When we speak about the baby boomer generation, we think about a number of revolutionary events that happened during the sixties. Images of flower power, the birth of rock n roll, Martin Luther King, man on the moon, the Vietnam War, the Beatles – they all come to mind. The baby boomer generation was born between 1946 and 1964. Much of what happened during their time shaped the world as we know it today. It is therefore ironic that such a futuristic generation could not plan financially to retire.

The baby boomers

According to a study conducted by Legg Mason, an American investment management firm,

Baby boomers who are now between 53 and 71 years of age would require a savings kitty of $658,000 to retire comfortably. However, the survey revealed that the average boomer in the US had only $263,000 in savings, with a large shortfall of $395,000 to cover. This gap looks difficult to cover via the existing retirement income options available to those within the age groups.

Boomers in the higher age bracket of 65 to 74, who have either already retired or are close to retirement have so far managed an average of only $300,000 in their individual savings pots, which is still not going to be enough. British boomers were not far behind. Figures released by the Office of National Statistics (ONS) show an alarming 75% rise of people in their 50s and 60s working in the UK, with no signs of slowing down.

Learn How to Add Gold Bullion To Your Pension with our FREE Insiders Guide here

Early retirement is a pipe dream for these boomers as many haven’t saved enough for the rest of their lives. Moreover, with the increase in life expectancy, more money would now be required for these couples to carry on living comfortably. Saga, the company that caters to the boomers has christened them ‘generation W’ – the working generation.

The baby boomers are known as the progressive generation of the sixties

Conservative investment approach

Part of this predicament could be linked to their investment philosophy. Many boomers were hit particularly hard by the Great Recession, which greatly impacted the economies of industrialised nations. Many lost their careers, leading them to search for alternative employment. Their risk appetite took a nosedive during this period, leading to conservative investing trends. QS Investors, an investment management company found that boomers preferred to put more money in cash deposits, allocating 30% of their investable capital to this asset class. However, with abysmal interest rates since 2008, the goose they reaped in the past ten years could hardly be called golden.

Boomers also invested 24% and 22% in equities and fixed income products respectively. According to the new age asset allocation model put forward by an investment expert, distribution of assets between equities and bonds at the age of 60 needs to follow a ratio of 60 – 40. Of course, as we can see with the boomers, this is hardly the case. Boomers allocated only 8% in real estate and 2% in precious metals.

The boomer’s shortfall – other reasons

Of course, inflation is another factor that has eroded the savings of baby boomers. At a time when boomers could have been on their home run to make enough to beat inflation, the recession happened. Another important factor is that the new generation has also been disenfranchised by the recession, dashing their hopes of a new mortgage and financial independence. A recent study found that people under the age of 45 in Britain owned only 900bn pounds in assets. The struggles of the new generation have put pressure on many baby boomers, who are now having to support their children.

Call our investment experts to discuss your retirement

A lucrative investable asset class missed out by the baby boomers is precious metals. Call our investment experts now to discuss how building a gold nest egg can set your mind at peace during your later years. We offer SIPP schemes as part of our pension gold packages on which you can avail of a 45% income tax relief as a UK resident. Call our investment team on 020 7060 9992 or get in touch with the team online and an advisor will reach out to you at the earliest.

Image Credit: Giorgio Montersino

The case for regular investments

Investors who are serious about building a strong financial portfolio usually invest regularly. It doesn’t matter what asset class you pick, the periodic churning of your portfolio is the only way to keep it optimised. Building a precious metals portfolio is, of course, no exception.

When you invest regularly, you end up buying at various price points. So, you don’t have to worry about timing the market because the market fluctuations average out over a long period of time. For example, if you were to buy mutual funds and you invested every two months, you would build a sizable investment portfolio over a period of time, without laying undue financial stress on your budget, while gaining the advantage of averaging the various price points in the market out. Eventually, if you stayed invested for say, 6 years, you would make money.

Download our FREE 7 step Cheat Sheet to Successful gold and silver investing here

Monthly gold plan

As precious metals brokers and investment advisors, we often advise investors to put together a regular investment plan. Our monthly saver gold bundle is an excellent investment option for investors who aren’t sure about the products they want to buy. The minimum monthly threshold starts at £350 and we set you up to buy tax-free gold coins.

Investors receive different varieties of sovereigns and half-sovereigns delivered to their door. They cannot choose the coins they receive. Given that the spot prices of gold vary, you would also buy the coins at different price points, spreading your risk. This is a great way to build the foundations of a strong portfolio of physical gold. Before you know it, you would have amassed a small fortune. You can simply get started by filling out the form on this page.

A regular monthly investment can help you build a quality gold portfolio over time

The director’s pick

If on the other hand, you wanted to kick-start your gold portfolio, we also have a ‘director’s pick’ option. You can choose to invest a couple of thousand pounds, going all the way up to 50k. The tax-free gold coins you will receive are handpicked by our director, Daniel Fisher and have great investable value. All of our products come with a certificate of authenticity and we also offer a guaranteed buyback scheme.

