Gold Britannia coins are extremely popular amongst investors for several reasons. Firstly, being one of the most popular British coins in the world, the coin offers a tremendous amount of liquidity for any investor’s portfolio. However, there are other reasons for its popularity too.

Since 2013, gold Britannia coins are available in 24-carat gold. Therefore, the coin presents an irresistible opportunity to acquire a 1-ounce gold coin manufactured with 99.9% pure gold. It’s important to note that until 2012, gold Britannias were minted using 22-carat gold, with a fineness of 91.7%.

The gold Britannia coin was originally introduced in 1987. From 1987 till 1989, copper was the base metal introduced into gold. This was changed from 1990 to silver, making the Britannia coin minted completely out of precious metals.

Tax efficiency

A question that many investors ask is whether the gold Britannia is a legal tender coin.

Yes, Gold Britannias are legal tender within the UK. All Britannia fractions and precious metals feature Queen Elizabeth on the obverse of the coin and a face value, including silver versions. These features qualify the coins as legal tender so in theory they can be spent in shops. However, with the 1oz gold Britannia boasting a £100 face value but being worth ten times that it would be foolish to do so. More commonly, the legal tender status increases the coins’ appeal due to it not being subject to Capital Gains Tax.

The British round pound has been discontinued since 2017

There is no upper limit to the Capital Gains Tax exemption on gold Britannia coins so larger investors who sell their Britannias at substantial profits remain tax efficient too.

General tax free allowance

The Government do currently allow you to make £12,300 capital gains before they’ll tax you. But this is reducing to £6,000 in April 2023 and all the way down to just £3,000 in 2024. So you could buy one taxable piece of gold for £2,000, sell it for £4,000 and pay no Capital Gains Tax.

However, there are dangers to this approach, which is why sticking to tax free gold coins like Britannias is a prudent choice.

The tax free allowance includes all assets you sell within a tax year. So you may only make £2k profit on your gold, but if you also sell shares that year, you could breach your tax free threshold and end up paying tax.

Just as problematic, is that the allowance isn’t guaranteed for ever. Any Government can reduce the threshold if they wish, or abolish it altogether if they want to raise some tax. So if you’ve bought some taxable gold and they abolish the tax free threshold, you’re going to get taxed when you sell.

Maundy money is also considered legal tender

Download The Ultimate Insiders Guide to Tax Efficient Gold & Silver Investments HERE

What is a legal tender coin?

Any official currency that has a face value, minted by the Royal Mint and signed off under the Royal Proclamation is considered to be legal tender in the UK. These rules are part of the Coinage Act 1971 and the Currency Act 1983. Legal tender coins include all coins in circulation, Maundy money and precious metal coins minted by the Royal Mint. Coins that have been withdrawn from circulation do not qualify as legal tender in the UK. For example, the old ‘round pound’ has been withdrawn from circulation and does not qualify as legal tender from 15th October 2017. However, they can be exchanged in a bank.

Other important points to note about legal tender currency

An important point to note is that gold and silver coins may not qualify as legal tender if the weight of the coin is found to be less than the specified weight denoted on the coin. Even today, several places outside the UK accept British legal tender coins.

These are British Overseas Territories and Crown Dependencies, like the Channel Islands, Falkland Islands, and many other places like Gibraltar and Ascension Island. However, the local currencies of these places are not accepted as legal tender in the UK. An interesting anomaly is Scotland and Northern Ireland, where Bank of England notes are not considered to be legal tender.

Talk to Physical Gold for all coin related information

The coin experts at Physical Gold are always willing and ready to respond to any queries you may have regarding precious metal coins. Get in touch with us today on (020) 7060 9992 or visit our website and contact us online.

Image credits: Thomas Duesing and Wikimedia Commons

The Britannia is one of the most famous coins ever released in British coinage history. It is the pride and joy of the Royal Mint and also forms the backbone of any precious metal coin portfolio. The Britannia is available in both gold and silver and offers tremendous liquidity to the portfolio of an investor. Due to its reputation as one of the best-known coins in the world, it is easily saleable for cash.

