Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

Metalor 10g Gold Bar

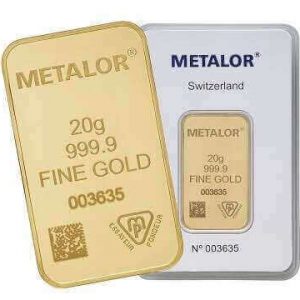

The 10g Gold bar is produced by Swiss refiners Metalor and recognised by the LBMA and can be traded anywhere globally. Each brand-new bar contains 10g of fine gold and comes in a sealed, tamper-proof credit-card-sized package with a unique serial number and certification, for security and buyer confidence.

Please note that on occasion, you may receive an alternative brand of the bar if Metalor is out of stock. Brands will be of equal purity, reputation and presentation. Examples would be Credit Suisse, UBS, Heraeus or Perth Mint

Our expert opinion

As a brand, Metalor hits the sweet spot for investors. Swiss manufacturers have an unrivalled reputation in this space for producing quality, high purity gold bars. That reputation provides the buyer with peace of mind, but also the reassurance that it will fetch a good price when selling. The sealed packaging with serial number provides further comfort of authenticity and provenance. As one of the most popular gold bullion brands, Metalor bars are mass-produced and have better value than competitors like Pamp, who charge a premium.

As a gift for a friend or family, it provides a unique and impressive choice, but also a thoughtful one to encourage children to start building a nest egg for their future. The 10g gold bar affords a talking point as recipients are always keen to show it off.

As an investment, its cost-effectiveness will depend on the size of the overall outlay. For any investor with £1,000 or more seeking efficiency, and as much gold as possible for their money, it may be a wiser choice to buy larger gold bars that reduce the price paid per gram (such as 100g gold bars). There are also price reductions if buying larger quantities of 10g bars in any one purchase. Therefore it may be wise to accumulate cash to buy as many as possible in one go to achieve discounts.

The disadvantage when buying larger bars like the 1kg gold bar is one of a lack of divisibility. Even if you’re certain you won’t need to sell part of your portfolio for several years, owning just 1 large piece of gold doesn’t afford you to sell a portion of your investment, even if circumstances change. Physical Gold always recommends striking a balance between overall cost and owning as many pieces of gold as possible. Buying silver bars is a viable alternative, with a 1KG silver bar being an alternative investment strategy.

At 10g in weight, the other main investing alternative would be the Sovereign gold coin, which is 22 carats and provides 7.32g of gold. We compare gold bars versus gold coins here. Generally, while Sovereign coins aren’t packaged impressively like the Metalor bars, they can be bought at lower premiums and have the advantage of being Capital Gains Tax free.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

This product is stored at Loomis International in the UK and held on a fully allocated and segregated basis.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.

- Standard storage fees are and 0.5 %+VAT (Gold) and 0.75%+VAT (Silver) semi-annually, subject to minimum charges.

- View your holding’s up-to-the-minute value within your Physical Gold account section

- Semi-annual storage dates are 15 March and 15 September each year.

- Storage is charged at point of purchase to the next semi-annual roll date.

- You’ll be invoiced for the subsequent semi-annual storage period 7-14 days before the next roll date.

- Selling back from storage is quick and easy by filling out our sale form.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.