Silver monthly saver

While we don’t run the same auto-pay monthly saver for silver, it’s still possible to regularly save in silver coins. Silver investors need to make individual purchases of silver from our online portal every month. Once an account has been created, single orders are very quick to complete.

Talk to our precious metal experts for the best investment options

At Physical Gold, we take customer satisfaction to new heights. Just call our team of investment experts if you’re unsure which monthly saver package is best for you. Call 020 7060 9992 or drop us an email and a member of the team will be in touch with you shortly. We are a BNTA registered precious metals broker and we always ensure that every customer gets the best value for their money. Call now.

Image credits: Mark Herpel

Investors have consistently turned to gold for safety during times of global turmoil. If we study gold prices over 20 years, we can see that the demand for gold spiked at specific points in time, when the capital markets had crashed. This ‘safe haven’ driven demand sent the spot prices of gold skyrocketing at those specific junctures. Back in 2002, the price of gold registered an increase of 23.96% and the trend continued into 2003 with prices rising once again by 21.74%. Gold climbed 31.59% in 2007 as the world was pushed to the brink of recession.

The years of the great recession were 2007 to 2009. The US officially went into recession by December 2007, but the early reflections were felt through 2007, sending investors scurrying for gold. Likewise, the ripple effects were felt long after, and even now, the world has not completely recovered from the devastating effects of that recessionary period. Sure enough, gold hit a record high of $1420.25 per troy ounce during 2010 – 2011.

Download our Ultimate Insider’s Guide to Gold Investment here

Stability of the yellow metal

It may be concluded therefore that gold is simply a stop-gap cover for investors looking to hedge their risks against market uncertainties. But let’s stop for a minute and take a long hard look at gold prices again. Gold offers stability and provides steady returns for the long-term investor with a serious view and a sustainable time horizon. Prices of gold were only $369 in 1996 Through the ups and downs, gold has consistently emerged stronger, leading to a high of $1664 in 2012.

Investors need to look at gold as insurance for their portfolios and use steady returns to create a stable base for their portfolio. Those who waited were rewarded with fourfold increases in gold prices over a span of 20 years. These people were rewarded because they had stable investing habits, coupled with a long-term vision for gold. Having faith in your investments goes a long way and chalking out a timeline you can follow before cashing it in.

Having a sustainable investment horizon is crucial for enjoying success with gold

Is gold still a safe haven?

The world’s fair share of economic woes continue unabated

Call our investment experts for sound advice in gold investing

At Physical Gold, setting gold investment strategies is what our investment team does best. We love to guide investors just like you on how and when to buy the precious metal. So, call us today on 020 7060 9992 or get in touch online to find out how a long-term view on gold may be just what you need in the years to come.

Image credit: Michael Steinberg

Mobiles sell by their billions each year, with smart devices and feature phones proving essential for modern life. But as handsets are replaced and e-waste mounts up, the focus is turning to recycling and the recovery of gold and other salvageable items from old mobile phones.

Old phones offer gold recovery opportunities

Phones as a gold mine

Even with the first dip in sales reported in the final three months of 2017, mobiles remain a hot property on the global market. What unifies every device, no matter its feature set or price, is a reliance on electronic circuitry and, by association, various precious materials.

Find out how to maximise profits when selling your gold coins. Download FREE here

Gold is present in fairly small amounts within almost every mobile that has ever been manufactured. An iPhone, for example, contains about 0.034g of gold. When you consider that in the UK alone the average consumer discards up to 25kg of electronic waste annually, it’s clear to see how quickly this waste can accumulate.

Other treasures exist…

Gold is not the only valuable substance found within phones. Collectively it is theoretically possible to recover 34kg of gold from a million mobiles, along with a hefty 350kg of silver and a full 16 tonnes of copper. Since there is a limited amount of gold in the world, such a resource shouldn’t be ignored.

The e-waste issue

The problem with all that gold being locked up in old phones starts when you look at upgrade trends and recycling rates.

Most people replace their phone once every two years, although this varies in different parts of the world. This is good for manufacturers in terms of sales, but bad for the environment because the illegal dumping of e-waste is rife, with levels as high as 90 per cent by some estimates.

This equates to up to 300 tonnes of gold being lost annually, which is something that needs to be addressed through education of consumers.

The gold recovery conundrum

The next issue that has to be overcome is that once old phones have been collected, it’s necessary to go about extracting their precious metals as efficiently and affordably as possible.

Older strategies have been criticised for their use of toxic substances, including cyanide, creating additional complications in terms of the environmental impact.

But methods are changing for the better….

The good news is that techniques are improving, new chemical processes are being developed and recovery efforts are being streamlined and rolled out in many countries. Research carried out at Edinburgh University has been important in this respect and might even impact the price of gold in the future.

