Most valuable precious metals

Investors are always keen to build a portfolio of precious metals. Throughout history, this is typically meant the acquisition of gold and silver. Traditionally accepted as precious metals all over the world, these metals enjoy great liquidity – irrespective of whether they are available in bars or coins.

Gold and silver also enjoy vibrant global markets, due to the internationally regulated exchanges that they are traded in. This creates transparency and dependability for investors, making these precious metals a popular choice for commodity investments.

Of course, gold and silver are also used in the making of jewellery and are greatly valued as ornaments across different cultures. Many countries in Asia have the tradition of gifting gold at the time of a child’s christening ceremony or marriage. In many countries around the world, the purchase of gold is also considered to be auspicious and gold is often bought during times of religious events in the year. However, are we restricted to only gold and silver when it comes to precious metals investing? Which is the most expensive metal? How do we know which is the most valuable metal?

Thinking of buying gold or silver? Find out the most important buying factors here.

We ask and answer the question – “What are 8 of the World’s Most Expensive Metals?”

Rhodium produces white polished rings

1) Platinum

Close on the heels of gold and silver comes Platinum, a popular precious metal, partially due to its durability and versatility. Platinum enjoys demand from consumers and several companies manufacture jewellery and ornaments using the precious metal. Platinum is unique in the fact that its weight is close to double that of a gold carat.

This means that in terms of its density and weight, it is the heaviest in the list of precious metals. Apart from the jewellery industry, Platinum is in great demand in many other industrial fields such as aeronautics and dental implements. The metals name is derived from Platino, a word in the Spanish-language, meaning ‘little silver’.

2) Rhodium

Interestingly, Rhodium is as rare as it is expensive. In fact, it is considered to be the most expensive metal in the world. Deposits of rhodium are scarce, adding to its rarity. The metal has a very high melting point and does not corrode easily. This is why it is greatly in demand across several industries. Of late, a popular precious metal is known as white gold. This is an alloy that uses rhodium, the most expensive metal as a plating medium to achieve the white colour and create a non-corrosive, scratch-resistant, reflective surface. Rhodium is scarce in supply however, countries like South Africa, Canada and Russia are well-known for its manufacture.

Gold has always been used to make jewellery, even as early as 200 AD

1) Gold

Of course, gold is a time-tested precious metal, well-known as a repository of value. It is considered to be the classic precious metal across all countries in the world. Throughout history, gold has considered to be the most expensive metal. It is commonly used for a variety of uses, of which the most popular ones that we know of are jewellery making, coinage and investment. However, gold is also considered the most valuable metal across several industries as well, due to its unique properties of malleability and conductivity. For example, the audio industry uses gold frequently in the manufacture of cables and audio contact terminals.

2) Ruthenium

The precious metal enjoys high demand from the industry, particularly in the manufacture of electronic goods. This is primarily due to its property of extreme hardness and it is often used to reinforce other metals. It is well-known across the world as one of the most valuable metals within the Platinum category. It is possible to use the metal for the manufacture of jewellery, however, the incidence of this use is rare.

3) Silver

The white metal has always been a close runner-up to gold. However, like gold, silver is also in great demand across the world for a variety of uses. Historically, it has been used for coinage, manufacture of utensils and jewellery. Due to its high industrial demand, silver is much sought after today. Therefore, silver investments have risen substantially, and investors often invest in silver bars and coins.

4) Iridium

It is a rare metal to find, which makes it feature on the list of most expensive metals. Like Rhodium, it also has an extremely high melting point and does not corrode easily. Its use is primarily industrial, ranging from the electronics industry to its use in the automobile industry, particularly electric cars. Iridium has also been used widely as one of the most valuable metals for the manufacture of watches and South Africa remains the largest producer of this metal.

5) Osmium

It is a bluish, silver metal that also has a super high melting point. However, it does not enjoy the other properties, found in most precious metals. Unlike gold and silver, which are extremely malleable, Osmium is hard and brittle. It is primarily used in the industry for the manufacture of electrical components and electric bulb filaments.

6) Palladium

This precious metal is greyish white and also enjoys the properties of malleability and stability. It is rare, one of the most valuable metals, and has the unique property of being able to absorb large amounts of hydrogen, even at room temperature. The jewellery industry also uses this metal to create their alloys of white gold, while it is popular in the automobile industry as an emission reduction agent. Recently, there has been a fall in both supply and demand for this precious metal.

Call us for advice on your precious metal purchases

Physical Gold is one of the country’s most reputable precious metal dealers. Our team can advise you on the purchase of the most valuable metal products. Call us today on (020) 7060 9992 or get in touch with us by email.

Image credits: Wikimedia Commons and Wikimedia Commons

Now the nights are drawing in and the chill of autumn is in the air, thoughts turn to this year’s Diwali celebrations, which this year falls on Saturday 14th November. With the promise of plenty of delicious food, family time and fun, the buying of gold will as always be a prominent theme in the festivities.

