Bullion Coins

22/07/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

The term bullion is widely used in the precious metals world, often misunderstood or misapplied. Simply put, bullion refers to gold, silver, or other precious metals in the form of bars or coins, primarily bought and held for investment purposes.

When it comes to coins, “bullion” specifically denotes modern coins, typically minted after the 1930s, whose market value is based almost entirely on their precious metal content, rather than any collectible or numismatic value.

Unlike proof, commemorative, or historic coins, bullion coins are produced in large volumes and intended for investors. This means you won’t pay high premiums for limited edition packaging, unique finishes, or exclusivity – making them one of the most cost-efficient ways to invest in gold or silver.

At Physical Gold, we offer a secure, straightforward way to buy gold coins online in the UK, ensuring all our bullion coins meet international standards of authenticity and quality.

Gold coins once played a central role in global commerce. For centuries, they were trusted stores of value, used in everyday transactions and as reserves by central banks. However, dramatic shifts in the global financial system during the 20th century led to the phasing out of gold coins as circulating currency. This pivotal transformation set the stage for their re-emergence as investment tools and collector pieces in the modern era.

In the aftermath of World War I and into the Great Depression of the 1930s, many nations faced severe economic instability. To combat deflation and increase monetary flexibility, major economies such as the United States and the United Kingdom abandoned the gold standard. This shift allowed governments to issue more currency without being limited by gold reserves.

As a result, gold coins were recalled from the public and ceased to be used in everyday commerce. In the U.S., the 1933 Executive Order 6102 famously prohibited the hoarding of gold coins, bullion, and certificates by individuals. Similar actions followed in other countries. Gold was no longer a medium of exchange. It was now a strategic financial reserve.

Although gold coins disappeared from tills and wallets, they never vanished entirely. Governments and mints around the world continued to produce gold coins, now aimed at collectors and investors rather than the general public.

Many of the coins removed from circulation, such as pre-1933 British Sovereigns, U.S. Double Eagles, French 20 Francs, and German Marks, have since become the backbone of today’s thriving secondary gold coin market. Their historical value, combined with their precious metal content, makes them attractive to both investors and numismatists. The iconic 1933 Gold Double Eagle for example, gained incredible value. One such coin fetched a record-breaking £7.5 million at auction in 2002, showing that bullion coins can sometimes bridge the gap between investment and collectability.

This dual appeal led to a robust market where older coins are frequently bought and sold based not only on gold weight but also on rarity, condition, and historical significance. At the same time, modern bullion coins like the Krugerrand and Britannia were introduced to meet the demand for standardised, investment-grade gold coinage.

Free ultimate guide for keen precious metals investor

Bullion coins are one of the most popular and trusted ways to invest in physical gold. Whether you’re protecting your wealth, diversifying your portfolio, or seeking a hedge against inflation, buying gold bullion coins offers a flexible and cost-effective solution. Known for their consistent quality and high liquidity, these coins are ideal for both first-time buyers and seasoned gold investors.

Unlike collectible or numismatic coins, gold bullion coins derive their value primarily from their gold content. This makes pricing transparent and easy to track using live market rates, giving investors confidence and control when buying or selling.

Below are the top reasons why smart investors continue to invest in gold coins as part of their financial strategy.

One of the key benefits of gold coin investment is global recognition. Coins like the Gold Britannia, Krugerrand, American Eagle, and Canadian Maple Leaf are trusted and traded worldwide. These coins are minted by respected sovereign mints and feature markings that guarantee their weight, purity, and origin.

Unlike numismatic coin collecting, which focuses on rarity, historical significance, and aesthetic appeal, investing in bullion coins is primarily about acquiring physical gold at the lowest possible premium, with value based on metal content rather than collector demand.

Thanks to their reputation and standard specifications, these coins are easy to sell or trade quickly, often at competitive rates. This makes them one of the most liquid gold investments available – far more convenient than jewellery or obscure collectible coins.

Additionally, built-in security features such as reeded edges and micro-engraving help prevent counterfeiting, further enhancing their trust and value. The Britannia in particular, features world-leading anti-fraud characteristics.

When you buy bullion coins, you’re not restricted to large investments. Many gold coins are available in smaller fractional weights, allowing you to build your portfolio gradually and liquidate selectively.

Common sizes include:

This flexibility means you can start with a modest budget and scale up over time. Fractional gold coins also allow you to sell only part of your holdings when needed, unlike larger gold bars that must be sold in full.