Some countries are taking a more proactive approach to this than others. In Japan, the medals for the 2020 Olympic Games will be made from gold recovered from old phones. This raises awareness about the issue in a way that makes it easy for the public to connect with. Furthermore as gold is a more stable investment prospect than newer alternatives, there are yet more motivations to boost recovery efforts.

Get in touch with our experts for incisive advice on gold

Looking to learn more about gold and its uses? You can talk to the specialists at Physical Gold to get the lowdown on how this precious metal remains hugely influential around the world. Speak to us by calling 020 7060 9992 or contacting us online for more information.

Image Credit: Pixabay

Bollywood is a hugely popular branch of global cinema, selling around two billion tickets a year in India alone and wielding vast cultural influence. But why is gold the metal, and the colour, so commonly featured in Bollywood movies?

Traditional Indian clothing and jewellery with gold detailing

Gold in Indian Culture

To trace the roots of gold’s power on the silver screen in Bollywood, we have to look at how gold is perceived and used in the country that gave birth to this cinematic phenomenon.

While many countries see gold as a

Weddings in India are a perfect example of this. There are around 10 million each year and 50 per cent of the nation’s total spending on jewellery is specifically focused on preparing for the marriage event. The richest families will happily splash out hundreds of thousands of pounds on gold for weddings.

Edible gold is also a huge trend in India, with expensive sweets made using gold leaf that has been pummelled wafer-thin seen as a delicacy amongst those that can afford them.

With gold being ever-present in Indian life, it’s easy to see why it also plays a major role in the movies the country produces.

Gold in Bollywood

Onscreen, gold can be seen in the jewellery that characters sport and in the elaborate costumes they wear. It often features prominently in promotional material for the movies themselves, as posters for movies like Mogul and King of Bollywood demonstrate.

In terms of the Bollywood movie plots which revolve around gold, a classic example is Jewel Thief, released all the way back in 1967. Its plot focuses on a case of mistaken identity, a gold-obsessed crook and of course a healthy dose of romance.

A more recent Bollywood movie that puts gold front and centre is Players, which hit screens in 2012 and was India’s answer to vintage crime caper The Italian Job. Interestingly it was inspired not by the original Michael Caine film, but by the 2003 remake starring Mark Wahlberg.

Want the ultimate inside guide on gold investing? Download our comprehensive FREE guide here

Tasked with capturing a huge haul of gold bars with a value equivalent to over £1.1 billion, the attitude-fuelled gang at the core of the plot indulge in a few more musical numbers than Western audiences would expect to see in a gold heist.

Away from the cameras, the stars of Bollywood are just as committed to embracing the culture of gold, whether it be with their highly publicised wedding outfits or their endorsement deals with jewellery firms. The colour itself remains an inspiration for the frocks the female stars sport at major industry events, including the Golden Globes.

Get gold investment advice from Physical Gold

Our team of investment specialists will help you out with any questions you might have, whether you have gained an interest in gold from watching Bollywood movies or appreciating Indian culture in other ways. Email us via our site or call 020 7060 9992 to get bespoke guidance.

Image Credit: Pixabay

A country’s monetary policy usually has some kind of knock-on effect on the prices of all stocks, bonds and commodities. Of course, although we view gold and silver as precious metals, they are essentially traded as commodities. So, all monetary policies will have certain effects on the gold and silver markets. Investors are often confused about what quantitative easing really is and how this move affects markets. Let’s dive in and find out.

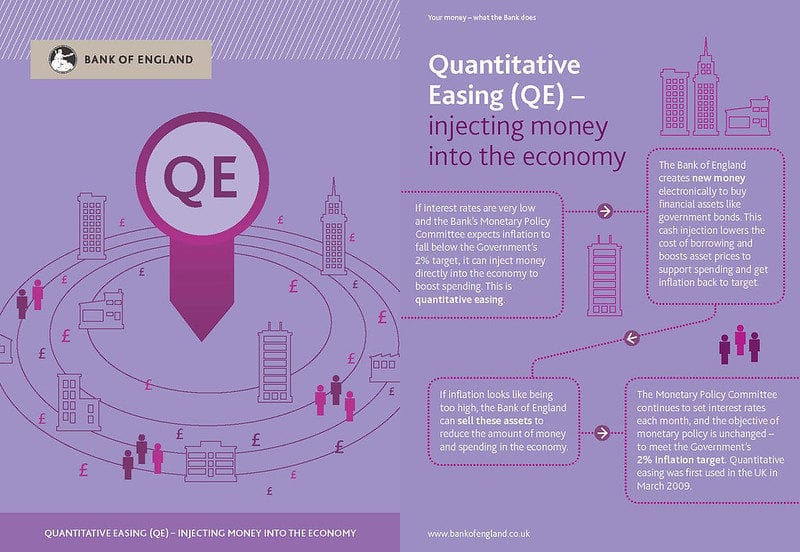

What is quantitative easing?