Gold rings and jewellery

The importance of gold at Diwali

Diwali is known as the Festival of Light. It came about over the centuries thanks to the legend in Hindu culture that the son of King Hima was supposed to be killed by a bite from a venomous snake on the 4th day of his marriage. Legend has it that the only way he survived a slow and painful death was because his wife heaped up all the family gold she could find outside the door. According to the story, the snake became so dazzled by the gold that he couldn’t get to the prince to administer the bite and therefore slithered away.

This is why gold holds such importance at Diwali, symbolising wealth, hope and luck. Golden jewellery and other gifts of gold are exchanged between loved ones in remembrance of the son of King Hima and the gold barrier his wife made to save his life.

Download our FREE Insiders Guide to Gold Investment here

The five days of Diwali

The Diwali festival is over five days, with Diwali itself being on day 3. So, the days and dates in 2020 are:

- Day One (Thursday, November 12th) – Dhanteras (Day of fortune)

- Day Two (Friday, November 13th) – Naraka Chaturdasi (Day of knowledge)

- Day Three (Saturday, November 14th) – Diwali (Day of light)

- Day Four (Sunday, November 15th) – Annakut (New Year)

- Day Five (Monday, November 16th) – Bhai Duj (Day of love between siblings)

Investing in gold at Diwali

During recent years, gold has been the investment of choice for many families all year round, not just at Diwali time. High-value investment items such as gold coins and bullion have increased in popularity and it’s not hard to see why. Although there is a massive cultural attachment to gold within the Hindu religion, there are shrewd financial gains too.

This is undoubtedly because gold retains its value very well in an ever-changing national currency market. By default, gold is seen as less of a wealthy luxury for the https://www.cialispascherfr24.com/prix-de-cialis-en-pharmacie/ elite but instead as an essential financial security for everyone.

Investment and protection…

When global economies and currencies are more and more unpredictable in a world that seems to lurch from one financial crash to the next, the international price of gold has steadily increased. As the value of Indian currency has reduced in recent years, along with a massive rise in inflation, the purchase of gold bars and coins has increasingly become the prudent and financially reliable way to save for the future. Diwali celebrations offer the ideal time to research the options out there for gold investment and to put some well thought through plans in place.

Buying gold at the best time

Around the time of Diwali, world gold demand rises and therefore its value reaches a peak. This is a very typical trend which happens year after year – infact in 2016, the price jumped massively by 3.9 percent.

With this in mind, if you’ve decided to purchase gold for Diwali this year, either as a present for a loved one or as a sound financial investment, it’s highly worth keeping an eye on the market and not leaving it too late to make your move – i.e get in there early before the prices go up.

Invest with Physical Gold today

If you’re interested in buying gold coins or bullion the good news is you’ve come to the right place. Please feel free to browse our commemorative gold coins selection, in particular, these would make ideal gifts for loved ones at Diwali.

At Physical Gold we are experts in all there is to know about gold and silver and can help with any aspects of your investment. Speak to us on 020 7060 9992 or drop us an email so we can help.

Image Credits: Pixabay

Rumours of significant Capital Gains Tax increases have spooked the investment market. But gold could be the answer to shield you from imminent tax rises.

UK’s rising debt

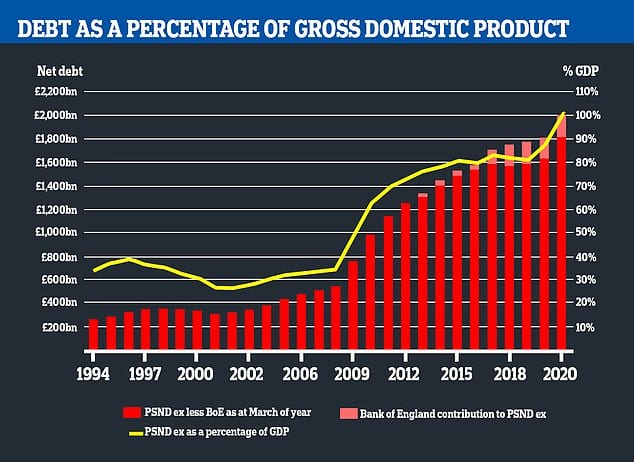

Getting the UK’s burgeoning debt under control has been a primary focus for recent Conservative Governments. Austerity measures have aimed to reduce UK PLC’s growing debt problem, despite its impact on large swathes of the population. UK Public sector debt (excluding public sector banks) has now exceeded £2 trillion for the first time. July’s level of £2,004 billion was a staggering £227.6 billion more than at the same point the previous year.

Furlough scheme extended to March and beyond

Chancellor Rishi Sunak has been praised for his speedy and decisive response to Covid-19’s impact on individuals and companies to work. A wide-reaching Furlough scheme has targeted those unable to work due to Covid-imposed restrictions. The scheme has evolved both in breadth, to cover more sectors like the self-employed, and in duration. Initial timeframes have been extended as we’ve entered the inevitable second wave of the virus and another national lockdown.

