Saving for your retirement is a top priority

If you’re currently saving for your retirement, then it’s possible that you’re using a Self Invested Personal Pension (SIPP) as one of your main methods of saving.

Your SIPP will probably carry a range of bonds, funds, shares and other elements, known as asset classes, depending on how it was set up. If you manage your SIPP yourself, then you may have added certain shares to it over time. If a company manage it on your behalf, then they will likely assign your SIPP to various funds.

Download our FREE 7 step cheat sheet to gold investment here

SIPP Gold

However, did you know that you can also add gold to your SIPP?

Gold is a separate asset class on its own and can be a very valuable part of your SIPP. But why is this? How do you add gold to your SIPP and how does it benefit your pension savings?

Firstly, the reason many people have gold in their SIPP is to provide a ‘hedge’ against the other elements of their pension. Gold isn’t linked to the price of traded shares, so for example, if the markets go down, it doesn’t necessarily mean the price of gold will also fall. In fact, historically, gold has tended to rise when traded shares have fallen.

This can help your SIPP maintain its value due to this balance. Having a diversified SIPP like this can mean that, overall, your SIPP retains its value, or at least is protected because of this diversification, if the markets were to fall.

In this way, gold can provide security and protection to your SIPP, where otherwise it might be viewed as being exposed to market crashes, regardless of which shares or funds it’s invested in.

Gold can serve as an excellent diversification tool for a retirement portfolio

Hedging against inflation

The other big reason to add gold to your SIPP is to hedge against inflation. Although the consumer price index (CPI) data shows that inflation has fallen significantly in the last four years, the current forecast for 2018 shows inflation hovering around the 2.4% mark. Infact, UK inflation fell from 4.5% in 2011 to 0% in 2015 – a huge drop. But then, in the last two years, it rose by 2.7%, a big jump. This kind of volatility in inflation rates is ample cause for worry when it comes to protecting your investments. Inflation is one of the important market forces that simply erode your investments, as the value of your nest egg diminishes as the buying power of the pound crumbles. However, investing in gold protects your investments from both these factors. As the prices of goods and services in the economy go up, so does gold, hedging you against the risk of inflation. In addition, market trends show that investors always turn to gold, when their faith in global currencies like the dollar or pound is shaken. This creates additional market demand, further driving up the prices of gold. Since you invested wisely years ago, you are able to reap your harvest now and cash in on the higher prices.

Hedging against global crisis

Yet another important consideration is to hedge against global uncertainty. If there is a constant in our world today, this is it. Now, let’s say you’re currently in your 50s. You have another 15 odd years to retire. There’s no telling whether the current global situation is going to get better or worse. The US-China trade wars are probably going to become more intensive, as India and China become economically stronger each year. The rifts and uncertainty in Europe that started with Brexit could get worse. Already, the Russian government is seriously hedging by increasing its gold reserves as are India and China. This needs to be an important consideration when saving for your retirement and you could be better off diversifying that retirement portfolio that you’re working on, by adding gold to your SIPP, by simply downloading our investment instruction form.

Get in touch to know more about adding gold to your SIPP

Adding gold to your SIPP is also easy. If you

Pension gold is a great way to save for your retirement and a great way to ‘hedge’ your existing investments for a more secure future. You can find out more about how Physical Gold can help you do this here.

Call us on 020 7060 9992 or contact us online to find out more.

Daniel Fisher formed Physical Gold in 2008, after working in the financial industry for 20 years. He spent much of that time working within the new issue fixed income business at a top tier US bank. In this role, he traded a large book of fixed income securities, raised capital for some of the largest government, financial, and corporate institutions in the world and advised the leading global institutional investors. Daniel is CeFA registered and is a member of the Institute of Financial Planning.

Image credit: Wikimedia Commons

Much has been written and said about the subject of precious metals and its pursuit by humans. Many have spoken about the joy and splendour of acquiring precious metals like silver and gold. Still, others have spoken about the futility of material pursuits and its lifelong obsession by its pursuers. In this section, we explore 15 quotes about gold that could possibly tickle our intellect.

1)

“Don’t gain the world and lose your soul; wisdom is better than silver and gold” – Bob Marley

In this quote, famous reggae singer-songwriter Bob Marley reminds us about the futility of chasing material things and alludes to the fact that knowledge and wisdom is far more precious an asset than man’s love for silver and gold. Source: Brainyquote.com.

2)

“It’s health that is real wealth, not pieces of gold and silver” – Mahatma Gandhi

Freedom fighter and champion of peace and non-violence, Mahatma Gandhi was an international personality, famous for his philosophy and frugal living. Indeed, this thought process is quite apt. People who ignore their health and focus only on building wealth, may not be able to enjoy the fruits of their labour, once their health breaks down. Source: Sparkpeople.com

Gold is the universal precious metal of desire for many across the world

3)

“Gold medals aren’t really made of gold. They’re made of sweat, determination and a hard to find alloy called guts.”

– Dan Gable

Former American freestyle wrestler and coach Dan Gable talks about the real ingredients required inside a human being to win a gold medal. With greater introspection, we realise that it isn’t just the gold medals won in a tournament that he is referring to. It’s every achievement in life, and nothing good comes easy. Source: Goodreads.com

Interested in gold investment? Download our FREE 7 step cheat sheet here first

4)

“All that is gold does not glitter, not all those who wander are lost; the old that is strong does not wither, deep roots are not reached by the frost.”

