Platinum Mining: Process, Locations, and Uses Explained

10/09/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Platinum is one of the world’s rarest and most valuable metals. Known for its bright silver-white appearance and exceptional durability, it’s used in everything from fine jewellery to catalytic converters in cars.

Because it occurs in such small concentrations deep within the Earth’s crust, extracting platinum is both complex and resource-intensive.

Platinum mining is the process of extracting platinum-bearing ore from underground or open-pit mines, refining it, and producing pure platinum metal. Most of the world’s platinum comes from South Africa and Russia.

According to the World Platinum Investment Council (WPIC), platinum is one of the rarest and most versatile metals in the world. In this guide, we’ll explore how platinum is mined, where it’s found, and why it’s so important for industries and investors alike.

Platinum is a precious metal belonging to the platinum group elements (PGEs), which also includes palladium, rhodium, and ruthenium. Its key properties include:

See our guide on the Physical Properties of Platinum.

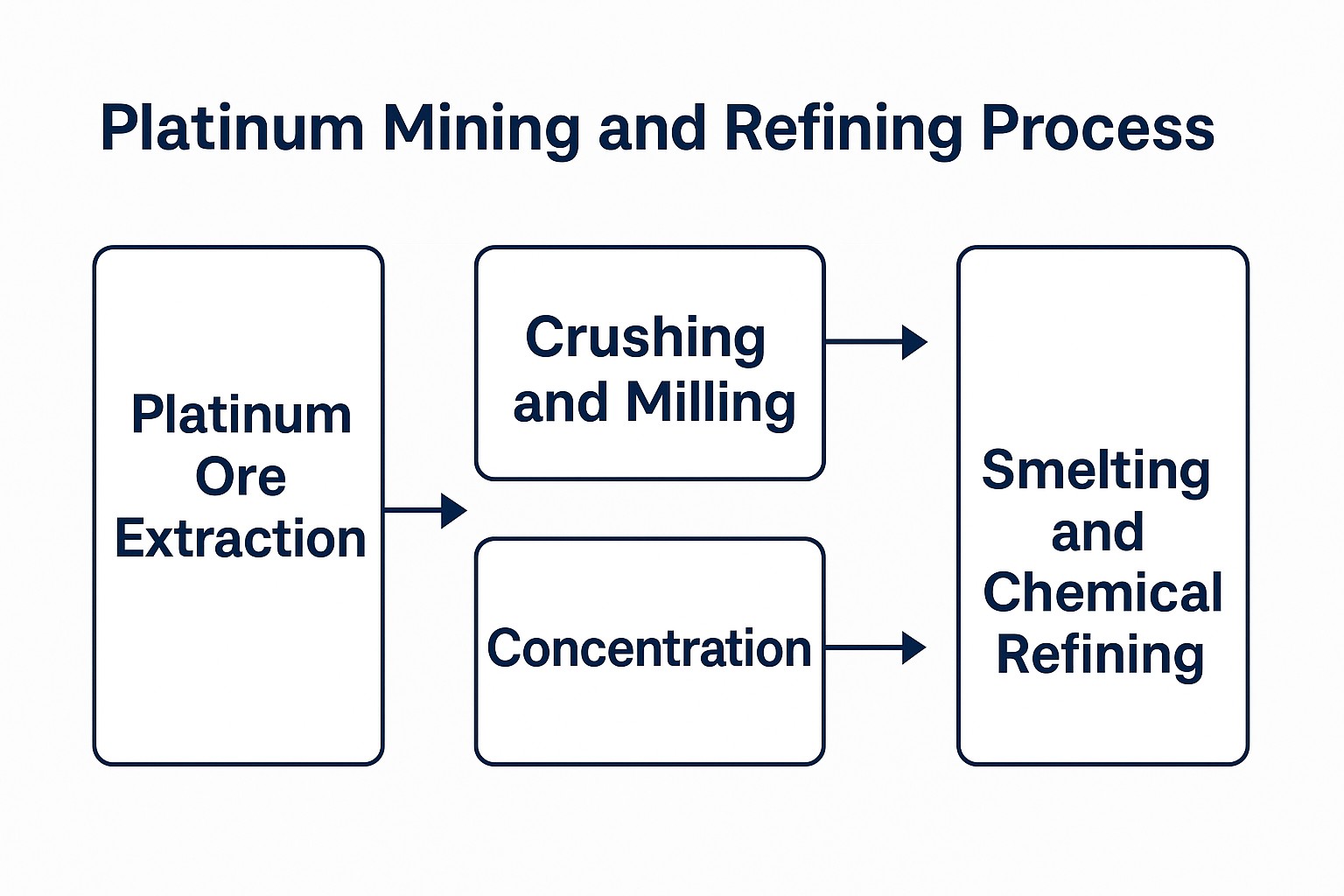

Unlike mining gold, where the metal is sometimes found in visible nuggets, platinum is almost always bound within other minerals. Extracting it is a large-scale industrial operation that requires deep mining, advanced technology, and complex refining. The journey from ore to pure platinum involves several steps.