Need to tackle growing Government debt

But for a Government so focussed on balancing the books, this vast sum of debt has put a massive spanner in the works. Debt as a percentage of GDP has now reached parity after levelling off at around 80% from 2015 to 2019. With the virus still raging and furloughing in full swing, the chancellor has already turned his attention to ways of reducing this mind-boggling national debt from next year onwards.

(Daily Mail) UK Debt now at 100% of GDP

Experts suggest Capital Gains Tax could be key to reducing debt

The Institute for Public Policy Research has recommended raiding middle-class investors and entrepreneurs to help plug the leaky public finances.

Reducing or abolishing the Capital Gains Tax (CGT) tax-free allowance would increase the number of people paying the tax by up to 300%, plus the amount paid by those already affected by CGT.

The Treasury calculates that CGT could raise a whopping extra £90 billion over 5 years if aligned with income tax brackets. The tax is levied on gains made on sale of shares, second homes and the sale of businesses. But an annual tax free threshold of £12,300 means that many people escape the tax altogether due to modest profits, while shrewd investors can split sales across tax years to minimise impact.

Part of the planned changes would see this threshold reduced or even scrapped. Estimates are that reducing the allowance to £5k would double the number of people paying the tax and reducing to £1k would triple the amount.

Owning physical gold coins can reduce your tax bill to zero

As an investor or business owner, it’s important to take pro-active action to prepare for possible tax increases next year.

Whether you’re buying as an individual or from company profits, gold’s popularity as an investment has hit new heights in 2020. Primarily enticed by healthy returns in the gold price, investors are now also recognising the tax free benefits of certain gold coins.

Owning certain gold coins can keep away the tax man

Which gold coins are tax free and why?

While all investment grade gold is VAT exempt, only certain gold qualifies as CGT free.

As a UK investor, selling gold bars or non-UK gold coins at a profit, could incur CGT if you make more than your allowance. But sticking to UK legal tender gold coins will mean any profits are completely free from CGT.

That’s because HMRC cannot tax individuals for gains made from selling its own legal currency. Coins issued by Royal Mint with a face value qualify as legal tender.

The two main choices are Gold Britannias and Gold Sovereigns. But The Royal Mint also produces more limited issue legal tender series such as Lunar coins and Queens Beasts.

These are the Royal Mint’s highest face value coin and weigh 1oz in weight. Gold purity is 999.9 / 1,000 parts gold and the most popular UK tax free coin for larger investors due to their low premiums. The 2021 version features high-tech laser produced security features, making it one of the most impressive bullion coins on the market.

Pre-owned Britannias are occasionally available and offer investors the chance of reducing premiums further. Britannias are also CGT free if bought in it’s fractional versions (half, quarter and tenth), or the silver version.

The Britannia is our best selling investment coin

One of the world’s best known gold coins, the humble Sovereign also qualifies as tax free.

At around a quarter of the size of the Britannia, the Sovereign offers a more affordable route to gold for modest investors or more divisibility for those seeking flexible portfolios. The modern Sovereign has existed for more than 200 years, so it offers huge variety for investors and collectors alike. Best value Sovereigns offer the cheapest option, while historical editions from the Victorian era are more scarce, but expensive.

Half Sovereigns are slightly more costly per gram but appeal to those after smaller coins.

