Selling silver coins can be more difficult than you think. When someone goes to the high street to sell silver, it’s difficult to get the real value that the silver may be worth. Generally, when selling silver coins, you should receive a price below the spot price of silver on that day. However, the price you get will largely depend on how you have stored your silver coins and the condition they are in. In this article, we will explore the best ways to sell your silver coins and receive the best price.

It’s best to sell silver coins through a reputed dealer

Identifying an online broker

The best way to sell your silver coins is to identify a reliable broker. A list of reputed and reliable precious metal dealers can be found on the website of the British Numismatic Trade Association (BNTA). Once you have identified a broker near you, it’s important to establish a good working relationship with the company. If you regularly buy and sell silver coins, you should be able to quickly establish a good relationship that can ensure the best prices for your coins. Remember, most reliable brokers will already have a buyback guarantee, so if you buy coins from them, selling these should not be a problem.

They can be sold in various ways. Many silver dealers can be found online who will pay you according to the weight of silver, and potentially extra if the coins have a historical or scarcity premium. They will be able to explain the process, but generally, you will need to send the coins to them after agreeing on a price. These coins can also be sold at auctions (for highly valuable coins or large collections), at a local jeweller if convenience is a higher priority than price, or privately.

Online auctions

Online auctions posted by sites like eBay, may look like a good place to sell your silver coins, however, you may not get the best possible price. Your coins may mostly be purchased by dealers who will try to pay the least possible price to get a bargain.

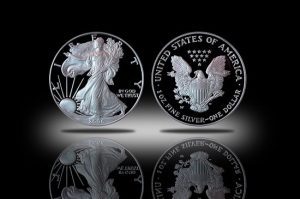

Well known coins like the Silver Britannia are great for investors

Taking care of your silver coins

You are likely to receive a higher price if the silver coins are in good shape. When you purchase your silver coins, ensure that they remain intact inside the sealed packaging. This proves that the coin has not been tampered with and usually, the sealed packaging also comes with a certificate of authenticity. This can ensure better prices for your silver coins. If you buy your silver coins from another collector, and they arrived without packaging, please ensure that you store your coins in a dry environment, so that they do not tarnish. When polishing your silver coins, make sure you do not use chemicals or abrasives that are likely to damage the coins.

Buying the right coins

When you purchase your silver coins, it’s important to ensure that you do not end up buying obscure coins that are unknown. Buying well-known silver coins like the silver Britannia ensures liquidity and these well-known coins are more likely to fetch you the best prices and sell quickly. If you do invest in rare and collectable coins, research them thoroughly before you purchase. If the coin commands a rarity premium, then you are likely to attract interest from collectors. In such cases, the value of the coin will be much more than its weight in silver and depending on the demand of the coin, you should receive a good price.

Before selling silver coins, speak to our experts

Physical Gold is one of the country’s best-known precious metal dealers. Our coin experts can advise you on the best way to sell your silver coins and the prices you could receive. Please call us on (020) 7060 9992 or get in touch with us online before you make a sale.

Image Credits: feiern1 and Eric Golub

It is often said that investors tend to invest in bullion coins, so that they may maximise the value of gold for the price they pay. Likewise, collectors buy proof versions of coins. In this article, we will explore what is a proof coin and why they are highly valued amongst collectors.

What is a proof coin?

A publisher would like to study the edited, proofed, and ready to go to the print version of an author’s work before mass copies are printed. In the same way, a proof coin or a set of coins is produced initially to secure approvals from important authorities like the Ministry of finance, the Chancellor of the Exchequer and the Directors of the Mint. Apart from procuring these important approvals, a proof coin can be used to check the accuracy of the dies used in minting the coins.

Silver proof coins

The dies are specially polished to produce the proof coin set. It is quite different from a mass-produced bullion coin. A proof coin has an extremely high-quality finish and a polished shine. The edges are sharp, and the design stands out magnificently. The manufacturing dies are often chemically treated to create a frosty finish in certain areas on the face of the coin.

When the coin is presented in its case, there is a mirror-like appearance, which is appealing to most coin lockers. Historically, they were usually archived after approvals had been procured and the coin issued to the general public. However, the Royal Mint today releases limited editions of proof coin sets that can be purchased by collectors. Commemorative issues are also interesting to the general public, who would pay a premium to procure these coins.

Why are collectors buying proof coins?

First of all, many collectors are well aware of what is a proof coin. The mintage of these sets is limited and attractive to collectors, simply because their rarity, may go up in the years to come. The aesthetic look and feel of a proof coin, with its high-quality finish and attractiveness make it desirable to collectors. Needless to say, these coins are sold with hefty premiums.

A set of 1887 Queen Victoria proof coins

Proof coins as an investment

Bullion coins have always appealed to investors as a better bet. Bullion coins come with an uncirculated finish that does not have the finesse of a proof coin. However, these coins offer the investor an opportunity to acquire gold or silver at a cheaper price per gram than paying huge premiums for a proof coin.

