Gold Supply

Gold is becoming increasingly scarce in the world, with scarcity driving up the price. Of course, many people who already hold a large amount of gold and gold dealers believe that this scarcity is a good thing that will continue to keep the spot prices of gold up. But, let’s just stop for a moment and figure out how much gold is left on the planet that hasn’t yet been mined.

Well, the World Gold Council thinks that 190,040 tonnes of gold have already been extracted from the ground throughout human history. According to them, if all the mined gold were gathered up and put together, it would form a large cube with a height close to a 7-storey building.

The availability of gold

Now, human civilisations have mined gold for thousands of years. It would probably be impossible to assess how much gold these predecessors of ours mined and used up. Infact, current estimates are dependent on the price of gold. Now, if you’re wondering what the current spot price of gold can have anything to do with estimating the amount of gold that’s underground, stop for a moment and think again. The current market price of gold has to be able to pay for exploration and extraction of gold from below the ground. Mining companies incur huge operational costs in removing the gold from the mines. If the current prices are unsustainable, then it’s pointless for the companies to continue to operate and explore these resources. So, current estimates of gold calculated by the large mining companies are divided into two categories.

Many gold mines have already exhausted supplies and have been abandoned

‘Reserves’ mean the amount of gold available and ready to mine, provided its economical to do so at the current prices of gold. Then, there are ‘Resources’ which are unviable to extract from the ground at the current spot prices. However, the company is willing to wait for this gold to become available for extraction at a different price point. The price should cover all the costs incurred by the company including exploration and discovery of new sites, geological and environmental surveys and the operational cost of mining.

Download our FREE 7 step cheat sheet to successful gold investing here

The peak of gold

Now, gold is certainly one of the rarest elements on this planet, spanning around 0.003 per millionth part of the Earth. The rarity of gold postulates the question, “How much of it is left anyway?” According to Eugene King, gold analyst at investment bank Goldman Sachs, the peak of gold has come and gone in 2015. The report claims that there may be only 20 years of gold mining left. According to King, ‘known’ reserves of gold will be depleted around the year 2035. However, similar predictions were made about oil and the Hubbert’s Peak Theory claimed that global oil had already peaked in the 1970s. However, new reserves of oil continue to be discovered even today. So, the key factor in these theories is that they are somewhat based on sources that have already been identified.

Some analysts predict that the last gold nugget could be extracted around 2035

Space mining is a possibility

In all probability, 2035 may come and go, and even if we deplete all the known reserves of gold, mining companies and governments would continue to invest in exploration in the hope of discovering new supplies of gold, in response to the world’s rising demand for the precious metal. There is even speculation that mankind would be able to discover new reserves of precious metals on extra-terrestrial locations like the moon and certain asteroids. Interestingly, former American President, Barack Obama even approved new legislation that allows mining in space.

Gold volumes mined today

Currently, international mining companies

Assuming that prices were to keep rising, serious investors need to be aware of the market trends and start investing in gold now, in order to maximise their gains in the years to come. In fact, the amount of gold underground isn’t really that important, as some of it may be there in the depths of the Earth and may never be extracted. It’s important to predict how much-known gold reserves could be taken out in the years to come.

Talk to our gold experts to understand the future of gold

At Physical Gold, our industry experts invest a lot of time in research to understand exactly which way the precious metals markets are headed. We base our investor advice on this research and you can benefit from this as well. Talk to a member of the investment team today on 020 7060 9992 or get in touch online. Our team has many man-years experience in this industry and are best placed to give you the right advice for your gold investments.

Image credits: Pixabay and Wikimedia Commons

Gold: A safe haven during accelerated inflation?

We’re only half way through 2022 yet, already a record amount of physical gold, gold exchange-traded funds and other exchange-traded products have been purchased by investors this year. This caused the gold price to rise to near all-time highs of over £1500 an ounce this March, a level not seen since August 2020, during the height of the COVID-19 pandemic. There is no doubt why. Looking back to the start of the pandemic, gold was a strong performer throughout 2020 and it had the highest return of any major asset class, returning close to a 25% yield.

