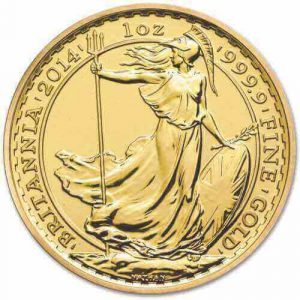

2026 King Charles III Gold Britannia 1oz Coin

£3,836.46

Incl. £0.00 VAT

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

2026 1oz Gold Britannia – King Charles III

The 2026 1oz Gold Britannia continues its legacy as one of the world’s most secure and sought-after bullion coins. This is the fourth Britannia to feature King Charles III’s portrait, designed by Martin Jennings, following the historic 2023 Coronation issue and the first full-year 2024 and 2025 editions.

Unlike the limited Coronation coin, the 2026 Britannia is priced for investors seeking maximum value while still offering the prestige and collectability of Royal Mint craftsmanship.

Browse our complete range of 2026 gold coins.

Coin Specifications

- Weight: 1 troy ounce (31.1g)

- Purity: 999.9 fine gold (24 carat)

- Face Value: £100 (legal tender, CGT exempt in the UK)

- Manufacturer: The Royal Mint

- Packaging: Supplied loose or in tubes of 10. Protective capsules available.

Looking for a more affordable option? Explore the 2026 1/2oz Gold Britannia.

Cutting-Edge Security Features

The Britannia remains the most secure bullion coin in the world, with advanced features introduced in 2021 and perfected in the 2026 release:

- Animated Waves – Micro-detailed background that shimmers and moves as the coin is angled.

- Latent Hologram – A trident that transforms into a padlock, symbolising strength and security.

- Micro-Text – The Latin phrase DECUS ET TUTAMEN (“An ornament and a safeguard”) encircles the reverse design.

- Shield Detailing – Britannia’s shield displays intricate laser-engraved patterns for added protection.

These features make the Britannia virtually impossible to counterfeit while enhancing its striking design.

Prefer a smaller size? Discover the 2026 1/4oz Gold Britannia.

Why Choose the 2026 Britannia?

- Tax Benefits: VAT-free and exempt from Capital Gains Tax (CGT) in the UK.

- Historical Significance: Third year of King Charles III’s reign, making these coins particularly collectable.

- Sustainability: The Royal Mint continues its move towards recycled and responsibly sourced gold, appealing to ESG-minded investors.

- Global Recognition: Britannias are traded worldwide, ensuring strong liquidity and resale value.

- Investment Value: Mass-produced to bullion standard, keeping premiums lower than limited editions.

Shop the 2026 1/10oz Gold Britannia – perfect for new investors or gifts.

Background – The Britannia’s Story

First launched in 1987 to rival the South African Krugerrand, the Britannia quickly established itself as the UK’s flagship bullion coin. Originally struck in 22 carat gold, it was upgraded to 24 carats (999.9 purity) in 2013, aligning with global demand and appealing strongly to the Asian market.

Over the years, the Britannia has expanded into fractional sizes (½oz, ¼oz, ¹⁄₁₀oz) and silver editions, making it versatile for both modest investors and large portfolio holders. Limited-edition versions – from the 30th Anniversary coin to designs with oriental borders – have cemented the Britannia’s reputation in both the bullion and collector markets.

Expert Opinion

The 2026 1oz Gold Britannia remains one of the best all-round choices for investors:

- The 1oz size offers the lowest premium relative to gold content.

- Its legal tender status ensures CGT exemption, making it one of the most tax-efficient gold coins for UK buyers.

- Quantity discounts reward bulk purchases, while limited supply supports second-hand values.

- With coins rarely sold back onto the market, prices are well supported by consistent long-term demand.

For many buyers, Britannias are not just investments but heirlooms, passed down through generations. The 2026 issue continues that legacy.

How to Buy

Purchasing the 2026 Gold Britannia is simple:

- Order online 24/7 with instant price locking.

- Pay securely by debit or credit card with no additional fees.

- Choose free, insured UK delivery in discreet packaging or opt for secure vault storage with digital account access.

- Build your portfolio gradually with our monthly gold savings plan.

Need advice? Our specialists are here to help you build a tax-efficient gold portfolio. Call us on 020 7060 9992 or email info@physicalgold.com.

✅ Secure your wealth with the 2026 Gold Britannia – the perfect blend of history, security, and investment value.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

This product is stored at Loomis International in the UK and held on a fully allocated and segregated basis.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.

- Standard storage fees are and 0.5 %+VAT (Gold) and 0.75%+VAT (Silver) semi-annually, subject to minimum charges.

- View your holding’s up-to-the-minute value within your Physical Gold account section

- Semi-annual storage dates are 15 March and 15 September each year.

- Storage is charged at point of purchase to the next semi-annual roll date.

- You’ll be invoiced for the subsequent semi-annual storage period 7-14 days before the next roll date.

- Selling back from storage is quick and easy by filling out our sale form.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.