– J. R. Tolkien

This is an old saying, which simply reiterates the old maxim that everything isn’t always what it appears to be. It is taken from a poem written by Tolkien for the book – The Lord of the rings. Source: Wikipedia.

5)

“Truth, like gold, is to be obtained not by its growth, but by washing away from it all that is not gold.”

– Leo Tolstoy

Tolstoy applies the principle used by gold diggers during the gold rush, where gold was sifted from river beds and dirt and gravel washed away. In the same way, the truth emerges once all other possibilities are considered and ruled out. Source: Supanet.com

6)

“Fire is the test of gold; adversity, of strong men”

– Martha Graham

Martha Graham was an American dancer and choreographer. The quote refers to the laboratory practice of removing impurities and base metals from gold by heating it up to 1100 degrees to extract 24k gold for conversion into gold bars and gold coins. Graham uses the comparison to say that winners come out stronger during tough times. Source: Quotefancy.com

Gold is often heated to very high temperatures to remove impurities

7)

“But in truth, should I meet with gold or spices in great quantity, I shall remain till I collect as much as possible, and for this purpose, I am proceeding solely in quest of them”

– Christopher Columbus

Indeed, Christopher Columbus, the great Spanish conquistador echoes the sentiment of the explorers – to amass untold wealth and carry it back to their country. Source: izquotes.com

8)

“Everything has its limit – iron ore cannot be educated into gold”

– Mark Twain

Mark Twain, the great American novelist reminds us that people can be educated and empowered, but everyone’s own innate ability has limitations. Beyond that limit, no amount of empowerment is beneficial, in the same way, that alchemists failed to turn base metals into gold, although they tried for centuries. Source: Setquotes.com

Watch our video now – Gold & silver investment jargon explained

9)

“Praise, like gold and diamonds, owes its value only to its scarcity”

– Samuel Johnson

Samuel Johnson was an English writer and a poet. The writer compares praise to precious metals and concludes that praise when showered frequently, loses its value. It is valuable only when scarce, just like gold and silver. Source: quodid.com

10)

“The most pitiful among men is he who turns his dreams into silver and gold”

– Kahlil Gibran

Gibran, the award-winning Lebanese-American author speaks about the futility of chasing riches for a lifetime, instead of enriching themselves. Source: wishafriend.com

11)

“Brass shines as fair to the ignorant as gold to the goldsmiths”

– Elizabeth I

The Tudor queen, Elizabeth I, daughter of Henry VIII ruled England from 1558 – 1603. This period was known as the Elizabethan era and the country prospered greatly. She was a visionary and successful ruler and is quoted frequently. Here she implies that things that have no value seem otherwise to ignorant people, in the same way, that a seasoned goldsmith recognises gold instantly. Source: quotes.yourdictionary.com

12)

“Commodities such as gold and silver have a world market that transcends national borders, politics, religions, and race. A person may not like someone else’s religion, but he’ll accept his gold”

– Robert Kiyosaki

Robert Kiyosaki is an American businessman and author. He has authored 26 books, including a personal finance bestseller called ‘Rich Dad, Poor Dad’. In this great quote, Kiyosaki establishes the timelessness of gold and its appeal across the world. The universal value of gold and other precious metals are recognised by people who come from different cultures and every walk of life. Gold is of course insulated from political uncertainty as savvy investors move their investments to gold in order to escape market volatility caused by geo-political forces. Source: Goldsilver.com

The Spanish explorers had an insatiable desire to amass as much gold as they could

13)

“The desire of gold is not for gold. It is for the means of freedom and benefit”

– Ralph Waldo Emerson

Emerson was an American lecturer, philosopher and poet who lived in the 19th century. In this visionary quote, he equates the acquisition of wealth to personal freedom and the means to pursue whatever is desired. Indeed, most gold investors invest in precious metal with this end in mind. Source: Novascotiagold.ca

14)

“The desire for gold is the most universal and deeply rooted commercial instinct of the human race”

– Gerald M. Loeb

Gerald M. Loeb was an American stockbroker and investment guru who founded E. F. Hutton & Co., a well-known Wall Street brokerage company. Forbes magazine called him ‘the most quoted man on Wall Street.’ In this quote, Loeb alludes to the human instinct of wealth accumulation, which motivates and energises everyone. Investors take every opportunity to amass wealth whenever the opportunity presents itself. Source: Marketslant.com

15)

“Gold is a treasure, and he who possesses it does all he wishes to in this world and succeeds in helping souls into paradise”

– Christopher Columbus

Christopher Columbus, the explorer believes that gold can be a solution to all desires and can empower humans to do anything in the world, including saving their souls. Gold, he believes has the power of the heavens. Of course, we must remember that Columbus had been given a task by the Spanish king – to amass wealth and return. Source: azquotes.com

Call us to find out everything you need to know about gold

At Physical Gold, we love hearing from customers just like you. We have a great team of experts who are ever willing to help you out by finding out more about your investment goals and imparting advice on how to build your investment portfolio with gold. Call us on 020 7060 9992 or contact us through our website to find out more.