Firstly, quantitative easing is not a normal step taken by the central bank of a country. It is an extraordinary and somewhat unconventional move in which a country’s central bank basically increases the money supply. Many of you may think that’s inflation. But we must understand that quantitative easing does not involve the printing of extra banknotes. The central bank (in the UK it would be the Bank of England) simply buys government securities and other financial instruments from the market in a bid to lower interest rates and increase the money supply, thereby creating more liquidity.

An explanation of quantitative easing from the Bank of England

So, the assumption here is that lowering interest rates would add stimulus to the economy by encouraging industry to invest more. When companies invest and start new projects, more jobs are created and additionally, there is a positive ripple effect that kick starts smaller suppliers to also start providing services to the bigger players.

Gold is a safe haven for investors during times of uncertainty

What are the benefits of quantitative easing?

So, quantitative easing (QE) increases the supply of money and financial institutions benefit by increasing their capital base. This promotes lending and increases liquidity, ushering in a revival of the economy. Quantitative easing is usually a step taken when short-term interest rates have fallen to zero or are nearing zero levels. Going by past experience, we can say that if the central banks invest $600bn, the move typically triggers a fall in interest rates of 0.15 to 0.2%.

When did the UK first start exploring quantitative easing and what were the results?

At the height of the last financial crisis, in 2009, the interest rates were dropped to 0.5% for the first time in the history of the Bank of England. The UK economy badly needed a shot in the arm and the first QE programme for the UK was started with an infusion of £75 billion. This was eventually raised to £200 billion. The programme was rolled out on 5th March 2009. The Bank of England had been contemplating a drop in interest rates to 0.5% from 1.00% for a while. By November 2008, the financial pundits of the Gordon Brown government knew that the drop to 0.5% wasn’t going to be enough. It had to be backed by a parallel strategy that could save Britain from going into a long drawn economic depression.

Alistair Darling, the Chancellor of the Exchequer adopted a financial technique that had been used in Japan during the early 2000s. Interestingly, the same technique had also been adopted by Ben Bernanke, the chairperson of the American Federal Reserve, during the US chapter of the crisis, which triggered the fall of Lehman Bros. The radical macroeconomic technique was designed to put cash back into the hands of banks by buying out the government and corporate bonds they held.

These resources would have a two-pronged effect. Firstly, the new demand for these gilts would drive up their prices, triggering the required fall in the interest rates. Banks would now have money to pump back into the economy and things would be easier for businesses and individuals, as the cost of borrowing would be radically reduced. That was pretty much how the under-performing banks like RBS were saved back in the day. The government was able to bail them out via the QE programme.

Many homeowners also rejoiced at the time, since their mortgage repayments dropped to a negligible level. Many homeowners across Britain seized the opportunity to opt for capital repayment, ensuring that banks were able to recover their sub-prime housing loans, injecting more cash into their reserves. The move was hailed as having a double whammy effect for the sub-prime housing market in the UK. While the banks were able to claw back the money they had loaned, homeowners were able to reduce their debt exposure and free up equity in their homes.

However, many critics have been sceptical about the success of the U.K.’s QE programme. It has been 11 long years since the programme was rolled out. It had been purported as an emergency measure, designed to revive the economy and not a permanent fixture. Additionally, interest rates never recovered completely and remained near zero, as we plunge headlong into the next financial crisis. So, the verdict in the minds of many is that the program was a relief mechanism that did not have long-term success. However, in the backdrop of these criticisms, one must not forget that the UK has had the longest sustained quarterly growth record of any G-7 nation.

What quantitative easing was taken during the Coronavirus pandemic of 2020?

US response

On 15th March 2020, the US Fed announced its fourth round of quantitative easing. The Fed is purchasing $700 billion worth of mortgage-backed securities ($200 billion) and treasuries ($500 billion) with three main priorities:

- boosting liquidity within financial systems and

- increasing the aggregate demand by expanding the supply of money

- helping the US to avoid going into a recession

Part of the Fed announcement from 15th March said

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On March 23rd, 2020 the Federal Reserve announced:

“it would purchase an unlimited amount of Treasuries and mortgage-backed securities in order to support the financial market.”

UK response

On 19th March 2020 the Bank of England increased quantitative easing in the UK by £210 billion (from £435 billion to £645 billion) through the purchase of government bonds.

Andrew Bailey the new Governor of the Bank of England announcing the £210 billion quantitative easing said:

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On 18th June, 2020 the Bank of England raised quantitative easing by an additional £100 billion (from £645 billion to £745 billion) through an additional purchase of government bonds.

Andrew Bailey said after the additional easing

“As partial lifting of the measures takes place, we see signs of some activity returning. We don’t want to get too carried away by this. Let’s be clear, we’re still living in very unusual times.”

