For the longest time, gold has been the investment class of choice for investors who wish to hedge their risks and build wealth. Gold is an asset class that does not suffer from the volatility of other asset classes like equities. Gold can deliver steady returns over the short term and provide insurance for an investor’s portfolio. The yellow metal also beats other market forces like inflation and currency devaluation. Therefore, many investors are keen to move their money to gold, especially during times of economic uncertainty.

The economic impact of the pandemic

The global pandemic caused by COVID-19 has affected capital markets around the world since 2020. Of course, the price of gold rose to its highest ever point in August 2020, as investors started to move their investments to gold. This crisis is not over yet, and many countries around the world are grappling with the public health crisis and economies around the world continue to suffer due to restrictions and lockdown.

The Royal Mint produces beautiful coins, but they aren’t the best value for money

Buying investment-grade gold

As an investor, if you are thinking of purchasing gold to strengthen your portfolio, you need to be able to identify the right places to buy gold. There are many options, including high-street dealers, private auctions and online gold dealerships. However, many of these are fraught with risk, and it’s important to identify the safest avenues for your gold purchases.

Needless to say, high-street dealerships do not provide you with a wide range of gold products. Also, many would not give you a certificate of authenticity and there is no way for you to tell whether the gold you are buying is genuine or not. Similar risks would be encountered when buying gold from a private auction on sites like eBay.

If you’re wondering where to buy gold for investment, then the best bet is to focus on specialist dealers. These brokers should be a member of the British Numismatic Trade Association (BNTA), have a track record and positive customer reviews. Many of these dealers will have an online shop with live pricing and offer quantity discounts on investments. The best ones will also provide free advice and guidance as to which are the most suitable coins and bars.

It’s always important to check the authenticity of the gold you’re buying

The Royal Mint

One other option is the Royal Mint. The mint has been the torchbearer of British coinage for centuries. So, the gold coins that you buy from the mint can be trusted and they would also be immaculate in quality and condition. However, there are certain drawbacks to buying gold from the Royal Mint. They only sell new coins, avoiding circulated coins or bullion. The gold coins are sold at a premium and the mint does not offer a buyback scheme. Therefore, you can procure beautiful coins that come with great packaging from the mint. But, you would receive far less gold for your money, when compared to buying gold elsewhere.

Looking for a reliable gold dealer

The best place to buy investment-grade gold is from a UK gold dealer. The British Numismatic Trade Association (BNTA) publishes a list of gold dealers were registered with them on their website. This is the best place to start. Once you identify a few dealers, it is important to establish a relationship with them and explain your investment objectives. This can help the dealer identify the best deals for you and notify you when these come on the market. You need to ensure that the dealer provides a buyback scheme and a certificate of authenticity. Reliable dealers will also answer your queries and provide storage options, as well as an insured delivery service.

Talk to us before you purchase gold for investment

Physical Gold is one of the U.K.’s best-known, reliable and reputed gold dealerships. Our website can provide you with many options to build your gold portfolio and our experts are always happy to discuss your purchases and help you identify the best options. Call us today on (020) 7060 9992 or reach out to us online and we will be in touch right away.

Image credits: Wikimedia Commons and Jeremy Schultz

Portfolio diversification is a key consideration for many investors. During a market downturn, like the one we witnessed throughout 2020 due to the global pandemic, many investors turned to gold. Other precious metals also witnessed healthy demand, but gold is generally seen as a safe asset class that is used to hedge market risks. The price of gold rose steadily throughout 2020 and eventually reached its highest point in August. However, many investors want to consider alternatives to buying physical gold. This can have the added advantage of further diversification for your investment portfolio.

Physical gold avoids counterparty risk, but gold ETFs have certain advantages too.

What are gold ETFs?

A Gold ETF, otherwise known as an Exchange Traded Fund, is essentially a mutual fund that invests in gold. The fund may consider diverse routes of gold investments. These may not be limited to physical gold alone. Many ETFs invest in gold mining stocks, gold manufacturing companies and other gold-related investments. Of course, the fund would also invest in gold bars, coins and other types of physical gold. The fund can also invest in other forms of paper gold, like government bonds. These decisions are made by the fund manager and his team, who can acquire better margins in the market as an institutional investor. Retail investors would generally not have the opportunity to acquire gold at these prices

Advantages of investing in gold ETFs

Buying a gold ETF can be a good investment to provide a safe haven element to your overall portfolio. The value of the ETF should rise when stock markets fall, providing a sound hedge against market downturns. As an electronic investment, it benefits from efficient buying and selling margins, but also poses additional counterparty risks that coins and bars do not.

Additionally, a gold ETF may be able to provide you with some additional benefits, listed below:

- The fund provides a hedge against other market forces like inflation, currency devaluation and fluctuation in the currency markets.

- Since gold ETFs are part of a regulated marketplace, you need not worry about local price fluctuations.

