Buy Silver Britannias in the UK

Silver Britannias are ideal for small investors and anyone who wishes to diversify their portfolio as they are the most popular silver bullion coin in the UK.

As the lowest premium British coin available on the market, a Silver Britannia coin is available at a low entry cost and represents a highly divisible but stable asset.

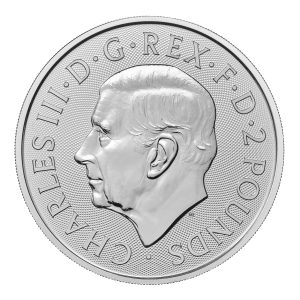

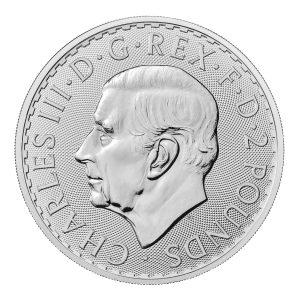

As legal tender, silver Britannias are capital gains tax-free, meaning any profits you make on resale are yours to keep. One of the most popular investments is the 1oz British Silver Britannia, issued by the Royal Mint since 2013, Which is minted to a purity of 999.0 containing 1 troy ounce of silver.

Physical Gold Ltd offers Britannias at competitive prices, which are updated according to the worldwide gold spot prices. We offer you a secure and easy way of investing in physical silver.

Browse our website and find a large selection of the best value and collectable silver coins for your portfolio such as the Silver 2oz Tudor Beasts and the silver 1oz American Eagle coin. We guarantee you an excellent sales process and seamless after-sale service.