Gold is one of the world’s oldest asset classes that investors have always depended upon. It is seen as a generally safe asset class that acts as insurance for your investment portfolio. The yellow metal provides safety and security for investors and generates steady returns over the short term. Due to these attributes, investors have repeatedly turned to gold during times of economic uncertainty. Many investors consider gold as removing risk from their lives. The price of gold also beats inflation and protects the value of an investor’s portfolio from depleting. So, we need to understand the risks of gold investment. How do investors perceive these risks and what are they?

The risk of gold investments

While deemed as low risk, gold investment isn’t completely risk-free. The first risk is that the gold price moves lower in the time you hold the gold, known as market risk. This becomes less likely over the medium term, as any market volatility is ironed out. If buying paper gold, there are further risks such as possible leveraging of the asset and counterparty risk.

Gold investments are relatively risk-free

Counterparty risk

When you invest in physical gold bars and coins, you are free from counterparty risk. This is a risk generally associated with investments that are dependent on the fulfilment of a transaction by a third party. If there is a crisis in the market or the company that has issued you the paper gold performs poorly, the value of your investments could erode. In such cases, the value may drop to zero, in a worst-case scenario. However, the market price of gold has never fallen drastically over the last 20 years. Gold is an asset class that is free from counterparty risks and holds an intrinsic value.

Market risks of gold

The price of gold can rise or fall due to market demand. Gold is traded in the international markets at a daily price, known as the spot price. The spot price of gold is calculated in US dollars per Troy ounce. There may be price fluctuations over the short term, however, gold has always posted healthy returns over the medium to long term. The price of gold rises in value faster than the inflation rate over the medium to long-term horizon. Therefore, investors view gold as a dependable store of wealth. If we look at price charts of gold over the last 10 years, we can see that the price of gold has never gone below $1,000 per ounce during this time.

Investing in gold coins can have great tax advantages

Gold price movements

During the mid-1990s, the price of gold was quite different from what it is now. In 1996, the gold price was around $400 per ounce. Then, it rose steadily due to demand from investors. Over the next 20 years, the price of gold escalated by four times its price in the mid-90s. The price of gold started moving up around 2005. It reached the $1,000 mark in 2009. By this time, the world was in the middle of the 2008 financial crisis. Investors were moving their money to gold. In August 2011, it crossed the $1,900 mark. At the time, it was the highest peak. Then, in 2020, gold breached the $2,000 mark and is currently priced at $1,780 per ounce.

Talk to the experts at Physical Gold about gold investments

Physical Gold is one of the nation’s most trusted gold dealers. We are always proud to serve our customers and our advisors would be happy to discuss your investment plans. Call us on (020) 7060 9992 or reach out to us online via our website.

Image credits: Marco Verch and Jeremy Schultz

When you think of gold, there are many different things that come to mind. After all, it is one of the most widely used commodities on the planet and one of the world’s most prized natural resources. Today gold is used in everything from jewellery to computer chips and new uses for the metal are being discovered all the time.

Where does the term “gold” come from?

The term “gold” literally means “yellow” and is taken from the Old English Anglo-Saxon word ‘geolo’.

Want to know more about gold? Get our FREE Ultimate Guide to Gold here

Where is gold found?

Gold is a rare precious metal that has been discovered in countries all over the world. Some of the world’s biggest miners of gold include South Africa, China and Russia.

Gold rounds

Why is gold such a popular precious metal?

Gold has many beneficial properties making it ideal for use in all sorts of different things. Not only is it an excellent conductor of heat, light and electricity, it is also highly malleable and does not tarnish. Due to its flexibility, gold can be shaped into virtually anything which is why it has been held in high regard as an object of great value for thousands of years. Gold is also relatively scarce which makes it an attractive proposition for investors who wish to benefit from its rarity and keep it as a store of wealth.

Gold as a medium of exchange

Gold has been used as a medium of exchange for thousands of years.

The first gold coins were struck back in 6th century BC, and throughout history, gold has frequently been used in the creation of coins. Early civilizations such as the Romans and the Greeks had a huge influence in developing gold coinage and gold had a pivotal role in helping them develop their empire.

On 28th October 1489, King Henry VII ordered the Royal Mint to create the largest and most valuable gold coin in circulation. The gold sovereign became the first official gold coin to be minted in the UK. England was also the very first country to adopt the gold standard back in 1821. This was upheld until 1931 when the global depression and failure of the banks lead to the country eventually abandoning the gold standard. Up until as recently as the 1970’s countries around the world including the United States still upheld the gold standard.