Underground mining like that found in Bushveld Igneous Complex, South Africa

Once ore is brought to the surface, it is transported to processing plants. In South Africa’s Bushveld mines, ore is typically crushed on site and then milled into a fine powder. This step increases the surface area of the rock, making it easier to separate platinum from waste material.

The milled ore undergoes froth flotation, where air bubbles and chemicals help separate platinum-bearing minerals from the rest of the rock. This produces a concentrate containing not only platinum but also other platinum group metals (PGMs).

At Zimplats in Zimbabwe, for example, flotation plants are a critical part of maximising recovery from lower-grade ores.

The concentrate is smelted at extremely high temperatures (over 1,500°C). Impurities form a glassy by-product known as slag, while a heavier metal-rich liquid known as matte sinks to the bottom.

In Norilsk, Russia, huge smelting facilities process ore on a massive scale, producing a mixture rich in nickel, copper, and PGMs, which then move on to refining.

The final step involves separating the individual metals. Chemical techniques, including the use of aqua regia (a mixture of hydrochloric and nitric acid), are employed to isolate platinum with a purity of 99.95%.

At refineries in South Africa, platinum is separated from palladium, rhodium, and ruthenium – all of which have their own industrial uses. The refined platinum is then cast into bars, granules, or sponges for use in jewellery, automotive, and investment markets.

The U.S. Geological Survey’s Mineral Commodity Summaries provide detailed data on platinum production and refining.

