Silver Investment

All you need to know about the world of silver investing. Comparing silver coins and bars, benefits of silver investment and the supply/demand dynamic.

Investing in Silver

Whilst the concept of investing in gold may be familiar, even to those who have never done it, silver investing through reputed silver dealers remains slightly more marginalised and outside of the thought process of many investors.

However, that situation only makes this investment more attractive for a savvy investor. With a lower price point than gold, silver can be more attractive to the casual investor, whilst also allowing the experienced investor to further diversify their portfolio. It’s reassuring to know that you can silver investment is quick and easy in the modern trading environment.

Over the last five years, investors have slowly begun to realise the potential benefits, but the retail investor is still far behind that of the gold markets. The result is an undervalued market with great potential for profit. Learn more about the growing trend for silver stacking in our revealing blog article.

History of silver

Silver has almost always been considered a recognisable store of wealth, evolving to its current status as the most exciting commodity in which to invest.

Whilst pure silver is rarely used as currency now, there is the odd exception. The US state of Utah, for example, still accepts silver as legal tender, to be used in the payment of ‘all debts’! However, these days, it is more commonly used as a traditional commodity and as a natural resource, which can be used in various applications.

Around 40% of silver is used for a huge array of industrial purposes. Being the most conduction metal known on earth, it’s a perfect choice for electrical components. Due to its antibacterial properties, the use of silver in medical and cosmetic applications has also grown in recent years.

Silver Britannia Coins

View products

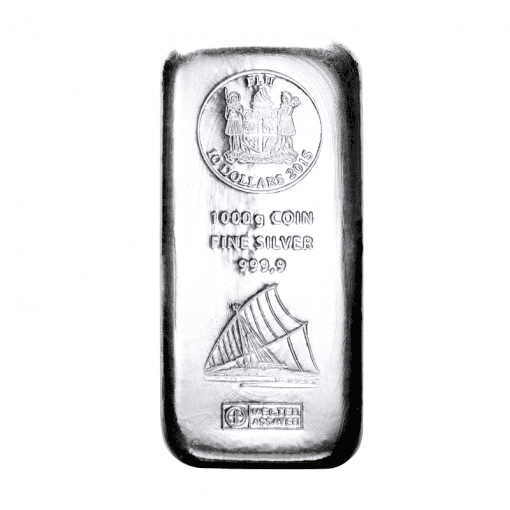

1kg Silver Bar

View products

Foreign Silver Coins

View products

Silver Queen's Beasts

View productsSilver Supply and Demand

Like other commodities, the key driver of the silver price is the ever-changing relationship between supply and demand.

Unlike gold, however, the volume held on the planet, and available to purchase, is generally accepted to be diminishing. This is due to the fact that numerous industrial applications of silver, including photographic supplies, can only use the silver involved once. Coupled with the increasing industrial use of silver, the situation creates a landscape in which silver demand will grow, whilst supply diminishes. As a result, silver investing is widely acknowledged as one with an almost guaranteed profit projection.

CGT-Free Silver Investing

Unlike gold, silver investing is not inherently VAT free.

However, through a properly structured purchase, it is possible to invest without paying Capital Gains Tax (CGT). Buying Britannia silver coins, for example, avoids CGT as they’re classed as legal tender. Since the beginning of 2021, sourcing silver coins and bars from the EU will no longer be VAT-Free due to Brexit changes. Learn more about how you can be tax-efficient while investing with our ‘All you need to know’ VAT guide.

Learn about the 7 Crucial Considerations before investing in silver

An insider’s step-by-step insight into choosing the best silver investment

Why invest in silver instead of gold?

Silver offers many alternative benefits to gold. Whilst providing a hedge to paper assets, it also provides further diversification if you already own gold

A silver investment is far more affordable than gold bars (especially larger bars such as 1KG) and gold coins, which makes it a more accessible option as a valuable hedge. Traditionally silver has been around 15 times cheaper than gold but the gap between the two has widened dramatically in recent years, prompting many experts to predict a far greater profit potential than gold.

