How Much Gold in the World is There?

21/11/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

While gold is abundant in cultural significance, it is surprisingly rare in nature. As global demand for gold continues to increase, it is becoming a scarcer resource. All the gold ever mined could fit into just a few Olympic-sized swimming pools—a striking visualization of its limited supply.

Despite modern advances in mining and technology, the exact quantity of gold in the world remains an enigma. Estimates vary, and much of it lies locked in vaults, embedded in everyday products, or hidden deep beneath the Earth’s surface. This scarcity is what makes gold so valuable and fuels ongoing efforts to uncover more.

We pondered how much gold has already been discovered, where it’s found, and whether there’s more waiting to be unearthed. Along the way, we explore the challenges of measuring the global gold supply and consider what the future holds for gold supply.

Gold’s allure is partly due to its rarity and limited availability. To understand its value, we must explore how much gold has been mined, where it is distributed, and just how scarce it truly is.

As of February 2024, the experts from World Gold Council estimate that around 212,582 metric tonnes of gold have been mined throughout history, with approximately two-thirds mined since 1950. Due to gold’s resilience and unique properties, a vast majority of the world’s discovered gold remains, unlike more destructible metals.

To put that into perspective, if all the gold were melted down, it would form a cube just 22 meters (72 feet) on each side or fill roughly 3.5 Olympic-sized swimming pools.

While this may sound like a significant amount, it’s surprisingly small compared to other metal resources. Steel for example has an annual global production capacity of around 2.4 billion tonnes. That’s the ability to supply around 11,500 times more steel every single year than the total quantity of gold mined in history.