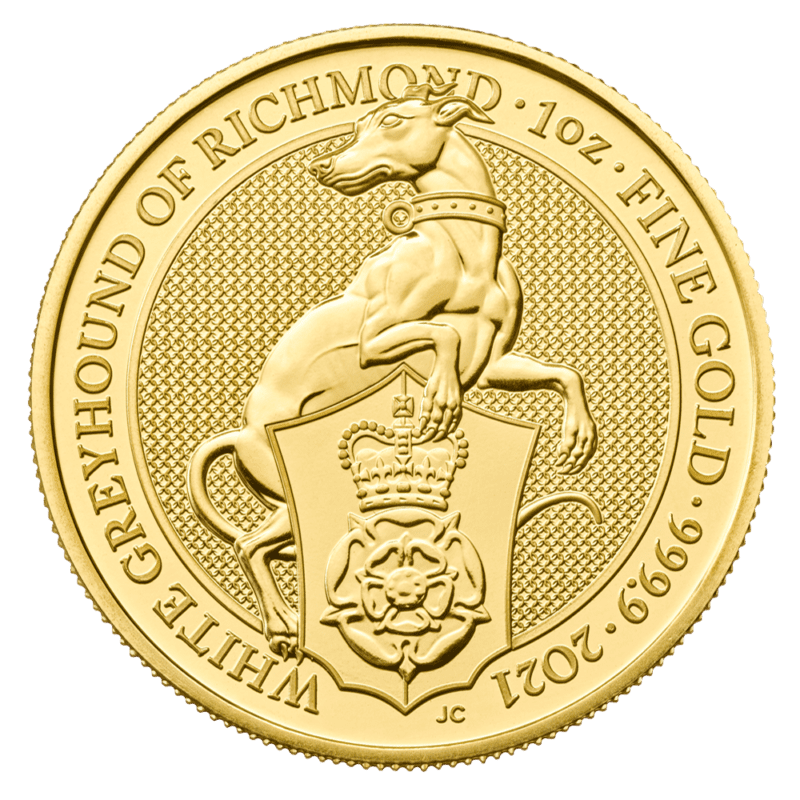

One of the most popular limited issue Royal Mint series is the Queens Beasts range of coins.

These are primarily 1oz 24 carat coins, although quarter ounce coins are also available. Limited to a series of 10, the coins’ stunning design is a major pull, but their limited issue quantity has also led to many of them increasing in value at a far quicker pace than other UK coins.

The White Greyhound of Richmond is the most recent and final issuance in the set. It currently trades at modest premiums, so could be a good bet if its value follows earlier coins upwards.

With the same £100 face value as Britannias, these coins also provide a tax free shelter.

Queen’s beasts are a stunning coin collection, with enhanced upside potential

Gold likely to offer high returns as a safe haven asset

With a lethal cocktail of high Government debt, increased taxes, high unemployment, recession, falling stock and property markets, weak currency and rock bottom confidence, 2021 and beyond looks like an economic nightmare.

But gold tends to benefit in these times, attracting investment from those seeking a safe haven. Indeed, gold has risen around 25% so far in 2020 as of mid-November. The previous gold bull run saw double digit rises every year from 2005 to 2011.

So gold isn’t just a way of shielding from capital gains tax, but also growing your savings.

Types of gold

Gold has and will remain one of the most popular investment vehicles of all-time. It provides balance, insurance and safety for most investors. Investors have always moved their money to gold during an economic crisis. It is interesting to note that the current economic debacle that was precipitated due to the COVID 19 global pandemic has pushed up the spot price of gold to more than $1800 an ounce. The historic all-time high still stands at over $1900 per ounce in August 2011. As an investor interested in gold skyrockets, it’s time to take a look at the different types of gold investments.

Gold can come in many physical forms ranging from gold dust and nuggets in their raw state, through to coins and bars for investment, and finally jewellery and ornaments at the highly refined and designed end. The purity and colour of gold can also vary greatly depending on its alloy mix. The most common gold colour types are yellow (when gold is at its 24 carat purest), white gold, when mixed heavily with silver, nickel and zinc to toughen its resilience and red gold when a higher element of copper is present. It’s also possible to create green, black and purple gold with various alloy mixes.

Gold bars are highly attractive to investors

Paper investments in gold

There are also gold ETFs and gold company shares that provides investors with access to the gold market. However, it’s important to know that these investment vehicles carry counterparty risks. Gold mining shares are subject to the inherent risks of the global capital markets. There are also gold funds which invest specifically in gold mining companies. These coins spread the risk of owning gold company shares by investing in a variety of companies in the market. But, they too are subject to capital market risks, and also charge on-going management fees

2 kinds of Investment Gold: Gold coins and bars

Perhaps the safest and most satisfactory form of investment in gold remains the purchase of gold bars and coins. There is a wide variety of gold coins and bars available in the market. These investments are free from counterparty risks and offer investors complete control over the assets, as they are physically held. Of course, the storage of gold and its safety during transport needs to be ensured. When you buy your gold assets from a reputed gold dealer, always insisted that they are delivered to your door via an insured courier. Many well-known dealers can also make arrangements to segregate and store your gold in a commercial vault.

The design and production costs of gold jewellery cannot be recovered

Investing in gold ornaments

When you buy bars or coins, you acquire investment-grade gold, which has 99.9% purity. Since gold is a malleable metal, ornaments cannot be manufactured without reducing the purity by adding base metals. So, most gold ornaments will be made out of 18-carat gold or a lower level of purity. Also, the manufacturing and designing charges cannot be recovered when selling. So, it isn’t a great investment. While red, black, purple and green gold is aesthetically attractive, one must remember that the percentage of gold is less.

Best kinds of gold for tax efficiency

All investment-grade gold in the UK is VAT free. This is a major advantage when putting your money in gold, as it reduces the purchase price by 20%. UK gold coins offer an even better avenue for investors, as the profits collected from its sales can be enjoyed without paying Capital Gains Tax. However, it’s important to know that the CGT exemption threshold is £12,000 of profits in a single tax year.

The investment team at physical gold can offer you great advice

At Physical Gold, our team of experts can help you plan your gold investments and advise you on the right bars and coins to buy. Call us today on (020) 7060 9992 or get in touch with us online via our website. We pride ourselves on good customer service and would love to speak to you.

