Types of Gold

02/09/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

With gold being so valuable, everyone wants to know they’re buying the right type of gold and ask which types is best? The various types of gold can refer to a number of different areas. The most obvious starting point is to cover the diverse forms of gold, from its unrefined nugget and dust form when first extracted from the earth, to beautifully crafted gold jewellery and coins.

The gold we see in high street jewellers comes in an assortment of gold colours, depending on various alloys each item has been mixed with. The different categories of gold purity are also a factor to understand as it impacts both the value of the item, along with its softness and malleability.

Finally, we look at the various amounts of gold used in certain items such as jewellery and collectible gold pieces. The sorts of gold coating or use can vary from cheaper gold-plating, through to an item consisting of solid gold.

The different types of gold investment is a whole subject itself, ranging from some of the physical gold forms like coins and bullion covered in this article, to electronic gold investment types like gold ETFs and gold futures.

When people think of types of gold, they usually imagine huge brick-like gold bars in vast, elitist bank vaults. Or they might imagine pirate-like treasure chests full of gold coins. Others imagine nuggets of gold, prized from the earth, or some various expressions alluding to gold dust.

There’s no better way to enjoy gold’s alluring beauty than wearing a carefully crafted jewellery item. Items can range from necklaces, the earrings, bracelets to watches. Gold’s unique properties lend themselves perfectly to creating unique and intricate trinkets and charms who’s lustre never tarnishes.

Most often gold is combined with other metals to improve durability for daily wear. Gold’s flexibility and universal appeal lends itself to both contemporary and traditional designs, which can be adorned as a way of displaying wealth, success and style. Beyond just its inherent value, gold jewellery can represent special moments in time and become cherished keepsakes.

Gold leaf and gold dust, made from particles of pure gold, are more widespread than you may think.

Gold in leaf form is gold hammered down or processed into sheets just microns or thousandths of a millimetre thick. The tissue-thin sheets visually disappear when applied to surfaces but add a lustrous gold gleam to decorate fine artwork, books and furnishings. The near weightless nature stretches the precious material substantially for cost-effective gilding rather than solid gold crafting.

Gold dust is produced by finely grinding gold into a powdery consistency. It lends a sparkling effect when incorporated into paints, inks, foods or applied onto artwork. Just tiny amounts capture light magnificently.

Both leaf and dust offer affordable ways to make items unique and special.

A form of gold which has endured millennia is gold coins. Harnessing gold’s scarcity, the precious metal has been a popular choice to represent monetary value around the world. Thousands of types of gold coin exist, some as legal tender and others as collectibles, with varying purities, sizes, and weights.

While the use of gold in everyday currency has dwindled due to cost and the digital age, gold coins are still minted in significant volume as bullion and commemorative issues. Gold coin types like Sovereigns have existed for centuries but remain popular amongst the investment community due to their tax efficiency and liquidity.

Gold bullion is the most recognisable form of gold as it’s the one represented most often in films. Unlike coins, gold bars are typically valued solely for their gold content and weight rather than any design or historical significance.

They range in size from tiny 1-gram bars suitable for individual investors with limited capital, to larger kilogram bars for more accomplished investors and institutional buyers. Gold bullion is predominantly known as pure gold, with bars being made from solid 24 karat gold. The largest 12.5KG gold bars, known as ‘good delivery bars’, are held by central and commercial banks due to their lower relative cost and ability trade without the need to physically exchange.

Gold nuggets are naturally occurring pieces of unrefined gold. While featured in books and films, nuggets are far rarer than finding gold flakes.

Ranging vastly in shape and size, nuggets form when gold deposits get eroded out and shaped into chunks and fragments by the elements. While gold dust and tiny flakes are found in gold bearing rivers, nuggets constitute larger jagged chunks that contain anywhere from a fraction of an ounce up to many pounds of pure precious metal.

Highly coveted by prospectors and collectors, large gold nuggets are exceptionally rare prizes sometimes selling for many times their simple melt value due to uniqueness. Even miniature “picker” nuggets retain an allure and special value beyond their metal takings due to their uniqueness and origin story.

Free ultimate guide for keen gold investors

The marketing of white gold alongside yellow gold as a jewellery option is long established. But did you realise that there are actually range of different gold colours and hues. In its purest form, gold holds its recognisable yellow sheen. Its colour changes when mixed with other metals known as alloys. Just like blending two different paint colours, gold will take on a different shade, depending on the proportions of each mixer.

Various alloys are used to create varying appearances and amend gold’s consistency to suit the specific needs of the item.

The most common colours of gold are;

Yellow gold retains enduring popularity in jewellery thanks to its beautiful, rich glow. It’s the colour most synonymous with gold as yellow is its colour in natural state. While the depth of the yellow will be greatest with 24 karat gold, most jewellery is made with lower purity due to the softness of pure gold. Gold alloys blend in harder metals to bolster durability without distorting its signature golden tone too much. Yellow keeps a luxurious, classic look across formal and casual pieces.

