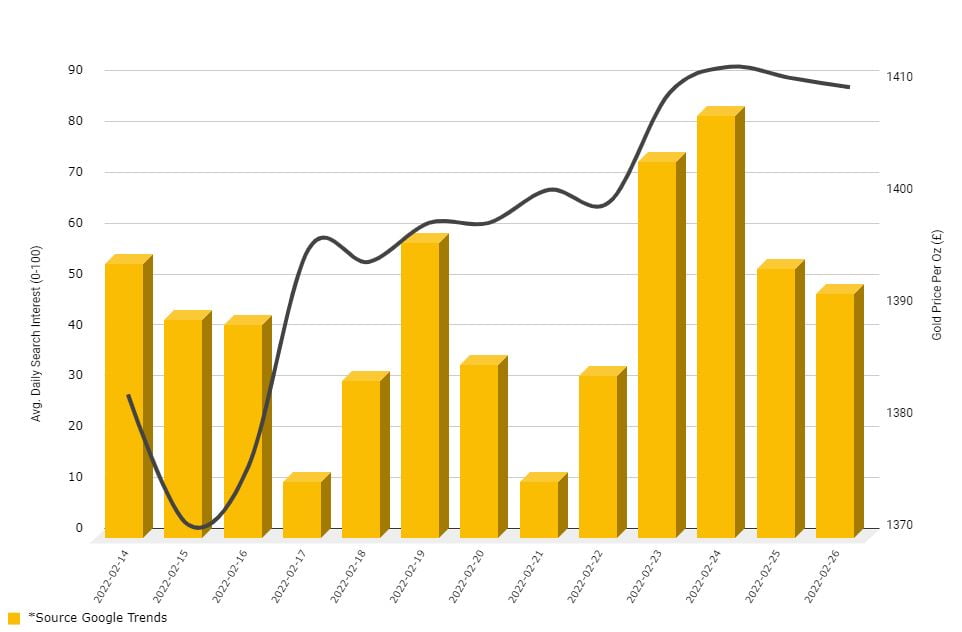

Daily search demand vs gold price

Demand for buying gold online surged on the day of the invasion

Last week, Daniel Fisher, CEO, Physical Gold said that demand had “gone crazy” since the Ukraine crisis escalated. As more investors pile into gold investing, the market broke past £1,404 an ounce last week and has now surged to around £1,450/oz, with Mr Fisher explaining people didn’t want to be left out now the price was moving quickly.

With the invasion of Ukraine, the biggest assault on a European state since World War Two, spot gold prices jumped around 2% to $1928 at Monday’s opening in Asian trade.

The UK is Europe’s fifth most gold-hungry nation

During the last week leading up to the invasion the UK had the fifth highest search interest in “buy gold” phrases. Italy led the way with the most interest, followed by Austria, Germany and France.

Portugal, Finland and Norway were the least concerned with “buy gold” phrases in the lead up to the invasion of Ukraine.

Physical Gold has seen a particular rise in investors new to gold looking for a safe investment option. Markets are facing a turbulent time from the economic fallout with investors scrambling for safe havens such as gold and this can be reflected in the huge increase in search volume.

The Gold Price Today

In this video, I’ll show you how to find the gold price today, track and analyse its performance and then exploit any themes and strategies to invest over the medium to long term.

The simplest and quickest way to track the gold price right now is to look at the top of our website. The price is updated every 60 seconds and displayed in both ounces and grams. An alternative would be to download a gold app like Kitco to your phone so you can track prices on the move.

It’s important to understand that this is the benchmark price, not necessarily the exact price at which you can buy and sell gold. If you want to learn more about how the gold price works, be sure to checkout out our other video ‘Understanding the gold price’.

If you want to dive a bit deeper, then our Gold Price Chart page features an interactive historical price graph and explains the gold price in detail, including;

- Factors influencing the gold price

- The LBMA’s role

- Currency influence on prices

- A market history

- And, Pricing gold coins and bars

If you want to invest in gold, be sure to study this page first.

So now we know the gold price, how can we profit over the medium to long term?

1. Buy in dips

Over the short term, the gold price can be volatile.

Looking at historical price charts will help you understand where the current gold price is in a historical context. Right now, we can see the price is still below its all-time high of 2020. Buying during the quieter times when the price is relatively low has proven to produce the best long term profits time and again.

2. Long term portfolio insurance and wealth preservation

Rather than trying to trade the gold market, or predicting price movements, a good strategy is to see gold as a long term protection. Its safe haven status means that regardless of the current gold price if stock markets and paper currency devalue, gold tends to rise in worth. This means, your overall wealth is protected from nasty market downturns.

With low interest rates, bank savings rates are also low, usually lower than inflation itself. This can mean that leaving money in the bank actually devalues every day it’s sat there. Gold has shown to outperform inflation over the long term, appealing to those seeking a store of wealth.

3. Buy gold regularly

An alternative strategy overcomes the need to really look at the gold price at all. Buying gold on a regular basis can average out the cost of gold so that when the price falls, you buy at the lower level. This approach appeals to those with limited capital to invest, but like the idea of gradually building up a gold holding, perhaps on a monthly basis. We offer a simple solution to achieve this with our Gold Monthly Saver, which starts from only £350/month.

So there you go. Start by doing some research on the gold price, understand how it works, and take a look at historical performance. Then grab one of our 3 strategies and invest away!

I hope you’ve found today’s video helpful. If so, please make sure you also check out our full catalogue of video guides covering everything you need to know about gold and silver.

Buy gold at the best prices from Physical Gold

If you’re looking to buy gold coins and bars at competitive prices, then take a look at Physical Gold’s online store. We’re able to offer gold at rock bottom prices, updated every 60 seconds with the live gold price. Quantity discounts are displayed online so you can decide the most economical way of buying.

If you need guidance on the buying process, or simply need help on which gold coins or bars to buy, then our friendly team are here to help. You can call on 020 7060 9992, engage on live chat from the website or leave us a message here.

Who follows the price of gold the most?

Gold is widely seen as the best investment when it comes to commodity markets as it, more often than not, increases in value over time, so it’s no wonder so many people are interested in investing in solid gold.

Intrigued about who is most interested in gold prices worldwide, we sought to find out which country is tracking the price of gold the most. To do this, we analysed search data to find out how many times the phrases ‘gold price’ and ‘price of gold’ were searched per month in 155 countries before exploring these search results per 1,000 active internet users in each nation*.

To make the data as reliable as possible, we explored each of the phrases related to gold prices both in English and the specific country’s primary language. This created a clear picture of which countries are tracking gold prices the most around the world.

The top 20 countries tracking gold prices

The top 20 countries tracking gold prices

Country most interested in price of gold

Taking the top spot for the country tracking gold prices the most is the United Arab Emirates, with a staggering 521,000 average monthly online searches, or 58.45 online searches a month for gold price per 1,000 active internet users, either looking to invest in solid gold bars or being interested in the current value of the metal.

Singapore, self-titled ‘Garden City’, comes in second place. According to our research, Singaporean’s search for the price of gold 184,500 times a month on average, which equates to 38.27 searches per 1,000 active internet users.

Third places goes to Qatar – one of the world’s richest countries – where residents make 76,800 searches per month on average. Despite having fewer searches than UAE and Singapore, when compared to the number of internet users in the country, this means there are 30.33 searches per 1,000 active internet users.

Even though New Zealanders make just 39,000 searches for ‘gold price’ on average each month, this equates to 9.12 searches a month per 1,000 active internet users in the country, ranking in eighth place.

UK and US in top 10

The United States and the United Kingdom follow closely behind each other in places nine and ten, respectively. The USA makes a total of 2,506,000 searches each month, which is equivalent to 8.02 searches per 1,000 internet users in the country. Comparatively, the UK falls short of this figure with 7.98 searches for ‘gold price’ for every 1,000 active internet users, after making 519,300 searches overall each month on average.