However, 2022 will be a different year. Despite gold’s strong recovery from its 13% dip in 2021, unprecedented global factors still pose significant risks to the economy. The sluggish recovery from COVID-19, Brexit ramifications and now the European energy crisis from the conflict in Ukraine mean that uncertainty is rife. Now, mid 2022 as the UK government collapses, investors are still facing down inflation as one of the biggest risks to their savings. Is gold once again the safe harbour to ride out the financial storm?

How has gold performed historically during times of high inflation?

Gold’s performance over the past 50 years tends to support the theory that gold is a hedge when inflation is significantly higher than any target set by Westminster.

According to a study by the World Gold Council, over the last half a century, gold has returned 15% per annum on average when inflation is higher than 3%, compared to just over 6% per annum when inflation is lower than 3%.

How does inflation impact the economy?

Enter May 2022. Consumer inflation reached its highest level in more than four decades due to rising fuel prices and food costs. Pressures resulting from inflation have a wide range of economic ramifications. Increasing the cost of retail goods and services, inflation first reduces purchasing power.

Due to increased risk, borrowing costs may also increase as interest rates rise. Furthermore, inflationary pressures can fuel further inflation, resulting in a feedback loop.

As people spend faster in order to reduce the amount of time they spend holding depreciating currency, the supply of money exceeds the demand, causing the currency’s purchasing power to fall even further.

In a nutshell, money buys fewer goods and services, decreasing the incentives to save cash and encouraging diversification into other assets or instant spending.

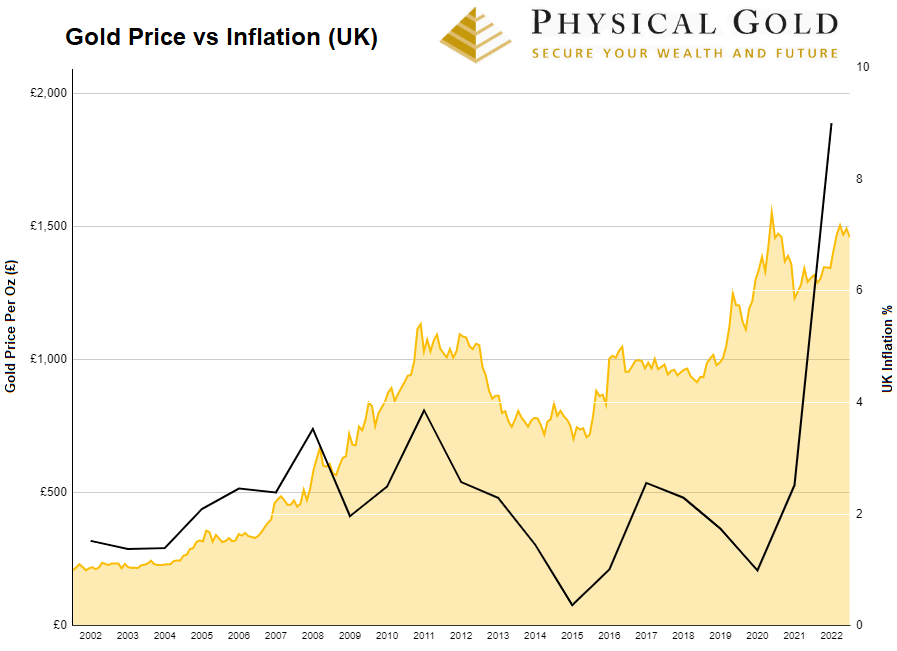

Assets, however, can retain their value more easily. Cars (which have seen 28% increase in prices this year according to Autotrader), houses at 12%, and gold with 20% increases from June 2021 to 2022. In the chart below the last few crises are apparent, 2008 subprime mortgage disaster and more recently 2019-2022 with the triple whammy of Brexit, Covid and Ukraine.

Gold Price per Oz (£) vs UK Inflation (%) 2002-2022

Why does inflation increase gold prices?

Inflation increases the price of consumer goods, resulting in the pound losing value. As inflation rises, the price of gold denominated in pounds increases.

Because investors convert their cash holdings into gold to protect their assets against inflation, gold is a good hedge against inflation. It is possible that an increase in investor interest will lead to a bull market in gold until the inflation effect subsides.