Assortment of gold bars

Interesting facts about gold

– Gold is highly valued for its unique yellow colour. it is currently the only known metal that is naturally yellow or “golden”. Other metals may develop a yellow hue if they become oxidised with other chemicals.

– Gold is literally from out of this world. It is believed that the precious metal is formed when two stars collide causing heavy elements to be ejected outwards. Check out the video here.

– Gold is non-toxic and non-irritating when ingested which means you can eat it without consequence. Edible gold leaf has frequently been used to decorate extravagant items of food.

– The world’s largest gold nugget ever found was discovered in Australia in 1872. It weighed an incredible 204lbs and was over 5 feet tall.

– It is estimated that around 20 million tons of gold is lying under the ocean.

– China is currently the biggest producer of gold in the world, responsible for producing over 463.7 tonnes of the precious metal in 2016 alone.

Gold as an investment

Gold is one of the most popular forms of investment available today. Not only is it considered an excellent store of wealth, but it is also very liquid and easily transferrable. There are many different types of gold investments including gold bars, gold coins and gold ETF’s. Investors circumstances and what you’re looking to achieve from your investment will determine which option is the best choice for you. For example, if you don’t have a safe at home you may not wish to store gold coins in the house, and therefore you may decide it is less risky to buy gold ETF’s. Since the financial crisis of 2008, more and more investors have turned to gold as a protection against economic uncertainty particularly in countries like China and India. This is because gold is a physical asset and not so reliant on unstable currencies and market movements.

Invest in gold today with Physical Gold

Physical Gold is one of the UK’s leading gold dealers specialising in a wide range of gold investments suitable for every requirement. You can browse our catalogue of gold investments here or for more information please call us on 020 7060 9992.

Image Sources: Wikipedia and Pixabay

Various Gold Investments

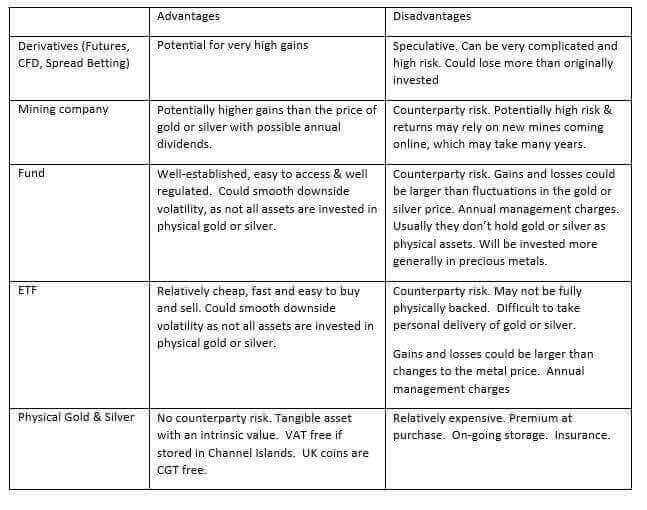

While our focus is physical gold bars and coins, it’s important to consider all different types of gold when considering an investment. Gaining exposure to the gold market can be achieved in many ways, each with its merits and likely one may suit your objectives more than others. We evaluate each option available here. In the meantime, if you conclude that it is indeed the tangible physical gold that appeals, then read on.

Different Types of Physical Gold

When people think of types of gold, they usually imagine huge brick-like gold bars, in vast, elitist bank vaults. Or they might imagine pirate-like treasure chests, full of gold coins. Others imagine nuggets of gold, prized from the earth, or some various expressions alluding to gold dust.

Our most frequent encounter with gold is with jewellery – whether it be gold rings, necklaces or bracelets. Gold jewellery as an investment differs from gold coins and gold bars in several ways. Firstly, it has a use. You can gain pleasure from wearing jewellery. Apart from running your fingers through it, gold coins and bars don’t have an actual use (although owning them still provides pleasure!). Secondly, gold jewellery has a design element that can make each piece unique.

We also see gold in leaf form (which is usually 22 karat gold) more often than you might think. Very thin layers of gold are used for gilding and have been used throughout history to adorn fine artwork and also as a decoration (e.g. in book covers). At a microscopic level, gold is also available as gold dust, this has value if enough can be accumulated into one piece.

So, is jewellery a worthwhile investment?

This design element means the value of the gold jewellery is subjective. The price you pay for jewellery far exceeds the value of the gold content itself. For this reason, gold jewellery tends to be less effective as a form of investment than gold coins and bars. If the gold price rises, your jewellery will appreciate at a slower rate, as its value consists of subjective design value, not just gold. The only way gold jewellery will ever rise in value faster than gold bars or coins is if the designer becomes renowned or the piece becomes very rare.