Free ultimate guide for keen precious metals investor

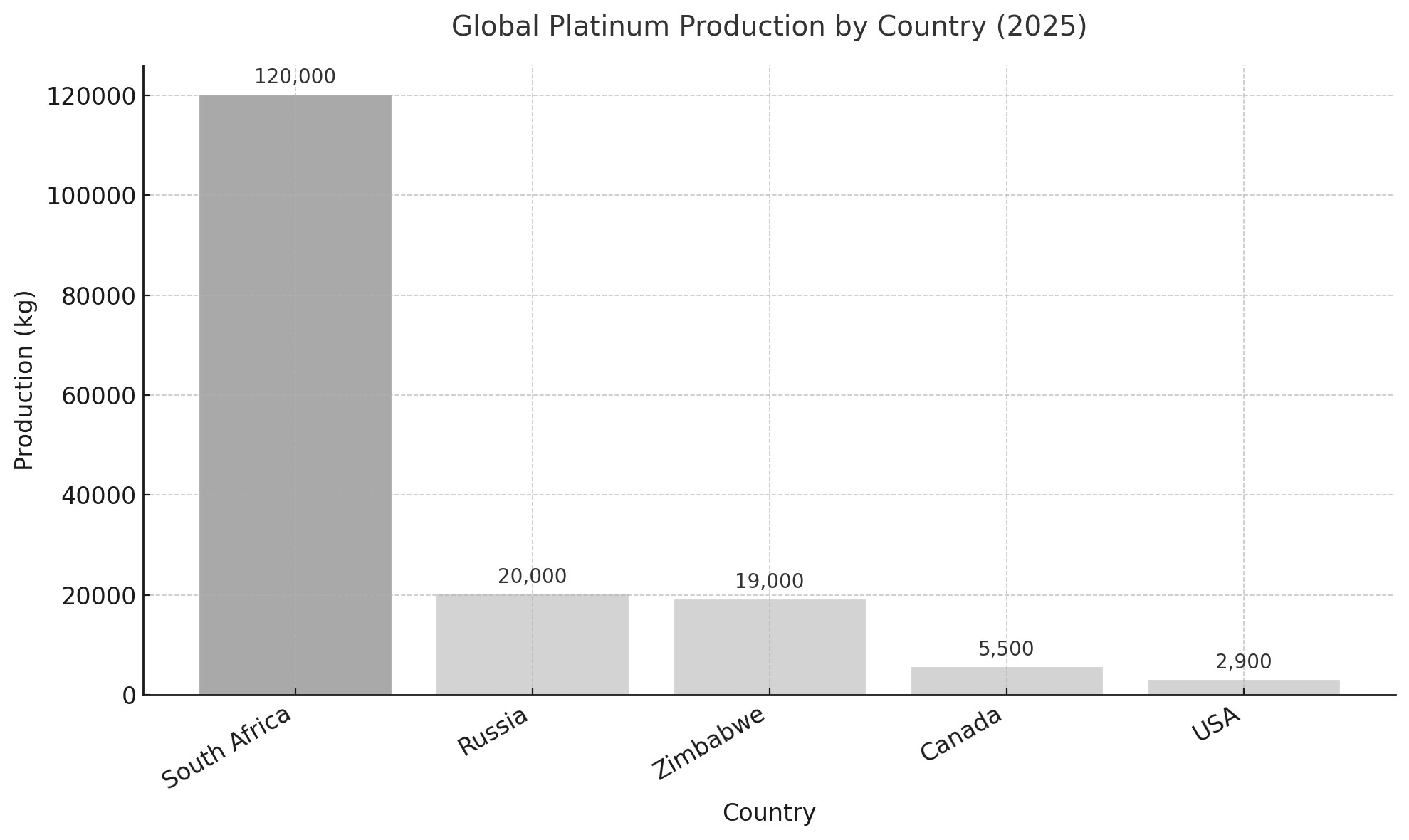

Platinum is extremely rare – about 30 times rarer than gold. Its production is geographically concentrated in just a few regions.

The chart below illustrates the most recent annual platinum output by country, highlighting how South Africa leads the industry.

South Africa dominated the world's platinum production.

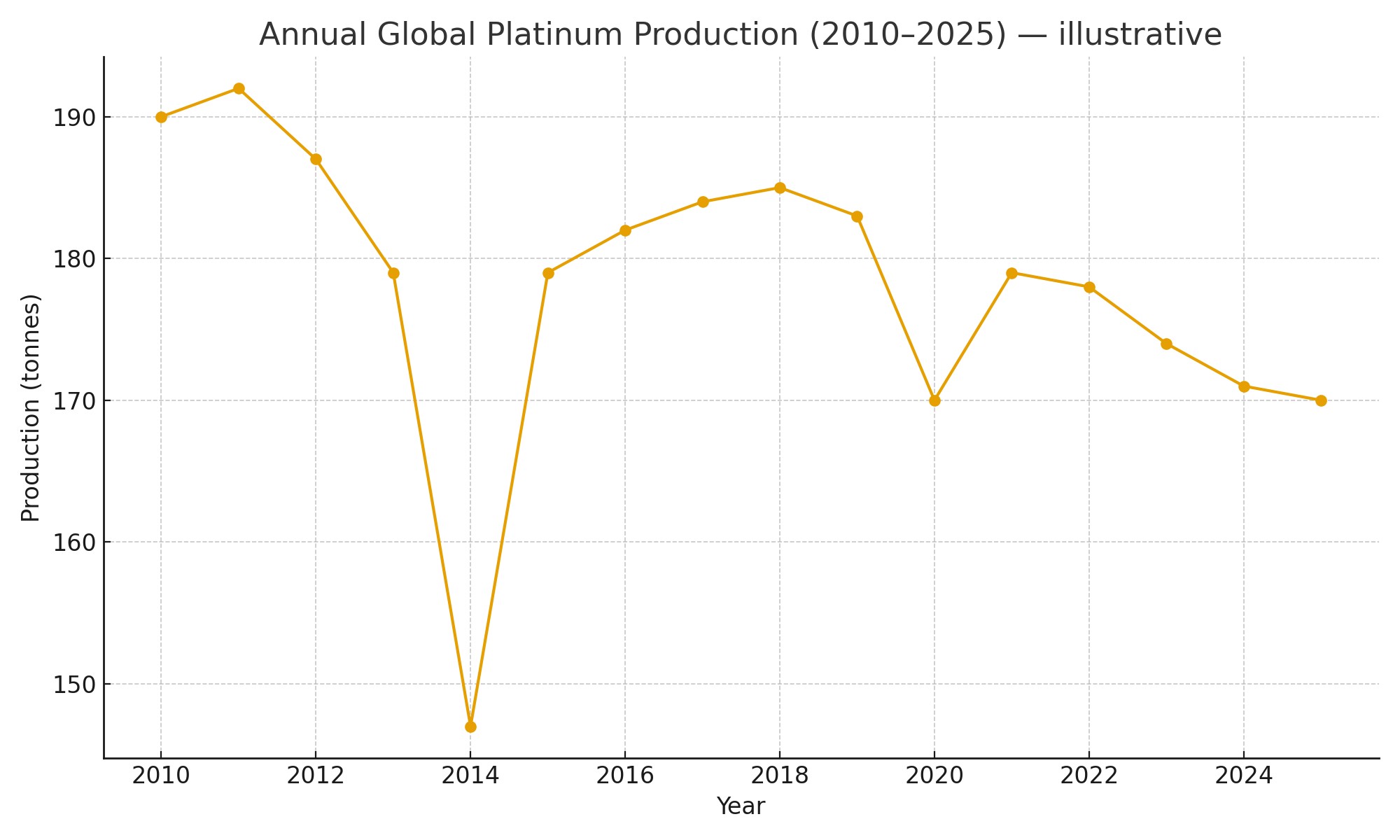

2014 strike dip, 2020 COVID dip

For quick reference:

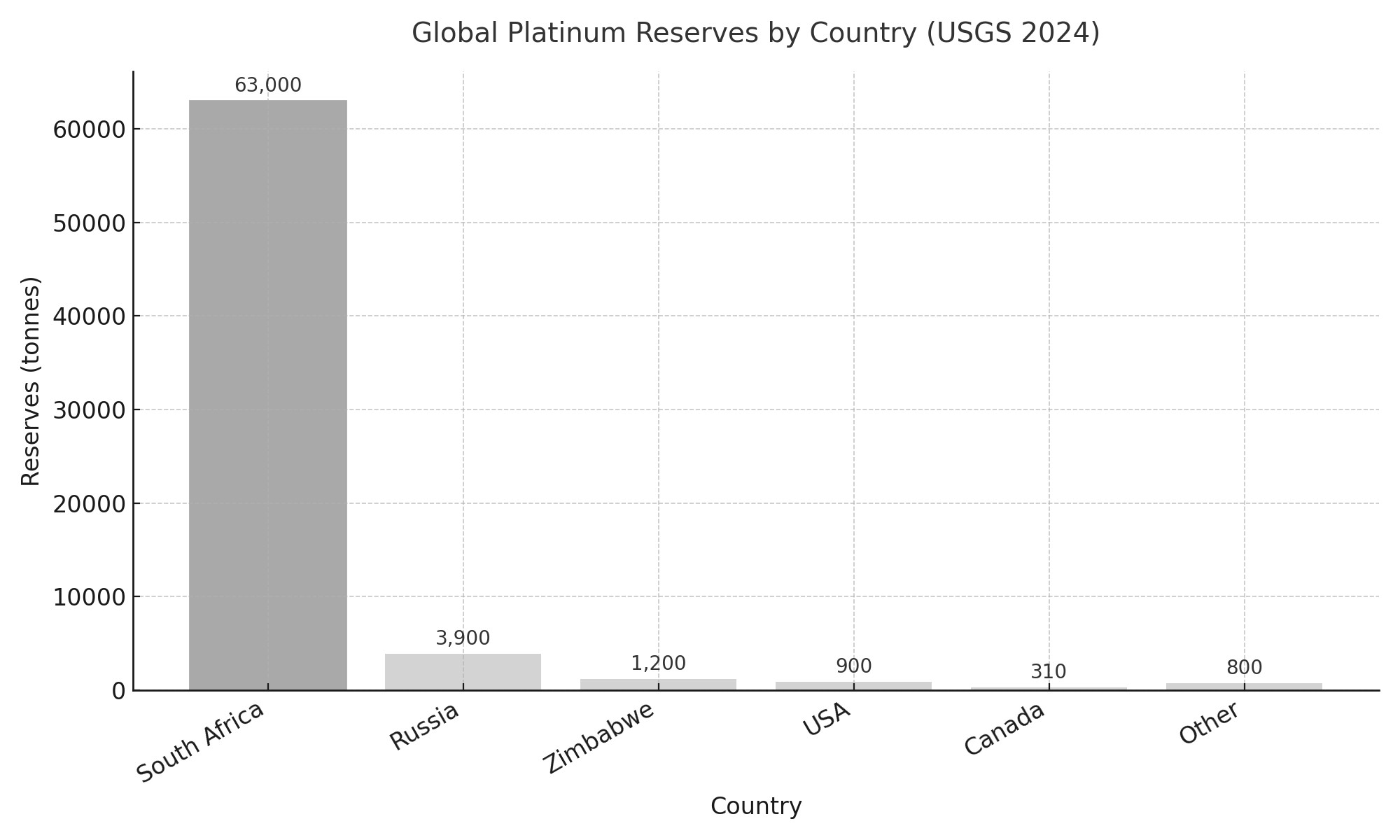

Platinum is mainly found in South Africa, Russia, Zimbabwe, Canada, and the United States – with South Africa dominating global supply.

South Africa not only leads current platinum production but also dominates future supply potential. According to USGS estimates, the country holds around 63,000 tonnes of platinum reserves, which is more than 90% of the world’s total. Russia follows with 3,900 tonnes, while Zimbabwe, the USA, Canada, and other nations hold smaller but significant reserves.

Like all large-scale mining, platinum extraction has environmental and social consequences:

Sustainable mining initiatives are increasingly important. Many producers are working to reduce emissions, improve recycling of PGEs, and support community development. The International Council on Mining and Metals outlines how the industry is adopting greener standards.