- Anybody can invest in the fund during the operating hours of the stock exchanges. One need not worry about bargaining with gold dealers about premiums and price differences.

- As an investor, you can use your gold ETFs as security collateral for obtaining loans from financial institutions.

- Investments are simpler to make, and you need not worry about the risk of theft, paying locker charges, insurance costs or the costs associated with storing your gold securely.

- Since the price of gold is not subject to large market fluctuations, investments in gold ETFs can stabilise your returns, even if equity investments are performing poorly.

Gold ETFs can provide further diversification to an investor’s portfolio

Download the FREE Insiders Guide to Gold & Silver Investment. Click HERE

Disadvantages of gold ETFs

- Counterparty risks – these are risks generally associated with any paper investments. If the fund or the company performs poorly, the value of your investments can erode quickly. So, it is a third party risk associated with your investments. When you buy gold in its physical form, you take control of the asset and these risks are non-existent

- Your gold ETF investments can attract long-term Capital Gains Tax (CGT). After a year, you may be liable for paying certain taxes, however, in the UK, most investment-grade gold can be bought CGT free.

- When investing in a gold ETF, you may need to pay certain brokerage charges. It’s important to shop around and find a good fund that levies minimal charges

Call us to find out more about gold investments

Physical Gold is one of the most reputed gold dealers in the country and our advisory team can assist you in making the best gold investments. Call us today on (020) 7060 9992 or reach out to us online via our website.

Image credits: hamiltonleen and Marco Verch

Silver and gold are both precious metals that are attractive to most investors. Many investors are keen to strike a balance between the two precious metals in their portfolio. To do that, one must understand the differences in the way these precious metals behave.

Setting your objectives

The initial step in deciding whether to buy silver or gold depends upon your investment objectives. Gold has always been perceived as a repository of value. Gold investments can offset the investment risks that your portfolio is exposed to. So, if your investment objectives are to build wealth and remove risk, gold can be the right choice for you. However, silver investments are more volatile, but the profit potential is great. So, if your objective is to make significant profits in the long run, silver is an excellent choice for you as an investor.

Silver investments can be lucrative over a long-term horizon

Profit potential

Over the last year, as the global pandemic engulfed the world, investors rapidly moved their money to gold. This was an expected development since gold is generally perceived as a safe haven for most investors. As a result of the large demand for gold, the price of the precious metal shot up to its highest levels. Currently, the spot price of gold is US$1,736 per ounce. However, in August 2020, gold prices breached the US$2,000 mark to reach its highest ever level of US$2,067 on 7th August 2020. Investors who had invested their money in gold with a five-year horizon had the opportunity to make great returns when selling.

A year in turmoil

2020 was an interesting year for other precious metals as well. Due to the high demand for gold, the gold-silver price ratio widened to an all-time high above 150:1 in March 2020, when gold reached its peak. However, the ratio has now fallen to 66:1. The current spot price of silver is US$26 per ounce. This is a significant rise from March 2019, when silver was trading at USD $15 per ounce. However, the industrial demand for silver continues to rise, in the face of dwindling supplies. This has led to speculation amongst investors that eventually the price of silver is likely to skyrocket, providing an excellent opportunity for profits.

Divisibility

Silver has in recent times between around 75 times cheaper than gold so is ideal for those with modest investment funds. Silver Britannia coins cost around £20 each so a silver portfolio can comprise of many coins offering increased divisibility over gold where you may only have one item. Due to its low price and vast uses in technology, there are numerous advantages of silver when compared to gold.

Gold has always been a great repository of value

Affordability

Silver offers investors the opportunity to enter the precious metals market at a low price point. However, the production costs of silver bars and coins are proportionally higher when compared to gold. If you consider the value of a gold bar, its production price becomes negligible. This is not the case with a silver bar. But, due to lower prices, silver offers investors a great chance to lock in prices and reap profits in the long run.

Tax efficiency

All investment-grade gold is VAT free and Capital Gains Tax exempt in the UK. Therefore, gold can be a better investment from a tax standpoint. Buying physical silver will add 20% to the overall price of the purchase due to VAT. Despite this, many investors find Silver attractive, due to the lower capital investment.

Discuss your silver and gold investments with the experts at Physical Gold

Our precious metal experts offer you free advice on investing your money into gold or silver. Our in-depth research of the precious metal markets enables us to offer you the right advice when it comes to making investments. Call us today on (020) 7060 9992 or reach out to us online through our website.

Image credits: kschneider2991 and Pxhere

As a precious metal, gold has very little competition. Its amazing chemical properties make it invaluable in the industry. Gold is used to manufacture jewellery, as a conductor in electronic components and even pulled out into wires. More importantly, gold is purchased by investors as coins and bars. Due to its price stability, investors often convert their money into gold during times of economic crisis. Investment-grade gold will normally be 22 carats or higher, with a fineness of 99.9%. All investment-grade gold bought in the UK is VAT exempt and CGT (Capital Gains Tax) exempt up to a limit.

