Decimalisation in the UK: When, Why and How?

13/10/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

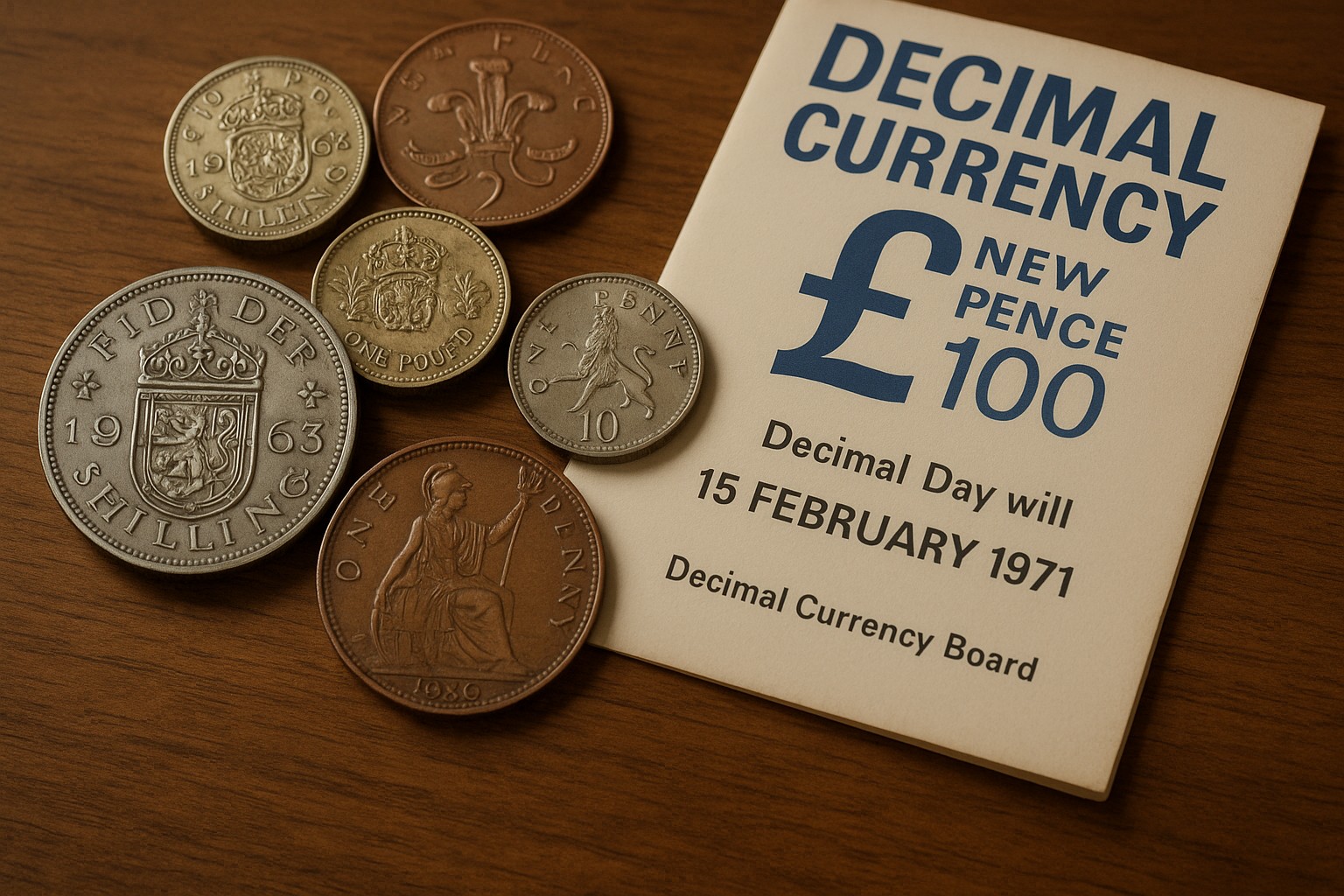

On 15 February 1971, millions across Britain woke up to a new way of counting their cash. Known as Decimal Day, this historic event marked the moment the United Kingdom shifted from pounds, shillings and pence to a simpler, base-ten system of pounds and new pence.

The change was monumental – not just for consumers, but also for Britain’s economy, coinage, and future trade. In this article, we’ll explore when, why and how decimalisation happened, the long path leading to it, and how it fits into the broader history of British money – from the Gold Standard to today’s fiat system, where money no longer represents physical gold.

