Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

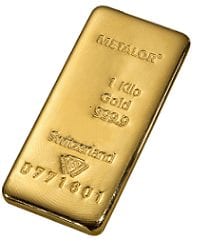

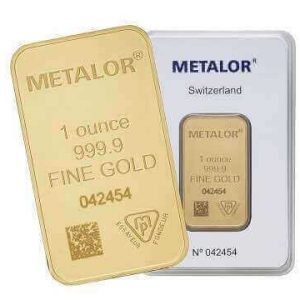

Metalor 1 Kilo Gold Bar

The brand new 1kg gold bar is produced by Swiss refiners Metalor and recognised by the LBMA. The cast gold bar can be traded anywhere globally. Each bar contains 1000g of fine gold and comes with a unique serial number and certificate, for buyer confidence.

Our Expert Opinion

The 1kg gold bar is a popular choice for investors with substantial funds, seeking value and simplicity. As the biggest gold bar we offer, the 1kg Metalor can be purchased at the most economical price due to its large size. Manufacturing costs for one large piece of gold are lower than producing the equivalent gold in coins or smaller bars, so for those prioritising the lowest price per gram, this is a great choice. Metalor is a world-renowned gold producer so selling your bar will always fetch the maximum return. The brand name can be more important with bars of this size because in theory there are fewer buyers of a 1kg bar (people who can afford it), than those seeking 1oz gold bars. So if you compromise and buy an obscure 1kg gold bar, your sale price may well also be affected. Metalor strikes a perfect balance between having a premier Swiss reputation while offering far better value than the likes of Pamp.

How big is the bar

A bar of this size can also bring the unique satisfaction that holding physical gold can afford. Most people imagine brick-like gold bars like the gold in the movies, so when they end up purchasing some gold coins or 20g gold bars, many are left underwhelmed with the amount their money can buy. While the 1kg bar does resemble the brick size bars in films, it is more modest in proportions, while maintaining the same desired effect. Generally, bars featured in films and on TV, and those bought and sold by Central Banks are in fact 12.5kg bars (or 400oz)! For those able to afford the 1000g gold bar, instant comfort and pleasure can be derived from simply handling the bar. Unlike the smaller 5g to 100g bars, the 1kg Metalor bar is a cast gold bar. This means the gold is produced by pouring molten gold into a set 1kg cast rather than cutting the bars from a sheet of gold. It’s only important for aesthetics that you understand the difference before you buy. There’s no difference in the value of a cast or minted gold bar, but the cast bars have more rounded edges and look more rugged. The fact the bar has a stamped serial number and accompanying certificate is all you need. We also sell a silver bar equivalent, which is the 1 kilo silver bar from Metalor.

Any alternatives?

Individual circumstances and objectives will dictate whether the 1kg bar is the most economical choice for an investor. Certainly, the purchase cost is low. As part of a much larger investment, it can play the role of reducing the average cost of a gold portfolio, when combined with coins or smaller bars. If bought on its own, it can present the issue of divisibility for that investor, limiting liquidation choices. After all, if you wish to sell half your holding and you only own one gold bar, then the hacksaw needs to come out (joke!).

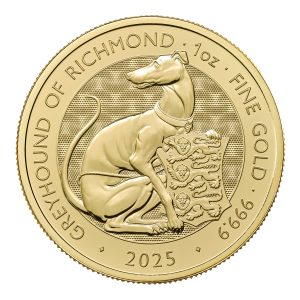

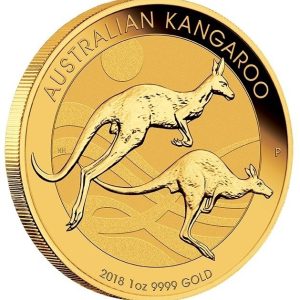

A compromise we see often with those focussed on gold bars is to perhaps make up 1kg from a combination of smaller gold bullion bars. You’ll only pay marginally more to buy 1x500g, 1x250g, 2x100g, and 1x50g for instance, but you’ll gain the advantage of the flexibility to sell part of your holding. Of course, many investors with £30k+ to buy gold will opt for tax-free gold coins. Price reductions are still achieved with coins by purchasing in larger quantities, although the price per gram will still be slightly higher than that of a 1kg bar. As well as the divisibility benefit we’ve already mentioned, the UK coins also benefit from being Capital Gains Tax-free. The Gold Britannia, for example, can be bought at very low premiums as it’s mass-produced in a bullion finish and is 4 times the size of a Sovereign, and therefore cheaper to produce. However, as UK legal tender, any profits made are completely tax-free. Unlike owning lots of smaller bars (or coins), possessing a 1 kilo gold bar doesn’t enable you to sell your portfolio strategically between tax years to be tax efficient.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

All gold & silver orders are stored at Loomis International in the UK and held on a fully allocated and segregated basis.

Storage fees are 1%+VAT/year for gold and 1.5%+VAT/year for silver, subject to minimum charges.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.

Storage is charged at point of purchase by selecting ‘Buy with Storage’ to the next semi-annual pay date. Semi-annual storage dates are 15 March and 15 September each year and are subject to minimum charges for the period.

A recurring storage fee will be taken from your card at each semi-annual storage date.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.