However, when gold is used in industry, it needs to be melted down, according to the requirements of certain applications. Gold is often melted and then merged with other base metals like copper to achieve a certain level of hardness. Since gold is a soft metal, jewellery and other items cannot be formed when the metal is in its purest form. Gold is also alloyed with certain metals to obtain specific colours, which are popular amongst customers. The formation of gold bars also requires the metal to be melted and poured into casts.

Gold is converted to its liquid state at a temperature of 1064 Celsius

The melting point of gold

Gold changes its form, i.e. melts from its solid-state into a liquid at 1064°C. Its boiling point can also be obtained at 2856°C. As we can see, these are extremely high temperatures and the gold melting point is usually achieved in specialised industrial facilities. If other metals are already present in the gold, then the temperature required to achieve the melting point of gold will vary. Therefore, 18-carat or 14-carat gold will typically contain a larger percentage of other base metals, causing a variance in the melting point of gold.

The process to arrive at the gold melting point

As discussed above, this industrial process usually requires a furnace to apply the heat in order to execute the process efficiently. The extremely high temperature at which the gold melting point is reached can be generated by a high power furnace. It is important to understand the difference between the words ‘melting point of gold’ and smelting. The process of melting simply converts the metal into a liquid state. In this case, the chemical qualities of the metal remain unchanged. There is simply a change of state. Smelting, on the other hand, is a different process in which impurities contained within the gold are burned off. Therefore, the temperature required to do this may vary from the gold melting point. Once these impurities have been burnt off, the remainder in most cases is almost pure gold.

A furnace is usually required for the commercial melting of gold

Other processes that can achieve the melting point of gold

The process of melting gold has been around for thousands of years, long before the invention of high-powered furnaces. How did we melt gold through these years? Well, did you know that the ancient Egyptians used a combination of charcoal along with blowpipes to hit the gold melting point? They were also able to remove impurities from the gold by using this process. For jewellery craftsmen or individuals who want to melt their own gold at home, or operate a small-scale industry, there are propane-powered gold melting kilns available today. Flux can be used in these devices to extract impurities. However, only small amounts of gold can be processed by using these kits.

Call Physical Gold for any gold-related questions

At Physical Gold, our experts are happy to help you with queries related to precious metals. We can also advise you on making the best purchases when it comes to gold or silver. Please call us on (020) 7060 9992, or get in touch with us online by visiting our website. We are always happy to help.

Image credits: andressolo and PxHere

Gold is considered to be the most popular precious metal, due to its repository of value. Over thousands of years, nations across the world, kings and queens, governments and their banks have all accepted gold as the principal precious metal. There are other precious metals that exist, a couple of which are more expensive than gold. However, gold continues to enjoy unfettered liquidity across the world.

Gold is widely traded as a commodity and the COMEX gold prices decide the rate at which gold is bought or sold at any given point in time. This is known as the spot price of gold and it is calculated in US dollars per Troy ounce. But, have you ever wondered how is gold formed? Many of us know that it is mined in a few countries across the world. But, more importantly, where does it come from?

Gold nuggets like these can be mined out of the Earth

Where does gold come from?

It is common knowledge that gold can be obtained from gold mines. However, gold flakes are also available in rivers and streams and certain parts of the sea. It has a yellow metallic colour, which has led to many people calling it the yellow metal. Gold has certain rare properties which include malleability, conductivity, and ductility. It is known as an element with its symbol represented by ‘AU’. Its properties of ductility and conductivity make it attractive to the industry as an electrical conductor. How is gold formed? It is interesting to know that the formation of gold took place long before our planet was formed.

Many scientists believe that the element was formed during collisions between supernovae and neutron stars even before the birth of our solar system. However, during the formation of our planet, gold was deposited in the core of the Earth. Cosmic events that took place over millions of years on Earth, such as the Earth’s collision with asteroids made some of this gold available to us.

Is it possible to synthesise gold?

Yes, in theory, scientists can create gold by bombarding Mercury with radiation. As the decay of mercury takes place, the formation of gold can take place. However, in reality, it is difficult to produce gold through this route. The finite amount of gold available on the Earth needs to be mined and extracted.

It is thought that asteroids like these bombarded the Earth millions of years ago to bring gold to the surface

Where can we find gold inside the Earth?

As explained earlier, when our planet was formed, heavy elements such as iron, and gold made their way to the core of the planet. However, when the asteroid collisions took place billions of years ago, the layers of our planet were churned. This resulted in large amounts of gold being deposited into the upper layers.

How much gold is there on Earth?

Well, it is difficult to calculate exactly how much gold could be found inside the Earth’s crust and mantle. However, a 2016 survey conducted in the United States revealed that approximately 196,320 tons of gold have been extracted and produced ever since human civilisation started. Gold is an extremely dense metal (19.32 g/cm³) and does not occupy a lot of space. It is estimated that there may be 1,000,000 tons of gold embedded within a kilometre of the Earth’s surface. Of course, the volume of the precious metal inside the mantle and the core of the Earth is unknown but could be a lot more. With advancements in technology, it may be eventually possible to access these deposits of gold as well.