Image credits: Pixnio, Pixabay and Bullion Vault

Numismatists and their passion for collectables

The practice of collecting coins, paper notes, tokens, etc. is called numismatics. Numismatists can be found all over the world, from every walk of life, and they are passionate about finding and collecting. There is an inherent thrill about digging up remnants of the past and finding a piece of history and holding it in your hand.

Owning a piece of history

Of course, many such collectors also get involved in the history of the coins they find and conduct their own research. That can be an absorbing experience in itself. For many, it’s also about the value that the particular coins command. So, just for clarity, numismatists do not necessarily collect only gold and silver coins. For example, this coin from one Mughal emperor in India dates back to 1538 and is highly collectable, but made of the base metal, copper and not silver or gold.

The Birch Cent is an important piece of American coinage history and very valuable today

Again, many numismatists as well as people who aren’t numismatists also collect gold and silver coins for their value. Some collect coins as bullion, as an investment in precious metals. Others purchase historic or collectable coins that are greater in value than their just their price in gold or silver, This is due to the fact that these collectable coins enjoy great demand from collectors and their market value is decided by the price that collectors are willing to pay for them. In this article, we’ll look at 20 highly collectable coins that are not just collectable, but also a great investment.

Download our FREE Insiders Guide to successful gold investment here

1) The flowing hair dollar, USA, 1794

This was the first dollar ever issued by the US federal government as a coin, post the war of independence. The coins were originally minted in 1794 and 1795 and made of silver. The silver dollar from 1794 is one of the rarest and most valued. The coin fetched $10.01mn at an auction in 2013.

2) The gold double eagle, USA, 1933

The double eagle is a 20 dollar coin, which is otherwise known as the St. Gauden’s Double Eagle. These were minted in 1933, just before World War II. However, they were never released and ordered to be melted down. Interestingly, 20 survived and were eventually picked up by collectors, however, the US government spared no effort in recovering them and nine were taken back and melted. Most of the remaining ones are held by the US government and only one is privately held, which was purchased in 2002 for $7.59mn.

Only 20 double eagles survived out of which there is only one in a private collection

3) Brasher doubloon, USA, 1787

The Brasher Doubloon is a 22 karat gold coin minted by Ephraim Brasher in 1787. It was a coin he minted privately along with other gold coins and copper ones when he petitioned the State of New York to mint copper coins and was denied. The doubloon that survived weighs 26.6g and was sold at an auction in 2018 for $5mn.

4) $10 proof eagle, USA, 1804

The $10 eagle was issued by the US mint up to 1933. The Mint issued the first eagle in 1792. It was the largest of all the coin denominations, the others being the cent, the dime and the dollar. In October 2007, a $10 gold eagle sold for $5mn.

5) Liberty head nickel, USA, 1913

The liberty head nickel, a 5 cent coin, was produced in very small quantities, which was unauthorized by the US mint at the time. This makes it one of the most coveted coins for numismatists. Only 5 of these exist now and in 2010, one of them fetched $3.7mn at an auction.

6) The bust dollar, USA, 1804

Another name for this dollar dated 1804, which was struck post-1830 is the Bowed Liberty Dollar. There are only 15 in existence, and it is a very sought after coin. One of these coins sold for $4.1mn in 1999.

7) The birch cent, USA, 1792

The 1792 cent is an important part of US history. In 2015, this coin sold for $2.5mn at an auction. An engraving of liberty is visible on the front of the coin.

Download the 10 secrets to selling your coins at the highest price. Free pdf here

8) The quarter eagle, USA, 1808

The quarter eagle was born during the coinage act of 1792 in the US. Its value was 250 cents or two and a half dollars. Few were struck and the ones from the early 1800s are quite rare. In 2015 a quarter eagle sold for $2.35mn.

9) The rolled edge eagle, USA, 1907

The rolled edge 10 dollar American eagle weighs 16.70 grams and is made of pure gold. Only 42 were minted and in 2011, one was auctioned at $2.1mn.

10) Polish 100 ducats, Polish-Lithuanian Commonwealth, 1621

The 100 ducat coins were minted by the then ruler of the Polish-Lithuanian Commonwealth to commemorate his victory over the Turkish Ottoman invasion at the battle of Chocim. On the obverse is the head of the king in full regalia. It is the most expensive Polish coin ever minted and recently in 2018, it fetched a price of $2.1mn.

Polish-Lithuanian monarch Sigismund III released gold ducats. The image above shows the 40 ducat coin. The 100 ducat is worth 2 million dollars.

11) Barber dime, USA, 1894

The Barber Dime gets its name from the Barber coinage where it was produced. Only 24 were made and 9 have survived till date. It is one of the rarest US coins for numismatists and in 2016, one sold for $1.9mn.

12) Ummayad Dinar, Ummayad Caliphate, 723 A.D.

The Ummayad Dinar is a coin issued by the Ummayad Caliphate, to commemorate the occasion of the Caliph leading a pilgrimage to Mecca. It is a very rare Islamic coin and in April 2011 one was sold at $6.02mn.

13) Edward III Florin, Great Britain, 1343

The English king, Edward III attempted to establish

a coinage for Europe in the 1300s and coined a gold coin. The continental florin weighed only 3.5g of pure gold and was rejected by merchants and subsequently withdrawn. In 2006, a buyer paid $680,000 for one of the three surviving coins.