Download the 7 Crucial Considerations before you buy gold here

India’s affinity with gold

Despite having the highest number of searches for ‘gold price’ on average each month (3,720,600), India comes in fifteenth place when compared to searches made by web users in the country. In fact, there are 4.92 average monthly searches per 1,000 internet users in the Asian nation, which is 53.53 fewer searches than the United Arab Emirates in the first place.

This low ranking is a surprise as it’s common knowledge that gold has a central role in the country’s culture. The precious metal is considered a store of value, a symbol of wealth and status, and a fundamental part of many rituals, which explains why up to 25,000 tonnes of gold is accumulated in Indian households in jewellery, bars and coins.

Lastly, rounding off the top 20 countries most interested in tracking the price of gold are Austria and Nepal. According to our research, both countries have 2.21 average monthly searches per 1,000 active internet users.

You may also like: Benefits of Gold Investment

Continents most interested in tracking gold prices

Continents most interested in tracking gold prices

To identify which continents are most interested in tracking the price of gold, we calculated which continents each of the top 20 countries originate from.

Our analysis found that Asia is home to the most countries interested in tracking gold prices, as we found 13 Asian countries featured in the top 20. Europe comes next with four entries, including the UK, Ireland, Croatia, and Austria. Trailing behind with just two countries each are the continents of North America and Australia.

The full results

Placings of all 50 countries researched

*Methodology:

- For each country in the top 50, Physicalgoldcom gathered data for the number of overall active internet users in each of the respective countries.

- To get the results for online searches for gold price per 1,000 active internet users – www.physicalgold.com divided the overall figure for the number of active internet users in each country by thousand.

- Thereafter, the average monthly online searches for gold price for each country figure was then divided by the answer from the calculation that was made in stage two for each respective country to establish the average monthly online searches for gold price per 1,000 internet users in each of the countries in the top 50.

- There wasn’t enough data to include China in our results.

Please note: When analysing the data, the two key search terms/phrases related to gold prices were explored in English as well as each country’s respective primary language (where applicable) to increase the reliability of the results.

Until 2009, few people, if any, had heard about the virtual currency called Bitcoin. In 2008, this new form of currency, otherwise known as a cryptocurrency was invented. To date, no one knows who created the Bitcoin, but its invention has been attributed to a person or a team of individuals who used the name, Satoshi Nakamoto. The cryptocurrency was formally launched in 2009 and came into the market as open source.

Advantages of Bitcoin

As a cryptocurrency, Bitcoin has certain distinct advantages. It is a decentralised digital currency that does not have any control or governance by the banks of any nation. It is not controlled by the government of any country. The currency operates across a peer-to-peer network, eradicating the need for any third-party or intermediary. All transactions that use this cryptocurrency are verified electronically by network nodes. These transactions are encrypted and stored on a distributed ledger system known as a blockchain.

Bitcoin has become the most important cryptocurrency

The blockchain derives its name from the way it operates. It is a chain of blocks, where every block contains a hash code connecting it to the previous block, all the way to the first one, which is known as the genesis block. This ensures that the system cannot be easily hacked into, as it is extremely difficult to alter the information contained across the entire chain. When a Bitcoin transaction happens, the information is sent to this network using purpose-built software applications. At this point in time, the network nodes validate these transactions and write them into the respective ledgers. The information is then broadcast to the other nodes within the system. Apart from data protection, the system also ensures that double-spending is prohibited. To make this happen, every input needs to have a previous unspent output within the blockchain. The first commercial transaction using Bitcoin took place in 2010 when the cryptocurrency was used to pay for two pizzas. At the time, the value of the Bitcoin was very low and the transaction was done for 10,000 Bitcoins.

How are Bitcoins generated?

Bitcoins are created through a process known as mining. It is essentially a service that creates records by using the processing power of computers. This activity maintains the sanctity of the blockchain, ensuring its consistency and completeness. At the same time, the process also ensures the security of the transactions, by making them un-alterable through the use of an SHA-256 cryptographic hash, which links across the blocks through the entire chain. However, every new block must have proof of work (POW), to ensure its acceptance by the entire network.

In the early days, Bitcoin miners used powerful computers known as GPUs (graphics processing unit) for this operation. These computers were faster and more adaptable in creating POW algorithms. However, today mining operations for Bitcoins been taken over by companies and these companies use large data centres, fitted with dedicated, specialised mining hardware. The mining companies generate Bitcoins through this intricate, expensive and energy-intensive process. Despite the complex security process, Bitcoins have been stolen from exchanges. The cryptocurrency has also come under criticism for the gigantic amounts of electricity used by the mining companies, at a time when the entire world wants to conserve energy and move towards green energy.

Bitcoin mining is extremely energy-intensive

The legal status of Bitcoin

Due to the decentralised nature of the cryptocurrency, its regulation has been difficult. Since the currency is mainly traded in online exchanges, its use in the early days was fraught with controversy. Bitcoins have certain unprecedented characteristics that no other currency has seen before.

- There is no central authority.

- There is no central repository server – the cryptocurrency operates through a peer-to-peer network.

- Central storage like currency holdings in a bank does not exist. Bitcoins use a distributed ledger system.

- The distributed ledger is accessible to everybody, and anyone can store it on their computers.

- The administration of the cryptocurrency is also distributed. Its ledger is maintained by a network of Bitcoin miners.

- An amazing feature of the system is that anyone can become a miner.

- Additions to this distributed ledger system are highly competitive. Any miner can create a new block, and it is impossible to predict who will.

- New Bitcoins are generated as a reward for creating a new block. Therefore, anyone within the network can achieve this target. According to the protocol, only 21 million Bitcoins can be created.

- New Bitcoin addresses require no approval system for its creation and anyone can create it.

- Transactions do not need approval, and a confirmation is generated by the network once the transaction is deemed legitimate.

Several national banks across the world felt threatened by the new autonomy and lack of control presented by Bitcoin. In September 2017, China started the process of imposing a ban on trading in Bitcoins. The ban formally came into effect in February 2018. In the US, warnings were issued about trading and investments in Bitcoins. In July 2018, the Commodity Futures Trading Commission in the United States reiterated that any form of trading in cryptocurrencies is speculative and that there could be inherent risks associated with theft from hackers, as well as fraud and misrepresentation. Earlier, similar warnings had been issued by the European Banking Authority, regarding the price volatility of Bitcoins, absence of regulatory structure and the risk of fraud.

Bitcoin uses a peer to peer network to validate transactions

Risk of price manipulation

In May 2018, an investigation was launched by the US Justice Department about the possibility of price manipulation. The final price settlement of Bitcoin futures in the US is dependent on four cryptocurrency exchanges. The investigation looked into transaction data on these four exchanges in order to detect any unfair market practices.

History of the Bitcoin price

Bitcoin inventor Satoshi Nakamoto is estimated to have mined close to 1,000,000 Bitcoins, before handing over the controls to the Bitcoin Foundation and retiring from public life. By 2011, Bitcoins started to have parity to internationally accepted currencies. At the time, the Bitcoin price in US dollars was only $ 0.30. In 2011, the average USD to GBP price was 1.60. Therefore, the Bitcoin to GBP conversion was approximately 18p. Some people bought Bitcoins at this price. Imagine how rich they are today! Bitcoin closed in the year 2011, with the Bitcoin to GBP price at £3.29. However, Bitcoin to GBP prices faced extreme volatility at the time, with the Bitcoin to GBP price rising to £19.68 in June that year, before heading into a downward spiral.

The following year, 2012, saw the prices of Bitcoin in GBP rise to around £8.36 at the close of the year. However, volatility continued with the prices falling by as much as 49% to 57% throughout the year, followed by a period of stabilisation. This rollercoaster ride of the Bitcoin in GBP prices kept prudent investors away. However, that year also witnessed the creation of the Bitcoin Foundation. This was done primarily to lend a direction to the development of Bitcoin, leading to renewed hope in the prices of Bitcoin in GBP.

