Why is Silver Cheaper Than Gold?

09/05/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold and silver are the two most popular precious metals to invest in. While they share a number of similarities, they also possess some distinct and pivotal differences.

Arguably the most obvious of these is their huge price difference. So why does an ounce of silver cost so much less than the equivalent weight in gold?

While both metals are valuable, the reasons behind the price gap go beyond simple supply and demand. In this post, we’ll break down the key factors that make silver cheaper than gold. From how they’re mined to how they’re perceived by communities the world over. This knowledge may provide insight into possible future silver price movements, presenting great trading opportunities

Comprehending how silver and gold compare in practical terms provides a sound foundation to grasping the value variance of the two metals. Afterall, it’s these key differences that drive much of their price gap.

A precious metal is a naturally occurring metallic element that holds high economic value due to a few key traits:

Gold and silver both fit this definition, but their market value depends on how these traits play out in real-world applications.

As you can see, gold and silver share many traits that qualify them both as precious metals and valued commodities. So why is silver so much more affordable than gold? The answer lies in examining the extent to which each metal meets these criteria, along with the handful of unique qualities each possesses.

This is a straightforward one. While both metals are precious, gold is far more so than silver. It’s significantly rarer in the Earth’s crust than silver, but it’s also mined in smaller quantities each year. This scarcity increases its perceived and actual value. Simply put: less supply often means higher prices. Gold has an abundance of 0.004 parts per million in the Earth’s crust, while silver is 19 times more common at 0.075 parts per million (68th most abundant element). Want to know how much gold exists in the world? Read our report.

Silver is often mined as a byproduct of other metals like copper, zinc, or lead, making it cheaper and easier to produce in large amounts.

Gold, on the other hand, is usually extracted through more targeted — and expensive — mining operations. Greater availability of silver leads to a larger supply, keeping silver prices lower.

Silver has strong industrial demand in products like solar panels, electronics, batteries, and medical devices. This is due to its incredible properties such as being the most conductive metal known to man. But despite silver’s usefulness, industrial buyers aim to keep costs low — which limits how much they’re willing to pay. Gold, meanwhile, is driven more by investment demand. It’s held by central banks, used in wealth preservation, and less affected by price-sensitive industries.

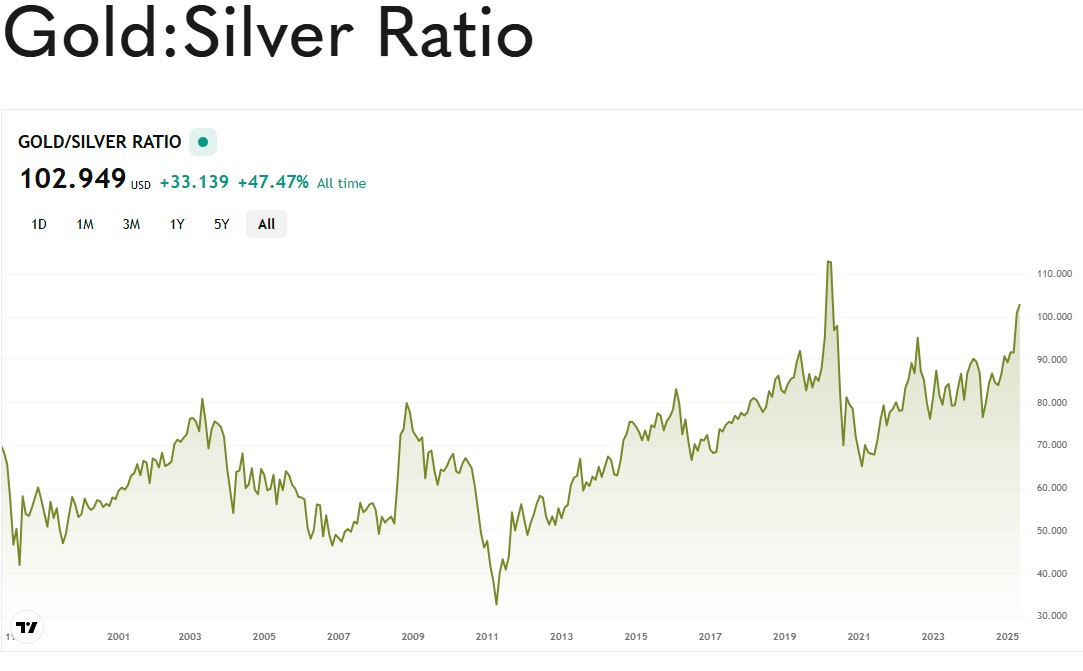

In theory, the variance in gold and silver’s price (known as the gold:silver ratio, should narrow when global growth and economies thrive due to increased industrial demand. This could be turbocharged as we move increasingly into a digital world which further demands silver components.