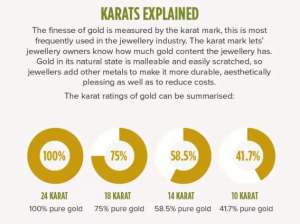

High relative production cost

The biggest problem with investing in gold jewellery is the making charge. Essentially, this is the cost associated with the production process, which includes design. There are labour costs involved with this that cannot be recovered when you sell that jewellery back into the market. Dealers only pay for every ounce of gold that’s actually in the jewellery. Moreover, 24 karat gold is no good when it comes to crafting jewellery. It’s way too malleable to retain shape and bring out all the detail in the design. So, 18 or 14 karat gold is the material of choice for making jewellery. This means when, you’re buying jewellery, you’re not getting gold with 999.9 purity.

Inefficient use of gold

In addition to the above, there are wastage charges to consider. To create attractive gold jewellery that boasts stunning designs, there’s unwanted gold that’s removed and discarded as scrap. However, the customer, i.e. you, still have to pay for this. So, you’re paying for gold that doesn’t actually come to you. Wastage charges may be as much as 5 to 7% and could vary with each job. Interestingly, as most jewellery is crafted today using precision technology and high-quality machines, not a lot of gold should actually be wasted. However, jewellers continue to charge customers ‘wastage charges’ as a percentage of the actual cost of making the jewels. Also, it’s important to remember that gold, as a precious metal can simply be melted down and used again by the jeweller. So, in essence, the customer ends up paying for gold that is reused by the jeweller.

Cost calculation of gold jewellery

The actual costs of ordering custom made gold jewellery from a jeweller can be calculated as the total amount of gold to be used, priced at the spot price on that day, labour and making charges, wastage charges and VAT. If your jewellery includes precious stones, that’s yet another component you need to include within the pricing. Also, one needs to be sure of the exact karat of gold being used and if you’re not careful, you could well end up paying for 18 or 22 karat gold, while your jewellery could be made out of gold with lesser purity. Often customers are at sea when it comes to all this, due to an inherent lack of understanding of the intricacies and mechanics of the gold jewellery industry. Most customers would not own professional equipment for measuring the purity of the metal or stones. All of this adds up to the uncertainty and risks associated with investing in gold jewellery. Of course, gold jewellery continues to remain evergreen, as it symbolises the status and power of the person wearing it.

It’s true; there are many different types of gold for investment,

but it doesn’t have to be confusing. When investing in physical gold it’s important to establish which form offers the best value as an asset and which will be the easiest to sell at the highest price. In the same way as trying to sell an unusual house, realizing your profits on an obscure form of gold could prove to be difficult. The world of jewellery transforms gold into various colours for several reasons:

but it doesn’t have to be confusing. When investing in physical gold it’s important to establish which form offers the best value as an asset and which will be the easiest to sell at the highest price. In the same way as trying to sell an unusual house, realizing your profits on an obscure form of gold could prove to be difficult. The world of jewellery transforms gold into various colours for several reasons:

- Appeal – customers want gold in various colours for design/aesthetic reasons

- Durability – gold is highly malleable and bent/scratched easily. Adding other metals increases durability

- Price reduction – by adding cheaper metals, the price of the jewellery is reduced

Popular colours used in the jewellery industry for gold are:

- Blue gold – created by adding indium or gallium

- Green gold – also called Electrum this is created by adding silver and copper

- Purple gold – usually consists of 79% gold and 21% aluminium, so is 18 karat gold

- Rose gold – made by adding copper and silver, with a higher proportion of copper than in green gold

- White gold – created by adding platinum or palladium, especially popular in jewellery designs

- Yellow gold – naturally reddish-yellow the intensity of yellow can be intensified by adding copper, silver and zinc

Investment Gold

Part of our process is helping you choose the best type of gold investment to meet your individual goals. Whatever your circumstances, you should always stick to the recognised forms of investment gold.

The HM Revenue & Customs definition is gold in the form of a bar or coin with a minimum purity of 995 thousandths for bars and 900/1000 for coins (minted after 1800). In short, that’s 22 karat gold coins and 24 karat gold bars.

Why does this matter to me?

There are a few benefits of focussing on investment-grade gold.1. The quality and purity of gold are assured and consistent. You always know exactly what you’re getting. I like to think of it as buying a bottle of wine from the supermarket, which is a brand you know, and the alcohol content is clearly stated. Compare that to buying alcohol in the prohibition era, and you never knew what you were drinking! This certainty is particularly important with a high-value investment where you need to eradicate the risk2. With standardised investment grade, gold such as well recognised bullion coins from renowned mints and Swiss manufactured gold bars, you enjoy the comfort of knowing your gold is liquid. This means it’s easy to sell whenever you need it. That’s mostly down to the fact that these investment-grade gold coins (e.g. Sovereigns and Britannias) and bars are globally renowned and sought.