Our previous articles have discussed the advantages of gold as an investment and its importance as a means of protection from inflation. Creating more fiat currency lowers the value of each pound in circulation when inflation occurs.

Gold prices during the 2007 financial crisis

Taking a step back just a few years more, we can see how gold reacts to another financial crisis. In our chart we see a steep increase in the price of gold during the financial crisis that was arguably started with the failure of a variety of investment banking firms from March 2008. Over the course of this period, gold prices first rose, then fell by about 25% during the first few months. Prices then went on to regain all losses within a short period of time and rally to historic highs. Short term the market was very volatile, longer term for anyone holding gold from that time it was a great investment that outperformed other assets.

What makes gold a safe hedge vs inflation?

There is a good reason for the reputation of gold as a hedge against inflation. Since fiat money (paper money) decreases in value during times of inflation, people turn to the assets that have been used as money throughout history – gold and silver. Among the former metals, gold has the reputation of being the ultimate inflation-hedge (silver is regarded as a primarily industrial metal today).

Therefore, inflation and the gold price exhibit a strong positive relationship. As seen throughout the last 25 years in the gold and inflation chart above, gold rallies when inflation rises. An increase in the money supply leads to an increase in the price of goods and gold is a liquid asset.

It has long been a widespread belief that interest rates have a significant impact on the prices of gold and silver. On the face of it, this would appear to be true. If interest rates were to rise, then it would make sense that the appeal of bonds and savings accounts should go up and demand for physical assets go down. In reality, however, there is no real statistical evidence to support this. This is because there are many other factors that drive the prices of gold and silver.

Correlation between interest rates and prices of gold/silver

Whilst there is some level of correlation between interest rates and the prices of gold and silver, it is not enough to say for definite whether rising interest rates have a positive or negative effect. Over the last 50 years, the correlation between interest rates and the price of gold has only been at around 28%.

Rising interest rates have also been shown to have a bullish effect on

If investors foresee that interest rates might rise, then the prices of gold and silver may drop a long time before the changes in interest rates are actually introduced. After interest rates have risen there may actually be a bounce in gold and silver prices as investors look to hedge their bets for the future. According to recent statistics, the chance of gold prices being higher 12 months after a Fed hike is 61%.

That’s not all

Precious metals are also purchased by many investors as a hedge against inflation. They, therefore, make quite timely investments when purchased during the course of a rate-hike cycle. Hyper-inflation in countries like Venezuela is likely to drive citizens of the country to invest their cash savings in commodities that will hold their value like gold and silver. This serves as a warning to everyone to keep an eye on the direction of inflation in their own countries as what appears to be relatively stable conditions can change quickly if confidence turns.

Gold and silver ten oz. bullion bars

Other factors influencing gold and silver prices

The main reason that interest rates do not tend to have a significant impact on the price of precious metals, is that there are many other factors normally involved. Investors buy gold and silver for all sorts of different reasons. They may invest in precious metals as a response to potential economic and geopolitical risks for example. After Brexit demand for gold and silver went through the roof as people were worried about the country’s economic future and how potential trade links with the rest of Europe would be affected. This uncertainty meant that people didn’t trust the markets as much as they would have normally and so investing in physical assets represented a viable alternative as well as a way to protect their wealth in the event of a market crash. Other geopolitical factors such as Trump’s administration in the US have also had an effect on gold and silver prices.

Learn more in our YouTube video – “The Gold price today & investing in gold medium to long term”

Another factor that has a big influence on gold and silver prices is the performance of the stock market. If the stock market is underperforming or has declined significantly then one of the first investments people tend to turn to is silver or gold.

Silver prices

Silver has a wide variety of industrial uses which means its price isn’t always affected by the same factors that influence gold. Due to its heavy industrial use, silver prices can also be influenced by a wide range of other economic forces, depending on how other markets are performing.

Purchase gold or silver through Physical Gold

Physical Gold are specialist dealers in gold and silver. We offer a wide range of investments suitable for all investors including silver bars and gold bars and CGT tax-exempt bullion coins (silver and gold). For more information on our services and how we can help you, please give us a call on 020 7060 9992.

Image Sources: Digital Money World

Is it a good time to buy gold as an investment?

