A Guide to Coin Grading: Are Graded Coins Worth Buying?

16/01/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

When considering buying or selling coins, it’s important to understand and distinguish the variations on coin condition. This is of particular relevance to gauge values when trading in the second-hand coin market.

This guide firstly seeks to equip you to recognize which signs to look out for and then introduces the established grading systems when can help benchmark a coin’s condition.

We then discuss how to get your coins officially graded and whether there’s any value in doing so. Finally we tackle the frequent question of whether it’s better to buy already graded coins or simply stick to cheaper ungraded versions.

Coin grading is a systematic process used to evaluate and assign a standardized grade to a coin based on its condition, wear, and overall state of preservation. The primary purpose of coin grading is to provide a universally accepted and consistent way to communicate a coin’s quality and rarity. This grading system helps collectors, investors, and enthusiasts assess the value and authenticity of a coin accurately.

In essence, coin grading involves examining various aspects of a coin, such as its surface, details, and overall appearance, to determine its grade on a predetermined scale. The assigned grade indicates the coin’s relative state of preservation and provides crucial information to potential buyers or sellers.

The practice of coin grading has evolved over time, mirroring the growth and sophistication of the numismatic community. In the earlier days of coin collecting, enthusiasts relied on subjective descriptions to communicate a coin’s condition, leading to inconsistencies and misunderstandings.

As the demand for a more standardized approach increased, the concept of coin grading took shape. One of the pivotal moments in this evolution was the introduction of the Sheldon Coin Grading Scale in the United States in the 20th century. Developed by numismatist Dr. William Sheldon, this scale assigned numerical values to different levels of wear and preservation, providing a more objective and standardized method for assessing coins.

The adoption of the Sheldon Scale marked a turning point in the numismatic world, and it laid the foundation for other grading systems globally. Different regions and countries developed their own grading systems, tailored to their unique historical and numismatic contexts. This standardization not only facilitated easier communication among collectors and dealers but also enhanced the transparency and reliability of coin transactions.

Today, coin grading has become an integral aspect of the numismatic landscape. It enables collectors to make informed decisions about their acquisitions, provides a common language for enthusiasts worldwide, and ensures the preservation of the rich historical and artistic value encapsulated in each coin. As we explore further into this guide, we will delve into the specific grading systems and factors that contribute to the nuanced world of coin grading.

Coin grading is particularly suitable with rare coins

It will come as no surprise that various grading systems have developed around the world over the years. Here we explain the three best-known and referenced systems.

The Sheldon Coin Grading Scale is a foundational system in the world of coin grading, serving as a widely accepted standard for assessing the condition and value of coins. Developed by Dr. William Sheldon in 1949, this numerical grading scale revolutionized the way collectors and dealers communicated about coin quality. The scale ranges from 1 to 70, with lower numbers indicating more wear and higher numbers representing coins in better condition.

1-20 (Poor to Extremely Fine): Coins in this range exhibit significant wear, with details often worn smooth. These are typically considered as heavily circulated coins.

40-60 (About Uncirculated): Coins in this middle range may show traces of wear but generally retain their original details. They are often referred to as lightly circulated or almost uncirculated.

61-70 (Mint State): Coins in this upper range are considered Mint State, indicating little to no wear. The higher the number, the fewer imperfections are present, with 70 being a perfect, flawless coin.

The Sheldon Scale is particularly influential in the grading of United States coins and proof coins, and it has been adopted by major grading services such as NGC (Numismatic Guaranty Corporation) and PCGS (Professional Coin Grading Service). Understanding the Sheldon Scale is crucial for collectors and investors as it’s the most globally recognized system, used by the dominant providers of professional grading.

The British coin grading system stands as a distinct approach in the assessment of coin condition, reflecting the unique numismatic traditions of the United Kingdom. Unlike the numerical Sheldon Scale used in the United States, the British system employs descriptive terms to categorize the condition of coins.