14) Pattern Disme, USA, 1792

The 1792 Half Disme pattern coin is thought to be the first coin struck by the US Mint. Around 200 of these survive to date. In 2014, one of the coins commanded a price of $528,750.

15) Gold 2000 Yuan, China, 1992

The China mint struck pairs of 1 kg pure gold coins, one with a seismograph design and the other a compass. The coins have been certified by NGC. Only 10 were minted and in 2011 one was sold at a record $1.29mn.

16) Confederate half dollar, USA, 1861

There are only four Confederate Half Dollars struck at the New Orleans Mint during the civil war. An NGC certified half dollar recently realised a price of $960,000 at an auction in 2017.

17) Five dollars small eagle, USA, 1795

The small eagle five dollar coin was the first gold coin introduced in 1795. The coin weighs 8.75 grams in pure gold and fetched a price of $586,500 in 2008.

18) Eagle on globe quarter dollar, USA, 1792

The eagle on globe quarter dollar was struck in copper by the US mint, and not with precious metals. However, the coin, which dates back to 1792, is an important part of American coinage history. In 2015, a job lot of a dozen coins sold for $2.2mn.

19) Lavriller pattern penny, Great Britain, 1933

By far the most expensive copper coin in the world, only four of these George V pennies were coined in 1933. In 2016, one of these coins sold for £72,000 at an auction by A.H. Baldwin and Sons.

20) Edward VIII gold proof sovereign, Great Britain, 1937

The Edward VIII gold sovereign is the most expensive coin to be coined by the Royal Mint. Due to the abdication of the King in under a year, the coin was never introduced for circulation. In 2014, the sovereign sold for a record £516,000.

Call us to know more about the best coin investments

At Physical Gold, our numismatics experts can impart valuable advice on investing in coins that are worth more than their weight in gold or silver. Call us on 020 7060 9992 or contact us via email to get in touch and find out more.

Image credits: Wikimedia commons, Wikimedia Commons and Wikimedia Commons

Why invest in gold?

We find “why invest in gold?” is one of the most frequently asked questions we receive. Apart from the fact that investments in gold make perfect sense during financial crises, it’s also a much sought-after asset class for creating a wealth-building portfolio. But how much gold should an investor’s portfolio have? In a report published by the World Gold Council, $7.5 trillion is the total value of all the gold mined on the planet so far.

This is approximately 4% of the total valuation of the international markets, spanning equity, bonds, stocks and precious metals. So, a great starting point is to have 4% gold in your overall portfolio to begin with. Of course, investors tend to step up their gold investments as time goes by if they believe that gold is likely to outperform over a certain length of time. For example, August 2011 was one such time when gold peaked at over $1990 per troy ounce. At the time, many investors pulled out of the global capital markets and moved their investments into gold.

Gold bars can provide a great investment base for your portfolio in the long run

Thinking of investing in gold? Download our FREE Insiders Guide to successful gold investment here

5 ways you can benefit from long term gold investments

Apart from the steady rise in gold prices over the years, there are several more reasons why you should build a gold legacy that can benefit your descendants, to whom you can bequeath your estate.

- Firstly, gold is a hard tangible asset that does not tarnish, diminish and or devalue over the years. Given that gold has continually appreciated in value, buying now can mean that your investments bear fruit in the later years of your life.

- Many investors do not prefer to hold physical gold and instead invest in gold futures, or gold ETFs. However, we must remember that these investment vehicles carry counterparty risk. Counterparty risk is the risk posed by a counterparty. For example, if you buy gold backed paper ETFs, the company issuing the paper purchases certain amounts of gold to back your paper certificate. However, the company also sells similar investment vehicles to other investors. What is there isn’t enough gold to back the paper in the event of a market crash? Then you run the risk of losing your money. On the other hand, if you hold gold in its physical state, you avoid this risk altogether.

- Gold is an excellent choice of asset class that can serve as ballast to form a strong and unshakable base for your diversified portfolio. What’s more, they are tax-free.

- Fiat money, stocks and bonds are all subject to the forces of inflation, while gold is not in the short term. Over the longer term, gold is also subject to inflationary forces. However, we must remember that gold delivers value in the long-term. This is why it’s such a great long term investment.

- Building a gold portfolio is easy. Why not register for a free account on Physical Gold, select the gold you need and add it to your online shopping cart. You will find three types of gold that are available on the website. You can get a monthly saver account and invest into this through a SIPP. There is a Pension Gold option that you can explore or simply buy gold coins and bars and opt for our secure delivery and storage option.

Investment in a set of gold coins like the Canadian Maple Leaf is also a great way to build your portfolio

Buying gold coins as part of your legacy portfolio

Gold coins also make a great investment

Speak to our investment experts to discuss how to build a lasting portfolio

Our team of gold investment experts are always happy to advise you on what products to buy and when to buy them. Call us on 020 7060 9992 or contact us through our website to speak to our gold investment team, who can help you plan for your long-term investment goals.