Call us to know everything about precious metals

Physical Gold is a highly reputed precious metal dealer in the UK. Our experts can address all your queries related to precious metals. Call us on (020) 7060 9992 or reach out to us online through our website.

Image credits: James St John and Wikimedia Commons

Until 2009, few people, if any, had heard about the virtual currency called Bitcoin. In 2008, this new form of currency, otherwise known as a cryptocurrency was invented. To date, no one knows who created the Bitcoin, but its invention has been attributed to a person or a team of individuals who used the name, Satoshi Nakamoto. The cryptocurrency was formally launched in 2009 and came into the market as open source.

Advantages of Bitcoin

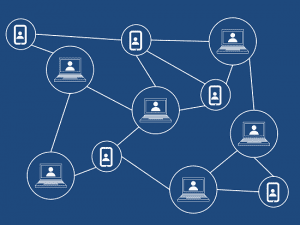

As a cryptocurrency, Bitcoin has certain distinct advantages. It is a decentralised digital currency that does not have any control or governance by the banks of any nation. It is not controlled by the government of any country. The currency operates across a peer-to-peer network, eradicating the need for any third-party or intermediary. All transactions that use this cryptocurrency are verified electronically by network nodes. These transactions are encrypted and stored on a distributed ledger system known as a blockchain.

Bitcoin has become the most important cryptocurrency

The blockchain derives its name from the way it operates. It is a chain of blocks, where every block contains a hash code connecting it to the previous block, all the way to the first one, which is known as the genesis block. This ensures that the system cannot be easily hacked into, as it is extremely difficult to alter the information contained across the entire chain. When a Bitcoin transaction happens, the information is sent to this network using purpose-built software applications. At this point in time, the network nodes validate these transactions and write them into the respective ledgers. The information is then broadcast to the other nodes within the system. Apart from data protection, the system also ensures that double-spending is prohibited. To make this happen, every input needs to have a previous unspent output within the blockchain. The first commercial transaction using Bitcoin took place in 2010 when the cryptocurrency was used to pay for two pizzas. At the time, the value of the Bitcoin was very low and the transaction was done for 10,000 Bitcoins.

How are Bitcoins generated?

Bitcoins are created through a process known as mining. It is essentially a service that creates records by using the processing power of computers. This activity maintains the sanctity of the blockchain, ensuring its consistency and completeness. At the same time, the process also ensures the security of the transactions, by making them un-alterable through the use of an SHA-256 cryptographic hash, which links across the blocks through the entire chain. However, every new block must have proof of work (POW), to ensure its acceptance by the entire network.

In the early days, Bitcoin miners used powerful computers known as GPUs (graphics processing unit) for this operation. These computers were faster and more adaptable in creating POW algorithms. However, today mining operations for Bitcoins been taken over by companies and these companies use large data centres, fitted with dedicated, specialised mining hardware. The mining companies generate Bitcoins through this intricate, expensive and energy-intensive process. Despite the complex security process, Bitcoins have been stolen from exchanges. The cryptocurrency has also come under criticism for the gigantic amounts of electricity used by the mining companies, at a time when the entire world wants to conserve energy and move towards green energy.

Bitcoin mining is extremely energy-intensive

The legal status of Bitcoin

Due to the decentralised nature of the cryptocurrency, its regulation has been difficult. Since the currency is mainly traded in online exchanges, its use in the early days was fraught with controversy. Bitcoins have certain unprecedented characteristics that no other currency has seen before.

- There is no central authority.

- There is no central repository server – the cryptocurrency operates through a peer-to-peer network.

- Central storage like currency holdings in a bank does not exist. Bitcoins use a distributed ledger system.

- The distributed ledger is accessible to everybody, and anyone can store it on their computers.

- The administration of the cryptocurrency is also distributed. Its ledger is maintained by a network of Bitcoin miners.

- An amazing feature of the system is that anyone can become a miner.

- Additions to this distributed ledger system are highly competitive. Any miner can create a new block, and it is impossible to predict who will.

- New Bitcoins are generated as a reward for creating a new block. Therefore, anyone within the network can achieve this target. According to the protocol, only 21 million Bitcoins can be created.

- New Bitcoin addresses require no approval system for its creation and anyone can create it.

- Transactions do not need approval, and a confirmation is generated by the network once the transaction is deemed legitimate.

Several national banks across the world felt threatened by the new autonomy and lack of control presented by Bitcoin. In September 2017, China started the process of imposing a ban on trading in Bitcoins. The ban formally came into effect in February 2018. In the US, warnings were issued about trading and investments in Bitcoins. In July 2018, the Commodity Futures Trading Commission in the United States reiterated that any form of trading in cryptocurrencies is speculative and that there could be inherent risks associated with theft from hackers, as well as fraud and misrepresentation. Earlier, similar warnings had been issued by the European Banking Authority, regarding the price volatility of Bitcoins, absence of regulatory structure and the risk of fraud.

