Futures contracts provide investors with a more flexible way to invest in precious metals without the need for investing the full amount up front. To buy or sell a futures contract, investors need not put up the whole value of the contract, but must instead pay a margin deposit as a show of good faith that they will make good on the contract.

How futures contracts work

Futures contracts are a contract for the future sale of an item specifying

The idea behind futures contracts is that it allows both consumers and producers of gold to manage gold price risk by locking in the price they wish to buy/sell that product for in the future. For investors, gold futures offer them the chance to invest in the future price of gold for only a fraction of the total cost of the contract. Most of the time, the futures contract isn’t actually settled financially as the contract is sold on before any physical gold changes hands.

Why invest in futures contracts?

Investors of futures contracts fall into two main categories. Hedger and speculator. Hedgers purchase gold futures as a hedge in order to against the price of gold going up or down whereas speculators hope to make money by taking advantage of favourable price movements in the market.

An example of a hedger might be someone who believes the price of gold will rise and wants to take out a futures contract to lock in a guaranteed price should prices indeed go up. This way they can offset any future price increases by selling the futures contract.

How else can you use futures?

A speculator, on the other hand, hopes to benefit from market volatility by gambling on potentially favourable price movements. For example, imagine you purchased a futures contract when gold prices were at their lowest and the value of gold suddenly shot up, you could then sell it on at a profit. Alternatively, if you thought gold prices were likely to go down, you could then sell your gold futures while their prices were still at a peak.

Download the Ultimate Insiders Guide to gold investment FREE

The best part….

One of the main benefits of investing in gold futures as opposed to buying gold outright is that it requires considerably less capital. The higher amount of financial leverage afforded by gold futures also provides a higher risk/higher return investment.

The disadvantage of futures contracts versus physical gold purchases, however is the risk that you could lose greater sums of money if the price of gold moves quickly in the opposite direction to your futures bet.

Gold Futures Offer an Alternative To Physical Gold

Long/short positions & gold options

When investing in gold futures you have the option to take up either a long position or short position.

Short position

If you think the price of gold is likely to go down, then you might take up a short position on futures contracts. In which case you would pay a margin price to take temporary ownership of the stock and sell them straight on. If the price of gold then goes down, you can then buy the gold back at a profit before returning the stock to the original seller, having made a profit. The main risk of taking out a short position is that if the market doesn’t go the way you predicted you will still have to return the gold even if you have made a loss on it.

Long position

If you think the price of gold is likely to go up, then you would then opt for a long position on futures contracts. This is where you would take full ownership of the stock and hold on to it in the hope that gold prices go up over time.

Gold options

Gold options are slightly different to futures contracts. An options contract allows an investor to make a bet on whether the price of gold will go up or down in the future. On reaching the date specified in the contract, they will then have made a profit or loss based on the difference between where the price actually finishes and how much they’ve predicted it to go up or down by.

Here’s the deal…..

Options contracts are divided into two classes, either calls or puts. If you think gold prices will go up, you would purchase Gold call options. If you believe that gold prices will fall then can buy gold put options instead.

Overall options are a higher risk investment than buying physical gold as you could lose all the money you have invested if the market turns against you.

Discover more about the gold investment market with Physical Gold

Physical Gold are specialist brokers in gold and silver. We offer a wide range of gold based investments as well as providing additional insight into the industry and all the latest news and tips on investing. (See our insights page) For more information please contact one of our friendly and helpful advisers on 020 7060 9992.

Image sources: Pexels

Scrap gold can be a hidden treasure

Many of us have some unused gold lying around the house. In many cases, its jewellery belonging to grandparents that are old and unused and have lost its lustre through the years. Although the gold may look tarnished, it’s still gold and does have a market value. Then we spot dealers posting ads on television offering cash for all that scrap gold, and it tempts us to pull out that unused old gold lying around the house, never to be used to again. Why not put it all in an envelope and post it off to that scrap gold buying service and hope for some cold hard cash?

