Gold is likely to remain the preferred investment option for most investors. The yellow metal does not suffer from the volatility associated with other asset classes. Gold has consistently delivered steady returns to investors over the short and long term and protected assets by providing insurance against market downturns.

The rate of returns provided by gold has also beaten inflation and all of these reasons have been instrumental in the preference of gold when building an investment portfolio. Investors need to understand the best places to buy gold safely. Regular gold investments can help beat ups and downs in the market and provides stability to an investor’s portfolio. Therefore, many investors look for the best avenues to buy gold in the market.

Many investors prefer gold coins over bars

Making regular investments

The gold market has certain ups and downs like any other commodity market. The gold price can rise or fall by a certain amount, over a period of time. To protect yourself against these price movements, it is best to follow a strategy of making regular gold investments. Investing at different price points at different times averages out these price changes.

When we look at gold price charts, it becomes abundantly clear that gold has outperformed the market and provided steady returns over decades. Currently, due to the economic crisis caused by the global pandemic, gold prices are high. In August 2020, the price of gold reached its highest ever peak as investors decided to move their money to gold to protect themselves against market volatility caused by the COVID-19 pandemic. The current price of gold is $1,789 per ounce.

Where to buy investment-grade gold?

The best option for any investor who wishes to buy investment-grade gold is to purchase it from a reputed online dealer. Online dealers provide investors with far greater choices when it comes to gold products. High-street retailers, jewellery shops and pawnbrokers do not hold this level of inventory.

A high street gold shop in Bramley, UK

Avoid online sites such as eBay and Craig’s List. By buying from these sites, you risk paying over the odds and even worse, buying gold that isn’t genuine. The best bet is to search for trustworthy online gold dealers in Google. Results will bring several options. Only consider sites that provide transparent up to the minute pricing. Research each dealer for track record and reviews and ensure they will buy back your gold. Then it’s down to price.

It is important to research the reputation of the online gold dealer you intend to trade with. Checking their reviews on Google can give you a clearer picture of the experience that other customers may have had with them. Also, check if they have been in business for a long time. Most reputed gold dealers in the market will have a solid reputation and will have been in business for years. Good dealers will also be available to answer any questions you may have regarding your purchases and provide free advice. They should also be able to provide you with a certificate of authenticity for your purchases, as well, as have a buyback scheme. The British Numismatic Trade Association (BNTA) lists all the reputed gold dealers on their website.

Building a relationship with your gold dealer

To avail of the best customer experience, you must establish a strong relationship with your gold dealer. This can play a key role in the dealer. Understanding your investment objectives and recommending the best products for you to buy. Also, if you are a regular buyer, you are more likely to get better price discounts on bulk purchases.

Get in touch with Physical Gold for all your gold investment needs

Physical Gold has a strong reputation as one of the country’s most reliable and dependable online gold dealers. Our team offers free advice to customers and guide them on buying the best gold bars and coins. Please get in touch with us on (020) 7060 9992 or visit our website to send an email to our investment team.

Image Credits: Mick Baker and Wikimedia Commons

The many reasons to buy gold have been very well documented over the past few years. Most people are aware that the price has increased dramatically, they understand that gold offers great portfolio balance, protection against inflation and security against economic and political uncertainty.

Whats less obvious is which forms and types of gold to invest in. Like any tangible asset you buy, it is the price you ease you can sell it for which will determine your profit. If you buy a piece of gold that no one wants then it doesnt matter how much the gold spot price has risen.

Gold Sovereigns

Sovereign gold coins offer a number of compelling reasons to invest.

First of all, theyve been around for hundreds of years so enjoy a very well established reputation and deep developed the secondary trading market. This means theyre easy to sell anywhere globally. The very fact that there are a huge number in circulation throughout the years also means a buyer has a great choice when buying. This contrasts with another UK coin, the Britannia, which has only been around for 20 or so years. So buyers generally only have the choice of brand new coins.

As a relatively small coin, they offer the chance of owning a larger number and variety than

A major selling point of Gold Sovereigns is their tax free status. As a 22 carat coin Sovereigns are classified as investment gold and so are VAT exempt. This contrasts to some other forms of gold such as jewellery and gold nuggets, and indeed other precious metals such as Silver and Platinum which all attract VAT of 20%.

Tax Free Gold

The real bonus with Gold Sovereigns is that theyre also Capital Gains Tax free for UK residents. As legal tender in the UK, the Government dont tax the movement of legal currency. This means that unlike some great foreign coins like the Krugerrand and Maple Leaf, investors get to keep 100% of their profits upon disposal rather than pay up to 28% to the tax man!