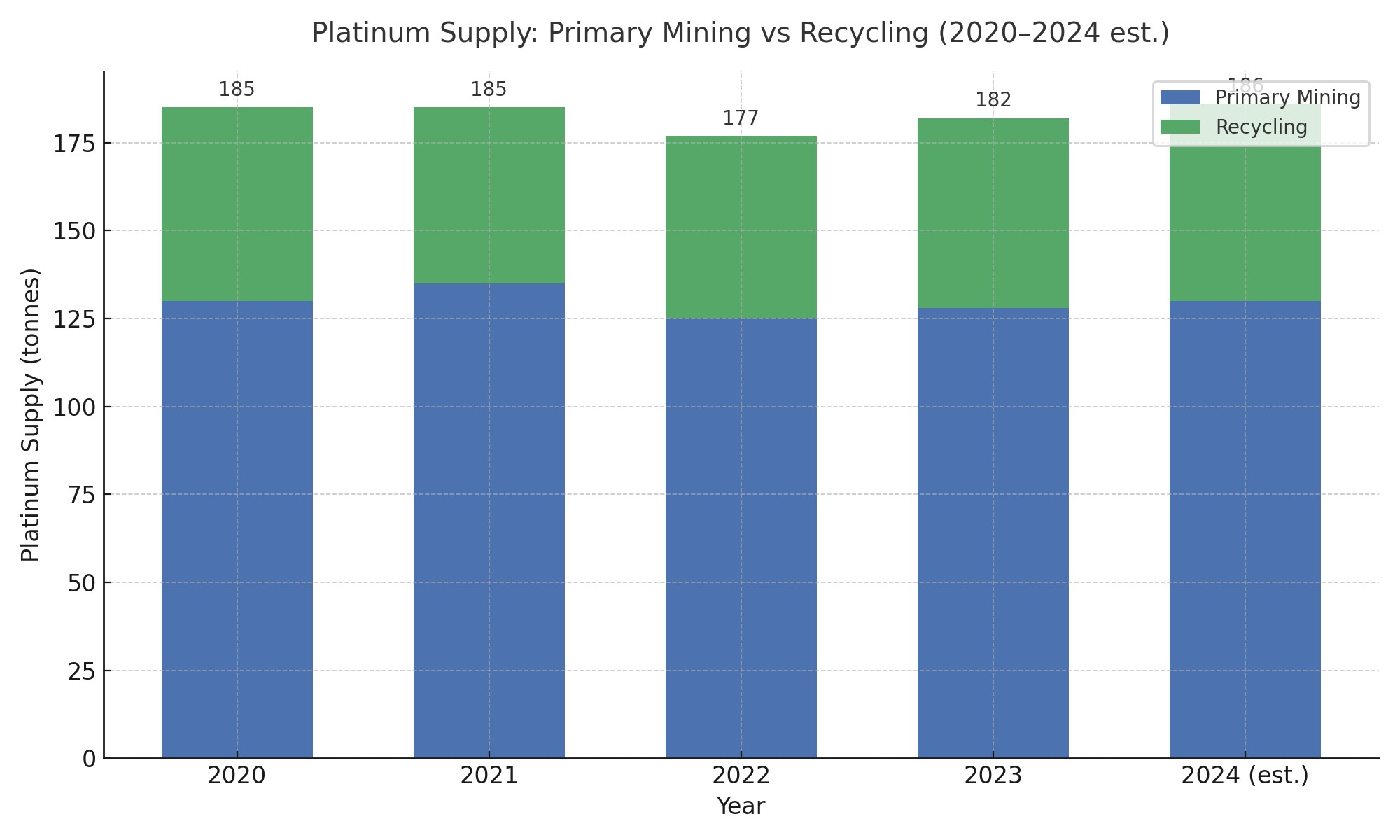

Recycling has become an increasingly important contributor to global platinum supply, accounting for roughly 30% of total output each year. Most recycled platinum comes from end-of-life catalytic converters, as well as jewellery and industrial scrap. By reducing reliance on primary mining, which is energy-intensive and carbon-heavy – recycling helps to lower the environmental footprint of platinum production. However, just as with silver, not all mined platinum is recoverable or recycled. Our article How much silver is recycled, lost, or expires with use? explores these challenges for another precious metal in detail.

As demand for platinum grows in clean energy technologies like hydrogen fuel cells, recycling will play a critical role in ensuring a sustainable and secure supply chain. Similar challenges are faced in the production of other precious metals, such as silver mining, where energy use and waste management also play critical roles.