White gold currently reigns as the most on-trend metal for jewellery. By mixing yellow gold with white metals like silver and platinum, jewellers achieve its bright finish. A rhodium plating applied on top enhances hardness and shine, needing occasional touch-ups as it wears down over time. White gold can irritate the skin of some people due to the common use of nickel.

Rose gold, also referred to as red gold, has increased in demand in recent years with its vintage vibe and warm reddish radiance when copper joins with pure gold. Depending on the amount of copper added, the end hue can vary between red and a range of pinks.

Rose gold isn’t coated in the same way as white gold, as the aging process is deemed to add to its antique loved look, rather than try to keep a perfect finish. This relaxed look appealed in predominantly in 19th century Russia, being referred to globally as ‘Russian Gold’.

For an even more unique finish, specific alloys can be used to create bold and exclusive gold hues. The rarer blues (using indium or gallium), purples and greens populate primarily artsy designer works rather than mainstream commercial collections focused on traditional yellows, whites and pinks.

This table shows the different industry standard metal mixes for various types of gold colour. The range of four distinctive green hues demonstrates how slight changes in alloy composition are used to create subtle shade changes, primarily driven by fashions in the jewellery industry.

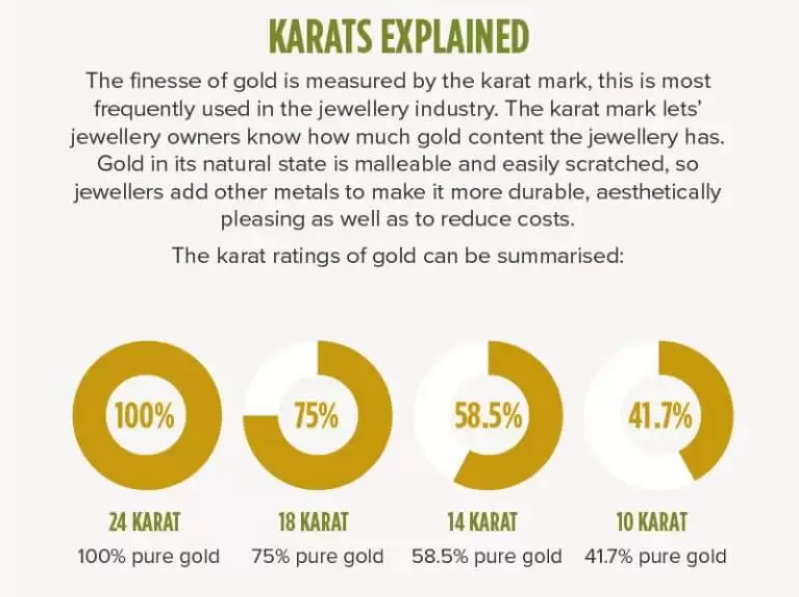

Gold doesn’t just come in different colours and forms. Gold products such as jewellery, coins and ornaments are also produced in varying purities. Clearly, when alloys are added to gold to either enhance the colour, resilience or malleability, the overall gold composition is reduced. Commonly jewellery is produced in varying levels of gold purity to hit different customer price points. As cheaper alloys are added, both gold purity and the cost of production are reduced.

The most common way to express the assortment of purities is in Karats. This provides a set scale so that buyers of gold products have complete clarity on how pure the gold used is. The spelling of this term varies between karat and carat which can be confusing. Technically, the term carat refers to the size of gemstones such as diamonds, while purity of gold is measured in karats. While this distinction is common around the world, it’s accepted that the two spellings are interchangeably associated with gold purity in countries such as the UK.

Another expression used to measure the numerous levels of gold purity is fineness. This gauge is designed to be both more precise than karats and easier to comprehend. The increased accuracy derives from the fineness scale being far wider than that of carats, measuring up to 1,000, instead of just 24.

Its aim of simplicity relies on stating gold purity (and other precious metals) as a percentage. It does this by expressing the purity of gold per 1,000 grams of a particular coin or bar. This is known as the ‘parts per thousand’ rule. As an example a gold fineness number of 375 indicates 375 parts gold, mixed with 625 parts alloy. Or in other words 37.5% purity gold.

Still with me?! You won’t be surprised to know that the gold carat scale is best known and relied upon by the general public wanting to know if a gold coin is 22 or 24 carat, or a necklace 9 or 18 carat. Fineness tends to be used more by precious metals dealers and professionals, where the liquidity of a large gold bar can materially vary if its 999.9 (99.99%) fineness or just 999 (99.9%).

In theory, the karat scale goes all the way from 1 to 24, with 24 being the purest gold and 1 being the most diluted. However, in practise there are a fixed number of karat amounts indicating the ratio of gold to alloys.

The most familiar and common carat levels are;

This number indicates the top purity available, referred to as pure gold. In reality, 24 karat gold won’t be 100% pure due to limitations in the refining process. The negligible presence of other metals equates to a maximum fineness level generally found in gold of 999.9. This is the most common purity of gold bullion bars and is the purity of gold referred to when calculating the gold spot price.

For gold jewellery 24 carat gold presents the brightest yellow, but also the highest price tag. In practise, pure gold is rarely used to produce jewellery items as its extreme softness and malleability make it impractical. 24 carat jewellery would not only scratch easily but also bend out of shape in no time.