All quantitative easing to date by the central bank for quantitative easing purposes have been (click here for further details):

- November 2009 – £200 billion

- July 2012 – £175 billion and

- August 2016 – £60 billion

- March 2020 – £210 billion

- June 2020 – £100 billion

EU response

On 18th March, Christine Lagarde the President of the European Central Bank announced the €750 billion Pandemic Emergency Purchase Programme (PEPP). This was for the purchase of private and public sector securities to mitigate the economic risks caused by the COVID-19 pandemic. Purchases will be made up until the end of 2020 for all asset categories, which are eligible under their asset purchase programme.

On 4th June, the EU announced an additional €600 billion of quantitative easing with an aim of controlling inflation and stimulating vulnerable areas of the EU economy caused by the COVID-19 pandemic. This brings the total response to €1350 billion of quantitative easing when added to the €750 billion from March.

Relative comparisons of response – US, UK and EU

Although, this is a moving picture as at 22nd March the following amount of quantitative easing has been provided by the 3 different central banks:

- US – $700 billion – 3.3% of GDP initially, but this is unlimited

- UK – £310 billion – c14% of GDP and

- EU – €1350 billion – c13% of Eurozone GDP

The US response was the first and is now seen as a small intervention in the markets. Almost certainly there will be further rounds of quantitative easing from the 3 central banks.

How did the 2008 financial crisis affect QE?

The 2008 financial crisis triggered massive falls in interest rates in the UK. As the crisis broke out, interest rates were at 4.5% on 8th October 2008. By 5th March 2009, it had fallen to 0.5%. Unemployment rose as businesses failed due to their cash flows being affected by the bank’s refusal to lend. Overall consumer confidence plummeted and the entire economy entered a bearish phase. By March 2009, quantitative easing was introduced. The Bank of England put in an initial tranche of £75bn in new money, rising up to £375bn eventually.

If you want to know “How to sell gold for the most cash”, watch our YouTube video.

The Bank of England actually called it ‘asset purchase facility’ and bought assets from financial institutions like high street banks. Many of us remember the bailing out of Northern Rock at the time. The Bank of England formally started its QE program on 5th March 2009 after bailing out the high street banks. Initially, it was just long-term government bonds, but by the 25th of March, the program had been expanded to purchasing corporate bonds as well, in an effort to boost business confidence and increase lending to companies. In 2013, Japan announced a massive QE program going into trillions of dollars to boost its economy, in response to the global financial crisis.

The Bank of England introduced quantitative easing in 2009 as part of the monetary policy

In recent years, the ECB has announced a halt to its QE programme, in spite of a continuing slowdown in the European economy. The ECB is currently investing 30bn euros in buying bonds, although this program was slated to phase out by the end of 2018, Coronavirus and the world economy has caused a change in plan!

What are the effects of quantitative easing on gold and silver?

So, now that we know what quantitative easing is all about and how large industrialised economies used it during the global recession, let’s look at how it affects the gold and silver markets. Well, firstly quantitative easing is a step usually taken by central banks during economic turmoil. We already know that gold and silver act as safe havens during these times. So, if we look at price charts for gold during the period 2009 to 2011, we can see that gold prices skyrocketed during this period.

According to economist Marc Faber, quantitative easing hurts currencies and sends people rushing to buy gold. In 2016 he predicted that gold would continue to rise on the back of the fourth round of QE undertaken by the US federal reserve. On June 14th, 2018 when the ECB made the announcement to phase out QE by the end of 2018, they also announced that the European economy was still soft and interest rate hikes would not take place till March 2019. This news saw the gold market responding positively on that very day. Therefore, we can surmise that while QE is good news for the economy in terms of its GDP growth at a time of crisis, it’s not good for the stability of currencies. It’s both these reasons that spur the rise of gold prices at these times.

Call us to know more about gold investments

Our investment experts can guide you on the best times to invest in gold and silver and how to approach them. Call Physical Gold Limited on 020 7060 9992 or get in touch online and a member of our team will get in touch with you shortly to discuss your investment objectives and how precious metals can be an important part of your investment plan.

We sell a range of gold bars (sizes from 1oz, 100g to 1 kilo), gold coins (including gold Sovereigns and gold Britannias).

We also sell an excellent silver range, including silver bars (such as a 1 kilo silver bar) and silver coins (including silver Britannias).

Image credit: Wikipedia

Gold investment versus diamond investment

Diamonds are forever, goes the old song by Shirley Bassey. But which is the better asset class of choice for long-term wealth building? Gold or diamonds? Of course, much like gold, silver or any other precious metal, a diamond is a great store of value and is a desirable and investable asset class. However, in order for us to unlock this value, we have to find a buyer who will be willing to buy it at a higher price than we bought it in the first place. In order to find the answers to this all-important debate for investors, we need to first understand the pros and cons of investing in each.

Once polished and cut, diamonds have an irresistible charm

Diamond investment – pros

Innate beauty and appeal

Like gold, diamonds too are mined from underground and a rough diamond, much like a gold nugget isn’t much to look at. It needs to be polished and cut by skilled artisans before it can attain its true beauty. Like gold, diamonds also have transferable beauty and adds this to the person wearing them.