The Britannia coin

The Britannia gold coin is a 1-ounce coin with a purity of 999.9 and a face value of 100 GBP that was launched by the Royal Mint in 1987. It is available in bullion and proof finishes, as well as fractional sizes. The Royal Mint also introduced a silver Britannia coin in 1997, which has a face value of 2 pounds. The silver Britannia contains one Troy ounce of fine silver. Both the gold and the silver coin feature a portrait of the reigning British monarch, Queen, Elizabeth II on the obverse of the coin. The reverse of the coin features the classic image of Britannia. The event featured on the coins issued from 1987, was designed by Philip Nathan. In 2018, the Royal Mint also released a Platinum version of the Britannia coin that contains one Troy ounce of Platinum and has a face value of £100.

The iconic image of Britannia above Somerset House in London

Who was Britannia?

In 43AD Britannia meant Roman Britain. This was an area to the south of what is known today as Scotland. In 197AD Roman Britain was divided into 4 provinces and 2 of these were Britannia Superior and Britannia Inferior. Britannia was the name given to this Island. In the 2nd Century, Roman Britannia was what is recognised today as the goddess armed with a trident and shield. Britannia was featured on all modern British coinage until being redesigned in 2008.

The Romans used the term ‘Britannicae’ to refer to the British Isles. The inhabitants of Britain were called ‘Britons’ at the time. Another name for the people of the British Isles used by the Romans was ‘Britanni’. Since the British Isles represented the furthest territory of the Roman Empire, it became symbolised with the goddess of warfare and water. Roman mythology portrays a goddess called Minerva, who is popularly known as the torchbearer of arts, commerce, strategy and wisdom. The image of Britannia was based on the icon of goddess Minerva and came to personify the British Isles over the years.

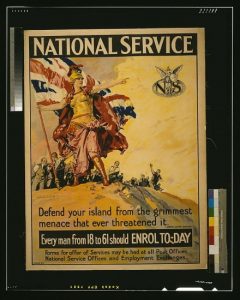

A World War 1 Poster depicting Britannia

Reinforcement of the Britannia image

After the invasion of England by the Anglo-Saxons, the ethnicity of the country changed drastically, with the exodus of the original Celtic Britons. However, years later, as Queen Elizabeth, I combined England, Scotland, Ireland. and Wales and significantly increased the nation’s naval power, the image of Britannia was restored as a representation of the nation’s power and the Queen. This was further reinforced during the reign of the great Queen Victoria when the British Empire became the most powerful empire in the world and Britannia ruled the waves. The iconic image of Britannia was then put firmly in place to represent the power of the British Empire, and its monarch.

Physical Gold can assist you in purchasing Britannia coins

Whether it’s gold Britannias or silver ones that you’re after, our coin experts at Physical Gold can advise you on how to get the best deals. Call us on (020) 7060 9992 or drop us an email and a member of our team will reach out to you at the earliest.

Image credits: Alastair Rae and Picryl

Britannia coins are the one-ounce British Bullion coins issued by the Royal Mint since 1987. Both proof and bullion versions have been issued every year to date and fractional versions are commonly available. The Britannia coin is available in either silver or gold and since 2013 has a purity value of 999.9. It is currently the largest, purest British legal tender coin available on the market.

Britannia coin

County: Great Britain

Face Value: £100 GBP

Gold Content: 1 ounce (31.104g) – Alloyed with copper or silver depending on year (pure from 2013)

Purity: 917 / 1000 (22 karat) (1987-2012) or 999.9/1000 (24 karat) (2013-)

Gross Weight: 34.0500 g (1987-2012) or 31.104g (2013-)

Coin Diameter: 32.69 mm (1987-2012) or 38.61mm (2013-)

First Year of issue: 1987

British coinage history

Britain has a long history of coinage. The first coins that were minted in Britain were Celtic ones around 80 BC. The first gold coins and silver coins in Britain were introduced by the Romans. The gold one was called ‘Aureus’ and the silver ‘Denarius’.

Sell your Gold Britannias at the highest possible price. Find out how with our 10 simple rules

Why Britannia?

The ‘Britannia’ first appeared on the coins of the Roman Emperor Hadrian in AD119.

