Physical Gold Insights Hub

Investors who have a vision of building their wealth by investing in precious metals like gold and silver, irrespective of whether they are beginners or experts, always benefit from regular industry insights from our experts. Our section on insights has been created with this end in mind and provides you with helpful information like how you can buy gold, how to start investing in gold sovereigns, how you can start buying silver mitigating risks when investing in precious metals, or the best places to get market information or buy bullion.

Where to Buy Gold Bullion in London

London’s bustling streets are not only filled with history and culture but also serve as a hub for gold bullion trading. From prestigious financial districts to renowned jewellery quarters, London offers a diverse array of venues where gold bullion can be purchased.

Understanding Allocated vs. Unallocated Gold: What’s the Difference?

In the modern investment landscape, two primary forms of physical gold ownership have emerged: allocated and unallocated gold. While both offer exposure to the precious metal, they differ significantly in terms of ownership structure, security, and flexibility.

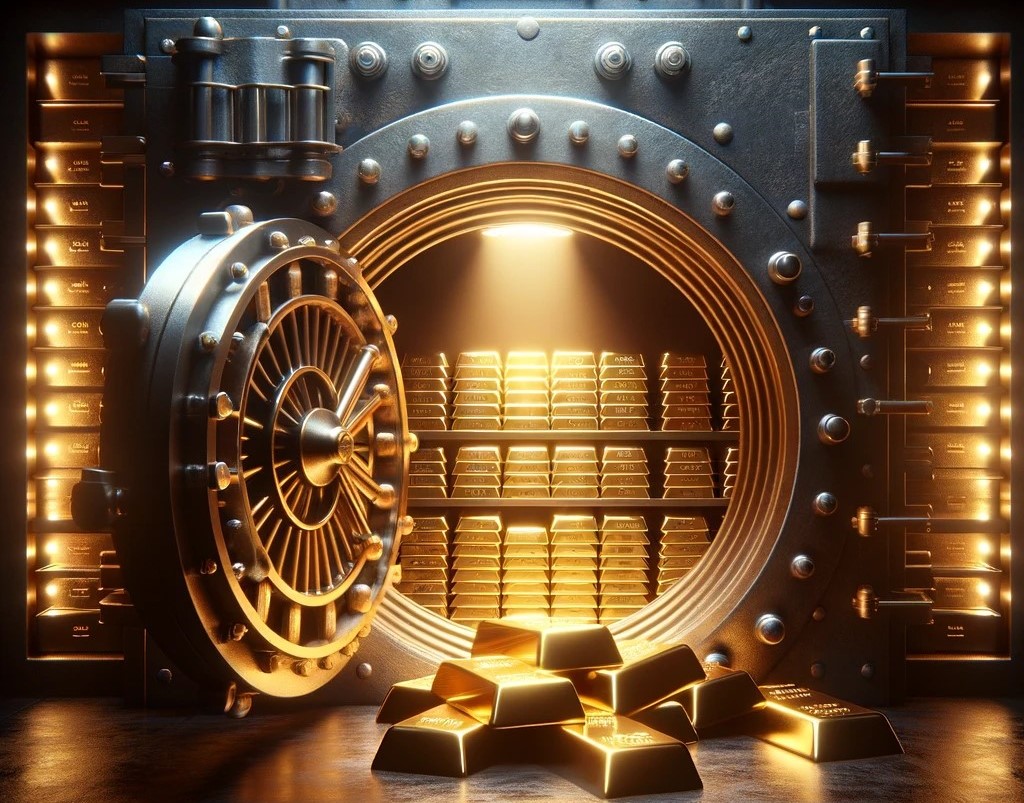

UK Gold Reserves

Gold reserves are a critical component of a country’s economic foundation, often regarded as a symbol of financial strength and stability. Simply put, gold reserves refer to the amount of gold held by a nation’s central bank or government as part of its overall monetary reserves.

American Eagle Coin

This guide recounts when the Eagle was first launched and what it aimed to achieve. We note the various types, designs, and specifications of American Eagle coin so buyers and sellers know which coins are available.