Bitcoin uses a peer to peer network to validate transactions

Risk of price manipulation

In May 2018, an investigation was launched by the US Justice Department about the possibility of price manipulation. The final price settlement of Bitcoin futures in the US is dependent on four cryptocurrency exchanges. The investigation looked into transaction data on these four exchanges in order to detect any unfair market practices.

History of the Bitcoin price

Bitcoin inventor Satoshi Nakamoto is estimated to have mined close to 1,000,000 Bitcoins, before handing over the controls to the Bitcoin Foundation and retiring from public life. By 2011, Bitcoins started to have parity to internationally accepted currencies. At the time, the Bitcoin price in US dollars was only $ 0.30. In 2011, the average USD to GBP price was 1.60. Therefore, the Bitcoin to GBP conversion was approximately 18p. Some people bought Bitcoins at this price. Imagine how rich they are today! Bitcoin closed in the year 2011, with the Bitcoin to GBP price at £3.29. However, Bitcoin to GBP prices faced extreme volatility at the time, with the Bitcoin to GBP price rising to £19.68 in June that year, before heading into a downward spiral.

The following year, 2012, saw the prices of Bitcoin in GBP rise to around £8.36 at the close of the year. However, volatility continued with the prices falling by as much as 49% to 57% throughout the year, followed by a period of stabilisation. This rollercoaster ride of the Bitcoin in GBP prices kept prudent investors away. However, that year also witnessed the creation of the Bitcoin Foundation. This was done primarily to lend a direction to the development of Bitcoin, leading to renewed hope in the prices of Bitcoin in GBP.

The rise of Bitcoin

2013 was an important year for Bitcoin. The year witnessed the greatest price rise of 1 Bitcoin in GBP. At the start of the year, the value of 1 Bitcoin in GBP was £8.36. However, by the end of the year, the price of 1 Bitcoin in GBP had risen to £484. But, it was also a year in which the cryptocurrency became mired in controversy. In March of the same year, there were problems with the blockchain and the distributed ledger system split into two independent chains for a few hours, before the problem was rectified.

In the same year, the US authorities also seized around 30,000 Bitcoins from an illegal trading site called Silk Road. The authorities also started taking action against Bitcoin exchanges in the US if they had not registered with the appropriate legal authorities. After China prohibited the use of Bitcoins, prices started falling drastically. At the start of 2014, the price of 1 Bitcoin in GBP stood at £484 but reduced to £206 by the end of the year.

Blockchain’s distributed ledger system is at the heart of Bitcoin’s security

Bitcoin revival

From this period of uncertainty, Bitcoins made a slow recovery. By the end of 2015, 1 BTC to GBP conversion price rose to £285. The price continued to rise throughout 2016 and by the beginning of 2017, the price of 1 BTC to GBP had risen to £804. 2017 marked the revival of Bitcoin prices, partly fuelled by a software upgrade on the Bitcoin network. This upgrade, called Segwit, improved prices by around 50%. By July 2017, the price of one BTC to GBP was approximately £2,216. By the end of the year, the price of one BTC to GBP stood at £10,816.

The Chinese ban on Bitcoin trading, which started in February 2018 saw prices plummeting. The Bitcoin to pound price dropped to approximately £4,974 on 5th February 2018. By January 2019, the Bitcoin to pound price was £2,882, down by 72% from the peaks achieved in 2018.

In February 2019, the Quadriga Fintech controversy surfaced, when the company’s founder was reported dead in India. The Canadian cryptocurrency exchange, subsequently filed for bankruptcy, with around $200 million unaccounted for. Despite this market shock, Bitcoin continued to perform well and by June 2019, the Bitcoin to pound price had risen to £10,000. In an act of legitimacy, Intercontinental Exchange, the company that owns the New York Stock Exchange (NYSE), started a Bitcoin exchange to trade in its futures.

The Bitcoin Foundation steers the direction of the cryptocurrency

The COVID-19 pandemic

It would be unbelievable if the global pandemic had not impacted Bitcoin. As the pandemic took hold around the world, BTC to GBP prices fell to approximately £3,225 and below. However, 2020 witnessed a lot of support for the cryptocurrency from financial companies, who moved a percentage of their total assets to Bitcoins. The payment gateway, PayPal also allowed its customers to buy and sell Bitcoin using their payment platform. By November 2020, the BTC to GBP price had recovered and stood at £16,016.