Download our free step-by-step guide HERE before you buy gold and silver coins

An important problem also crops up at the time of sale. Dealers are unprepared to repay the premiums paid on these coins. The coins are therefore valued for their gold content, and the premium originally paid for the proof version of the coin is lost. Due to these factors, a proof coin is best acquired as a collectable or given to someone as a present.

It is also important to note that many dealers will offer good discounts when you place an order for a large number of bullion coins. These deals do not apply to proof coins. The premium paid is largely due to the finishing, detail, production costs and limited mintage. So, if you are building a gold portfolio, it is far better to invest in the gold Britannia or the Sovereign, both of which are bullion coins with abundant availability, available at low premiums.

Find out more from Physical Gold

Our precious metal experts at Physical Gold have a great deal of knowledge that you can benefit from. We are one of the country’s largest and most reputed online dealers. We can leverage our expertise and assist you in getting the best deals for gold and silver coins. Please call us on (020) 7060 9992 for a chat. You can also reach out to us via our website.

Image credits: Matthew Heinrichs and Wikimedia Commons

Investors often buy silver coins expecting the prices of silver to rise in the future. The other reason that investors are often interested in buying the white metal, is that it provides them with an easy route to enter the precious metals market. This is because silver is a lot cheaper than purchasing gold and large quantities of silver can be bought at the same price that one would pay when buying a small amount of gold. However, the silver market is not limited to only those coins whose value is decided by the spot price of silver. There are plenty of rare and old silver coins that command large premiums based on their scarcity and history. Today, we will explore some of the best and rarest silver coins in the market

Rare coins with history are always worth more than coins based on weight alone. Collectors are willing to pay huge premiums for scarcity. Some Morgan Silver Dollar coins worth 1$ Face value and £8 melt value, are actually worth over £300k due to their scarcity. Based on weight alone, the popular 1kilo coins such as the Perth Mint Koalas and Kookaburra coins are worth around £500 each.

The Flowing Hair Dollar was the first dollar minted in the US

The American Flowing Hair Dollar 1794

The coin was the first dollar coin to be minted by the US Mint. In the US, the coinage act of 1792, paved the way for the establishment of a new Mint. At the time, the Spanish silver dollars were already being used in the US. The Flowing Hair Dollar contained 0.773 ounces of 90% silver. The coin is valuable due to its rarity and one of these coins fetched $10 million at an auction in 2013.

The American Half Dollar (1797)

Popularly known as the Draped Bust Half Dollar, the coin was minted by the US Mint as a replacement for the flowing hair dollar, due to its unpopularity. The Draped Bust Half Dollars were minted in 1796 and 1797. These coins featured a new design, called the ‘Small Eagle’. Since the coins were minted in two subsequent years, most collectors prefer to complete their set by acquiring the half dollars, with the Small Eagle from both years. It must be noted that the scarcity of this coin is because very limited numbers were ever minted. 1796 witnessed only 934 of these coins being made, while a further 3,000 were minted in the next year. A 1797 Draped Bust Half Dollar fetched US$1,527,500 in an auction in 2015.

The Morgan Silver Dollar is one of the rarest and most valuable silver dollars

The 1870 Seated Liberty Dollar

This historic coin became a part of US coinage for a little more than 30 years from 1840 to 1873. It is considered historic since it was the last silver dollar minted by the US Mint prior to the coinage act of 1873. The coinage act was an important milestone for the United States, as it would put the country on the gold standard. Well, by 1870, the production of these coins had been moved to other cities like San Francisco. These are very rare and an 1870 Seated Liberty Dollar produced in San Francisco was priced at US$1,092,500 in 2003.

1889 Morgan Silver Dollar

Despite the nation being on a gold standard, a financial crisis prompted the US Mint to produce the Morgan silver dollars. These were minted from 1878 to 1904. It was named after the design of the coin, George T Morgan. Due to the limited numbers of production, the coin is considered to be very rare and one of these was sold for $ 881,250 in 2013.

Talk to our silver experts to buy the best silver coins

Physical Gold is a highly reputed precious metals dealer in the country. Our advisors are best placed to discuss your silver investments and identify the best silver coins for you to buy. Please call us today on (020) 7060 9992 or get in touch with us online, via our website.

Image credits: Northern Lights Numismatics and Public Domain Pictures

Investors have found the white metal alluring for some time now. Due to the potential to make significant gains once prices rise, the popularity of silver is gaining ground. The gold-silver ratio has widened considerably and silver is now more than 100 times cheaper than gold. Investment options and silver include bars of varying sizes and a variety of choice in coins.

There are important differences in buying bars and coins. These include considerations of important investment factors like divisibility, value, variety and liquidity. In this article, we will explore these differences and understand whether it is prudent to invest in silver coins or bars.

Large silver bars carry lower production costs

Coins offer distinct advantages

Coins are usually a better bet for investment for a couple of reasons. They offer far better divisibility than owning large silver bars, providing flexibility to sell small amounts. If living in the country of issue, they can also be Capital Gains Tax-free. Bars can be slightly cheaper due to lower production cost, but quantity discounts are achievable when buying lots of coins.