So the case for buying Sovereigns is strong, but you still need to ensure youre getting the best value for money. Almost always avoid buying proof Sovereigns if youre an investor. You can pay 15-30% premium over bullion coins and will likely receive a fraction of this benefit when you come to sell. You should only consider proof coins if youre paying close to the bullion price or if youre a collector.

If youre considering choosing between full Sovereigns and half or quarter Sovereigns, then always go for a full Sovereign if you can afford it. Youll likely pay a higher premium for the smaller fractional coins equating to less gold for your money. I also think there is less demand for the half and quarter Sovereigns as they really are very small coins. Conversely, I think the £2 double Sovereign and £5 quintuple Sovereign represent good options.

Finally, you need to ensure you buy the right age of Sovereign. This rule is relatively simple. Right now brand new Sovereigns remain expensive in my opinion. While they are beautifully finished you can pay 5% or more on top of second-hand prices. Like buying a car, that coin will not be the latest mint year within a year, so will represent bad value. I dont see a huge difference in the various years of issue in second-hand Sovereigns. Infact, I see value in holding a nice mix of coins, whether they be Elizabethan, Edwardian, Georgian or Victorian. As long as the condition is decent, it can be beneficial and enjoyable to hold coins from a number of eras. Some dealers may pay a little more for Edward VII Sovereigns purely because of his short stay on the throne but the difference is marginal.

When buying gold sovereign coins watch our YouTube video – “6 Hacks to buying the best value gold sovereign coins”

All our semi-numismatic Gold Sovereigns are of at least selected quality which means we handpick our coins for a large number, rejecting those that may be showing their age more than others.

Happy investing!

Are you looking for a unique and special gift to give a loved one this Easter? Easter is now the second biggest holiday of the year for gifting presents, after Christmas. It is no longer enough to simply buy someone chocolate. Gift giving at Easter is becoming increasingly popular. Here at Physical Gold, we specialise in a wide range of one-off gold investments including bullion coins and gold bars, the perfect gifts this Easter.

Easter 2023 Dates

The dates for Easter 2023 are:

- Good Friday – April 7th, 2023

- Easter Sunday – April 9th, 2023

- Easter Bank Holiday Monday – April 10th, 2023

Gold’s association with Easter

There are many traditions that are typically associated with the Easter holidays. Bunny’s, cards, chocolate eggs, and hot cross buns to name but a few. Gold’s association with Easter, however, goes a long way back and it has often been a common practice to paint an egg gold or decorate it in gold leaf at Easter.

This practice was partly influenced by King Edward 1 who once ordered 450 eggs to be gold leaved and coloured to give as gifts to the royal household. Gold is widely recognised as one of the official colours of Easter, along with purple (colour of lent), white (colour of Easter Sunday) and red (the blood of Jesus).

Before this though, graves in Egypt have found ostrich eggs decorated in gold and silver which were dated to five thousand years ago, so the link between gold and eggs actually far pre-dates Easter.

Read the FREE Gold Insider’s Guide PDF to ensure you buy the best gold

Golden Easter Eggs

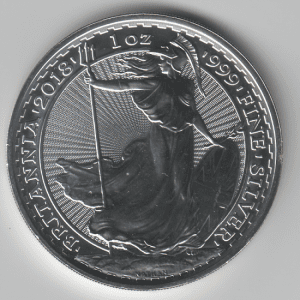

In 2009 Selfridges made headlines when they advertised a gold themed Easter egg for the incredible sum of £1000. The Easter egg contained a particularly rare one-ounce gold Britannia coin no longer produced by the Royal Mint and was advertised as the ultimate luxury gift.

Why gold coins are the perfect gift this Easter

During the 13th century, the British royal family gave gifts of food, clothes and coins to the poor on the Thursday before Easter. By the time Charles II came to the throne in 1630, special coins known as Maundy money were produced specifically for the occasion. In the US, one of their long-standing Easter traditions is to fill Easter eggs with chocolate coins or sometimes even real coins can be used.

Gold coins such as Sovereigns and Britannias make very special and unique Easter gifts. Gold is seen as an excellent store of wealth and has continually held its value over long periods. The gift of gold is one that will last a lifetime as opposed to just the 15 minutes it takes to eat an Easter egg. Gold coins that are classed as British legal tender also benefit from being Vat and Capital gains tax-free in the UK providing, they are over 22 karats.

Here are three specific gold investments you may want to make this Easter, which suit a variety of budgets:

- Best value 100g gold bars – around £5,000 each

- 2023 King Charles 1oz Gold Britannia – around £1,680 each and

- 2022 Gold Memorial Sovereign Coin – 7.988 grams – around £410 each

Gift the gift of gold this Easter

Gold represents the perfect gift for either a loved one or special family member this Easter. Not only is it something they can cherish and look after, with a view to possibly handing it down to future generations, it also introduces them to the world of investing.