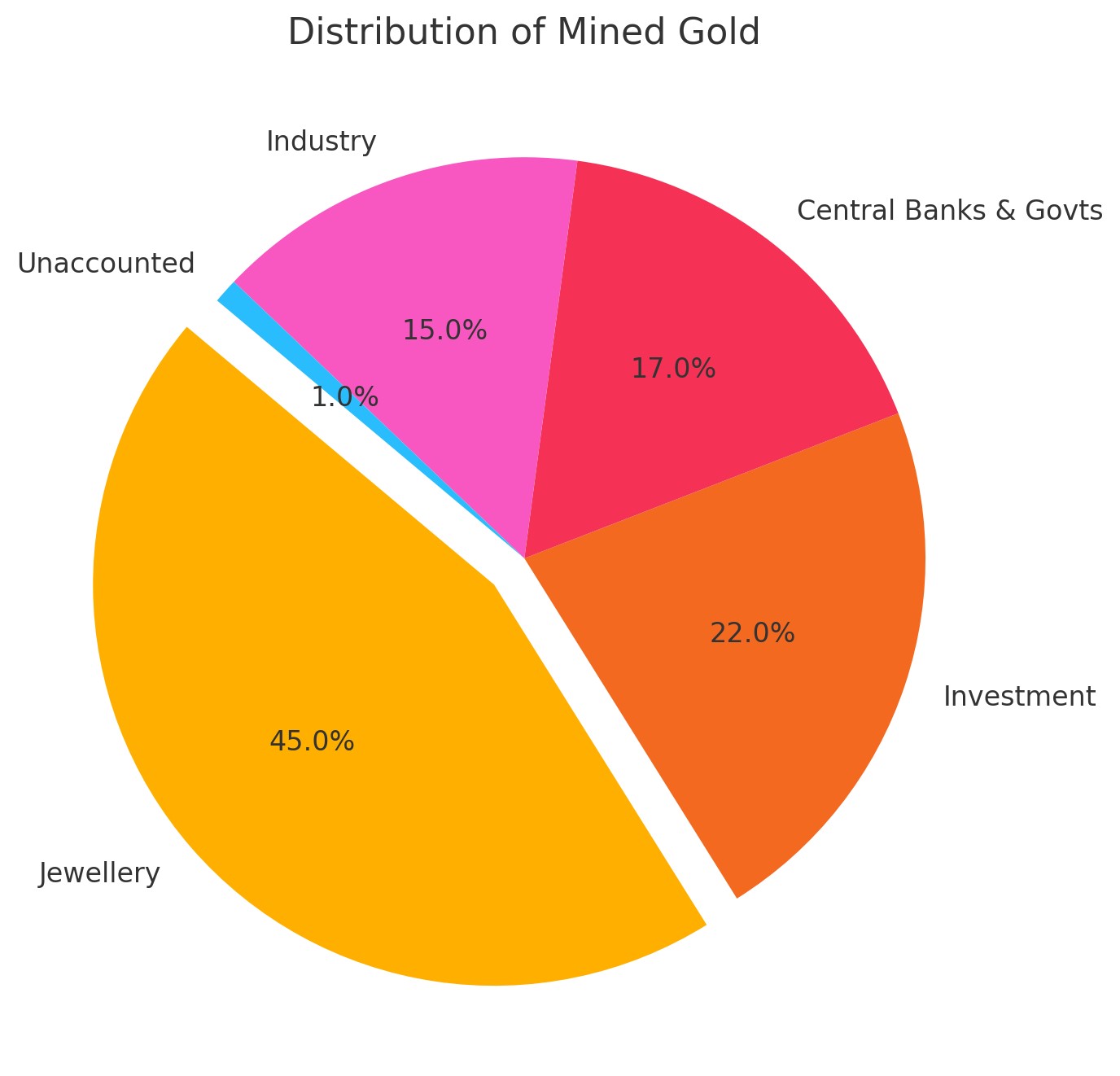

The gold mined so far is distributed across various sectors, reflecting its diverse roles in human society:

Approximately 45% of all mined gold is crafted into jewellery. This sector dominates gold’s usage due to its cultural and symbolic significance. From wedding bands to intricate cultural adornments, gold has been cherished for millennia as a mark of wealth, beauty, and tradition. This is particularly prevalent in cultures in south Asia where demand for gold spikes during festivals such as Diwali.

Around 22% of gold exists in the form of bars, coins, and bullion held by private investors and institutions. This includes the less obvious quantity held for gold-backed ETFs. Gold’s status as a “safe haven” asset makes it a popular choice during economic uncertainty. Its perceived stability against inflation and currency fluctuations ensures its enduring appeal among investors. This demand continues to escalate as traditional currencies devalue at a phenomenal rate.

About 17% of the world’s gold is held in reserves by central banks and sovereign nations. Countries like the United States with its infamous Fort Knox, Germany, and China maintain significant stockpiles, using gold to back their economies and ensure financial stability. The presence of gold in these reserves highlights its pivotal role in the global financial system. An increasing number of central banks are gradually shifting away from the reliance in US Dollar reserves and diversifying into gold. You can read about the UK’s gold reserves here.

Roughly 15% of gold is utilized in technology and industry. Gold’s excellent conductivity, resistance to tarnish, and biocompatibility make it invaluable in electronics, aerospace components, and medical applications such as dental fillings and surgical devices.

A small but significant portion of gold is untracked. Some of this may exist in private collections, family heirlooms, or buried treasures. Additionally, historical artifacts and shipwrecks may still hold vast quantities of gold yet to be rediscovered.

Breakdown of where processed gold is held

Gold is indeed scarce, making up just 0.003 parts per million of the Earth’s crust. For comparison, silver is about 19 times more abundant, and copper is 600 times more common. To extract even a small amount of gold, vast quantities of ore must be processed, with miners typically obtaining less than 10 grams of gold per ton of rock, about the weight of a small coin. This rarity is a key factor behind its high value and widespread appeal.

However, while gold is rare, it’s far from the rarest substance on Earth. For comparison:

Found at about 0.005 parts per million, platinum is slightly more common than gold but is considered more difficult to mine due to its geological distribution.

Significantly rarer, rhodium exists at only 0.0002 parts per million in the Earth’s crust. Its scarcity makes it one of the most expensive precious metals, used primarily in automotive catalytic converters and high-end jewellery.

A metal rarer than gold, iridium is found at around 0.0004 parts per million and is often associated with meteorite impacts. It’s used in high-performance applications like spark plugs and space equipment.

