Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

2017 Silver Philharmonic coin

This is a bullion finish 1oz silver coin. Coins are shipped loose for small orders, in tubes of 20, and boxes of 500.

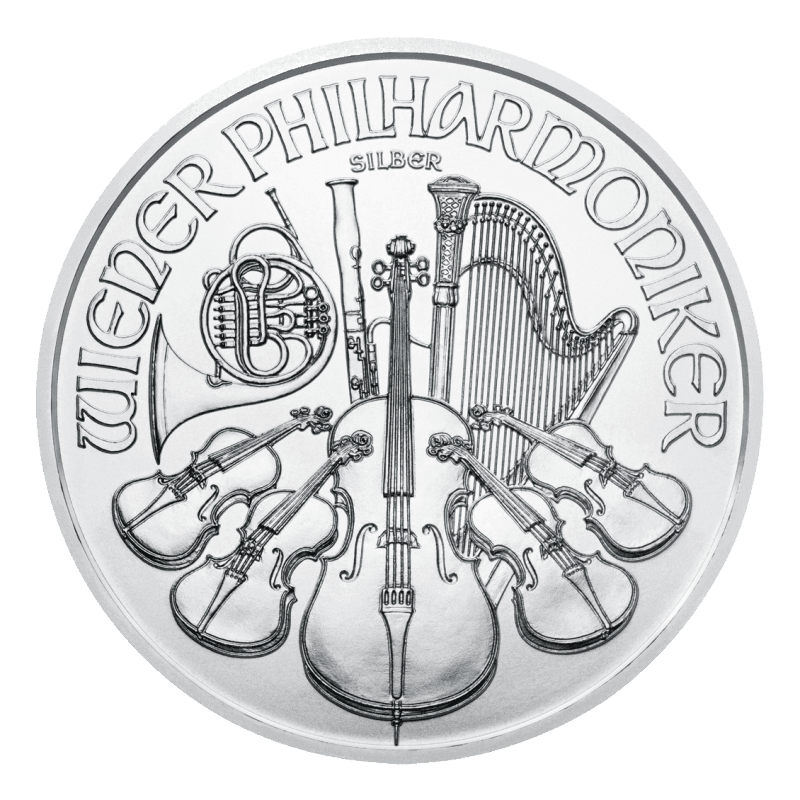

First produced in 2008, the 1oz Austrian Silver Philharmonic coin is the most highly minted coin in Europe and qualifies as legal tender in Austria with a face value of Euro 1.50. The obverse features the Great Organ in the Viennese Musikverei concert hall while the reverse displays a host of instruments representing the world-famous Philharmonic orchestra. This reflects Austria’s long association with classical music and composition.

History

First minted on 1 February 2008, the Silver Philharmonic’s first year of issuance was around 7.7 million pieces – its lowest annual issue amount. Once the Austrian Mint recognised its popularity and potential as an investment coin, they subsequently ramped up the annual issuance, surpassing 17 million units in some years, making it the most common and well recognised silver bullion coin on the continent. It could be argued that the Austrian Mint has its roots as far back as 1194 when Duke Leopold V granted freedom to Richard the Lionheart in exchange for 12 tonnes of silver, which he used to produce coins. This marked the beginning of an 800-year rich history of Austrian silver coin production, although historical records only recognise its official existence 200 years later. Originally called The Vienna Principal Mint, its name changed to the Austrian Mint in 1989.

The original design of the coin by Thomas Pesendorfer was used initially on the 1oz gold Philharmonic from 1989. The coin has always been revered as one of the most beautiful bullion coins available on the market.

Our Expert Opinion

The Austrian Philharmonic Silver coin is a must for any silver coin collection. The design is world-renowned and admired, but the coin also provides fantastic value as an investment coin. Premiums on the coin are low, especially as you increase the quantity. We’d recommend buying as many in one go as possible to benefit from the generous sliding price scale this coin offers. As a well established and consistent coin, it also commands a strong buyback price, making it an excellent choice for pure value silver investment. For larger buyers, its foreign status does mean that it doesn’t possess the same tax-free status as the UK coins. If you think Capital Gains Tax (CGT) could be an issue, you may be better off selecting one of the British coins like the best-selling Silver Britannia. Don’t let this put you off though, everyone in the UK is allowed to make annual capital gains of around £12,300 before CGT is charged. Even with large portfolios of non-UK coins, they can be sold strategically in tranches year to year to avoid a tax hit on your well-deserved profits.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

All gold & silver orders are stored at Loomis International in the UK and held on a fully allocated and segregated basis.

Storage fees are 1%+VAT/year for gold and 1.5%+VAT/year for silver, subject to minimum charges.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.

Storage is charged at point of purchase by selecting ‘Buy with Storage’ to the next semi-annual pay date. Semi-annual storage dates are 15 March and 15 September each year and are subject to minimum charges for the period.

A recurring storage fee will be taken from your card at each semi-annual storage date.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.