Image credit: Wikimedia Commons and Nuzree

In the summer of 2020 traditional avenues of investments have been depleted with the unfolding of yet another economic crisis, on the back of the COVID 19 pandemic. The demand for gold is soaring and already, the spot price of gold has touched $1800 per ounce.

In the immediate post-pandemic world, things are likely to remain the same. Time after time, investors have always turned to gold during times of global economic crisis. If we revisit the historical gold charts for 2011, we can see that the peak of the last worldwide economic crisis brought about the highest price of gold in August 2011, when the spot price went above $1900 per ounce. We are slowly getting there. Like many other investors, if you are considering gold investments, it is important to understand where to purchase your gold.

Download the Insider’s Guide to buying tax free gold here

If you’re looking to buy gold coins and bars, the best places to buy are from specialist gold merchants. A list of approved gold dealers can be found on the British Numismatic Trade Association website. They will be trustworthy to charge fair prices and ensure all products are authentic and of high quality. If you’d prefer to buy in person, then certain area specialises in selling gold. In London, Hatton Garden features many stores in the same street, so prices can be easily compared. In the Midlands, the Jewellery Quarter also possesses several options. Just be aware that choice may be limited when compared to specialist online gold brokers.

It is safest to buy gold bullion bars from a reputed dealer

Buying gold without counterparty risks

Physical gold investments are safer since you possess the tangible assets you purchase. There are other forms of gold investments like gold company stocks or gold ETFs. These carry counterparty risks, which implies that the non-performance or the bankruptcy of the company that issued you the paper investment certificate can result in your investments being eroded. Physical gold investments mean buying gold bars and coins.

Buying gold from eBay

Large online retailers like eBay are great at giving you amazing deals on books, music, electronics, and many other product categories. However, buying precious metals from eBay can prove to be extremely risky. Most of the auctions on these online sites are re-sales and being able to ascertain the authenticity of the gold you’re buying can be difficult. Verification of the quality of gold requires sophisticated testing equipment. In the absence of these, you could be exposing yourself to fraud. In addition to these concerns, PayPal fees are high on sites like eBay and once these costs have been built into the buying price, it’s not a great deal any more.

A reputed gold dealer can arrange to have your gold stored in a secure facility

The best places to buy gold in the UK

The answer is simple. To acquire high-quality gold bullion, which has been verified and comes with an authenticity certificate at the best prices, you need to find a reputed UK gold dealer. The British Numismatic Trade Association (BNTA) maintains a registered of trusted gold dealers in the UK. An additional advantage of identifying a UK dealership from this source is adherence to an industry code of conduct. If there is any dispute regarding the quality of the dealer’s goods and services, a complaint process is available to you.

How can you identify a reputed gold dealer?

Once you have collated your list of contacts from the BNTA, check the reputation of dealerships over the internet. A reputed business should have a proven track record going back some years and you can view customer ratings about their trustworthiness, quality of products and services. After you have prepared a shortlist, it’s a good idea to pick up the phone and call the dealerships. Good dealers will always be ready to answer any questions you may have and will offer certificates of authenticity and a buyback scheme for the gold they’re selling. Many of them can also arrange secure storage for your gold and offer you insured delivery for your products. Once you’ve checked out all these points, you would have if you reputed online dealers. These are the best places for you to buy your gold in the UK.

We can help you identify a reputed gold dealer

If you need to buy gold, and you’re looking for a specialist gold dealer, give us a call. The team of investment experts at Physical Gold can help you identify a reliable gold dealer. Call us on (020) 7060 9992, or contact the team online through our website.

Image credit: Wikimedia Commons and Pkist

Gold is an incredibly versatile precious metal. It is possibly one of the most liquid asset classes. Gold can be sold in the secondary market and converted into cash quite quickly. If you have invested wisely and distributed your investments across small sizes of gold, this can provide flexibility to your portfolio. This simply means that you can sell the required part of your holdings and raise money to fund your cash flow requirements. But a key dilemma that many investors have on their minds is – how long should the investment horizon be?

Gold investment should be for at least the medium term and act as a permanent part of an overall investment strategy. This is for two reasons. Firstly, gold performs extremely well during times of crisis and economic turbulence. By always owning some gold, you’ll be prepared for sudden market downturns. Reacting to events is too late as the gold price would likely have already risen. Secondly, the gold price can be volatile, so short-term investing can lead to losses if the timing is unlucky.

Gold – a solid and stable safety net

Most asset classes are dependent on a strong global economy to boost their performance. However, gold investing is different. Investors tend to move to gold when the global economy goes into a downward spiral. Back in 2011, the world witnessed the highest peak price of gold ever at the height of a global economic crisis that eroded currency markets and the capital markets worldwide. Have you been following the spot price of gold recently? As we brace ourselves for yet another period of economic turmoil, the gold price has been steadily rising and has reached the $1800 mark on the US exchange. Investors who built up their gold portfolio five or six years ago are ready to rake in their profits.