It is interesting to know that silver coins are available in 10 ounces and 1 kg versions. One of the compelling reasons for the popularity of silver bars is that they carry lower production costs. This offers investors the opportunity to acquire more silver for their money. However, large coins are almost similar to investing in bars. Additionally, these coins are tax-efficient if they have a face value.

The importance of divisibility

Investing in a variety of smaller coins will enable the investor to spread the value of the investments. This is an important factor as it allows you to take advantage of different price points when the market is good. Investing in a large bar gives you that one opportunity to sell, while smaller coins can be sold bit by bit to maximise profits.

Silver bars can offer greater value

The experience of purchasing a large silver bar is altogether different from acquiring coins. There are large bars available that weigh 1 kg or 5 kg, and they offer an excellent opportunity to acquire more silver at a cheaper price per gram. This is simply because silver bars carry lower production costs and design costs. If the purpose of your investment is simply to acquire a larger amount of silver at cheaper prices, then bars could be the right choice for you. However, you need to bear in mind that large silver bars do not tick the boxes for divisibility, variety and tax efficiency.

Silver coins offer tax advantages

Tax-efficient investments in silver

Unlike gold, 20% VAT is payable on all silver bars and coins. Needless to say, this escalates your purchase price and eats into your profit margins.

Physical Gold, a well-known precious metals dealer in the country prior to Brexit offered VAT free silver. Sadly this is no longer possible, due to the terms of the UK’s exit from the EU. However, even with paying 20% VAT, the price differential is negligible. This is because:

a) We have reduced our product range of silver products. This means we are buying at highly competitive prices and pass this discount on to our customers!

b) We can also now provide free delivery on silver, as we ship now directly from the UK. Delivery was previously charged for

In addition, we can also supply silver and gold together in the same order now, whereas previously to attract VAT free silver we needed to accept “silver only” orders.

Silver coins that carry a face value, on the other hand, is recognised as legal tender in the country. Therefore, they can be acquired CGT free. While you will end up paying VAT when buying these coins, the profits you make when selling them are tax-free up to a level of £ 12,000 in a single tax year. It is important to be aware of these tax implications when investing in silver to make the right choices when building your portfolio.

Call our silver experts to get the right advice before buying

At Physical Gold, our precious metals experts can offer you impartial advice on making the right purchases. Call us on (020) 7060 9992 or get in touch with us online to discuss buying your silver.

Image credits: Wikimedia Commons and feiern1

The silver Britannia has won its place in British coinage history as one of the most iconic UK coins to be ever released. The coin was introduced in 1997 and had a fineness of 95.8% in its original issue. The 1-ounce silver coin reflected the design elements of the original gold Britannia, which was introduced by the Royal Mint 10 years earlier. The popularity of the gold Britannia prompted the Royal Mint to start minting a similar coin using silver. Within two years of its release, the fineness of the silver Britannia had been increased to 99.9%. Needless to say, the 24-carat silver coin enjoyed immense popularity amongst collectors and investors alike.

The image of Britannia used in an earlier British coin

The iconic design

The silver Britannia, like its gold counterpart, features the classic image of Britannia on its reverse. The Britannia icon was possibly conceived as early as Roman times. It is the image of a goddess warrior, carrying a shield and a trident. This classic image is a testament to the spirit and bravery of the people of Britain. The design elements used in the silver Britannia coin was created by the famous designer, Jody Clark. The obverse of the coin features an image of our reigning Queen, Elizabeth II. Since its issue, the coin has seen some changes in design and mintage with different weights and dimensions.

Silver Britannias are the most popular silver investment coin in the UK. They represent very good value as they are mass-produced to bullion finish which keeps production costs low. They are legal tender, so any gains made are also tax-free.

Investors are keen to invest in silver coins, like this USA silver dollar bullion coin

The value of a silver Britannia for an investor

The value of the coin is dependent on the spot price of silver. As a thumb rule, the coin can fetch a sale value of approximately the 1-ounce silver spot price. Generally, the sale price would be just under the spot price of silver, unless the coin commands a premium due to a collector’s edition. The bullion version of the coin is mass-produced and attracts low premiums. In addition to this, bulk orders of the bullion coin can qualify for attractive discounts, when buying from a reputed dealer. The best part is that the silver Britannia offers investors an incredible opportunity to enter the precious metals market at a lower price point. On the other hand, the gold Britannia is a prohibitively expensive coin to buy.

The rising price of silver

One of the reasons that the coin has enjoyed popularity amongst investors is the expectation that silver prices will eventually rise in the future. The use of silver in industrial applications has grown over the years and will continue to rise in the coming years, as electronic cars, solar power solutions and other electronic products continue to dominate the marketplace.

However, the production of silver has dipped over the years. Market experts believe that a price rise is imminent for silver, and investors who purchase silver Britannia coins today can expect to book healthy profits once the price of silver reaches its peak.

The precious metal experts at Physical Gold can advise you on buying silver coins

Physical Gold is one of the country’s most reputed gold and silver dealers, who offer free advice to precious metal investors. Call us on (020) 7060 9992 or drop us an email by visiting our website, and a member of our team will be in touch with you to discuss your silver investments.

Image credits: Wikimedia Commons and Snappygoat.com