The rise of Bitcoin

2013 was an important year for Bitcoin. The year witnessed the greatest price rise of 1 Bitcoin in GBP. At the start of the year, the value of 1 Bitcoin in GBP was £8.36. However, by the end of the year, the price of 1 Bitcoin in GBP had risen to £484. But, it was also a year in which the cryptocurrency became mired in controversy. In March of the same year, there were problems with the blockchain and the distributed ledger system split into two independent chains for a few hours, before the problem was rectified.

In the same year, the US authorities also seized around 30,000 Bitcoins from an illegal trading site called Silk Road. The authorities also started taking action against Bitcoin exchanges in the US if they had not registered with the appropriate legal authorities. After China prohibited the use of Bitcoins, prices started falling drastically. At the start of 2014, the price of 1 Bitcoin in GBP stood at £484 but reduced to £206 by the end of the year.

Blockchain’s distributed ledger system is at the heart of Bitcoin’s security

Bitcoin revival

From this period of uncertainty, Bitcoins made a slow recovery. By the end of 2015, 1 BTC to GBP conversion price rose to £285. The price continued to rise throughout 2016 and by the beginning of 2017, the price of 1 BTC to GBP had risen to £804. 2017 marked the revival of Bitcoin prices, partly fuelled by a software upgrade on the Bitcoin network. This upgrade, called Segwit, improved prices by around 50%. By July 2017, the price of one BTC to GBP was approximately £2,216. By the end of the year, the price of one BTC to GBP stood at £10,816.

The Chinese ban on Bitcoin trading, which started in February 2018 saw prices plummeting. The Bitcoin to pound price dropped to approximately £4,974 on 5th February 2018. By January 2019, the Bitcoin to pound price was £2,882, down by 72% from the peaks achieved in 2018.

In February 2019, the Quadriga Fintech controversy surfaced, when the company’s founder was reported dead in India. The Canadian cryptocurrency exchange, subsequently filed for bankruptcy, with around $200 million unaccounted for. Despite this market shock, Bitcoin continued to perform well and by June 2019, the Bitcoin to pound price had risen to £10,000. In an act of legitimacy, Intercontinental Exchange, the company that owns the New York Stock Exchange (NYSE), started a Bitcoin exchange to trade in its futures.

The Bitcoin Foundation steers the direction of the cryptocurrency

The COVID-19 pandemic

It would be unbelievable if the global pandemic had not impacted Bitcoin. As the pandemic took hold around the world, BTC to GBP prices fell to approximately £3,225 and below. However, 2020 witnessed a lot of support for the cryptocurrency from financial companies, who moved a percentage of their total assets to Bitcoins. The payment gateway, PayPal also allowed its customers to buy and sell Bitcoin using their payment platform. By November 2020, the BTC to GBP price had recovered and stood at £16,016.

This new BTC to GBP price was at an all-time high, and reinforced the faith of investors, as the cryptocurrency was able to buck its performance, while under pressure from the economic situation caused by the pandemic. The revival of the Bitcoin GBP price witnessed other corporate powerhouses following suit in the support of Bitcoin. These included life insurance companies, who were converting a part of their assets to Bitcoin and the high-tech automobile company Tesla that invested £1.08 billion in Bitcoin. Based on these factors, the Bitcoin GBP price went up to £35,597. Earlier in 2021, the Bitcoin GBP price rose by approximately £3,846 in an hour, when the Bitcoin received an endorsement from Elon Musk, founder of Tesla. With that rise alone, the Bitcoin price GBP reached a price of £28,691.

A Bitcoin mining farm

Current status of the Bitcoin price GBP

The live price of Bitcoin to pounds is a dynamically changing price, just like any other global currency. Most live price charts will update the Bitcoin price GBP within five seconds. After a turbulent start, Bitcoin has now established itself as the most important cryptocurrency, which is in high demand. Due to this, the Bitcoin to pounds price is quite high. However, investors believe that the Bitcoin to pounds price will continue to rise in the future.

From a high of £35,597 on 8 February 2021, the Bitcoin price pounds has already reduced slightly to £34,301 on 12 February 2021. But the Bitcoin price pounds had earlier in the day reached a high of £34,487. So, as an investor, these illustrations should give you an indication of the fluctuation and volatility of the Bitcoin price pounds. Many precious metal investors are now turning to Bitcoin, as there is speculation that it may replace precious metals as a repository of value.

Bitcoins may soon replace precious metals as a repository of value

Call us at Physical Gold to compare cryptocurrencies with precious metals

Our precious metal experts at Physical Gold can help you with the right advice and knowledge when it comes to comparisons between cryptocurrencies and precious metals. Call us today on (020) 7060 9992 or simply get in touch with us online through our website.

Image credits: PxHere, nifco, Tumisu, TLC Jonhson, Wikimedia Commons, Freeimg.net and Wikimedia Commons

It is not surprising that many people find scrap gold inside their homes. Sometimes you may inherit the belongings of an old relative, or you may have some old jewellery, which is broken or damaged. All of this constitutes scrap gold. But what is the best way to evaluate this fortune in your possession? More importantly, how will you sell it? Read on to find out.

Old jewellery in your home will often be considered as scrap gold

A gold price calculator from Physical Gold

What you need is a gold price calculator. As one of the country’s most reputed precious metal dealers, Physical Gold offers you a fair value for your scrap gold. We are able to tell you the price we are willing to pay for your gold in advance. Before you use a calculator, it is important to find out the total weight of the items you wish to sell. All you need is a digital weighing scale, and you can get a fairly accurate idea of the amount of gold you’re selling. An online gold price calculator is extremely easy to use.

All you need to do is enter the weight of your gold in grams. You also need to know the fineness of the gold. Many people would already be aware of this, however, if you aren’t, you can simply enter the number of carats you believe it to be. That’s all you really need to do. You can then click on the button, and we will show you the price we are willing to pay. We will even explain how we arrived at that price.

How can I sell my scrap gold?

The best and easiest way is to call Physical Gold on (020) 7060 9992. A member of our team will then guide you on what to do with your gold. If you have already evaluated the gold you possess through the online calculator, we will pay you the price indicated, after checking the weight and purity. Within five working days, the money can be in your account.

If you wish to post your gold to us, you must first book in the sale and then use the Royal Mail Special Delivery to send it to us. It is also recommended that you insure your parcel. If you need more information about how to sell your scrap gold, you can get in touch with us online by visiting our website.

Image credit: PxHere

What is the gold price?

This is a generic question that many precious metal buyers ask. However, it is important to clarify certain key concepts when it comes to discussing the gold price today. Firstly, it is important to not confuse the concept of ‘value of gold items’ with today’s gold price. Investors are often confused when faced with this dilemma. A layperson would be led to believe that the value of a gold item, whatever it may be, can simply be calculated by weighing the gold and multiplying it by today’s gold spot price. However, this is not true.

The value of gold items

Well, it all depends on the gold item that you own. Is it a gold bar? If it is, then we need to check the purity of the gold by looking at the refiner stamp on the bar. The gold price today relates to pure gold, also known as 22-carat gold. If the refiner stamp on your gold bar states that it is 22 carat gold with a purity of 999.9, then today’s price for gold will apply. If, however, the item you own is a piece of jewellery, an artefact or something else, then the gold price today may not apply.

This is simply because of design and making charges for jewellery or other items cannot be recovered. It is also highly likely that the purity of the gold may have been diluted to harden it. This is usually done with the addition of base metals like copper or nickel so that the jewellery can be manufactured without breakages. The malleability of pure gold does not allow it to be fabricated into such items easily.

The value of a gold bar can be calculated according to the current price

Today’s gold price

The price of gold today isn’t really a fixed-price. It is a dynamic price that changes every second, whenever the markets are open. The gold market is a global one, and today’s price keeps fluctuating if the gold markets are operational anywhere in the world. So, Asian markets operate at different times when compared to the New York London markets and the price of gold today keeps moving on. Apart from this, the gold markets do not operate during weekends and major international holidays like New Year’s Day.