This Hungarian gold coin dates back to 1491 and may be rare, but difficult to sell immediately

The multiple benefits of investing in the long-term

Gold investments aren’t just about protecting yourself from global economic woes. The yellow metal provides a healthy dose of balance, liquidity, and insurance for your investment portfolio. Gold creates balance by hedging the risks you may otherwise have faced when investing in other asset classes. Certain asset classes like real estate cannot be sold instantly. Gold is one of the most liquid forms of investment that can be sold into the secondary market at any point in time, providing much-needed liquidity for your portfolio. There are other benefits of investing in gold as well. Adverse economic forces over which you may have no control like inflation, counterparty risks and currency deflation can impact the overall value of your investments. Gold provides insurance against these risks by beating the rate of inflation and reducing volatility through predictable returns.

The gold Krugerrand is a liquid coin, but not tax efficient in the UK

Tax efficiency

Tax bills play an important role in determining the total value of returns on your investments. Investments in most asset classes are taxable and the taxman axes the profits you make over time. Investments that may appear to have a strong performance can suddenly look pale when your tax bill is factored in. Gold, on the other hand, is a hugely tax-efficient investment avenue. In the UK, all investment-grade gold is VAT free. Additionally, gold coins that have a face value and are considered legal tender in the UK are exempt from Capital Gains Tax (CGT). As an investor, you can save CGT on a threshold of £12,000 in profits in a single tax year. This is a significant amount of tax relief and if you hold onto your gold investments over time and plan any sales by factoring in CGT exemptions year-on-year.

Call Physical Gold to discuss your gold investment horizons

At Physical Gold, we are continuously studying the gold market and we can advise you on the right times to buy and sell. Please call us on (020) 7060 9992 to discuss your investment objectives and horizons. You can also reach us online by visiting our website.

Image credits: Wikimedia Commons and Wikimedia Commons

Investing in Britannia Gold coins

The gold Britannia is perhaps the most famous UK gold coin. The coin is well-known all over the world for its popularity and liquidity. Gold experts believe that it is a flagship coin that every investor needs to start with when building a portfolio. The coin has only been around since 1987, and therefore, does not command high premiums based on age and rarity. It is available with every gold dealer as a bullion coin.

The Britannias track the gold spot price and can appreciate or depreciate with that price. It’s arguably the most popular gold investment in the UK as the coins are very good value due to mass production and their larger size. They’re completely tax-free due to their legal tender status, and their Royal Mint heritage enhances their global appeal.

The iconic Britannia is also available in silver

The spot price plays a critical role in determining the value of a gold Britannia. Of course, supply and demand for particular coins can vary in the market. Although the coin has only been around for four decades, specific years of issue can be hard to find. These coins may carry premiums up to 5% due to their scarcity. In general, the 1-ounce gold Britannia has been known to command, approximately 98% of the current spot price of gold.

What are the factors that can affect the investment value of a gold Britannia?

Apart from the spot price, there are a few other factors that may impact the value of a gold Britannia. To start with, it is a bigger coin and provides investors with more gold content. This makes it very attractive as an investable coin. Larger gold coins provide investors with the opportunity to acquire more gold at a lesser price per gram, due to lower production costs. The gold Britannia falls under this category and is considered to be a lucrative coin to invest in. As discussed earlier, scarcity of specific issues and special commemorative issues can escalate the price of those specific coins.

The Britannia icon, seen here as a national statue, is represented on the coin

Tax efficiency makes it a lucrative investment

The gold Britannia is a highly tax-efficient coin, making it attractive to investors. Since the coin is minted with investment-grade gold, it can be bought VAT free. Similarly to the Gold Sovereign, the Britannia is legal tender in the UK and therefore qualifies for CGT exemption. This is an added fillip for investors, as any profits accrued from the sale of the coin up to £12,000 per tax year can be had without paying any Capital Gains Tax.

Fineness of gold

Since 2013, the gold Britannia is being minted using 24-carat gold with a fineness of 0.999. This is a very powerful reason for investors to acquire the coin. The coins released before 2012 contained 22-carat gold with a fineness of 0.917. Since 1990, the gold alloy used to construct the coin contained silver, instead of copper.

Different dimensions

Another reason for the gold Britannia to be the backbone of every gold portfolio is the variety factor. The coin was initially released in four sizes – 1 ounce, half-ounce, quarter-ounce and one-tenth. However, since 2013, a 5-ounce coin is available, which is very lucrative for investors. Additionally, a fractional coin that is one 20th of an ounce is also available in the market. This has improved, divisibility, as well as variety, making the gold Britannia an excellent investment.