Image credits: Public Domain Files and Money Metals

The Future for gold

Gold 2048 brings together industry-leading experts from across the globe to analyse how the gold market is set to evolve in the next 30 years.

| Download the report |

Key insights from authors such as George Magnus, senior economist; Rick Lacaille, Global Chief Investment Officer of State Street Global Advisors; and Michelle Ash, Chief Innovation Officer at Barrick Gold include:

- The expanding middle class in China and India, combined with broader economic growth, will have a significant impact on gold demand.

- Use of gold across energy, healthcare and technology is changing rapidly. Gold’s position as a material of choice is expected to continue and evolve over the coming decades.

- Mobile apps for gold investment, which allow individuals to buy, sell, invest and gift gold will develop rapidly in India and China.

- Environmental, social and governance issues will play an increasing role in re-shaping mining production methods.

- The gold mining industry will have to grapple with the challenge of producing similar levels of gold over the next 30 years to match the volume it has historically delivered.

Industrial use of gold is changing

To read the full 51-page white paper click below

| Download the report |

Trading gold and silver

The proliferation of the internet has made it possible for all of us to buy and sell precious metals from the comfort of the bedroom without having to step out and go to a high street retailer. Simple as this may sound, it has changed the rules of the game for both buyer and seller. Large volumes of precious metals are now traded everyday online. The phenomenon has reached as far as India. The country is one of the largest consumers of gold in the world, with the World Gold Council estimating Indian gold demand to be as high as 800 tonnes is 2018. Upon entering the digital gold market, one Indian retailer alone reported sales of $18.4mn, which is only a small fraction of the country’s insatiable demand.

How about the UK?

Meanwhile, in the UK, total gold imports in 2017 was 851 tonnes, most of which was headed for specialist bullion bar vaults in London. In fact, it was reported in October 2017 that 7,827 tonnes of gold in the form of gold bars are held in the London vaults in the custody of special custodian companies whose chief expertise is in the handling of bullion.

Download our FREE Ultimate Insider’s Guide to Gold & Silver Investment here

A bulk of this gold comes from online traders who store gold in safe custody on behalf of clients who purchased their assets but opted to leave these in storage with the company. Indeed, this is one of the trends that has changed since online trading in gold gained popularity.

Gold bars can now be easily purchased through the internet and stored in secure vaults

Online reputation management

It’s not just the delivery and storage factor that has changed with the rise of online trading. The currency of online trading is reputation. The internet lends anonymity to traders. When it comes to valuable assets like gold, silver, platinum, etc., buyers need to be certain about who they’re dealing with. Simply having a glitzy website, a phone number and a shared office address is not enough to offer customers the confidence they need. In fact, online reputation management is an important game today. Previously, in the days of brick and mortar high street retailers, reputation was built by word of mouth. Satisfied customers simply recommended a business to people they knew.

But things have changed…

Well, it isn’t that simple any longer. As a successful online trader of precious metals, customers come from everywhere and aren’t necessarily connected with each other in any way. Additionally, with visible online ratings for every seller, any customer can view ratings before making a decision to buy. Therefore, it’s important to ensure that every sale leads to a great customer experience. It’s also important to communicate with them after the sale to remind them to leave a good review on the website. This then becomes ammunition for marketing. As more and more reviews pour in, you can rest assured that more customers are going to walk in through the door. Although this kind of online marketing is usually popular among retail stores, it is now prevalent in the world of online trading for precious metals.

Social media has changed the way precious metals are traded

Social media marketing

Several online retailers have listed themselves on popular social media pages. Interestingly, Facebook does not allow the sale of bullion. So, online traders use the site to maintain a presence and divert traffic onto their websites. Other popular social media sites where one can buy or sell precious metals include Etsy and Instagram. It is interesting to note that several online players have turned to Instagram as a form of online showcase. The site is great for posting images of precious metal products, be it jewellery, bars, coins, etc. Sure enough, these products are visually attractive and several customers are tempted to get in touch with the online trader to find out more. Facebook also has certain private groups for online traders of precious metals.

Data security

Yet another big change that has entered the world of online trading in precious metals is the security of client data and their financial details. Businesses that deal with items of value like precious metals are more likely to be hit by hackers. Simply having watertight encryption and 3D secure systems when handling customer data is not enough, it is important that customers know that the online trader is using these methods so that they feel safe and secure.

Handling confidential customer data

In keeping with data protection laws, online retailers of precious metals are expected to store customer data safely. Now, additional steps need to be taken by all online traders as the new

General Data Protection Regulation (GDPR), will kick in from 25th May, 2018 across the EU. Under the new privacy act, EU customers are expected to be able to exercise greater control over how companies process and store their personal details. This covers all personal and financial details, as well as IP addresses of computers they use and log in to. Companies need to put in place extra efforts, systems and processes in order to comply with the new directive.

Silver coins are often a popular choice for online buyers of precious metals

Advantages of buying precious metals online

The internet has changed the business models for many products and services and the precious metals trade is no exception. Standalone brick and mortar stores had limited inventory and limited options for customers in their stores. This was largely due to space constraints in their stores or warehouses. The internet changed all that. Large online traders like Physical Gold are now connected to big ticket manufacturers across the world. They are able to source products at rock bottom prices, due to economies of scale and pass on these price benefits to customers, making them highly competitive. The choice of products is huge and once customers place an order, the company is able to source them very quickly and deliver.