Well, the idea seems to be a practical one, but let’s run through the steps you need to follow to ensure that some rogue or slick conman doesn’t get your gold off you for peanuts.

1. Understanding market prices

Gold is always sold everywhere at spot prices. This is the value of gold per troy ounce at a particular point in time. A troy ounce is different from a standard ounce, and it’s important to know the difference before walking into a high street gold shop. A little online research will get you up to speed on prices, so you won’t get fooled by a dealer attempting to short change you.

It’s important to evaluate your scrap gold before selling

2. Get your gold valued

You can go to a reliable gold dealer to get your gold valued. It’s important to figure out whether your gold items are worth more in their current form or as scrap gold. For example, you may have a coin that’s worth much more than its weight in gold on account of its numismatic value. Sometimes, your gold jewellery may be worth more than simply selling it as scrap. These are important considerations before you get around to selling your gold.

10 Commandments when selling your gold coins. Download our free cheat sheet here

3. Timing is important

Knowing when to sell is critical when selling gold. Of course, many people may require emergency cash and may make a distress sale. But ideally, it’s best to look at price trends and sell when the price of gold is up.

4. Determine the purity

Knowing the purity of the gold you possess

5. Weigh your gold

Before heading out to sell your gold, it’s important to first weight it. Gold is measured in troy ounces. Again, there are kits available in the market to help you accurately weigh your gold.

6. Clean your gold

Gold may tarnish over time. Cleaning your gold is yet another important step prior to selling. Some warm water, dish soap and a soft toothbrush should do the trick. Just let it dry at room temperature and then wipe it before selling.

7. Identify a reputable gold dealer

Settling for a price given by your nearest gold dealer isn’t a smart idea. Shop around to see the best price you can get. Postal gold buyers are popular these days. When sending any gold to a dealer, keep a record of what you’re sending by clicking a few images. Always send your gold via insured delivery and fully understand the terms and conditions of the sale. Selling to a rogue buyer could mean that you stand to lose your money. Reputed buyers will always insist on checking your photo ID before closing a deal.

Talk to our gold experts before closing a deal

Our precious metals advisory team is best placed to evaluate your gold before you sell and will let you know the price you can expect. Call us now on 020 7060 9992 or drop us a line and a member of our team will be in touch with you at the earliest.

Image Credit: Nuzree

Buying gold online

One of the biggest disruptions that have changed our world in the last decade has been the mercurial growth of online trading. The precious metals industry has not been left behind. The industry lost no time in embracing new technologies to create a robust online marketplace where gold and silver could be traded.

There are several inherent advantages of buying gold online, however, safety and security remain a key concern for investors. Reputed dealers like Physical Gold, have taken steps to make the online buying process simple, comprehensive and safe. In this article, we will explore how investors can easily purchase gold products online and build a portfolio.

Firstly, find a trustworthy gold dealer. They should have been around for a long time, have a large number of customer reviews and offer good customer service. Next, you can simply set up an online account with that gold company and add gold coins or bars to your basket. Payment options are varied and usually include an array of cards up to £5,000 in value and bank transfer for larger sums. PayPal and American Express are rarely offered due to tight margins in the industry. Good gold dealers may be able to offer advice as to which gold to buy to meet your objectives.

Gold bullion coins can be easily bought online

Finding a reputed gold dealer

A reputed gold retailer will have a proven track record of transactions and reliable customer service. When researching a gold dealer on the internet, look for customer feedback and trust ratings. If you cannot find this information about a certain company, it’s perhaps best not to deal with them. Almost all reputed gold dealers will be registered with a regulatory body in the industry, like the BNTA. Visiting their website and going through the list of dealers registered with them can be an easy way to identify the best dealers to buy from. This is often the first step and doing your research diligently can ensure the safety of your transactions with minimal chances of getting ripped off.

Checking the variety of products

Many online dealers will be able to offer you a far greater variety of gold products, than your local high-street gold dealer. Online gold dealerships have thousands of products that you can browse and select from the safety and comfort of your living room. This gives you greater flexibility to find the right products that match your investment objectives. Of course, there are safety considerations when buying gold on the high street. When you buy your gold from a high-street store and leave, your safety could be compromised. These are some of the many important considerations why you should opt to buy your gold online.