How can I benefit?

This helps both the speed at which you can realise your profit and also the price you can fetch. Compare this with the scenario of trying to sell non-investment grade gold such as a gold nugget. The uncertainty and ambiguity surrounding its purity, authenticity and weight will narrow buying opportunities dramatically.

3. Any gold classified as investment grade is VAT-exempt to purchase. Clearly saving 20% in the UK is a great incentive, especially when engaging in an investment. All the gold we sell is investment grade as we believe in focusing on value investments with tax efficiency a priority. If you’d like to learn more about VAT and how it works with precious metals, read our revealing analysis here.

One common misconception is that a 1oz 22 karat coin has less gold than a 1oz 24 karat coin or bar, but this is not true! All of these have 1oz of pure gold. The 22 karat coins simply have an additional 2 carats of an alloy (copper and silver) to improve their wear and tear.

Our gold credentials

We are one of the most reputed gold dealers in the business. Our company is a registered member of the British Numismatic Trade Association (BNTA). Our team consists of precious metal investment experts who have many man-years of valuable industry experience. We take pride in being able to leverage that expertise for your benefit. Our experts are best placed to discuss your investment goals and advise you on the best gold products to buy. Of course, we sell gold bars and bullion coins ourselves. We also sell coin sets, which contain sets of proof coins, which have great collector value to numismatic collectors. All our products come with a watertight certification of genuineness, along with a full buyback guarantee. We also offer our customers highly secure storage and delivery service.

Watch the Physical Gold video – “The Gold price today & investing in gold medium to long term”

Diversification of investments is very important when it comes to gold investing, and those with a limited budget can take advantage of the monthly saver gold bundle from Physical Gold. With this plan, we source the best gold coins on your behalf and create a wonderful investment starter opportunity. This is a great way to eventually build up a robust physical gold portfolio, while taking advantage of the best prices in the market that we can source for you, due to our long-standing market expertise. As you receive and pay for your gold every month, the volatility in market prices is conveniently levelled out.

Common Customer Questions About Types of Gold and our Expert Answers

Read on to learn about the various types of gold available and what type of investments these make. Listed below you will see questions with their answers.

What are the various methods of gold mining?

There are four main methods of gold mining, varying according to the country of production and their method of extraction. Placer mining, hard rock mining, by-product mining and processing of gold ore. Gold which has accumulated as a placer deposit (naturally separated from rock through gravity) is extracted through placer mining which uses water as the loose material is unsuitable for tunnelling. This is the type recognised by many as typical gold prospecting, where manual panning can be used, although not commercially.

There are numerous methods of gold mining

The most recognised gold mining is hard rock retrieval which uses tunnels underground and machinery in open pits to extract gold. The larger scale enables far greater quantities to be mined.

Of course, mining for other minerals can sometimes provide the added bonus of accumulating gold in small quantities. Typically, mining for copper and gravel can end up discovering deposits of gold as a by-product. Due to the scale of the operations, some mines subsequently find large quantities of gold this way.

Gold ore describes rock and earth with fine traces of gold which are extracted through the addition of chemicals. The use of chemicals (namely cyanide) is expensive for the small yield of gold achieved, so this method is shrinking in popularity.

What are the types of gold standard?

There are three types of the gold standard. The Gold Bullion standard refers to an agreement to exchange paper currency for a fixed amount of gold bullion (not coins). The gold specie standard converts paper notes into the value of circulating gold coins. Finally, the gold exchange standard is where a government does not use the first two methods of exchange but instead guarantees a rate between its own currency and that of another country that itself use a gold standard. With the two currencies now tied, the first country is linked to the gold standard by default.

What are the types of gold futures contracts available?

There are eight varying gold contract types on offer between the two main exchanges. The Commodity Exchange (COMEX) offers the most common simple gold contracts (GC), representing 100 troy ounces of gold, deliverable on several set dates. The gold volatility index (GVF) is a pure-play on volatility with a multiplier of $500 and cycles semi-annually. miNY Gold (QO)is aimed at the more modest trader, split into 50 troy ounce contract sizes. E-micro Gold (MGC) is the smallest of all, based on 10 troy ounces. The Multi-Commodity Exchange (MCX) is based in India. The most recognisable is Gold futures (GOLD) with a 1KG notional size and a daily price limit of 3%. Gold Mini offers smaller contract sizes or 100 grams, while Gold Guinea is aimed at the smaller contract again, at just 8 grams each. All three pose a single person limit of 2 metric tonnes. Gold Petal is the final gold contract type, representing just 1 gram of gold each.