Another change is the way these items of value are collected by the customer. In the past, one had to go down to a high street store and take delivery. Needless to say, this places the buyer in a risky situation. These stores are frequently watched and targeted by criminals and one can be followed home, or even robbed on the way back. If the gold or silver is stored at home, this could increase the probability of the house being burgled. As discussed earlier, customers are frequently opting to have their precious purchases stored at a secure location. For example, when you buy gold or silver from Physical Gold, each item comes with a buyback guarantee, certificate of authenticity and a legal agreement of storage to prove ownership of the assets. The company stores precious metals on behalf of their customers in LBMA approved vaults. Of course, if the buyer wants to take delivery at their address, this is despatched via secured and insured delivery. There are also popular accessories available for customers to be able to keep their valuables safely in their own homes.

Gold vaults like the one above, used by the Bank of England are used for safe storage

The authenticity of the trader

It is also important to check whether the online trader is a registered, bona fide company. A quick check on the companies’ house website should quickly reveal the company details. Another source where company credentials can be checked is the British Numismatic Trade Association (BNTA). If the online trader is genuine, the firm will be registered with the BNTA.

Talk to our team of experts to buy gold online

Physical Gold is proud to be a reputed online trader, serving customers over the years. Our team of experts are always keen on helping customers make the right decision when purchasing precious metals online. If you have any queries or concerns about buying gold or silver online, please speak to our team by dialling 020 7060 9992 or get in touch online. Whether you’re new to buying precious metals, or a seasoned investor, our investment team has all the information you require to make a sound decision.

Image credits: Wikimedia Commons, Wikimedia Commons, Money Metals and Bank of England

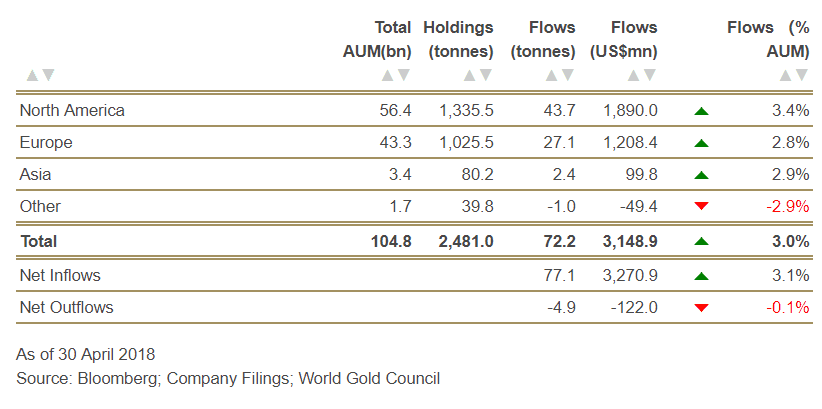

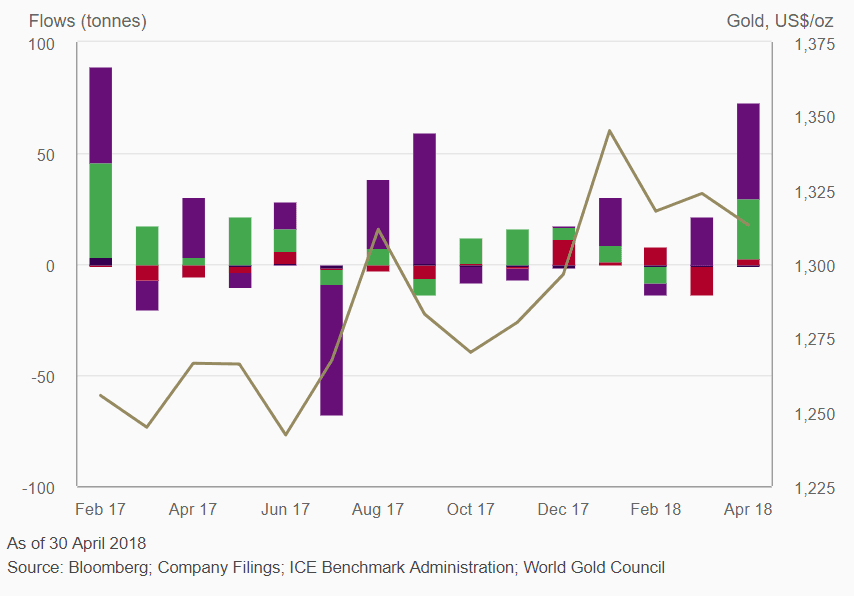

Gold-backed ETFs had their strongest inflows since early 2017

Global gold-backed ETFs holdings added 72.2 tonnes(t) to 2,481t in April. This is the strongest month of net inflows in more than a year. Growth in global holdings was led by significant North American and European inflows and supported by a small increase in Asia.

Our analysis of gold-backed ETFs and similar products provide detailed information and insights on global trends in gold investment demand.

Download our 7 step gold investment cheatsheet

Regional flows

- North American and European funds saw solid net inflows in April, growing by 44t (US$1.9bn, 3.4%) and 27t (US$1.2bn, 2.8%), respectively

- Total fund holdings in Asia rose by 2.4t (US$100mn, 3.0%) to 80.2t

- Funds in other regions had a marginal loss of 1t or 3.0% of assets.