The British grading system provides a nuanced language for describing coin condition, emphasizing the preservation of details and overall visual appeal. This descriptive approach caters to collectors who appreciate the aesthetic qualities of coins and wish to communicate their condition in a more narrative fashion. Understanding the British coin grading system becomes essential when dealing with UK coins or engaging in transactions within the British numismatic community.

Free ultimate guide for keen precious metals investors

The European coin grading system represents a diverse approach to assessing the condition of coins, incorporating regional nuances reflective of Europe’s rich numismatic history. Unlike standardized numerical scales, the European system often varies between countries, each employing unique terminology to describe a coin’s state of preservation.

Here are some typical regional expressions for varying coin conditions. A more comprehensive list can be found in table below;

France (Fleur de Coin – FDC): Similar to the British system, Fleur de Coin denotes a coin in impeccable condition, free from wear, and often displaying a brilliant luster.

Germany (Stempelglanz – STGL): Stempelglanz indicates a coin in mint state, exhibiting no wear and maintaining sharp details. This term aligns with the concept of uncirculated coins.

Italy (Fior di Conio): Fior di Conio, translating to “flower of the die,” signifies a coin in pristine condition, often considered equivalent to uncirculated or near-mint state.

Spain (EBC – Estado Brillante de Conservación): Estado Brillante de Conservación denotes a coin in brilliant condition, akin to uncirculated coins in other grading systems.

While some European countries align with broader numismatic traditions, others may have country-specific grading practices. Understanding these regional variations is crucial for collectors and enthusiasts engaging with European coins, ensuring accurate communication regarding a coin’s condition and value.

The European coin grading system reflects the diverse cultural and historical contexts within the continent. Numismatists navigating European coins or participating in transactions within the European numismatic community benefit from familiarity with country-specific terms and practices. This system underscores the importance of considering regional influences when evaluating coins and reinforces the notion that coin grading is a dynamic and evolving field, shaped by the unique perspectives of different cultures.

When it comes to determining the grade of a coin, several factors come into play. These considerations provide a standardized framework for evaluating a coin’s condition, helping collectors and investors accurately assess its value. Here are the key factors influencing a coin’s grade:

The extent of wear on the coin’s surface, particularly on high points or details, directly impacts its grade. Less wear generally results in a higher grade.

The original lustre, or shine, of a coin and any toning or discoloration it has acquired over time contribute to its overall appearance and, consequently, its grade.

The presence of scratches, nicks, or other blemishes on a coin’s surface can lower its grade, as these imperfections affect both aesthetics and preservation.

The precision of the coin’s design, including how well-defined and sharp the details are, is a crucial factor. Coins with well-preserved striking details often receive higher grades.

The condition of the rim is essential, and dents or damage to this area can influence a coin’s grade. Rims provide structural support and play a role in overall aesthetics.

Understanding these factors requires a keen eye and attention to detail. Numismatists carefully examine each aspect to determine the overall state of preservation and condition of a coin. As we move forward, we’ll delve into simple practical steps you can follow to assess these factors when grading a coin yourself.

Examine coins yourself to gauge its condition and grade

Grading a coin may seem like a daunting task, but with a systematic approach, you can evaluate its condition more confidently. It may not be an official certified grading, but this knowledge can help you be more savvy when assessing a coin’s condition.

Start by inspecting the high points of the coin where wear is most likely to occur. Look for smoothness or dulling of the metal, indicating varying degrees of wear.

Hold the coin at different angles under a light source to observe its lustre. Note any toning or discoloration, which can impact both the visual appeal and the overall grade.

Carefully examine the entire surface for any marks, scratches, or blemishes. These imperfections can significantly affect a coin’s grade, especially if they are prominent or numerous.

Focus on the coin’s design elements. Check how well-defined and sharp the details are, paying attention to the central and peripheral features. Well-preserved striking details contribute to a higher grade.

Inspect the rim of the coin for any dents or damage. A smooth, undisturbed rim is generally preferable, as dents can affect both aesthetics and structural integrity.