When buying online, it’s best not to invest in rare and valuable coins as they are hard to sell

Opening an online account

Once you identify a dealer of choice and you have spent enough time going through their website and selecting the products you want, it is time to open an online account. Most reputed dealers will allow you to register for free. Simply add the gold items you want to purchase into the online cart. After you select your products, you can pay for your purchases using a debit or credit card. It’s that simple.

Making online payments

Cards may be used for purchases up to £5,000. If you wish to make purchases over and above this amount, you can do so using bank transfers. Larger purchases will require proof of identification as well. Most reputed dealers use secure payment gateways, so your bank details would not be compromised. At this point, you should also select the method of delivery. Always opt for insured delivery if you intend to collect your gold at your residence. You should also make prior arrangements for safe storage of your gold in your home. Most well-known dealers would also offer you the option of storing your gold in a secure storage facility, arranged by them.

Visit the Physical Gold website for your online purchases

Physical Gold has a very comprehensive online store that uses a 3-D secure system to make payments. Several investors have used our website to buy gold. Go on to our website and register for a free account. By following five simple steps, you can easily make online purchases. If you want to find out more about buying gold online, give us a call on (020) 7060 9992 or drop us an email.

Image credits: Public Domain Pictures and Wikimedia Commons

While some people are seasoned gold investors, gold investment in the UK can be a whole new world for many. In the past decade, gold investment has evolved to become far more mainstream, but most investors remain novices. As such, we regularly help our customers answer questions they have about the market, buying process and how to sell.

One thing’s for sure, you shouldn’t be embarrassed or shy to ask these questions. You need to feel comfortable and understand any asset if you’re considering investing your hard-earned cash. As leading gold investment UK specialists we’ve heard all possible questions many times.

Got questions about gold investment? Download our FREE 7 step cheat sheet here

But what are the most common questions we receive?

Type of gold

Clearly, there’s a choice when you come to buy your gold. Questions range from whether you should buy bars or gold coins, 22 or 24-carat gold, or whether various year coins are worth investing in over others. It’s certainly worth doing your research independently as well as seeking advice from experts. Together you should be able to make the right choice. Gold should always be seen as a medium to long-term investment, so there’s no rush to buy. Make sure you’re happy with the type of bar or coin you wish to buy before taking the plunge. While we at Physical Gold focus on selecting the best type of gold for investment purposes, other gold merchants are simply shops and might try to persuade you to buy a type of gold which they have in stock and can’t shift.

The simple answer to these questions is that the best type of gold will vary from individual to individual, which is why our consultation process starts from the beginning and looks at your specific motivations and needs.

Is timing important with gold investment UK?

The golden question (if you’ll pardon the pun!), is what the prospects are for gold in 2022, and whether now is a good time to buy. Be wary of any gold dealer who guarantees returns. No-one has a crystal ball. As mentioned previously, the exact level at which you enter the market isn’t crucial, as gold generally gains in value above the rate of inflation in the long term. However, a good dealer will certainly help you buy in a trough to pick up that extra bit of value and also help you select gold which offers value at that time of purchase. For example, it may be a bad time to buy Maple Leaf coins as there may be a shortage leading to inflated premiums, whereas other coins may provide a buying opportunity as they’re currently trading cheaper.

One shrewd method of eradicating the timing issue is to drip-feed money into gold or split your investment into 2 or 3 tranches. Therefore you iron out some of the volatility and secure various prices, hedging your bets.

Are there tax-efficient ways of buying gold?

If an investment is the main purpose for buying gold, then it’s not only your buy and sell price which contributes to overall returns. Tax plays a crucial role also. Everyone wants to know the best ways to invest in gold. Seeking guidance from a reputable gold dealer will help select tax-efficient gold as gold investment in the UK has several tax advantages. Anyone who’s watched James Bond films may dream of owning huge gold bars. But selling them may incur 28% Capital Gains Tax. Others may not realise that 18-carat gold attracts VAT, whereas 22-carat and 24-carat coins and bars are exempt. UK Tax-free gold coins are usually a safe bet for cash investors, and Pension Gold is a great method of adding bullion to your retirement plan while avoiding VAT, CGT and receiving tax relief on your purchase.