Gold coins have now become more valuable due to price rises

Finding out the gold price today

Today’s gold price is stated in USD per Troy ounce. Most reputed dealers will have this price published on their websites. You can also find out the gold price today by searching on a search engine. The current gold price is known as the spot price. Currently as I write, the spot price of gold is $1843 per Troy ounce. The Troy ounce is a unit of measure used to weigh precious metals. It is slightly different from the regular ounce. A Troy ounce equals 31.10g, according to the metric system. The regular ounce equals 28.34 g. So, now we understand that today’s gold price is the price in US dollars for 31.10 g of gold.

Premiums over today’s gold price

When buying or selling, another key concept to be aware of is that investors cannot sell or buy exactly at the gold price today. When buying, a small premium needs to be paid over and above the gold price today. When selling, you lose this premium. The premium accounts for dealer margins, manufacturing and designing costs and other logistics.

Find out more about gold prices from Physical Gold

Our gold experts are best placed to advise you on the right price to buy or sell your gold. To benefit from this advice, please call (020) 7060 9992 or drop us a line via our website and we will be in touch with you.

Image credits: Wikimedia Commons and Pixabay

Having stood the test of time over the years, the yellow metal has turned into an asset class that investors frequently depend on during times of economic turmoil. Gold has historically been seen as a safe haven and an investment vehicle that generates steady returns.

While the appetite for gold has risen and fallen over the years, it is obvious that gold demand skyrockets during times of crisis. The world has seen much of this in the last couple of decades. The demand for gold feeds on the fear of investors and looking back to 2011, we can see that the spot price of gold reached its highest point in August of that year. The all-time high, which crossed $1900, was at the height of the global economic crisis at the time.

Physical gold investments have gone through the roof during COVID-19

Economic fears and social collapse

Most researchers study the anatomy of an economic crisis by measuring the financial impact, supply and demand issues and political ramifications. However, one of the largest problems that follow a global crisis is social impact. Epidemic diseases create the fear of death, which in turn breaks down society. Standard economic measures taken by governments can only soften the blow to an extent. In reality, there would still be people who cannot pay their bills, housing foreclosures and a growing banking crisis.

Currently, we are in the middle of what could be the largest global pandemic the world has ever seen. At the time of writing this article, the US has approximately 6.1 million confirmed cases of COVID-19, with 186,000 deaths. Likewise, the UK has over 335,000 cases and more than 41,000 deaths. The numbers are staggering and continue to grow every day. Unemployment in the United States reached an all-time high of 14.70% in April 2020. Needless to say, these economic pressures have penetrated deep into the heart of American society, destroying any semblance of economic stability that was previously there.

The multiple impacts of COVID-19

Impact on the economy and other asset classes

One of the key barometers of Britain’s economy is its housing market. These figures show a drop in demand of around 40% at the end of March 2020, according to Zoopla, a well-known property-related website. The drop in demand isn’t linked to the availability of housing. Importantly, it is the outcome of a shrinking economy, where the lack of job security has resulted in an exodus of buyers. Many businesses have become bankrupt during the lockdown and this has also had a huge impact on commercial properties. Moreover, the post-pandemic era is likely to see a greater number of people moving to homeworking. Prime commercial property, for example in Central London, will lose its lustre due to reduced demand.

Prime real estate in London currently has few takers

Other areas of the economy have also taken a significant hit. A report by the Financial Times indicated that automobile sales were down by 97% in May 2020 – the biggest drop in three decades. The United Nations has published a report that estimates the damage to the global economy to be US$1 trillion. In fact, the UN has requested countries all over the world to spend now, in order to avoid a long period of economic uncertainty. The economic think tank of the UN has advised that a lot more needs to be done, rather than reducing interest rates and cutting taxes. In March 2020, the US government released a stimulus package designed to help businesses across the country. The package included payroll tax cuts and certain emergency measures to reduce job losses across businesses.

The UK government was pro-active in the creation of an employee welfare scheme called the ‘furlough scheme’. This scheme was designed to help UK employers retain employees during crisis periods when employees could lose their jobs, the company ‘furloughs’ the worker, i.e. puts them on the scheme. The government pays 80% of the wages, up to £2,500 a month, while he/she is laid off. Two out of three British employers have used the scheme in the past. However, this scheme is likely to be pulled to reduce government spending. Many UK workers are likely to face tough times once the scheme is shut down.

Impact on the European economy

Closer to home, the German economy entered into a recessionary phase due to the impact of COVID-19. Germany had gone into recession in 2009, during the last global financial crisis. This time around, the country’s economy shrank by 2.2%, pushing the nation into recession.

Along with Germany, the Eurozone has also been plagued with problems of its own. Countries like Italy are reeling with high debt and zero or negative growth. During the previous financial crisis, nations like Italy, Greece and Portugal were bailed out by countries like Germany and the UK. This time around, things are looking grim. Brexit has already brought the continent under pressure throughout 2019. Now, the future of the Eurozone lies in the balance and radical economic action and fiscal measures are required by Brussels to ensure the inclusion of countries like Italy.

The demand for investment silver has risen since COVID-19

Impact on other asset classes

Other assets have also been impacted. De Beers, one of the world’s largest manufacturers of diamonds reported a 28% decline in sales. Leading companies have also been forced to close down their sales channels, including exhibitions. Some companies have begun exploring the option of selling online however sales volumes are yet to rise.

The price of silver had fallen to a low of $12.01 on 19th March 2020, but as the COVID-19 crisis hit the price has surged to a current $27.53. This represents a stunning 129% price rise in just five months. This topic is discussed in detail later but is largely due to silver similarly to gold being classified as a safe haven investment.

Panic and uncertainty

There is an intangible impact of the pandemic, which many people don’t realise. Yet, this impact is disastrous for financial markets. It is often said that the money runs away from where it is scared. Fuelled by speculations on social media and the media, the virus of fear has spread throughout the global economy. In countries where a strict lockdown was designed to stop the virus from spreading, an economic disaster ensued, killing off businesses and depleting jobs. On the other hand, the countries that followed a lighter approach ended up having unbridled transmission of the virus, resulting in the loss of human lives. This is the paradox that the world is dealing with. It is an unprecedented situation, to which there appears to be no immediate solution.

The global stock markets have responded similarly, with the FTSE downward slide started from March 2020. Similar crashes were recorded in the S&P index and the Dow Jones. As the markets turned bearish, investors pulled out their investments. The domino effect of the coronavirus is likely to beleaguer the economy long after the threat of the virus has passed. This is a crisis with a magnitude of epic proportions that no one could predict.

Panic buying resulted in depletion of supplies from supermarket shelves

Panic buying of commodities

Another significant impact of COVID-19 has been the turmoil witnessed in consumer markets across the world. As the crisis unfolded, people rushed out to stock food, toiletries, essential items, sanitizers and other disposables. Nielsen, the market research company reported that sales of pasta increased by 168% during the pandemic, while canned pasta and canned meat were up by 148% and 147%, respectively. This kind of consumer behaviour creates a void in the economy, creating supply and demand issues.

When there is an unprecedented spike in the demand for food and other commodities, systems often struggle to respond, and shortages are created. In many developing countries, the COVID-19 crisis has resulted in speculative prices of commodities being charged by unscrupulous traders. In a situation where unemployment is on the rise and families are cash-strapped, this creates a vicious cycle that can severely impact underprivileged members of society.

2019 was the year of Brexit

2019 was Brexit, 2020 is COVID-19

At the same time last year, no one had anticipated that the pandemic would be upon us soon. 2019 was the year of Brexit. Post the general election in the UK during the previous year, Prime Minister Boris Johnson moved forward to sign the Brexit deal with the European Union. As the threat of a no-deal Brexit loomed over the country for a long time, the price of Sterling had weakened. Naturally, the gold prices went up, as investors lost confidence in the British pound. The uncertainty that the UK might leave the EU without a deal in hand, further impacted the value of the Sterling. The price of gold had shot up shortly after the Brexit vote in June 2016.