At 91.67% purity, 22 carat gold is the next widespread step down from pure gold. While it contains some alloys, it remains relatively soft and unsuitable for most jewellery. The role of clasping precious gemstones in ornate jewellery designs is best left to the more reliable lower carat gold.

However, 22 karat gold does mark a significant point in the minting of gold bullion coins. Investors in physical gold coins are seeking maximum exposure to the gold price and as such want to own coins with high levels of purity. While a majority of the world’s investment-focussed gold coins are minted in 24 carat gold, a notable number are still produced in 22 carat form. Arguably the two best-known gold coins, the Krugerrand and Sovereign, are both 22 karat.

Buying and selling prices of these coins is based on the pure gold weight only, so the investor is essentially getting the alloys for free. The addition of the other metals ensures the gold coins are far more resilient to scratches, ensuring maximum resale value.

Most crucially, 22 karat gold is the minimum purity required for gold coins or bars to be deemed ‘Investment Grade’. This vital classification qualifies the physical gold is VAT-exempt, making it a more viable investment proposition.

Along with 9-carat gold, this is the most common gold fineness found in jewellery. At around 75% gold content, 18 karat gold is cheaper than using pure gold, but maintains its lustrous yellow colour. The 25% of alloys provide more resilience to wear and tear and a tougher metal all round. It feels significantly heavier and more luxurious than 9 karat gold and is a popular choice for wedding bands and high-end necklaces. Resale value of 18 carat gold is more reliable than 9 carat versions.

The cheapest gold purity contains around 37.5% gold but is the most hard-wearing of all the blends.

Far lighter than higher purity versions, 9 karat gold jewellery is easy to wear daily. Its relative affordability positions it perfectly towards the mass-market. Its hardness makes it the ideal choice for use as a precious stone clasp.

Jewellery and ornaments may state they use ‘real gold’ or even ‘24-carat gold’, but their value and quality can vary dramatically depending on the types of gold process used to craft them. The item may be coated with gold, with the rest consisting of cheaper metals. While most of us are familiar with the terms ‘gold-plated’ and ‘solid gold’, it’s not common knowledge to discover two more types of coating that sit between these two extremes.

As the term suggests, the entire object is made with gold, of varying purities. The world’s mints generally produce all their gold bars and coins in solid gold. The only exceptions are a tiny number of commemorative coins which may use gold elements just on the surface to combine appeal with affordability.

Jewellery made with solid gold will have the highest price tag but also be the most durable.

Regarded as the closest alternative to solid gold for jewellery, this type of gold coating offers a more affordable option. It consists of a thick layer of solid gold, mechanically bonded to the base metal in the middle (usually bronze or brass) using heat and pressure. This method of gold coating is popular as it contains 100 times more gold than gold-plated jewellery and is less prone to tarnishing due to the permanence of its bonding. It can also be referred to as rolled gold or gold overlay.

A sterling silver base may dupe buyers into thinking that vermeil construction is more desirable than a gold-filled piece which bonds to cheaper metals. However, the gold coating is not only far thinner than that used in gold-filled products, but the different bonding process compromises its quality. Rather than the permanent bonding method in gold-filling, vermeil relies upon an electroplated procedure which is less durable. This reduces the lifespan of the piece as the gold can tarnish quicker and the jewellery is not water-safe.

Items made with gold-plating are cheaper but come with a raft of possible drawbacks to consider. A very thin layer of gold makes up a maximum of 0.05% of the piece’s total composition. This covers the brass or copper base metal. Due to the thinness of the gold coating, plating can easily wear away, reducing the longevity of the piece. Gold-plated jewellery suffers when exposed to water and sweat and can cause some people skin irritation.

For a friendly, relaxed conversation about investments in physical gold, call us now on 020 7060 9992. You can also complete our contact form.

Read on to learn about the various types of gold available and what type of investments these make. Listed below, you will see questions with their answers.

In addition to the high cost of using pure gold, there are a number of reasons why 24 carat gold isn’t used to make jewellery. Its softness limits its durability, leading to items scratching easily. Jewellery would also lose its shape quickly due to pure gold’s extreme malleability.

The two most common gold purities sold by jewellers in 9 and 18-carat. While 9 carat pieces are cheaper, 18 karat gold is heavier and feels more up market. The quality of gold varies between being 100% solid gold and the cheaper gold-filled method.

18 karat gold is more expensive, consisting of around 75% gold purity. Its heavier and feels more opulent than 9 karat gold. 9k gold is ideal for price sensitive buyers, is durable due to its high alloy content and can suit certain skin tones with its paler colour.

The best type of gold depends on your intended use of it. Investment grade gold coins and bars are best for investors as its VAT-exempt. Solid 18k gold is the best choice for wedding rings and luxury jewellery items, while 9k is the cheapest.

There are several types of gold. It can come in the form of jewellery, coins, bullion, dust & gold leaf. The purity of gold can vary from pure 24-karat, down to 9k gold. The colour can differ from bright yellow, to white, rose and even green!

Use our automated portfolio builder and see just how far your investment can go.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.