How many gold carat types are there?

There is a total of 24 carats that make up pure gold. Each is of equal value and so is 1/24th pure gold by weight. Investment-grade gold is either 22 carat (most common amongst Sovereigns and other popular bullion coins) or 24 carats (now used for some 1oz bullion coins like the Britannia and most gold bars (e.g. 1oz, 100g and 1KG sizes)).

Even 24-carat gold is not completely pure but instead will be somewhere in the region of 99.9% gold. Jewellery can commonly be made of lower carat gold such as 9 carats and 18 carats which are more resilient than higher purities, cheaper and more suited to clasping precious stones.

How many different gold coin types are there?

We have provided a separate post to answer this question. Click here for a detailed answer.

What types of different gold investments are there?

To read our detailed answer to this question, click this link.

What kind of rocks is gold found in?

Gold is located in many rock types, so prospectors are more successful in searching for these rocks rather than for gold itself. Gold deposits can be found in quartz which itself exists in river beds and large hillside seams. Heavy particles like gold can also collect within a harder intrusive rock which is formed when molten magma squeezes between existing softer rocks. Gold deposits can also be unearthed at the bottom of Alluvium deposits in river beds. This is an accumulation of sediment gathered into one area of the river, with heavier materials such as gold resting at the bottom.

How to identify types of gold?

The most common distinction between gold types is their carat or purity. This can be difficult to simply detect with the naked eye. 24-carat gold is virtually 100% pure, while 9-carat purity is as low as 37.5% purity. In its purest state, the gold will be relatively soft, while it tends to feel harder to the touch when mixed with more alloys. The colour can also vary, with pure gold displaying a distinct yellow-orange. When mixed more with silver, the white gold effect is present, while red gold contains a higher amount of copper. Assay marks on the gold will display the purity but not all gold will be hallmarked. Other than that, it is best to take it to a jeweller to safely perform a test and determine if it’s real in the first place!

There are many types of gold, with gold bars being a particular favourite

Read our detailed reply to this question, by clicking this link.

What kind of electronics use gold?

With a conductivity score of 70%, gold is a popular choice for use in electronics. Most commonly, gold is used as an electroplated coating on contacts and connectors. It shines as the superior choice due to its high conductivity, corrosive resistance, and resilience (especially when mixed with nickel). Copper and silver are both cheaper and more conductive than gold, so tend to be used in a far wider array of electronic applications. Encasing electronics in gold is increasing in popularity to appeal to the luxury market such as the Gold Apple watch.

Speak to us about physical gold investing

For a friendly relaxed conversation about investments in physical gold and any aspect of this infographic call us now on 020 7060 9992. You can also complete our contact form at https://www.physicalgold.com/contact.

Here we explore an age-old debate of cash versus gold, the benefits/disadvantages of cash and why we conclude that gold is better than cash in the bank!

Note: when we refer to cash, we are meaning cash in both a physical form as well as cash held in a bank account, which can readily be withdrawn.

Gold bars or cash, we discuss which is the best option

Benefits of cash

We start our discussions with the benefits of cash, because clearly there are many which we have listed below:

- Familiar – as a type of investment cash is familiar to everybody. Cash can readily be traded for goods and services as required

- Highly liquid – a major benefit of cash is that it is highly liquid. In times of need, the cash owner can use this for whatever purposes they require

- No counterparty risk – holding physical cash has no counterparty risk. Cash in the bank has the risk (albeit small) of the banking collapse and forfeiture/freezing by government authorities

Get the best prices for your gold coins. Download our special guide

Disadvantages of cash

There are many disadvantages of cash as a form of investment, we go on to discuss just some of these below:

- Destructible – cash in a physical form is destructible, notes will burn for example

- Devaluation – cash could literally become worth a reduced amount through an overnight currency devaluation by the issuing government

- Fraud – cash can be fraudulently copied and may cause the owner to have worthless paper (when stored physically)

- Inflation – as inflation rises the value of cash declines, in times of rampant inflation an investment nest egg can seriously deteriorate

- Local use only – most currencies can only be used locally, for global use they need to be converted, which usually attracts an exchange rate conversion fee

- No capital gains opportunity – there is literally no capital gains to be made from cash (other than perhaps in an economy in deflation, which is rare)

- Theft/loss – physical cash could be stolen or lost. Cash in a bank account could be stolen through fraud and/or bank employee misconduct

Inflation is a major enemy of cash

Why invest in gold rather than keep the cash?