Employ a magnifying glass to get a closer look at the coin’s details. This tool can reveal subtle imperfections that might not be apparent to the naked eye.

Always handle the coin with clean, dry hands. Use soft surfaces or gloves to avoid introducing additional scratches or damage during the grading process.

Utilize reputable coin grading guides or online resources to cross-reference your observations. This step can provide additional insights and ensure a more accurate assessment.

Strive for consistency in your grading approach. Over time, developing a consistent methodology will enhance your ability to accurately evaluate different coins.

By following these straightforward steps and practicing regularly, you’ll develop a more discerning eye for grading coins. Remember that coin grading is both a skill and an art, and with experience, you’ll become more proficient in assessing the condition and value of your numismatic treasures.

Use professional coin grading services such as PCGS to get your coin graded

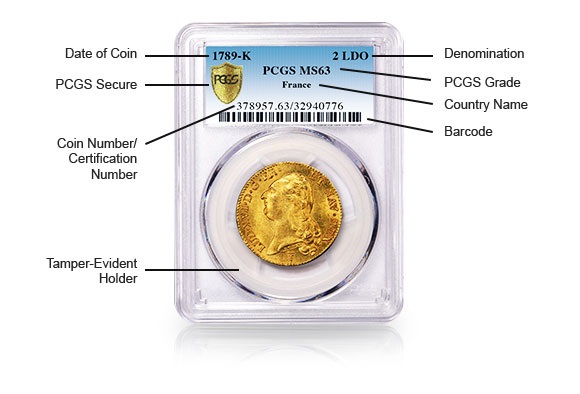

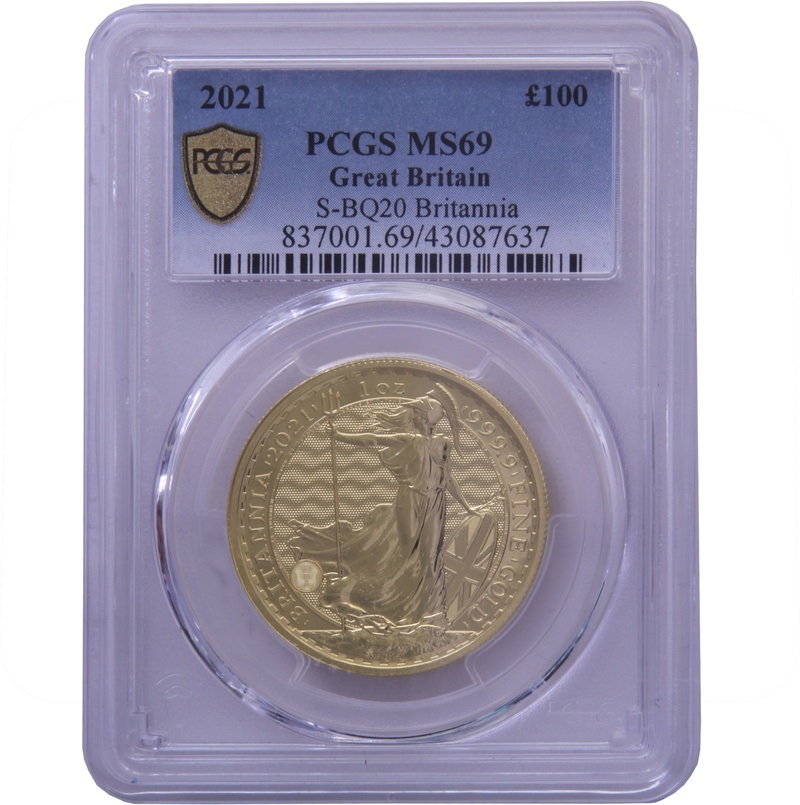

Professional grading services play a crucial role in the world of coin collecting and investing, providing a standardized and unbiased assessment of a coin’s condition. Opting for professional grading services offers numerous advantages, including authentication, preservation, and increased marketability. Choosing between NGC, PCGS, or ANACS often depends on individual preferences, market dynamics, and the specific needs of collectors and investors. Regardless of the service chosen, the certification from these reputable entities adds credibility and confidence to the grading process. The graded coin returns in an appealing plastic container including certification of the grade, authenticity and condition. This plastic slab packaging is the reason that some collectors refer to graded coins as slabbed coins.