Individual flows

- SDPR® Gold Shares and iShares Gold Trust took the lion’s share of North American inflows, increasing 25.1t (US$1.1bn, 3%) and 17.1t (US$700mn, 6.4%) during the month

- Inflows in Europe were led by Xtrackers Physical Gold (7.9t, 34.2%), Invesco Physical Gold (6.2t, 5.5%), Xetra-Gold (6.2t, 3.1%) and ETFS EUR Daily Hedged Physical Gold (5t, 107.4%)

- Huaan Yifu Gold ETF was the only Asian fund to break into the top 15 inflows, as it added (1.7t, 10.5%).

Year-to-date trends

- North American funds continue to account for the overwhelming majority (54%) of gross global inflows, led by iShares Gold Trust (45t, US$1.9bn), SDPR® Gold Shares (33.7t, US$1.5bn). Elsewhere, Xtrackers Physical Gold (15.6t, US$0.7bn) and Bosera Gold (11.7t, US$0.5bn) have also captured significant flows

- Holdings in Asian gold-backed ETFs remained in the red, down 1.4t so far this year – this has been primarily the result of Bosera migrating assets from its non-listed to its listed fund

- Despite seeing little movement in assets during Q1 2018 (-1t, US$0.2bn), European holdings are now comfortably up since the end of December mostly as a result of 26t of inflows in April.

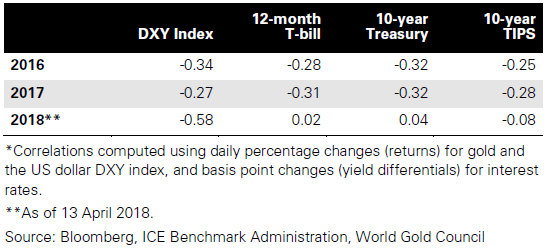

Investors often use the direction of the US dollar as a bellwether for gold’s performance. However, over recent years, short-term movements in gold have been more heavily influenced by US interest rates and expectations of policy normalisation. Our analysis shows that the correlation between gold and US rates is waning and that the US dollar is again a stronger indicator of the direction of price. And, in our view, this will continue over the coming months – even while the dollar won’t explain gold’s movements entirely. Furthermore, the analysis shows that higher real rates have not always resulted in negative gold returns.

Linking gold, the US dollar and interest rates

There is no one single driver of the price of gold. Generally, gold’s price drivers can be grouped into four categories:

1) wealth and economic expansion; 2) market risk and uncertainty; 3) opportunity cost, and 4) momentum and positioning (see page 3).

Table 1: The influence of US rates on gold has fallen behind that of the dollar

Correlations between gold, the US dollar, and various interest rate benchmarks*

In the short and medium term, two variables attract investors’

Yet, gold continues to trend higher – increasing by 8.5% since the Federal Reserve rate hike in December 2017 – despite interest rates rising at an accelerated pace. A key question for investors is, therefore, what matters more – the direction of the US dollar or the direction of interest rates? The answer is, generally, the US dollar. But there are exceptions to this rule.

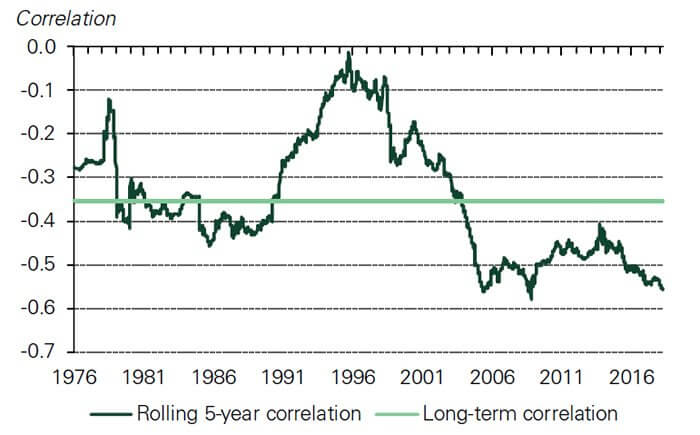

Chart 1: There is a consistently negative correlation between gold and the US dollar

Correlation between gold (US$/oz) and the US dollar real exchange rate*

*Based on weekly returns between January 1971 and March 2018.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

As with any investment, there is a certain amount of risk to negotiate when investing in gold or silver. Here at Physical Gold we have many years of industry experience and can help you make an informed decision when purchasing precious metals. Here are some of our top tips for mitigating some of the risks involved in purchasing gold and silver:

Buy from a trusted dealer

When purchasing gold and silver in any form, whether it’s jewellery, bars or coins, it is always important to make sure you do so through a trusted dealer. There’s a huge amount of counterfeit goods out there, particularly online, so it’s always important to go to a recognised dealer and do some research on them beforehand. You also need to be aware of any hidden fees and costs when purchasing gold and silver as a lot of dealers advertise really low prices but then charge extortionate prices for handling, shipping costs etc. We’re members of various trade associations, including the BNTA and British Numismatic Society.

