What is the Face Value of Gold and Silver Coins?

19/02/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

In the world of coins, understanding the concept of face value is essential, particularly when it comes to precious metals like gold and silver. While many might assume that the face value of a coin directly correlates with its worth, the reality is more nuanced.

With no apparent direct correlation between face value and actual worth, it may seem tempting to disregard the subject. But comprehending the implications of a coin’s face value plays a significant role in choosing the best gold and silver coins to invest in, as it can directly impact your profits.

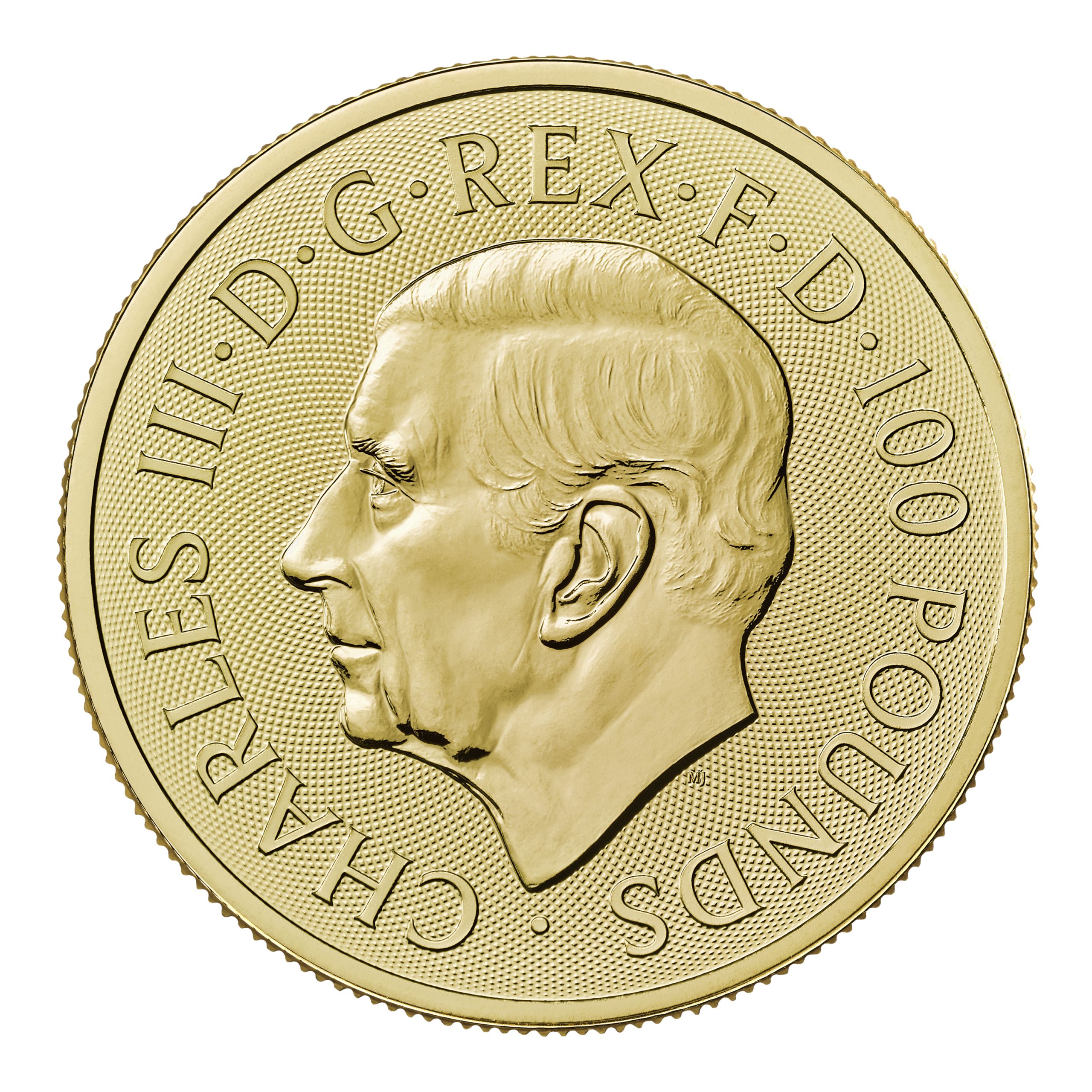

The face value of a coin refers to the monetary denomination that is officially assigned to it by the issuing authority, typically stamped or engraved on the coin itself. This face value serves as a legal recognition of the coin’s nominal worth and is a crucial aspect of its design and function. While the face value has obvious current utility on everyday legal currency like 50p coins and £1 coins, a face value can also be assigned to precious metals coins.

Unlike currency coins, it’s important to note that the face value of gold and silver coins rarely reflects its actual market value. In other words, while the face value indicates the nominal amount for which the coin can theoretically be used as a form of currency, it may not accurately represent its true intrinsic worth or the price it commands in the marketplace.

This discrepancy between face value and market value highlights the distinction between the nominal value assigned by authorities for legal tender purposes and the actual value dictated by factors such as the coin’s metal content, rarity, and collector demand.