Call Physical Gold to discuss your gold Britannia purchases

Our gold experts are adept in acquiring the best deals for the gold Britannia coin as well as the silver Britannia coin. We can advise you on the right investments in gold and silver coins to strengthen your portfolio. Call our team today on (020) 7060 9992 or drop us an email and a member of our team will reach out to you right away.

Image credit: Eric Golub and Wikimedia Commons

Buying Gold and Silver Bullion

Gold and silver bullion commonly refer to bars rather than bullion finish coins. Precious metals merchants generally buy and sell both metals so it’s possible to buy gold and silver from the same place. There are certain distinct advantages to buying bullion. The most important advantage is the elimination of counterparty risk and taking control of one’s wealth. Counterparty risk refers to the risk associated with the promise of delivery from a third party. If you invest in gold company stocks, paper gold or other gold instruments, you open yourself up to these risks. Therefore, buying gold and silver bullion can be an excellent strategy to minimise risks and maximise returns.

Click here to download the FREE Insider’s Guide to Buying Gold and Silver Bullion

Knowing the spot price of gold and silver

The first step in purchasing gold and silver bullion is to know the spot price and how it works. Nowadays, it’s very easy to find out the prevailing spot prices of these precious metals. Most reputed online dealers and regulatory bodies like the LBMA display the spot price on their website. Since the spot price is a dynamically changing number, it will be displayed as a ticker. It’s important to understand that you will never buy gold or silver bullion at the exact spot price. When buying, you would likely pay a small premium, over and above the spot price. Similarly, when selling, the price you achieve will be slightly below the spot price. Researching the spot prices and knowing about the market is an essential first step to buy gold and silver bullion.

Buying bullion coins can generate healthy returns

Getting to know a reputed dealer

Another important step in making the right investments in gold and silver is to go through a reputed dealer. Firstly, a high-street gold seller will not have a wide choice of products available to purchase. Secondly, making high-value purchases on the high street is usually a risky business. Check out the company’s track record and reviews before placing an order online. It may be worth calling them first to check their customer service. Larger bullion will be better value, but divisibility should also be a consideration.

Gold bullion bars carry lower production costs

At Physical Gold, every product we sell comes with a buyback guarantee. This assures customers that the gold bullion they buy from us is certified and genuine. This also makes a difference to buyers, as they can sell off their investments easily through the same dealer. It’s important to do your own research when selecting a dealer so that you can pick the right one.

Dangers of buying from Mints

Another way to buy gold and silver coins is to buy it directly from the Royal Mint. If you choose to buy non-UK bullion, there are other reputed mints in the world, like the Perth Mint in Australia, from where you may be able to purchase your bullion online through their websites. However, you may end up paying more for packaging and processing costs. Many reputed mints will also try to sell you proof coins. These are more polished and better looking and attract higher prices due to their finish. However, you must bear in mind that the gold and silver content remains the same. So, you are unlikely to receive a higher price at the time of selling, simply because they are proof coins. If your objective is to maximise your gains, you may be better off picking the right bargains from the secondary market through a dealer.

Get in touch with us to plan your gold and silver bullion investments

The economic crisis of the post-pandemic era has already started unfolding through the first half of 2020. Many investors are moving to precious metals in order to hedge their risks. If you are thinking of buying bullion, call us directly on (020) 7060 9992, to discuss your investments. We are certain you can benefit from the right advice. You may also reach our investment team through our website.

Image Credits: Tony Media and Pxfuel

Gold Coin Investing

In the world of precious metals investing, it is often said that there is no match for gold. Investing in gold coins can be extremely lucrative, both as a hobby and as a profit-generating investment vehicle. Many investors consider coins to be a better investment since they add liquidity and divisibility to any portfolio. However, it’s important to understand the philosophy and the rules of investing before buying gold coins.

Buying gold coins can be an excellent investment for those seeking portfolio balance. Owning gold in the form of coins, means you have the flexibility to sell small parts of your holding. Sticking to the main bullion coins such as Sovereigns, Krugerrands and Britannias, will enable you to buy at low prices and sell easily. Buying UK gold coins additionally benefits UK investors because any gains made on the sale of the coins is free from tax.

Download the 7 Crucial Considerations before buying Gold coins. Click here

British gold coins are both VAT and CGT exempt, offering investors a wonderful opportunity to maximise their tax savings on their investments. All investment-grade gold is VAT free in the UK and UK gold coins, being legal tender in the country, are also CGT free. That means any profits you make generate when selling is automatically tax-free.

Gold coins are a lucrative investment

Buy gold coins that enjoy a healthy secondary market

Several investors make the mistake of investing in obscure coins due to their collectability and rarity value. But, this is never a good strategy. Your investments in gold coins can reap great benefits if you buy liquid coins like the Britannia or the gold Sovereign. These coins are easily available in the market, without hefty premiums as they are mass-produced. Discounts can be availed on large quantity purchases. By following these simple strategies, you can achieve good returns on your gold coin investments. Liquid coins are much easier to sell at any point in time, as opposed to obscure gold coins.

