Everyone is well aware that if there is a Mecca for shopping in the centre of the world, it is London. Precious metals remain high on the lists of desirables that people want to purchase, whether they are serious investors or hobby shoppers, and London is a great place to do just that. But, where can one go to purchase silver in London? There are innumerable sellers of silver in the UK’s capital, online as well as brick and mortar. Many of these are reputed and reliable sellers who have been plying the trade for long. Let’s take a close look at some of them.

Download our silver cheat sheet to learn the 7 crucial considerations before buying

The premises of the London silver vaults dates back to 1876

Physical Gold

Although the name indicates that the company is a gold coins, bars and silver dealer, Physical Gold is also a leading silver dealer in the UK. Based out of the 5th floor of Tower 42 on Old Broad Street in London, the company is a reputed dealer of precious metals and definitely worth a visit if you’re shopping for silver. Of course, the company also has a very strong online presence and buyers can speak to a member of the team on 020 7060 9992 or send an email.

The company employs a team of experts, ranging from

The best part?

The company provides bespoke investment advice, taking into account an individual’s personal investment goals. As a gold and silver specialist, the company’s investment team helps individuals make planned investments in precious metals. This is a sophisticated and planned approach to buying silver, rather than making a one-off purchase from a high street retailer.

That’s not all…

However, Physical Gold also caters to customers who simply want to buy silver as a collectable or for gifting. Numismatists frequently purchase silver bullion coins like the silver Britannia or the 1oz silver UK lunar year of the dog. Customers can rest assured that when they buy silver online from Physical Gold, their purchase is always protected by a 3D authentication payment system, ensuring that their bank details do not fall into the wrong hands. The company also assists customers in easy liquidation of their silver and also has investment schemes like a self-invested personal pension (or SIPP).

The company has a delivery scheme through which your silver is delivered directly to your location or your silver can also be stored at the company’s secure storage facility at Loomis International. Loomis International is a member of the British Security Industry Association. Physical Gold also ensures that your investments are protected via insurance through Lloyds of London.

Apart from coins, silver bars are a popular purchase for silver enthusiasts in London

Other places to shop for silver

London’s Hatton garden is another great place to shop for silver. There are many dealers in the area who offer good deals on silver. Another way to source silver is to go to auctioneers. There are online auctioneers, as well as physical ones in London where you can grab a bargain on silver items.

Yet another place to shop for silver in the British capital is the London Silver Vaults. It was earlier known as the Chancery Lane safe deposit and dates back to 1876. These were basically strong rooms where citizens could keep their valuables and artefacts in safe storage.

The facility was also open to businesses who were required to use safe storage. After the war, the premises was re-built in 1953 and rented out to silver dealers who continue to ply their trade even today. There are approximately 30 silver dealers who operate their businesses within the premises and could be worth checking out when shopping for silver. Indeed, rumour has it that the London Silver Vaults has served elite clientele, including Hollywood stars, rock n roll stars and members of the royalty.

“Britannia silver coins – a collectable investment” – a YouTube video from Physical Gold Ltd.

Call us to get the best deals on silver

At Physical Gold, we guarantee that the silver coins and silver bars (such as 1 kilo) you buy from us are 100% genuine and vetted by qualified numismatists. A certificate of authenticity accompanies every purchase made from our store, discounts are available for bulk purchases. If you’re looking for great deals on silver, contact us online or simply call us on 020 7060 9992.

Image credits: Sprott Money and Matt Brown

Silver, the precious metal with its irresistible lustre has certain amazing physical properties that make it so valuable to industry. Infact, the demand for silver has grown by leaps and bounds in recent times, mainly due to its use in the electronics and solar energy industries. The annual demand for silver from the electronics industry was recently estimated at around 249.9mn ounces. This number is a whopping 41.5% of the total demand for industrial silver, which was 599mn ounces, as of 2017.

But what makes silver such a useful commodity and why is its industrial demand rising?

Well, silver is an element, with its chemical symbol Ag, derived from the Latin word ‘Argentum’. Silver’s popularity as an ornamental metal comes from its white colour, and its natural lustre, which can be polished to create a shiny appearance. But there are other amazing properties that ensure that the metal stays in high demand from the industry.

