In 2017, investors added gold to their portfolios as incomes increased, uncertainty loomed, and gold’s positive price momentum continued: US$8.2bn flowed into gold-backed ETFs and the US$ gold price rose 13.5%, its best year since 2010 As 2018 begins we explore four key market trends and their implications for gold:

As 2018 begins we explore four key market trends and their implications for gold:

- synchronised global economic growth

- shrinking central bank balance sheets and rising rates

- frothy asset prices

- market transparency, efficiency, and access.

We believe that these trends will support demand and maintain gold’s relevance as a strategic asset.

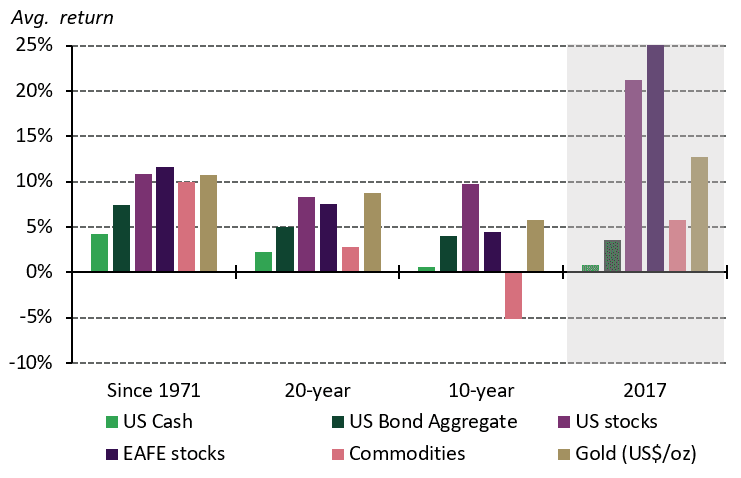

Gold has delivered positive returns over the long run, outperforming key asset classes

Annual average returns over various time periods*

*As of 31 December 2017. Annual return computations are based on total return indices, except gold where the spot price is used. This arrangement more accurately reflects portfolio level performance.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council