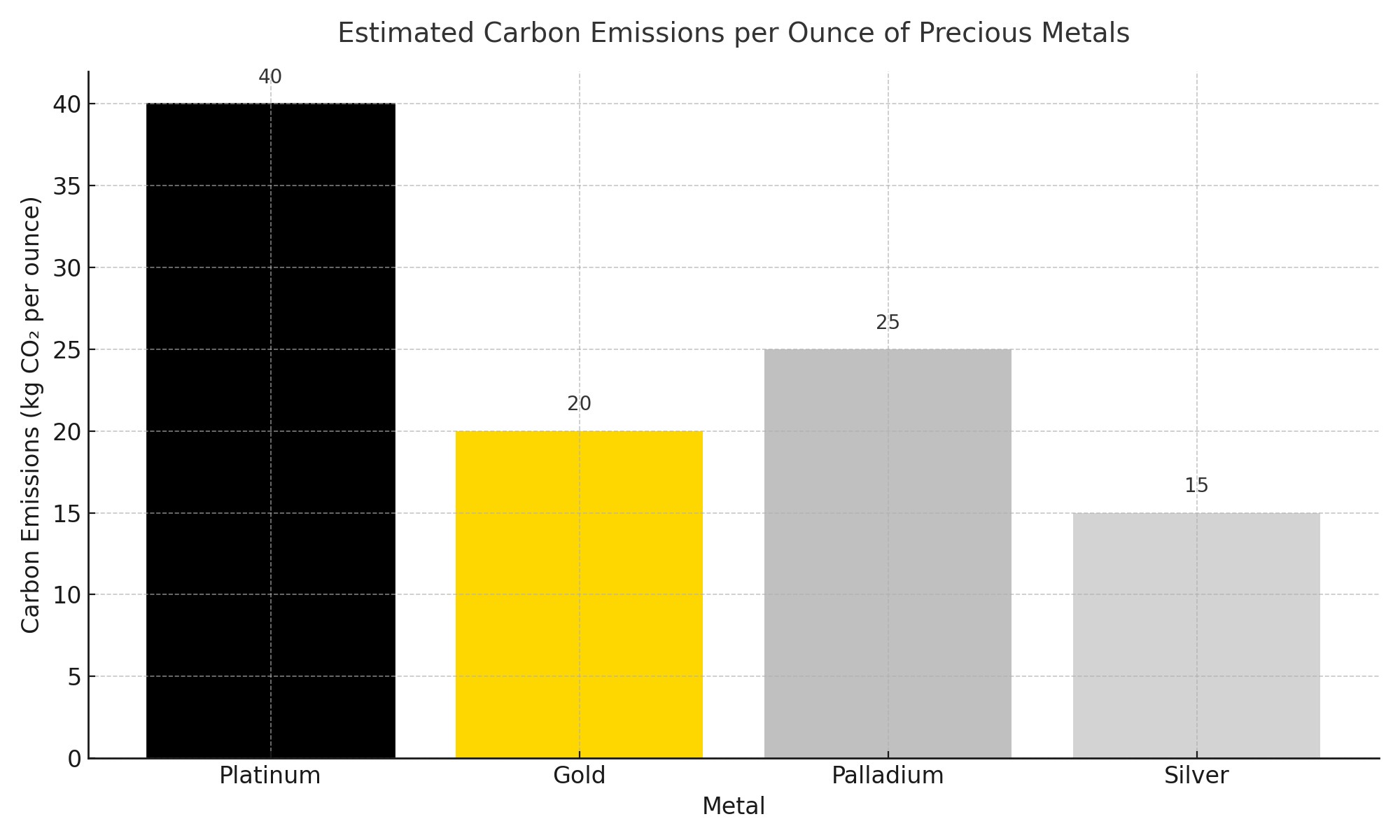

Producing platinum is significantly more carbon-intensive than other precious metals. On average, mining and refining one ounce of platinum emits around 40 kg of CO₂, nearly double the emissions linked to gold and far higher than silver. This is largely due to the energy-intensive nature of deep underground mining in South Africa, where electricity is often generated from coal. Palladium, while also a platinum group metal, typically has a lower footprint because it is often extracted as a by-product of nickel or copper mining.

These figures highlight why the industry is under growing pressure to adopt renewable energy sources, improve efficiency, and increase recycling rates. Reducing emissions in platinum mining is critical if the metal is to play a leading role in sustainable technologies such as hydrogen fuel cells. The Carbon Trust highlights how recycling reduces the environmental burden of platinum mining.

Several factors drive platinum’s high value:

Platinum’s price is historically volatile, influenced by supply disruptions in South Africa, geopolitical issues in Russia, and shifts in demand. The LBMA provides benchmark prices and trading data for platinum and other precious metals.

If you’re weighing platinum against other precious metals, our blog Which is the Better Investment, Gold or Platinum? explores this comparison in detail.

The future of platinum is closely tied to global energy and technology trends:

Supply challenges – limited geographical distribution means production is vulnerable to strikes, power shortages, and political instability.