Increasing global silver demand

Increases in silver price are expected to take place due to the increased demand for silver globally, primarily due to industrial demand.

The electric car industry, the solar energy industry, and electronics component manufacturers all use silver heavily in their operations. On the other hand, silver is becoming increasingly scarce and production levels are dropping globally. For example, Peru, a leading producer of silver globally, has published warnings that their production levels have dropped significantly. The government state that supply has dropped significantly in Cajamarca, the largest producing region in the country. The government report states that the output of from mines has dropped as much as 12%.

This is likely to have a significant impact on the silver spot price and we are soon likely to witness a steady increase in silver prices. Therefore, now looks like a good time to invest in silver and hold on to the investments over the long term to gain from the price differential. With the gold-silver price parity at 85:1, silver is a great buy without having to invest a lot of money. There are plenty of options as well from VAT free silver bars (such as 1KG) to silver bullion, as well as valuable collectable coins of numismatic interest. Overall, the relative low-level price point, opportunity for profit and further diversification of your investment portfolio make silver worth investing in. The buying options give investors a good choice in liquidity and can be very divisible should you need to.

Your Silver Investing Options

At Physical Gold, our silver investment experts specialise in advising clients just like you on how to invest in precious metals.

Our silver investment experts can guide you on how to buy silver and where you can get the best deals, this is the role of silver dealers. It’s also worth knowing more about buying silver bullion if you’re just interested in buying and holding silver investments. On the other hand, if you’re interested in buying collectable coins that have numismatist value, that’s an entirely different subject. In addition to the guide we spoke about earlier, the ‘insights’ section on our website has a great knowledge base, with a number of articles, including our FAQs. Also, visit our silver shop to understand the product ranges available.

In much the same way as gold, you can invest in silver in a variety of forms including coins or bars. Both types offer a range of denominations and you can add to your silver investment portfolio from as little as £350 with our range of silver coins. Our silver shop stocks a good range of collectable, limited edition, rare and foreign silver coins. And with the benefits of some coins being exempt from capital gains taxes, there is even more incentive for silver investing.

Buying Silver Coins

There’s a variety of coin sizes, types and manufacturers to choose from.

For the pure outright price, the Silver Britannia and Austrian Philharmonic are unbeatable as they’re mass-produced for the lowest possible cost. For those seeking limited edition coins, we provide access to fantastic Royal Mint issues such as the Lunar and Queen’s Beasts Series. These cost a little more to purchase, but their collectability, relative rarity and global desirability will no doubt rise in value quicker and command a premium in the future. We also cater for the need to have different size coins in a portfolio. Coins vary between 1oz, 2oz, 10oz and huge 1kg varieties!

As legal tender in the UK, Royal Mint silver coins such as The Britannia are Capital Gains tax-free for British residents. The provides a huge incentive for investors to buy these coins rather than non-UK coins or silver bars.

Owning a silver portfolio comprising silver coins also means you have flexibility to sell small amounts rather than being forced to sell one huge bar each time. With concerns about the future validity of fiat currency, ownership of 1oz silver coins could be useful to barter for goods. With the coins being very desirable, it’s incredibly easy to sell your silver so you can be assured of liquidity whenever you need it.

Buying Silver Bars

With silver so cheap, many investors are investing in silver bars to own as much silver as possible.

While 1oz silver bars are available to purchase, most buyers of silver bullion bars tend to buy larger denominations. 1 Kilo silver bars are the most popular size to purchase for investors as they provide a balance between value and size. Buying a kilo silver bar will offer a saving versus a kilo of silver 1oz coins of 6-8%. So for those seeking the absolute most silver for their money, the silver bars are the preferred option.

Clearly, the silver bars don’t benefit from having a face value like the silver coins. So in theory, profits made when investing in silver bars is taxable for Capital Gains. However, with a tax-free threshold in place (currently £6k per year), many silver investors feel they can sell either side of a tax year end and fall within those thresholds.