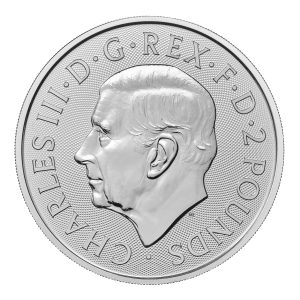

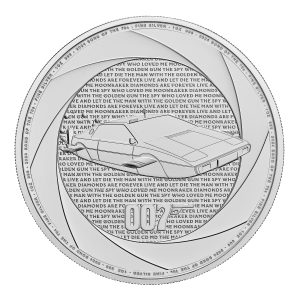

Buy Silver Bullion Coins

Shop our huge selection of silver bullion coins from around the world. UK coins such as the Britannia and Queen’s Beasts silver coins have the advantage of being tax-free on any profits you make. Order now for FREE insured delivery or segregated storage.

Showing 1–16 of 127 results