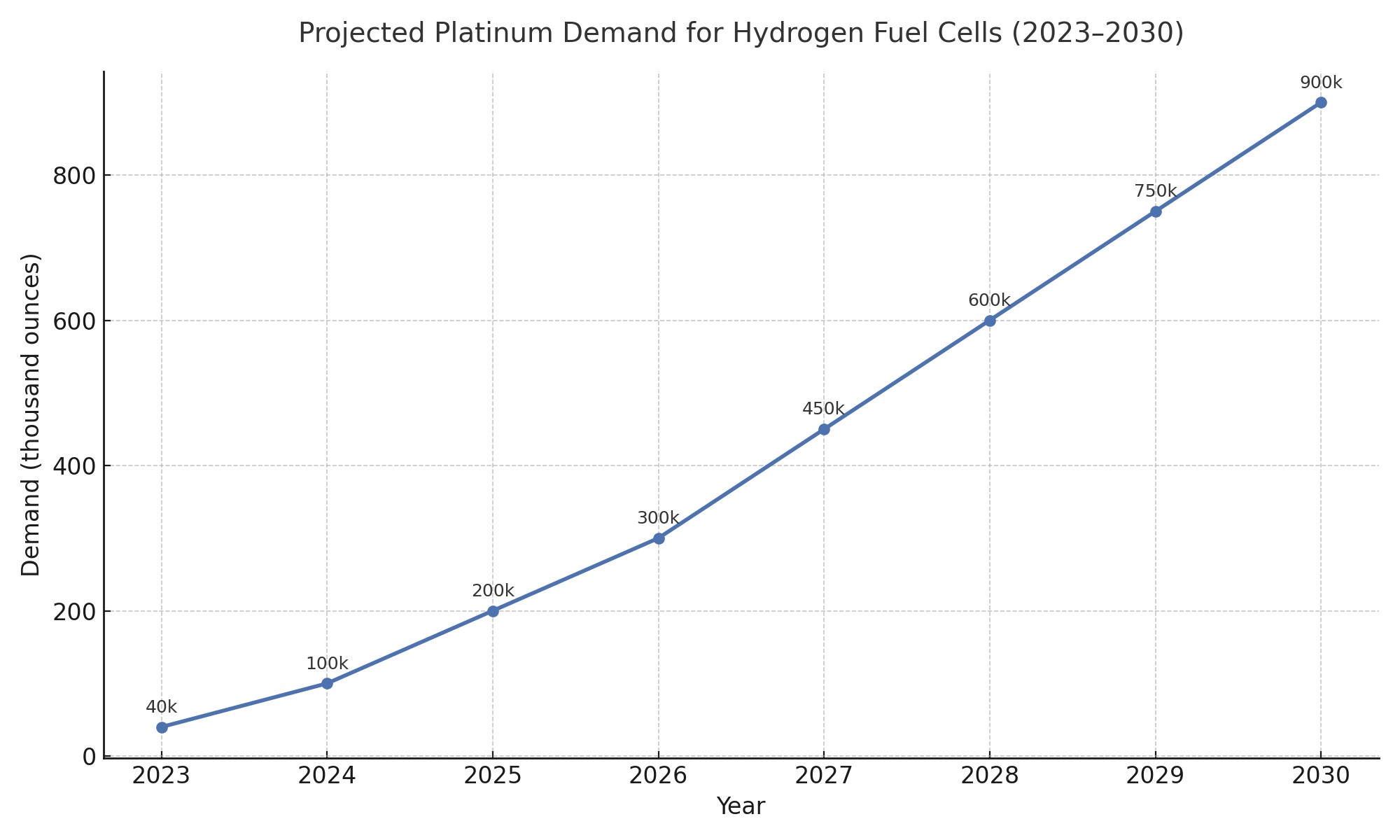

Hydrogen technologies, especially PEM electrolysers and fuel cells, are fast becoming pivotal demand drivers for platinum. Estimates show hydrogen-related usage climbing from about 40,000 oz in 2023 to nearly 900,000 oz by 2030, marking a dramatic 22.5-fold rise in just seven years. Fuel cells themselves are expected to account for over 600,000 oz of that total.(Investing News Network (INN))