Power

Diamonds are a symbol of power and are worn by members of the higher echelons of society to establish this. Diamonds enjoy considerable demand globally as a status symbol.

Want the inside line on gold investment? Download our FREE ultimate guide here

Intrinsic value

Diamonds have an important place in our society to mark important occasions like weddings, engagements and anniversaries. The marketing machine of the diamond manufacturers have, in fact, picked up on this and emotional marketing of diamonds has raked in millions of dollars.

A safe haven for investors

Just like gold, investors often

Cons

- One of the biggest issues with purchasing diamonds is that it generates no yield. So, unlike gold, there is no steady return on the investment.

- The diamond trade has historically suffered from a bad reputation through the use of child labour and this has caused huge restrictions on the supply of African diamonds into Europe.

- Selling diamonds is not easy and usually, auction houses take their cut during a sale, thereby reducing the return on investment

- The diamond market has a steep learning curve and investors need to spend considerable time buying and selling diamonds before they learn the ropes of the industry. Similarly, novice investors can be cheated due to the intricacies involved in the identification and knowledge of good diamonds.

Gold investments are less risky and generate steady returns over the long term

The gold advantage

Gold, on the other hand, is also used as a hedge against inflation as well as disaster insurance. Diversification is a strong factor for investors to invest in gold. But perhaps the most important advantage of buying and selling gold lies in its simplicity. Online gold broking has today revolutionised the gold market. When buying gold from Physical Gold, for example, all one has to do is to register for a free account, select the gold products and add it to the online basket, checkout and pay. Storage solutions are also available if required and if the buyer is taking delivery, the gold is sent via insured post.

Learn about “Gold investment as part of a balanced investment portfolio” in this Physical Gold Ltd. YouTube video.

Call us now to discuss your gold investments

Call our expert investment advisory team on 020 7060 9992 or reach us online and a member of the team will be in touch with you shortly. If you’re thinking of investing in gold, look no further. All the products on our website are 100% genuine and come with a buyback guarantee. What’s more, our team are always happy to offer no strings attached advice on how to invest in gold and help you choose the right products to meet your investment goals.

Image Credits: Wikimedia Commons and Wikimedia Commons

Finding images on the internet has now become quite easy thanks to the popularity of social media. User-generated content (UGC) is now king, and millions of high-quality videos and images are posted every day by users, who simply want to share their content for free. Much of this content is covered by the creative commons license, which allows other users to simply download these images or videos for free, without having to pay any royalty or fees. Of course, there are certain conditions that need to be fulfilled. For example, some users insist that their work is attributed to them when it is used for any purpose, be it commercial or non-commercial. Still, others want that none of the original content, in this case, the images, should be modified in any way whatsoever.

Exclusivity versus cost

In some cases, links to the photographer’s own website need to be displayed. Many others, however, are quite happy to give it all up for free and take nothing in return and may at best request that you pay them a small fee via PayPal, as a token payment for their efforts, due to which your hassle of sourcing an image has now been reduced. One thing to bear in mind though is that, when you are sourcing images from a shared, social media-driven image bank or site, you cannot expect exclusivity. Others may also download those images for free and use them on their websites or brochures, and chances are that a reader browsing through the internet could well see the same images on someone else’s site. So, if its exclusivity that you want, be prepared to fork out some of your hard-earned cash in return for that assurance that the image you’re buying will not be available to others.

Download our FREE Insiders Guide to successful gold investment here

Of course, searching for free images can be tedious, as social media sites like Flickr, don’t always have images you like. There could be other challenges, like resolution, size in pixels, etc. But, most importantly, you may not always get enough free images relating to the subject you’re looking for. Gold, however, is one very popular theme for which there are plenty of images on sites like Flickr. In this article, we will point out 10 of the best images for gold on Flickr, and share the links with you.

1. Gold and silver bars

This soothing image of gold and silver bars weighing 10 ounces of pure gold with a purity of 999.9 has been posted by Mark Herpel. The image shows the bars displayed against a lustrous dark grey background along with a diffused white light that brings out the contrast of the bars against the backdrop. The image was taken on 4th April 2008.

2. Gold Bars from Toolstotal

This exquisite image of gold bars with 999.9 purity from toolstotal.com was uploaded by Flickr user John Jones on 3rd April 2018. The image features 8 different sizes of gold bars and the red velvety backdrop is a marvellous image for any gold-related content. The image is covered by a creative commons 2.0 attribution license. This means any user can use the image, transform, modify it, etc. as long as the source is mentioned.

3. Gold bullion coins

Contributed to Flickr by

4. Gold bars – city museum of Melbourne

This image features a number of gold bars on display in the basement of the city museum of Melbourne. The image is a great one and has been uploaded on Flickr by Brian Giesen in 2009. The image is an imposing one, showing all the bars in a shiny glow.

5. Real pure gold bar

This Flickr image features a one-kilo gold bar of 999.9 purity. The image was uploaded by JC Awe in 2012 and has a unique background and lighting effect that makes it stand out among the many images of gold bars on Flickr.