Bullion coin market growth

After the 80s saw significant growth in the global bullion market, the Royal Mint introduced Britannia coins to their bullion portfolio. Designed by Philip Nathan, the coin featured a new interpretation of Britannia that was powerful, yet elegant and it caught the imagination of the entire nation. Introduced in 1987, the coin made a worldwide impact and became a classic. Today, 30 years later, the classic design still remains the same – with a small addition. The new design displays a radial sunburst on her back.

The beautifully designed Gold Britannia

The Britannia – Europe’s premier modern coin

The Britannia coin is fast becoming Europe’s premier modern coin and is regarded as one of the world’s most beautiful coins. This coin is admired by collectors, dealers and investors from around the world, and is, therefore, one of the World’s most liquid coins.

With the face value of £100 UK Britannia coin is considered legal tender in Great Britain and it is therefore not subject to Capital Gains Tax when sold for a profit by UK residents. As the law currently stands you are required to pay CGT for any personal goods you have sold or made a profit on over the tax-free allowance rate of £11,300. As gold and silver Britannia’s are CGT exempt, however, you can sell as many as you want over the tax year without having to pay CGT.

Design features

The classic design featured on the 2018 1oz Britannia coin

displays a stroking image of a standing Britannia who is portrayed as a beautiful young woman, wearing a centurion’s helmet and holding her trident aloft. The reverse side of the coin features the most recent portrait of Queen Elizabeth II which was designed by Jody Clark of the Royal Mint and first introduced in 2015. Like previous editions of the Britannia coin, it has a purity of 999.9 and is created in 24 karat gold.

Britannia gold coins originally had a fineness of 91.7% or (22 karats) gold with the alloy being copper until 1989 and silver from 1990. The Royal Mint increased purity to 24 karats from 2013 to appeal to the ever-growing Asian market.

Collectable and with solid investment potential

These lovely 24 karat coins are an amazing investment for any numismatist or an investor. They are worth their weight in gold and have a purity of 999.9 since 2013. The 2018 edition is an excellent value for money and fitting addition to any coin collection. Investors on the other hand, who want to invest serious money in these coins as an investment in gold, would benefit from purchasing a large number of the coins. This is because it works out considerably cheaper to buy gold bullion in bulk rather than individual coins. The advantage of purchasing gold in small denominations such as a coin also gives the investor an advantage in terms of liquidity. At a later point in time, when the investor wishes to exit gold as an investment strategy, he need not dilute all his investments. He can simply sell the ones he wishes to and transfers a part of that investment to another asset class.

Britannia coins are also currently available in a range of different weights and denominations depending on the amount you wish to invest. These include 1/2, 1/4 and 1/10th troy ounce coins which have face values of £50, £25, and £10 respectively. Since 2013 two additional sizes of Britannia coin have been introduced – a 5-ounce coin and 1/20th ounce-coin. These have face values of £500 and £5.

Another reason to invest in Britannia Coins is that they present European and UK investors with the opportunity to purchase physical gold totally exempt from VAT. All of our Britannia coins are available to purchase VAT free and CGT exempt.

The Britannia is a prestigious coin, famous all over the world and makes an excellent companion to gold sovereign coins. It would make an excellent Christmas gift item for someone in the family or a loved one. So, as we can see, investing in a Britannia isn’t just about parking money and hedging risks. The coin is a true work of art and would make a fitting family heirloom to be passed down from one generation to the other. The coins come with their own case and are suitable for display as an outstanding work of art and a great symbol of British history. Call us on 020 7060 9992 to discuss how Physical Gold Limited may help you invest in the Britannia 2017.

What is a Gold Britannia worth?

The value of a gold Britannia coin is based on the underlying spot price on the market, combined with the supply and demand for the particular coin. Generally, the 1oz gold coin will fetch around 96-98% of the current spot gold price. Gold Britannia coins have only been around since 1987, but certain years of issue are harder to source than others, so their value is higher than the current year of issue, sometimes by up to 5%

The spot price isn’t the only thing that affects the value of a Britannia

There are other factors that can affect the value of the Britannia. It is a larger coin and provides investors with more gold content at its price. This is simply due to the fact that larger gold coins enjoy lower production costs. When we calculate the cost of production against its price, we can see that the Britannia is available at a lower price per gram than smaller coins such as Sovereigns.