When looking through the above list of benefits and disadvantages of cash one conclusion can be drawn,

physical gold has all the benefits and most of the disadvantages can be mitigated against. Gold has well and truly stood the test of time and has been used as a method of exchange in trade for 5,000+ years.

Analysing the benefits of cash, we can also say that physical gold is familiar in both coin and bullion formats, is also highly liquid and has no counterparty risk.

Looking at the disadvantages of cash it is clear that physical gold doesn’t have these disadvantages in common. Physical gold is virtually indestructible, and it can’t be devalued by the whim or economic needs of a government. Physical gold stored by the owner isn’t subject to fraud and generally (looking at history) as inflation rises so does the price of gold, which is renowned as an investment product to use to hedge against inflation.

Gold investment as part of a balanced investment portfolio

Gold is the same worldwide, there is no need to convert at a cost into a local currency. Unlike with cash, there is a chance of capital gains with gold, historically gold prices have performed well. Physical gold could be at risk of theft, so the owner does need to make sure that strong security is in place, sometimes this could be through third-party storage, which needs to be investigated carefully to reduce counterparty risk.

Convert cash into gold now

Call 020 7060 9992 and speak to Physical Gold now about your requirements and we can advise on the best approach for you. We can advise on strategies of how to best convert your paper wealth into physical gold and in doing so realise the benefits previously described. If you prefer to, email us now at https://www.physicalgold.com/contact/ for an early reply and to start discussions.

Image Credits: Hamilton Leen and Geralt

Accessing Gold & Silver

It’s not what you do, it’s the way that you do it! It’s possible to gain exposure to gold and silver in many ways, but the outcome may be completely different from one to another. The most common ways to get involved with gold investment are;

By purchasing physical bullion, buying shares in an exchange traded fund (Gold ETF), a traditional fund or mining company, or riskier option such as spread betting, futures or contracts for difference (CFD).

Gold ETF, fund or Physical Gold. Which option is best for me?

Each option of exposure to precious metals has its merits. The right choice will depend on your individual objectives. For example, if you have a high appetite for risk, then you may fancy your luck investing in a mining company. Alternatively, if you’re looking to actively trade the market, then electronic options such as ETFs will be the most efficient way to achieve the short-term speculation.

Risk

However, the most powerful benefit offered by gold and silver, is balance and protection. As well as professional traders, regular, everyday people buy gold and silver to REDUCE their overall risk.

Electronic and paper options provide investors with exposure to the market, but they also present additional risks. This undermines the value of gold & silver as a crisis hedge, or as portfolio insurance in the first place. Investment experience should also play a role in deciding which type of gold investment to opt for. Certainly derivatives should be left well alone by most people as they’re far more suitable for experienced investors. If the market moves against you, the amount you lose isn’t just limited to your original investment due to leverage.

Thinking of gold investment? Download the crucial 7 steps cheat sheet first

Similarly, if you’re tempted to invest into a gold mining company, far more research is required. Not only do you need to understand the gold market itself, but also you’ll need to examine into the underlying mining company, it’s structure and the ability of its management. Selecting a gold fund reduces the risk of depending on one company’s performance. However, you’re still investing into mining companies rather than gold itself. At the end of the day, you only actually own a piece of paper. Your exposure is not only to the underlying companies within the fund, but also to the manager’s of the fund itself.

A Gold ETF can be a better way of gaining exposure to gold itself, but it too represents certain risks. The fund may be leveraged, so that the amount invested into the ETF isn’t necessarily backed up by the equivalent amount in gold bullion. This means that if sufficient holders of the gold ETF wished to sell their holding simultaneously, there possibly won’t be enough physical gold to satisfy all those sales.

Costs and tax efficiency

Undoubtedly, if your buying cost is your main focus, then ETFs and funds are the cheapest ways to buy gold or gold related companies. The cost of manufacturing gold coins and bars is more expensive than simply buying something electronically. However there are other costs to consider. Funds generally have ongoing management fees to pay. Physical Gold needs to be stored which costs money, although an increasing number of investors are taking personal possession of their coins and bars to storage cheaply at home.

A major factor commonly overlooked is tax efficiency. Investment grade gold is VAT-exempt and certain coins are Capital Gains Tax (CGT) free making ownership fully tax efficient. For the few percent extra you pay when buying, you may well be saving up to 28% later when you sell at a profit.

CGT more important 2022 and beyond

In 2022 and beyond, CGT is a prime target for the UK Government to raise taxes in an attempt to reduce some of their furlough-induced debt. The two areas that have been discussed for amendment are;

- The current CGT tax free allowance of £12,300 could be reduced. Calculations predict that reducing this threshold to £5k, would double the Treasury’s income from CGT. Abolishing the allowance entirely would triple tax receipts

- Increasing the rate that CGT is charged at to match an investors income tax level (up to 40-45% for some!)