6. Gold coin of the emperor Valentinianus

Carlo Raso’s image of a rare gold coin is an award-winning Flickr image that features the gold coin of emperor Valentinianus, showing a profile of the king and a commemoration of one of his victories. The original coin is part of the numismatic collection at the archaeological museum in Naples, Italy.

7. US gold five dollars 1987

Kevin Dooley’s image of an American 1987 gold five-dollar coin is a great image on Flickr due to its detail of the obverse of the coin. The coin is a US gold eagle coin with the eagle portrayed on the reverse, which is available from Physical Gold.

8. Pouring liquid gold

Dan Brown uploaded this amazing image in 2006 of liquid gold being poured into a crucible to form a gold bar. A truly brilliant image.

9. Gold bullion pyramid

This image of a pyramid of gold bars is presented from the collection of the National Bank of Ukraine on Flickr in 2017. It is a great image that conveys the splendour and lure of gold bars.

10. Vancouver Olympics 2009 gold maple leaf

This lovely image of a 1oz gold maple leaf coin from the Vancouver Olympics 2009 collection is presented on Flickr by Eric Golub. The image was uploaded in 2015.

Call our experts to know more about gold investment

If you liked these images of gold on Flickr, and are seriously interested in building your own gold portfolio, do call our gold investment team on 020 7060 9992 or drop us a line via our website. Who knows? Maybe someday you could end up with some great treasures like these as part of your personal wealth portfolio.

Image Credits:

Mark Herpel, John Jones, Mick Baker, Brian Giesen, JC Awe, Carlo Raso, Kevin Dooley, Dan Brown, National Bank of Ukraine and Eric Golub

Comparing gold investment to stock funds is a common choice many invetsors debate. Where would your money work best and which will provide highe returns?

Capital markets have generated good returns during upswings in the stock markets around the world. However, investing in company stocks is a risky business. Capital markets were initially isolated and rose and fell based on market forces and investor sentiment within regional economies. But with the advent of globalisation, it all changed. In today’s day and age, events in one part of the world create ripple effects across the important global stock exchanges like the London stock exchange (LSE), New York stock exchange (NYSE), the Hang Seng of Hong Kong and the Bombay stock exchange (BSE) in India. Numerous forces are at work, including interest rates, fiscal measures implemented by countries, the forces of inflation and geopolitical scenarios across regions.

Forces at work

It’s not just macro-economic forces that are at work; the economics of supply and demand within industry sectors, competitor action and drivers within each industrial segment are all responsible for the rise and fall in stock prices. In order to analyse all this information and derive a successful investment strategy is a full-time job. In addition to this, picking the right stocks that are likely to generate the desired level of returns within your investment horizon requires special skills.

Investments in physical gold are more stable than equity mutual funds

Equity research

Due to this, thousands of retail investors invest their money in mutual funds and rely on the fund managers to make the investment decisions. Being an institutional investment house, mutual fund companies employ teams of research analysts who conduct research on companies based on industry sectors. This involves assessing the fundamentals of the companies, financials, the quality of the company management and their performance in the market. Key performance indicators (KPIs) like total shareholder returns (TSR), price earnings ratio and returns on capital employed (ROCE) are also taken into account.

Download our FREE 7 step cheat sheet to tax efficient gold investment here

Market unpredictability

In spite of all the science behind investments, it is virtually impossible to predict global events that lead to boom and bust cycles in the stock markets. For example, no one could have predicted 9/11 and the impact it would have on the global economy. If you were the greatest fund manager with an unerring ability to pick winning stocks each and every time, you would still have been caught unawares. Mutual fund investments, therefore are fraught with markets risks, no matter the quality of fund management or NAV (Net Asset Value) performance.

Mutual funds are subject to the inherent risks of the capital markets

Mutual funds vs gold

Apart from market risks, let’s explore some of the other drawbacks of mutual fund investments. Gold, on the other hand, is an asset class that’s simpler, more robust, steady and delivers sustainable value over a period of time. To start with, there’s less volatility within the class itself. As discussed earlier, mutual fund performance is dependent on the state of the stock markets. Even diversified equity funds that spread their risks by allocating investments over a range of industry sectors are sometimes overweight in a certain sector, making it vulnerable to sectoral risks.

High fees – Well managed funds need to

Selling price – You can’t sell your mutual fund investments like you sell shares. Since funds operate on the principle of a daily NAV, when you issue an instruction to sell, the price isn’t fixed until the trading day ends. Physical gold, on the other hand, is sold as per the spot price per troy ounce and the selling price is decided at the time of the sale.

Capital gains tax conundrum – Mutual funds charge their capital gains tax bills back to the investors simply by distributing them regardless of how long you’ve been invested. If you were invested in direct equity, on the other hand, your CGT bill would have been lower, if you had held your positions for the long term. Of course, long-term capital gains taxes are lower.