Easy availability and low premiums

A good thing about investing in the gold Britannia is that the coin does not command any kind of historical or numismatic premium. Apart from a few difficult to acquire years, most Britannia coins are easily available. You can also avail of bulk discounts if you order larger numbers. This enables you to acquire a larger amount of gold for your money, making it a lucrative investment.

Market supply and demand

During periods of intense economic, political or social turmoil, demand for gold tends to soar. We’ve experienced this repeatedly over the years as the economy goes through it’s various cycles. In particular, demand for gold investment coins such as the Britannia has been at all time highs during the recent Covid pandemic. While these ‘black swan events’ occur, it’s common for demand to out-strip supply significantly. The Royal Mint struggle to increase production sufficiently due to capacity restrictions.

In these circumstances it’s common that the value of Britannias increases sharply. Not only does the underlying gold spot price increase rapidly due to the increased demand in the gold market. But also, premiums rise to reflect the dynamic. Sellers benefit from obtaining higher premiums (near or even above the spot price), but buyers are forced to pay 2-5% extra.

A highly tax-efficient investment

Most investors simply focus on the price and ignore other key factors like the impact of taxes. Of course, all investment-grade gold is VAT free in the UK and the gold Britannia benefits from this tax-exempt status. Additionally, there is the double advantage of Capital Gains Tax (CGT) exemption, as the Britannia is a UK legal tender coin.

The iconic image of Britannia is shared by the gold and the silver version, pictured here

Currency conversions also affect the price

As you may be aware, the spot price of gold in the international markets is always quoted in US dollars. So, when you buy or sell the Britannia in the UK, this price needs to be converted to Sterling. You will need to divide the price in US dollars per ounce by 31.103. After that, you’ll need to look up the current exchange rate between the US dollar and the GBP. Once you apply the exchange rates, the current price of the coin can be derived. Now, we often see several websites in the UK quoting the per ounce price in GBP. But, you need to be aware that these websites have already done the conversions. So, we can see that it’s not just the movement of the spot price that has an impact on the value of a gold Britannia. Currency price fluctuations will always impact the final price of a gold coin.

Premiums need to be factored in as well

Now that we’ve explored the impact of spot prices and global currencies on the buying and selling price of a gold Britannia, let’s take a quick look at premiums. All gold investments need to be made at a premium, charged above or below the spot price. Premiums are charged to compensate for design, delivery and production costs. So, it’s important to factor this as well when calculating the price of a gold Britannia coin.

A winner on all counts

Ultimately, it’s a great coin to invest in. Once the price has been calculated, it’s important to remember that the gold Britannia enjoys a vibrant secondary market, providing liquidity to your investments. All these factors make the gold Britannia a truly versatile coin.

Contacting Physical Gold

Contacting us couldn’t be easier. Simply visit our Contact Us Page, or call Physical Gold Ltd on 020 7060 9992.

Image credit: Eric Golub

Gold Sovereigns versus Britannias

Building a strong gold portfolio can be a challenging task, requiring an investor to study the different gold coins available in the market. Two of the most popular British coins that have stood the test of time are undoubtedly the Gold Britannia and the Gold Sovereign. Either coin holds an important place in your portfolio, so it’s worth finding out the pros and cons of investing in these coins, based on certain key attributes.

Variety

Variety is the key consideration when choosing gold coins for your portfolio. Coins that have a wide range of issues, sizes and denominations are likely to enhance the value of your portfolio. The Sovereign is an obvious choice if variety is to be considered. The iconic British coin has been around for more than 200 years and several issues through the reigns of different monarchs are available in a wide variety of choices. There are plenty of sizes to choose from, including the half, double and quintuple Sovereign.

Download the 7 Crucial Considerations To Buying Tax Free Gold Coins Here

If we take a close look at the reign of Queen Victoria, we can find sovereigns that feature the great Queen’s young and old portrait, and also the Jubilee head. Therefore, choosing sovereigns create great value, as well as balance for your portfolio. The Britannia has only ever featured Queen Elizabeth on its obverse, whereas the Sovereign has contained numerous monarchs.

The gold sovereign provides great variety for a portfolio

Value

Most investors find it lucrative to purchase coins that offer more quantity of gold for the price.