Physical Gold has one of the largest selections of gold available in the UK. Whether you’re looking to purchase gold sovereigns or gold bars, we have the ideal gift for you this Easter. For more information on any of our product or services, please give us a call on 020 7060 9992.

Image Sources: Postapo

(Click image above to expand infographic)

Gold Storage or Delivery

Is gold storage something you’re thinking about? Are you interested in purchasing physical Gold or silver, but concerned about where you’ll store it? Our infographic highlights the various options available; to help put your mind at rest.

The main advantage of owning physical gold is that it’s the real thing! There’s no counterparty risk, as there’s no electronic trading or paper involved. It’s as real and solid as can be and something that you have the pleasure of holding in your hand.

But how do you keep a precious metal safe and secure?

Insured delivery direct to your door

Delivered to you fully insured, our delivery is discreet, so the whole neighbourhood won’t know what you’re taking delivery of. It’s packaged in plain, padded envelopes, safely and securely. We also track every package that we post, which allows us to follow up on any queries and provide reassurance on when you should expect your delivery. If your gold or silver is in stock, and you place your order before 2pm, then we should be able to get it to you by the next working day. Before 1pm to be precise. Should your order be out of stock then we’ll aim to deliver it within 2 – 3 days – depending on the stock availability. From 2018 all gold orders benefit from free UK delivery.

Thinking of buying gold? Download the FREE 7 step cheat sheet first

Home safes often have a digital locking device

Gold Storage Options

Once you’ve received your package and signed for it, there are several options for you to consider regarding storage:

Home storage

Many people choose to keep their gold stored safely at home and there are many options available for home storage. A steel safe is the most obvious choice for safety and security – preferable bolted down to the floor. But if bolting the safe isn’t an option, then try to keep them safe somewhere out of sight, like in a cupboard, hidden by other items.

You can also use everyday household cupboard items, like tins, packets of cereal, boxes of tea bags etc. to hide and conceal your gold, but it’s important that you remember where you’ve stored it so it doesn’t accidentally get thrown away. There are many different steel safes available for home use. These include fireproof and waterproof ones. There are even models that can be unlocked by using your fingerprints. They can also be installed inside the flooring, underneath the carpet.

There are a number of ingenious secret storage items that you can purchase from www.physicalgold.com, such as clocks or wall sockets, to help you conceal & store your precious metals.

Hiding things under the mattress is also more common than you might think, but whichever home storage option you choose, you must ensure your home insurance covers the total value of the gold. The advantage of keeping your gold at home is that you know exactly where it is, you can keep it close and touch it, as often as you wish.

Bank Deposit Box

Safety deposit boxes at banks are considered to be extremely safe and secure, so it’s worth visiting your bank to ask about the availability of one if this is of interest to you. Many banks have been withdrawing these facilities over the past few years though, so there may be a waiting list or a box may be quite difficult to acquire.

Safety Deposit Facility

A third-party safety deposit facility offers boxes for you to rent to keep your small, personal household items safe. These facilities are usually open 9 – 5pm for you to visit and generally cost between £100 – £1000 per year to rent.

Since tariffs are expensive, it could work well as a short-term arrangement. The benefits of using a safety deposit facility are that your valuable assets are stored away from your home.

Additionally, these boxes are available in various sizes and you can choose one according to your requirements. Of course, one of the disadvantages of this arrangement is that you cannot access the box at any time of your choice. You can only do so when the facility is open. Also, there could be a natural disaster like a flood that could damage your belongings stored inside the box. In many cases, the operator may refuse to re-compensate you for your damages when this happens, simply because their insurance may not cover it

Professional Vault Storage

The most common (and safest) gold storage option is to arrange for the secure storage of your gold with your chosen dealer, as they have access to secure vaults. These professional vaults offer 24hr safety and security, giving you reassurance and peace of mind. The vaults are highly secure and generally don’t allow public visits, but rest assured your gold will be personally allocated and stored separately in a fully segregated account, within your own little section in the vault.

At www.physicalgold.com, pension gold, silver coins and gold coins are stored at Loomis International, UK – one of the UK’s most secure gold storage facilities. Silver Bars are stored at Network Securities in the Channel Islands – a specialist vault facility that has dual controlled security systems and a direct connection to the local police station.

So if you choose to store your precious metals with us, we can reassure you that all of our stored gold and silver is fully insured, segregated and completely ring-fenced and you can request home delivery of your gold at any time. However, given the high levels of security involved, it’s often not possible for the public to request to view their gold, but we can assure you that it is there – safe and secure.

Gold or Silver Investment – which do I choose?