Clearly, once you’ve invested in gold, any changes to CGT are out of your control. Therefore, physical gold and silver coins are by far the safest way of providing long-term stability and remain tax efficient.

It’s also the most suitable way of passing wealth down the generations. Trust me, kids prefer to receive something tangible with real value than a piece of paper promising worth. They present the most secure method of protecting your family’s wealth in a tax efficient way.

One of the questions we hear regularly, particularly from investors who are new in the gold business is one touching on the worth of a gold bar. In a bid to answer this question comprehensively, we will explore all the factors that directly affect the value of a gold bar.

Gold bars aren’t all worth the same

Before we begin, it is worth noting that all gold bars cannot cost the same. Even those that have similar weight and size may not necessarily have the same value. Also, worth noting is that the price of gold bars keeps changing each day that markets are open in accordance with the gold spot price.

Read the Ultimate Insiders Guide to gold bar and coin investment. FREE pdf

Factors that determine the value of a gold bar

1) The current spot price of gold

Since the gold bar is just a piece of precious metal, it makes sense for the going price of gold to determine its value. The gold spot price tells buyers about the market’s dollar value of one troy ounce of pure gold. Visitors to our site can always see the latest spot price for gold and silver at the top left-hand side of our web pages.

The price of gold bars continuously changes

It is important to keep in mind that the gold spot price varies from minute to minute when the market is open, and also after hours in the Asian markets. After knowing the latest spot price of gold, you should then proceed with the following steps to know the value of a gold bar.

2) Weight and purity

After knowing the current price of gold, you should proceed to know more about the

purity and weight of the gold bar. Typically, manufacturers stamp purity and weight details somewhere on the gold bar – either at the back or on the front.

For the most part, gold bars are either .9999 or .999 pure albeit some brands may be .995 pure. If a buyer comes across a gold bar devoid of this information, it might not be real gold. Copper and bronze are common alloy metals that resemble gold in appearance. On the other hand, gold bar weights vary dramatically from about one gram to 1 kilogram. So, the size may affect the pricing as well.

3) Gold bar melt value

After obtaining the information about the purity and gold spot price, buyers should take gold bar’s weight (in troy ounces) and multiply that by the purity. The result will be the bar’s total pure-gold weight. After that, multiply the result by the gold’s spot price.

For example, if the gold bar weighs 10 grams (or 0.321507 troy ounces), and the gold spot price is $1250 with the purity of .9999, the gold bar value will be:

[0.321507 x .9999] x $1250 = $401.84

Therefore, in this case, the value of pure gold in the 10-gram gold bar is $353.62. This doesn’t include the premium, which is the cost above the melt value that the gold bar might sell for.

Gold bars have a melt value

4) Premium

A premium refers to the price added to the melt value of the gold bar. Calculation of the premium depends on many factors. Often, the demand and cost of production are the main reasons a gold bar may sell high and above the spot price. Premiums may vary depending on the gold bar’s weight, manufacturer or condition. It is usually indicated as a dollar value or percentage. Typically, as the gold bar’s weight increases, the premium will reduce.

So what’s the best value gold bars when buying?

The price you pay for physical gold will generally reduce as you buy more. In the case of gold bars, if you calculate the price per gram, larger bars are far better value than small gold bars. Infact any gold bars below an ounce in weight are really not of great value due to the high production cost. Most new small bars will be beautifully manufactured to include being encapsulated in a plastic cover, complete with certification. In comparison, similar size gold bullion coins such as Sovereigns (7.32g of pure gold) and Britannias, can be bought at lower premiums as they’re sold loose. 100g gold bars offer decent value, with 250g and 500g slightly better again, and 1kg trading pretty close to the underlying spot price.

Watch our related video – “How much is a gold bar worth?”

So 1kilo bars are the best for worth?

The problems with 1kg gold bars are that many people can’t afford to invest £30k+ into gold at once and secondly, it limits flexibility. After all, if you buy a 1kilo gold bar to reduce the cost as far as possible, then you can’t liquidate £10k worth of gold if you need to. You’re forced to sell the whole bar or nothing at all.

An alternative method to buy gold bullion at the best value is to approach quantity discounts in another way, depending on how much you have to spend. While 1kilo bars undoubtedly offer the best value, discounts are still available for buying a quantity of more modest-sized gold bars (e.g. 1oz).

Instead of buying one 1 kg gold bar, it could provide a good compromise to buy 10 x 100g bars instead. Buying ten 100g gold bars at once will enable you to receive a discount (although not quite as cheap as 1x1kilo bar), but still maintain a degree of divisibility so you can sell some of your holdings if needed.