💡 Insider Tip: Price per gram increases as the coin version gets smaller, so beware when buying tiny fractional coins.

A major advantage of choosing certain bullion coins is the potential for tax-free gold investment in the UK.

Here’s how you can legally reduce your tax liability:

These tax benefits make UK-issued bullion coins some of the best gold coins to invest in for long-term wealth building.

Gold has always been regarded as a safe haven asset during times of crisis. Investing in gold coins allows you to hedge against inflation, market volatility, and currency devaluation.

When traditional financial assets like stocks, bonds, or currencies decline in value, the price of gold often rises. Holding physical gold in coin form offers tangible security and peace of mind during economic instability. Offering similar comfort to owning bricks and mortar, physical bullion coins hold intrinsic value rather than just a paper promise.

Adding bullion coins to your investment portfolio can help reduce overall risk and improve resilience, especially in turbulent markets.

Bullion coins typically have lower premiums over the spot price of gold compared to other gold products. This means more of your money goes directly toward gold content, rather than added costs like design, packaging, or rarity.

At Physical Gold, we focus on sourcing the most recognised and liquid investment-grade gold coins, ensuring you get excellent value at competitive rates. We also offer volume discounts, so the more coins you buy, the more you save.

Popular low-premium coins include:

These coins are widely traded and easily resold, making them ideal for both long-term investment and short-term opportunities.

Once you’ve decided to invest in physical gold, choosing the right bullion coins is crucial. With many options available, selecting the best coin type, size, and origin can significantly impact your investment’s long-term performance, liquidity, and tax efficiency.

Bullion coins are available in a range of weights to suit different budgets and strategies. The most common sizes include:

When it comes to cost efficiency, larger coins typically offer better value per gram of gold. This is because minting smaller coins incurs higher relative production costs and handling fees, which are passed on to the buyer in the form of higher premiums over the spot price.

Here’s a quick breakdown:

💡 Insider Tip: Balancing your holdings between larger coins (for value) and smaller coins (for liquidity and flexibility) is often a smart move. Buying pre-owned ‘best value’ coins can be more cost effective than sticking to brand new coins.

Buying bullion coins produced in your country has several benefits:

For example, UK residents typically get the best value and tax benefits by investing in British Sovereigns and Britannias, while U.S. investors may favour American Eagles for similar reasons.

If you travel frequently, live in multiple countries, or are planning for international relocation, diversifying your coin holdings with internationally recognised bullion coins can be wise.

A well-diversified gold coin portfolio includes both local coins for efficiency and international coins for mobility- a smart hedge for global citizens.

Here’s a breakdown of some of the most trusted and widely traded gold bullion coins worldwide, including their unique features and investment advantages:

British Sovereigns are historic, cost-efficient, and widely recognised. Older Sovereigns (pre-1933) also carry semi-numismatic interest while remaining liquid and tradeable. Their smaller size makes them perfect for portfolio flexibility and partial sales.

The Gold Britannia combines pure gold content with official UK legal tender status. Modern security features such as a latent image and micro-text help deter counterfeiting. A top pick for value, purity, and tax efficiency.

Introduced in 1967, the Krugerrand was the world’s first modern bullion coin. It remains one of the most traded coins globally, often carrying among the lowest premiums in the market, making it a favourite among large-scale investors.

The American Gold Eagle, backed by the U.S. Mint, is a popular choice for American investors. Its classic design and global recognition make it ideal for diversification. The alloy mix adds durability, which is useful for handling and storage.

The Gold Maple Leaf is prized for its high purity and beautiful design. Produced by the Royal Canadian Mint, it also features cutting-edge security features like radial lines and a laser-micro-engraved maple leaf.

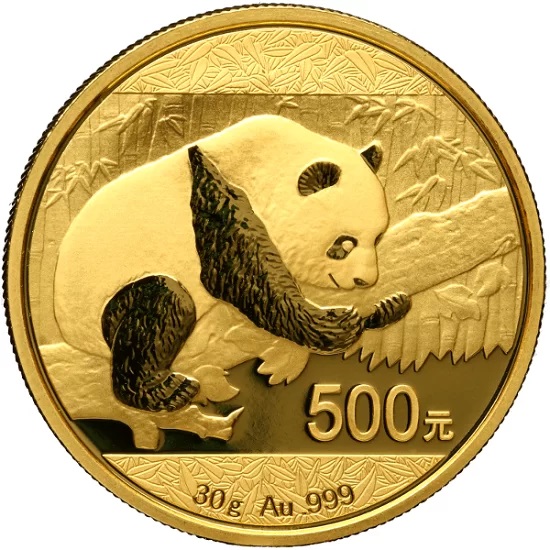

Each year, the Chinese Gold Panda features a new design, making it unique among bullion coins. This collectible appeal adds potential value beyond gold content. It’s a top choice for those who enjoy both investment and artistry.