Gold Britannias provide a lower price per gram than Sovereigns due to being four times the size. Both fetch similar prices per gram when being sold and both are Capital Gains Tax-free due to their legal tender status. It’s also important to note that many issues of the Sovereign carry hefty premiums due to their historical value. However, the gold Britannia is available at far lower premiums, since it is a more recent coin. The Britannia is four times larger than the Sovereign, making it a more expensive coin. Lower stake investors could find its purchase to be way beyond their means, while the Sovereign provides easier access to the gold market for these investors.

Divisibility

The Sovereign’s smaller size offers more divisibility,

Liquidity

Both the coins enjoy an extremely strong secondary market, making it easy to sell at any point in time. Liquidity is an important consideration when investing in gold coins. Investing in illiquid coins defeats the very purpose of your investment, as you may be unable to realise its value at a time when you need it most.

Choosing the right coin

Daniel Fisher, CEO of Physical Gold provides a guideline to choosing these coins in a fascinating video released by the company. According to him, the choices are guided by the portfolio size. For a smaller portfolio of around £2,000 – £5,000, Sovereigns are a better choice. However, if the portfolio size is in excess of £10,000, the Britannia should be included.

Call the experts at Physical Gold to make the right choice

Our investment experts can help answer all your questions about investing in gold coins, whether you want to buy the gold Britannia or the Sovereign. Call us today on 020) 7060 9992 or simply drop us an email. A member of our team will be in touch with you right away.

Image credit: Wikimedia Commons

Gold Britannia coins are popular with numismatists and investors alike. We frequently receive questions about these popular coins, so have prepared this page of gold Britannia coins FAQs with answers, which we hope helps you with your research.

What are the cheapest Britannia gold coins?

Please visit https://www.physicalgold.com/insights/what-are-the-cheapest-gold-britannia-coins to read a comprehensive answer to this question.

How do I sell Britannia gold coins?

Please refer to our detailed answer to this question by clicking this link.

Are gold Britannias legal tender?

Read our answer to this especially important question here, https://www.physicalgold.com/insights/are-gold-britannias-legal-tender.

Are gold Britannias a good investment?

Please visit https://www.physicalgold.com/insights/are-gold-britannias-a-good-investment/, for a detailed reply to this question.

Gold Britannia vs Sovereign

Please read our detailed answer to this question at this link.

Buy the Gold Britannia coin directly from Physical Gold Limited

Was Britannia on Roman coins?

Britannia has actually appeared on Roman coins since 119 AD. The practice of using the persona of an authoritative female to portray a nation has existed for hundreds of years. When the Romans invaded Britain, they used the depiction of Britannia to signify the colonised country on their coins.

Can you get Platinum Britannia coins?

We have provided a separate blog post to answer this question, please see https://www.physicalgold.com/insights/can-you-get-platinum-britannia-coins.

Should I buy old or new Britannia coins?

For a detailed reply to this question, visit this link.

What is the value of Britannia gold coins?

See https://www.physicalgold.com/insights/whats-the-value-of-gold-britannia-coins/ for a detailed answer to this question.

Which years does Britannia face left?

There is no pattern to which way Britannia faces on the reverse of UK coins and this adds to the collectability. Examples of Britannia facing to the left include the 2001 ‘Una & The Lion’ Britannia and the 2005 Philip Nathan designed coin which features a seated Britannia.

Who is Britannia on the coins?

Read our detailed answer to this question at https://www.physicalgold.com/insights/who-is-britannia-on-the-coins.

What are Britannia gold coins?

Please read our detailed answer to this question by clicking this link.

How to buy gold Britannia coins?

The best place to buy Gold Britannias is directly from a reputable bullion dealer. Most will have online stores where Britannias can be bought with a variety of payment methods and delivery is usually free, insured, and quick. These sites usually feature live pricing which updates with the spot price every 60 seconds. Bullion dealers should be members of the BNTA to ensure trustworthiness.

Do you have any more questions?