Download The 7 Crucial Considerations when buying gold & silver FREE. Click HERE

The former Governor of the Bank of England, Mervyn King said,

“The world economy is sleepwalking into a new financial crisis”.

Lord King was in charge of the Bank of England in Threadneedle Street during the 2008 financial crisis. He warned that a stagnating world economy was poised at the brink of yet another major financial crisis. A low growth trap, compounded by the uncertainty around Brexit, the US-China trade wars, political tensions within Europe regarding the direction of the Euro and socio-political issues in the emerging economies were all key factors for pushing the world towards another debacle.

Ironically, in hindsight, we realise that the world economy was already fraught with numerous problems. No one knew that COVID-19 would soon arrive. By August 7, 2019, the price of gold breached the $1,500 mark. It hovered at these levels through the next few months, reaching a price of $1,527 on 2nd January 2020. It reached a new high of $2,067 on 6th August 2020.

The Great Depression of the 1920s – Australian schoolchildren queue up for free soup

Financial markets in turmoil

Businesses in the UK were already struggling, amidst plummeting sales driven by a drop in consumer demand. For example, high-street retailer Laura Ashley was struggling by February 2020, to save the business. The company reported an 11% drop in sales through the latter half of 2019. The company’s share price went down by 38% when the media reported the news. By this time, borrowing restrictions were already in place by the major banks and struggling high-street businesses were finding it hard to stay above water.

The 2020 oil crisis

A well-known parameter used to check the health of the world economy is the oil price. During the 2008 recession, global oil prices had dropped to $33.87 a barrel in December 2008. The 2020 oil crisis, also known as the coronavirus oil crash, had very little to do with the virus. The breakdown of talks between Russia and Saudi Arabia triggered a price war in March 2020, when the OPEC failed to stabilise the market. Saudi Arabia went on to dump crude oil into the market at heavy discounts. As a result, WTI crude plunged by 24.59% to trade at $31.13 per barrel. This was a historic low since the Middle Eastern war in 1991. Goldman Sachs, the global investment bank cut back its 2nd and 3rd quarter Brent forecast for the year to $30 a barrel, indicating that prices could eventually fall as low as $20. Read our detailed article about the relationship between gold and oil prices.

Banking and the global stock markets

Sergio Ermotti, who heads the Union Bank of Switzerland (UBS), has been quoted as saying that he has never witnessed the magnitude of what he is seeing now. Banks have been saddled with a problem of epic proportions, which include weak profits, little or no dividends or bonuses. Sadly, this comes at a time when investors are already tight-fisted. After the sub-prime housing market crisis of 2008, most banks across the world took steps to protect themselves against another similar meltdown. However, the COVID-19 crisis has caught everyone off-guard. A combined sum of US$139 billion has been set aside for loan loss provisions. However, the financial experts at Accenture have predicted that the actual cost of bad debts could rise to US$880 billion by 2022.

Back home, things aren’t great either. In June 2020, Forbes magazine published a scathing article titled “The UK economy is broken”. In that article, the Bank of England chief is reported to have said that the current financial crisis is the worst in 300 years. That takes us back to an era that predates the industrial revolution. The implications of that statement are huge. It would imply that as the current crisis unfolds, it will reach a dimension never seen by anyone in their living memory.

Government debt level has crossed 101% and is headed upwards. On the other hand, the tax coffers are emptying, as overall tax collections have reduced by 28% or more. This includes VAT, down by 46% and income tax, down by 29%. In the scheme of things, the government would find it very hard to bail out the UK banks in the event of a collapse, like it had done in the case of Northern Rock and RBS, back in 2008.

Investors queue up to recover their savings from Northern Rock in 2008

The stock market crash 2020

The COVID-19 stock market crash started on 20th February 2020. By March, the global stock markets had fallen by approximately 25%. Of course, this was a case of investors turning bearish as the pandemic started spreading and the news hit the stands. It’s interesting to note that barely a few days before, on 12 February the global stock markets were at an all-time high. This included the S&P, NASDAQ and the Dow Jones. It goes to show how fragile and volatile equity markets can be. In reality, when the market free-falls, there is no safety net.

By May, there was a recovery rally and the US indices hit new highs on 17th August 2020. Interestingly, this bull-run on Wall Street was led by technology companies who operate in areas like cloud computing and machine learning. The lockdown had proved to everyone around the world that education, business and many other services were moving online in the post-pandemic phase.

Virtual events were being hosted all over the world, while consumers have moved to ‘no contact’ online shopping. Videoconferencing players like Zoom are suddenly seeing a huge surge in their businesses, as all business meetings and conferences are being conducted through remote facilities. Investors were, therefore, keen to invest early in these companies, along with the likes of the big players like Amazon, Microsoft and Apple.

It’s important to note that the current correction and buoyancy in the stock market is not reflective of the global economy at large. Stock markets have historically risen on investor sentiment. At the moment, it appears that investors have turned to the market in the hope of making quick gains, despite the fear of coronavirus. The nature of such volatility usually creates a bubble that the general public should be wary of.

Restaurants like Nandos have suffered huge losses during COVID-19

The decline of other business sectors

In reality, a closer look at the high-street tells us that every sector in business is suffering. Airlines have suffered huge losses, along with the tourism and hospitality industry. The popular European airline Flybe, which had been rescued from the brink of a financial collapse last year, has gone into administration. The weakening Sterling has impacted all UK airlines, with an increase in the cost of aviation fuel and aircraft leasing. However, this added to the woes of Flybe, which had a 40% exposure to the regional UK air travel market. Once the domestic market shut down due to COVID-19, it was practically the last nail in the coffin for the airline.

In the hospitality segment, restaurants and tourism were hit hardest by reduced consumer spending and travel prohibitions. 27% of UK residents delayed their vacation plans due to the outbreak of the virus, while a further 11% were forced to cancel their existing holidays. This has had a huge impact on the entire tourism sector in the UK. The country regularly enjoys a surge of tourism during the summer months from overseas residents, which has come to a grinding halt this year.

Tourism in England alone brings £106 billion annually, supporting 2.6 million jobs in the UK. Market pundits now predict that the tourism sector in the UK is likely to shrink by 59%, leading up to 2021. It’s important to bear in mind that these figures merely represent the leisure segment. Commercial and business travel, which is a huge contributor to the UK economy has vanished completely.

Likewise, the sports and sports event sectors have also taken a hit. The revenue in these sectors come from multiple streams. Firstly, fans and audiences contribute to revenues by attending events. Then, there are revenues associated with travel and tourism-related to sports. The collection of viewership revenues from television channels is yet another big contributor. Lastly, the sector generates employment for individuals tasked with security, maintenance, ticket collection, and several other services. Sports education is also a major contributor.

In an unprecedented turn of events, the Olympics and Paralympics scheduled to be held in Tokyo, Japan were postponed till 2021. The world had geared up for this great sports extravaganza, but now all the revenues and jobs surrounding the events have been shelved temporarily. While the games are scheduled to be held in 2021, it remains to be seen how the coronavirus battle will be played out. If the pandemic is still around in 2021, the games may be further rescheduled or cancelled altogether.

The Tokyo Olympics has been postponed to 2021

Business dependencies on China

The coronavirus could not have picked a worse time to enter the world. The US-China trade war had just started easing out when the coronavirus pandemic took hold. Possibly one of the biggest fallouts has been the exposure of dependencies on China that global businesses have today. The US, Japan and France have started advising their companies to limit their reliance on Chinese manufacturing within their supply chains. In fact, when the pandemic started in China, the first thing that happened was a breakdown of the international supply chains linked to Chinese manufacture. In a globalised economy, the effects of the coronavirus disruption were felt instantly as the supply of goods simply vanished.