The phrase we hear more often than any is; “Is now a good time to buy gold?”. I’ll address that in this update.

One good phrase for timing the gold market is; “Its not the timing of the market, but time in the market”. Trying to buy at the bottom and sell at the top may sound like a wise strategy, but in reality it’s impossible and can lead to reducing your returns and security. The fact is that holding gold over the long term has proven over the years to provide a secure storage of wealth and outperform inflation.

But I don’t want to just beat inflation, I want big returns…..

It’s human nature to want to beat inflation by a large margin and gain more substantial returns. So timing in and out of the market plays a role in achieving this.

Add gold to your portfolio

While it’s impossible to predict the future, despite many so-called market experts making gold price predictions, timing is about stacking the odds in your favour. This means you look at market fundamentals and choose to invest in assets which look most likely to perform well.

While allocating your money into different asset classes is always recommended, it’s fair to say that now seems like a good time to buy gold.

Because gold has such a long history, we’re able to see how gold has performed before to help predict how it might perform over the next few years.

The gold price has almost always risen in times of severe economic downturns.

Are we heading into an economic downturn?

Even before the pandemic, markets were overheated and global debt at record highs. Since Covid took hold, Governments around the world have opted to print more fiat money to support their suffering communities in the form of furlough support. Now, nearly 2 years on from the start, there seems to be a lethal cocktail mixing which could lead to the mother of all recessions.

With financial markets, there is always an element of counterparty risk

The following ingredients are now in play;

- Inflation is rising quickly around the world. This is expected when Quantitative Easing programs around the world have been operating at full tilt. Increase the supply of a currency, and it’s value will fall. But we’re also witnessing inflation from broken supply chains. Petrol, building materials, electronic components for cars, food, carbon dioxide, the list goes on. They are all contributing to prices rising at alarming rates. Consequence; Money in the bank is losing value every day. The cost of living is rising. Interest rates will rise soon, increasing mortgage payments for many.

- Tax hikes are being put in place to try to reduce (or more realistically stem) the spiralling debt. This can be in the form of increasing National Insurance, reduced tax free thresholds for taxes like Capital Gains, and reduced welfare. Consequence: Less disposable income for the average person means economic growth will be strangled

- Continued restrictions are dampening trade. Travel limitations and business restrictions are preventing businesses getting back to anywhere near full capacity. High streets are quiet and shops are closing. Furloughing has ended so the safety net is now gone. Consequences: We’re likely to see a spike in companies going under and individuals losing their jobs

- Equity and property markets will likely fall in response to negative growth, poor company performance and less ability to afford to move home.

- Continued uncertainty will dampen consumer and corporate confidence. With further spikes in Covid cases, potential further lockdowns and possible ‘long-Covid’ consequences, companies will limit investment and consumers spend less.

How is gold supply and demand at the moment?

During the height of the pandemic, we saw enquiries increase around 700% year on year. That initial rush has calmed, but demand from new investors now seeking the security and protection gold offers as a safe haven, continues to grow. Overall demand remains above pre-pandemic levels and we expect this to rise as recession kicks in.

Institutional money will also increase gold holdings as many competing asset classes suffer. They will look to move allocations out of stocks, bonds and cash, and into gold.

And gold supply….?

Supply of new coins and bars is managing to keep pace with demand. However, due to very few gold holders wishing to sell, we still see huge shortages in the secondary market. It has now been 2 years since we saw decent amounts of sellers in the markets. With the looming economic difficulties ahead, I can’t envisage this changing anytime soon. Premiums on many gold coins are increasing.

Shortage of pre-owned gold coins

Where is the gold price?

As of the time of writing (November 2021), the gold price is moving upwards. It remains more than 10% below it’s all time high in 2020, but has gained around 8% in the past month, as momentum builds.

This was expected as we moved out of the furlough support and inflation began to take hold. While we can’t predict with certainty where the gold price will move in the short term, it seems that now represents good value.

With all these elements working together and interest rates likely to rise for the first time in a decade, it seems like now is a good time to be buying gold.

[button size=”medium” style=”primary” text=”Shop Tax Free Gold” link=”https://www.physicalgold.com/gold-coins/” target=”_blank”]