This synthetic element is exceedingly rare and not naturally occurring. A gram of Californium costs tens of millions of dollars, as it is produced in minute quantities in nuclear reactors.

These comparisons highlight that while gold is precious and rare, other substances surpass it in scarcity. What sets gold apart is its unique combination of rarity, utility, and timeless cultural value. It strikes a balance: rare enough to be valuable, yet abundant enough to remain widely used and accessible across industries and societies.

Free ultimate guide for keen precious metals investor

Gold’s rarity and value make the search for new deposits a continuous endeavour. While significant quantities have already been extracted, much of Earth’s gold may still lie hidden, both in untapped reserves and unconventional sources. But how much remains, and how long can we continue mining it?

Currently, global gold reserves are estimated at 59,000 metric tons, with some of the richest sources located in countries like South Africa, Australia, China, and Russia. These reserves represent gold that is economically viable to mine with today’s technology.

However, there’s more gold embedded in the Earth’s crust that hasn’t been discovered or accessed yet. Potential deposits may exist in:

Remote and less accessible areas such as the Arctic and dense tropical forests could contain significant gold reserves.

Advances in technology may eventually allow mining operations to profitably extract gold from ores that are currently considered too low in concentration.

Despite these possibilities, finding new deposits is becoming increasingly challenging. Just like the lowest hanging fruit on a tree, many of the easiest-to-access gold sources have already been depleted, forcing mining companies to explore deeper underground or venture into uncharted territories.

According to Eugene King, gold analyst at investment bank Goldman Sachs, the peak of gold has come and gone in 2015. The report claims that there may be only 20 years of gold mining left. According to King, ‘known’ reserves of gold will be depleted around the year 2035. However, similar predictions were made about oil and the Hubbert’s Peak Theory claimed that global oil had already peaked in the 1970s. However, new reserves of oil continue to be discovered even today. So, the key factor in these theories is that they are somewhat based on sources that have already been identified.

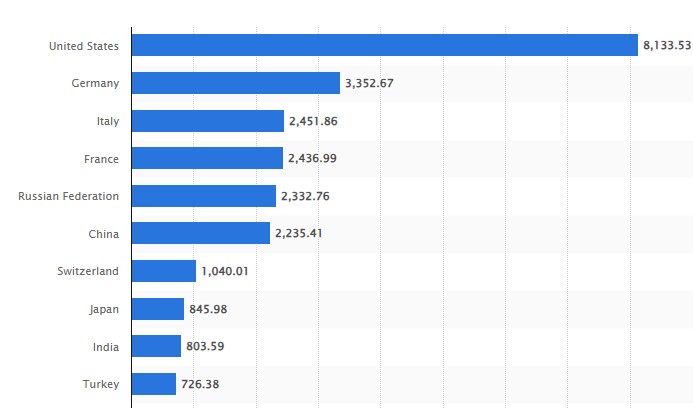

Top 10 Gold Reserves by Country 2023 (Metric Tonnes) Source: Statista

As terrestrial gold becomes scarcer, scientists and entrepreneurs are exploring unconventional sources:

The seabed holds vast quantities of gold, often in the form of microscopic particles embedded in sediments or hydrothermal vents. Although estimates suggest the oceans contain over 20 million tons of gold, the cost and technology required to extract it make deep-sea mining a formidable challenge. Environmental concerns also loom large, as disrupting delicate marine ecosystems could have far-reaching consequences.

Beyond Earth, asteroids present a tantalizing source of gold and other precious metals. Afterall, all gold originally came from Asteroids that hit the Earth millions of years ago, so it seems a promising source to explore.

For example, the asteroid Psyche 16 is thought to contain enough metals, including gold, to dwarf the value of all economies on Earth combined. However, space mining is still in its infancy, with technological, financial, and logistical hurdles to overcome before it becomes viable.

Both deep-sea and space mining remain speculative but could one day revolutionize gold exploration if the challenges are surmounted.

At the current rate of mining — about 3,000 metric tons per year — estimates suggest that known reserves could be depleted within 15–20 years. However, this timeline is not set in stone and depends on:

Advances in exploration techniques may uncover previously hidden reserves.