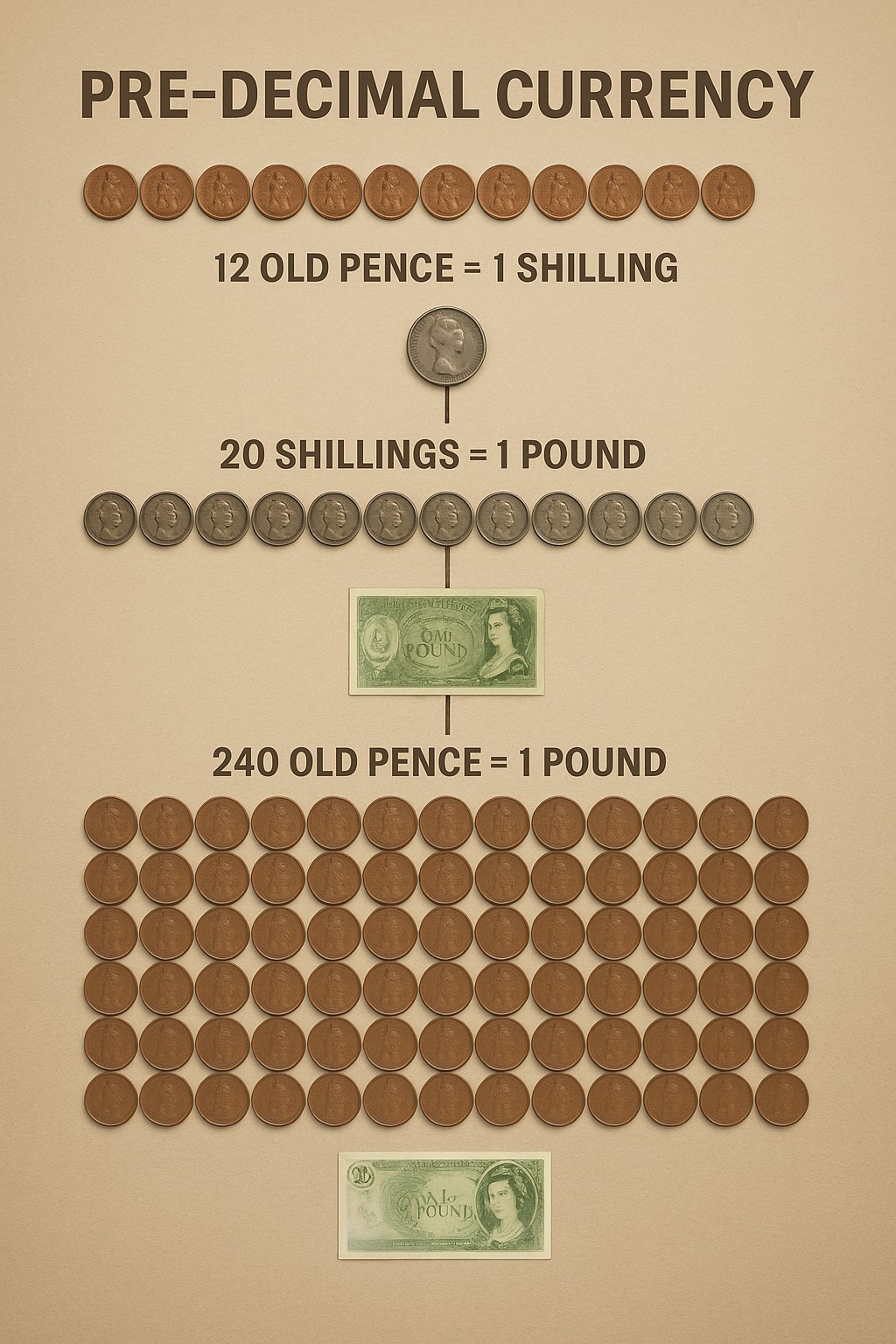

Decimalisation refers to converting a currency to a decimal system – one based on powers of ten. Instead of dividing the pound into 20 shillings of 12 pence each (240 pence total), the new system simplified the pound into 100 new pence (p).

The UK and the Republic of Ireland both decimalised their currencies on 15 February 1971, modernising centuries of tradition in one coordinated transition.