The pharmaceutical industry is trying to limit their reliance on Chinese drug manufacturers by initiating efforts to build a raw material supply chain within the United States and Europe. Sanofi SA, a leading French pharmaceutical company is putting an API supplier in place to reduce its dependency on China. The company management says that this development will be an important one for the pharmaceutical giant, as it will become the second-largest global producer, notching up annual sales figures of €1 billion by 2022.

In 2019, Chinese manufacturing companies had secured US$223.7 billion worth of business. Automobile parts, computer peripherals, and even plastic goods arrive in the West from China. Apart from being a base for low-cost manufacturing, China is also a lucrative market. The country has more than 1.3 billion consumers, many of whom are upwardly mobile and display healthy spending patterns. This provides much-needed relief for international companies, whose markets in the West have significantly declined due to lack of consumer liquidity.

The US Dollar is emerging as a strong global currency due to the pandemic

Currency markets in turmoil

The long arm of COVID-19 has reached well beyond the global banking sector, stock markets and business sectors in countries. It’s no surprise that the global currency markets have felt a significant impact. The weakening global economy, backed by the rise of unemployment in the US and Europe has led to investors moving to the US dollar as a solid, safe currency.

Although many believe that this could be a silver lining for the US, in reality, these movements do not reflect a long-term commitment to the US economy. Government debt is at an all-time high, along with rising unemployment. The fundamentals of the US economy could be undermined by these long-term factors, and the current price of the dollar could be driven by short-term investor sentiment. A lot depends on the US elections scheduled for November 2020. Additionally, the rise of the US dollar will create inflation for other currencies around the world, impacting imports of goods and services.

The British pound, however, has declined to its lowest level in 30 years. Market experts believe that the weakness of the pound could be dependent on speculations regarding the UK government’s plans to fund emergency economic measures to weather the storm of the coronavirus pandemic in the country. The package of fiscal measures announced by the British government simply means more borrowing for the UK. Economic experts are worried that the UK may be steering headlong into a debt crisis with no immediate solution in sight.

Gold has performed extremely well during the pandemic

Why has gold bucked the trend and remained up?

It is now abundantly clear from the points discussed above, that the COVID-19 pandemic has hit deep into the heart of the global economy. Gold, however, has beaten the pandemic blues and continues to climb to record levels. This is largely because gold is considered to be a safe haven for investors. During the height of the 2008 economic crisis, gold reached an all-time high, crossing the $1900 barrier. That record has now been broken and the spot price of gold crossed $2000 in August this year. Falling interest rates, lack of confidence in the world economy and the uncertainty in the currency markets have all contributed to the rise of gold. With the gold demand in focus, an unprecedented level of 734t of gold has flowed into gold-backed ETFs.

The journey to this unprecedented price point had already started in 2019. Although the world was unaware that the coronavirus pandemic would soon be coming, wary investors had already started moving to gold to strengthen their investment portfolios. There were talks of yet another global recession on its way. If we look at gold price charts from September 2017, we can see that the spot price of gold never crossed the $1,500 price point up to August, last year. On 7th August 2019, the price of gold reached $1,506 for the first time in three years, almost a year ago. In April, earlier this year, the gold price hit the $1,700 mark, subsequently reaching its highest point of $,2067 on 6th August 2020.

Supplies of gold remained strong and resilient throughout this period. In the first quarter of 2020, many refineries were shut, along with mining company operations. The travel restrictions also disrupted the supply chain. These disruptions caused market premiums to rise on the back of high demand.

The table below covers the percentage growth rates of gold from 2005 to 2011 during the bull-run. In the adjoining column, the Bank of England interest rates during these years are shown. In 2009, the UK embarked on its first quantitative easing programme, dropping interest rates to a historic 0.50% and releasing £75 billion into the economy through quantitative raising. There were no other quantitative easing programmes launched during 2005- 2011. The next one was during the Eurozone debt crisis, releasing £375 billion of relief into the UK economy. The Brexit QE program released £445 billion in 2016 and the 2020 coronavirus pandemic QE program released £745 billion.

| Years | Percentage Rise for Gold | Bank of England Base Rate | Quantitative Easing (QE) |

| 2005 | 31.06% | 4.50 | |

| 2006 | 8.95% | Aug 06 – 4.75 Nov 06 – 5.00 | |

| 2007 | 28.88% | Jan 07 – 5.25 May 07 – 5.50

Jul 07 – 5.75 Dec 07 – 5.50

|

|

| 2008 | 42.75% | Feb 08 – 5.25

Apr 08 – 5.00 Oct 08 – 4.50 Nov 08 – 3.00 Dec 08 – 2.00 |

|

| 2009 | 14.77% | Jan 09 – 1.50

Feb 09 – 1.00 Mar 09 – 0.50 |

UK’s first QE program reduces the base rate to 0.50 and QE of £75 billion announced to aid the economy. |

| 2010 | 32.82% | 0.50 throughout | |

| 2011 | 12.28% | 0.50 throughout |

Why is gold lucrative for investors?

When building a portfolio, gold is a great choice for investors since it creates insurance and balance for the portfolio. It insures against times like these when the global economy and capital markets go into a tailspin. Gold is essentially a mechanism for hedging the risks associated with other vehicles of investment. An important attribute of gold is that it is not subject to counterparty risks. These are risks that are inherent in any form of paper-based investments, such as stocks, mutual funds, bonds, etc.

Silver prices rise in 2020

Silver was at a 10-year low price of $12.01 per oz on 19th March, which was around the time that COVID-19 really started to take a grip in Europe and the US. Following this, silver prices added 25% between April to June 2020, with May alone rising from $14.94 to $18.28. The main factors causing this were:

- Safe haven investments – silver’s association with gold as a safe haven investment meant that silver retained and improved its value as it was seen as a cheaper alternative to gold which was rising massively.

- Retail bars and coins surge – there was a surge in silver bars and coins demand, with coin sales in particular 60% higher year on year. This at a time where transportation of products was challenging lead to supply problems, longer lead-times for delivery and product premiums.

- Silver jewellery demand – the demand for jewellery has also surged, with massive demand reported in India and China, where Seeking Alpha reports a 104% increase

- Silver equities – similarly there were share price increases of silver ETFs and mining companies rose sharply in the period. This was due to a surge of investments in these equities, which was against the market trend (not every sector loses with COVID-19).

- Reduction in supply – silver mines production are expected to fall by 5% in 2020, to 797 million ounces with other inputs (e.g. recycling), there will be total supply of 978 million ounces. This is the lowest silver supply globally since 2009.

There are too many factors to list all of them, but the above will give an idea. The silver price increase was in spite of a drop in industrial demand due to COVID-19 disruptions to industrial output (e.g. photovoltaic cells in solar panels).

The gold to silver ratio currently is 71.2, which suggests that silver remains an excellent investment as for much of history this has traded at only 15 oz of silver for 1 oz of gold.

Call Physical Gold to buy gold bar bundles of 3,5 and 10

Call Daniel Fisher, CEO of Physical Gold to discuss gold investments during COVID-19

To respond to the increased demand for gold, we have added some excellent bundled deals that can protect your wealth and strengthen your portfolio. We now have a bundle of 10 bars, with each bar weighing 10g. Similarly, there are 3 bar and 5 bar bundles weighing 50g and 100g, respectively.

The gold price is clearly at an all-time high, no matter which currency you want to buy gold in. In GBP terms, the price of gold has shot up by more than 35.6% in 2020 alone. Many investors are adopting a ‘wait and watch’ policy. We often receive feedback from these investors that they feel they’ve missed the price point and now need to wait for the prices to go down, for them to invest. This couldn’t be farther from reality. Gold prices rise steadily, and a gold bull-run does not necessarily end at the end of the year.