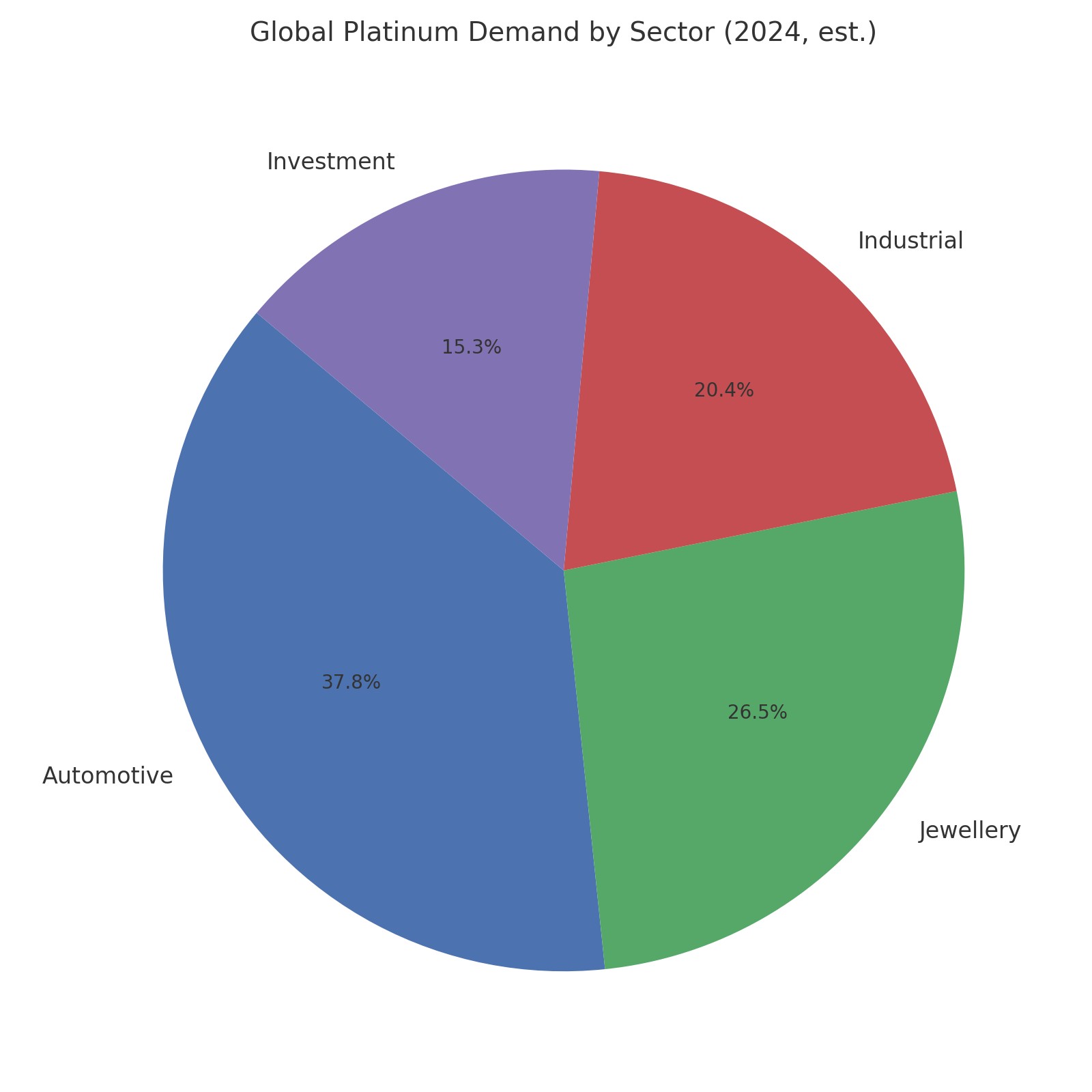

This surge is not only a testament to global decarbonisation efforts but signals a structural shift: hydrogen could soon represent around 11% of total platinum demand.(CME Group)

Yes. Platinum is around 30 times rarer than gold in the Earth’s crust. Annual platinum production averages about 170 tonnes, compared to over 3,000 tonnes of gold mined each year.

South Africa is the leading platinum producer, supplying over 70% of the world’s platinum. The majority comes from the Bushveld Igneous Complex, one of the richest platinum deposits on Earth.

Platinum is mined mainly through underground shafts and open-pit operations. The ore is then crushed, milled, concentrated, smelted, and chemically refined into 99.95% pure platinum. Most platinum mining occurs in South Africa, Russia, and Zimbabwe.

Platinum has four main uses:

A typical catalytic converter contains 3–7 grams of platinum, although the exact amount depends on the vehicle’s make, model, and year. Converters may also contain palladium and rhodium in smaller quantities.

Platinum can be a good diversification asset. It is valued for its rarity and industrial demand, but its price is historically more volatile than gold. Investors typically buy platinum through coins, bullion bars, or exchange-traded funds (ETFs).

Platinum mining is energy- and carbon-intensive, particularly in South Africa where electricity is largely coal-powered. Producing one ounce of platinum emits about 40 kg of CO₂. Water use and chemical waste are also significant, which is why recycling platinum is growing in importance.

Yes. Hydrogen fuel cells use platinum as a catalyst. Demand is projected to grow from about 40,000 ounces in 2023 to nearly 900,000 ounces by 2030, making hydrogen one of the fastest-growing drivers of platinum demand.

Both are platinum group metals (PGMs), but platinum is denser and more widely used in jewellery, while palladium is mainly used in catalytic converters. Palladium prices surged above platinum in recent years due to higher demand from petrol vehicles.

Platinum mining is a complex process that begins deep underground and ends with one of the most valuable and versatile metals on Earth. Concentrated in just a handful of countries, platinum plays a vital role in reducing vehicle emissions, advancing medical technology, and driving the clean energy transition.

As industries move towards a greener future, platinum’s importance, and the way it is mined, will continue to evolve.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.