Download our FREE 7 Step cheatsheet to successful silver investing here

Malleability

Silver is an extremely malleable metal, which means it can be beaten into thin sheets without the material cracking or shattering. One interesting use of malleable silver comes from the south-east Asian sweets manufacturing industry, where sheets of pure silver, a few micrometres thick are used as a covering for sweets and almost 250 tonnes of silver is eaten in this way every year.

The malleability of silver allows it to be beaten into sheets to make silverware

Ductility

Silver is also ductile, which means it can be drawn into thin wires several metres long. Gold is the most ductile of metals, followed by silver.

Electrical and thermal conductivity

Among all the precious metals, silver is the most efficient conductor of electricity and thermal energy. Due to this, silver is used for the contact points in all printed circuit boards and is also used in electrical conductors as a coating. The electronics and solar energy industry generate a high demand for silver. The thermal conductivity property of silver makes it indispensable for its use in photovoltaic cells in solar panels. Installation of solar panels has gone up by 24% in 2017, creating a surge in the demand for silver.

Special gloves are now available for use with touchscreen phones, created from nylon fibres woven with silver. These gloves utilise the conductivity of silver to ensure that the bio-electricity from human hands are allowed to permeate through the gloves onto the touchscreen so that users can wear the gloves outdoor in winter and still use their smartphones.

The density of silver ensures that counterfeit coins are difficult to produce

Silver as a catalyst

Silver has a unique catalytic property and is able to convert ethylene into ethylene oxide. Several organic compounds can be synthesised from ethylene oxide and this makes silver very useful in the chemical industry.

Anti-bacterial properties

Silver is known for its strong anti-bacterial properties and its use in the medical industry. It is used as a part of special clothing in order to prevent bacteria from spreading, giving rise to unpleasant odours. Silver is also present at the fingertips of specially manufactured gloves in order to prevent bacterial growth.

Density of silver

Silver is a noble metal with a high density. The density of silver is 10.5 grams per cubic centimetre. The high density of silver makes it difficult for counterfeiters to produce fake silver coins. If the size of the coin is right, but it isn’t made of silver, it is easy to detect by weight. Similarly, if the coin is made using a base metal at the right weight, its size would be incorrect. As pure silver is too soft a metal. Jewellery is often made with sterling silver, which is an alloy with 92.5% pure silver, blended with other base metals like copper, nickel or zinc.

Silver investing in 2019 and beyond – learn from Daniel Fisher

Call our team of precious metals experts to find out more about silver

At Physical Gold, our team of precious metal experts can help you to assess the genuineness of your silverware, coins or artefacts. They can also guide you on how to invest in silver, such as silver Britannia coins and silver bars (such as our 1KG bar). All our silver products are 100% genuine and come with a buyback guarantee. Call us now on 020 7060 9992 or get in touch with us online to avail of the best expert guidance on buying silver.

Image Credits: Wikimedia Commons and A_Different_Perspective

Silver has occupied a special place in our history throughout the centuries. Since the 14th century, all the way up to the 1800s, Mexico and Peru used to be the largest producers of silver on the planet, mining around 85% of all the silver in the world. As silver gained popularity, in 1794 the United States started minting silver dollars.

Silver Investment

Silver bullion today is a highly desirable form of investment, with market analysts becoming increasingly bullish on silver prices. Investors in the UK are worried about uncertainty in the global capital markets and the falling US dollar. In order to hedge their risk and diversify their investment portfolios, investors are turning to precious metals like silver. So, where can they buy silver in the UK? There are several dealers of precious metals in the UK, with London being one of the main hubs of trading activity.

If you’re looking to buy silver, then make sure you read the 7 step cheat sheet first. Download FREE

Large financial institutions are able to invest in silver direct from the leading mints across the world. For example, the United States Mint will only sell precious metals to registered financial institutions and registered numismatic dealers. But, if you’re an individual investor in the UK, you’ll need to do your homework in order to identify reliable silver bullion dealers before you fork out your hard earned cash and purchase.

Identifying reliable silver dealers in the UK

Reliability and safety are key factors to consider when buying silver from a UK trader. Obviously, you don’t want to be scammed or compromise the security of your bank details when conducting a transaction. There are other important factors to consider, like ascertaining the authenticity of your purchase and of course, transportation, delivery and storage.