NGC is one of the leading coin grading services globally, known for its rigorous standards and expertise. Coins graded by NGC receive a numeric grade on the Sheldon Scale, providing a clear indication of their condition. NGC-certified coins often come encapsulated in protective holders, preserving their grade and authenticity.

PCGS is another highly respected grading service, recognized for its commitment to accuracy and consistency. Similar to NGC, PCGS assigns numeric grades to coins using the Sheldon Scale. PCGS-certified coins also receive secure encapsulation for long-term preservation.

ANACS, established by the American Numismatic Association, is recognized for its commitment to education and transparency. ANACS uses a grading scale similar to the Sheldon Scale but also includes a “+” designation to indicate a coin’s placement within a particular grade.

PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Corporation) charge the following fees currently to grade and encapsulate these typical gold coins.

Additional charges may apply for faster turnaround times, ancillary services like TrueView imaging, or additional guarantees like the NGC Gold Label of authenticity. But the base grading fees listed above represent the standard rates.

PCGS and NGC both provide coin grading and authentication services for submissions from the UK. Here are some key details:

So collectors in the UK have access to submission networks for both major third-party grading companies. The coins ultimately get graded at NGC’s US location or PCGS’s European branch, then returned to the dealer or collector submitter back in the UK.

Here is a breakdown of the estimated market share held by major professional coin grading companies:

PCGS and NGC together dominate the global coin grading and encapsulation market, with estimated shares of around 90-95% combined. As the oldest and most established brands, they authenticate, attribute, grade and certify the majority of collectible coins submitted by dealers and collectors around the world.

ANACS and ICG have diminished market share today, but still command some brand recognition in vintage holders from decades past. Newer entrants like SEGS take negligible share while PCGS and NGC retain their strong positions in the industry built over 30+ years. Their consistency, reputation, resale value, and new security technologies and features make them the go-to companies for most coin submissions currently.

Our automated portfolio builder will provide suggestions based on various investment objectives.

Grading coins is a meticulous process that involves assessing their condition, and this leads to a common question among collectors and investors: Does the act of grading make a coin inherently more valuable? The simple answer is – not always.

In the world of numismatics, the perceived value of graded coins is subjective and contingent on various factors. While grading can contribute to a coin’s marketability and protection, it’s crucial to weigh the associated costs against the potential increase in value. Additionally, individual preferences, collector trends, and market dynamics all play a role in determining the worth of a graded coin.

Here’s a straightforward exploration of whether graded coins are worth more than their non-graded counterparts.

Graded coins provide a standardized and universally recognized indication of a coin’s condition. This clarity can enhance the coin’s appeal and may justify a higher valuation.

Graded coins often instill confidence in buyers. The certification from reputable grading services assures authenticity and accuracy in assessing a coin’s grade, reducing the uncertainty associated with ungraded coins. For many novices, the fear of buying counterfeit coins can prevent venturing into the market at all.

The encapsulation of graded coins in tamper-evident holders protects them from environmental elements, wear, and mishandling. This preservation can contribute to maintaining the coin’s condition over time, which is a factor in determining value.

While grading can potentially increase a coin’s value, it’s essential to factor in the costs associated with the grading process. Grading fees can vary, and these costs may impact the overall return on investment.

Some collectors place a higher value on coins in their original, unaltered state. For these individuals, the appeal lies in the coin’s history and authenticity, and they may not necessarily prioritize graded coins.

The value of graded coins can also be influenced by broader numismatic trends. Coins from certain periods, mints, or with specific attributes may command higher prices in the market, regardless of grading.