This new BTC to GBP price was at an all-time high, and reinforced the faith of investors, as the cryptocurrency was able to buck its performance, while under pressure from the economic situation caused by the pandemic. The revival of the Bitcoin GBP price witnessed other corporate powerhouses following suit in the support of Bitcoin. These included life insurance companies, who were converting a part of their assets to Bitcoin and the high-tech automobile company Tesla that invested £1.08 billion in Bitcoin. Based on these factors, the Bitcoin GBP price went up to £35,597. Earlier in 2021, the Bitcoin GBP price rose by approximately £3,846 in an hour, when the Bitcoin received an endorsement from Elon Musk, founder of Tesla. With that rise alone, the Bitcoin price GBP reached a price of £28,691.

A Bitcoin mining farm

Current status of the Bitcoin price GBP

The live price of Bitcoin to pounds is a dynamically changing price, just like any other global currency. Most live price charts will update the Bitcoin price GBP within five seconds. After a turbulent start, Bitcoin has now established itself as the most important cryptocurrency, which is in high demand. Due to this, the Bitcoin to pounds price is quite high. However, investors believe that the Bitcoin to pounds price will continue to rise in the future.

From a high of £35,597 on 8 February 2021, the Bitcoin price pounds has already reduced slightly to £34,301 on 12 February 2021. But the Bitcoin price pounds had earlier in the day reached a high of £34,487. So, as an investor, these illustrations should give you an indication of the fluctuation and volatility of the Bitcoin price pounds. Many precious metal investors are now turning to Bitcoin, as there is speculation that it may replace precious metals as a repository of value.

Bitcoins may soon replace precious metals as a repository of value

Call us at Physical Gold to compare cryptocurrencies with precious metals

Our precious metal experts at Physical Gold can help you with the right advice and knowledge when it comes to comparisons between cryptocurrencies and precious metals. Call us today on (020) 7060 9992 or simply get in touch with us online through our website.

Image credits: PxHere, nifco, Tumisu, TLC Jonhson, Wikimedia Commons, Freeimg.net and Wikimedia Commons

Coins become increasingly attractive to collectors and investors as their rarity increases. Bullion coins may be easily available in abundance at low premiums, making them attractive for investors. However, coins with a history are always more attractive to collectors and numismatists. The gold Sovereign coins, which have been around for centuries are a classic example.

The Sovereigns are available with the portraits of several British monarchs during whose reigns, these coins were issued. Queen Victoria alone has three different portraits on these Sovereigns. As a coin collector, it is exciting to delve into the history of these coins. But, let us look at a more recent event that has significantly impacted how coins were struck. Decimalisation has created two distinct category of coins – pre-decimal coins and post decimal.

When was decimalisation

Throughout the history of British coinage, a separate system was in existence for centuries. This was a system that divided the coinage of the nation into pounds, shillings and pence. This system divided the denomination of British currency and everyone knew that 12p was equivalent to a shilling. A shilling was one 20th of a pound, so 20 shillings added up to a pound. However, this was a complex system and needed to be simplified. It’s not that past governments did not realise that there was a need for a simpler system. However, it hadn’t been put in place.

In 1848, there was an attempt to introduce a decimal coin. This coin was called the Florin. Its value was 1/10 of a pound. But, the values of other coins remained the same. The decimalisation system had been suggested during the 19th century by Sir John Bowring, who was a Member of Parliament. It was due to his suggestions that the Florin had been introduced.

King Edward VIII abdicated to marry Mrs Simpson. Coins created for his reign are rare

The decimalisation idea would divide British currency into pre-decimal coins, which would be withdrawn from circulation. A special task force was created in 1961 to debate and decide on the introduction of a decimalisation system for the British currency. The question on everyone’s minds was, “When was decimalisation going to kick in?” “When was decimalisation money, or post decimal coins going to be available?”

Eventually, the decision to withdraw the old system and pre-decimal coins were finally announced in March 1966. The D- Day or, Decimal Day was 15th February 1971. It was on this date that pre-decimal coins were finally withdrawn from British coinage. Decimal Day will celebrate its Golden Jubilee, or completion of 50 years on 15th February 2021. Today, with the passing of years, not everyone remembers the date and many people from the younger generation ask, “When was decimalisation?” As we celebrate its 50th year, it is certainly a date that changed the coinage of our country forever.

What pre-decimal coins should I collect?

Well, not all pre-decimal coins would command a high value. Firstly, only some of them are made of gold and silver. Others are made with copper. Although they have been withdrawn from circulation, they are freely and abundantly available. However, some of them have become rare over the years and can fetch a tidy sum. For example, the 1917 George V Sovereign from the London Mint could be worth around £ 15,000. Another pre-decimal coin that’s worth quite a bit is the 1937 Edward VIII brass threepence. Only 10 were produced and their release was withdrawn due to the abdication of the King.

One of these could be worth as much as £45,000. Amongst the pennies, the 1933 George V penny is highly valued, mainly due to its rarity. Only seven were issued at the time, and if you manage to get your hands on one, it could fetch you as much as £72,000. There is also a 1937 copper one penny coin that had been struck to be released during the reign of King Edward VIII. Only a few were produced and one of these fetched £111,000 at an auction in 2019. So, if you were to find one of these in your attic, you could make a hefty sum of money very quickly.