Many people think that the COVID-19 pandemic will simply end, as suddenly as it appeared, and the economy will revert to normalcy by 2021. At Physical Gold, we believe that this is likely to be a sustained run and buying gold can protect your wealth even now if you haven’t bought already. The last gold bull-run took place from 2005 to 2011. During that time, we had countless discussions with buyers about what they should do. If you’re thinking of buying gold during the current pandemic, please speak to Daniel Fisher, by calling (020) 7060 9992 or contact us online and we’ll get back to you.

Image Credits: Pixabay, Wikimedia Commons, feiern1, Wikimedia Commons, Public Domain Pictures, Wikimedia Commons, Wikimedia Commons, Wikimedia Commons, Wikimedia Commons, Christoph Meinersmann/54, Jeremy Schultz and Wikimedia Commons

It is becoming increasingly apparent that the COVID-19 crisis has caused unprecedented disruption in the markets. Accepted constants in the market have been broken, as the price of gold has skyrocketed, while other commodities have moved in different directions. For more than 2 ½ decades, the gold oil ratio has been around 15:8. In layman’s terms, this means that 15.8 barrels of crude oil are worth the same as a troy ounce of gold.

Back in 2005, this ratio dropped to 6:2 due to massive rises in the price of oil. But, apart from these periodic aberrations, the gold-oil ratio has more or less remained constant. Oil price volatility has also driven this ratio up to 47:6 in 2016. So, what happened in 2016? The price of gold rose by 6% to jump to $ 1127 per ounce. Oil prices performed poorly in that year, along with the stock markets, but the ratio was disrupted as gold prices continue to rise.

The price of crude oil is intrinsically linked to gold prices

Why is the oil to gold price ratio so important?

The common umbilical cord shared by both gold and oil is the US dollar. Since both gold and crude oil are priced in the market in US dollars, there is a correlation between the two commodities. Gold is considered by many to be more than a commodity – a precious metal that locks in value provides insurance against inflation and other market forces and hedges unwanted market risks. Oil, on the other hand, is representative of the energy we use in a fossil fuels based world. This simply means that all countries in the world have to acquire monetary resources to buy oil to run their economies.

Apart from being dollar-denominated assets, the price of crude oil is an important influencer in the stipulation of gold prices, gold mining company stocks and ETFs. Due to their valuation in the same global currency, a rise in the US dollar usually means the fall of other dollar-denominated assets. In this scenario, investors are wary of purchasing these assets as they become more expensive. So, ideally, when the US dollar falls, gold falls, as it becomes more affordable due to their strong linkage.

Gold has delinked itself from oil prices in 2020

Inflation is also linked to the price of oil and gold

Interestingly, there is another dimension to the problem. The rise of crude oil prices usually pushes up inflation. However, as we know, gold protects investors against inflation. The demand for gold, and subsequently its value also increases whenever there is a spike in inflation. So, now we can see the direct relationship between gold and oil prices. Gold does not behave like other dollar-denominated assets. The demand for these may plummet with the rise of oil prices, but gold, due to its inflationary protection attributes continues to remain attractive to investors when inflation is pushed up, due to oil prices.

Economic slowdown due to the increase in oil prices

Since all countries have to buy oil to fuel their economic growth, a rise in the price of oil slows down the economy. The domino effect that this has on industry dampens economic growth. Consequently, there is a fall in equity markets and investors move to gold. Once again, there is a direct correlation between the price of oil and that of gold. Recessionary phases like these can be lucrative for precious metal investors as they can book profits with the price of gold moving upwards. Surging oil prices can adversely impact the share price of mining companies, as well. Since oil is widely used in mining, rising oil prices squeeze the margins of these companies, resulting in a dip in their share prices.

So, what changed through 2019 and 2020?

At the beginning of 2019, the gold price ratio was 23:1, which was already high, but it rose further. Numerous factors affected the price of gold, resulting in significant increases. The world was already poised on the brink of a financial implosion that led to an avalanche.

Investors starting to move their investments to gold bars (with sizes such as 1oz, 100g and 1 kilo) and gold coins (such as gold Britannias and gold Sovereigns). Other factors responsible for the rise of gold were:

- the economic uncertainty in Europe due to Brexit

- increased government debt in most countries in the developed world

- the US-China trade wars and

- socio-political tensions across the Middle East and other parts of the world.

All of these factors also led to the volatility of the global stock markets, resulting in more demand for gold. The COMEX gold futures price breached the $1400 per ounce mark in June 2019.

Crude oil remains the lifeblood of the global economy

How did the pandemic change the game?

For all practical purposes, 2020 is not a normal year. The oil crisis started with Russia and Saudi Arabia at loggerheads with each other regarding the future of oil. Russia had refused to ramp up production to keep oil prices up. The price war was eventually triggered in March 2020, when OPEC failed to stabilise the market. Saudi Arabia started dumping crude oil into the market at heavily reduced prices.

This resulted in the WTI crude going down by 24.59% and reached a price of $31.13 per barrel. These prices have never been witnessed since the Middle Eastern war, which took place in 1991. The global investment bank, Goldman Sachs cut back on its outlook on Brent oil for the second and third quarter of the year, reducing it to $30 a barrel, with indications that eventually prices are likely to be as low as $20.

Has COVID-19 changed the gold oil ratio forever?

So, here was a new trend with oil prices falling and the price of gold reaching its highest point ever to $2067 on 6th August 2020. As we have seen above, the price of gold falls along with the price of oil. However, COVID-19 was different. While oil was dumped at cheaper rates, global economic fears prompted investors to buy gold in the hope of protecting their wealth.

The 2020 fall in oil prices was not entirely linked to coronavirus, but a reduction in industrial demand for oil due to manufacturing output reduction was. As were corresponding drops in fuel usage by the public as they travelled less and also the reduction in worldwide travel also created a reduction in demand for oil.

The rise of gold was certainly linked to the implosion of the global economy caused by COVID-19. It would be premature to say that the gold oil ratio has changed forever. 2020 has not been a normal year. It may take a couple of years during the post-pandemic era for things to stabilise, but once they do, the correlation between oil prices and gold may revert to pre-2020 levels.

For more advice on buying gold at the right time, call Physical Gold

Our gold researchers continuously study economic trends related to the international gold markets. Many people believe that the current price of gold isn’t viable for them to make a purchase. To get the right advice on selling and buying gold and silver, call Physical Gold Limited on (020) 7060 9992 or contact us online. We would love to speak to you and impart the right advice on buying gold.

Image Credits: Needpix, Pikist and Wikimedia Commons

Tax-free gold price on the way up

With tensions in Syria reaching boiling point, a few years ago, it hasn’t gone unnoticed that the price of gold had steadily risen at the time as the world prepared for conflict. Since then, a plethora of myriad challenges has hit the world economy. It has now been a long 12 years since the days of 2008 when the world faced its most severe financial crisis.

The US sub-prime housing market collapse triggered off a chain of events that eventually brought global financial institutions down to their knees. The period witnessed the demise of Lehman Bros and a large number of global financial institutions followed suit. But, economists all over the world had hoped that in time, the crisis would dissipate, and the world economy would be buoyant once more.

Ongoing crisis fuels gold price

This was not to be. Instead of a healthy recovery, the global financial markets simply settled into a bearish and sluggish phase that lasted for most of the decade. A change of guard at the helm of the great nations could not provide a viable solution to the problem. On the other hand, geopolitical events around the world continue to queer the pitch for a recovery.

The uncertainty surrounding Brexit and government debt across Europe created a problem. Of course, there was a renewed escalation of conflict in the Middle East, along with the increasing threat of global terrorism that led to greater levels of economic uncertainty. This was further compounded by other factors like the US-China trade war.

Gold coins are attractive to investors for hedging risks

At the height of the recession, gold reached its highest ever peak in August 2011, when the spot price of 1 ounce of gold touched $ 1900. This rise was attributed to wary investors moving away from market-linked instruments and hedging their risks by investing in gold. Now, in 2020, we can once again see the spot price rising all the way up and it has already reached above the $1600 mark. Investors are once again depending on the safety of gold.