Stay away from online marketplaces like eBay, when buying precious metals like silver or gold. Checking the purity and quality of your silver could be a huge problem, and you could easily become a victim of fraud. Another issue to consider is that the price you pay for your silver is likely to be a lot more, thanks to hidden costs like PayPal fees, delivery and insurance charges.

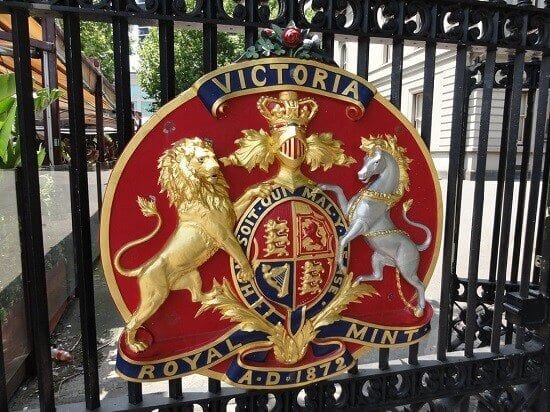

The Royal Mint is a trusted and premier dealer of silver in the UK

A reliable and trusted source of buying silver in the UK is, of course, the Royal Mint. The Royal Mint is a reputed producer of silver coins historically, for coins such as the Britannia and the Sovereign, and you can rest assured about the quality and purity. The mint provides free delivery of your coins and silver bars on purchases above £45. An important point to note, however, is that the mint does not buy back your silver, so if you plan to resell, you’ll need to go to a reputed dealer.

Who can I trust?

In order to identify reliable silver dealers in the UK, you can always use the BNTA register. The British Numismatic Trade Association (BNTA) ensures that all dealers registered with them adhere to a code of ethics and need to abide by certain industry rules and regulations set by the association. Remember, all good dealers will provide you with certification, paperwork and will always be willing to speak to you over the phone to answer all your queries and provide guidance on your purchase.

Should I invest in gold or silver? – This question is answered in our YouTube video.

Buying silver from Physical Gold

Physical Gold has always been a reliable and trusted dealer

of precious metals in the UK. Buying your silver online from www.physicalgold.com is very simple, with discounts applied for bulk purchases. All you need to do is create an online account and select the silver you wish to buy.

Bars and coins cannot be bought together so you will need to complete separate transactions for each category. There is 3D authentication system in place to ensure that your financial information is not at risk when you complete your transaction.

When you buy silver from the site, every product is guaranteed to be 100% genuine. We always provide certification and relevant papers to each and every customer. Moreover, we ensure that coins are sent to your registered address by an insured courier, while bars (such as our silver 1KG bars) are sent to our secure offshore storage to maintain their tax-free status.

A quick check on the company’s reputation online would surely assure you that we are a highly reputed and reliable dealer of silver and other precious metals. So, instead of taking a chance with high street retailers, you are advised to consider buying your silver from Physical Gold for a hassle-free, smooth transaction. If you are a regular investor, we also have structured monthly plans that help you invest regularly in silver and build up a robust portfolio that will stand the test of time and deliver great returns on your investment in the years to come.

Silver is a timeless asset class, popular with many UK investors

Call us to discuss buying silver in the UK

Our investment advisors are always ready to help customers out, and they provide advice on how to invest your money by picking great deals. Call us on 020 7060 9992 or contact us online to speak to a member of our investment team. We would love to hear from you and would welcome the opportunity to serve you and guide you on making the right silver investments over the years to come.

Image credits: E Guide Travel and Money Metals

The silver Britannia has won its place in British coinage history as one of the most iconic UK coins to be ever released. The coin was introduced in 1997 and had a fineness of 95.8% in its original issue. The 1-ounce silver coin reflected the design elements of the original gold Britannia, which was introduced by the Royal Mint 10 years earlier. The popularity of the gold Britannia prompted the Royal Mint to start minting a similar coin using silver. Within two years of its release, the fineness of the silver Britannia had been increased to 99.9%. Needless to say, the 24-carat silver coin enjoyed immense popularity amongst collectors and investors alike.