If you’re interested in how Britain’s monetary system evolved from a gold-backed currency to paper and digital money, see our article on Gold vs Paper Money.

Decimalisation in the UK took place on 15 February 1971, known as Decimal Day. On this date, Britain replaced its centuries-old pounds, shillings and pence (£sd) system with a simpler decimal currency, dividing one pound into 100 new pence.

Before decimalisation, Britain’s money system was famously complex. Known as ‘old money’, it used three denominations:

Together, these Latin terms reflected the Roman roots of the system.

For example:

The structure was charmingly traditional but impractical for arithmetic and commerce – especially in an increasingly globalised world.

There were economic, political, and practical reasons behind the shift:

For more on how government and financial systems evolve alongside currency policy, read What Is the UK Monetary Supply?.

Free ultimate guide for keen precious metals investor

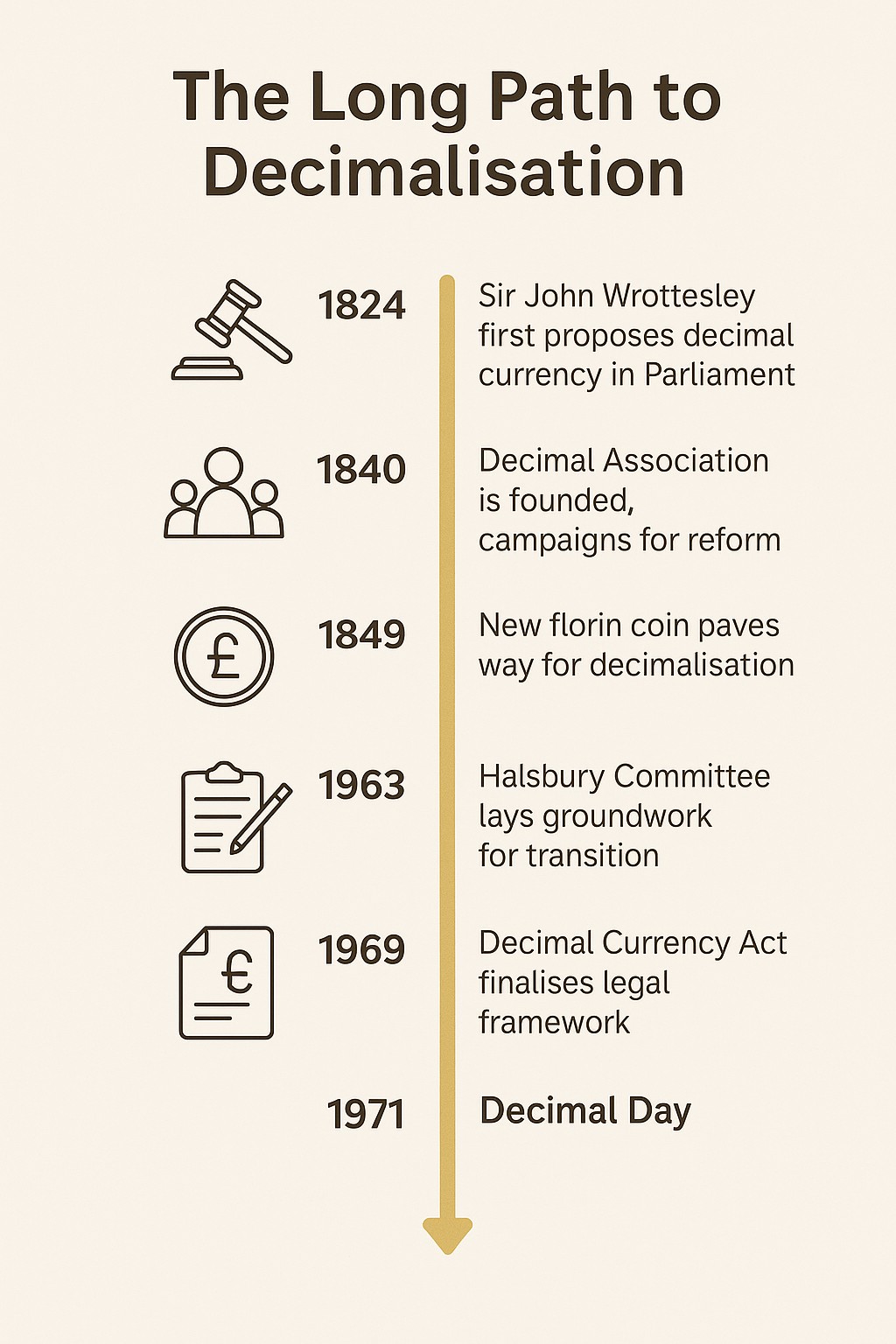

Although Decimal Day arrived in 1971, the idea was centuries in the making:

Meanwhile, South Africa had already adopted a decimal system in 1961 when it introduced the Rand, and launched the Krugerrand gold coin in 1967 – showing how gold-backed and decimal currencies could coexist. (Learn more about gold’s enduring role as both asset and money in Is Gold a Commodity or Currency?)

The UK government spent over £1 million on public education and advertising. Shops, banks, and post offices displayed posters and jingles – including the well-known “Decimalisation Song” by Max Bygraves.

Banks closed for five days (10–15 February) to prepare, reopening on ‘D Day’ with the new money.

Despite initial confusion, especially among older consumers, Britain adapted remarkably quickly.

The Royal Mint played a central role in designing and producing the new coinage ahead of the switch. You can read more about the process and see images of the original coins on The Royal Mint’s Story of Decimalisation

Decimalisation transformed British coinage. Here’s a quick comparison of old vs new:

The decimal half-penny (½p) was the smallest UK coin but proved unpopular and was withdrawn in 1984. The £1 coin (1983) and £2 coin (1998) came later, reflecting further evolution.

For more on the coinage’s link to gold and value systems, visit our guide to Gold vs Paper Money.

The Crown, worth five shillings (or a quarter of a pound), was traditionally a large silver coin used for ceremonial occasions rather than everyday transactions. It was later issued mainly as a commemorative piece, a practice that continues today with modern £5 coins.

The Pound, often called the Sovereign when minted in gold, became the core unit of British currency. Gold Sovereigns remain highly valued by collectors and investors, linking directly to Britain’s era under the Gold Standard.

The Guinea, valued at 21 shillings (£1.05), was originally made of gold and used from the 17th to early 19th centuries. Although it ceased to circulate after 1816, the term “Guinea” lived on as a symbol of prestige and luxury pricing—for example, fine art, thoroughbred horses, and bespoke tailoring were traditionally priced in Guineas to signify status and quality.

Ireland adopted decimalisation on the same day as the UK – 15 February 1971. The Irish Pound (or Punt, IR£) mirrored the British system until replaced by the Euro in 1999, with coins entering circulation in 2002.

Britain was surprisingly late to decimalise. Other nations did so long before:

By 1971, Mauritania and Madagascar were the only countries still using non-decimal currencies – a fact that remains true today.

Many feared price inflation and loss of value, but decimalisation ultimately simplified trade and daily life. Britain’s financial system became more efficient and globally aligned.

For investors and collectors, this period represents a fascinating divide between pre-decimal and post-decimal coins – many of which are prized today for their gold and silver content.

The transition was widely documented in schools, media, and government materials. For a fascinating look at the posters, jingles and teaching aids used to educate the public, see The National Archives’ Decimalisation Educational Resources.

To understand the wider evolution from tangible metal value to fiat currency, explore:

For collectors and precious metals enthusiasts, decimalisation marks a defining era in British coinage. It bridged the gap between historic pre-decimal coins, featuring monarchs such as Queen Victoria and George VI, and modern decimal issues, such as the early coins of Queen Elizabeth II.

Many pre-decimal coins – especially those struck in gold or silver – are now highly sought after. Collectors value them for their craftsmanship, rarity, and historical importance.

If you own older coins, check their metal content:

Our in-depth analysis of silver fineness covers the entire spectrum of purities.

Step-by-step Guide

Decimalisation took place on 15 February 1971, known as Decimal Day, when the UK switched from pounds, shillings and pence to a system of 100 new pence per pound.

To simplify transactions, modernise its economy, and align with international trade and technology standards.

Before decimalisation, £1 = 20 shillings, and 1 shilling = 12 pence – meaning 240 pence to the pound.

Coins minted before 1947 often contain high silver content and are prized by collectors, especially those featuring Queen Victoria, George V, or George VI.

Gold once underpinned Britain’s money through the Gold Standard, but the UK now operates a fiat system, discussed further in Gold vs Paper Money.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.