No worries, if you need any further support, please contact us at:

- By phone – 020 7060 9992

- By contact form – https://www.physicalgold.com/contact

There are many gold coins in the market and an investor needs to decide which ones to add to his portfolio. Undoubtedly, two of the best British coins that are attractive to investors are the Gold Britannia and the Gold Sovereign. In this article, we will explore the merits and demerits of both these coins and assess them based on key attributes and fundamentals required for building a strong portfolio.

Variety is the spice of life

A key consideration when choosing any gold coin for your portfolio is variety. As an investor, you need to have a good distribution of popular gold coins in different sizes and dimensions. There can also be variations based on the year of issue. The Gold Sovereign is an excellent choice when it comes to variety. The coin has been around for more than two centuries and several issues over the years are available from the reigns of different British Kings and Queens. In terms of size, there is also a wide choice that’s available.

A Sovereign from the reign of King George IV

The Sovereign comes in different denominations such as the half, double and quintuple Sovereigns. Within the reign of just one British monarch – Queen Victoria, there are three available variations of the Sovereign. These are well-known as the Young Head, the Jubilee Head and the Old Head. When one takes into consideration all the attributes of the Gold Sovereign, it can be called an excellent choice that adds divisibility, variety and balance to your investment portfolio. When we compare the Britannia to the Sovereign, it’s worth noting that the Britannia only carries the portrait of our current Queen, Elizabeth II. On the other hand, the modern Sovereign carries the images of eight British monarchs.

Value for money

Gold Sovereigns are around one quarter the size of Britannias (1oz), making them slightly more expensive per gram due to the higher relative production cost. However, their smaller size provides more flexibility for gold investors. A mix of both is preferable in a portfolio, especially as both coins are tax-free in the UK due to their legal tender status.

The Gold Britannia is the flagship coin of the Royal Mint

Some Sovereigns may carry premiums based on their rarity and historical value, however, Sovereigns that were minted as a bullion coin are easily available at low premiums. By this comparison, the Gold Britannia is also a bullion coin that has been around since 1987. Since it is a recent coin, Gold Britannias do not carry any historical premiums. The coin is easily available from most gold dealers with greater discounts on larger volume purchases. However, the Britannia is four times larger than the Sovereign in size, making it a more expensive coin.

Download the 7 Crucial Considerations before you buy Gold HERE

Divisibility provides balance to your portfolio

The Sovereign provides a greater variety and choice when compared to the Gold Britannia. Due to its smaller sizes, the Sovereign provides investors with the freedom and flexibility to sell the coin at various price points in the market by trading in different sizes and denominations.

Liquidity is an important consideration

In terms of liquidity, both coins are evenly poised, since they enjoy a strong secondary market. For investors, liquidity is a very important factor as investing in obscure coins defeats the objective of investment. The coin should be saleable at any given point in time for an investor to redeem its value. The Gold Britannia and the Sovereign are both excellent coins in this respect.

Which is the right coin for you?

The gold experts at Physical Gold can answer this question, based on the fundamentals and objectives of your investment. They can offer you free advice on whether you should buy, the Gold Britannia or the Gold Sovereign. Two find out more, call us on (020) 7060 9992 or drop us an email and a member of our team will be happy to get in touch with you.

Image credits: picryl.com, Wikimedia Commons

The gold Britannia is an iconic British coin that enjoys popularity and liquidity all over the world. The flagship coin has become the backbone of any gold investment portfolio. It is interesting to note that, unlike the gold sovereign, the Britannia has only been around since 1987. So, the coin is available at relatively low premiums and does not command a historical or rarity value. Due to continuous mintage by the Royal Mint, the coin is easily available in abundance.

Why is the gold Britannia an attractive investment?

For gold investors, these coins offer amazing value due to mass production and large sizes. Additionally, the gold Britannia is completely tax-free in the UK due to its status as legal tender. Investors do not have to pay VAT or CGT (Capital Gains Tax) on these coins. This means that any profits that an investor may make through the sale of gold Britannia coins are tax-free up to a limit of £12,000 in a single tax year. Undoubtedly, the tax efficiency factor hugely enhances its appeal for investors.

Gold bullion coins do not carry hefty premiums

Where can one buy cheap gold Britannia coins?