While buying a graded coin may suit a coin collector or nervous buyer, inevitably it’s unsuitable for serious coin investors. While buying an already graded coin provides comfort of certification, the financial cost inhibits the purchase as a viable investment.

Most dealers sell graded coins for huge premiums versus their ungraded counterparts. For anyone considering buying gold or silver coins, this represents a huge additional outlay and risk. Paying a 30-50% premium for an encapsulated graded coin rarely pays off in financial terms. It’s incredibly unlikely that any potential buyer, including the original dealer, will want to pay the same inflated premium for your coin. Afterall, ungraded coins with the in the same grade of condition will be available at a fraction of the price.

When attempting to sell a graded coin it’s natural to want to recoup as much of the perceived ‘additional value’ as possible. This inevitably means pairing your coin with the perfect collectable buyer which can severely delay the selling process. In a market where the underlying precious metals fluctuate along with the desirability of certain coins, being able to sell quickly and efficiently can add crucial margin to your investment. Timing can be everything when buying and selling gold.

Certainly for investors purchasing a number of coins, the process of selling a large quantity of graded coins would prove very inhibitive. We always recommend investors buy ungraded coins from an established and reputable dealer to obtain the absolute best value and increase their chances of trading a quantity of coins at a profit. A strategy that some coin investors apply is to purchase ungraded coins from dealers and then get them graded themselves. The cost of doing this is far lower than buying already graded versions.

Coin grading is the evaluation of a coin’s condition using standardized criteria. This process, essential for determining rarity, collectability, and value, ensures a universal language among collectors and investors. By assessing wear, details, and overall preservation, coin grading provides accurate insights, guiding transactions and preserving the integrity of numismatic treasures.

The Sheldon Coin Grading Scale, ranging from 1 to 70, assesses a coin’s condition numerically. Lower numbers indicate more wear, while higher numbers represent coins in better condition. Developed by Dr. William Sheldon, this widely used scale provides a standardized way to communicate a coin’s quality and plays a crucial role in the numismatic world, aiding collectors and investors in assessing and trading coins.

Graded coins can be worth more due to increased authenticity, standardized grading, and preservation. However, factors like grading costs, collector preferences, and market dynamics influence their overall value. While collectors may pay more for high-graded coins, it’s essential to weigh the costs against potential financial gains and consider individual goals before opting for graded coins.

While learning to grade coins yourself is possible, it requires a keen eye and understanding of key factors like wear, lustre, and striking details. Utilize online resources, follow step-by-step guides, and consider professional grading services for reference. While it takes practice to master, self-grading can empower collectors and enthusiasts to assess their coins more confidently over time.

It is not advised to buy graded coins for investment purposes. The mark-up to buy graded coins can be significant to the point of negating any profit potential. Unless you need the re-assurance of a coin’s official condition and authenticity, then it’s best to stick with ungraded bullion coins to derive maximum value and returns.

The cost of grading a coin varies based on factors like the grading service, the coin’s value, and the desired turnaround time but $30-50 covers a majority of coin types. The cost will increase once factors such as transporting the coins are added and any extras like expediting the process, especially if you reside outside of the US.

Getting coins graded provides valuable insights into a coin’s rarity, authenticity, and condition. Utilizing reputable coin-grading services instills confidence in transactions, especially when buying coins ‘unseen’ through mail order or online auctions. However, the decision to get coins graded should be weighed against associated costs and individual preferences.

While professional grading services typically charge fees, some online platforms, such as PCGS’s Photograde, offer a free resource for visual reference. Photograde allows users to assess their coins by providing images for various grades. It’s important to note that this service does not involve the actual grading process conducted by professional grading companies, and obtaining an official grade usually incurs fees.

Slabbed coins are numismatic treasures encased in transparent holders, preserving and authenticating their condition. Graded by professional services, these coins gain value and desirability among collectors for their certified authenticity and preservation.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.