The image of Britannia used in an earlier British coin

The iconic design

The silver Britannia, like its gold counterpart, features the classic image of Britannia on its reverse. The Britannia icon was possibly conceived as early as Roman times. It is the image of a goddess warrior, carrying a shield and a trident. This classic image is a testament to the spirit and bravery of the people of Britain. The design elements used in the silver Britannia coin was created by the famous designer, Jody Clark. The obverse of the coin features an image of our reigning Queen, Elizabeth II. Since its issue, the coin has seen some changes in design and mintage with different weights and dimensions.

Silver Britannias are the most popular silver investment coin in the UK. They represent very good value as they are mass-produced to bullion finish which keeps production costs low. They are legal tender, so any gains made are also tax-free.

Investors are keen to invest in silver coins, like this USA silver dollar bullion coin

The value of a silver Britannia for an investor

The value of the coin is dependent on the spot price of silver. As a thumb rule, the coin can fetch a sale value of approximately the 1-ounce silver spot price. Generally, the sale price would be just under the spot price of silver, unless the coin commands a premium due to a collector’s edition. The bullion version of the coin is mass-produced and attracts low premiums. In addition to this, bulk orders of the bullion coin can qualify for attractive discounts, when buying from a reputed dealer. The best part is that the silver Britannia offers investors an incredible opportunity to enter the precious metals market at a lower price point. On the other hand, the gold Britannia is a prohibitively expensive coin to buy.

The rising price of silver

One of the reasons that the coin has enjoyed popularity amongst investors is the expectation that silver prices will eventually rise in the future. The use of silver in industrial applications has grown over the years and will continue to rise in the coming years, as electronic cars, solar power solutions and other electronic products continue to dominate the marketplace.

However, the production of silver has dipped over the years. Market experts believe that a price rise is imminent for silver, and investors who purchase silver Britannia coins today can expect to book healthy profits once the price of silver reaches its peak.

The precious metal experts at Physical Gold can advise you on buying silver coins

Physical Gold is one of the country’s most reputed gold and silver dealers, who offer free advice to precious metal investors. Call us on (020) 7060 9992 or drop us an email by visiting our website, and a member of our team will be in touch with you to discuss your silver investments.

Image credits: Wikimedia Commons and Snappygoat.com

Silver investment benefits

Silver has been witnessing healthy interest from investors over the past few years. Many investors who want to enter the precious metals market opt for silver investing, primarily due to the difference in the price between gold and silver. Indeed, the silver-gold ratio has provided investors with a great reason to buy the white metal. Historically, gold has always been more expensive than silver and not long ago, the attractiveness of silver was based on the fact that it was 85 times cheaper than gold.

Silver has the potential for capital appreciation due to rising demand and naturally limited supply as a precious metal. Silver investment is cheap relative to buying gold and has no counterparty risk when bought in coin and bar form. It can rise in value as a safe haven during volatile stock markets, but also benefit from increased industrial demand for silver during technological booms.

Silver bars are popular amongst investors

As the COVID 19 pandemic draws on, volatility has increased in both the prices of silver, as well as the gold-silver ratio. In March 2020, the ratio jumped to a high of 125:1. Currently, it has come down to 87:1. The price of gold itself continues to rise and has reached levels of $ 1771 per ounce. As geopolitical turmoil has adversely impacted the global economy, investors have rushed to protect their assets by turning to gold, which is always viewed as a safe haven. Interestingly, the current price of gold is slowly inching upwards towards the all-time high mark, which was $ 1917 per ounce.

Silver performance over the years

Of course, silver investing isn’t simply dependent on the gold-silver ratio. If we look back over the last 10 years, we can see that silver investors were rewarded with good returns for many of those years. Silver has also acted as a safe haven, much like gold. The spot price of silver reached $48 an ounce back in 2011, during the height of the last global financial crisis. If we compare gold and silver prices over the long-term, we can see that silver has always tracked gold, which is a significant reason for investors to invest in silver.

Tax considerations

Purchasing silver coins that have a face value in the UK can deliver tax relief to investors. Silver coins which are legal tender in the UK are Capital Gains Tax (CGT) exempt. There are certain silver bars that can also be purchased without paying VAT. In fact, one such bar is available from Physical Gold.