Usually, the latest year of issue Britannia is the cheapest for the simple reason that they are the most plentiful. It is important to note that investors should look for bullion coins to be able to buy at the best rate. According to the Royal Mint, the Gold Britannia bullion coin is manufactured each year with an unlimited mintage. However, this does not imply that infinite numbers of the coin will become available every year.

The actual production numbers are largely dependent on market demand. These numbers are also dependent on the amount of gold that the Royal Mint can source every year to meet the required demand and produce the gold Britannia coins. The coins are struck at the Royal Mint’s facility in Llantrisant where blank, faceless 1-ounce gold coins are received by the state of the art coin pressing machinery and printed with the obverse and reverse of the Britannia coins. Of these, the basic, mass-produced bullion version is cheaper than any special edition varieties or proof productions.

What are the other avenues of buying the cheapest gold Britannia coins?

Generally, older Britannias cost more due to scarcity and collectability, but occasionally it may be possible to find even cheaper pre-owned coins if someone has sold a large quantity at one time. In fact, one of the guiding principles in buying gold coins is to generally avoid older coins that carry hefty premiums and totally avoid obscure gold coins.

Low mintage in specific years can also be a problem, raising the price of the coin due to scarcity. For example, in 1998, the Royal Mint released only 750 gold Britannia bullion coins. Similarly, in 2002, only 945 coins of the 1-ounce gold Britannia were released. These numbers are much smaller when compared to 2010 when 14,727 gold Britannia bullion coins were minted.

So, buying the cheapest gold Britannia coins can mean looking out for the years of issue with easy availability and large mintage numbers. Of course, since 2013 the gold Britannia is also available in a greater number of size options like the half, quarter, one 10th and one 20th of an ounce. These are likely to be cheaper, due to the lesser amount of gold contained in the coin.

The Royal Mint manufacturing facility in Llantrisant

Call Physical Gold to find out about the best deals in gold coins

Physical Gold is a highly reputed, leading gold dealer in the country. We can offer the best advice when it comes to purchasing gold Britannia coins at the cheapest prices. Call us today on (020) 7060 9992 or get in touch with us via email.

Image credits: Jeremy Schultz and Wikimedia Commons

Investing in Britannia Gold coins

The gold Britannia is perhaps the most famous UK gold coin. The coin is well-known all over the world for its popularity and liquidity. Gold experts believe that it is a flagship coin that every investor needs to start with when building a portfolio. The coin has only been around since 1987, and therefore, does not command high premiums based on age and rarity. It is available with every gold dealer as a bullion coin.

The Britannias track the gold spot price and can appreciate or depreciate with that price. It’s arguably the most popular gold investment in the UK as the coins are very good value due to mass production and their larger size. They’re completely tax-free due to their legal tender status, and their Royal Mint heritage enhances their global appeal.

The iconic Britannia is also available in silver

The spot price plays a critical role in determining the value of a gold Britannia. Of course, supply and demand for particular coins can vary in the market. Although the coin has only been around for four decades, specific years of issue can be hard to find. These coins may carry premiums up to 5% due to their scarcity. In general, the 1-ounce gold Britannia has been known to command, approximately 98% of the current spot price of gold.

What are the factors that can affect the investment value of a gold Britannia?

Apart from the spot price, there are a few other factors that may impact the value of a gold Britannia. To start with, it is a bigger coin and provides investors with more gold content. This makes it very attractive as an investable coin. Larger gold coins provide investors with the opportunity to acquire more gold at a lesser price per gram, due to lower production costs. The gold Britannia falls under this category and is considered to be a lucrative coin to invest in. As discussed earlier, scarcity of specific issues and special commemorative issues can escalate the price of those specific coins.

The Britannia icon, seen here as a national statue, is represented on the coin

Tax efficiency makes it a lucrative investment

The gold Britannia is a highly tax-efficient coin, making it attractive to investors. Since the coin is minted with investment-grade gold, it can be bought VAT free. Similarly to the Gold Sovereign, the Britannia is legal tender in the UK and therefore qualifies for CGT exemption. This is an added fillip for investors, as any profits accrued from the sale of the coin up to £12,000 per tax year can be had without paying any Capital Gains Tax.