With around 90% of mined gold still in circulation, recycling could alleviate some of the pressure on mining. Jewellery, electronics, and industrial products are increasingly being recycled for their gold content.

Innovations in mining methods may make it possible to extract gold from previously inaccessible sources, such as lower-grade ores or ocean sediments.

While gold’s finite nature ensures that it will remain a valuable resource, the combination of exploration, recycling, and new technology may extend the timeline before we reach the limits of accessible gold. The quest for this precious metal continues, driven by its enduring appeal, universal importance, and lucrative nature.

Check out the latest prices

Determining the exact amount of gold in the world is not an exact science. In fact, educated estimations are needed when determining both above-ground stocks and underground reserves. Gold’s widespread distribution, varied uses, and the secrecy surrounding some of its reserves add layers of complexity.

As of 2024, it’s estimated that approximately 212,000 metric tonnes of gold have been mined throughout history. However, accurately accounting for all this gold is a challenge for several reasons:

Gold held by individuals—whether in the form of jewellery, coins, or bullion—is difficult to track. While central banks report their holdings, private collections are far less transparent, and many people intentionally keep their gold holdings discreet.

Over centuries, gold has been lost in shipwrecks, buried treasure, and forgotten artifacts. Some of this gold may eventually resurface, but much of it could remain lost forever.

The high value of gold makes it one of the most recycled materials. Jewellery, electronics, and industrial products are often melted down and repurposed, making it challenging to determine how much of the mined gold is still in its original form.

Gold frequently changes hands through informal or unregulated markets, especially in regions where gold serves as a form of currency. These exchanges make it nearly impossible to track all existing gold accurately.

While measuring above-ground gold is complicated, estimating underground reserves is even more challenging. Current estimates place the world’s known gold reserves at about 59,000 metric tonnes, but this figure is far from precise. Factors contributing to uncertainty include:

Gold deposits are often deep underground or embedded in hard-to-reach locations, making accurate measurements difficult. Modern surveying techniques, like satellite imaging and geophysical surveys, help but are not foolproof.

Not all gold deposits are economically feasible to mine. Factors like ore grade, mining costs, and market prices influence whether a reserve is classified as “economically viable.” These conditions can change over time, altering reserve estimates.

Many countries are secretive about their gold reserves, either to protect national interests or for strategic reasons. For instance, some governments underreport their holdings, while others exaggerate them to boost investor confidence.

Unexplored areas may hold undiscovered gold deposits, but these potential reserves are speculative at best. The ongoing exploration of remote regions and innovative mining technologies could revise reserve estimates in the future.

Approximately 50,000 metric tons of gold remain in Earth’s known reserves, according to current estimates. This represents gold that is economically viable to mine with today’s technology. However, undiscovered deposits and advancements in mining techniques may reveal additional resources in the future, extending the supply.

The United States owns the most gold in the world, with 8,133 metric tonnes held primarily in Fort Knox and other secure locations. This accounts for over 70% of its foreign reserves. The U.S. gold holdings significantly surpass those of Germany, the second-largest holder, which owns 3,355 metric tonnes

While no planet’s gold quantity has been directly measured, Earth is the only planet known to have significant, accessible gold deposits due to mining activity. However, gas giants like Jupiter could theoretically contain larger quantities of gold deep within their massive interiors, although it remains inaccessible and unverified.

Approximately 212,000 metric tons of gold have been mined throughout history. This is roughly enough to fill 3.5 Olympic-sized swimming pools.

Current estimates suggest there are about 50,000 metric tons of known gold reserves in the Earth’s crust. This number represents gold that is economically viable to extract with today’s technology.

No, gold is rare but not the rarest. Metals like rhodium, iridium, and certain synthetic elements like californium are much rarer than gold. However, gold’s unique combination of scarcity, utility, and cultural significance makes it highly valuable.

Gold is distributed across sectors:

While known reserves could be depleted in 15–20 years at current mining rates, gold is constantly recycled from old jewellery, electronics, and other products. Additionally, future discoveries and advances in mining technology could extend the gold supply.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.