5) Does brand matter in worth?

When buying gold bars, then the worth absolutely varies according to which brand bars you purchase. Brands such as Umicore tend to be priced slightly lower than Swiss brands such as Pamp, which command a premium. However, the importance of brand diminishes when you look to sell. Certainly, we’d pay the same for a gold bar regardless of its brand. We simply base our price on the gold price, weight and purity. So unless you especially want a Swiss brand for ego, prestige, or as a present, buy the cheapest bar possible. Its value will be the same when it comes to selling. We sell pre-owned gold bars which are amongst our best sellers to savvy investors who realise a brand shouldn’t impact a gold bar’s worth.

6) Value of gold bars versus coins

If you’re interested in gold as an investment, then there are two main types of physical gold to consider. Gold coins and gold bars. As long as these forms of gold are at least 22 carats in purity, then both are exempt from VAT. Other types of gold like jewellery, gold dust, lower purity coins, etc, will attract VAT and so are less attractive as effective investments. Generally speaking, your gold bar will not be worth quite the same as the equivalent weight in gold coins. The value of both tracks the factors already discussed. However, gold dealers will likely pay you very slightly more for desirable bullion coins such as Sovereigns than a gold bar. This reflects that the British coins are Capital Gains tax free and can be sold to a number of potential buyers due to their modest size. Certainly larger gold bars will usually be sold back into wholesale, so premiums are slightly lower to reflect that. We’re not talking a big difference, but perhaps a percent or so, depending on the market.

Download our FREE 7 step cheat sheet to successful gold investing here

..and how about the worth of gold bullion versus older coins?

The bigger discrepancy will be when comparing the value of a gold bar with the equivalent weight in a more numismatic coin. If you look at the value of a Victorian gold Sovereign, for example, its worth is not only based on its gold content but also its age, scarcity and desirability. For that reason, the value of a gold bar will always be lower per gram. The value of gold bars will never outpace the general gold price as they don’t contain a historical or collectable value. However, gold bars would have been cheaper to buy in the first place.

Gold bars are not the same value as gold coins per gram

Will tax affect my gold bar’s worth?

While UK coins issued with a face value, such as Britannias and Sovereign coins, are Capital Gains tax free, gold bars are not. That means the value of your gold bar could be impacted by the tax. Obviously, if you sell your gold bar below the price you paid for it, then CGT will not have any impact on the gold bar’s worth. Similarly, if you’re gold bar has risen in value, but by not more than the annual CGT threshold (around £12k per annum), then no tax is applicable, and the bullion’s value is straightforward. However, for the larger investor, selling a considerable amount of bars at once, at a profit exceeding your annual £12k allowance, will incur tax, and therefore reduce the overall sale value of your gold bar.

One way around this for sellers of larger quantities of gold bars is to sell some bars before the April 5th tax year and others after the tax year. Spreading profits over two years, ensuring gains are below annual allowances will mean no tax. This strengthens the argument for buying lots of medium-sized bars instead of very large bars which may incur CGT.

7) Timing

Obviously, the underlying gold price affects the

Firstly, the general market sentiment and supply/demand dynamic can impact the value of gold bars. That’s because the premium or discount to the spot price can vary according to how busy the market is. When the gold price rises, demand for gold increases and the number of sellers reduces. In this scenario, premiums to buy gold bars can increase to reflect the robust demand and prices paid to buy back gold also increases.

The opposite is true when the gold price is in a period of downside. Fewer buyers mean that gold bars may be snapped up at slightly lower premiums, while dealers may pay a percent less for your gold bar if you’re selling as there are an increased number of sellers.

What can I learn from this?

To maximize your gold bar’s value, buy when the market is quiet (and low) and sell when the market is on fire (even though everyone will think you’re mad!).

Secondly, the value of your gold wafer or bar can be based on either the live gold price or one of the two daily fixings. This may sound like a moot point, but it’s important to understand that on a volatile day, perhaps when important economic figures are released or interest rates increase, the price can vary greatly from morning to afternoon. So if you’re seeking to sell your gold bar, make sure you agree if you’re basing it off the live price, the morning fix (10.30am) or the afternoon fix (3 pm), as this can greatly impact your bar’s worth.

Buy Gold Bars directly from us

Now that you know how to determine the value of a gold bar, why not contact Physical Gold to buy gold bars (or even silver bars) of the weight you want? You can call us on 020 7060 9992 or send us an email through our contact page, and we will be glad to serve you.

Image Credits: Public Domain Pictures and Hamilton Leen