Decimalisation changed the way the Royal Mint struck their coins

Call us at Physical Gold to find out more about rare coins

Our coin experts at Physical Gold can help you identify rare coins and assist you in purchasing them for your collection. Call us on (020) 7060 9992 or drop us an email today by visiting our website.

Image credits: Picryl and Wikimedia Commons

If you’re going to give a gift to a loved one this St George’s Day, then patriotic English gold coins are an excellent choice. Like St George himself, gold represents all of our traditional English values such as strength, 23rd passion and courage making it the perfect gift idea this 23rd April.

The legend of St George

Although St George isn’t English, (he was originally of Greek decent and believed to have been born in the region of Cappadocia, now part of Turkey) he is a Christian martyr who sacrificed his life for his faith and is the patron saint of many Christian countries.

After joining the Roman army at 17 years old, St George quickly rose in the ranks of Emperor Diocletian’s legion. In 303 A.D. however, there was a crackdown on the growing number of Christians in the Roman army and many of them faced expulsion. Saint George refused to give up his faith, despite Diocletian attempting to convert him with promises of wealth. He was executed on the 23rd April 303 A.D., which is why we now celebrate St George’s Day on the day of his passing. (23rd April – Julian Calendar or 6th May Gregorian Calendar). King Edward III made him Patron Saint of England in 1350 as he felt he reflected the country’s ideals of courage and passion.

St George’s Day was also known historically as Feast of Saint George (as the day was associated with a feast!)

St George’s Day Flags

St George and the dragon

According to popular legend, St George slew a dragon that was terrorizing a small town in what George called “Silene” in Libya. The town’s people were sacrificing their own children to appease the dragon until St George offered to kill it on the condition the whole town converted to Christianity which they later did.

The link between William Shakespeare and St George

William Shakespeare did all he could to keep the legend of St George alive. In Shakespeare’s play “Henry V” written in 1599, King Henry famously says in his pre-battle speech: “Cry God for Harry, England and St. George!”

Shakespeare also paid homage to St George by being born and dying on St Georges Day. William Shakespeare was born on 23rd April 1564 and died on 23rd April 1616.

Gold Sovereigns; the perfect St George’s Day gift

Gold sovereigns are often given as special gifts.

Due to the new sovereign’s design which was updated in 1817 and depicts St George himself slaying the famous dragon, a gold sovereign represents a particularly poignant gift this St George’s Day.

A 2018 gold half sovereign showing the George and Dragon symbol on the coin reverse

Over the years, the sovereign’s design has become a classic. Designed by the Italian gem engraver Benedetto Pistrucci, the coin is particularly favoured among gold coin collectors who appreciate the coins heraldry. The sovereign is also the perfect reflection of English strength and unity. It was once the largest gold coin ever minted in Britain and throughout history, the coin has become synonymous with the might of the English empire.

An 1886 Victorian Sovereign Young head coin reverse showing the George and Dragon symbol

Gold Britannia’s

Although they have only been minted since 1987, there are few coins that reflect English patriotism better than the Gold Britannia. If you’re looking for the perfect example of an English gold coin at its finest, then you might be interested in Britannia gold coins. These incredible coins are the largest denomination of all British gold coins and are VAT free if you purchase them through Physical Gold.

Give the gift of patriotic gold this St George’s Day

Here at Physical Gold, we stock a huge range of tax free gold coins as well as the latest issue Gold Britannia coins. For more information, please get in touch on 020 7060 9992.

Image Sources: Wikipedia

Gold and silver are often referred to as the ‘go-to’ precious metals for any investor. The yellow metal is revered around the world for its value and has many different uses. Gold has historically been one of the precious metals of choice for minting coins. Of course, it has numerous other industrial uses. Have you ever wondered why gold is used widely? Gold has certain properties that ensure its usefulness across industries. In this article, we will briefly overview some of these properties, and also focus on gold density.

Useful properties of gold

Gold is a highly malleable and ductile metal. The yellow metal is so malleable that 1 ounce can be pressed and spread over an area of 300 square feet. As a ductile metal, it can also be pulled out into wires. Gold has another property that makes it ideal for several industrial uses. It is a very good conductor of heat, as well, as electricity. This combination of ductility and conductivity make it invaluable in the electronics industry. Another great property of gold is that it does not corrode easily. Gold remains unaffected when exposed to air, or most other reagents.

Gold is one of the densest metals on Earth

The density of gold

Although gold is a malleable metal, the density is fairly high. Gold density is 19.3 g/cm³. When we refer to a metal density chart, we realise that the density of gold is much higher than most base metals. For example, lead has a density of only 11.3 g/cm³. Similarly, this number stands at 7.87 for iron, 8.90 for nickel and 7.7 for bronze. When compared to other precious metals, the density of gold is still higher than metals like rhodium or ruthenium, which are 12.4 and 12.1, respectively. However, platinum is higher than gold density and stands at 21.5. Similarly, the density of iridium is also higher than the density of gold at 22.5. Silver, on the other hand, is nearly half the density of gold at only 10.5.