7 crucial considerations for keen precious metals investors

Circulating currency coins are assigned a face value for two main reasons. Firstly, the creation of coins with a stated value serves as a means of standardized exchange for goods or services. This replaced the previous bartering system whereby communities would exchange their own possessions for others. A dairy farmer could offer a quantity of his cattle’s milk in return for a loaf of bread from the local baker.

Using the face value of coins to provide a more fractional and precise value to goods and services, allows for far more fluid and sophisticated transactions. It stipulates a standardized measure of value that facilitates everyday trade, allowing people to easily exchange goods and services.

Secondly, the face value helps establish the coin’s legal tender status, giving it the authority to be accepted for payments of debts and obligations. Enforcing the acceptance of currency within a country enables certainty to residents and oils the wheels of trade.

Originally, the value and acceptance of exchange of coins were primarily determined by their metal content, with gold and silver being the preferred metals due to their rarity and durability. Over time, face values were added to these coins as societies developed standardized currency systems. As the years passed, countries moved away from the gold standard and sought to mint coins from cheaper metals, while the face value acted to maintain a standard value of exchange.

Today’s currency coins are made from metals such as nickel and copper to optimize resilience to wear and tear and minting cost. Adding a face value to gold and silver coins has persisted even today, mainly as an ode to tradition rather than playing a direct role in its function. The inclusion of the value still acts to serve as an official mark of authority from the world’s mints and differentiate their official gold and silver coins from those produced by independent mints.

With many of the world’s most popular bullion coins now being created in a range of fractional coin sizes, the various face values also assist in depicting the various denomination sizes in the mint’s range.

The move towards using cheaper metals to produce currency coins has caused a disparity between a coin’s face value and metal value. Today’s UK Pound coin for example is made using nickel and brass with a total cost of production of around £0.04 per coin, including raw materials and production cost.

But there’s also an increasing differential in the face value and metal value of gold and silver coins, mainly due to inflation. While the face values assigned to gold and silver coins have remained unchanged, their intrinsic values, determined by factors such as the metal content and market demand, have risen dramatically as inflation has eroded the buying power of the face value.

Setting the face value of a coin can be influenced by various elements.

As we’ve already alluded, a coin’s face value and actual value no longer equate. While the intrinsic metal value of generic currency coins is lower than its face value, the opposite is true of gold and silver coins. Several factors impact the real market value of a silver or gold coin.

The primary factor influencing the actual value of gold and silver coins is their metal content and weight. The price of precious metals has more than kept pace with inflation over the years, so while a coin’s intrinsic value fluctuates, it has increased in value significantly over the long term. In basic terms, higher weight and purity coins will have a higher market value than smaller ones. However, other factors can impact their true value.

Another factor influencing the actual value of gold and silver coins is their numismatic value. Coins with unique designs, limited mintages, historical significance, or exceptional condition may command a premium above their metal value. Collector demand can significantly influence the market price of these coins, leading to higher values compared to similar coins without collector appeal.

The market supply and demand dynamics play a significant role in determining the actual value of gold and silver coins. Fluctuations in demand from investors, collectors, and industrial users, combined with changes in mining output and recycling rates, can impact the market price of these metals and, consequently, the value of coins made from them.

In addition to providing an element of official legitimacy to a gold or silver coin, adorning a face value enhances its investment potential. The addition of the face value qualifies these coins as legal tender which subsequently grants tax advantages to gold and silver investors. Any resident who sells a gold or silver legal tender coin at a profit is exempt from Capital Gains Tax (CGT). While that may hold no relevance to basic currency coins, it poses a distinct appeal to those seeking capital appreciation on their precious metal investments.

In the UK, popular coins such as the Britannia and gold Sovereign hold legal tender status, ensuring their popularity amongst UK investors who wish to be tax efficient. With CGT annual tax-free allowances shrinking, this loophole is becoming increasingly important to enhance profits.

Our automated portfolio builder will provide suggestions based on various investment objectives.

The face value of a full Sovereign coin is £1, representing its legal tender status. However, the true value of a Sovereign is determined by its gold content, which is 7.3224 grams. Investors calculate its value based on the current market price of gold and whether the Sovereign holds additional historical worth.

Face value refers to the nominal worth of a coin as designated by the issuing authority. It is typically printed or engraved on the coin itself and represents the value of the coin as currency within the monetary system.

Face value is the assigned monetary worth of a coin for legal tender purposes, while intrinsic value is derived from the metal content of the coin. Intrinsic value reflects the actual worth of the metal contained in the coin, such as gold, silver, or copper.

Gold and silver coins have face values primarily for practical and historical reasons. While their metal content may be more valuable, assigning face values facilitates transactions, provides legal tender status, and ensures consistency in currency systems.

Face values of coins generally remain static over time, regardless of changes in metal prices or economic conditions. However, in some cases, issuing authorities may adjust face values to reflect significant shifts in currency values.

While face value is important for transactions and legal tender status, collectors and investors often prioritize factors such as metal content, rarity, and historical significance when evaluating coins. Understanding the distinction between face value and actual value helps inform decisions in numismatics and investment.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.