The reliable safe-haven investment is now technically in a bull run again after gaining more than 20% from its June lows. Tracking the tax-free gold price is essential if you’re to time your entry into the market well and maximise returns.

When is gold tax-free?

Tax regimes can vary dramatically around the world, so we’ll just focus on the tax treatment of gold in the UK. All investment grade gold is VAT exempt, meaning you’ll pay no tax when you buy. To qualify as investment grade, the gold needs to be 22 carats or higher in purity and in the form of a bar or coin. So this instantly discounts the merits of lower grade jewellery, or gold in the form of dust as tax-free gold.

Owning physical gold bars and coins doesn’t produce any dividends like a gold mining share might, so a holder also avoids paying any tax while holding them.

The final piece in the jigsaw is whether any tax will be applicable upon sale – known as Capital Gains Tax (CGT). Generally speaking, any profits you’ve made are liable for CGT once you’ve breached your annual allowance. So, if you sell gold bars or foreign coins such as Krugerrands, you may have to pay CGT.

However, the amazing loophole lies with British coins. Namely UK Britannia and Sovereign gold coins are actually legal tender in the UK. As such, the Treasury can’t tax you on their movement, essentially rendering them CGT free! So if you want to avoid paying tax when buying, holding and selling gold – Sovereign coins are a great place to start.

What influences the tax-free gold price?

There are several variables which contribute to the price of Britannia and Sovereign coins. Firstly, the age and condition of the coins. Generally, brand new coins will trade at a 1-2% premium to circulated coins. In my opinion, older coins offer better value as you’re unlikely to receive the same premium you paid when you come to sell brand new coins.

Secondly, the number of coins you’re looking to purchase will impact the price you pay. Generally speaking, you should benefit from economies of scale with the premium you pay shrinking as you buy more.

Physical gold price affected by supply and demand

The fact that the UK gold coins are real and tangible, rather than simply paper gold like ETFs or mining shares, means that supply and demand will also influence the gold price. If the market experiences high demand and/or restricted supply, then you may find yourself paying higher premiums for the same coins.

Finally, the place from which you source your gold coins will have an impact on price. Buy direct from the Royal Mint and you’ll pay over the odds due to packaging and presentation. However, purchasing from a reputable gold dealer should keep premiums to a minimum.

All investment grade gold is VAT free in the UK

Where can I track current gold prices?

If you don’t want to have to call a gold dealer every 5 minutes to gauge prices, it’s useful to be able to trace the approximate price on the internet. There is a relatively easy way to do this. Reputed gold dealers will display the current price of gold on their websites.

As you may be aware, the price of gold is a dynamically moving number and is usually reflected on a ticker, which is displayed at the top of the website. The display gets automatically updated every minute. By checking the ticker, you can stay up-to-date with the current price of gold. Also, in today’s day and age, there is an app for just about anything. Several gold apps in the market can also track the price of gold in real-time and keep you updated.

If you’ve already bought gold coins, you may simply want to track their value. While the factors discussed above will determine the exact price, it is possible to estimate its value from the gold spot price. This price moves throughout the day and is fixed twice daily – known as the London fix. These fixes can be found on the LBMA website or the live price with a gold dealer such as Physical Gold Ltd. You can then simply add a premium of between 7-12% to obtain a decent guide to the price of tax-free gold.

Call us for any advice on buying gold

At Physical Gold, we have a specialist team who can advise you on all matters related to the sale and purchase of precious metals. This includes guidance on the price of gold and how to invest in tax-free gold. We are one of the most reputed online precious metal traders in the country. Call our gold experts today on (020) 7060 9992 or simply reach out to us via our website. Our friendly customer service team is always at hand to ensure that you make the right investments when it comes to gold and silver.

Image credits: Peakpx and Wikimedia Commons

Coronavirus and gold prices

February 24th, 2020 saw gold prices surge to a 7 year high. Concerns about a COVID-19 coronavirus global pandemic upset the markets, we investigate reasons for recent events in this latest article.

What is the COVID-19 coronavirus?

The expression “coronavirus” is actually a term used to describe a large family of viruses, which cause a range of conditions ranging from the common cold to more serious illnesses such as MERS and SARS. The virus outbreak in 2020 called the “coronavirus” is actually COVID-19, a new strain of the coronavirus family, which had previously not been known to have infected humans.

Signs to look for with COVID-19 are breathing problems, cough, fever, respiratory problems and shortness of breath. In most cases, the virus is fairly innocuous and only creates mild conditions in the sufferer. More severe complications can lead to acute conditions such as kidney failure, pneumonia, respiratory syndrome and worst-case scenario even death.

Find out how gold investment can provide a safe haven against market downturns. Click here

Mortality rates are not yet fully known, although the World Health Organisation estimates that between 1-2% of people infected with the virus will die. There is as of the time of writing (25th February 2020) no known vaccine, although research to create a vaccine is being undertaken rapidly around the world.

The COVID-19 coronavirus is causing concerns about a global pandemic

Why are there fears of a pandemic?

As I write the World Health Organisation says: “The World must prepare for a COVID-19 pandemic”. This doesn’t necessarily mean a pandemic will occur, but the world needs at least to be prepared.

According to the Merriam Webster Dictionary a definition for a pandemic is:

“An outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population. A pandemic outbreak of a disease.”

Currently, there have been 77,000 cases in China and 1,200 other cases around the world, which are spread over 30 countries. According to the NHS, COVID-19 is a High Consequence Infectious Disease. Although, seen as a lower-mortality rate than SARS and previous viruses it is the infectiousness of COVID-19 that makes a pandemic likely. The virus spreads itself mainly through the air but also can spread through bodily contact.

Reasons why the COVID-19 coronavirus outbreak is likely to increase gold prices

Now what you may be wondering will the impact of COVID-19 have upon gold and other precious metal prices? We summarise some of the main impacts below:

- Avoid risk and losses/investment channel switch – many investors will simply “ditch” some forms of investments (e.g. stocks and currency) and move to precious metals until the risk is reduced/eliminated

- Mitigate market uncertainty – investors are likely to have a balanced portfolio of investments. To mitigate market risks, investors are likely to switch at least a proportion of their portfolio into safe haven investments such as gold and silver

The recent surge in gold prices

On February 24th, the Dow Jones Index fell 3.5%, the UK FTSE fell 3.3% and the Milan stock market fell 6% (mainly because Italy had a large outbreak). These wiped out an entire year’s worth of index gain on the Dow Jones in just one day. Companies with high exposure to China (Disney, Nike and Apple) and travel companies were most affected with EasyJet falling 16.7% in one day and British Airways falling in price.

Events such as the coronavirus COVID-19 outbreak cause investors to seek safe haven investments

As shares are sold, generally investors will look for an alternative asset-class to invest their funds into (typically safe havens). Conversely to shares, gold prices hit a 7-year high on February 24th 2020. The reasons for this price rise are multi-faceted (as changes in gold price always are) but undoubtedly an underlying tension about the possible global economic impact of COVID-19 is the main factor.

Most Analysts believe that gold prices will continue to rise, particularly in the short to medium-term. Investors are currently moving out of stocks/shares and currencies and investing in safe haven assets such as gold and silver.

It proves once again that investors value the tangibility of gold and at times of economic uncertainty, investors value investments they can “feel and touch”, especially ones which can be used as a highly liquid alternative form of currency to traditional cash.

Buy gold and silver as a safe haven investment from Physical Gold Limited

The team at Physical Gold have vast experience in precious metals trading. Check our About Us page to view our accreditations and trade memberships.

Call us today on 020 7060 9992 or email us to contact the team. We can speak about your current circumstances and suggest the best gold/silver investment strategies to meet your needs.

Image Credits: The Digital Artist and Ben Taylor 55