So, we can see from the above comparisons that gold density is generally higher than most other metals. Despite this, it enjoys the properties of malleability and ductility, which is unique.

The density of silver is approximately half that of gold

How can we calculate the density of gold?

Well, the classical definition of the density of an object. Is the ratio of its mass to its volume. This is the reason why density is represented by grams per cubic centimetre – unit mass per unit volume. Now, mass is pretty much the same concept as weight. So, all we have to do is to weigh a bar of gold and divide this number by its volume. Therefore, one cubic centimetre of gold will weigh 19.3 g. Similarly, a cubic centimetre of silver will weigh 10.5 g

If the density of gold is higher than other metals, why is it softer?

The softness of a metal is its ability to easily change shape when pressure or stress is applied. The key to our answer lies deep in physics, where we analyse the structure of gold. Like all other metals, gold has a crystalline structure. This structure is essentially an arrangement of different planes of crystals. Metals which have a higher density like gold are more likely to have defects within these planes. These are called slip planes, and they allow the metal to bend easily. Gold and silver have more of these planes, making them extremely malleable. On the other hand, base metals like iron are more rigid and cannot be bent easily.

Find out more about gold from our experts at Physical Gold

When you call Physical Gold, your queries need not necessarily be about investments. We pride ourselves on being recognised as one of the most reputed precious metal dealers in the country. Our experts are extremely knowledgeable about gold and can answer all your questions related to the yellow metal. Call us on (020) 7060 9992. You can also visit our website and get in touch with us online and a member of our team will revert to you at the earliest regarding your queries.

Image credits: Wikimedia Commons and Wikimedia Commons

Is gold magnetic?

For several centuries, gold has been considered the definitive precious metal in the world. It acts as a great repository of value even today and has been used in jewellery making, coinage, investments, and several industrial applications. Its industrial users are many, owing to certain great properties that the yellow metal has.

Gold is well-known for its malleability, making it a versatile metal to use for industrial applications. At the same time, gold is also well-known for its tensile strength. This property coupled with its conductivity allows it to be used in industry for specialist wiring applications. However, the question we want to address today is “Is gold magnetic?”

A large electromagnet like this can create a very strong magnetic field

Gold and the property of magnetism

Gold does not automatically fall into the category of magnetic metals. For example, if we have a large electromagnet that emits a strong magnetic field, gold is unlikely to be drawn by it. Other metals like iron will be immediately attracted by the magnetic field and will attach itself to the magnet. However, gold does not behave in this manner.

The magnetic attraction of gold jewellery

Often people are surprised when certain types of gold jewellery may suddenly behave magnetically. A dealer may have sold a large ring to you, claiming that its pure gold. However, if it is attracted by a magnet, you may be wondering is gold magnetic? No, it is a certainty that the gold is not pure. There could be iron or nickel mixed into the metal, which causes this phenomenon.

This is one of the ways in which people try to detect the purity of the gold they possess. However, we must bear in mind that even if the item of jewellery is not attracted by a magnet, it doesn’t automatically imply that there are no base metals mixed into it. Base metals such as aluminium, copper, and lead, which are frequently mixed with gold do not have any magnetic properties.

Often metals like copper and nickel are mixed into gold to create colours, which are popular amongst buyers. Also, precious metals like platinum, silver and rhodium are frequently being used by the industry to make the surface of the gold harder and scratchproof. These metals do not have any magnetic attraction properties.

Tohoku University

Recent scientific developments

Although gold had always been considered a non-magnetic metal, a recent scientific discovery has put forth the possibility that gold can be magnetised through heating. But is gold magnetic? Researchers at Tohoku University in Japan discovered that by spinning the electrons and inducing heats at the same time, a small degree of magnetisation can be achieved in gold. In the experiment, a thin film of gold was used, and a magnetic field was applied in parallel with the flow of heat. Researchers believe that such discoveries can reveal the unknown properties of matter that may have useful industrial applications. It could be useful for innovative and new areas of science such as thermoelectric uses and energy harvesting.

Talk to the gold experts at Physical Gold

Our gold experts can assist you in identifying and assessing the purity of the gold you possess. Besides, they can help you identify the right opportunities to purchase gold for your investment portfolio. We conduct regular research on the international gold markets and can advise you on the purchase of your gold at the right time and price.

As one of the nation’s most reputed online dealers, we are also able to offer you great deals on a variety of gold products. We stock bars of different sizes and our numismatic experts can also help you with the purchase of excellent gold coins. Call us on (020) 7060 9992 or simply drop us an email and one of our investment experts will be happy to get in touch with you.

Image credits: Wikimedia Commons and Wikimedia Commons