Also, the fund may have sold some profitable equities and amassed a capital gains tax bill that they would distribute across the fund holders. But, if those profitable investments weren’t part of the scheme you invested in, and your scheme ended up posting losses, you’d still be paying a tax bill although you didn’t rake in any profits. However, investments in gold in the UK are capital gains tax-free. Now that’s a compelling reason to invest in gold from a tax point of view.

Call our gold investment experts to know more about how gold investments can benefit you

At Physical Gold, our investment advisors can help you make the right investment choices and help you select asset classes based on your investment goals. Call us on 020 7060 9992 or email us and a member of the investment team will get in touch with you right away.

Image credits: Michael Steinberg and Investment Zen

Best Gold and Silver Research sites

François-Marie Arouet, the classical French philosopher and writer commonly known as Voltaire (1694-1778) once said: “Paper money eventually returns to its intrinsic value – zero.” One of the earliest uses of fiat currencies is recorded in China in the year 1000 AD. Since then, modern global economics has successfully managed to keep the solvency of fiat currencies alive. Its intrinsic value was kept alive by linking it to gold so that businesses and tradesmen would honour paper notes and coins made of base metals as having an accepted representative value. This was popularly known as the gold standard and the practice ended at the end of the two world wars, as gold reserves eventually thinned out.

Do your research to really unlock the potential of gold and silver

Rising inflation has been eating into the value of fiat currencies over the last 20 years, and global economic turmoil has left few options to generate good returns for investors. Therefore, anyone looking for a sustainable, stable store of value with strong fundamentals in order to hedge against currency debasement and market risks would seriously consider gold and silver. With the prices of precious metals slated to go up in the near future, it is important to conduct your own research into gold and silver. In this article, we’ll run through the best blogs for you to read.

Investor research is an essential step before investing in gold bars

1. The World Gold Council blog

The World Gold Council focuses on developing the gold industry by creating awareness among investors, ensuring a steady demand for gold and establishing themselves as a market authority for gold. Their blog provides insights into the gold market and helps investors understand the drivers for supply and demand in the market. The blog also provides market commentary and tracks price trends for precious metal. Through its members, the World Gold Council seeks to be a collective voice in the gold industry. Several articles on the blog are available for free download and provide investors with effective guidance on how to invest in gold.

Interested in gold and silver? Read our Ultimate Insider’s Guide to tax efficient investment here

2. The LBMA blog

The London Bullion Market Association (LBMA) is a regulatory body that sets standards for the precious metals market. The association has a footprint across 30 countries, with more than 140 members. The LBMA sets trading standards for the industry in a number of areas including purity and form. As a regulatory body, the organisation value adds to the industry by ensuring that service providers adhere to the highest standards at all times. Their blog is essentially a collection of news articles, press releases and publications relating to the precious metals industry.

3. Gold trading experts

Based in Birmingham, Gold Trading Experts is a gold industry training services provider for investors. They provide online tutorials, training materials and information designed to assist their users in understanding the dynamics of the gold market. Regular video overviews of the market are regularly uploaded on their website. In order to gain full access to their services, users need to purchase a paid subscription. The gold blog provides market updates and price trends.

Coin buyers use blogs to do their research before buying coins made out of precious metals

4. The Royal Mint bullion blog

The Royal Mint has a long history that dates back to 886 AD, during the time of Alfred the Great. Since then, the Royal Mint has been the official flag bearer for British coinage. After centuries of existence as a mint owned by the British government, it is now a limited company, wholly owned by Her Majesty’s Treasury. The mint is the official manufacturer tasked with creating the nation’s coinage. The bullion blog published by the Royal Mint is a great repository of information about the London bullion market, price information, coin reviews and articles about important coins in the history of British coinage.

5. Mint news blog

The Mint News Blog provides

6. PNG news and events blog

The Professional Numismatists Guild (PNG) is one of the best-known certification agencies in the world for gold and silver coins. Their website features a blog page under the title ‘news and events’, which serves as a library of information for investors who wish to buy gold and silver coins. Set up in 1955, PNG is an industry regulator of repute, whose coin grading service is trusted all over the world.

7. The artisanal gold council blog

The artisanal gold council caters to the mining industry and champions the sustainable development of small-scale gold mining companies. The artisanal gold council blog publishes information, articles and news related to the gold mining industry and can be an interesting read for investors who wish to know about the sources of the gold they’re buying.

8. The silver institute blog

The Silver Institute is a non-profit organisation that acts as an industry body for the global silver industry. The institute’s website is essentially a blog aimed at educating silver investors across the world. It features industry news, the uses of silver, silver price charts and links to other online resources about silver investing.

Call the precious metals team at Physical Gold to know more

As a reputed online broker of precious metals, Physical Gold has a team that provides expert advice to investors. Call us on 020 7060 9992 or get in touch online to connect with a member of our team to know more about making the right investment decisions in precious metals.

Image credits: Wikimedia Commons and Pixabay