Our 7 step Cheat Sheet reveals the crucial considerations to minimise all risks. Download now

Gold and silver in the form of bullion bars and coins

Understand the pros and cons of investing in different forms of gold & silver

People invest in many different types of gold and silver. Whether it’s coins, bars or jewellery, it is always important to understand your requirements and what the best options are for you. For example, many people like to invest in bullion coins because they are easily stored and have a guaranteed purity. They are also fairly liquid should you need to raise money quickly. Some forms of gold and silver, including legal tender bullion coins such as Britannia’s and Sovereigns, also come with added tax benefits and are capital gains tax-free, making them an ideal purchase for many investors.

Do some background research

If you’re thinking about investing in gold or silver, then you should always make sure you do your research first. Have a look at look at futures tables and forecasts to make sure you get a picture of how the market is shaping up and consult with an expert if you’re unsure about anything. It is also worth checking the current spot price of gold and silver as this will give you a basic idea of what people are paying.

Think about different storage options

Before investing in any form of gold and silver, it is important to think about how you are going to store the goods. If you’re planning to store your goods at home for ease of access, then you will want to think about how this may affect your insurance and whether you have a suitable and safe place to store your gold or silver. You also need to be careful about who you divulge any info to regarding where the goods are secured as you don’t want them to be stolen.

If you’re purchasing gold and silver purely as an investment, then you might want to consider whether it’s worth storing it in an allocated vault. The cost of transporting gold and silver as well as insuring the content is often very expensive. You can save considerable costs by keeping your goods stored in a secure vault and it will also give you complete peace of mind that your items are safe and protected.

Contact Physical Gold for further advice

Physical Gold are expert brokers in gold and silver and will reduce your risks when buying precious metals. If you require any advice or additional information on how to invest in precious metals, then please give us a call on 020 7060 9992.

Image Source: Mark Herpel

Before investing in any physical commodity, whether it’s gold, silver or any other precious metal, it is always worth carrying out your own research beforehand. The internet is a great source of information and can tell you everything you need to know about beating the spread, spot prices and future price forecasts. If you’re looking for further information, iTunes is also a great place to check out. There is a great range of podcasts available giving you expert tips and advice. Best of all they are completely free. Here are 7 of the best podcasts currently available on iTunes.

Precious Metals Market Update

This Podcast is sadly no longer releasing new episodes however with over 100 episodes already amassed, it can provide you with a comprehensive overview of the gold and silver market. With expert advice from precious metals expert Tom Cloud, the podcast covers everything from global issues affecting the gold and silver price, storage advice and how gold and silver ratios can affect investors. Click here https://podcasts.apple.com/us/podcast/precious-metals-market-update/id903415429.

If you prefer reading to listening, download our FREE Insiders Guide to Gold and Silver Investment

Silver Doctors

The doc has been dishing out his expert advice on finance and economics for over a year and has so far released 100 episodes of his popular podcast in which he seeks to educate people on the benefits of investing in gold and silver. The podcast features a number of guests and experts each week who together address many important issues affecting gold and silver investments. Highlights include an interview with David Morgan of “The Morgan Report” who gives his predictions for the gold and silver market in 2018. Click here.

The Morgan Report

The Morgan Report is a vehicle for esteemed precious metals analyst David Morgan’s to talk about his perspectives and opinions on the precious metal market. Each week he gives his weekly perspective on the current state of the economy and how this could affect gold and silver investments. His podcasts are around 20 mins long and are perfect listening material when you’re on your lunch break at work or find yourself with a spare half an hour. Click here.

Learn about precious metals

Money Metals’ Weekly Market Wrap on iTunes

The granddaddy of all precious metals podcasts, Money Metals’ weekly wrap has been running since 2014 and in that time, they’ve released nearly 200 episodes of their popular podcast. Each episode clocks in at around 30 mins and focuses on how current affairs in the US are affecting the precious metal market. Industry experts including renowned precious metals expert Tom Cloud are also regularly invited onto the show. Click here.

“Gold & silver investment jargon explained” – a YouTube video we have published.

SchiffGold Friday Gold Wrap Podcast

A relatively new up and coming podcast released each Friday by US precious metal dealers SchiffGold. This quick and handy 10-minute podcast is a perfect soundbite and summary of the week’s precious metal news including some thoughtful commentary and opinions from the company themselves. Click here.

Precious Metals Investing

A short but informative podcast (some episodes are only 5 min long) that provides tips & advice on investing in the precious metals market. The podcast features Ted Sudol from PreciousMetalsInvesting.org and a weekly guest expert. Highlight episodes include “Gold futures – reading the charts” and “Bitcoin and Gold”. Click here.

The Daily Gold Podcast

A fascinating podcast hosted by Jordan Roy-Byrne,

editor and publisher of TheDailyGold.com and TheDailyGold Premium. This Podcast features regular guests from the gold industry and expert insight into where the gold industry is headed. Highlight episodes include an interview with Greg Weldon, one of the world’s premier independent macro analysts, who gives his opinions on the current state of the gold market and an update from gold exploration company Novo Resources. Click here.

Visit Physical Gold for more information

Physical Gold is one of the UK’s leading specialists in gold and silver investments. If you’ve been inspired by any of the podcasts mentioned in this article, you can find out more information on how to invest in gold and silver by checking out our website. You can also speak to one of our experts by giving us a call on 020 7060 9992.