How do I store gold?

Questions range simply from where to store gold, to the exact requirements and costs of each specific option. Certainly, if you’re seeking security and protection from your physical gold, then allocated and segregated storage is the only sure way to be safe. Ensure you receive the correct paperwork to prove your ownership. We’ve heard of horror stories of where gold bought and supposedly stored, wasn’t available when clients wished to taken delivery of that gold. Other rumours suggest that unallocated gold accounts will crumble if too many investors wish to sell at the same time.

How do I buy Gold?

Start off be contemplating what you’re trying to achieve from your investment. Is your primary motivation to maximise returns, or is it to buy small pieces of gold to pass onto grand children one day.

Your investment time-frame and appetite for risk may also help determine whether to go for older numismatic coins or simple bullion coins or bars.

We provide guidance as to which choices will best suit your needs. And for those who feel they want a mixed and balanced tax free portfolio, we offer a service to create a portfolio for you.

The word bullion is both widely used and misinterpreted. It basically refers to bars and coins produced in mass for investment purposes. With regards to coins, the term also refers to the standard of production of coins minted after the early 1930s. These coins are generally regarded as the most cost efficient way of purchasing gold coins as their market value is determined almost exclusively by their gold content. In contrast to other types of coins such as proofs, commemorative, or historic coins, you will not pay premiums for packaging, finish or exclusivity. Physical Gold offer an easy way to buy gold coins online in the UK.

The end of using bullion coins as currency

It was around the 1930s that the use of gold coins was lifted from circulation as the major economic powers around the world decided to recall their gold reserves and discontinue the use of gold in coinage. However, this did not stop the minting of gold coins and the major mints around the world continued to issue gold coins for the purpose of collection by numismatists and investors alike. Many of these coins are available at the value of their weight in gold. However, there are also coins from this period that have witnessed a significant escalation in value due to numismatic interest. For example, a 1933 gold double eagle fetched a record £7.5mn at an auction in 2002.

Knowing what you’re buying

Numismatists have always enjoyed collecting gold coins of collectable value. Coins that enjoy rarity and historical value have a great propensity to increase in value. This value is based on the demand of the coin itself, and not it’s weight in gold. However, needless to say, counterfeiters and rogue dealers also seize the opportunity of cashing in on such trends and there are a number of fake coins circulating in the market.

Bullion coin authenticity

When investing in bullion coins (including coin sets) as part of a portfolio, it is very important to determine whether the coin is genuine. There are internationally acclaimed coin certification agencies that can ensure that the bullion you are buying is genuine. The well-known ones across the world are the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC).

Getting your coin certified by one of these organisations is one way of getting it done. PCGS and NGC do appear often at important numismatic events, like the International Numismatic Convention in New York or the London based Coinex event, organised by BNTA, which has its 40th international convention due in September 2018. Collectors who want to have their coins graded, usually file their submissions in advance and collect them at the event, while networking with other collectors and viewing the displays.

Test for fake bullion coins yourself

However, there are other methods to determine whether the coin you’re buying is a fake. A coin gauge is a handy tool often used by dealers and collectors alike to detect counterfeits. Also, it is important to bear in mind that due to the unique properties of gold, coins are difficult to duplicate. Base metals have a lower density, which means that counterfeit coins would have the wrong dimensions or be underweight. Interestingly, there is even a mobile phone app that can ping the coin with sound and analyse the echo to detect a fake. In the UK, the forgery and counterfeiting act 1981 effectively outlawed the counterfeit trade. At Physical Gold, our team of numismatist experts always ascertain the genuineness of each and every coin we trade-in. We are also happy to help you ascertain the type of gold, authenticity, and the value of your gold coins, as well as guide you on how, where, and when to get the best deals on gold bullion.