Gold coin investing can be very tax-efficient

To save on taxes, it’s important to know which gold coins to buy. Well-known coins like the Krugerrand enjoy a great secondary market and possess all the attributes required to make it an attractive investment. However, only UK coins are considered to be legal tender and their sales are CGT exempt. By investing in British gold coins, you also get the double benefit of your purchases being VAT free. Needless to say, these are important considerations for any savvy gold investor whose objective is to build a strong portfolio and generate healthy returns over a period of time.

Non- UK gold coins like the Krugerrand do not qualify for CGT exemptions

You can also combine collectability and profits when investing in gold coins

Not all gold buyers are purely investors. Many collectors acquire gold coins as a hobby, and their purchases are based on numismatic interest. Of course, one can combine both these objectives and create a portfolio that has good numismatic value, as well as potential to generate profits. So, you don’t have to stick to buying only mass-produced bullion coins. A perfect example of a diversification strategy could be the Royal Mint’s Lunar series or the Queen’s Beast coins. These are well-known coins that enjoy liquidity and divisibility while generating added value as collector’s items. These coins have generated healthy returns for investors and values have risen by as much as 40% in a single year.

Our investment advisory team can help you invest in the right gold coins

At Physical Gold, we are always keen to help investors achieve their objectives through impartial advice. Call us today on (020) 7060 9992 or get in touch with us online to find out how our investment advisory team can help you identify the right gold coins for your portfolio.

Image credit: Pxfuel and Wikimedia Commons

Best type of gold for investment

Over the last few years, the world has witnessed unprecedented levels of adversity. Several geopolitical events like Brexit, the US-China trade war, the threat of global terrorism and rising levels of government debts have pushed the world to the brink of yet another severe financial crisis.

The final nail in the coffin has been the COVID-19 global pandemic, which has crippled the world economy. Gold prices have been soaring in the wake of these adverse events. The current spot price of gold has gone beyond $1600 per ounce and continues to rise. If you are an investor thinking of parking your money in gold, it’s important to focus on the right types of gold that can strengthen your portfolio and provide good returns.

Reasons to invest in gold

As an asset class, gold provides balance to your portfolio and insures you against any negative outcomes. Apart from providing you with the opportunity to hedge risks, gold investments also protect you against monetary factors like rising inflation and volatility in global currencies. Investing in bars and coins can have different outcomes, but at the end of the day, gold is always an excellent choice for investment.

Physical gold investments do not carry undue risks

Setting your objectives

Firstly, decide on your objectives. If you wish to trade in and out of the market and depend on timing, then electronic gold like ETFs may be the most efficient method. If you have a high-risk appetite, then buying gold mining shares could provide enhanced returns if that mining company outperforms the market. For those seeking, security and low risk, with tax-efficient returns, then buying physical gold as an investment is best, which can be achieved through a reputable gold dealer.

Read our 7 step cheat sheet to buying the best gold bars and coins

Achieving key objectives

Certain objectives are critical in planning your portfolio. For example, liquidity, value, divisibility and variety are key attributes that you need to focus on when investing in gold products.

Liquidity

When you invest your money in any asset class, the ability to generate funds as and when required is called liquidity. Gold bars that are manufactured by reputed companies like Metalor are very liquid. Likewise, when buying coins, you buy well-known coins like the gold Britannia or the Sovereign, which always ensures liquidity. Also, when buying your products from a reputed dealer, always check if they have a buyback scheme. This ensures that you can convert your gold to cash at any point in time.

Counterparty risk

The above term refers to the risk carried by an asset class whose performance depends on a third-party. When buying gold products is best to avoid the ones that carry counterparty risks. Any kind of paper gold products like ETFs, or mining company stocks will have exposure to such risks. It’s best to stick to physical gold investments, which are of course devoid of these risks.

Tax efficiency

In the UK, all investment-grade gold is VAT exempt. If you want to build a portfolio that maximises its tax efficiency, you should focus on gold coins that are legal tender in the UK. Such coins are CGT exempt and will provide you with much-needed tax relief. If you buy gold bars, they will be VAT exempt but you may have to cough up the capital gains tax applicable on profits above £12,000 in a tax year.

Divisibility

Investing in gold products that add divisibility to your investment makes good sense. Divisibility allows you to sell your gold investments in small denominations at various price points in the market. Gold coins are a great choice when it comes to divisibility. They are available in a variety of denominations and sizes, including fractional ones. This allows you to drip feed your investments into the market, rather than having to sell off all your gold at one time.

Call our investment team to plan your gold investments

As we can see, the key to selecting the right gold products for investment lies in meticulous planning. But, there’s nothing to worry about. Our investment experts are there to help. Call us on (020) 7060 9992 to speak to a member of our team, or simply drop us an email and we’ll get in touch with you to help you plan your investments.

Image Credit: Wikimedia Commons