Fineness of gold

Since 2013, the gold Britannia is being minted using 24-carat gold with a fineness of 0.999. This is a very powerful reason for investors to acquire the coin. The coins released before 2012 contained 22-carat gold with a fineness of 0.917. Since 1990, the gold alloy used to construct the coin contained silver, instead of copper.

Different dimensions

Another reason for the gold Britannia to be the backbone of every gold portfolio is the variety factor. The coin was initially released in four sizes – 1 ounce, half-ounce, quarter-ounce and one-tenth. However, since 2013, a 5-ounce coin is available, which is very lucrative for investors. Additionally, a fractional coin that is one 20th of an ounce is also available in the market. This has improved, divisibility, as well as variety, making the gold Britannia an excellent investment.

Call Physical Gold to discuss your gold Britannia purchases

Our gold experts are adept in acquiring the best deals for the gold Britannia coin as well as the silver Britannia coin. We can advise you on the right investments in gold and silver coins to strengthen your portfolio. Call our team today on (020) 7060 9992 or drop us an email and a member of our team will reach out to you right away.

Image credit: Eric Golub and Wikimedia Commons

Selling Gold Britannia coins

One of the golden rules of investing in gold coins is never to buy obscure coins. Gold Britannia coins offer liquidity to your portfolio. As a popular investment coin, it is easiest to sell Britannias to a reputable precious metals dealer, especially one whose focus is gold investing. The first consideration when selling gold Britannia coins is the spot price. The 1oz gold coin can usually be sold for around 98% of the prevailing spot price of gold in the market. However, supply and demand can also play an important role in the price you can achieve when selling gold Britannia coins. Although the coin has been around since 1987 and does not command premiums due to rarity and age, there are some years of issue that may be harder to get. These coins may achieve a higher premium – up to 5%. In this article, we will explore the best strategy is to adopt when selling gold Britannia coins.

The gold Britannia was launched by the Royal Mint in 1987

How does the spot price affect the value of a gold Britannia when selling?

The price will reflect the coin’s gold content and a sale can be tied up very quickly. Selling Britannias privately may achieve higher prices if you can find a collector, but issues of trust and time exist. In reality, the spot price only indicates a guideline at which the coin can be sold. Market conditions can dictate the amount of premium that you can hope to achieve over and above the spot price.

Download the Insiders Guide to Selling and Buying gold coins here

Now, it’s important to realise that other factors can impact the selling price of the gold Britannia. For example, if the coin you’re selling is larger, it benefits from lower production costs. Therefore, it is an attractive proposition for the buyer, as the coin becomes available at a lower price per gram.

Build a good relationship with a reputable dealer

An important step in selling gold Britannia coins is getting connected with a well-known dealer. Selling gold coins privately is a time-consuming option that is fraught with risk. If you attempt to sell your gold coins to a jeweller or a high-street gold shop, you will invariably receive far lower prices than expected. A reputable gold coin dealer can offer advice on the right time to sell the coins and assist you in achieving the price you desire.

Early intimation of your intention to sell can help your dealer scope the market and identify buyers in advance. Identifying reputed dealers can be fairly simple. Most of them are registered with the BNTA. Dealers like Physical Gold will also offer you a transparent process for selling and ensure you benefit from the right advice when you sell your coins with them.

Like the gold half Sovereign, the gold Britannia is a very popular and liquid coin

Ensure that you make tax-efficient sales

If you invested wisely, at the time of buying, you would have added divisibility to your portfolio by investing in different sizes and denominations of the gold Britannia coin. When selling, this should enable you to sell the exact amount of gold required to fund your cash requirements. This would also enable you to drip feed small amounts of gold into the market and take advantage of different price points.

The gold Britannia is legal tender in the UK and any profits you make from its sale are CGT exempt up to a level of £12,000 in a single tax year. It’s important to be aware of the tax implications when making a sale so that you are not misled by third-parties.

Talk to our investment team before selling your gold Britannia coins

Physical Gold is one of the nation’s most reputed online gold dealers. Our investment experts research the gold market at all times. If you intend to sell gold Britannia coins, please call us on (020) 7060 9992, so that we can give you the right advice on how and when to sell. Our investment team is also reachable online through our website.

Image credits: Wikimedia Commons and Wikimedia Commons