The advent of modern technology has ensured a mobile app to check gold coins

Bullion coin sizes

Bullion coins are available in various fractional denominations, but the general rule of thumb is you’ll pay increasingly more as the denomination reduces. We feel the common 1oz coins and the full Sovereigns offer a great balance of divisibility and value. Because we only source the world’s most recognised bullion coins, they are always easy to trade at the tightest margins. Investors also benefit from price savings as the quantity of bullion coins they buy grows.

Sovereign coins are now recognised by the Royal Mint as bullion quality as they’re issued to non-proof finish for investment purposes in laminated sheets. However, many older Sovereign coins are widely traded in today’s investment market alongside the newer coins. These coins pre-dating 1933 encompass the Sovereign heads of early Elizabeth, George V & VI, Edward VII & VIII and Queen Victoria. Due to their age and limited issue, they can be deemed to contain a degree of historical value – and may be classed as semi-numismatic.

In practice the cost of these coins is usually slightly less than their bullion cousins of the past 10-15 years as their historic value is cancelled out by their inferior condition. Just like with new cars, you tend to find that the latest year’s bullion coins may carry a slightly higher premium than ‘nearly new’ coins even though they are of identical design and condition. Our consultants will guide you as to the current premiums on these coins to ensure you assemble the best value portfolio of coins.

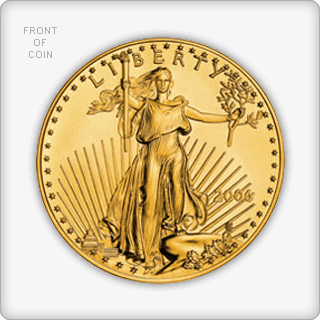

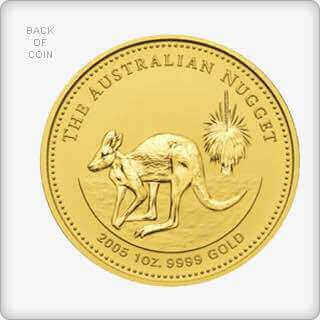

Below we list and describe some of the world’s best known bullion coins. The two main tax free bullion coins in the UK are the Britannia and the Sovereign. The Krugerrand is known as the world’s original bullion coin as it was the first to guarantee 1oz of pure gold.

Gold Coins

Those interested in investing in bullion have two main options – bars or coins. Whilst both have their benefits, the beauty of choosing gold bullion coins is that they offer more flexibility, especially for those planning to sell their gold coins on.

There are a variety of bullion coins in the UK, suitable for people with different aims. From rare and beautiful coins such as the Chinese Panda or American Eagle, to more common options, we’re pleased to supply an extensive range.

Buy Gold Coins online

Amongst our collection, you’ll notice some of the world’s most well recognised gold bullion coins, including the South African Gold Krugerrand. Attracting lower margins than many other coins, this makes them ideal for investment although your selection will no doubt depend upon a number of factors, including budget, taste and use.

Bullion coins are quite lucrative if the investments are managed properly

Bullion Coins

Aside from the type of coin itself, another consideration for those looking to buy gold coins online should be their storage. Naturally security will be a priority, leading many to store theirs in a safe, although some do choose to keep them in their homes. Those who do opt for the latter should make sure their coins are covered by their home insurance.

It may be useful for inexperienced buyers to take advantage of our expert advice before making any purchase.

Talk to our bullion experts before investing

Investing in gold bullion can be very lucrative, as well as an absorbing and immersive experience for many buyers like yourself. It is important to get the right advice before investing your hard earned money in buying coins. At Physical Gold, our team consists of numismatics experts who possess a wealth of knowledge and years of experience in advising clients on how to make the right buying decisions when it comes to bullion. Call us today on 020 7060 9992 or get in touch online by filling out the contact form provided on our website. Our team will be happy to get in touch with you right away.

Image credits: Pixabay and Pixabay

[gap]

[block id=”cta-guides”]