The Vienna Philharmonic is Europe’s best-selling bullion coin, admired for its elegant musical motif. Minted by the Austrian Mint, it’s a solid option for high-purity gold investors within the EU.

Historic Sovereign coins hold a unique position in the gold investment landscape. They bridge the gap between modern bullion coins, which closely track the gold spot price, and rare numismatic coins, which can command significant premiums based on rarity, historical context, and collector interest.

These older Sovereigns are often referred to as semi-numismatic – a hybrid category that combines intrinsic gold value with added collector appeal. Some investors may still refer to them as “bullion coins” due to their gold content and legal tender status, but in reality, their premiums tend to be higher than both brand-new bullion versions and recently issued pre-owned coins.

A Sovereign is generally considered historic if it was minted before 1933, a period that spans several British monarchs, including:

These coins were once part of circulating currency and were widely used throughout the British Empire, giving them not only monetary but also historical significance.

Unlike modern bullion Sovereigns, which are mass-produced to meet investor demand, historic Sovereigns are limited those that still exist and often come with greater age-related scarcity. As a result:

It’s this range of premium levels that gives historic Sovereigns their semi-numismatic classification. Not quite collectible rarities, but certainly a step above standard investment-grade bullion.

There are several reasons why semi-numismatic Sovereigns appeal to investors and collectors alike:

While historic Sovereigns are a rewarding addition to many portfolios, it’s important to buy wisely:

💡 Insider Tip: While semi-numismatic Sovereigns aren’t being minted anymore, they’re still relatively plentiful. If you’re an investor, wait to get discounted prices on them from dealers during sale periods. Discounts can sometimes shave far more off these coins than standard bullion coins.

Historic Sovereigns are a compelling investment choice for those looking to blend gold exposure with historical and numismatic interest. While they cost more than newly minted or recent bullion Sovereigns, their added value lies in their scarcity, age, and enduring popularity. Whether you’re a seasoned collector or a gold investor wanting to diversify, these semi-numismatic coins offer a unique balance of value, history, and market liquidity.

Which ones are better?

To avoid counterfeits, purchase certified coins from reputable mints or dealers. Trusted third-party coin grading agencies include:

These organisations certify the authenticity and condition of coins. They often participate in global events like Coinex (London) and the International Numismatic Convention (New York).

💡 Insider Tip: Avoid buying graded coins as many dealers will charge markups of up to 100% over the actual coin value. Buying bullion coins from trusted dealers is the cheapest way of ensuring authenticity.

Several simple methods can help detect counterfeit coins:

At Physical Gold, we rigorously authenticate every coin we handle. Our experts are always available to verify your coins and provide guidance.

Guidance You Can Trust

Whether you’re new to gold investing or expanding an existing portfolio, expert support makes all the difference. At Physical Gold, we offer:

📞 Call us on 020 7060 9992

📧 Or contact us online through our secure form for a free consultation.

Bullion coins are investment-grade coins made from precious metals like gold or silver. Their value is based primarily on their metal content, not rarity. Bullion coins are produced by government mints and are a popular choice for investors seeking physical gold or silver.

Bullion coins are valued for their metal content and trade close to the spot price. Numismatic coins, on the other hand, are collectible and priced based on rarity, age, and condition. Investors typically buy bullion; collectors often seek numismatic coins with historical value.

Coins like the Gold Sovereign and Britannia are exempt from Capital Gains Tax (CGT) because they are legal tender. Additionally, all investment-grade gold bullion is VAT-free in the UK. No gold is exempt from Inheritance Tax (IHT).

The best bullion coins to buy depend on your location and goals. UK investors often choose Sovereigns or Britannias for tax advantages. Globally, popular choices include the Krugerrand, Maple Leaf, and American Eagle due to their recognition and liquidity.

Yes, bullion coins are easy to sell, especially widely recognized coins like the Britannia, Sovereign, and Krugerrand. Their high liquidity and global acceptance mean they can be quickly traded through dealers, online platforms, or gold investment firms.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.