As investors increasingly turn to precious metals to protect their wealth, a common dilemma faced by many is whether to invest in gold or silver. The two metals behave quite differently, so it’s important to understand the dynamics of investing in either, before deciding to add them to your portfolio. Striking the right balance is essential to extricate value from your investments. Far too many people invest money into these asset classes without understanding what they’re getting into. Unfortunately, this can result in undesirable exposure to risk, further up the road. So, let’s take a close look at the right approach to combining your investments in both precious metals.

Historical analysis

Gold has historically been the precious metal of choice for most investors. During upheaval in the market, gold can provide safety and security for your investment portfolio. If we look back at every financial crisis, it is glaringly obvious that gold has risen to new heights during these times of uncertainty.

During the 2008 market crisis, gold reached its highest point in 2011. Similarly, at the height of the economic crisis created by the global pandemic last year, gold once again touched historical highs in August 2020. Even during a normal period in the market, gold performs steadily. Although the yellow metal may rise or fall in the course of market transactions, it does not suffer from extreme volatility. This makes it a fairly safe bet for most investors.

Silver bullion bars can be a great investment as the price is predicted to rise

Investment horizon

Investment planning is perhaps the most important step when investing money into any asset class. Gold and silver exhibit different behaviours across different time horizons. Gold has historically been seen as a safe and steady investment that generates returns and unlocks value over time. Silver, on the other hand, is often seen as a volatile precious metal.

Currently, there is a lot of interest in silver investments as pundits have predicted the mercurial rise of silver in the years to come. Gold is usually a better option for those investing with a shorter time horizon. Silver investors will require a much longer time horizon to unlock value from their investments. However, if the white metal behaves as predicted, there is an incredible opportunity to get in at lower price points and reap great returns in the future.

The gold-silver ratio

Another factor that governs investments in gold or silver is their price ratio. This has widened considerably over the years. It used to be 47:1 but now stands at 85:1. So, silver presents an incredible opportunity for investors to access the precious metals market as it is 85 times cheaper than gold. That is simply an incredible gap, and many investors want to get in and make hay while the sun shines.

But does it make sense to invest in silver? The white metal is a lot cheaper than gold and provides investors with affordable and easy access to the precious metals markets. Due to the widening gold-silver ratio, an entry-level investor may find it more attractive to buy silver.

Daniel Fisher, CEO of Physical Gold believes that the gap could widen further in the near future. According to his prediction, there is a possibility that it could soon be 100:1. Now, more than ever, it is imperative to strike the right balance between these two precious metals, when deciding to add both to your portfolio.

The silver Britannia is an excellent coin for investment

The demand for silver surges

Additionally, silver has suffered from production shortages in the last few years, while demand has risen substantially. As a metal, silver has certain sterling properties. It is one of the most conductive metals and also very ductile. Due to this, it is in demand across several industries like solar, electronics, electric vehicles, etc. Silver investors believe that the price of the white metal may escalate significantly in the years to come, and it may be prudent to lock in investments at low prices now. This may create a wonderful opportunity to reap profits when prices start to rise.

Precious metals portfolio – the right balance

Silver investments can be more volatile when compared to gold. Silver enjoys huge industrial demand and prices are expected to rise as supplies are thinning out. Historical price charts show us that silver tracks gold in terms of growth. Over the long-term, the gold-silver price ratio could reduce to 25:1. The production price is another factor that also needs to be taken into consideration.

In the case of gold, the production margins fade in comparison to its value. However, silver’s current spot price of around £11 does not allow the flexibility to absorb these margins. To strike a healthy balance, a prudent approach could be to maintain a holding of 8% in gold, followed by 20% in silver.

So, if you are focused on building a strong portfolio and hedging risks, gold may be a natural choice. However, if long-term profits attract you, silver investments may fulfil this objective. Gold offers better returns in the short-term and silver can provide you with an opportunity to capitalise over the longer term.

Physical gold investments can generate better returns in the short term

Combining the two metals

It’s actually most prudent to own a mix of both gold and silver. Gold is a more established safe-haven asset, so tends to gain more from market downturns and volatility. Silver can also perform well in these circumstances but also benefits when industrial demand for silver increases as it’s used so widely in electronics. While silver certainly has more opportunity for huge growth, gold is the steadier of the two.

Of course, there are certain tax advantages and disadvantages of buying silver. Silver coins that are legal tender in the UK can qualify for Capital Gains Tax (CGT) exemption. However, other silver investments may not.

The investment experts at Physical Gold can discuss your gold and silver investments

Our investment team is well-placed to offer expert advice to investors like you about investments in either precious metal. Get in touch with us by dialling (020) 7060 9992 or simply send us an email. We can assist you in making the right decision to balance your portfolio by adding both gold and silver.

Image Credit: tookapic