Conversely, gold’s price tends to extend away from silver’s when fear and uncertainty dominate markets. This creates a situation which reduces demand for industrial silver while increasing the appeal of gold as a safe haven asset.

This gold to silver price ratio chart reveals how values vary considerably over various time periods.

Silver is bulkier than gold when comparing equal Sterling values. It takes up more space, tarnishes over time, and is costlier to store and ship in large amounts. Gold’s compact, high-value nature makes it more efficient and attractive for investors who need to move or store wealth easily.

The storage fees we charge our customers reflects this difference with silver costing 50% more to vault and insure.

Gold has long been associated with luxury, royalty, and prestige. Its warm, rich colour and resistance to tarnish make it the metal of choice for fine jewellery and ceremonial objects.

Silver, while still beautiful, is seen as more accessible and practical — which plays into its lower status in terms of perceived value.

Gold has played a central role in global finance for centuries — most notably under the gold standard, where paper money was backed by a fixed amount of gold. This system, used widely until the 20th century, helped stabilize currencies and build public trust. Although the gold standard ended in the 1970s, its legacy remains.

Today, central banks around the world continue to hold gold reserves, treating it as a reliable store of value. Silver, on the other hand, hasn’t held the same monetary role in modern times and isn’t part of central bank reserves.

This long-standing institutional trust gives gold added credibility, reinforcing its role as a stable, long-term asset. It also shows how perception shapes value — gold is seen as money, while silver is viewed more as a commodity. This factor epitomises the impact of value perception on demand and prices.

Gold is often the go-to asset during economic uncertainty. When markets wobble, investors flock to gold as a safe haven, driving up demand and prices. Silver, while also considered a hedge, tends to be more volatile and speculative, which can make it less appealing during times of crisis.

We frequently simplify the differences between the two metals to customers who are unsure which metal to invest in. Gold, we explain is a great option if you wish to reduce the overall risk in your life. Meanwhile, silver is more suitable if you’re looking to take risk, perhaps with the incentive of higher possible returns.

Free ultimate guide for keen precious metals investor

Not necessarily. While silver is cheaper than gold in terms of market price, “cheaper” doesn’t always mean “less valuable.” Value depends on context — and silver brings its own unique strengths to the table.

Silver is more affordable, which makes it accessible to everyday investors. It also plays a critical role in high-tech industries like solar energy, electronics, and medicine. Its industrial utility gives it practical value beyond investment.

It also provides far more financial divisibility than gold. For example, while a 1oz gold coin may be worth £2,500, a 1oz Silver coin would fetch around £30. That means that investors have far more flexibility to sell small parts of their holding with silver, providing more nuanced control over selling.

Moreover, many precious metals investors are fearful that traditional fiat currencies will not function or be of any value in the medium-term future. In this possible scenario, using gold or silver to barter for goods is the likely requirement to survive. It would therefore be more valuable to have silver tokens worth £30 each rather than gold versions worth more than 80- times that if all you want is some groceries!

Gold, on the other hand, is prized for its rarity, cultural significance, and status as a store of wealth — especially in uncertain economic times. In these kind of situations gold is invaluable as a safe haven asset, providing reassurance and peace of mind. In this way, gold could be perceived as the ultimate form of insurance.

So while gold holds a higher price tag, silver’s versatility and wide range of uses make it an important and valuable metal in its own right. In short: silver isn’t “worse” — it’s just different.

Many market analysts perceive silver as being undervalued when compared to gold. The gold to silver price ratio can provide us with a benchmark to contrast the perceived cheapness of each metal. Historically this ratio has averaged around 47:1. In other words, silver has traditional been 47 times cheaper than gold over the past century. As of 2025, this ratio stands at over 100, suggesting that right now silver is very cheap indeed. Or perhaps gold is overpriced!?

When it comes to choosing between silver and gold, it really depends on your goals and priorities.

In many cases, a combination of both metals can provide a balanced, diversified approach to investing in precious metals. Gold offers security, while silver adds flexibility and industrial demand exposure.

Bottom line? Both metals have value — the best one for you depends on your strategy.

Not necessarily — silver is cheaper, but it still has real value, especially in industrial uses. Gold is more expensive due to its rarity, demand as an investment, and long-standing role in global finance.

Gold is more stable, widely held by central banks, and trusted as a safe-haven asset. Silver can be more volatile, but that also means it might offer more growth potential in the right conditions.

Yes. Silver is used in electronics, solar panels, and more, which creates steady demand. However, because it’s produced in large quantities, industrial demand doesn’t push the price up as much as you might expect.

Gold is rarer, easier to store, and more historically significant in global economies. It’s been used to back currencies and stabilize economies for centuries — silver hasn’t played the same role at that level.

It’s unlikely. Because gold is much rarer and more in demand as a financial asset, it typically maintains a higher price. However, silver can outperform gold during certain market cycles due to its volatility.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.