Silver coins are available in different denominations

The rising demand for silver

The price of silver is expected to rise significantly due to the increase in its demand. Silver is an essential component that is required for applications in many industries. The market for products like solar panels, electronics and electric cars is on the rise. Due to this, there has been a surge in the demand for silver over the past few years. However, the production of silver has also fallen during this period. Therefore, according to metal experts and analysts, this dramatic shift in the supply-demand curve for the white metal will ultimately result in sky-high prices. Investors who are currently buying silver can expect to make a windfall gain in a few years.

Reach out to us before you put your money in silver

The investment team at Physical Gold consists of highly qualified silver experts. Call us now on (020) 7060 9992 and we can offer you free advice on how and when to buy silver. You can also reach out to the team via our website, and discuss your silver requirements. We can help you make the right decisions to build a strong silver portfolio

Image credit: Tookapic and Wikimedia Commons

Any form of investment comes with certain risks, especially if you are investing in capital markets or commodity markets. Savvy investors attempt to mitigate risks by diversifying their portfolio. Investment advisors often do a scientific risk assessment exercise and evaluate risks of each asset class, when advising their clients. These assessments are based on historical data, price movements of that particular asset class, market sentiment and market response to macro-economic and other forces. Of course, silver is a much-preferred asset class, viewed by many as a lucrative investment. But, before investing money into this precious metal, let us first consider some of the risks associated with it.

Speculative risk

Investing in a commodity like silver means you are speculating on the future expectation that the price of the metal will go up at a future point in time. As silver is a commodity, this is likely to happen due to increased demand. Investors may buy more of the metal in a bid to house their investments safely during market crises. On the other hand, we are seeing a trend where the demand for silver is rising due to industrial requirements, not investor demand. Coupled with a global scarcity of the resource, it is indeed a possibility that prices could be driven up eventually.

Silver bullion is a great investment, but not without certain risks

Creation of a bubble

Markets usually react to sentiment and when a group of investors start buying up precious metals, the price movements trigger a wave of people who buy as well, hoping to make some quick money. In the process, the price balloons, creating a bubble. This is a very risky situation, because as an investor, if you cannot exit the bubble in time, the price crashes to rock bottom, eroding all your money.

Download our FREE 7 step cheat sheet to becoming a successul silver investor here

In 1997– 2000, we witnessed the dotcom bubble, where the same thing happened. A lot of people started investing in dotcom start-ups, believing that these stocks would deliver quick returns. Ultimately, the investments became lopsided and when investors realised that these new companies did not have strong enough fundamentals to deliver good returns, they dumped the stocks. The result was a huge market collapse in which several retail investors were completely wiped out. We saw a silver bubble in 2011 when many people moved their money to gold and silver in order to escape the capital markets and the price rose to almost $50 per ounce. But eventually, the bubble burst as investors moved out of the precious metal and went back to equities.

Price performance risks

Silver is considered to be a precious metal due to its historic acceptance by mankind. It may have several uses, beneficial factors and industrial demand, but that may not be enough to justify the investment. Some analysts would argue that its value is perception driven. Therefore, its value as an asset class is strictly governed by price performance. When we take a really long-term view of silver and go back 40 years or more, we realise that the total returns the metal generates are not that great. According to a study conducted by USA Today, silver has failed to post annual profits 43% of the time. So, if the theory of supply vs demand doesn’t bolster silver prices soon enough, it may not be a lucrative enough investment vehicle to warrant attention.

To safely store a large amount of silver, investors need specialised storage

Risk of secure storage

Taking physical delivery of precious metal and storing it in your own home opens you up to certain risks, such as theft or damage. On the other hand, if you buy silver certificates, you open yourself up to counterparty risk. Counterparty risk means that the other party, in this case, the issuer of the silver certificates, may not honour the certificate, if you choose to call for the money. This may be due to a number of reasons, such as the bank going down due to financial problems, etc. On the other hand, once you buy physical silver, you need to incur the costs of having a storage facility to house your investments. Also, investors need to bear in mind that since the price of silver is 75 times less than gold, a sizable investment in silver would also mean a large volume of the precious metal, which will need proper storage.

Call our team of experts to learn more about risks

Our investment team at Physical Gold have silver experts who can guide you through every step of the way. They can advise you about the risks associated with investing in silver and other precious metals. Call 020 7060 9992 to speak to a member of our team or you can get in touch online through our website and a member of our team will call you right back.

Image credits: Wikimedia Commons and Maxpixel